| | |

Filed Pursuant to Rule 424(b)(3) |

Registration No. 333-274947 |

PROSPECTUS SUPPLEMENT NO. 5

(to prospectus dated May 9, 2024)

Primary Offering of

Up to 9,808,405 Shares of Class A Common Stock Issuable Upon Exercise of Warrants

Secondary Offering of

Up to 85,964,719 Shares of Class A Common Stock

Up to 324,352,674 Shares of Class A Common Stock Issuable Upon Conversion of Class B Common Stock and Class C Common Stock

Up to 3,733,358 Shares of Class A Common Stock Issuable Upon Exercise of Warrants

Up to 3,733,358 Warrants to Purchase Class A Common Stock

This prospectus supplement is being filed to update and supplement the information contained in the prospectus dated May 9, 2024 (as supplemented or amended from time to time, the “Prospectus”), with the information contained in our Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission on August 14, 2024 (the “Quarterly Report”). Accordingly, we have attached the Quarterly Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the issuance by us of up to an aggregate of 9,808,405 shares of our Class A common stock, par value $0.0001 per share (“Class A Common Stock”), which consists of (i) 6,075,047 shares of Class A Common Stock issuable upon exercise of warrants originally issued in connection with the initial public offering of Aurora Acquisition Corp. (“AURC”) (the “Public Warrants”) and (ii) 3,733,358 shares of Class A Common Stock issuable upon exercise of warrants issued in a private placement in connection with the initial public offering of AURC (the “Private Warrants” and, together with Public Warrants, “Warrants”).

The Prospectus and this prospectus supplement also relate to the offer and sale from time to time by the selling securityholders identified in the Prospectus, or their permitted transferees (the “Selling Securityholders”), of up to an aggregate of 414,050,751 shares of Class A Common Stock, which consists of (i) 85,964,719 shares of Class A Common Stock, (ii) 252,475,391 shares of Class A Common Stock issuable upon conversion of our Class B common stock, par value $0.0001 per share (“Class B Common Stock”), (iii) 71,877,283 shares of Class A Common Stock issuable upon conversion of our Class C common stock, par value $0.0001 per share (“Class C Common Stock” and together with Class A Common Stock and Class B Common Stock, the “Common Stock”), and (iv) 3,733,358 shares of Class A Common Stock issuable upon exercise of Private Warrants, and of up to 3,733,358 Private Warrants.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

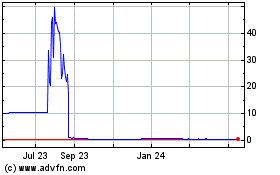

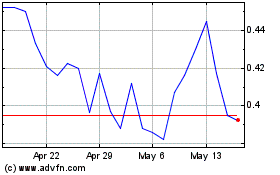

Our Class A Common Stock and Public Warrants are listed on the Nasdaq Capital Market under the ticker symbols “BETR” and “BETRW,” respectively. On August 9, 2024, the closing price of our Class A Common Stock was $0.41 per share and the closing price of our Public Warrants was $0.11 per warrant.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 16 of the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is August 14, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

OR

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-40143

Better Home & Finance Holding Company

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 93-3029990 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

3 World Trade Center

175 Greenwich Street, 57th Floor

New York, NY 10007

(Address of Principal Executive Offices, including zip code)

(415) 522-8837

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A common stock, par value $0.0001 per share | BETR | The Nasdaq Stock Market LLC |

Warrants exercisable for one share of Class A common stock at an exercise price of $11.50 | BETRW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | o | Accelerated filer | o |

| | | |

| Non-accelerated filer | x | Smaller reporting company | x |

| | | |

| | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of August 9, 2024, there were 424,761,553 shares of Class A common stock, 259,792,893 shares of Class B common stock and 71,877,283 shares of Class C common stock of the registrant issued and outstanding.

TABLE OF CONTENTS

Part I - Financial Information

Item 1. Financial Statements

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | | | |

| June 30, | | December 31, | | |

| (Amounts in thousands, except share and per share amounts) | 2024 | | 2023 | | |

| Assets | | | | | |

| Cash and cash equivalents | $ | 320,936 | | | $ | 503,591 | | | |

| Restricted cash | 26,464 | | | 24,475 | | | |

| Short-term investments | 57,844 | | | 25,597 | | | |

| Mortgage loans held for sale, at fair value | 349,206 | | | 170,150 | | | |

Loans held for investment (net of allowance for credit losses of $261 and none as of June 30, 2024 and December 31, 2023, respectively) | 31,260 | | | 4,793 | | | |

| | | | | |

| Other receivables, net | 20,359 | | | 16,888 | | | |

| Property and equipment, net | 16,254 | | | 16,454 | | | |

| Right-of-use assets | 17,693 | | | 19,988 | | | |

| Internal use software and other intangible assets, net | 25,941 | | | 38,126 | | | |

| Goodwill | 32,245 | | | 32,390 | | | |

| Derivative assets, at fair value | 4,730 | | | 1,716 | | | |

| Prepaid expenses and other assets | 54,951 | | | 51,386 | | | |

| | | | | |

| | | | | |

| Total Assets | $ | 957,883 | | | $ | 905,554 | | | |

| Liabilities and Stockholders’ Equity | | | | | |

| Liabilities | | | | | |

| Warehouse lines of credit | $ | 247,354 | | | $ | 126,218 | | | |

| Convertible Note | 516,394 | | | 514,644 | | | |

| | | | | |

| | | | | |

| Customer deposits | 36,594 | | | 11,839 | | | |

Accounts payable and accrued expenses (includes $66 and none payable to related parties as of June 30, 2024 and December 31, 2023, respectively) | 62,267 | | | 66,558 | | | |

| Escrow payable and other customer accounts | 4,097 | | | 3,376 | | | |

| Derivative liabilities, at fair value | 142 | | | 949 | | | |

| | | | | |

| Warrant and equity related liabilities, at fair value | 1,610 | | | 2,331 | | | |

| Lease liabilities | 27,201 | | | 31,202 | | | |

Other liabilities (includes none and $390 payable to related parties as of June 30, 2024 and December 31, 2023, respectively) | 17,316 | | | 25,837 | | | |

| Total Liabilities | 912,975 | | | 782,954 | | | |

Commitments and contingencies (see Note 12) | | | | | |

| | | | | |

| Stockholders’ Equity | | | | | |

Common stock $0.0001 par value; 3,300,000,000 shares authorized as of June 30, 2024 and December 31, 2023, and 755,548,679 and 751,773,361 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | 75 | | | 74 | | | |

| Notes receivable from stockholders | (9,130) | | | (10,111) | | | |

| Additional paid-in capital | 1,852,344 | | | 1,838,427 | | | |

| Accumulated deficit | (1,796,933) | | | (1,704,076) | | | |

| Accumulated other comprehensive loss | (1,448) | | | (1,714) | | | |

| | | | | |

| Total Stockholders’ Equity | 44,908 | | | 122,600 | | | |

| Total Liabilities and Stockholders’ Equity | $ | 957,883 | | | $ | 905,554 | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended

