true

0000933136

0000933136

2024-10-31

2024-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 16, 2025 (October 31, 2024)

Mr. Cooper Group Inc.

(Exact Name of Registrant as Specified in Charter)

| |

|

|

| Delaware |

001-14667 |

91-1653725 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

8950 Cypress Waters Blvd.

Coppell, TX 75019

(Address of Principal Executive Offices, and Zip Code)

469-549-2000

Registrant’s Telephone Number, Including Area Code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value per share |

COOP |

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

On

November 6, 2024, Mr. Cooper Group Inc. (the “Company”) filed a Current Report on Form 8-K (the “Initial

Report”) to report that on October 31, 2024, Nationstar Mortgage LLC (“Nationstar”), a Delaware limited liability

company and operating subsidiary of the Company, completed its previously announced acquisition (the “Acquisition”) of

certain assets, including mortgage servicing rights and related advances, customer relationship intangibles associated with

subservicing contracts, and third-party origination operations (the “Acquired Business”) from Flagstar Bank, N.A., a

national banking association and a wholly owned subsidiary of Flagstar Financial, Inc. (f/k/a New York Community Bancorp,

Inc.).

This Current Report on Form 8-K/A (this “Amendment”) amends

and supplements the Initial Report to provide financial statements and the pro forma financial information required by Item 9.01 of Form

8-K. No other modifications to the Initial Report are being made by this Amendment. This Amendment should be read in connection with the

Initial Report.

| Item 9.01 |

Financial Statements and Exhibits. |

(a) Financial statements of business acquired.

The audited abbreviated statement of assets acquired and liabilities assumed

of the Acquired Business as of December 31, 2023 and the audited abbreviated statement of revenues and direct expenses of the Acquired

Business for the year ended December 31, 2023 are attached hereto as Exhibit 99.1 and incorporated herein by reference herein.

The unaudited abbreviated interim financial statements of the Acquired

Business as of and for the nine months ended September 30, 2024 are attached hereto as Exhibit 99.2 and incorporated herein by reference

herein.

(b) Pro forma financial information.

The unaudited pro forma financial information of the Acquired Business required

to be filed in connection with the acquisition described in Item 2.01 in the Original Form 8-K is filed as Exhibit 99.3.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

| |

Mr. Cooper Group Inc. |

| |

|

|

| Date: January 16, 2025 |

By: |

/s/ Kurt Johnson |

| |

|

Kurt Johnson

Executive Vice President & Chief Financial Officer |

Exhibit 23.1

Consent of Independent Auditors

We consent to the incorporation by reference in the registration statements (Nos. 333-231552

and 333-226468) on Form S-8 of Mr. Cooper Group Inc. of our report dated January 15, 2025, with respect to the abbreviated financial statements

of the Mortgage Servicing & Third-Party Origination Business of Flagstar Financial, Inc. which report appears in the Form 8-K/A of

Mr. Cooper Group Inc.

/s/ KPMG LLP

New York, New York

January 15, 2025

Exhibit 99.1

| |

Table of Contents |

|

| |

|

|

| Abbreviated financial statements as of and for the year ended December 31, 2023 |

|

| |

|

|

| |

Independent Auditors Report |

2 |

| |

Abbreviated Financial Statements |

4 |

| |

Abbreviated Statement of Assets Acquired and Liabilities Assumed as of December 31, 2023 |

4 |

| |

Abbreviated Statement of Revenues and Direct Expenses for the year ended December 31, 2023 |

5 |

| |

Notes to Abbreviated Financial Statements |

|

| |

Note 1 - Description of Transaction and Basis of Presentation |

6 |

| |

Note 2 - Mortgage Servicing Rights |

7 |

| |

Note 3 - Advances and Other Receivables |

7 |

| |

Note 4 - Other Assets and Other Liabilities |

7 |

| |

Note 5 - Subsequent Events |

8 |

Independent Auditors’ Report

To the Board of Directors

Flagstar Financial, Inc.:

Report on the Abbreviated Financial Statements

Opinion

We have audited the abbreviated financial statements of the Mortgage Servicing & Third-Party

Origination Business of Flagstar Financial, Inc. (collectively, the Company), that consists of substantially all of the related mortgage

servicing and third-party origination business activities, which comprise the abbreviated statement of assets acquired and liabilities

assumed as of December 31, 2023 and the related abbreviated statement of revenues and direct expenses for the year ended December 31,

2023, and the related notes (the abbreviated financial statements).

In our opinion, the accompanying abbreviated financial statements present

fairly, in all material respects, the financial position of the Company as of December 31, 2023 and the revenues and direct expenses for

the year ended December 31, 2023, in accordance with U.S. generally accepted accounting principles.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United

States of America (GAAS). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for

the Audit of the Abbreviated Financial Statements section of our report. We are required to be independent of the Company and to meet

our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Emphasis of Matter — Basis of Accounting

We draw attention to Note 1 to the abbreviated financial statements, which describes that the

accompanying abbreviated financial statements were prepared for the purpose of complying with Rule 3-05 of Regulation S-X of the Securities

and Exchange Commission and are not intended to be a complete presentation of assets, liabilities, revenues and expenses. As a result,

the financial statements may not be suitable for another purpose. Our opinion is not modified with respect to this matter.

Responsibilities of Management for the Abbreviated Financial Statements

Management is responsible for the preparation and fair presentation of the abbreviated financial

statements in accordance with U.S. generally accepted accounting principles, and for the design, implementation, and maintenance of internal

control relevant to the preparation and fair presentation of the abbreviated financial statements that are free from material misstatement,

whether due to fraud or error.

Auditors’ Responsibilities for the Audit of the Abbreviated Financial Statements

Our objectives are to obtain reasonable assurance about whether the abbreviated financial statements

as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our

opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit

conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement

resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations,

or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or

in the aggregate, they would influence the judgment made by a reasonable user based on the abbreviated financial statements.

