Community Trust Bancorp, Inc. (NASDAQ-CTBI):

Earnings Summary

Earnings Summary

(in thousands except per share data)

3Q 2024

2Q 2024

3Q 2023

YTD 2024

YTD 2023

Net income

$22,142

$19,499

$20,628

$60,320

$59,345

Earnings per share

$1.23

$1.09

$1.15

$3.36

$3.32

Earnings per share - diluted

$1.23

$1.09

$1.15

$3.36

$3.32

Return on average assets

1.50%

1.35%

1.46%

1.38%

1.44%

Return on average equity

11.77%

11.03%

12.30%

11.15%

12.02%

Efficiency ratio

51.75%

52.17%

52.66%

52.91%

53.82%

Tangible common equity

11.79%

11.39%

10.55%

Dividends declared per share

$0.47

$0.46

$0.46

$1.39

$1.34

Book value per share

$42.14

$39.91

$36.30

Weighted average shares

17,962

17,939

17,893

17,942

17,882

Weighted average shares - diluted

17,991

17,959

17,904

17,965

17,892

Community Trust Bancorp, Inc. (NASDAQ-CTBI) achieved earnings

for the third quarter 2024 of $22.1 million, or $1.23 per basic

share, compared to $19.5 million, or $1.09 per basic share, earned

during the second quarter 2024 and $20.6 million, or $1.15 per

basic share, earned during the third quarter 2023. Total revenue

for the quarter was $1.4 million above prior quarter and $4.1

million above prior year same quarter. Net interest revenue for the

quarter increased $1.5 million compared to prior quarter and $4.1

million compared to prior year same quarter, and noninterest income

decreased $0.1 million compared to prior quarter but increased $0.1

million compared to prior year same quarter. Our provision for

credit losses for the quarter decreased $0.2 million from prior

quarter but increased $0.9 million from prior year same quarter.

Noninterest expense increased $0.1 million compared to prior

quarter and $1.7 million compared to prior year same quarter. Net

income for the nine months ended September 30, 2024 was $60.3

million, or $3.36 per basic share, compared to $59.3 million, or

$3.32 per basic share, for the nine months ended September 30,

2023.

3rd Quarter 2024 Highlights

- Net interest income for the quarter of $47.2 million was $1.5

million, or 3.3%, above prior quarter and $4.1 million, or 9.4%,

above prior year same quarter, as our net interest margin increased

1 basis point from prior quarter and 12 basis points from prior

year same quarter.

- Provision for credit losses at $2.7 million for the quarter

decreased $0.2 million from prior quarter but increased $0.9

million from prior year same quarter.

- Noninterest income for the quarter ended September 30, 2024 of

$15.6 million was $0.1 million, or 0.9%, below prior quarter but

$0.1 million, or 0.4%, above prior year same quarter.

- Noninterest expense for the quarter ended September 30, 2024 of

$32.5 million was $0.1 million, or 0.3%, above prior quarter and

$1.7 million, or 5.4%, above prior year same quarter.

- Our loan portfolio at $4.4 billion increased $89.2 million, an

annualized 8.3%, from June 30, 2024 and $365.5 million, or 9.2%,

from September 30, 2023.

- We had net loan charge-offs of $1.5 million, or an annualized

0.14% of average loans, for the third quarter 2024 compared to $1.4

million, or an annualized 0.13% of average loans, for the second

quarter 2024 and $1.2 million, or an annualized 0.12% of average

loans, for the third quarter 2023.

- Our total nonperforming loans increased to $25.1 million at

September 30, 2024 from $19.8 million at June 30, 2024 and $13.0

million at September 30, 2023. Nonperforming assets at $26.4

million increased $5.0 million from June 30, 2024 and $11.3 million

from September 30, 2023.

- Deposits, including repurchase agreements, at $5.1 billion

increased $110.2 million, or an annualized 8.8%, from June 30, 2024

and $211.1 million, or 4.3%, from September 30, 2023.

- Shareholders’ equity at $760.8 million increased $41.4 million,

or an annualized 22.9%, during the quarter and $107.7 million, or

16.5%, from September 30, 2023. Shareholders’ equity was positively

impacted by the improvement in interest rates and the resulting

decrease in unrealized losses on securities.

