2Q24 revenues at $140.2 million, 49% higher

YoY

GAAP net income at $1.2 million, and

adjusted EBITDA1 at $24.1 million

Bioceres Crop Solutions Corp. (Bioceres) (NASDAQ:

BIOX), a leader in the development and commercialization of

productivity solutions designed to regenerate agricultural

ecosystems while making crops more resilient to climate change,

announced financial results for the fiscal second quarter ended

December 31, 2023. Financial results are expressed in U.S. dollars

and are presented in accordance with International Financial

Reporting Standards. All comparisons in this announcement are

year-over-year (YoY), unless otherwise noted.

FINANCIAL & BUSINESS HIGHLIGHTS

- Total revenues in 2Q24 were $140.2 million, a 49%

increase compared to the same quarter last year. Top line growth

during the quarter was mainly driven by a strong summer crop season

in the Southern Hemisphere, with resumed product demand

post-drought in Argentina.

- Operating profit for the period was $16.8 million with GAAP

net income at $1.2 million, compared with $2.2 million and a

loss of $8.4 million, respectively, for the year-ago quarter.

- Adjusted EBITDA1 for the quarter was $24.1 million, more

than double last year´s metric and reflecting top line growth and

operational leverage.

- HB4 Wheat harvest completed, with resulting inventories

in line to meet FY24 guidance.

- New US Patent awarded for HB4 Soy, extending technology

protection until 2042.

________________________________

1

Adjusted EBITDA is a non-GAAP measure. See

“Use of non-IFRS financial information” for information regarding

our use of Adjusted EBITDA and its reconciliation from the most

comparable financial measure.

MANAGEMENT REVIEW

Mr. Federico Trucco, Bioceres´ Chief Executive Officer,

commented: “Despite the headwinds the industry experienced in the

quarter, we are pleased to announce record quarterly results. While

we are not immune to the broader destocking process in several

geographies, our portfolio of innovative products, secular growth

drivers, and strong execution by our commercial teams allowed us to

continue to outperform the industry and deliver our highest

quarterly revenues yet.

We also continue to make progress on HB4, namely:

- Results from the wheat harvest in Argentina validate the

competitiveness of our newer varieties against top commercial

varieties

- Our soybean program in Brazil is advancing quickly with a 7x

increase in hectares from last year

- We obtained new regulatory approvals for soybeans in Australia,

New Zealand, Thailand and Malaysia, and for wheat in Thailand

- We were granted an additional patent by USPTO that should

protect the HB4 Soy technology through at least 2042

Finally, our current wheat inventories are sufficient to meet

our FY24 guidance for this business, allowing us to focus on

commercial execution during the upcoming winter wheat planting

season in South America.”

Mr. Enrique Lopez Lecube, Bioceres´ Chief Financial Officer,

noted “Our quarterly performance continued to build on the momentum

we highlighted in the first quarter. Revenue growth was

broad-based, with all product families delivering solid results,

and margin recovery across many categories that had been affected

by record droughts last year in key geographies. Importantly, cost

discipline allowed us to deliver strong operating leverage in the

quarter, leading to record results. As we look forward to the

second half of our fiscal year, we remain focused on delivering

growth, by investing in our innovative portfolio, and advancing the

global penetration of our novel technologies.”

KEY FINANCIAL METRICS

Table 1: 2Q24 & 1H24 Key Financial

Metrics

(In millions of U.S. dollars)

2Q23

2Q24

% Change

1H23

1H24

% Change

Revenue by Segment

Crop Protection

53.3

71.2

34%

116.3

127.2

9%

Seed and Integrated Products

16.3

32.2

97%

30.2

54.5

81%

Crop Nutrition

24.7

36.8

49%

75.0

75.1

0%

Total Revenue

94.4

140.2

49%

221.5

256.8

16%

Gross Profit

35.3

51.5

46%

86.7

96.5

11%

Gross Margin

37.4%

36.7%

(62 bps)

39.1%

37.6%

(157 bps)

2Q23

2Q24

% Change

1H23

1H24

% Change

GAAP net income or loss

(8.4)

1.2

115%

(4.5)

(1.4)

68%

Adjusted EBITDA1

10.3

24.1

134%

34.9

40.4

16%

2Q24 Summary: Total revenues were $140.2 million in 2Q24,

a 49% year-over-year increase. Second fiscal quarter performance

was largely shaped by a strong summer crop season in the Southern

Hemisphere, with a normalization of weather conditions in

Argentina, and overall higher demand for Bioceres’ technologies.

