Avid Bioservices, Inc. (NASDAQ: CDMO) (“Avid” or the “Company”), a

dedicated biologics contract development and manufacturing

organization (“CDMO”) working to improve patient lives by providing

high quality development and manufacturing services to

biotechnology and pharmaceutical companies, today announced that it

has commenced mailing definitive proxy materials and a letter to

stockholders in connection with its pending transaction with GHO

Capital Partners LLP (“GHO”) and Ampersand Capital Partners

(“Ampersand”).

The Special Meeting to vote on the transaction is scheduled for

January 30, 2025, and Avid stockholders of record as of December

11, 2024, are eligible to vote at the Special Meeting.

The letter to stockholders highlights:

- How the transaction with GHO and Ampersand delivers

significant, immediate and certain cash value to Avid

stockholders;

- The robust process conducted by the Avid Board of Directors

maximizes value for stockholders; and

- The transaction de-risks for stockholders Avid’s future as a

standalone company.

The full text of the letter follows:

December 18, 2024

Dear Fellow Avid Bioservices Stockholders,

We are reaching out to let you know that you need to take action

to realize the full value of your Avid Bioservices investment.

Specifically, you need to vote FOR the pending

transaction with GHO Capital Partners LLP (“GHO”) and Ampersand

Capital Partners (“Ampersand”).

We firmly believe the transaction is in the best interest of all

Avid stockholders as it:

- Provides significant, immediate and certain cash value

to Avid stockholders;

- Reflects a robust process conducted by the Board to

ensure we are maximizing value; and

- De-risks for stockholders Avid’s future as a standalone

company.

Our Board of Directors unanimously recommends stockholders to

vote “FOR” the transaction today.

Delivering Significant, Immediate and

Certain Cash Value to Avid Stockholders

The $12.50 per share all-cash consideration

provides a significant premium to Avid

stockholders across multiple time periods at a compelling

valuation.

|

$12.50 Per share in cash |

$1.1 Billion Enterprise value |

13.8%Premium to Avid’s closing share price of

$10.98 on November 6, 2024, the last full trading day prior to the

transaction announcement (the “Unaffected Date”) |

|

63.8%premium to the Company's closing price of

$7.63 on June 4, 2024, the last trading day prior to GHO and

Ampersand’s June 5 Initial Proposal |

21.9%premium to the Company’s 20-day VWAP

ending on the Unaffected Date |

24.4%premium to the Company’s 90-day VWAP

ending on the Unaffected Date |

|

50.1%premium to the Company’s 6-month VWAP

ending on the Unaffected Date |

207.1%premium to the Company’s 52-week low

ending on the Unaffected Date |

6.5xmultiple to management forecasted FY2025E

revenue |

|

|

|

|

The Avid Board Conducted a Competitive

Process to Maximize Value

By the Numbers

|

The Avid Board of Directors is committed to maximizing the value

for Avid stockholders. That is why the Board conducted a

thoughtful, exhaustive and deliberate process that thoroughly

tested buyer interest, with support from its legal and financial

advisors, after receiving an initial unsolicited offer from GHO and

Ampersand to acquire the Company for $10.50 per share in cash. As

detailed in our proxy, our Board and management team know our

industry and the players in it well, having previously explored

other potential strategic transactions and conducted diligence as

part of those efforts. We did not proceed with those potential

alternatives as our Board did not believe they created the most

value for stockholders. When GHO and Ampersand made initial offers

to acquire the Company, the Board reviewed them and rejected them

as not sufficiently valuing the Company. The Board considered the

Company’s standalone prospects, the risks and uncertainties of

continuing to execute its standalone plans and the ability of Avid

stockholders to adequately recognize the future value of Avid’s

reasonable expectations for growth. The Board also conducted a

process, which included outreach to at least 24 most likely

strategic and financial buyers to gauge interest in a potential

sale of the company. That process resulted in confidential

discussions with seven parties and culminated with non-binding

proposals from GHO and Ampersand and another party. After a period

of back-and-forth communication with each party, the Board

determined to proceed with GHO’s and Ampersand’s increased

proposal. Ultimately, the process and negotiations with GHO

and Ampersand resulted in five improvements to price and a 19%

price improvement from the original unsolicited offer. The

Board is confident that this robust process has led to the

value maximizing outcome for stockholders. |

|

12Board meetings since receipt of initial

unsolicited offer to discuss the process |

|

|

24Most likely strategic and financial buyers

engaged to explore interest in acquiring the Company |

|

|

5Improvements to the GHO and Ampersand offer

resulting from the robust process and negotiations |

|

|

19%Price improvement from the initial unsolicited

offer |

|

|

|

|

The Transaction De-Risks Avid’s Future as

a Standalone Company

We are incredibly proud of the progress that we have made as a

public company. That said, in evaluating the transaction, our Board

considered factors that could impact our standalone financial and

operating results going forward. These included, among others:

- Industry-wide Macroeconomic Headwinds: There

are a range of challenges facing the biologics manufacturing

industry, including uncertainty around the recovery in biotech

funding, increased volatility resulting from escalating political

and global trade tensions that could disrupt supply chains, and

increasing competition.