Net Interest Income

Percent Change

3Q 2024 Compared

to:

($ in thousands)

3Q 2024

2Q 2024

3Q 2023

2Q 2024

3Q 2023

YTD 2024

YTD 2023

Percent Change

Components of net interest income:

Income on earning assets

$79,814

$76,648

$69,499

4.1%

14.8%

$231,464

$195,321

18.5%

Expense on interest bearing

liabilities

32,615

30,970

26,359

5.3%

23.7%

94,996

65,186

45.7%

Net interest income

47,199

45,678

43,140

3.3%

9.4%

136,468

130,135

4.9%

TEQ

280

292

298

(4.1%)

(5.8%)

866

894

(3.2%)

Net interest income, tax equivalent

$47,479

$45,970

$43,438

3.3%

9.3%

$137,334

$131,029

4.8%

Average yield and rates paid:

Earning assets yield

5.72%

5.66%

5.25%

1.1%

9.0%

5.64%

5.05%

11.8%

Rate paid on interest bearing

liabilities

3.36%

3.30%

2.93%

1.9%

14.7%

3.34%

2.52%

32.3%

Gross interest margin

2.36%

2.36%

2.32%

0.0%

1.7%

2.31%

2.53%

(9.0%)

Net interest margin

3.39%

3.38%

3.27%

0.3%

3.9%

3.34%

3.37%

(1.0%)

Average balances:

Investment securities

$1,091,258

$1,095,182

$1,178,707

(0.4%)

(7.4%)

$1,111,411

$1,220,135

(8.9%)

Loans

$4,300,652

$4,191,992

$3,952,096

2.6%

8.8%

$4,196,884

$3,843,441

9.2%

Earning assets

$5,570,160

$5,469,813

$5,274,542

1.8%

5.6%

$5,499,608

$5,199,072

5.8%

Interest-bearing liabilities

$3,859,978

$3,776,362

$3,567,343

2.2%

8.2%

$3,803,491

$3,455,666

10.1%

Net interest income for the quarter of $47.2 million was $1.5

million, or 3.3%, above prior quarter and $4.1 million, or 9.4%,

above prior year same quarter. Our net interest margin, on a fully

tax equivalent basis, at 3.39% increased 1 basis point from prior

quarter and 12 basis points from prior year same quarter. Our

quarterly average earning assets increased $100.3 million from

prior quarter and $295.6 million from prior year same quarter. Our

yield on average earning assets increased 6 basis points from prior

quarter and 47 basis points from prior year same quarter, while our

cost of funds increased 6 basis points from prior quarter and 43

basis points from prior year same quarter. Net interest income for

the nine months ended September 30, 2024 was $136.5 million

compared to $130.1 million for the nine months ended September 30,

2023.

Our ratio of average loans to deposits, including repurchase

agreements, was 85.8% for the quarter ended September 30, 2024

compared to 84.5% for the quarter ended June 30, 2024 and 83.2% for

the quarter ended September 30, 2023.

Noninterest Income

Percent Change

3Q 2024 Compared

to:

($ in thousands)

3Q 2024

2Q 2024

3Q 2023

2Q 2024

3Q 2023

YTD 2024

YTD 2023

Percent Change

Deposit related fees

$7,886

$7,308

$7,823

7.9%

0.8%

$22,205

$22,623

(1.8%)

Trust revenue

3,707

3,736

3,277

(0.8%)

13.1%

10,960

9,707

12.9%

Gains on sales of loans

80

119

105

(33.2%)

(23.8%)

244

341

(28.4%)

Loan related fees

813

1,320

1,283

(38.4%)

(36.6%)

3,485

3,325

4.8%

Bank owned life insurance revenue

1,214

1,815

1,108

(33.1%)

9.6%

4,321

2,701

60.0%

Brokerage revenue

563

683

452

(17.7%)

24.5%

1,736

1,188

46.2%

Other

1,300

727

1,448

78.8%

(10.2%)

3,454

4,049

(14.7%)

Total noninterest income

$15,563

$15,708

$15,496

(0.9%)

0.4%

46,405

43,934

5.6%

Noninterest income for the quarter ended September 30, 2024 of

$15.6 million was $0.1 million, or 0.9%, below prior quarter but

$0.1 million, or 0.4%, above prior year same quarter. Quarter over

quarter increases in deposit related fees ($0.6 million) and

securities gains ($0.7 million) were offset by decreases in loan

related fees ($0.5 million) and bank owned life insurance revenue

($0.6 million). Year over year increase in trust fees ($0.4 million

was offset by a decrease in loan related fees ($0.5 million).

