UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to §240.14a-12 |

Checkpoint Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if

other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rule 14a-6(i)(1) and 0-11. |

This Schedule 14A filing

consists of the following communications relating to the proposed acquisition of Checkpoint Therapeutics, Inc., a Delaware corporation

(the “Company”) by Sun Pharmaceutical Industries, Inc., a Delaware corporation (“Parent”), pursuant to the terms

of an Agreement and Plan of Merger, dated March 9, 2025, by and among the Company, Parent and Snoopy Merger Sub, Inc., a Delaware corporation

and a wholly owned subsidiary of Parent. The communications below were first used or made available on March 10, 2025.

LinkedIn Post by Amit Sharma, Director

Additional Information and Where to Find It

This communication may be deemed to be solicitation

material in respect of the proposed acquisition of Checkpoint by Sun Pharma pursuant to the Agreement and Plan of Merger, dated as of

March 9, 2025, by and among Sun Pharma, Checkpoint and Merger Sub. Checkpoint intends to file a preliminary and definitive proxy statement

with the SEC in connection with a special meeting of stockholders to be held in connection with the proposed acquisition. The definitive

proxy statement and a proxy card will be delivered to each Checkpoint stockholder entitled to vote at the special meeting in advance of

thereof. This Current Report on Form 8-K is not a substitute for the proxy statement, which will contain important information about the

proposed transaction and related matters, or any other document that may be filed by Checkpoint with the SEC. BEFORE MAKING ANY VOTING

OR INVESTMENT DECISION, CHECKPOINT’S STOCKHOLDERS AND INVESTORS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY

AMENDMENTS OR SUPPLEMENTS THERETO) IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED BY CHECKPOINT WITH THE SEC

IN CONNECTION WITH THE PROPOSED ACQUISITION OR INCORPORATED BY REFERENCE THEREIN BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE PROPOSED ACQUISITION AND THE PARTIES TO THE PROPOSED ACQUISITION. Investors and security holders will be able to obtain a free copy

of the proxy statement and such other documents containing important information about Checkpoint, once such documents are filed with

the SEC, through the website maintained by the SEC at www.sec.gov. Checkpoint makes available free of charge at its website at https://ir.checkpointtx.com/

copies of materials it files with, or furnishes to, the SEC.

Participants in the Solicitation

Checkpoint and its directors, and certain of its

executive officers, consisting of Michael S. Weiss, Chistian Béchon, Neil Herskowitz, Lindsay A. Rosenwald, Barry Salzman, Amit

Sharma, who are the non-employee members of the Company Board, and James Oliviero, President and Chief Executive Officer and a member

of the Company Board, and Garrett Gray, Chief Financial Officer, may be deemed to be participants in the solicitation of proxies from

Checkpoint’s stockholders in connection with the proposed acquisition. Information regarding Checkpoint’s directors and certain

of its executive officers, including a description of their direct or indirect interests, by security holdings or otherwise, can be found

under the captions “Security Ownership of Certain Beneficial Owners and Management,” “Executive Compensation,”

and “Director Compensation” contained in Checkpoint’s definitive proxy statement on Schedule 14A for Checkpoint’s

2024 annual meeting of stockholders, which was filed with the SEC on April 2, 2024 and under Item 5.02 in the current reports on Form

8-K filed with the SEC on May 14, 2024 and January 10, 2025. To the extent holdings of Checkpoint’s securities by its directors

or executive officers have changed since the applicable “as of” date described in its 2024 proxy statement, such changes have

been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed

with the SEC, including (i) the Form 4s filed by Mr. Béchon on May 16, 2024 and December 17, 2024; (ii) the Form 4s filed by Mr.

Gray on May 24, 2024, June 28, 2024, December 17, 2024, December 20, 2024, January 31, 2025 and February 7, 2025; (iii) the Form 4s filed

by Mr. Herskowitz on May 16, 2024 and December 17, 2024; (iv) the Form 4s filed by Mr. Oliviero on May 24, 2024, June 28, 2024, December

17, 2024, December 20, 2024, January 31, 2025 and February 11, 2025; (v) the Form 4s filed by Dr. Rosenwald on May 16, 2024 and December

17, 2024; (vi) the Form 4s filed by Mr. Salzman on May 16, 2024 and December 17, 2024; (vii) the Form 4 filed by Dr. Sharma on May 16,

2024; and (viii) the Form 4s filed by Mr. Weiss on May 16, 2024 and December 17, 2024. Additional information regarding the identity of

potential participants, and their direct or indirect interests, by security holdings or otherwise, will be included in the definitive

proxy statement relating to the proposed acquisition when it is filed with the SEC. These documents (when available) may be obtained free

of charge from the SEC’s website at www.sec.gov and Checkpoint’s website at https://ir.checkpointtx.com/.

Forward Looking Statements

This communication contains express or implied

forward-looking statements related to Checkpoint and the proposed acquisition.