In performing an audit in accordance with GAAS, we:

| • | Exercise professional judgment and maintain professional skepticism throughout the audit. |

| • | Identify and assess the risks of material misstatement of the abbreviated financial statements, whether due to fraud or error, and

design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding

the amounts and disclosures in the abbreviated financial statements. |

| • | Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the

circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly,

no such opinion is expressed. |

| • | Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management,

as well as evaluate the overall presentation of the abbreviated financial statements. |

| • | Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about

the Company’s ability to continue as a going concern for a reasonable period of time. |

We are required to communicate with those charged with governance regarding, among other matters,

the planned scope and timing of the audit, significant audit findings, and certain internal control–related matters that we identified

during the audit.

/s/ KPMG LLP

New York, New York

January 15, 2025

Mortgage Servicing & Third-Party Origination Business of Flagstar

Financial, Inc.

Abbreviated Statement of Assets Acquired and Liabilities Assumed

| | |

December 31, 2023 |

| (in millions) | |

|

| ASSETS: | |

| | |

| Mortgage servicing rights at fair value | |

$ | 1,111 | |

| Advances and other receivables | |

| 79 | |

| Other assets | |

| 456 | |

| Total assets | |

$ | 1,646 | |

| LIABILITIES: | |

| | |

| Other liabilities | |

| 461 | |

| Total liabilities | |

| 461 | |

| | |

| | |

| Net Assets | |

$ | 1,185 | |

The accompanying notes are an integral part of these Abbreviated Financial Statements

Mortgage Servicing & Third-Party Origination Business of Flagstar

Financial, Inc.

Abbreviated Statement of Revenues and Direct Expenses

| | |

Year ended

December 31, 2023 |

| (in millions) | |

|

| Revenues: | |

| | |

| Service related, net(1)(2) | |

$ | 370 | |

| Net gain on mortgage loans held for sale | |

| 64 | |

| Total revenues | |

$ | 434 | |

| | |

| | |

| Direct Expenses: | |

| | |

| Salaries, wages, and benefits | |

| 72 | |

| General and administrative | |

| 111 | |

| Total direct expenses | |

$ | 183 | |

| | |

| | |

| Other Expenses: | |

| | |

| Interest expense(3) | |

| 168 | |

| | |

| | |

| Net revenues after expenses | |

$ | 83 | |

| (1) | Includes $7 million of intercompany service fees to other non-mortgage units which are not presented herein. |

| (2) | Includes $69 million of other loan fees and charges related to third-party originations and other servicing

activities. |

| (3) | Interest expense on custodial deposits paid externally. Intercompany interest expense has been excluded.

Any interest income earned on custodial deposits has also been excluded from the Abbreviated Statement of Revenues and Direct Expenses

as the amount is not reasonably quantifiable. |

The accompanying notes are an integral part of these Abbreviated Financial

Statements

Note 1 - Description of Transaction and Basis of Presentation

Description of Transaction

On October 31, 2024, Flagstar Bank, National Association

(“Flagstar”), the wholly owned subsidiary of Flagstar Financial, Inc. (the “Company”), completed its previously

announced sale of certain assets, including mortgage servicing rights, subservicing contracts, and third-party origination assets (the

“Transaction”), to Nationstar Mortgage LLC, a Delaware limited liability company and operating subsidiary of Mr. Cooper Group

Inc. (“Nationstar”), for an aggregate purchase price of approximately $1.3 billion in cash. The Transaction was effected pursuant

to the terms of (1) the Agreement for the Bulk Purchase and Sale of Mortgage Servicing Rights, dated as of July 24, 2024, by and between

Flagstar and Nationstar (the “MSR Purchase Agreement”) and (2) the related Asset Purchase Agreement, dated as of July 24,

2024, by and between Flagstar and Nationstar (the “Asset Purchase Agreement”).

Basis of Presentation

The accompanying Abbreviated Statement of Assets Acquired

and Liabilities Assumed as of December 31, 2023 and the related Abbreviated Statement of Revenues and Direct Expenses for the year ended

December 31, 2023 (collectively, the “Abbreviated Financial Statements”) of the Mortgage Servicing & Third-Party Origination

Business of the Company have been prepared for the purpose of complying with Rule 3-05 of Regulation S-X of the United States Securities

and Exchange Commission (“SEC”) and for inclusion in Mr. Cooper Group Inc.’s filings with the SEC.

The Abbreviated Financial Statements of the Company

have been prepared using U.S. generally accepted accounting principles for the purpose of complying with Rule 3-05 of Regulation S-X of

the SEC and are not intended to be a complete presentation of assets, liabilities, revenues, expenses or cash flows. These financial statements

were prepared in lieu of full financial statements or carve-out financial statements. These Abbreviated Financial Statements have been

derived from the Company’s historical accounting records. In the opinion of management, the accompanying Abbreviated Financial Statements

contain all adjustments considered necessary to fairly present the assets acquired and liabilities assumed and the revenues and direct

expenses. The Abbreviated Financial Statements do not necessarily represent the assets, liabilities, revenues or direct expenses of the

Mortgage Servicing & Third-Party Origination Business of the Company had it been operated as a separate standalone entity.

The Abbreviated Financial Statements of the Company

conform to U.S. generally accepted accounting principles and to general practices within the banking industry. The preparation of financial

statements in conformity with U.S. generally accepted accounting principles requires the Company to make estimates and judgments that

affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the abbreviated

financial statements, and the reported amounts of revenues and expenses during the reporting period. Estimates are used in connection

with the valuation of the mortgage servicing rights. These Abbreviated Financial Statements include direct costs and are exclusive of

indirect allocations.

Mortgage Servicing Rights ("MSRs")

The Company

purchases and originates mortgage loans for sale to the secondary market and sells the loans on either a servicing-retained or servicing-released

basis. If the Company retains the right to service the loan, an MSR is created at the time of sale which is recorded at fair value. The

Company uses an internal valuation model that utilizes an option-adjusted spread, constant prepayment speeds, costs to service and other

assumptions to determine the fair value of MSRs.