June 30, |

| (Amounts in thousands, except share and per share amounts) | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Gain on loans, net | $ | 24,229 | | | $ | 26,425 | | | $ | 39,881 | | | $ | 39,187 | |

| Other revenue | 2,881 | | | 4,711 | | | 5,698 | | | 9,655 | |

| Net interest income | | | | | | | |

| Interest income | 9,397 | | | 7,574 | | | 18,033 | | | 13,964 | |

| Interest expense | (4,245) | | | (7,615) | | | (9,099) | | | (13,084) | |

| Net interest income/(loss) | 5,152 | | | (41) | | | 8,934 | | | 880 | |

| Total net revenues | 32,262 | | | 31,095 | | | 54,513 | | | 49,722 | |

| Expenses: | | | | | | | |

| Compensation and benefits | 35,254 | | | 33,996 | | | 73,327 | | | 72,108 | |

| General and administrative | 15,155 | | | 12,708 | | | 29,202 | | | 29,472 | |

| Technology | 6,582 | | | 11,163 | | | 12,040 | | | 25,609 | |

| Marketing and advertising | 8,531 | | | 3,101 | | | 13,085 | | | 10,861 | |

| Loan origination expense | 791 | | | 3,396 | | | 3,368 | | | 8,598 | |

| Depreciation and amortization | 7,990 | | | 10,822 | | | 17,064 | | | 22,299 | |

| Other expenses/(Income) | (879) | | | (537) | | | (1,062) | | | 10,527 | |

| Total expenses | 73,424 | | | 74,649 | | | 147,024 | | | 179,474 | |

| Loss before income tax (benefit)/expense | (41,162) | | | (43,554) | | | (92,511) | | | (129,752) | |

| Income tax (benefit)/expense | 203 | | | 456 | | | 346 | | | 1,880 | |

| Net loss | (41,365) | | | (44,010) | | | (92,857) | | | (131,632) | |

| | | | | | | |

| | | | | | | |

| Other comprehensive loss: | | | | | | | |

| Foreign currency translation adjustment, net of tax | 579 | | | (76) | | | 266 | | | (228) | |

| Comprehensive loss | $ | (40,786) | | | $ | (44,086) | | | $ | (92,591) | | | $ | (131,860) | |

| | | | | | | |

| | | | | | | |

| Per share data: | | | | | | | |

| Loss per share attributable to common stockholders: | | | | | | | |

| Basic | $ | (0.05) | | | $ | (0.15) | | | $ | (0.12) | | | $ | (0.44) | |

| Diluted | $ | (0.05) | | | $ | (0.15) | | | $ | (0.12) | | | $ | (0.44) | |

| Weighted average common shares outstanding — basic | 754,797,790 | | 298,172,434 | | 754,395,660 | | 297,845,356 |

| Weighted average common shares outstanding — diluted | 754,797,790 | | 298,172,434 | | 754,395,660 | | 297,845,356 |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (DEFICIT)

For the Three Months Ended June 30, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Common Stock | | | | | | | | | | |

| (Amounts in thousands, except share and per share amounts) | | | | | | Issued and Outstanding | | Par

Value | | Notes Receivables from Stockholders | | Additional Paid-In

Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Loss | | Total Stockholders' Equity (Deficit) |

| Balance as of March 31, 2024 | | | | | | 755,578,694 | | 75 | | | (10,976) | | | 1,844,786 | | | (1,755,568) | | | (2,027) | | | 76,290 | |

| | | | | | | | | | | | | | | | | | |

| Issuance of common stock for options exercised | | | | | | 17,629 | | | — | | | — | | | 1,435 | | | — | | | — | | | 1,435 | |

| Cancellation of common stock | | | | | | (859,697) | | | — | | | — | | | — | | | — | | | — | | | — | |

| Stock-based compensation | | | | | | — | | | — | | | — | | | 8,053 | | | — | | | — | | | 8,053 | |

| Tax withholding upon vesting of restricted stock units | | | | | | — | | | — | | | — | | | (84) | | | — | | | — | | | (84) | |

| Share issued for vested restricted stock units | | | | | | 812,053 | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | |

| Settlement of notes receivable from stockholders | | | | | | — | | | — | | | 1,846 | | | (1,846) | | | — | | | — | | | — | |

| Net loss | | | | | | — | | | — | | | — | | | — | | | (41,365) | | | — | | | (41,365) | |

| Other comprehensive loss— foreign currency translation adjustment, net of tax | | | | | | — | | | — | | | — | | | — | | | — | | | 579 | | | 579 | |

| Balance - June 30, 2024 | | | | | | 755,548,679 | | | $ | 75 | | | $ | (9,130) | | | $ | 1,852,344 | | | $ | (1,796,933) | | | $ | (1,448) | | | $ | 44,908 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (DEFICIT)

For the Three Months Ended June 30, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Convertible preferred stock | | | Common Stock | | | | | | | | | | |

| (Amounts in thousands, except share and per share amounts) | Shares | | Amount | | | Issued and Outstanding | | Par Value | | Notes Receivables from Stockholders | | Additional Paid-In

Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Loss | | Total Stockholders' Equity (Deficit) |

| Balance - March 31, 2023 | 108,721,433 | | $ | 436,280 | | | | 98,358,440 | | $ | 10 | | | $ | (55,581) | | | $ | 625,545 | | | $ | (1,255,278) | | | $ | (1,645) | | | $ | (686,949) | |

| Recapitalization of shares due to Business Combination | 223,593,304 | | — | | | | 202,281,077 | | 20 | | | — | | | (20) | | | — | | | — | | | — | |

| Adjusted Balance as of March 31, 2023 | 332,314,737 | | 436,280 | | | | 300,639,517 | | 30 | | | (55,581) | | | 625,525 | | | (1,255,278) | | | (1,645) | | | (686,949) | |

| Issuance of common stock for options exercised | — | | — | | | | 42,154 | | — | | | — | | | 853 | | | — | | | — | | | 853 | |

| Repurchase or cancellation of common stock | — | | — | | | | (127,028) | | — | | | — | | | — | | | — | | | — | | | — | |

| Stock-based compensation | — | | — | | | | — | | — | | | (185) | | | 5,287 | | | (32) | | | — | | | 5,050 | |

| Shares issued for vested restricted stock units | — | | — | | | | 157,474 | | | | | | | | | | | | |

| Vesting of common stock issued via notes receivable from stockholders | — | | — | | | | — | | — | | | (991) | | | | | — | | | — | | | (991) | |

| Net loss | — | | — | | | | — | | — | | | — | | | — | | | (44,010) | | | — | | | (44,010) | |

| Other comprehensive loss— foreign currency translation adjustment, net of tax | — | | — | | | | — | | — | | | | | (172) | | | — | | | (87) | | | (259) | |

| Balance - June 30, 2023 | 332,314,737 | | | $ | 436,280 | | | | 300,712,117 | | | $ | 30 | | | $ | (56,757) | | | $ | 631,493 | | | $ | (1,299,320) | | | $ | (1,732) | | | $ | (726,306) | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (DEFICIT)

For the Six Months Ended June 30, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Common Stock | | | | | | | | | | |

| (Amounts in thousands, except share and per share amounts) | | | | | | Issued and Outstanding | | Par

Value | | Notes Receivables from Stockholders | | Additional Paid-In

Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Loss | | Total Stockholders' Equity (Deficit) |

| Balance - December 31, 2023 | | | | | | 751,773,361 | | 74 | | | (10,111) | | | 1,838,427 | | | (1,704,076) | | | (1,714) | | | 122,600 | |

| Adjustment of transaction costs related to Business Combination | | | | | | — | | | — | | | — | | | (2,372) | | | — | | | — | | | (2,372) | |

| Issuance of common stock for options exercised | | | | | | 138,516 | | | — | | | — | | | 1,454 | | | — | | | — | | | 1,454 | |

| Cancellation of common stock | | | | | | (1,453,640) | | | — | | | — | | | — | | | — | | | — | | | — | |

| Stock-based compensation | | | | | | — | | | — | | | — | | | 17,196 | | | — | | | — | | | 17,196 | |

| Tax withholding upon vesting of restricted stock units | | | | | | — | | | — | | | — | | | (1,372) | | | — | | | — | | | (1,372) | |

| Share issued for vested restricted stock units | | | | | | 5,090,442 | | | 1 | | | — | | | — | | | — | | | — | | | 1 | |

| Vesting of common stock issued via notes receivable from stockholders | | | | | | — | | | — | | | (865) | | | 857 | | | — | | | — | | | (8) | |

| Settlement of notes receivable from stockholders | | | | | | — | | | — | | | 1,846 | | | (1,846) | | | — | | | — | | | — | |

| Net loss | | | | | | — | | | — | | | — | | | — | | | (92,857) | | | — | | | (92,857) | |

| Other comprehensive loss— foreign currency translation adjustment, net of tax | | | | | | — | | | — | | | — | | | — | | | — | | | 266 | | | 266 | |

| Balance - June 30, 2024 | | | | | | 755,548,679 | | | $ | 75 | | | $ | (9,130) | | | $ | 1,852,344 | | | $ | (1,796,933) | | | $ | (1,448) | | | $ | 44,908 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (DEFICIT)

