Selected Highlights BOULDER, Colo., Aug. 4 /PRNewswire-FirstCall/

-- Dynamic Materials Corporation (DMC) (NASDAQ:BOOM), the world's

leading provider of explosion-welded clad metal plates and

associated services, today reported financial results for its

second quarter ended June 30, 2005. Sales in the quarter increased

53% to $18.4 million versus $12.0 million in the second quarter

last year. Sequentially, sales increased 5% versus sales of $17.5

million in this year's first quarter. Gross profit margin improved

to 28% from 24% in the same period last year and 27% in this year's

first quarter. Income from operations increased 228% to $3.4

million versus $1.1 million in the comparable year-ago quarter.

Second quarter operating income increased 27% versus the $2.7

million reported in the first quarter. Second quarter net income

was $2.1 million, or $0.35 per diluted share, versus a net loss of

$0.5 million, or $0.09 per diluted share, in the second quarter

last year. Sequentially, second quarter net income increased 28%

versus first quarter net income of $1.6 million, or $0.28 per

diluted share, in this year's first quarter. Diluted shares

outstanding increased to 6,026,669 from 5,392,276 in last year's

second quarter and 5,930,550 in the first quarter. Bottom-line

results in last year's second quarter were impacted by a loss from

discontinued operations of $1.1 million, or $0.20 per diluted

share, which was associated with the company's former Spin Forge

division. Explosive Metalworking Group Sales at DMC's Explosive

Metalworking Group advanced 51% to $17.2 million from $11.4 million

in last year's second quarter, and were up 2% versus sales of $17.0

million in the first quarter. Operating income increased 201% to

$3.1 million from $1.0 million in the comparable period last year,

and was up 10% from the $2.8 million reported in the first quarter.

The Group ended the quarter with an order backlog of $33.2 million,

down slightly from the all- time high backlog of $34.1 million

achieved at the end of this year's first quarter. AMK Welding

Second quarter sales from the company's AMK Welding division

increased 102% to $1.1 million from $0.6 million in last year's

comparable quarter. Sales were up 108% versus the $0.5 million

reported in this year's first quarter. The division reported second

quarter operating income of $343,000 versus $19,000 in the second

quarter last year and a loss of $115,000 in the first quarter. The

improvements reflect the impact of recently commenced production

work on a previously discussed ground-based turbine project.

Management Commentary Yvon Cariou, president and CEO, said,

"Worldwide demand for clad metal remains strong, and our second

quarter results are indicative of DMC's ability to capitalize on

emerging global opportunities. Shortly after the close of the

second period, we received a $6.0 million order that increased our

backlog to a new all-time high. The order, which relates to a

project for international petrochemical producer Kuwait Olefins

Company, calls for the delivery of more than 2 million pounds of

clad plate, which will be manufactured at our facilities in France

and the United States. This order is illustrative of how our

international production capacity gives us a distinct competitive

advantage and allows us to better serve our customers' needs." Rick

Santa, chief financial officer, said the order is expected to ship

during this year's fourth quarter and the first quarter of fiscal

2006. "In addition to our strong operational performance, we have

made significant progress at strengthening our balance sheet,"

Santa said. "The combination of operating cash flow, proceeds from

stock option exercises and the conversion of a $1.2 million

convertible subordinated note during the first half of 2005 allowed

us to reduce line-of-credit borrowings and term-debt by

approximately $5.9 million to roughly $3.4 million at June 30."

"Current activity within many of the industries we target indicates

there should be sustained demand for our products going forward,"

Cariou said. "We remain encouraged by our opportunities for

continued growth." Six-Month Results Through six months, DMC

reported a sales increase of 62% to $35.9 million compared with

sales of $22.1 million at the six-month mark last year. Gross

profit margin improved to 27% from 23% in the respective periods.