Management obtains

third-party valuations of the MSR portfolio on a quarterly basis from independent valuation services to assess the reasonableness of the

fair value calculated by our internal valuation model. Changes in the fair value of our MSRs are reported on the Abbreviated Statement

of Revenues and Direct Expenses in service related revenue. For further information, see Note 2 - Mortgage Servicing Rights.

Loans with Government Guarantees

The Company

originates government guaranteed loans which are pooled and sold as Ginnie Mae MBS. Pursuant to Ginnie Mae servicing guidelines, the Company

has the unilateral right to repurchase loans securitized in Ginnie Mae pools that are due, but unpaid, for three consecutive months. As

a result, once the delinquency criteria have been met, and regardless of whether the repurchase option has been exercised, the Company

accounts for the loans as if they had been repurchased.

If the loan

is repurchased, the liability is cash settled and the loan with government guarantee remains. Once repurchased, the Company works to cure

the outstanding loans such that they are re-eligible for sale or may begin foreclosure and recover losses through a claims process with

the government agency, as an approved lender.

Note 2 - Mortgage Servicing Rights

The Company has investments in MSRs that result from

the sale of loans to the secondary market for which we retain the servicing. The Company accounts for MSRs at their fair value. A primary

risk associated with MSRs is the potential reduction in fair value as a result of higher than anticipated prepayments due to loan refinancing

prompted, in part, by declining interest rates or government intervention. Conversely, these assets generally increase in value in a rising

interest rate environment to the extent that prepayments are slower than anticipated.

Changes in the fair value of residential first mortgage

MSRs were as follows:

| (in millions) | |

Year Ended

December 31, 2023 |

| Fair value of MSRs at beginning of period | |

$ | 1,033 | |

| Additions from loans sold with servicing retained | |

| 208 | |

| Reductions from sales | |

| (51 | ) |

| Decrease in MSR fair value due to pay-offs, pay-downs, run-off, model changes, and other (1) | |

| (80 | ) |

| Changes in estimates of fair value due to interest rate risk (1) (2) | |

| 1 | |

| Fair value of MSRs at end of period | |

$ | 1,111 | |

| (1) | Changes in fair value are included within service related revenue on the Abbreviated Statement of Revenues

and Direct Expenses. |

| (2) | Represents estimated MSR value change resulting primarily from market-driven changes. |

Contractual

servicing and subservicing fees, including late fees and other ancillary income, are included within service related revenue on the Abbreviated

Statement of Revenues and Direct Expenses. Subservicing fee income is recorded for fees earned on subserviced loans, net of third-party

subservicing costs.

The following

table summarizes income and fees associated with owned MSRs and our mortgage loans subserviced for others:

| (in millions) | |

Year Ended

December 31, 2023 |

| Servicing fees, ancillary income and late fees (1) | |

$ | 227 | |

| Decrease in MSR fair value due to pay-offs, pay-downs, run-off, model changes and other | |

| (80 | ) |

| Changes in fair value due to interest rate risk | |

| 1 | |

| Net transaction costs | |

| 2 | |

| Subservicing fees, ancillary income and late fees (1) | |

| 154 | |

| Other servicing charges | |

| (3 | ) |

| Other loan fees and charges related to third-party originations and other servicing activities | |

| 69 | |

| Total income and fees included in service related revenue | |

$ | 370 | |

| (1) | Servicing fees are recorded on an accrual basis. Ancillary income and late fees are recorded on a cash

basis. |

Note 3 - Advances and Other Receivables

Advances and other receivables are substantially all

related to corporate and escrow advances, which are short-term receivables related to advances made by the Company in connection with

the servicing of mortgage loans. Corporate and escrow advances classified as advances and other receivables totaled $79 million at December

31, 2023. The allowance for credit losses on advances and other receivables is inconsequential as these receivables are short-term corporate

and escrow advances arising in the normal course of business, with no history of material loss, and repayment is expected in full.

Note 4 - Other Assets and Other Liabilities

The Company

originates government guaranteed loans which are pooled and sold as Ginnie Mae MBS. Pursuant to Ginnie Mae servicing guidelines, the Company

has the unilateral right to repurchase loans securitized in Ginnie Mae pools that are due, but unpaid, for three consecutive months. As

a result, once the delinquency criteria have been met, and regardless of whether the repurchase option has been exercised, the Company

accounts for the loans as if they had been repurchased. The balance of these loans and the corresponding liability was approximately

$456 million as of December 31, 2023, recorded within Other Assets and Other Liabilities, respectively,

in the Abbreviated Statement of Assets Acquired and Liabilities Assumed.

Note 5 - Subsequent Events

Subsequent events

were evaluated through January 15, 2025, the date on which these Abbreviated Financial Statements were available to be issued, and no

events were identified for disclosure.

8

Exhibit 99.2

| |

Table of Contents |

|

| |

|

|

| Abbreviated financial statements as of September 30, 2024 and December 31, 2023 |

|

| |

|

|

| |

Abbreviated Interim Financial Statements |

2 |

| |

Abbreviated Statements of Assets Acquired and Liabilities Assumed at September 30, 2024 (unaudited) and December 31, 2023 |

2 |

| |

Abbreviated Statements of Revenues and Direct Expenses - For the nine months ended September 30, 2024 (unaudited) and year-ended December 31, 2023 |

3 |

| |

Notes to Abbreviated Financial Statements (unaudited) |

|

| |

Note 1 - Description of Transaction and Basis of Presentation |

4 |

| |

Note 2 - Mortgage Servicing Rights |

5 |

| |

Note 3 - Advances and Other Receivables |

5 |

| |

Note 4 - Other Assets and Other Liabilities |

6 |

Mortgage Servicing & Third-Party Origination Business of Flagstar

Financial, Inc.