For the Six Months Ended June 30, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Convertible preferred stock | | | Common Stock | | | | | | | | | | |

| (Amounts in thousands, except share and per share amounts) | Shares | | Amount | | | Issued and Outstanding | | Par Value | | Notes Receivables from Stockholders | | Additional Paid-In

Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Loss | | Total Stockholders' Equity (Deficit) |

| Balance - December 31, 2022 | 108,721,433 | | $ | 436,280 | | | | 98,078,356 | | $ | 10 | | | $ | (53,225) | | | $ | 618,111 | | | $ | (1,167,656) | | | $ | (1,423) | | | $ | (604,183) | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Recapitalization of shares due to Business Combination | 223,593,304 | | — | | | | 201,705,065 | | 20 | | | — | | | (20) | | | — | | | — | | | — | |

| Adjusted Balance as of December 31, 2022 | 332,314,737 | | 436,280 | | | | 299,783,421 | | 30 | | | (53,225) | | | 618,091 | | | (1,167,656) | | | (1,423) | | | (604,183) | |

| Issuance of common stock for options exercised | — | | — | | | | 175,799 | | — | | | — | | | 2,206 | | | — | | | — | | | 2,206 | |

| Repurchase or cancellation of common stock | — | | — | | | | (453,329) | | — | | | — | | | (8) | | | — | | | — | | | (8) | |

| Stock-based compensation | — | | — | | | | — | | — | | | (331) | | | 11,204 | | | (32) | | | — | | | 10,821 | |

| Shares issued for vested restricted stock units | — | | — | | | | 1,206,226 | | — | | | — | | | — | | | — | | | — | | | — | |

| Vesting of common stock issued via notes receivable from stockholders | — | | — | | | | — | | — | | | (3,201) | | | — | | | — | | | — | | | (3,201) | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Net loss | — | | — | | | | — | | — | | | — | | | — | | | (131,632) | | | — | | | (131,632) | |

| Other comprehensive loss— foreign currency translation adjustment, net of tax | — | | — | | | | — | | — | | | | | | | — | | | (309) | | | (309) | |

| Balance - June 30, 2023 | 332,314,737 | | | $ | 436,280 | | | | 300,712,117 | | | $ | 30 | | | $ | (56,757) | | | $ | 631,493 | | | $ | (1,299,320) | | | $ | (1,732) | | | $ | (726,306) | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

| | | | | | | | | | | | |

| Six Months Ended June 30, |

| (Amounts in thousands) | 2024 | | 2023 | |

| Cash Flows from Operating Activities: | | | | |

| Net loss | $ | (92,857) | | | $ | (131,632) | | |

| Adjustments to reconcile net loss to net cash (used in)/provided by operating activities: | | | | |

| Depreciation of property and equipment | 1,932 | | | 3,538 | | |

| Impairments | — | | | 4,963 | | |

| Amortization of internal use software and other intangible assets | 15,132 | | | 18,763 | | |

| Gain on sale of loans, net | (28,195) | | | (33,221) | | |

| Non-cash interest and amortization of debt issuance costs and discounts | 2,853 | | | 476 | | |

| Change in fair value of warrants | (721) | | | (266) | | |

| | | | |

| Change in fair value of bifurcated derivative | — | | | (1,064) | | |

| Stock-based compensation | 16,325 | | | 8,464 | | |

| (Recovery of)/Provision for loan repurchase reserve | (6,942) | | | (688) | | |

| Change in fair value of derivatives | (3,821) | | | (260) | | |

| | | | |

| | | | |

| Change in fair value of mortgage loans held for sale | (2,265) | | | 32,185 | | |

| Change in operating lease of right-of-use assets | 2,295 | | | 2,052 | | |

| Change in operating assets and liabilities: | | | | |

| Originations of mortgage loans held for sale | (1,622,279) | | | (1,705,817) | | |

| Proceeds from sale of mortgage loans held for sale | 1,472,875 | | | 1,660,873 | | |

| Operating lease liabilities | (4,001) | | | (6,133) | | |

| Other receivables, net | (3,475) | | | 1,176 | | |

| Prepaid expenses and other assets | (3,564) | | | 5,656 | | |

| Accounts payable and accrued expenses | (8,034) | | | 16,761 | | |

| Escrow payable and other customer accounts | 721 | | | (2,871) | | |

| Other liabilities | 639 | | | (14,978) | | |

| Net cash used in operating activities | (263,382) | | | (142,023) | | |

| Cash Flows from Investing Activities: | | | | |

| Purchase of property and equipment | (1,732) | | | (81) | | |

| Proceeds from sale of property and equipment | — | | | 445 | | |

| Capitalization of internal use software | (2,076) | | | (6,207) | | |

| Acquisitions of businesses, net of cash acquired | — | | | (12,713) | | |

| | | | |

| Maturities of short-term investments | 65,057 | | | 7,656 | | |

| Purchase of short-term investments | (97,617) | | | (31,812) | | |

| Origination of loans held for investment | (28,428) | | | — | | |

| Principal payments received on loans held for investment | 1,822 | | | — | | |

| Net cash used in investing activities | (62,974) | | | (42,712) | | |

| Cash Flows from Financing Activities: | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Net borrowings/(repayments) on warehouse lines of credit | 121,136 | | | 2,432 | | |

| Repayments on finance lease liabilities | — | | | (205) | | |

| | | | |

| Net increase (decrease) in customer deposits | 24,755 | | | (1,281) | | |

| Repayments on corporate line of credit | — | | | (22,847) | | |

| | | | |

| | | | |

| | | | |

| Principal payments on convertible notes | (1,103) | | | (3,361) | | |

| | | | |

| | | | |

| Proceeds from exercise of stock options | 39 | | | — | | |

| | | | |

| Repurchase or cancellation of common stock | — | | | (224) | | |

| Net cash (used in)/ provided by financing activities | 144,827 | | | (25,486) | | |

| Effects of currency translation on cash, cash equivalents, and restricted cash | 863 | | | (911) | | |

| Net Decrease in Cash, Cash Equivalents, and Restricted Cash | (180,666) | | | (211,132) | | |

| Cash, cash equivalents, and restricted cash—Beginning of period | 528,066 | | | 346,065 | | |

| Cash, cash equivalents, and restricted cash—End of period | $ | 347,400 | | | $ | 134,933 | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the condensed consolidated balance sheets to the total of the same such amounts shown on the previous page.

