MARKET SNAPSHOT: U.S. Stock Futures Edge Lower As Oil Drops

December 07 2015 - 8:39AM

Dow Jones News

By Ellie Ismailidou and Victor Reklaitis, MarketWatch

Chipotle drops after warning on sales

U.S. stock futures edged lower on Monday, releasing earlier

gains, as the main market benchmarks looked set to pull back from

Friday's big rally amid a drop in oil prices.

S&P 500 futures fell 4 points, or 0.2%, to 2,0985, while Dow

Jones Industrial Average futures lost 43 points, or 0.2%, to

17,776. Nasdaq 100 futures were virtually unchanged at 4,713.

The S&P is going through a "period of backing-and filling"

as it has had a "loss of short-term momentum since October's

impressive upmove," said Katie Stockton, chief technical strategist

at BTIG, in a note Sunday.

"Resistance remains intact at the all-time high near 2,135," she

said, but added that "a breakout to new highs is attainable in the

weeks ahead as positive seasonal forces take hold."

On Friday, the S&P surged about 2%

(http://www.marketwatch.com/story/wall-street-poised-to-battle-back-as-jobs-data-swing-into-focus-2015-12-04),

while the Dow jumped 370 points, marking their biggest one-day

gains in nearly three months, following a strong November U.S. jobs

report. The two indexes scored weekly gains of 0.1% and 0.3%,

respectively. The S&P is up 1.6% for the year, while the Dow is

0.1% higher in 2015.

U.S. stocks this week are likely to be governed more by

fundamentals rather than central bank policy

(http://www.marketwatch.com/story/focus-on-stock-fundamentals-grows-as-fed-rate-hike-looks-more-likely-2015-12-06),

some analysts said, as a Federal Reserve rate hike looks to be a

done deal for the middle of the month. The market sees a 79% chance

that the Fed will raise interest rates at next week's meeting, in

what would be the first hike in nearly a decade. That is according

to the CME Group's FedWatch tool

(http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html).

The retreat in oil prices

(http://www.marketwatch.com/story/oil-prices-stuck-below-40-a-barrel-after-opec-decision-2015-12-07),

after the Organization of the Petroleum Exporting Countries's

decision Friday

(http://www.marketwatch.com/story/oil-prices-stuck-below-40-a-barrel-after-opec-decision-2015-12-07)

to keep crude production running at current levels, was also

dragging on energy stocks across the globe. This was evident in the

underperformance of the FTSE relative to Germany's DAX (DAX) due to

the U.K. index's higher weighting in oil and gas stocks relative to

its continental peers, said Colin Cieszynski, chief market

strategist at CMC Markets, in a note.

Economic news: At 12:30 p.m. Eastern Time, St. Louis Federal

Reserve President James Bullard is slated to give a speech about

the U.S. economy and monetary policy at Ball State University in

Muncie, Ind.

Bullard's talk is expected to be the last speech by a Fed

official before the central bank goes into a communication blackout

ahead of its Dec. 15-16 meeting.

There are no top-tier U.S. economic reports expected on

Monday.

Individual movers: Southwestern Energy Company (SWN) shares fell

5% before the opening bell and Chesapeake Energy Corporation (CHK)

shares dropped 4.8%, pulled down by a drop in oil prices.

Shares in Chipotle Mexican Grill Inc. (CMG) fell 9% in premarket

action after the burrito chain warned late Friday of a

fourth-quarter sales drop

(http://www.marketwatch.com/story/chipotle-e-coli-outbreak-causes-sales-slump-stock-tanks-2015-12-04)

in the wake of an E. coli outbreak.

Marvell Technology Group Lt. (MRVL) is heading 6% lower after

saying it's conducting an internal accounting probe

(http://www.marketwatch.com/story/marvell-tech-misses-profit-sales-expectations-and-conducts-internal-accounting-probe-2015-12-07).

On the upside, Keurig Green Mountain Inc. (GMCR) is surging more

than 70% in premarket action on news of a $13.9 billion buyout by

JAB Holding

(http://www.marketwatch.com/story/keurig-green-mountain-to-be-bought-out-by-jab-holding-in-a-139-billion-deal-2015-12-07).

Pep Boys-Manny Moe & Jack (PBY) is up nearly 4% after

activist investor Carl Icahn late Friday disclosed a 12% stake

(http://www.marketwatch.com/story/pep-boys-shares-surge-as-carl-icahn-takes-1212-stake-2015-12-04)

in the car parts retailer.

General Electric Co. (GE) said it has pulled the plug

(http://www.marketwatch.com/story/ge-terminates-deal-with-electrolux-after-antitrust-hurdles-2015-12-07)

on the sale of its appliance business to Sweden's Electrolux AB

(ELUXY). The deal faced antitrust hurdles.

Vail Mountain Resorts Inc. (MTN) is likely to see active trading

as the operator of ski resorts before the open posted a

smaller-than-expected loss

(http://www.marketwatch.com/story/vail-reports-narrower-than-expected-loss-2015-12-07)

for its most recent quarter. Revenue topped forecasts.

Other markets: Asian stocks closed mostly higher

(http://www.marketwatch.com/story/asian-stocks-end-mixed-after-us-jobs-report-2015-12-07)

on Monday, with Japanese shares up 1%. European equities

(http://www.marketwatch.com/story/european-stocks-rebound-after-worst-week-in-three-months-2015-12-07)

were also advancing. A key dollar index gained about 0.5%, weighing

on dollar-denominated commodities. Gold was moderately lower.

(END) Dow Jones Newswires

December 07, 2015 09:24 ET (14:24 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

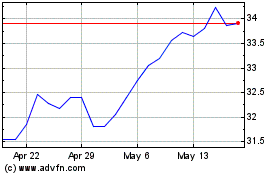

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Feb 2025 to Mar 2025

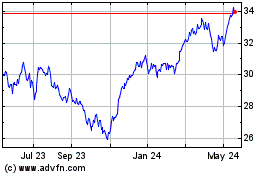

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Mar 2024 to Mar 2025