Abbreviated Statement of Assets Acquired and Liabilities Assumed

| | |

September 30, 2024

(unaudited) | |

December 31, 2023 |

| (in millions) | |

| |

|

| ASSETS: | |

| | | |

| | |

| Mortgage servicing rights at fair value | |

$ | 1,105 | | |

$ | 1,111 | |

| Advances and other receivables | |

| 59 | | |

| 79 | |

| Other assets | |

| 465 | | |

| 456 | |

| Total assets | |

$ | 1,629 | | |

$ | 1,646 | |

| LIABILITIES: | |

| | | |

| | |

| Other liabilities | |

| 470 | | |

| 461 | |

| Total liabilities | |

| 470 | | |

| 461 | |

| | |

| | | |

| | |

| Net Assets | |

$ | 1,159 | | |

$ | 1,185 | |

The accompanying notes are an integral part of these Abbreviated Financial Statements

Mortgage Servicing & Third-Party Origination Business of Flagstar

Financial, Inc.

Abbreviated Statements of Revenues and Direct Expenses

| | |

Nine Months Ended

September 30, 2024

(unaudited) | |

Year ended

December 31, 2023 |

| (in millions) | |

| |

|

| Revenues: | |

| | | |

| | |

| Service related, net(1)(2) | |

$ | 251 | | |

$ | 370 | |

| Net gain on mortgage loans held for sale | |

| 45 | | |

| 64 | |

| Total revenues | |

$ | 296 | | |

$ | 434 | |

| | |

| | | |

| | |

| Direct expenses: | |

| | | |

| | |

| Salaries, wages, and benefits | |

| 55 | | |

| 72 | |

| General and administrative | |

| 78 | | |

| 111 | |

| Total direct expenses | |

$ | 133 | | |

$ | 183 | |

| | |

| | | |

| | |

| Other Expenses: | |

| | | |

| | |

| Interest expense(3) | |

| 124 | | |

| 168 | |

| | |

| | | |

| | |

| Net revenue after direct expenses | |

$ | 39 | | |

$ | 83 | |

| (1) | Includes $4 million and $7 million at September 30, 2024 and December 31, 2023, respectively, of intercompany

service fees to other non-mortgage units which are not presented herein |

| (2) | Includes $64 million and $69 million at September 30, 2024 and December 31, 2023, respectively, of other

loan fees and charges related to third-party originations and other servicing activities. |

| (3) | Interest expense on custodial deposits paid externally. Intercompany interest expense has been excluded.

Any interest income earned on custodial deposits has also been excluded from the Abbreviated Statements of Revenues and Direct Expenses

as the amount is not reasonably quantifiable. |

The accompanying notes are an integral part of these Abbreviated Financial

Statements

Note 1 - Description of Transaction and Basis of Presentation

Description of Transaction

On October 31, 2024, Flagstar Bank, National Association

(“Flagstar”), the wholly owned subsidiary of Flagstar Financial, Inc. (the “Company”), completed its previously

announced sale of certain assets, including mortgage servicing rights, subservicing contracts, and third-party origination assets (the

“Transaction”), to Nationstar Mortgage LLC, a Delaware limited liability company and operating subsidiary of Mr. Cooper Group

Inc. (“Nationstar”), for an aggregate purchase price of approximately $1.3 billion in cash. The Transaction was effected pursuant

to the terms of (1) the Agreement for the Bulk Purchase and Sale of Mortgage Servicing Rights, dated as of July 24, 2024, by and between

Flagstar and Nationstar (the “MSR Purchase Agreement”) and (2) the related Asset Purchase Agreement, dated as of July 24,

2024, by and between Flagstar and Nationstar (the “Asset Purchase Agreement”).

Basis of Presentation

The accompanying Abbreviated Statements of Assets

Acquired and Liabilities Assumed as of September 30, 2024 and December 31, 2023 and the related Abbreviated Statements of Revenues and

Direct Expenses for the nine months ended September 30, 2024 and year ended December 31, 2023 (collectively, the “Abbreviated Financial

Statements”) of the Mortgage Servicing & Third-Party Origination Business of the Company have been prepared for the purpose

of complying with Rule 3-05 of Regulation S-X of the United States Securities and Exchange Commission (“SEC”) and for inclusion

in Mr. Cooper Group Inc.’s filings with the SEC.

The Abbreviated Financial Statements of the Company

have been prepared using U.S. generally accepted accounting principles for the purpose of complying with Rule 3-05 of Regulation S-X of

the SEC and are not intended to be a complete presentation of assets, liabilities, revenues, expenses or cash flows. These financial statements

were prepared in lieu of full financial statements or carve-out financial statements.. These Abbreviated Financial Statements have been

derived from the Company’s historical accounting records. In the opinion of management, the accompanying Abbreviated Financial Statements

contain all adjustments considered necessary to fairly present the assets acquired and liabilities assumed and the revenues and direct

expenses. The Abbreviated Financial Statements do not necessarily represent the assets, liabilities, revenues or direct expenses of the

Mortgage Servicing & Third-Party Origination Business of the Company had it been operated as a separate standalone entity.

The Abbreviated Financial Statements of the Company

conform to U.S. generally accepted accounting principles and to general practices within the banking industry. The preparation of financial

statements in conformity with U.S. generally accepted accounting principles requires the Company to make estimates and judgments that

affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the abbreviated

financial statements, and the reported amounts of revenues and expenses during the reporting period. Estimates are used in connection

with the valuation of the mortgage servicing rights. These Abbreviated Financial Statements include direct costs and are exclusive of

indirect allocations.

Mortgage Servicing Rights ("MSRs")

The Company

purchases and originates mortgage loans for sale to the secondary market and sells the loans on either a servicing-retained or servicing-released

basis. If the Company retains the right to service the loan, an MSR is created at the time of sale which is recorded at fair value. The

Company uses an internal valuation model that utilizes an option-adjusted spread, constant prepayment speeds, costs to service and other

assumptions to determine the fair value of MSRs.