| | | | | | | | | | | |

| Six Months Ended June 30, |

| (Amounts in thousands) | 2024 | | 2023 |

| Cash and cash equivalents, end of period | $ | 320,936 | | | $ | 109,922 | |

| Restricted cash, end of period | 26,464 | | | 25,011 | |

| Total cash, cash equivalents and restricted cash, end of period | $ | 347,400 | | | $ | 134,933 | |

| Supplemental Disclosure of Cash Flow Information: | | | |

| Interest paid | $ | 2,582 | | | $ | 5,746 | |

| Income taxes paid/(refunded) | $ | 330 | | | $ | (6,123) | |

| Non-Cash Investing and Financing Activities: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Capitalization of stock-based compensation related to internal use software | $ | 871 | | | $ | 1,371 | |

| Vesting of stock options early exercised in prior periods | $ | 1,415 | | | $ | 1,855 | |

| | | |

| Vesting of common stock issued via notes receivable from stockholders | $ | 865 | | | $ | 2,354 | |

| Settlement of Notes Receivable from Stockholders | $ | 1,846 | | | $ | — | |

| | | |

| | | |

| Acquisition earnout | $ | — | | | $ | 3,430 | |

| | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. Organization and Nature of the Business

Better Home & Finance Holding Company, formerly known as Aurora Acquisition Corp. (“Aurora”), together with its subsidiaries (collectively, the “Company”), provides a comprehensive set of homeownership offerings in the United States while expanding the Company’s offerings in the United Kingdom. The Company’s offerings include mortgage loans, real estate agent services, title and homeowner’s insurance, and other homeownership offerings. The Company leverages Tinman, its proprietary technology platform, to optimize the mortgage process from the initial application, to the integration of a suite of additional homeownership offerings, to the sale of loans to a network of loan purchasers.

Mortgage loans originated within the United States are through the Company’s wholly-owned subsidiary Better Mortgage Corporation (“BMC”). BMC is an approved Title II Single Family Program Lender with the Department of Housing and Urban Development’s (“HUD”) Federal Housing Administration (“FHA”), and is an approved seller and servicer with the Federal National Mortgage Association (“FNMA”) and the Federal Home Loan Mortgage Corporation (“FMCC”). The Company has expanded into the U.K. by acquisition of regulated entities to offer a multitude of financial products and services to consumers.

On August 22, 2023 (the “Closing Date”), the Company consummated its business combination, pursuant to the terms of the Agreement and Plan of Merger, dated as of May 10, 2021, as amended as of October 27, 2021, November 9, 2021, November 30, 2021, August 26, 2022, February 24, 2023 and June 23, 2023 (as amended, the “Merger Agreement”), by and among Aurora, Better Holdco, Inc. (“Pre-Business Combination Better”), and Aurora Merger Sub I, Inc., formerly a wholly owned subsidiary of Aurora (“Merger Sub”). On the Closing Date, Merger Sub merged with and into Pre-Business Combination Better, with Pre-Business Combination Better surviving the merger (the “First Merger”) and Pre-Business Combination Better merged with and into Aurora, with Aurora surviving the merger and changing its name to “Better Home & Finance Holding Company” (referred to as “Better Home & Finance” or the “Company”) (such merger, and together with the First Merger, the “Business Combination” and the completion thereof, the “Closing”).

Unless otherwise indicated, references to “Better,” “Better Home & Finance,” the “Company,” “we,” “us,” “our” and other similar terms refer to (i) Pre-Business Combination Better and its consolidated subsidiaries prior to the Closing and (ii) Better Home & Finance and its consolidated subsidiaries following the Closing.

The Company’s Class A common stock, par value $0.0001 per share (“Class A common stock”), and public warrants are listed on the Nasdaq Capital Market under the ticker symbols “BETR” and “BETRW,” respectively.

Going Concern Considerations—In connection with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 205-40, Basis of Presentation - Going Concern, the Company has evaluated whether there are conditions and events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the condensed consolidated financial statements are issued.

On October 12, 2023, and on April 9, 2024, the Company was notified by the Listing Qualifications Staff of The Nasdaq Stock Market, LLC ("Nasdaq") that the Company’s Class A common stock was not in compliance with the $1.00 minimum bid price rule for continued listing on Nasdaq, and would be subject to delisting for failure to regain compliance with such rule within the first 180-day compliance period (ending April 9, 2024) or a subsequent 180-day compliance period (ending October 7, 2024). If the Class A common stock is no longer listed on Nasdaq, or another national securities exchange, such delisting would constitute a fundamental change under the indenture for the Convertible Note (as defined below) that would require the Company to redeem the Convertible Note prior to maturity for an amount in cash equal to the principal amount of the Convertible Note plus accrued and unpaid interest to the redemption date. As of June 30, 2024, the Company had cash and cash equivalents, together with short-term investments of $378.8 million, compared to $528.6 million principal amount outstanding under the Convertible Note. If the Company is required to redeem the Convertible Note prior to maturity, the Company may not have sufficient available cash and cash equivalents or be able to obtain additional liquidity, on acceptable terms or at all, to enable the Company to redeem or refinance the Convertible Note and continue operating its business.

The Company applied for and, on March 7, 2024, received approval from Nasdaq to transfer the listing of its Class A common stock, from the Nasdaq Global Market to the Nasdaq Capital Market. The Class A common stock transferred to the Nasdaq Capital Market effective as of the opening of business on March 13, 2024 and continues to trade under the symbol “BETR.”

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

On April 9, 2024, the Company received formal notice that Nasdaq granted the Company’s request for an additional 180-day period, or until October 7, 2024, to evidence compliance with the $1.00 per share requirement for continued inclusion on The Nasdaq Capital Market pursuant to the Bid Price Rule. If at any time before October 7, 2024, the bid price of the Company’s Class A common stock closes at or above $1.00 per share or more for a minimum of ten consecutive business days, Nasdaq will provide the Company with written confirmation of compliance with the Bid Price Rule.

On June 4, 2024, at the 2024 annual meeting of the Company’s stockholders, the Company’s stockholders approved amendments to the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to effect one or more reverse stock splits of the Company’s Common Stock (as defined below) at a ratio ranging from any whole number between 1-for-2 and 1-for-100 and in the aggregate not more than 1-for-100, inclusive, as determined by the Company’s board of directors (the “Reverse Stock Split Authorization”).

On August 1, 2024, pursuant to the Reverse Stock Split Authorization, the Company’s board of directors approved a reverse stock split (the “Reverse Stock Split”) and set a split ratio of 1-for-50 of our Class A common stock, Class B common stock, par value $0.0001 per share (“Class B common stock”), and Class C common stock, par value $0.0001 per share (“Class C common stock” and, together with the Class A common stock and the Class B common stock, “Common Stock” ), provided that the Company’s board of directors reserved the right to modify or abandon the amendment prior to filing with the Secretary of State of the State of Delaware. As of the effective time of the Reverse Stock Split, one post-split share of our Common Stock will be issued in exchange for every 50 pre-split shares of our Common Stock. The Reverse Stock Split will result in the Company’s share price being above the $1.00 Bid Price Rule and mitigates the going concern conditions. The Reverse Stock Split is currently scheduled to become effective at 6:00 p.m. New York time on August 16, 2024.

2. Summary of Significant Accounting Policies

Basis of Presentation—The accompanying condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

In the opinion of the Company, the accompanying unaudited condensed consolidated financial statements contain all adjustments, consisting of only normal recurring adjustments, necessary for a fair presentation of its financial position and its results of operations, and stockholders’ equity (deficit) and cash flows. The results of operations and other information for the three and six months ended June 30, 2024 are not necessarily indicative of the results that may be expected for any other interim period or for the year ending December 31, 2024. The unaudited condensed consolidated financial statements presented herein should be read in conjunction with the audited consolidated financial statements and related notes of Better thereto for the year ended December 31, 2023.