- Additional Investments Needed: While Avid has

made a number of strategic investments in the business over the

last several years, more is needed to capitalize on the Company’s

growth potential.

- Updated Go-Forward Growth Expectations as a Public

Company: As part of its review of potential strategic

alternatives, the Board requested that Moelis prepare a financial

analysis on Avid management’s probability-adjusted five-year plan

for fiscal years 2025 through 2029. That review indicated that the

Company’s growth prospects were below its own previous guidance as

well as analysts’ consensus. Therefore, the Board determined that

the transaction with GHO and Ampersand represented a value

maximizing outcome for Avid stockholders, providing superior

risk-adjusted value and certainty of execution. We encourage

stockholders to read more about these financial projections and the

financial analysis conducted by our financial advisor in our

supplemental proxy filing materials.

We believe the transaction pays stockholders fair

value for the investments Avid has made to date and

eliminates for stockholders the execution risk of Avid continuing

to operate on a standalone basis.

YOUR VOTE MATTERS: TAKE ACTION AND VOTE

TODAY

We strongly encourage you to get your vote

“FOR” the transaction today so, you can obtain

significant, immediate and certain value for your Avid

investment.

Regardless of how many shares you own,

your vote matters. You can vote online, by phone or by

signing and returning the proxy card that was mailed with the

Company’s definitive proxy materials.

Thank you for your continued support.

Sincerely,

The Avid Bioservices Board of Directors

|

The Avid Board of Directors Unanimously Recommends that

Avid Stockholders Vote “FOR” the proposed transaction with GHO and

Ampersand. Vote TODAY online, by telephone or by signing

and returning the enclosed proxy card. If you have questions or

need assistance voting your shares, please

contact:MacKenzie Partners, Inc. 7 Penn Plaza New

York, New York 10001U.S. & Canada Toll-Free:

1-800-322-2885Elsewhere Call Collect: +1-212-929-5500Or Email:

proxy@MacKenziePartners.com |

Advisors

Moelis & Company LLC is serving as exclusive financial

advisor to Avid, and Cooley LLP is serving as legal counsel to

Avid.

About Avid Bioservices, Inc.

Avid Bioservices (NASDAQ: CDMO) is a dedicated CDMO focused on

development and CGMP manufacturing of biologics. The Company

provides a comprehensive range of process development, CGMP

clinical and commercial manufacturing services for the

biotechnology and biopharmaceutical industries. With more than 30

years of experience producing biologics, Avid's services include

CGMP clinical and commercial drug substance manufacturing, bulk

packaging, release and stability testing and regulatory submissions

support. For early-stage programs the Company provides a variety of

process development activities, including cell line development,

upstream and downstream development and optimization, analytical

methods development, testing and characterization. The scope of our

services ranges from standalone process development projects to

full development and manufacturing programs through

commercialization. www.avidbio.com

ADDITIONAL INFORMATION AND WHERE TO FIND

IT

The Company has filed a proxy statement with the

U.S. Securities and Exchange Commission (“SEC”) with respect to a

special meeting of stockholders to be held in connection with the

proposed transaction. Promptly after filing the definitive proxy

statement with the SEC, the Company will mail the definitive proxy

statement and a proxy card to each stockholder entitled to vote at

the special meeting to consider the proposed transaction.

STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY

AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS

THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may

obtain, free of charge, the preliminary and definitive versions of

the proxy statement, any amendments or supplements thereto, and any

other relevant documents filed by the Company with the SEC in

connection with the proposed transaction at the SEC’s website

(http://www.sec.gov). Copies of the preliminary and definitive

versions of the proxy statement, any amendments or supplements

thereto, and any other relevant documents filed by the Company with

the SEC in connection with the proposed transaction will also be

available, free of charge, at the Company’s investor relations

website (https://ir.avidbio.com/sec-filings). The information

provided on, or accessible through, our website is not part of this

press release, and therefore is not incorporated herein by

reference.

PARTICIPANTS IN THE

SOLICITATION

The Company and certain of its directors,

executive officers and employees may be deemed to be participants

in the solicitation of proxies in respect of the proposed

transaction. Information regarding the Company’s directors and

executive officers is available in the Company’s proxy statement

for the 2024 annual meeting of stockholders, which was filed with

the SEC on August 28, 2024 (the “Annual Meeting Proxy Statement”).