Noninterest income for the nine months ended September 30, 2024 was

$46.4 million compared to $43.9 million for the nine months ended

September 30, 2023.

Noninterest Expense

Percent Change

3Q 2024 Compared

to:

($ in thousands)

3Q 2024

2Q 2024

3Q 2023

2Q 2024

3Q 2023

YTD 2024

YTD 2023

Percent Change

Salaries

$13,374

$13,037

$12,755

2.6%

4.9%

$39,447

$38,120

3.5%

Employee benefits

6,147

6,554

5,298

(6.2%)

16.0%

19,787

17,146

15.4%

Net occupancy and equipment

3,072

3,089

2,875

(0.6%)

6.8%

9,189

8,798

4.5%

Data processing

2,804

2,669

2,410

5.1%

16.3%

7,991

7,096

12.6%

Legal and professional fees

1,024

978

722

4.7%

41.8%

2,834

2,450

15.7%

Advertising and marketing

876

856

767

2.4%

14.3%

2,309

2,291

0.8%

Taxes other than property and payroll

438

438

420

(0.0%)

4.4%

1,318

1,285

2.6%

Other

4,777

4,801

5,600

(0.5%)

(14.7%)

14,279

16,576

(13.9%)

Total noninterest expense

$32,512

$32,422

$30,847

0.3%

5.4%

$97,154

$93,762

3.6%

Noninterest expense for the quarter ended September 30, 2024 of

$32.5 million was $0.1 million, or 0.3%, above prior quarter and

$1.7 million, or 5.4%, above prior year same quarter. The increase

year over year primarily resulted from a $1.5 million increase in

personnel expense, which included a $0.6 million increase in

salaries and a $0.7 million increase in the cost of group medical

and life insurance benefits. Other noninterest expense was

positively impacted by the accounting method change related to

investments in tax credit structures (ASU No. 2023-02). Noninterest

expense for the nine months ended September 30, 2024 was $97.2

million compared to $93.8 million for the nine months ended

September 30, 2023.

Balance Sheet Review

Total Loans

Percent Change

3Q 2024 Compared to:

($ in thousands)

3Q 2024

2Q 2024

3Q 2023

2Q 2024

3Q 2023

Commercial nonresidential real estate

$834,985

$825,934

$788,287

1.1%

5.9%

Commercial residential real estate

485,004

480,418

404,779

1.0%

19.8%

Hotel/motel

453,465

417,161

386,067

8.7%

17.5%

Other commercial

440,636

428,263

377,449

2.9%

16.7%

Total commercial

2,214,090

2,151,776

1,956,582

2.9%

13.2%

Residential mortgage

1,003,123

978,144

916,580

2.6%

9.4%

Home equity loans/lines

163,013

154,311

139,085

5.6%

17.2%

Total residential

1,166,136

1,132,455

1,055,665

3.0%

10.5%

Consumer indirect

816,187

819,689

812,060

(0.4%)

0.5%

Consumer direct

154,061

157,327

160,712

(2.1%)

(4.1%)

Total consumer

970,248

977,016

972,772

(0.7%)

(0.3%)

Total loans

$4,350,474

$4,261,247

$3,985,019

2.1%

9.2%

Total Deposits and Repurchase Agreements

Percent Change

3Q 2024 Compared to:

($ in thousands)

3Q 2024

2Q 2024

3Q 2023

2Q 2024

3Q 2023

Noninterest bearing deposits

$1,204,515

$1,241,514

$1,314,189

(3.0%)

(8.3%)

Interest bearing deposits

Interest checking

156,249

138,767

125,107

12.6%

24.9%

Money market savings

1,658,758

1,664,580

1,412,679

(0.3%)

17.4%

Savings accounts

501,933

527,251

556,820

(4.8%)

(9.9%)