Management obtains

third-party valuations of the MSR portfolio on a quarterly basis from independent valuation services to assess the reasonableness of the

fair value calculated by our internal valuation model. Changes in the fair value of our MSRs are reported on the Abbreviated Statement

of Revenues and Direct Expenses in service related revenue. For further information, see Note 2 - Mortgage Servicing Rights.

Loans with Government Guarantees

The Company

originates government guaranteed loans which are pooled and sold as Ginnie Mae MBS. Pursuant to Ginnie Mae servicing guidelines, the Company

has the unilateral right to repurchase loans securitized in Ginnie Mae pools that are due, but unpaid, for three consecutive months. As

a result, once the delinquency criteria have been met, and regardless of whether the repurchase option has been exercised, the Company

accounts for the loans as if they had been repurchased.

If the loan

is repurchased, the liability is cash settled and the loan with government guarantee remains. Once repurchased, the Company works to cure

the outstanding loans such that they are re-eligible for sale or may begin foreclosure and recover losses through a claims process with

the government agency, as an approved lender.

Note 2 - Mortgage Servicing Rights

The Company has investments in MSRs that result from

the sale of loans to the secondary market for which we retain the servicing. The Company accounts for MSRs at their fair value. A primary

risk associated with MSRs is the potential reduction in fair value as a result of higher than anticipated prepayments due to loan refinancing

prompted, in part, by declining interest rates or government intervention. Conversely, these assets generally increase in value in a rising

interest rate environment to the extent that prepayments are slower than anticipated.

Changes in the fair value of residential first mortgage

MSRs were as follows:

| (in millions) | |

Nine Months Ended

September 30, 2024

(unaudited) | |

Year Ended

December 31, 2023 |

| Fair value of MSRs at beginning of period | |

$ | 1,111 | | |

$ | 1,033 | |

| Additions from loans sold with servicing retained | |

| 158 | | |

| 208 | |

| Reductions from sales | |

| (69 | ) | |

| (51 | ) |

| Decrease in MSR fair value due to pay-offs, pay-downs, run-off, model changes, and other (1) | |

| (91 | ) | |

| (80 | ) |

| Changes in estimates of fair value due to interest rate risk (1) (2) | |

| (4 | ) | |

| 1 | |

| Fair value of MSRs at end of period | |

$ | 1,105 | | |

$ | 1,111 | |

| (1) | Changes in fair value are included within service related revenue on the Abbreviated Statements of Revenues

and Direct Expenses. |

| (2) | Represents estimated MSR value change resulting primarily from market-driven changes. |

Contractual

servicing and subservicing fees, including late fees and other ancillary income, are included within service related revenue on the Abbreviated

Statement of Revenues and Direct Expenses. Subservicing fee income is recorded for fees earned on subserviced loans, net of third-party

subservicing costs.

The following

table summarizes income and fees associated with owned MSRs and our mortgage loans subserviced for others:

| (in millions) | |

Nine Months Ended

September 30, 2024

(unaudited) | |

Year Ended

December 31, 2023 |

| Servicing fees, ancillary income and late fees (1) | |

$ | 176 | | |

$ | 227 | |

| Decrease in MSR fair value due to pay-offs, pay-downs, run-off, model changes and other | |

| (91 | ) | |

| (80 | ) |

| Changes in fair value due to interest rate risk | |

| (4 | ) | |

| 1 | |

| Net transaction costs | |

| - | | |

| 2 | |

| Subservicing fees, ancillary income and late fees (1) | |

| 104 | | |

| 154 | |

| Other servicing charges | |

| 2 | | |

| (3 | ) |

| Other loan fees and charges related to third-party originations and other servicing activities | |

| 64 | | |

| 69 | |

| Total income and fees included in service related revenue | |

$ | 251 | | |

$ | 370 | |

| (1) | Servicing fees are recorded on an accrual basis. Ancillary income and late fees are recorded on a cash

basis. |

Note 3 - Advances and Other Receivables

Advances and other receivables are substantially all related to corporate

and escrow advances, which are short-term receivables related to advances made by the Company in connection with the servicing of mortgage

loans. Corporate and escrow advances classified as advances and other receivables totaled $59 million and $79 million at September 30,

2024 and December 31, 2023, respectively. The allowance for credit losses on advances and other receivables is inconsequential as these

receivables are short-term corporate and escrow advances arising in the normal course of business, with no history of material loss, and

repayment is expected in full.

Note 4 - Other Assets and Other Liabilities

The Company

originates government guaranteed loans which are pooled and sold as Ginnie Mae MBS. Pursuant to Ginnie Mae servicing guidelines, the

Company has the unilateral right to repurchase loans securitized in Ginnie Mae pools that are due, but unpaid, for three consecutive

months. As a result, once the delinquency criteria have been met, and regardless of whether the repurchase option has been exercised,

the Company accounts for the loans as if they had been repurchased. The balance of these loans and the corresponding liability were approximately

$465 million and $456 million as of September 30, 2024 and December 31, 2023, respectively, recorded

within Other Assets and Other Liabilities, respectively, in the Abbreviated Statement of Assets Acquired and Liabilities Assumed.

6

Exhibit 99.3

Unaudited Pro Forma Condensed Combined Financial Statements

The following table shows unaudited pro forma condensed combined financial

statements about the financial condition and results of operations, including per share data, after giving effect to the acquisition of

certain mortgage operation assets of Flagstar Bank, N.A. (“Flagstar”) by Mr. Cooper Group. Inc. (“Mr. Cooper) (the “Flagstar

Acquisition”). The unaudited pro forma condensed combined financial statements reflects the Flagstar Acquisition as an asset acquisition

by Mr. Cooper with the purchase price allocated to the acquired net assets on a relative fair value basis as of the date the Flagstar

Acquisition is completed.

