- Sequential and Year-over-Year OpEx Reductions

Reflect Continued Benefits of Cost Optimization Initiatives-

ClearOne (NASDAQ: CLRO), a global provider of audio and visual

communication solutions, reported financial results for the

three-month period ended June 30, 2024.

Revenue declined 58% sequentially and 39% year over year,

primarily due to a significant decrease in revenues from the audio

conferencing category, which includes our DSP mixer products. “We

believe this revenue decline was primarily due to the cumulative

impact of past production shortages,” said Derek Graham, CEO of

ClearOne. “Historically, we have seen a lag of several months

between the time that our professional conferencing products are

specified for a project and the date when those products are

purchased for installation. Since our product availability was

constrained through a significant part of Q4 2023 as a result of

delays in the transition of outsourced manufacturing from China to

Singapore throughout 2023, we believe our revenue was impacted

negatively by these market dynamics through much of Q2 2024. We

have also faced sales headwinds from our products’ lack of

Microsoft Teams certification, despite their longtime functional

compatibility with this platform. Our work through early 2024 has

focused on mitigating these impacts through maintaining consistent

dialogues, product demonstrations, and feedback cycles with end

users and channel partners, along with improving our visibility at

key industry events. Our sales in Q2 2024 were also impacted by our

transition to a new distributor in the Middle East. We anticipate,

although there can be no assurance, that our new Middle East

distributor will continue our previous history of sales growth in

the region, but there was an impact to our sales in that region due

to the transition.”

Operational Highlights

- The Company showcased its full line of collaboration and

conferencing solutions at Infocomm 2024, including seamless

integration with popular collaboration solutions from other

companies and a comprehensive portfolio of solutions for various

applications and meeting room sizes. The Company captured 60% more

sales leads due to in-person visitors during Infocomm USA 2024

compared to Infocomm USA 2023.

- The Company introduced the Versa Lite BMA 360D in Q2 2024. This

innovative bundle combines ClearOne’s industry-leading BMA 360D

Dante® enabled microphone array ceiling tile with the Versa® USB22D

Dante® adapter, offering a perfect audio solution for any

conferencing space with an easy connection to any computer or room

device via USB.

- The Company reduced operating expenses by 10.1% sequentially

and 9.33% year-over-year.

Graham continued, “During the first half of 2024, our team has

been diligently working to win back customers who have defected to

competing brands. We believe, although there can be no assurance,

those efforts will bear fruit soon. We continue to see strong

interest in our innovative products as demonstrated by the 60%

increase in visitors at our Infocomm USA booth even though overall

Infocomm USA attendance was only up 3% this year.”

Financial Summary

The Company uses certain non-GAAP financial measures and

reconciles those to GAAP measures in the attached tables.

•

Q2 2024 revenue was $2.3 million, compared

to $5.5 million in Q2 2023 and $3.6 million in Q1 2024. The 36.1%

sequential decrease was driven by reduced demand across all product

categories. We believe the flow of sales orders during Q2 2024 was

reduced due to the cumulative impact of past product shortages. We

believe the revenue decrease was mainly due to sustained inventory

sourcing and order fulfillment challenges for the Company's core

audio conferencing and beam forming microphone arrays as a result

of delays in the transition of outsourced manufacturing from China

to Singapore throughout 2023.

•

GAAP gross profit/(loss) in Q2 2024 was

$(0.02) million, compared to $1.8 million in Q2 2023 and $1.2

million in Q1 2024. GAAP gross profit margin was- 1% in Q2 2024,

compared to 32% in Q1 2024 and 34% in Q2 2023. The large decrease

in gross profit margin occurred due to increased inventory scrap

costs, increasing the inventory reserve to write down the value for

certain items, and an increase in purchase price variance from

increasing vendor costs.

•

Operating expenses in Q2 2024 improved to

$2.9 million, compared to $3.2 million in Q2 2023 and $3.2 million

in Q1 2024. Non-GAAP operating expenses in Q2 2024 improved to $2.8

million compared to $3.1 million in Q1 2024 and $3.1 million in Q2

2023. The sequential and year-over-year decrease in non-GAAP

operating expenses was mainly due to the continued benefits of the

cost-cutting measures initiated in 2022.

•

GAAP net loss in Q2 2024 was $(2.8)

million, or $(0.12) per share, compared to a net loss of $(1.0)

million, or $(0.04) per share, in Q2 2023 and a net loss of $(1.9)

million, or $(0.08) per share, in Q1 2024. The year-over-year

increase in net loss was primarily due to the aforementioned

decrease in revenue and gross profit, partially offset by a

decrease in operating expenses.

•

Non-GAAP net loss in Q2 2024 was $(2.7)

million, or $(0.11) per share, compared to a Non-GAAP net loss of

$(0.9) million, or $(0.04) per share, in Q2 2023 and a Non-GAAP net

loss of $(1.8) million, or $(0.07) per share, in Q1 2024. The

year-over-year increase in Non-GAAP net loss was driven by the

aforementioned decrease in revenue and gross profit partially

offset by a decrease in operating expenses.