Time deposits

1,316,807

1,161,686

1,219,097

13.4%

8.0%

Repurchase agreements

233,324

227,576

232,577

2.5%

0.3%

Total interest bearing deposits and

repurchase agreements

3,867,071

3,719,860

3,546,280

4.0%

9.0%

Total deposits and repurchase

agreements

$5,071,586

$4,961,374

$4,860,469

2.2%

4.3%

CTBI’s total assets at $6.0 billion as of September 30, 2024

increased $158.6 million, or 10.9% annualized, from June 30, 2024

and $328.0 million, or 5.8%, from September 30, 2023. Loans

outstanding at $4.4 billion increased $89.2 million, an annualized

8.3%, from June 30, 2024 and $365.5 million, or 9.2%, from

September 30, 2023. The increase in loans from prior quarter

included a $62.3 million increase in the commercial loan portfolio

and a $33.7 million increase in the residential loan portfolio,

partially offset by a $3.5 million decrease in the indirect

consumer loan portfolio and a $3.3 million decrease in the consumer

direct loan portfolio. CTBI’s investment portfolio increased $8.0

million, or an annualized 2.9%, from June 30, 2024 but decreased

$37.4 million, or 3.3%, from September 30, 2023. Deposits in other

banks increased $48.3 million from prior quarter and $5.0 million

from September 30, 2023. Deposits, including repurchase agreements,

at $5.1 billion increased $110.2 million, or an annualized 8.8%,

from June 30, 2024 and $211.1 million, or 4.3%, from September 30,

2023. CTBI is not dependent on any one customer or group of

customers for their source of deposits. As of September 30, 2024,

no one customer accounted for more than 3% of our $5.1 billion in

deposits. Only two customer relationships accounted for more than

1% each.

Shareholders’ equity at $760.8 million increased $41.4 million,

or an annualized 22.9%, during the quarter and $107.7 million, or

16.5%, from September 30, 2023. Net unrealized losses on

securities, net of deferred taxes, were $80.6 million at September

30, 2024, compared to $107.1 million at June 30, 2024 and $141.4

million at September 30, 2023. CTBI’s annualized dividend yield to

shareholders as of September 30, 2024 was 3.79%.

Asset Quality

Our total nonperforming loans increased to $25.1 million at

September 30, 2024 from $19.8 million at June 30, 2024 and $13.0

million at September 30, 2023. Accruing loans 90+ days past due at

$19.1 million increased $4.4 million from prior quarter and $11.0

million from September 30, 2023. Nonaccrual loans at $6.0 million

increased $0.9 million from prior quarter and $1.1 million from

September 30, 2023. Accruing loans 30-89 days past due at $20.6

million decreased $3.5 million from prior quarter but increased

$8.5 million from September 30, 2023. Our loan portfolio management

processes focus on the immediate identification, management, and

resolution of problem loans to maximize recovery and minimize

loss.

We had net loan charge-offs of $1.5 million, or an annualized

0.14% of average loans, for the third quarter 2024 compared to $1.4

million, or an annualized 0.13% of average loans, for the second

quarter 2024 and $1.2 million, or an annualized 0.12% of average

loans, for the third quarter 2023. Of the net charge-offs for the

quarter, $1.2 million were in indirect consumer loans, $0.2 million

were in direct consumer loans, and $0.1 million were in residential

loans. Year-to-date net loan charge-offs of an annualized 0.14% of

average loans are in line with management’s expectations.

Allowance for Credit Losses

Our provision for credit losses at $2.7 million for the quarter

decreased $0.2 million from prior quarter but increased $0.9

million from prior year same quarter. Of the provision for the

quarter, $1.1 million was allotted to fund loan growth.

Year-to-date provision for credit losses increased $3.4 million

from the nine months ended September 30, 2023. Our reserve coverage

(allowance for credit losses to nonperforming loans) at September

30, 2024 was 212.7% compared to 263.0% at June 30, 2024 and 375.2%

at September 30, 2023. Our credit loss reserve as a percentage of

total loans outstanding at September 30, 2024 was 1.23% compared to

1.22% at June 30, 2024 and September 30, 2023.