The unaudited pro forma condensed combined balance sheet gives effect to

the Flagstar Acquisition as if the transactions had occurred on September 30, 2024. The unaudited pro forma condensed combined statements

of operations for the nine months ended September 30, 2024 and the year ended December 31, 2023 give effect to the transactions as if

the transactions had become effective on January 1, 2023. The unaudited selected pro forma condensed combined financial statements have

been derived from and should be read in conjunction with the consolidated financial statements and related notes of Mr. Cooper, which

were included in Mr. Cooper’s Annual Report on Form 10-K for the year ended December 31, 2023 and Mr. Cooper’s Quarterly Report

on Form 10-Q for the quarterly period ended September 30, 2024, and the abbreviated financial statements and related notes of Flagstar,

which were included as Exhibits 99.1 and 99.2 to this Current Report on Form 8-K/A.

The unaudited pro forma condensed combined financial statements are presented

for illustrative purposes only and do not indicate the financial results of the combined business had the assets acquired and liabilities

assumed actually been combined at the beginning of the period presented, nor the impact of possible business model changes.

UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEET

AS OF SEPTEMBER 30, 2024

(millions of dollars)

| | |

Mr. Cooper Historical | |

Flagstar Historical | |

Pro Forma Adjustments | |

Ref (Note 3) | |

Combined Pro Forma |

| ASSETS: | |

| | | |

| | | |

| | | |

| |

| | |

| Cash and cash equivalent | |

$ | 733 | | |

$ | - | | |

$ | (108 | ) | |

(a)(f) | |

$ | 625 | |

| Restricted cash | |

| 186 | | |

| - | | |

| - | | |

| |

| 186 | |

| Mortgage servicing rights at fair value | |

| 10,035 | | |

| 1,105 | | |

| 64 | | |

(b) | |

| 11,204 | |

| Advance and other receivables, net | |

| 940 | | |

| 59 | | |

| (18 | ) | |

(b) | |

| 981 | |

| Mortgage loans held for sale | |

| 1,962 | | |

| - | | |

| - | | |

| |

| 1,962 | |

| Property and equipment, net | |

| 58 | | |

| - | | |

| - | | |

| |

| 58 | |

| Intangible assets | |

| 23 | | |

| - | | |

| 105 | | |

(c) | |

| 128 | |

| Deferred tax assets, net | |

| 315 | | |

| - | | |

| 22 | | |

(e) | |

| 337 | |

| Other assets | |

| 1,934 | | |

| 465 | | |

| (464 | ) | |

(b)(d) | |

| 1,935 | |

| Total assets | |

$ | 16,186 | | |

$ | 1,629 | | |

$ | (399 | ) | |

| |

$ | 17,416 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY: | |

| | | |

| | | |

| | | |

| |

| | |

| Unsecured senior notes, net | |

$ | 4,885 | | |

$ | - | | |

$ | - | | |

| |

$ | 4,885 | |

| Advance, warehouse and MSR facilities, net | |

| 4,379 | | |

| - | | |

| 1,150 | | |

(f) | |

| 5,529 | |

| Payables and accrued liabilities | |

| 1,841 | | |

| 470 | | |

| (412 | ) | |

(b)(d) | |

| 1,899 | |

| MSR related liabilities - nonrecourse at fair value | |

| 443 | | |

| - | | |

| - | | |

| |

| 443 | |

| Total liabilities | |

| 11,548 | | |

| 470 | | |

| 738 | | |

| |

| 12,756 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Stockholders’ equity: | |

| | | |

| | | |

| | | |

| |

| | |

| Common stock | |

| 1 | | |

| - | | |

| - | | |

| |

| 1 | |

| Additional paid-in-capital | |

| 1,068 | | |

| - | | |

| - | | |

| |

| 1,068 | |

| Retained earnings | |

| 4,767 | | |

| - | | |

| 22 | | |

(e) | |

| 4,789 | |

| Treasury shares | |

| (1,198 | ) | |

| - | | |

| - | | |

| |

| (1,198 | ) |

| Total stockholders’ equity | |

| 4,638 | | |

| - | | |

| 22 | | |

| |

| 4,660 | |

| Total liabilities and stockholders’ equity | |

$ | 16,186 | | |

$ | 470 | | |

$ | 760 | | |

| |

$ | 17,416 | |

See accompanying notes to the unaudited pro forma condensed

combined financial statements.

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

NINE MONTHS ENDED SEPTEMBER 30, 2024

(millions of dollars, except for per share data)

| | |

Mr. Cooper

Historical | |

Flagstar Historical | |

Pro Forma Adjustments | |

Ref (Note 3) | |

Combined Pro Forma |

| Revenues | |

| | | |

| | | |

| | | |

| |

| | |

| Service related, net | |

$ | 1,251 | | |

$ | 251 | | |

$ | (4 | ) | |

(g) | |

$ | 1,498 | |

| Net gain on mortgage loans held for sale | |

| 320 | | |

| 45 | | |

| - | | |

| |

| 365 | |

| Total revenues | |

| 1,571 | | |

| 296 | | |

| (4 | ) | |

| |

| 1,863 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Expenses | |

| | | |

| | | |

| | | |

| |

| | |

| Salaries, wages and benefits | |

| 509 | | |

| 55 | | |

| - | | |

| |

| 564 | |

| General and administrative | |

| 443 | | |

| 78 | | |

| 15 | | |

(c) | |

| 536 | |

| Total expenses | |

| 952 | | |

| 133 | | |

| 15 | | |

| |

| 1,100 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Other income (expense), net: | |