Consolidation—The accompanying condensed consolidated financial statements include the accounts of the Company and its consolidated subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates—The preparation of condensed consolidated financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Significant items subject to such estimates and assumptions include the fair value of mortgage loans held for sale, the fair value of derivative assets and liabilities, including interest rate lock commitments and forward sale commitments, the determination of a valuation allowance on the Company’s deferred tax assets, capitalization of internally developed software and its associated useful life, determination of fair value of the stock options at grant date, the fair value of acquired intangible assets and goodwill, the provision for loan repurchase reserves, and the incremental borrowing rate used in determining lease liabilities and warrant liabilities.

Short-term investments—Short term investments consist of fixed income securities, typically U.S and U.K. government treasury securities and U.S. and U.K. government agency securities with maturities ranging from 91 days to one year. Management determines the appropriate classification of short-term investments at the time of purchase. Short-term investments reported as held-to-maturity are those investments that the Company has both the positive intent and ability to hold to maturity and are stated at amortized cost on the condensed consolidated balance sheets. All of the Company’s short term investments are classified as held to maturity. The Company has not recognized any impairments on these investments to date and any unrealized gains or losses on these investments are immaterial.

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Allowance for Credit Losses–Held to Maturity (“HTM”) Short-term Investments—The Company’s HTM Short-term investments are required to utilize the Current Expected Credit Loss approach to estimate expected credit losses. Management measures expected credit losses on short-term investments on a collective basis by major security types that share similar risk characteristics, such as financial asset type and collateral type adjusted for current conditions and reasonable and supportable forecasts. Management classifies the short term investments portfolio by security types, such as U.S. or U.K. government agency securities.

The U.S and U.K. government treasury securities and U.S. and U.K. government agency securities are issued by the U.S. and U.K. government entities and agencies, respectively. These securities are either explicitly or implicitly guaranteed by the respective governments as to timely repayment of principal and interest, are highly rated by major rating agencies, and have a long history of no credit losses. Therefore, credit losses for these securities were immaterial as the Company does not currently expect any material credit losses on these short-term investments.

Mortgage Loans Held for Sale, at Fair Value—The Company sells its loans held for sale (“LHFS”) to loan purchasers. These loans can be sold in one of two ways, servicing released, or servicing retained. If a loan is sold servicing released, the Company has sold all the rights to the loan and the associated servicing rights.

If a loan is sold servicing retained, the Company has sold the loan and kept the servicing rights, and thus the Company is responsible for collecting monthly principal and interest payments and performing certain escrow services for the borrower. The loan purchaser, in turn, pays a fee for these services. The Company generally sells all of its loans servicing released. For interim servicing, the Company engages a third-party sub-servicer to collect monthly payments and perform associated services.

LHFS primarily consists of mortgage loans as well as home equity line of credit and closed-end second lien loans (together defined as “HELOC”), originated for sale by BMC. The Company elects the fair value option, in accordance with ASC 825 – Financial Instruments (“ASC 825”), for all LHFS with changes in fair value recorded in gain on loans, net in the condensed consolidated statements of operations and comprehensive loss. Management believes that the election of the fair value option for LHFS improves financial reporting by presenting the most relevant market indication of LHFS. The fair value of LHFS is based on market prices and yields at period end. The Company accounts for the gains or losses resulting from sales of loans based on the guidance of ASC 860-20 – Sales of Financial Assets.

The Company issues interest rate lock commitments (“IRLC”) to originate mortgage loans and the fair value of the IRLC, adjusted for the probability that a given IRLC will close and fund, is recognized within gain on loans, net. Subsequent changes in the fair value of the IRLC are measured at each reporting period within gain on loans, net until the loan is funded. When the loan is funded, the IRLC is derecognized and the LHFS is recognized based on the fair value of the loan. The LHFS is subsequently remeasured at fair value at each reporting period and the changes in fair value are included within gain on loans, net until the loan is sold on the secondary market. When the loan is sold on the secondary market, the LHFS is derecognized and the gain/(loss) is included within gain on loans, net based on the cash settlement.

LHFS are considered sold when the Company surrenders control over the loans. Control is considered to have been surrendered when the transferred loans have been isolated from the Company, are beyond the reach of the Company and its creditors, and the loan purchaser obtains the right (free of conditions that constrain it from taking advantage of that right) to pledge or exchange the transferred loans. The Company typically considers the above criteria to have been met upon receipt of sales proceeds from the loan purchaser.

Loans Held for Investment—The Company originates, primarily through its U.K. operations, loans held for investment, for which management has the intent and ability to hold for the foreseeable future or until maturity or payoff and are reported at amortized cost, which is the principal amount outstanding, net of cumulative charge-offs, unamortized net deferred loan origination fees and costs and unamortized premiums or discounts on purchased loans.

The allowance for credit losses is a valuation account that is deducted from the loans held for investment amortized cost basis to present the net amount expected to be collected on the loans. Loans are charged-off against the allowance when management believes the loan balance is deemed to be uncollectible. Management’s estimation of expected credit losses is based on relevant information about past events, current conditions, and reasonable and supportable forecasts that affect the collectability of the reported amounts, including expected defaults and prepayments. See Note 6.

Fair Value Measurements—Assets and liabilities recorded at fair value on a recurring basis on the condensed consolidated balance sheets are categorized based upon the level of judgment associated with the inputs used to measure

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

their fair values. Fair value is defined as the exchange price that would be received for an asset or an exit price that would be paid to transfer a liability in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. The price used to measure fair value is not adjusted for transaction costs. The principal market is the market in which the Company would sell or transfer the asset with the greatest volume and level of activity for the asset. In determining the principal market for an asset or liability, it is assumed that the Company has access to the market as of the measurement date. If no market for the asset exists, or if the Company does not have access to the principal market, a hypothetical market is used.

The authoritative guidance on fair value measurements establishes a three-tier fair value hierarchy for disclosure of fair value measurements as follows:

Level 1—Unadjusted quoted market prices in active markets for identical assets or liabilities;

Level 2—Inputs (other than quoted prices included in Level 1) are either directly or indirectly observable for the asset or liability. These include quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or liabilities in markets that are not active; and

Level 3—Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

Assets and liabilities measured at fair value on a recurring basis include LHFS, derivative assets and liabilities, including IRLCs and forward sale commitments, mortgage servicing rights, and warrant and equity related liabilities. When developing fair value measurements, the Company maximizes the use of observable inputs and minimizes the use of unobservable inputs. However, for certain instruments, the Company must utilize unobservable inputs in determining fair value due to the lack of observable inputs in the market, which requires greater judgment in measuring fair value. In instances where there is limited or no observable market data, fair value measurements for assets and liabilities are based primarily upon the Company’s own estimates, and the measurements reflect information and assumptions that management believes a market participant would use in pricing the asset or liability.

Warehouse Lines of Credit—Warehouse lines of credit represent the outstanding balance of the Company’s warehouse borrowings collateralized by mortgage loans held for sale or related borrowings collateralized by restricted cash. Generally, warehouse lines of credit are used as interim, short-term financing which bears interest at a fixed margin over an index rate, such as the Secured Overnight Financing Rate (“SOFR”). The outstanding balance of the Company’s warehouse lines of credit will fluctuate based on its lending volume. The advances received under the warehouse lines of credit are based upon a percentage of the fair value or par value of the mortgage loans collateralizing the advance, depending upon the type of mortgage loan. Should the fair value of the pledged mortgage loans decline, the warehouse provider may require the Company to provide additional cash collateral or mortgage loans to maintain the required collateral level under the relevant warehouse line. The Company did not incur any significant issuance costs related to its warehouse lines of credit.