Forward-Looking Statements

Certain of the statements contained herein that are not

historical facts are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act. CTBI’s actual

results may differ materially from those included in the

forward-looking statements. Forward-looking statements are

typically identified by words or phrases such as “believe,”

“expect,” “anticipate,” “intend,” “estimate,” “may increase,” “may

fluctuate,” and similar expressions or future or conditional verbs

such as “will,” “should,” “would,” and “could.” These

forward-looking statements involve risks and uncertainties

including, but not limited to, economic conditions, portfolio

growth, the credit performance of the portfolios, including

bankruptcies, and seasonal factors; changes in general economic

conditions including the performance of financial markets,

prevailing inflation and interest rates, realized gains from sales

of investments, gains from asset sales, and losses on commercial

lending activities; the effects of epidemics, pandemics, or other

infectious disease outbreaks; results of various investment

activities; the effects of competitors’ pricing policies, changes

in laws and regulations, competition, and demographic changes on

target market populations’ savings and financial planning needs;

industry changes in information technology systems on which we are

highly dependent; failure of acquisitions to produce revenue

enhancements or cost savings at levels or within the time frames

originally anticipated or unforeseen integration difficulties; and

the resolution of legal proceedings and related matters. In

addition, the banking industry in general is subject to various

monetary, operational, and fiscal policies and regulations, which

include, but are not limited to, those determined by the Federal

Reserve Board, the Federal Deposit Insurance Corporation, the

Consumer Financial Protection Bureau, and state regulators, whose

policies, regulations, and enforcement actions could affect CTBI’s

results. These statements are representative only on the date

hereof, and CTBI undertakes no obligation to update any

forward-looking statements made.

Community Trust Bancorp, Inc., with assets of $6.0 billion, is

headquartered in Pikeville, Kentucky and has 72 banking locations

across eastern, northeastern, central, and south central Kentucky,

six banking locations in southern West Virginia, three banking

locations in northeastern Tennessee, four trust offices across

Kentucky, and one trust office in Tennessee.

Additional information follows.

Community Trust Bancorp, Inc. Financial Summary

(Unaudited) September 30, 2024 (in thousands except per

share data and # of employees) Three Three Three Nine Nine

Months Months Months Months Months Ended Ended Ended Ended Ended

September 30, 2024 June 30, 2024 September 30, 2023 September 30,

2024 September 30, 2023 Interest income

$

79,814

$

76,648

$

69,499

$

231,464

$

195,321

Interest expense

32,615

30,970

26,359

94,996

65,186

Net interest income

47,199

45,678

43,140

136,468

130,135

Loan loss provision

2,736

2,972

1,871

8,364

4,996

Gains on sales of loans

80

119

105

244

341

Deposit related fees

7,886

7,308

7,823

22,205

22,623

Trust revenue

3,707

3,736

3,277

10,960

9,707

Loan related fees

813

1,320

1,283

3,485

3,325

Securities gains (losses)

213

(474

)

355

110

738

Other noninterest income

2,864

3,699

2,653

9,401

7,200

Total noninterest income

15,563

15,708

15,496

46,405

43,934

Personnel expense

19,521

19,591

18,053

59,234

55,266

Occupancy and equipment

3,072

3,089

2,875

9,189

8,798

Data processing expense

2,804

2,669

2,410

7,991

7,096

FDIC insurance premiums

629

645

612

1,916

1,828

Other noninterest expense

6,486

6,428

6,897

18,824

20,774

Total noninterest expense

32,512

32,422

30,847

97,154

93,762

Net income before taxes

27,514

25,992

25,918

77,355

75,311

Income taxes

5,372

6,493

5,290

17,035

15,966

Net income

$

22,142

$

19,499

$

20,628

$

60,320

$

59,345

Memo: TEQ interest income

$

80,094

$

76,940

$

69,797

$

232,330

$

196,215

Average shares outstanding

17,962

17,939

17,893

17,942

17,882

Diluted average shares outstanding

17,991

17,959

17,904

17,965

17,892

Basic earnings per share

$

1.23

$

1.09

$

1.15

$

3.36

$

3.32

Diluted earnings per share

$

1.23

$

1.09

$

1.15

$

3.36

$

3.32

Dividends per share

$

0.47

$

0.46

$

0.46

$

1.39

$

1.34

Average balances: Loans

$

4,300,652

$

4,191,992

$

3,952,096

$

4,196,884

$

3,843,441

Earning assets

5,570,160

5,469,813

5,274,542

5,499,608

5,199,072

Total assets

5,891,157

5,795,937

5,603,586

5,824,780

5,524,343

Deposits, including repurchase agreements

5,014,506

4,959,382

4,750,448

4,977,040

4,722,207

Interest bearing liabilities

3,859,978

3,776,362

3,567,343

3,803,491

3,455,666

Shareholders' equity

748,098

711,331

665,129

722,683

660,063

Performance ratios: Return on average assets

1.50

%

1.35

%

1.46

%

1.38

%

1.44

%

Return on average equity

11.77

%

11.03

%

12.30

%

11.15

%

12.02

%

Yield on average earning assets (tax equivalent)