| | | |

| | | |

| | | |

| |

| | |

| Interest income | |

| 574 | | |

| - | | |

| - | | |

(h) | |

| 574 | |

| Interest expense | |

| (556 | ) | |

| (124 | ) | |

| (67 | ) | |

(i) | |

| (747 | ) |

| Other income | |

| (16 | ) | |

| - | | |

| - | | |

| |

| (16 | ) |

| Total other income (expense), net | |

| 2 | | |

| (124 | ) | |

| (67 | ) | |

| |

| (189 | ) |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Income before income tax expense | |

| 621 | | |

| 39 | | |

| (86 | ) | |

| |

| 574 | |

| Less: Income tax expense | |

| 156 | | |

| - | | |

| (22 | ) | |

(e) | |

| 134 | |

| Net income | |

$ | 465 | | |

$ | 39 | | |

$ | (64 | ) | |

| |

$ | 440 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Earnings per share | |

| | | |

| | | |

| | | |

| |

| | |

| Basic | |

$ | 7.21 | | |

| | | |

| | | |

| |

$ | 6.82 | |

| Diluted | |

$ | 7.06 | | |

| | | |

| | | |

| |

$ | 6.68 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Weighted average shares of common stock outstanding (in thousands): | |

| | | |

| | | |

| | | |

| |

| | |

| Basic | |

| 64,503 | | |

| | | |

| | | |

| |

| 64,503 | |

| Diluted | |

| 65,859 | | |

| | | |

| | | |

| |

| 65,859 | |

See accompanying Notes to the unaudited pro forma condensed

combined financial statements.

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

YEAR ENDED DECEMBER 31, 2023

(millions of dollars, except for per share data)

| | |

Mr. Cooper

Historical | |

Flagstar Historical | |

Pro Forma Adjustments | |

Ref (Note 3) | |

Combined Pro Forma |

| Revenues | |

| | | |

| | | |

| | | |

| |

| | |

| Service related, net | |

$ | 1,440 | | |

$ | 370 | | |

$ | (7 | ) | |

(g) | |

$ | 1,803 | |

| Net gain on mortgage loans held for sale | |

| 354 | | |

| 64 | | |

| - | | |

| |

| 418 | |

| Total revenues | |

| 1,794 | | |

| 434 | | |

| (7 | ) | |

| |

| 2,221 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Expenses | |

| | | |

| | | |

| | | |

| |

| | |

| Salaries, wages and benefits | |

| 634 | | |

| 72 | | |

| - | | |

| |

| 706 | |

| General and administrative | |

| 538 | | |

| 111 | | |

| 26 | | |

(c) | |

| 675 | |

| Total expenses | |

| 1,172 | | |

| 183 | | |

| 26 | | |

| |

| 1,381 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Other income (expense), net: | |

| | | |

| | | |

| | | |

| |

| | |

| Interest income | |

| 528 | | |

| - | | |

| - | | |

(h) | |

| 528 | |

| Interest expense | |

| (537 | ) | |

| (168 | ) | |

| (89 | ) | |

(i) | |

| (794 | ) |

| Other income | |

| 41 | | |

| - | | |

| - | | |

| |

| 41 | |

| Total other income (expense), net | |

| 32 | | |

| (168 | ) | |

| (89 | ) | |

| |

| (225 | ) |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Income before income tax expense | |

| 654 | | |

| 83 | | |

| (122 | ) | |

| |

| 615 | |

| Less: Income tax expense | |

| 154 | | |

| - | | |

| (31 | ) | |

(e) | |

| 123 | |

| Net income | |

$ | 500 | | |

$ | 83 | | |

$ | (91 | ) | |

| |

$ | 492 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Earnings per share | |

| | | |

| | | |

| | | |

| |

| | |

| Basic | |

$ | 7.46 | | |

| | | |

| | | |

| |

$ | 7.34 | |

| Diluted | |

$ | 7.30 | | |

| | | |

| | | |

| |

$ | 7.18 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Weighted average shares of common stock outstanding (in thousands): | |

| | | |

| | | |

| | | |

| |

| | |

| Basic | |

| 67,070 | | |

| | | |

| | | |

| |

| 67,070 | |

| Diluted | |

| 68,549 | | |

| | | |

| | | |

| |

| 68,549 | |

See accompanying Notes to the unaudited pro forma condensed

combined financial statements.

Notes to Unaudited Pro Forma Condensed Combined Financial Statements

Note 1 - Basis of Presentation

The unaudited pro forma condensed combined balance sheet has been prepared

to give effect to the Flagstar Acquisition as if the transaction had occurred as of September 30, 2024. The unaudited pro forma condensed

combined statement of operations has been prepared to give effect to the Flagstar Acquisition as if the transaction had occurred as of

January 1, 2023.

The unaudited pro forma condensed combined financial statements are presented

for illustrative purposes only and are not necessarily indicative of the results of operations or financial position had the Flagstar

Acquisition been consummated during the period presented, nor is it necessarily indicative of the results of operations in future periods

or the future financial position of the combined entities. Certain historical financial information of Flagstar have been reclassified

in the pro forma adjustment column to conform to the current presentation.

Note 2 - Flagstar Acquisition

On July 24, 2024, Mr. Cooper entered into an asset purchase agreement (the

“Asset Purchase Agreement”) and an Agreement for the Bulk Purchase and Sale of Mortgage Servicing Rights (the “MSR Purchase

Agreement”) with Flagstar Bank, N.A. (collectively, “the Flagstar Acquisition”). Per the Asset Purchase Agreement, Mr.

Cooper will purchase and assume from Flagstar, certain assets and related liabilities related to Flagstar’s mortgage servicing and

third-party origination operations. Per the MSR Purchase Agreement, Flagstar has agreed to sell, and Mr. Cooper has agreed to purchase,

certain MSRs held by Flagstar. The Flagstar Acquisition closed in the fourth quarter of 2024 for a total consideration of approximately

$1.3 billion in cash, funded through available cash and drawdowns of existing MSR lines. The acquired assets primarily consist of approximately

$1.2 billion of MSRs and related advances, and $101 million of customer relationship intangibles associated with subservicing contracts.