Convertible Note—As part of the Closing of the Business Combination, the Company issued the Convertible Note. Upon initial issuance, the Convertible Note is evaluated for redemption and conversion features that could result in embedded derivatives that require bifurcation from the notes. Upon initial issuance, any embedded derivatives are measured at fair value. Convertible Note proceeds are allocated between the carrying value of the note and the fair value of embedded derivatives on the initial issuance date. Any portion of proceeds allocated to embedded derivatives are treated as reductions in, or discounts to, the carrying value of the Convertible Note on the issuance date. Embedded derivatives are adjusted to fair value at each reporting period, with the change in fair value included within the consolidated statements of operations and comprehensive income (loss). See Note 10 for further details on the Convertible Note.

Income Taxes—Income taxes are calculated in accordance with ASC 740, Accounting for Income Taxes. An estimated annual effective tax rate is applied to year-to-date income (loss). At the end of each interim period, the estimated effective tax rate expected to be applicable for the full year is calculated. This method differs from that described in the Company’s income taxes policy footnote in the audited consolidated financial statements and related notes thereto for the year ended December 31, 2023, which describes the Company’s annual significant income tax accounting policy and related methodology.

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Revenue Recognition—The Company generates revenue from the following streams:

1)Gain on loans, net includes revenues generated from the Company’s loan production process, see Note 3. The components of gain on loans, net are as follows:

i.Gain on sale of loans, net—This represents the premium the Company receives in excess of the loan principal amount and certain fees charged by loan purchasers upon sale of loans into the secondary market. Gain on sale of loans, net includes unrealized changes in the fair value of LHFS, which are recognized on a loan by loan basis as part of current period earnings until the loan is sold on the secondary market. The fair value of LHFS is measured based on observable market data. This also includes activity for loans originated on behalf of the integrated partnership that are subsequently purchased by the Company as well as the portion of the sale proceeds to be received by the integrated partner. The portion of the sale proceeds that is to be allocated to the integrated partner is accrued as a reduction of gain on sale of loans, net when the loan is initially purchased by the Company from the integrated partner.

Gain on sale of loans, net also includes the changes in fair value of IRLCs and forward sale commitments. IRLCs include the fair value upon issuance with subsequent changes in the fair value recorded in each reporting period until the loan is sold on the secondary market. Fair value of forward sale commitments hedging IRLCs and LHFS are measured based on quoted prices for similar assets.

ii.Integrated partnership fees—Includes fees that the Company receives for originating loans on behalf of an integrated partnership, which are recognized as revenue upon the integrated partner’s funding of the loan.

iii.Provision for loan repurchase reserve—In connection with the sale of loans on the secondary market, the Company makes customary representations and warranties to the relevant loan purchasers about various characteristics of each loan, such as the origination and underwriting guidelines, including but not limited to the validity of the lien securing the loan, property eligibility, borrower credit, income and asset requirements, and compliance with applicable federal, state and local laws. In the event of a breach of its representations and warranties, the Company may be required to repurchase the loan with the identified defects. The provision for loan repurchase reserve, represents the charge for these potential losses.

2)Other revenue consists of revenue from the Company’s additional offerings such as real estate services, insurance, and international lending revenue, which is recognized based on ASU 2014-09, Revenue from Contracts with Customers (“ASC 606”). ASC 606 outlines a single comprehensive model in accounting for revenue arising from contracts with customers. The core principle, involving a five-step process, of the revenue model is that an entity recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

For real estate services, the Company generates revenues from fees related to real estate agent services, mainly from cooperative brokerage fees from the Company’s network of third-party real estate agents, which assist customers in the purchase or sale of a home. The Company recognizes revenues from real estate services upon completion of the performance obligation which is when the mortgage transaction closes. Performance obligations for real estate agent services are typically completed 40 to 60 days after the commencement of the home search process. Payment for these services is typically settled in cash as part of closing costs to the borrower upon closing of the mortgage transaction.

Also included in real estate services are settlement services, which are revenue from fees charged for services such as title search fees, wire fees, policy and document preparation, and other mortgage settlement services. The Company recognizes revenues from settlement services upon completion of the performance obligation, which is when the mortgage transaction closes.

Insurance revenue primarily consists of fees earned on homeowners insurance policies and title insurance. The Company generates revenues from agent fees on homeowners insurance policies obtained by customers through the Company’s marketplace of third-party insurance carriers. The Company offers title insurance as an agent and works with third-party providers that underwrite the title insurance policies. For title insurance, the Company recognizes revenue from fees upon the completion of the performance obligation which, is when the mortgage transaction closes. For homeowners insurance and title insurance, the Company is the agent in the transactions as

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

the Company does not control the ability to direct the fulfillment of the service, is not primarily responsible for fulfilling the performance of the service, and does not assume the risk in a claim against a policy.

For international lending revenue, the Company generates revenue primarily from broker fees earned in the U.K. The Company recognizes international lending revenue upon completion of the performance obligation, which is when the mortgage transaction closes.

3)Net interest income includes interest income from LHFS, including HELOCs, calculated based on the note rate of the respective loan, interest income from short-term investments, and interest income on loans held for investment. Interest expense includes interest expense on warehouse lines of credit, interest expense on customer deposits, as well as interest expense on the Convertible Note.

Compensation and Benefits—Compensation and benefits include salaries, wages, and incentive pay as well as stock-based compensation, employee health benefits, 401(k) plan benefits, and social security and unemployment taxes. Stock-based compensation includes expenses associated with restricted stock unit grants, performance stock unit grants, and stock option grants, under the Company’s stock plans. Compensation expense for the stock-based payments is based on the fair value of the awards on the grant date. Compensation and benefits expenses are expensed as incurred with the exception of stock-based compensation, which is recognized in a straight-line basis over the requisite service period.

General and Administrative Expenses—General and administrative expenses include rent and occupancy expenses, insurance, and external legal, tax and accounting services. General and administrative expenses are expensed as incurred.

Technology Expenses—Technology expenses consist of direct costs related to vendors engaged in product management, design, development, and testing of the Company’s websites and products. Technology expenses are expensed as incurred.

Marketing and Advertising Expenses—Marketing and advertising expenses consist of direct costs related to customer acquisition expenses, brand costs, and paid marketing. For customer acquisition expenses, the Company primarily generates loan origination leads through third-party financial service websites for which they incur “pay-per-click” expenses. A majority of the Company’s marketing and advertising expenses are incurred from leads purchased from these third-party financial service websites. Marketing and advertising expenses are expensed as incurred.

Loan Origination Expenses—Loan origination expenses consist of costs directly attributable to the production of loans such as appraisal fees, processing expenses, underwriting, closing fees, and servicing costs. These expenses are expensed as incurred.

Other Expenses—Other expenses consist of direct costs related to other non-mortgage homeownership activities, including settlement service expenses, lead generation expenses, expenses incurred in relation to our international lending activities, and gains and losses from equity related liabilities. Settlement service expenses consist of fees for transactional services performed by third-party providers for borrowers while lead generation expenses consist of fees for services related to real estate agents. Other expenses are expensed as incurred.

Segments—The Company has one reportable segment. The Company’s chief operating decision maker, the Chief Executive Officer, reviews financial information presented on a company-wide basis for purposes of allocating resources and evaluating financial performance.

Reclassification of Prior Period Presentation in the Balance Sheet and Statement of Operations and Comprehensive Loss—Reclassifications of the previously reported statement of operations and comprehensive loss have been made to conform to the current period’s presentation, which provides increased transparency to the nature of the costs. To conform to the current presentation, the following changes were made to the prior period statement of operations:

Assets

•Loans held for investment—Loans held for investment has been reclassified from prepaid expenses and other assets to loans held for investment on the condensed consolidated balance sheets.

Revenue

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

•Gain on loans, net (Previously mortgage platform revenue, net)—Loan repurchase reserve recovery (provision) has been reclassified from mortgage platform expenses to gain on loans, net. The Company’s mortgage related activities that do not include originating and selling loans, namely in the U.K., have been reclassified to other revenue.