All statements other than statements of historical

fact are statements that could be deemed “forward-looking statements” within the meaning of the “safe harbor”

provisions of the United States Private Securities Litigation Reform Act of 1995, including all statements regarding the intent, belief

or current expectation of the companies and members of their senior management teams. Words such as “will,” “could,”

“would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,”

“estimate,” “predict,” “project,” “potential,” “continue,” “target,”

variations of such words, and similar expressions are intended to identify such forward-looking statements, although not all forward-looking

statements contain these identifying words.

Examples of such forward-looking statements include,

but are not limited to, express or implied:

| · | statements regarding the transaction and related matters, including the benefits of and timeline for closing

the transaction, any payments under the CVRs, prospective performance and opportunities, post-closing operations and the outlook for the

companies’ businesses; |

| · | statements of targets, plans, objectives or goals for future operations, including those related to Checkpoint’s

products, product research, product development, product introductions and product approvals as well as cooperation in relation thereto; |

| · | statements containing projections of or targets for revenues, costs, income (or loss), earnings per share,

capital expenditures, dividends, capital structure, net financials and other financial measures; |

| · | statements regarding future economic performance, future actions and outcome of contingencies such as

legal proceedings; and |

| · | statements regarding the assumptions underlying or relating to such statements. |

These statements are based on current plans, estimates

and projections and are not predictions of actual performance. By their very nature, forward-looking statements involve inherent risks

and uncertainties. Checkpoint cautions that a number of important factors, including those described in this document, could cause actual

results to differ materially from those contemplated in any forward-looking statements.

Factors that may affect future results and may

cause these forward-looking statements to be inaccurate include, but are not limited to: uncertainties as to the timing of completion

of the Merger; uncertainties as to whether Checkpoint’s stockholders will vote to approve the transaction; the possibility that

competing offers will be made; the possibility that various closing conditions for the transaction may not be satisfied or waived, including

that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the transaction (or only grant approval

subject to adverse conditions or limitations); the possibility that the proposed transaction may not be completed in the time frame expected

by Checkpoint, or at all; failure to realize the anticipated benefits of the proposed transaction in the time frame expected, or at all;

the effects of the transaction on relationships with employees, other business partners or governmental entities; potential adverse reactions

or changes to business relationships resulting from the announcement or completion of the proposed transaction; significant or unexpected

costs, charges or expenses resulting from the proposed transaction; negative effects of this announcement or the consummation of the proposed

acquisition on Checkpoint’s common stock and/or Checkpoint’s operating results; the difficulty of predicting the timing or

outcome of regulatory approvals or actions; the risks related to non-achievement of the CVR milestone and that holders of the CVRs will

not receive payments in respect of the CVRs; other business effects, including the effects of industry, economic or political conditions

outside of the companies’ control; transaction costs; actual or contingent liabilities; risk of litigation and/or regulatory actions

related to the proposed acquisition; adverse impacts on business, operating results or financial condition in the future due to pandemics,

epidemics or outbreaks, and their impact on Checkpoint’s business, operations, supply chain, patient enrollment and retention, clinical

trials, strategy, goals and anticipated milestones; government-mandated or market-driven price decreases for Checkpoint’s products;

the existence or introduction of competing products; reliance on information technology; Checkpoint’s ability to successfully market

current and new products; Checkpoint’s and its collaborators’ ability to continue to conduct research and clinical programs;

and exposure to product liability and legal proceedings and investigations. Further risks and uncertainties that could cause actual results

to differ materially from the results anticipated by the forward-looking statements are detailed from time to time in Checkpoint’s

periodic reports filed with the SEC, including the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023,

Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and the definitive proxy statement to be filed by Checkpoint with the SEC

in connection with the proposed transaction. These filings, when available, are available on the investor relations section of Checkpoint’s

website at https://ir.checkpointtx.com or on the SEC’s website at https://www.sec.gov.

Any forward-looking statements speak only as of

the date of this communication and are made based on the current beliefs and judgments of Checkpoint’s management, and the reader

is cautioned not to rely on any forward-looking statements made by Checkpoint. Unlisted factors may present significant additional obstacles

to the realization of forward-looking statements. Unless required by law, Checkpoint is under no duty and undertakes no obligation to

update or revise any forward-looking statement after the distribution of this communication, whether as a result of new information, future

events or otherwise.

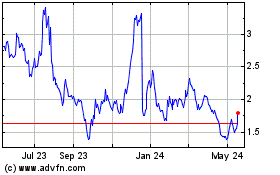

Checkpoint Therapeutics (NASDAQ:CKPT)

Historical Stock Chart

From Feb 2025 to Mar 2025

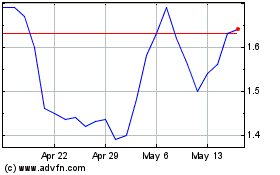

Checkpoint Therapeutics (NASDAQ:CKPT)

Historical Stock Chart

From Mar 2024 to Mar 2025