false

0001304421

0001304421

2024-12-20

2024-12-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

December 20, 2024

Consolidated Communications Holdings, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

000-51446 |

|

02-0636095 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 2116

South 17th Street, Mattoon, Illinois |

| 61938-5973 |

| (Address of principal executive offices) |

| (Zip Code) |

Registrant's telephone number, including area code: (217) 235-3311

Not Applicable

Former name or former address, if changed since

last report

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common

Stock - $0.01 par value |

|

CNSL |

|

The

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if

the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

On July 31, 2024, plaintiff

Thomas C. Longman (“Plaintiff”) filed a Verified Class Action Complaint (the “Complaint”) in

the Court of Chancery of the State of Delaware against Consolidated Communications Holdings, Inc., a Delaware corporation (the “Company”),

and the members of the board of directors of the Company (the “Board”), captioned Longman v. Consolidated Communications

Holdings, Inc., et al., C.A. No. 2024-0811-NAC (the “Action”). In the Action, Plaintiff alleged that

the Agreement and Plan of Merger, dated as of October 15, 2023, by and among Condor Holdings LLC, a Delaware limited liability company,

Condor Merger Sub Inc., a Delaware corporation, and the Company (the “Merger Agreement”) was not approved in accordance

with 8 Del. C. § 251 under the reasoning of the Court of Chancery’s decision in Sjunde AP-Fonden v. Activision Blizzard, Inc.

While the Company and the

Board deny all of the allegations of wrongdoing in the Complaint and believe that the Board’s adoption of the Merger Agreement complied

with Delaware law, on December 20, 2024, in order to eliminate any potential uncertainty and ambiguity created by the Complaint,

pursuant to Section 204 (“Section 204”) of the Delaware General Corporation Law, the Board ratified its approval

of the Merger Agreement and the Company’s entry into the Merger Agreement.

The statutory notice to the

Company’s stockholders required by Section 204 is set forth in Exhibit 99.1 hereto (the “Notice”) and

is incorporated by reference herein. The Notice sets forth additional information relating to the Complaint, the ratification of the Board’s

approval of the Merger Agreement and the Company’s entry into the Merger Agreement, and the rights of stockholders in regard to

the ratification.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

|

|

|

| |

CONSOLIDATED COMMUNICATIONS HOLDINGS, INC.

|

| |

By: |

/s/ Fred A. Graffam III |

| |

|

Name: |

Fred A. Graffam III |

| |

|

Title: |

Chief Financial Officer |

| |

|

|

|

Date: December 27, 2024

Exhibit 99.1

NOTICE OF RATIFICATION

BY THE

BOARD OF DIRECTORS OF CONSOLIDATED COMMUNICATIONS

HOLDINGS, INC.

(Pursuant to Section 204(g) of the Delaware

General Corporation Law)

Notice is hereby given, pursuant to Section 204

(“Section 204”) of the Delaware General Corporation Law (the “DGCL”), that on December 20,

2024, the Board of Directors (the “Board”) of Consolidated Communications Holdings, Inc., a Delaware corporation

(the “Company”), adopted resolutions approving the ratification of certain potentially defective corporate acts, as

described below (the “Ratification”).

The possible defects in corporate authorization

described below were alleged by plaintiff Thomas C. Longman (“Plaintiff”) in a Verified Class Action Complaint

(the “Complaint”) filed in the Court of Chancery of the State of Delaware (the “Court”) against

the Company and the Board on July 31, 2024, captioned Longman v. Consolidated Communications Holdings, Inc., et al.,

C.A. No. 2024-0811-NAC (the “Action”). In the Action, Plaintiff alleged that the Agreement and Plan of Merger,

dated October 15, 2023, by and among Condor Holdings LLC, a Delaware limited liability company, Condor Merger Sub Inc., a Delaware

corporation, and the Company (the “Merger Agreement”) was not approved in accordance with 8 Del. C. § 251 under

the reasoning of the Court of Chancery’s decision in Sjunde AP-Fonden v. Activision Blizzard, Inc. (“Activision”).

On October 14, 2023, the Board adopted resolutions

approving and declaring advisable a proposed form of the Merger Agreement, which was then executed on October 15, 2023. On February 29,

2024, the Court issued the Activision opinion, in which the Court held that a board of directors must approve a merger agreement

on final or essentially final terms under Section 251 of the DGCL and declined to dismiss a claim that a merger agreement was not

approved by a board of directors in accordance with Section 251 of the DGCL on the basis that the form of merger agreement approved

by the board of directors was not “essentially complete.”

Plaintiff has alleged in the Action that the Merger

Agreement and related transactions were not effected in accordance with Section 251 of the DGCL pursuant to the Court’s reasoning

in Activision. Specifically, the Action asserts that, although the Board approved and declared advisable a form of the Merger Agreement

on October 14, 2023, the form of Merger Agreement approved by the Board failed to contain certain final terms and exhibits material

to the Merger Agreement (including, among other matters, the consideration to be received by the Company’s stockholders, the parties

to the Merger, the outside date for closing the transactions contemplated by the Merger Agreement and disclosure schedules).

Although the Board believes that the Merger Agreement

was approved in accordance with Section 251 of the DGCL, in order to resolve the uncertainty created by the Complaint and to provide

clarity to the market, the Board determined that it was advisable and in the best interests of the Company and its stockholders to ratify,

and adopted resolutions approving the ratification pursuant to Section 204 of, the Board’s approval and declaration of the

advisability on October 14, 2023 of the Merger Agreement, including all the information, agreements, schedules and instruments attached

thereto or incorporated therein by reference, and the Company’s entry into the final Merger Agreement, and the execution thereof

on October 15, 2023.

Any claim that the defective corporate acts

identified in this notice and ratified by the Board pursuant to Section 204 is void or voidable due to the failure of authorization,

or any claim that the Court should declare in its discretion that the Ratification not be effective or be effective only on certain conditions,

must be brought within 120 days from the date of this notice, December 27, 2024.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

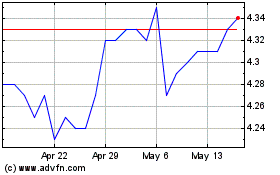

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Feb 2024 to Feb 2025