Please refer to the sections captioned “Security Ownership of

Certain Beneficial Owners, Directors and Management,” “Director

Compensation,” and “Executive Compensation-Outstanding Equity

Awards at Fiscal Year-End” in the Annual Meeting Proxy Statement.

To the extent holdings of such participants in the Company’s

securities have changed since the amounts described in the Annual

Meeting Proxy Statement, such changes have been reflected on

Initial Statements of Beneficial Ownership on Form 3 or Statements

of Change in Ownership on Form 4 filed with the SEC: Form 4, filed

by Nicholas Stewart Green on October 11, 2024, Form 4, filed by

Richard A. Richieri on October 11, 2024, Form 4, filed by Matthew

R. Kwietniak on October 11, 2024, and Form 4, filed by Matthew R.

Kwietniak on October 15, 2024. Other information regarding the

participants in the proxy solicitation and a description of their

direct and indirect interests, by security holdings or otherwise,

will be contained in the definitive proxy statement and other

relevant materials to be filed with the SEC in connection with the

proposed transaction when they become available. Free copies of the

Annual Meeting Proxy Statement, the definitive proxy statement

related to the proposed transactions and such other materials may

be obtained as described in the preceding paragraph.

FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking

statements” which include, but are not limited to, all statements

that do not relate solely to historical or current facts, such as

statements regarding the Company’s expectations, intentions or

strategies regarding the future, or the completion or effects of

the proposed sale of Avid to GHO and Ampersand. In some cases,

these statements include words like: “may,” “might,” “will,”

“could,” “would,” “should,” “expect,” “intend,” “plan,”

“objective,” “anticipate,” “believe,” “estimate,” “predict,”

“project,” “potential,” “continue” and “ongoing,” or the negative

of these terms, or other comparable terminology intended to

identify statements about the future. These forward-looking

statements are subject to the safe harbor provisions under the

Private Securities Litigation Reform Act of 1995. The Company’s

expectations and beliefs regarding these matters may not

materialize. Actual outcomes and results may differ materially from

those contemplated by these forward-looking statements as a result

of uncertainties, risks, and changes in circumstances, including

but not limited to risks and uncertainties related to: the timing,

receipt and terms and conditions of any required governmental and

regulatory approvals of the proposed transaction that could delay

the consummation of the proposed transaction or cause the parties

to abandon the proposed transaction; the occurrence of any event,

change or other circumstances that could give rise to the

termination of the merger agreement entered into in connection with

the proposed transaction; the possibility that the Company’s

stockholders may not approve the proposed transaction; the risk

that the parties to the merger agreement may not be able to satisfy

the conditions to the proposed transaction in a timely manner or at

all; risks related to disruption of management time from ongoing

business operations due to the proposed transaction; the risk that

any announcements relating to the proposed transaction could have

adverse effects on the market price of the Company’s common stock;

the risk of any unexpected costs or expenses resulting from the

proposed transaction; the risk of any litigation relating to the

proposed transaction; and the risk that the proposed transaction

and its announcement could have an adverse effect on the ability of

the Company to retain and hire key personnel and to maintain

relationships with customers, vendors, partners, employees,

stockholders and other business relationships and on its operating

results and business generally. Additional risks and uncertainties

that could cause actual outcomes and results to differ materially

from those contemplated by the forward-looking statements are

included under the caption “Risk Factors” and elsewhere in the

Company’s most recent filings with the SEC, including the Company’s

Quarterly Report on Form 10-Q for the quarter ended October 31,

2024 and any subsequent reports on Form 10-K, Form 10-Q or Form 8-K

filed with the SEC from time to time and available at

http://www.sec.gov.

The forward-looking statements included in this information

statement are made only as of the date hereof. The Company assumes

no obligation and does not intend to update these forward-looking

statements, except as required by law.

Contacts:

Avid Bioservices

Stephanie Diaz (Investors)Vida Strategic

Partners415-675-7401sdiaz@vidasp.com

Tim BronsVida Strategic

Partners415-675-7402tbrons@vidasp.com

Bob Marese / John Bryan (For Voting Inquiries)MacKenzie

Partners, Inc.1-800-322-2885proxy@MacKenziePartners.com

Aaron Palash / Allison Sobel (Media)Joele Frank, Wilkinson

Brimmer Katcher (212) 355-4449

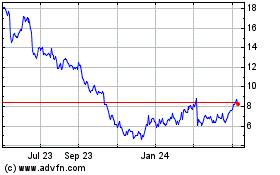

Avid Bioservices (NASDAQ:CDMO)

Historical Stock Chart

From Dec 2024 to Jan 2025

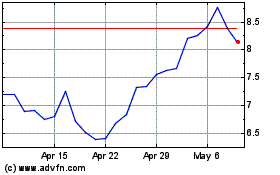

Avid Bioservices (NASDAQ:CDMO)

Historical Stock Chart

From Jan 2024 to Jan 2025