•Net interest income:

•Interest income—Interest income from short-term investments has been reclassified from other income.

•Interest expense (Previously warehouse interest expense)—Interest expense and amortization on non-funding debt has been reclassified to interest expenses from interest expense and amortization on non-funding debt.

Expenses

•Loan origination expense (Previously mortgage platform expenses)—The Company’s expenses that were not incurred to originate and sell loans, namely in the U.K., have been reclassified to other expenses.

•Other expenses (Previously other platform expenses)—Restructuring and impairment expenses, change in fair value of convertible preferred stock warrants, and change in fair value of bifurcated derivative have been reclassified to other expenses.

Previously Allocated Expenses

•Compensation and benefits—Compensation and benefits, which includes stock-based compensation, was previously allocated to mortgage platform expenses, other platform expenses, general and administrative expenses, marketing and advertising expenses, and technology and product development expenses based on allocated headcount is now presented as its own financial statement line item.

•Rent and occupancy—Rent and occupancy, which is now included within general and administrative expenses, was previously allocated to mortgage platform expenses, other platform expenses, general and administrative expenses, marketing and advertising expenses, and technology and product development expenses based on allocated headcount.

•Depreciation and amortization—Depreciation and amortization was previously allocated to mortgage platform expenses, other platform expenses, general and administrative expenses, marketing and advertising expenses, and technology and product development expenses based on allocated headcount is now presented as its own financial statement line item.

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The impacts of the reclassifications on the condensed consolidated statements of operations and comprehensive loss are as follows:

| | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in thousands) | | Six Months Ended June 30, 2023 |

| Caption name change | As previously reported | | Reclassifications | | As reclassified | | |

| Revenues: | | | | | | | | |

| Mortgage platform revenue, net | Gain on loans, net | $ | 39,832 | | | $ | (645) | | | $ | 39,187 | | | |

| Cash offer program revenue | | 304 | | | (304) | | | — | | | |

| Other platform revenue | Other revenue | 8,022 | | | 1,633 | | | 9,655 | | | |

| Net interest income | | | | | | | | |

| Interest income | | 8,860 | | | 5,104 | | | 13,964 | | | |

| Interest expense | | (6,786) | | | (6,298) | | | (13,084) | | | |

| Net interest income | | 2,074 | | | (1,194) | | | 880 | | | |

| Total net revenues | | 50,232 | | | (510) | | | 49,722 | | | |

| | | | | | | | |

| Expenses: | | | | | | | | |

| Compensation and benefits | | — | | | 72,108 | | | 72,108 | | | |

| Mortgage platform expenses | Loan origination expense | 50,156 | | | (41,558) | | | 8,598 | | | |

| Cash offer program expenses | | 398 | | | (398) | | | — | | | |

| Other platform expenses | Other expenses/(Income) | 8,465 | | | 2,062 | | | 10,527 | | | |

| General and administrative expenses | | 52,483 | | | (23,011) | | | 29,472 | | | |

| Marketing and advertising expenses | | 11,981 | | | (1,120) | | | 10,861 | | | |

| Technology and product development expenses | | 44,914 | | | (19,305) | | | 25,609 | | | |

| Restructuring and impairment expenses | | 10,829 | | | (10,829) | | | — | | | |

| Depreciation and amortization | | — | | | 22,299 | | | 22,299 | | | |

| Total expenses | | 179,226 | | | 248 | | | 179,474 | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Interest and other income (expense), net | | | | | | | | |

| Other income (expense) | | 4,210 | | | (4,210) | | | — | | | |

| Interest and amortization on non-funding debt | | (6,298) | | | 6,298 | | | — | | | |

| Change in fair value of convertible preferred stock warrants | | 266 | | | (266) | | | — | | | |

| Change in fair value of bifurcated derivative | | 1,064 | | | (1,064) | | | — | | | |

| Total interest and other expense, net | | (758) | | | 758 | | | — | | | |

| | | | | | | | |

| Loss before income tax (benefit) expense | | (129,752) | | | — | | | (129,752) | | | |

| Income tax (benefit) expense | | 1,880 | | | — | | | 1,880 | | | |

| Net loss | | $ | (131,632) | | | $ | — | | | $ | (131,632) | | | |

| | | | | | | | |

Reclassification of the Statement of Cash Flows—To conform to the current presentation, borrowings on warehouse lines of credit and repayments of warehouse lines of credit on the statement of cash flows have been combined into net borrowings (repayments) on warehouse lines of credit within cash (used in)/provided by financing activities as well as the breakout for gain on sale of loans, net from proceeds from sale of mortgage loans held for sale within cash used in operating activities.

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Recently Issued Accounting Standards Not Yet Adopted

In July 2023, the FASB issued Accounting Standard Update (“ASU”) 2023-03, Presentation of Financial Statements (Topic 205), Income Statement—Reporting Comprehensive Income (Topic 220), Distinguishing Liabilities from Equity (Topic 480), Equity (Topic 505), and Compensation—Stock Compensation (Topic 718): Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 120, SEC Staff Announcement at the March 24, 2022 EITF Meeting, and Staff Accounting Bulletin Topic 6.B, Accounting Series Release 280—General Revision of Regulation S-X: Income or Loss Applicable to Common Stock (“ASU 2023-03”). This ASU amends or supersedes various Securities and Exchange Commission ("SEC") paragraphs within the applicable codification to conform to past SEC staff announcements. This ASU does not provide any new guidance. ASU 2023-03 will become effective for the Company once the addition to the FASB Codification is made available. As of June 30, 2024, the Company does not expect ASU 2023-06 will have a material impact on the consolidated financial statements.

In August 2023, the FASB issued ASU 2023-04, Liabilities (Topic 405): Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 121 (“ASU 2023-04”). This ASU amends and adds various SEC paragraphs to the FASB Codification to reflect guidance regarding the accounting for obligations to safeguard crypto assets an entity holds for platform users. This ASU does not provide any new guidance. ASU 2023-04 will become effective for the Company once the addition to the FASB Codification is made available. As of June 30, 2024, the Company does not expect ASU 2023-04 will have any impact on the consolidated financial statements.

In October 2023, the FASB issued ASU 2023-06, Disclosure Improvements: Codification Amendments in Response to the SEC’s Disclosure Update and Simplification Initiative (“ASU 2023-06”). This ASU incorporates certain SEC disclosure requirements into the FASB ASC. The amendments in the ASU are expected to clarify or improve disclosure and presentation requirements of a variety of Codification Topics, allow users to more easily compare entities subject to the SEC’s existing disclosures with those entities that were not previously subject to the requirements, and align the requirements in the Codification with the SEC’s regulations. ASU 2023-06 will become effective for each amendment on the effective date of the SEC’s corresponding disclosure rule changes. As of June 30, 2024, the Company does not expect ASU 2023-06 will have a material impact on the consolidated financial statements.

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280) - Improvements to Reportable Segment Disclosures. This ASU improves reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. This ASU is effective for our annual fiscal year 2024, and interim periods starting in fiscal year 2025. Early adoption is permitted. A public entity should apply the amendments in this ASU retrospectively to all prior periods presented in the financial statements. The Company is currently assessing the impact of the disclosure requirements on the consolidated financial statements.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which provides qualitative and quantitative updates to the rate reconciliation and income taxes paid disclosures, among others, in order to enhance the transparency of income tax disclosures, including consistent categories and greater disaggregation of information in the rate reconciliation and disaggregation by jurisdiction of income taxes paid. The amendments in ASU 2023-09 are effective for fiscal years beginning after December 15, 2024, with early adoption permitted. The amendments should be applied prospectively; however, retrospective application is also permitted. The Company is currently assessing the impact of the disclosure requirements on the consolidated financial statements.