Income from operations increased 236% to $6.2 million compared with

$1.8 million in the same period a year ago. Net income advanced to

$3.8 million, or $0.63 per diluted share, versus a net loss of $0.3

million, or $0.05 per diluted share, during the same period a year

ago. Diluted shares outstanding increased to 5,979,348 from

5,380,286 in last year's six-month period. Last year's net loss

through six months was impacted by a loss from discontinued

operations of $1.3 million, or $0.24 per diluted share, associated

with the former Spin Forge division. The Explosive Metalworking

Group reported six-month sales of $34.2 million, a 62% increase

versus sales of $21.1 million at the six-month mark a year ago.

Operating income increased 218% to $5.9 million compared with $1.9

million during the same period a year prior. The improvement in

operating income reflects both increased sales and more effective

expense absorption within the division. Six-month sales at the AMK

Welding division improved 58% to $1.7 million compared with $1.1

million during the comparable period last year. Operating income

for the period improved to $227,000 compared with an operating loss

of $34,000 during the same period a year ago. About Dynamic

Materials Corporation Based in Boulder, Colorado, Dynamic Materials

Corporation is a leading international metalworking company. Its

products include explosion-welded clad metal plates and other metal

fabrications for use in a variety of industries, including

petrochemicals, refining, hydrometallurgy, aluminum smelting and

shipbuilding. The company operates two business segments: the

Explosive Metalworking Group, which uses proprietary explosive

processes to fuse dissimilar metals and alloys, and AMK Welding,

which utilizes various technologies to weld components for use in

power-generation turbines, as well as commercial and military jet

engines. With more than 30 years of international experience, DMC

has captured a commanding share of the worldwide market for

explosion-welded clad metals. For more information, visit the

company's website at http://www.dynamicmaterials.com/. Except for

the historical information contained herein, this news release

contains forward-looking statements that involve risks and

uncertainties including, but not limited to, the following: the

ability to obtain new contracts at attractive prices; the size and

timing of customer orders; fluctuations in customer demand;

competitive factors; the timely completion of contracts; the timing

and size of expenditures; the timely receipt of government

approvals and permits; the adequacy of local labor supplies at the

company's facilities; the availability and cost of funds; and

general economic conditions, both domestically and abroad; as well

as the other risks detailed from time to time in the company's SEC

reports, including the report on Form 10-K for the year ended

December 31, 2004. DYNAMIC MATERIALS CORPORATION & SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE SIX MONTHS

ENDED JUNE 30, 2005 AND 2004 (Dollars in Thousands, Except Per

Share Data) (unaudited) Three months ended Six months ended June

30, June 30, 2005 2004 2005 2004 NET SALES $18,376 $11,985 $35,886

$22,145 COST OF PRODUCTS SOLD 13,161 9,148 26,020 17,043 Gross

profit 5,215 2,837 9,866 5,102 COSTS AND EXPENSES: General and

administrative expenses 898 846 1,707 1,573 Selling expenses 870

941 1,995 1,697 Total costs and expenses 1,768 1,787 3,702 3,270

INCOME FROM OPERATIONS OF CONTINUING OPERATIONS 3,447 1,050 6,164

1,832 OTHER INCOME (EXPENSE): Other income 13 2 16 7 Interest

expense (82) (111) (168) (234) Interest income 16 7 20 12 INCOME

BEFORE INCOME TAXES AND DISCONTINUED OPERATIONS 3,394 948 6,032

1,617 INCOME TAX PROVISION 1,279 385 2,269 645 INCOME FROM

CONTINUING OPERATIONS BEFORE DISCONTINUED OPERATIONS 2,115 563

3,763 972 DISCONTINUED OPERATIONS: Loss from operations of

discontinued operations, net of tax -- (451) -- (650) Loss on sale

of discontinued operations, net of tax -- (619) -- (619) Loss from

discontinued operations -- (1,070) -- (1,269) NET INCOME (LOSS)

$2,115 $(507) $3,763 $(297) INCOME (LOSS) PER SHARE - BASIC:

Continuing operations $0.38 $0.11 $0.69 $0.19 Discontinued

operations -- (0.21) -- (0.25) Net income (loss) $0.38 $(0.10)

$0.69 $(0.06) INCOME (LOSS) PER SHARE - DILUTED: Continuing

operations $0.35 $0.11 $0.63 $0.19 Discontinued operations --

(0.20) -- (0.24) Net income (loss) $0.35 $(0.09) $0.63 $(0.05)

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING - Basic 5,535,466

5,106,912 5,441,818 5,098,231 Diluted 6,026,669 5,392,276 5,979,348

5,380,286 DYNAMIC MATERIALS CORPORATION & SUBSIDIARY CONDENSED

CONSOLIDATED BALANCE SHEETS (Dollars in Thousands) June 30,

December 31, 2005 2004 ASSETS (unaudited) Cash and cash equivalents

$1,824 $2,404 Accounts receivable, net 13,485 13,936 Inventories

10,789 8,000 Other current assets 2,620 1,906 Total current assets

28,718 26,246 Property, plant and equipment, net 12,000 11,844

Other long-term assets 5,602 5,663 Total assets $46,320 $43,753

LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable $7,517 $6,041

Dividend payable 1,155 -- Other current liabilities 3,762 4,519

Bank lines of credit 7 3,216 Current portion of long-term debt

1,101 3,186 Total current liabilities 13,542 16,962 Long-term debt

2,329 2,906 Other long-term liabilities 3,786 3,815 Stockholders'

equity 26,663 20,070 Total liabilities and stockholders' equity

$46,320 $43,753 DYNAMIC MATERIALS CORPORATION & SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE SIX MONTHS

ENDED JUNE 30, 2005 AND 2004 (Dollars in Thousands) (unaudited)

2005 2004 CASH FLOWS FROM OPERATING ACTIVITIES: Income from

continuing operations $3,763 $972 Adjustments to reconcile income

from continuing operations to net cash provided by operating

activities - Depreciation and amortization 717 683 Amortization of

capitalized debt issuance costs 26 41 Provision for deferred income

taxes (10) 627 Tax benefit related to stock options 2,294 -- Change

in working capital, net (3,631) 794 Net cash flows provided by

operating activities 3,159 3,117 CASH FLOWS FROM INVESTING

ACTIVITIES: Payment received on other receivable 874 53 Acquisition

of property, plant and equipment (1,376) (630) Change in other

non-current assets 148 (16) Net cash flows provided by (used in)

investing activities (354) (593) CASH FLOWS FROM FINANCING

ACTIVITIES: Borrowings / (repayments) on lines of credit, net

(2,949) 90 Payments on long-term debt (1,530) (1,478) Net proceeds

from issuance of common stock 1,181 63 Other cash flows from

financing activities 32 (182) Net cash flows used in financing

activities (3,266) (1,507) EFFECTS OF EXCHANGE RATES ON CASH (119)

(7) CASH FLOWS USED IN DISCONTINUED OPERATIONS -- (842) NET

INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS (580) 168 CASH AND

CASH EQUIVALENTS, beginning of the period 2,404 522 CASH AND CASH

EQUIVALENTS, end of the period $1,824 $690 DATASOURCE: Dynamic

Materials Corporation CONTACT: Geoff High of Pfeiffer High Investor

Relations, Inc., +1-303-393-7044, for Dynamic Materials Corporation

Web site: http://www.dynamicmaterials.com/

Copyright

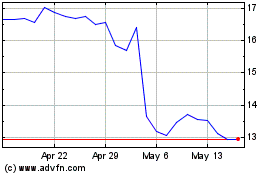

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

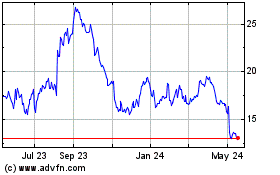

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jul 2023 to Jul 2024