5.72

%

5.66

%

5.25

%

5.64

%

5.05

%

Cost of interest bearing funds (tax equivalent)

3.36

%

3.30

%

2.93

%

3.34

%

2.52

%

Net interest margin (tax equivalent)

3.39

%

3.38

%

3.27

%

3.34

%

3.37

%

Efficiency ratio (tax equivalent)

51.75

%

52.17

%

52.66

%

52.91

%

53.82

%

Loan charge-offs

$

2,736

$

2,836

$

2,012

$

8,239

$

5,730

Recoveries

(1,212

)

(1,441

)

(842

)

(3,692

)

(3,472

)

Net charge-offs

$

1,524

$

1,395

$

1,170

$

4,547

$

2,258

Market Price: High

$

52.22

$

44.32

$

39.86

$

52.22

$

47.35

Low

$

41.50

$

39.28

$

33.48

$

38.44

$

32.68

Close

$

49.66

$

43.66

$

34.26

$

49.66

$

34.26

As of As of As of September 30, 2024 June 30, 2024 September

30, 2023

Assets: Loans

$

4,350,474

$

4,261,247

$

3,985,019

Loan loss reserve

(53,360

)

(52,148

)

(48,719

)

Net loans

4,297,114

4,209,099

3,936,300

Loans held for sale

115

350

-

Securities AFS

1,098,076

1,090,322

1,135,878

Equity securities at fair value

3,266

3,054

2,900

Other equity investments

10,060

14,022

12,557

Other earning assets

157,092

108,823

152,064

Cash and due from banks

85,944

54,935

69,291

Premises and equipment

47,519

47,178

44,962

Right of use asset

14,718

15,121

16,100

Goodwill and core deposit intangible

65,490

65,490

65,490

Other assets

183,574

195,945

199,390

Total Assets

$

5,962,968

$

5,804,339

$

5,634,932

Liabilities and Equity: Interest bearing checking

$

156,249

$

138,767

$

125,107

Savings deposits

2,160,691

2,191,831

1,969,499

CD's >=$100,000

753,253

637,206

666,808

Other time deposits

563,554

524,480

552,289

Total interest bearing deposits

3,633,747

3,492,284

3,313,703

Noninterest bearing deposits

1,204,515

1,241,514

1,314,189

Total deposits

4,838,262

4,733,798

4,627,892

Repurchase agreements

233,324

227,576

232,577

Other interest bearing liabilities

64,893

64,954

65,136

Lease liability

15,530

15,880

16,801

Other noninterest bearing liabilities

50,197

42,808

39,492

Total liabilities

5,202,206

5,085,016

4,981,898

Shareholders' equity

760,762

719,323

653,034

Total Liabilities and Equity

$

5,962,968

$

5,804,339

$

5,634,932

Ending shares outstanding

18,052

18,026

17,991

30 - 89 days past due loans

$

20,578

$

24,099

$

12,098

90 days past due loans

19,111

14,703

8,069

Nonaccrual loans

5,980

5,127

4,916

Foreclosed properties

1,344

1,626

2,175

Community bank leverage ratio

13.99

%

13.90

%

13.78

%

Tangible equity to tangible assets ratio

11.79

%

11.39

%

10.55

%

FTE employees

943

930

951

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241016686097/en/

MARK A. GOOCH, CHAIRMAN, PRESIDENT, AND CEO, COMMUNITY TRUST

BANCORP, INC. AT (606) 434-4331

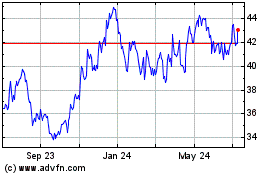

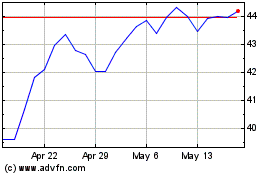

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Dec 2023 to Dec 2024