Recent Securities and Exchange Commission (SEC) Final Rules Not Yet Adopted

In March 2024, the SEC adopted final rules under SEC Release No. 33-11275: The Enhancement and Standardization of Climate-Related Disclosures for Investors, which requires registrants to provide certain climate-related information in their registration statements and annual reports. The rules require information about a registrant's climate-related risks that are reasonably likely to have a material impact on its business, results of operations, or financial condition. The required information about climate-related risks will also include disclosure of a registrant’s greenhouse gas emissions. In addition, the rules will require registrants to present certain climate-related financial metrics in their audited financial statements. These requirements are effective for the Company in various fiscal years, starting with its fiscal year beginning January 1, 2027. Disclosures will be required prospectively, with information for prior periods required only to the extent it was previously disclosed in an SEC filing. On April 4, 2024, the SEC determined to voluntarily stay the final rules pending certain legal challenges. The Company is currently evaluating the impact of these final rules on its consolidated financial statements and disclosures.

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

3. Revenue

Revenue— The Company disaggregates revenue based on the following revenue streams:

Gain on loans, net consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (Amounts in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Gain on sale of loans, net | $ | 18,374 | | | $ | 20,697 | | | $ | 28,195 | | | $ | 33,221 | |

| Integrated partnership fees | 2,476 | | | 2,917 | | | 4,744 | | | 5,278 | |

| Loan repurchase reserve recovery/(provision) | 3,379 | | | 2,811 | | | 6,942 | | | 688 | |

| | | | | | | |

| Total gain on loans, net | $ | 24,229 | | | $ | 26,425 | | | $ | 39,881 | | | $ | 39,187 | |

Other revenue consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (Amounts in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| International lending revenue | $ | 1,219 | | | $ | 680 | | | $ | 2,327 | | | $ | 1,668 | |

| Insurance Services | 537 | | | 1,196 | | | 1,176 | | | 1,825 | |

| Real estate services | 653 | | | 2,997 | | | 1,000 | | | 5,867 | |

| Other revenue | 472 | | | (162) | | | 1,195 | | | 295 | |

| Total other revenue | $ | 2,881 | | | $ | 4,711 | | | $ | 5,698 | | | $ | 9,655 | |

Net interest income consisted of the following: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | |

| (Amounts in thousands) | 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Mortgage interest income | $ | 4,468 | | | $ | 4,803 | | | $ | 7,432 | | | $ | 8,728 | | | | | |

| Interest Income from Investments | 4,929 | | | 2,771 | | | 10,601 | | | 5,236 | | | | | |

| Warehouse interest expense | (2,577) | | | (4,007) | | | (4,766) | | | (6,786) | | | | | |

| Other interest expense | (1,668) | | | (3,608) | | | (4,333) | | | (6,298) | | | | | |

| Total net interest income | $ | 5,152 | | | $ | (41) | | | $ | 8,934 | | | $ | 880 | | | | | |

| | | | | | | | | | | |

4. Restructuring and Impairments

In December 2021, the Company initiated an operational restructuring program that included plans for costs reductions in response to a difficult interest rate environment as well as a slowing housing market. The restructuring program, which continued during the six months ended June 30, 2024, consists of reductions in headcount and any associated costs that primarily include one-time employee termination benefits. The Company expects the restructuring initiatives to continue at least through the end of 2024.

Due to reduced headcount, the Company has also reduced its real estate footprint. The Company has impaired right-of-use assets related to office space that is no longer in use or has been completely abandoned. Leases where the Company is unable to terminate or amend the lease with the landlord remain on the balance sheet under lease liabilities. In February 2023, the Company entered into a lease amendment with a landlord to surrender an office floor and reassign the lease to a third party. The amendment relieves the Company of the primary obligation under the original lease and as such is considered a termination of the original lease. In February 2023, the Company impaired the right-of-use asset of $13.0 million and removed the lease liability of $13.0 million related to one of the office spaces and as part of the amendment the Company incurred a loss of $5.3 million, which included a $4.7 million payment in cash to the third party and $0.6 million other related fees to terminate the lease early. For the six months ended June 30, 2024 and 2023, the Company impaired property and equipment of none and $4.8 million, respectively, which was related to termination of lease agreement and sale of laptops resulting from a reduction in the workforce.

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended June 30, 2024 and 2023, the Company’s restructuring and impairment expenses consist of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (Amounts in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

Employee one-time termination benefits(1) | $ | 184 | | | $ | 1,266 | | | $ | 905 | | | $ | 1,554 | |

| | | | | | | |

Impairments of Right-of-Use assets (2) | — | | | 119 | | | — | | | 119 | |

| | | | | | | |

Real estate restructuring loss (2) | — | | | — | | | — | | | 5,289 | |

Gain on lease settlement (2) | — | | | — | | | — | | | (977) | |

Impairment of property and equipment (2) | — | | | 302 | | | — | | | 4,844 | |

| Total Restructuring and Impairments | $ | 184 | | | $ | 1,687 | | | $ | 905 | | | $ | 10,829 | |

(1)Employee one-time termination benefits are included in compensation and benefits on the condensed consolidated statements of operations and comprehensive loss.

(2)Impairments of Right-of-Use Assets, real estate restructuring loss, gain on lease settlement, and impairment of property and equipment are included in other expenses on the condensed consolidated statements of operations and comprehensive loss.

The cumulative amount of one-time termination benefits, impairment of loan commitment assets, impairment of right-of-use assets, and impairment of property and equipment as of June 30, 2024 is $123.2 million, $105.6 million, $8.5 million, and $12 million, respectively.

5. Loans Held for Sale and Warehouse Lines of Credit

The Company has the following outstanding warehouse lines of credit:

| | | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in thousands) | Maturity | | Facility Size | | June 30, 2024 | | December 31, 2023 |

Funding Facility 1 (1) | July 31, 2024 | | $ | 100,000 | | | $ | 69,228 | | | $ | 61,709 | |

| | | | | | | |

| | | | | | | |

Funding Facility 2 (2) | December 6, 2024 | | 150,000 | | | 122,988 | | | 40,088 | |

Funding Facility 3 (3) | August 2, 2024 | | 175,000 | | | 55,138 | | | 24,421 | |

| Total warehouse lines of credit | | | $ | 425,000 | | | $ | 247,354 | | | $ | 126,218 | |

__________________

(1)Interest charged under the facility is at the 30-day term SOFR plus 2.125%. Cash collateral deposit of $15 million is maintained and included in restricted cash. Subsequent to June 30, 2024, the Company extended the maturity to August 31, 2024.

(2)Interest charged under the facility is at the 30-day term SOFR plus 2.10% - 2.25%. Cash collateral deposit of $3.8 million is maintained and included in restricted cash.

(3)Interest charged under the facility is at the 30-day term SOFR plus 1.75% - 3.75%. There is no cash collateral deposit maintained as of June 30, 2024. Subsequent to June 30, 2024, the Company extended the maturity to August 3, 2025.

BETTER HOME & FINANCE HOLDING COMPANY AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The unpaid principal amounts of the Company’s LHFS are also pledged as collateral under the relevant warehouse funding facilities. The Company’s LHFS are summarized below by those pledged as collateral and those fully funded by the Company:

| | | | | | | | | | | | | |

| (Amounts in thousands) | June 30, 2024 | | December 31, 2023 | | |

| Funding Facility 1 | $ | 69,404 | | | $ | 63,483 | | | |

| Funding Facility 2 | 123,506 | | | 42,316 | | | |

| Funding Facility 3 | 54,337 | | | 26,894 | | | |