Mr. Cooper accounted for the two transactions as one asset acquisition in accordance with Accounting Standard Codification Topic 805,

Business Combinations, whereby the total purchase price was allocated to acquired net assets based on their relative fair values.

Additionally, costs directly related to the Flagstar Acquisition were capitalized as a component of the purchase price.

The purchase price and the cost allocated to the assets acquired by Mr.

Cooper are as follows (amounts in millions):

| Pro Forma Total Purchase Price: | |

|

| Cash payment for asset acquisition | |

$ | 1,256 | |

| Asset acquisition holdback payable | |

| 54 | |

| Direct acquisition-related cost | |

| 2 | |

| Pro forma total purchase price | |

$ | 1,312 | |

| | |

| | |

| Cost allocated to assets acquired: | |

| | |

| Mortgage servicing rights | |

$ | 1,169 | |

| Advances | |

| 41 | |

| Other assets | |

| 1 | |

| Assets acquired | |

| 1,211 | |

| | |

| | |

| Payables and accrued liabilities | |

| 4 | |

| Liabilities assumed | |

| 4 | |

| | |

| | |

| Total net tangible assets acquired | |

$ | 1,207 | |

| Intangible assets acquired: | |

| | |

| Customer relationships | |

$ | 101 | |

| Acquired workforce | |

| 4 | |

| Total intangible assets acquired | |

$ | 105 | |

Note 3 - Pro Forma Adjustments

The following pro forma adjustments have been reflected in the unaudited

pro forma condensed combined financial statements.

(a) Represents the payment from available cash and cash equivalents of

$106 million to fund the purchase price for the Flagstar Acquisition. In addition, total cash of $2 million was used to pay transaction

costs associated with the Flagstar Acquisition, including legal and advisory fees.

(b) Represents adjustments due to changes in the underlying account balances

as well as allocating the costs based on relative estimated fair value. The majority of adjustments are related to mortgage servicing

rights. Fair value for these were assessed based on the following:

| 1. | Mortgage

servicing rights - Fair value was estimated using our internal estimation process that combines the use of a discounted cash flow model

and analysis of current market data. The discounted cash flow model is driven by loan level data and key assumptions, including mortgage

prepayment speeds, option adjusted spread, and costs to service. In addition, the pro forma adjustment accounts for changes in the underlying

loan balance activity in the normal course of business between pro forma balance sheet date and the acquisition date. |

| 2. | Advance

and other receivables - Acquired advances and other receivables are substantially all related to escrow and corporate, which are contractual

receivables related to advances made by the servicer in connection with servicing the mortgage loan. Due to the contractual nature of

these receivables, the fair value of these advances and other receivables approximate carrying value. In addition, the pro forma adjustment

accounted for the advances and other receivables that were not acquired by Mr. Cooper as well as changes in account balances in the normal

course of business between pro forma balance sheet date and the acquisition date. |

(c) Reflects recognition of the estimated fair value of identifiable intangible

assets attributable to the Flagstar Acquisition. See Note 2, Flagstar Acquisition, for further discussion. The identifiable intangible

assets consist of and result in the following pro forma adjustment (amounts in millions):

| ($ in millions) | |

Fair Value | |

Amortization Expense in the Nine Months Ended September 30, 2024 | |

Amortization Expense in the Year Ended December 31, 2023 | |

Average Estimated Useful Life (Years) |

| Customer relationships (1) | |

$ | 101 | | |

$ | 14 | | |

$ | 25 | | |

| 5 | |

| Acquired workforce(2) | |

| 4 | | |

| 1 | | |

| 1 | | |

| 3 | |

| | |

$ | 105 | | |

$ | 15 | | |

$ | 26 | | |

| | |

| (1) | The estimated fair value for customer relationships was measured using the discounted cash flow method. |

| (2) | The estimated fair value for acquired workforce was measured using the replacement cost method. |

(d) Flagstar originated and serviced government guaranteed loans which

are pooled and sold as Ginnie Mae mortgage-back securities (“MBS”). Pursuant to Ginnie Mae servicing guidelines, Flagstar

has the unilateral right to repurchase loans securitized in Ginnie Mae pools that are due, but unpaid, for three consecutive months for

loans it has sold to Ginnie Mae. As a result, once the delinquency criteria have been met, and regardless of whether the repurchase option

has been exercised, Flagstar accounts for the loans as if they had been repurchased. The pro forma adjustment represents adjustment of

$465 million to properly derecognize loans subject to repurchase from Ginnie Mae previously recorded by Flagstar since Mr. Cooper is not

the issuer of the related MBS, and therefore not subject to the Ginnie Mae repurchase provision.

(e) Represents the income tax effects of the pro forma adjustments in connection

with the Flagstar Acquisition.

(f) Represents $1,150 million drawdowns on existing MSR lines to fund the

Flagstar Acquisition.

(g) Represents removal of intercompany service fees charged to other non-mortgage

units of Flagstar Bank, N.A.. Mr. Cooper did not acquire those non-mortgage units, and does not expect to continue to earn such service

fees from them following the completion of the Flagstar Acquisition.

(h) Pro forma adjustment does not include interest income earned on acquired

custodial deposits as the amount is not reasonably quantifiable.

(i) Represents interest expense for the drawdowns on existing MSR lines

to fund the Flagstar Acquisition. The interest rate is based on SOFR rate as of the date the Flagstar Acquisition is completed, plus the

margins specified in the borrowing agreements. A 1/8 of a percentage point increase or decrease in the interest rate would result in a

change in interest expense of approximately $1.0 million for the nine months ended September 30, 2024 and approximately $1.4 million for

the year ended December 31, 2023.

v3.24.4

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

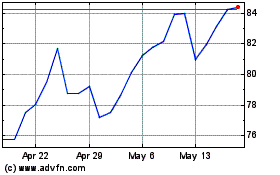

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Feb 2024 to Feb 2025