($ in 000, except per share)

Three months ended June

30,

Six months ended June

30,

2024

2023

Change in %

Favorable/(Adverse)

2024

2023

Change in %

Favorable/(Adverse)

GAAP

Revenue

$

2,304

$

5,483

(58

)

$

5,926

$

9,661

(39

)

Gross profit

(20

)

1,848

(101

)

1,131

3,163

(64

)

Operating expenses

2,904

3,203

9

6,133

6,707

9

Operating loss

(2,924

)

(1,355

)

(116

)

(5,002

)

(3,544

)

(41

)

Net loss

(2,820

)

(1,019

)

(177

)

(4,718

)

(1,851

)

(155

)

Diluted loss per share

(0.12

)

(0.04

)

(200

)

(0.20

)

(0.08

)

(150

)

Non-GAAP

Non-GAAP operating expenses

$

2,830

$

3,051

7

$

5,925

$

6,413

8

Non-GAAP operating loss

(2,835

)

(1,201

)

(136

)

(4,777

)

(3,250

)

(47

)

Non-GAAP net loss

(2,731

)

(865

)

(216

)

(4,493

)

(2,907

)

(55

)

Non-GAAP Adjusted EBITDA

(2,660

)

(710

)

(275

)

(4,367

)

(2,389

)

(83

)

Non-GAAP diluted loss per share

(0.11

)

(0.04

)

(175

)

(0.19

)

(0.12

)

(55

)

About ClearOne

ClearOne is a global company that designs, develops, and sells

conferencing, collaboration, and network streaming solutions for

voice and visual communications. The performance and simplicity of

its advanced comprehensive solutions offer unprecedented levels of

functionality, reliability, and scalability. Visit ClearOne at

www.clearone.com.

Non-GAAP Financial Measures

To supplement our consolidated financial statements presented on

a GAAP basis, ClearOne uses non-GAAP measures of gross profit,

operating income (loss), net income (loss), adjusted Earnings

Before Interest, Taxes, Depreciation and Amortization (EBITDA) and

net income (loss) per share, which are adjusted to exclude certain

costs, expenses, gains and losses we believe appropriate to enhance

an overall understanding of our past financial performance from

period to period and also our prospects for the future. These

adjustments to our current period GAAP results are made with the

intent of providing both management and investors a more complete

understanding of ClearOne’s underlying operational results and

trends and our marketplace performance. The non-GAAP results are an

indication of our baseline performance before certain gains,

losses, or other charges that are considered by management to be

outside of our core operating results. In addition, these adjusted

non-GAAP results are among the primary indicators management uses

as a basis for our planning and forecasting of future periods. The

presentation of this additional non-GAAP financial information is

not meant to be considered in isolation or as a substitute for

gross profit, operating income (loss), net income (loss), income

(loss) per share or other financial measures prepared in accordance

with GAAP. There are limitations to the use of non-GAAP financial

measures. Other companies, including companies in ClearOne’s

industry, may calculate non-GAAP financial measures differently

than ClearOne does, limiting the usefulness of those measures for

comparative purposes. A detailed reconciliation of non-GAAP

financial measures to the most directly comparable GAAP financial

measures is included in this release below.

Forward Looking Statements

This release contains “forward-looking” statements that are

based on present circumstances and on ClearOne’s predictions with

respect to events that have not occurred, that may not occur, or

that may occur with different consequences and timing than those

now assumed or anticipated. Such forward-looking statements and any

statements of the plans and objectives of management for future

operations and forecasts of future growth and value are not

guarantees of future performance or results and involve risks and

uncertainties that could cause actual events or results to differ

materially from the events or results described in the

forward-looking statements. Such forward-looking statements are

made only as of the date of this release and ClearOne assumes no

obligation to update forward-looking statements to reflect

subsequent events or circumstances. Readers should not place undue

reliance on these forward-looking statements. The information in

this press release should be read in conjunction with and is

modified in its entirety by, the Quarterly Report on Form 10-Q (the

“10-Q”) filed by the Company for the same period with the

Securities and Exchange Commission (the “SEC”) and all of the

Company’s other public filings with the SEC (the “Public

Filings”).

In particular, the financial information contained herein is

subject to and qualified by reference to the financial statements

contained in the 10-Q, including the footnotes thereto, as well as

the Company’s annual report on Form 10-K for the year ended

December 31, 2023 (the “10-K”), the footnotes thereto and the

limitations set forth therein. Investors may not rely on the press

release without reference to the 10-Q, the 10-K, and the Public

Filings.