All three business segments delivered strong growth compared to the

year-ago quarter – which had been marked by a historic drought in

Argentina – and contributed almost evenly to the $45.8 million

increase in revenues. Top line growth in Crop Protection and Crop

Nutrition was achieved with margin expansion as sales mix favored

higher margin technologies. The increase in Seed and Integrated

Products revenues was driven by higher HB4 seed and downstream

sales, with a less favorable product mix compared to the year-ago

period. Overall, the 49% increase in revenues was achieved with a

steady gross margin of 37%. 2Q24 results build on 1Q24´s strong

performance, and confirm double-digit growth rates for revenues,

net income and adjusted EBITDA1 for the first half of the fiscal

year.

For a full version of Bioceres second quarter 2024 earnings

release, click here.

SECOND QUARTER 2024 EARNINGS CONFERENCE CALL

Management will host a conference call and question-and-answer

session, which will be accompanied by a presentation available

during the webcast or accessed via the investor relations section

of the company’s website.

To access the call, please use the following information:

Date:

Thursday, February 8, 2024

Time:

4:30 p.m. EST, 1:30 p.m. PST

US Toll Free dial-in number:

1-833-470-1428

International dial-in numbers:

Click here

Conference ID:

507024

Webcast:

Click here

Please dial in 5-10 minutes prior to the start time to register

and join.

The conference call will be broadcast live and available for

replay here and via the investor relations section of the company’s

website here.

A replay of the call will be available through February 15,

2024, following the conference.

Toll Free Replay Number:

1-866-813-9403

International Replay Number:

+44 204 525 0658

Replay ID:

203673

About Bioceres Crop Solutions Corp. Bioceres Crop

Solutions Corp. (NASDAQ: BIOX) is a leader in the development and

commercialization of productivity solutions designed to regenerate

agricultural ecosystems while making crops more resilient to

climate change. To do this, Bioceres’ solutions create economic

incentives for farmers and other stakeholders to adopt

environmentally friendlier production practices. The company has a

unique biotech platform with high-impact, patented technologies for

seeds and microbial ag-inputs, as well as next generation Crop

Nutrition and Protection solutions. Through its HB4® program, the

company is bringing digital solutions to support growers’ decisions

and provide end-to-end traceability for production outputs. For

more information, visit here.

Forward-Looking Statements This communication includes

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements may be

identified by the use of words such as “forecast,” “intend,”

“seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,”

“plan,” “outlook,” and “project” and other similar expressions that

predict or indicate future events or trends or that are not

statements of historical matters. Such forward-looking statements

include estimated financial data and, among others, statements

related to the expected or potential impact of the novel

coronavirus (COVID-19) pandemic, and the related responses by

governments, clients and the company, on our business, financial

condition, liquidity position and results of operations, and any

such forward-looking statements, whether concerning the COVID-19

pandemic or otherwise, involve risks, assumptions and

uncertainties. These forward-looking statements include, but are

not limited to, whether (i) the health and safety measures

implemented to safeguard employees and assure business continuity

will be successful, (ii) the uncertainty related to COVID-19 in the

farming community will be short lived, and (iii) we will be able to

coordinate efforts to ramp up inventories. Such forward-looking

statements are based on management’s reasonable current

assumptions, expectations, plans and forecasts regarding the

company’s current or future results and future business and

economic conditions more generally. Such forward-looking statements

involve risks, uncertainties and other factors, which may cause the

actual results, levels of activity, performance or achievement of

the company to be materially different from any future results

expressed or implied by such forward-looking statements, and there

can be no assurance that actual results will not differ materially

from management’s expectations or could affect the company’s

ability to achieve its strategic goals, including the uncertainties

relating to the impact of COVID-19 on the company’s business,

operations, liquidity and financial results and the other factors

that are described in the sections entitled “Risk Factors” in the

company's Securities and Exchange Commission filings updated from

time to time. The preceding list is not intended to be an

exhaustive list of all of our forward-looking statements.

Therefore, you should not rely on any of these forward-looking

statements as predictions of future events. All forward-looking

statements contained in this release are qualified in their

entirety by this cautionary statement. Forward-looking statements

speak only as of the date they are or were made, and the company

does not intend to update or otherwise revise the forward-looking

statements to reflect events or circumstances after the date of

this release or to reflect the occurrence of unanticipated events,

except as required by law.