CLEARONE, INC UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS (Dollars in thousands,

except par value)

June 30, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

2,450

$

17,835

Current marketable securities

1,852

3,480

Patent cross license receivable

—

4,000

Receivables, net of allowance of $326

2,574

3,279

Inventories, net

14,599

10,625

Income tax receivable

27

36

Prepaid expenses and other assets

3,855

4,062

Total current assets

25,357

43,317

Long-term marketable securities

621

916

Long-term inventories, net

1,772

3,143

Property and equipment, net

552

530

Operating lease - right of use assets,

net

804

990

Intangibles, net

1,582

1,689

Other assets

108

109

Total assets

$

30,796

$

50,694

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

1,901

$

1,945

Accrued liabilities

1,726

2,290

Deferred product revenue

23

30

Total current liabilities

3,650

4,265

Operating lease liability, net of

current

515

665

Other long-term liabilities

1,079

1,079

Total liabilities

5,244

6,009

Shareholders' equity:

Common stock, par value $0.001, 50,000,000

shares authorized, 23,969,148 shares issued and outstanding

24

24

Additional paid-in capital

31,616

46,047

Accumulated other comprehensive loss

(294

)

(310

)

Accumulated deficit

(5,794

)

(1,076

)

Total shareholders' equity

25,552

44,685

Total liabilities and shareholders'

equity

$

30,796

$

50,694

CLEARONE, INC. UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS (Dollars in thousands, except per share amounts)

Three months ended June

30,

Six months ended June

30,

2024

2023

2024

2023

Revenue

$

2,304

$

5,483

$

5,926

$

9,661

Cost of goods sold

2,324

3,635

4,795

6,498

Gross profit

(20

)

1,848

1,131

3,163

Operating expenses:

Sales and marketing

1,191

1,323

2,503

2,515

Research and product development

868

873

1,762

1,916

General and administrative

845

1,007

1,868

2,276

Total operating expenses

2,904

3,203

6,133

6,707

Operating loss

(2,924

)

(1,355

)

(5,002

)

(3,544

)

Interest expense

—

(91

)

—

(383

)

Other income, net

119

437

297

2,103

Loss before income taxes

(2,805

)

(1,009

)

(4,705

)

(1,824

)

Provision for income taxes

15

10

13

27

Net loss

$

(2,820

)

$

(1,019

)

$

(4,718

)

$

(1,851

)

Basic weighted average shares

outstanding

23,969,148

23,955,802

23,969,148

23,955,785

Diluted weighted average shares

outstanding

23,969,148

23,955,802

23,969,148

23,955,785

Basic loss per share

$

(0.12

)

$

(0.04

)

$

(0.20

)

$

(0.08

)

Diluted loss per share

$

(0.12

)

$

(0.04

)

$

(0.20

)

$

(0.08

)

Comprehensive loss:

Net loss

$

(2,820

)

$

(1,019

)

$

(4,718

)

$

(1,851

)

Unrealized loss on available-for-sale

securities, net of tax

(3

)

14

19

14

Change in foreign currency translation

adjustment

(1

)

(1

)

(3

)

4

Comprehensive loss

$

(2,824

)

$

(1,006

)

$

(4,702

)

$

(1,833

)

CLEARONE, INC. UNAUDITED

RECONCILIATION OF GAAP MEASURES TO NON-GAAP MEASURES (Dollars

in thousands, except per share values)

Three months ended June

30,

Six months ended June

30,

GAAP operating loss

$

(2,924

)

$

(1,355

)

$

(5,002

)

$

(3,544

)

Stock-based compensation

39

25

65

47

Amortization of intangibles

50

129

160

247

Non-GAAP operating loss

$

(2,835

)

$

(1,201

)

$

(4,777

)

$

(3,250

)

GAAP net loss

$

(2,820

)

$

(1,019

)

(4,718

)

(1,851

)

Stock-based compensation

39

25

65

47

Amortization of intangibles

50

129

160

247

Other income adjustment

—

—

—

(1,350

)

Non-GAAP net loss

$

(2,731

)

$

(865

)

$

(4,493

)

$

(2,907

)

GAAP net loss

$

(2,820

)

$

(1,019

)

$

(4,718

)

$

(1,851

)

Number of shares used in computing GAAP

diluted loss per share

23,969,148

23,955,802

23,969,148

23,955,785

GAAP diluted loss per share

$

(0.12

)

$

(0.04

)

$

(0.20

)

$

(0.08

)

Non-GAAP net loss

$

(2,731

)

$

(865

)

$

(4,493

)

$

(2,907

)

Number of shares used in computing

Non-GAAP diluted loss per share

23,969,148

23,955,802

23,969,148

23,955,785

Non-GAAP diluted loss per share

$

(0.11

)

$

(0.04

)

$

(0.19

)

$

(0.12

)

GAAP net loss

$

(2,820

)

$

(1,019

)

$

(4,718

)

$

(1,851

)

Stock-based compensation

39

25

65

47

Interest expense

—

91

—

383

Depreciation

56

54

113

108

Amortization of intangibles

50

129

160

247

Other income adjustment

—

—

—

(1,350

)

Provision for income taxes

15

10

13

27

Non-GAAP Adjusted EBITDA

$

(2,660

)

$

(710

)

$

(4,367

)

$

(2,389

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240815414420/en/

Investor Relations Contact:

Simon Brewer 385-426-0565 investor_relations@clearone.com

http://investors.clearone.com

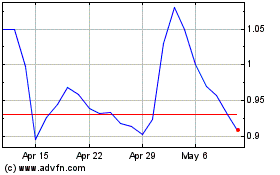

ClearOne (NASDAQ:CLRO)

Historical Stock Chart

From Nov 2024 to Dec 2024

ClearOne (NASDAQ:CLRO)

Historical Stock Chart

From Dec 2023 to Dec 2024