Unaudited Consolidated Statement of

Comprehensive Income (Figures in million of U.S.

dollars)

Three-month period

ended 12/31/2023

Three-month period

ended 12/31/2022

Revenues from contracts with customers

140.3

94.6

Initial recognition and changes in the

fair value of biological assets at the point of harvest

(0.1)

(0.1)

Cost of sales

(88.7)

(59.1)

Gross profit

51.5

35.3

% Gross profit

37%

37%

Operating expenses

(34.8)

(31.9)

Share of profit of JV

2.1

0.0

Change in net realizable value of

agricultural products

(0.7)

(1.5)

Other income or expenses, net

(1.2)

0.3

Operating profit

16.8

2.2

Financial result

(7.3)

(10.0)

Profit/(loss) before income tax

9.6

(7.7)

Income tax

(8.3)

(0.7)

Profit/(loss) for the period

1.2

(8.4)

Other comprehensive profit

0.5

0.6

Total comprehensive

profit/(loss)

1.7

(7.8)

Profit/(loss) for the period

attributable to:

Equity holders of the parent

0.1

(8.2)

Non-controlling interests

1.1

(0.3)

1.2

(8.4)

Total comprehensive profit/(loss)

attributable to:

Equity holders of the parent

0.5

(7.8)

Non-controlling interests

1.2

(0.1)

1.7

(7.8)

Weighted average number of shares (in

million)

Basic

62.8

61.7

Diluted

63.9

61.7

For the three-month period ended December

31, 2022, diluted weighted average number of shares was equal to

basic as the effect of potential ordinary shares would be

antidilutive.

Unaudited Consolidated Statement of

Financial Position (Figures in million of U.S.

dollars)

ASSETS

12/31/2023

06/30/2023

CURRENT ASSETS

Cash and cash equivalents

24.4

48.1

Other financial assets

17.0

12.1

Trade receivables

199.7

158.0

Other receivables

24.9

28.8

Income and minimum presumed income taxes

recoverable

1.1

9.4

Inventories

123.7

140.4

Biological assets

0.9

0.1

Total current assets

391.9

397.1

NON-CURRENT ASSETS

Other financial assets

0.4

0.4

Other receivables

1.6

2.5

Income and minimum presumed income taxes

recoverable

0.0

0.0

Deferred tax assets

7.1

7.3

Investments in joint ventures and

associates

42.4

39.3

Investment properties

3.8

3.6

Property, plant and equipment

71.4

67.9

Intangible assets

172.7

173.8

Goodwill

112.2

112.2

Right-of-use leased asset

13.7

13.9

Total non-current assets

425.4

420.9

Total assets

817.2

818.1

LIABILITIES

CURRENT LIABILITIES

Trade and other payables

164.0

150.8

Borrowings

113.5

107.6

Employee benefits and social security

8.2

9.6

Deferred revenue and advances from

customers

23.5

24.9

Income tax payable

0.9

0.5

Consideration for acquisition

4.1

1.4

Lease liabilities

4.0

3.9

Total current liabilities

318.2

298.7

NON-CURRENT LIABILITIES

Borrowings

31.5

60.7

Deferred revenue and advances from

customers

0.7

2.1

Investments in joint ventures and

associates

0.1

0.6

Deferred tax liabilities

40.7

35.8

Provisions

0.5

0.9

Consideration for acquisitions

2.6

3.6

Secured notes

78.0

75.2

Lease liability

9.6

10.0

Total non-current liabilities

163.7

188.9

Total liabilities

482.0

487.6

EQUITY

Equity attributable to owners of the

parent

300.5

298.6

Non-controlling interests

34.7

31.9

Total equity

335.3

330.5

Total equity and liabilities

817.2

818.1

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240208046705/en/

Bioceres Crop Solutions Paula Savanti Head of Investor Relations

investorrelations@biocerescrops.com

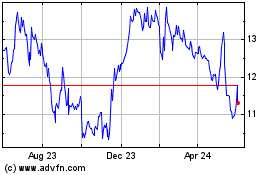

Bioceres Crop Solutions (NASDAQ:BIOX)

Historical Stock Chart

From Dec 2024 to Jan 2025

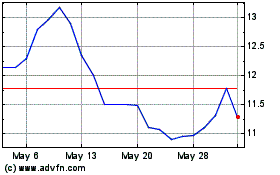

Bioceres Crop Solutions (NASDAQ:BIOX)

Historical Stock Chart

From Jan 2024 to Jan 2025