false

0001342958

0001342958

2025-02-13

2025-02-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 13, 2025

DIGITAL

ALLY, INC.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

|

001-33899 |

|

20-0064269 |

| (State

or other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

14001

Marshall Drive, Lenexa, KS 66215

(Address

of Principal Executive Offices) (Zip Code)

(913)

814-7774

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

stock, $0.001 par value |

|

DGLY |

|

The

Nasdaq Capital Market |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On

February 13, 2025, Digital Ally, Inc. (the “Company”) issued a press release (the “Press Release”) announcing

the pricing of a firm commitment underwritten public offering (the “Offering”). A copy of the Press Release is attached as

Exhibit 99.1 to this Report and is incorporated herein by reference.

The

Company has established a record date of February 14, 2025 with respect to a special meeting of the Company’s stockholders

to be held in order to approve certain matters related to the Offering.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

February 13, 2025

| |

Digital

Ally, Inc. |

| |

|

|

| |

By: |

/s/

Stanton E. Ross |

| |

Name: |

Stanton

E. Ross |

| |

Title: |

Chief

Executive Officer |

Exhibit 99.1

Digital

Ally, Inc. Announces Pricing of $15.0 Million Underwritten Public Offering

LENEXA,

KS, February 13, 2025 — Digital Ally, Inc. (Nasdaq: DGLY) (the “Company”), which develops, manufactures, and markets

advanced video recording products and other critical safety products for a growing variety of industries and organizational functions,

including law enforcement, emergency management, fleet safety and event security, today announced the pricing of a firm commitment underwritten

public offering with gross proceeds to the Company expected to be approximately $15.0 million, before deducting underwriting fees

and other estimated offering expenses payable by the Company.

The

offering consists of 100,000,000 Common Units (or Pre-Funded Units), each consisting of (i) one (1) share of Common Stock or one

(1) Pre-Funded Warrant, (ii) one (1) Series A Registered Common Warrant (“Series A Warrant”) to purchase one (1) share of

Common Stock per warrant at an exercise price of $0.1875 and (iii) one (1) Series B Registered Common Warrant (“Series B

Warrant” and together with the Series A Warrant, the “Warrants”) to purchase one (1) share of Common Stock per warrant

at an exercise price of $0.300. The public offering price per Common Unit is $0.15 (or $0.149 for each Pre-Funded

Unit, which is equal to the public offering price per Common Unit to be sold in the offering minus an exercise price of $0.001

per Pre-Funded Warrant). The Pre-Funded Warrants will be immediately exercisable and may be exercised at any time until exercised in

full. For each Pre-Funded Unit sold in the offering, the number of Common Units in the offering will be decreased on a one-for-one basis.

The initial exercise price of each Series A Warrant is $0.1875 per share of Common Stock. The Series A Warrants are exercisable

following stockholder approval and expire five (5) years thereafter. The initial exercise price of each Series B Warrant is $0.300

per share of Common Stock or pursuant to an alternative cashless exercise option. The Series B Warrants are exercisable following

stockholder approval and expire two and one half (2.5) years thereafter. The number of securities issuable under the Series B Warrant

is subject to adjustment as described in more detail in the report on Form 8-K to be filed in connection with the offering.

Solely

to cover over-allotments, if any, the Company has granted Aegis Capital Corp. (“Aegis”) a 45-day option to purchase additional

shares of Common Stock and/or Warrants of (i) up to 15.0% of the number of shares of Common Stock sold in the offering, (ii) up to 15.0%

of the number of Series A Warrants sold in the offering and (iii) up to 15.0% of the number of Series B Warrants sold in the offering.

The purchase price to be paid per additional share of Common Stock will be equal to the public offering price of one Common Unit (less

$0.00001 allocated to each Warrant), less the underwriting discount. The purchase price to be paid per additional Warrant will be

$0.00001.

Aggregate

gross proceeds to the Company are expected to be approximately $15.0 million. The transaction is expected to close on or about

February 14, 2025, subject to the satisfaction of customary closing conditions. The Company expects to use the net proceeds from the

offering, together with its existing cash, for general corporate purposes and working capital.

Aegis Capital Corp. is acting as the sole book-running

manager for the offering. Sullivan & Worcester LLP is acting as counsel to the Company. Kaufman & Canoles, P.C. is acting as counsel

to Aegis Capital Corp.

The

Offering is being made pursuant to an effective registration statement on Form S-1 (No. 333-284448) previously filed with the U.S. Securities

and Exchange Commission (the “SEC”) and declared effective by the SEC on February 12, 2025. The offering is being made only

by means of a prospectus. A final prospectus describing the terms of the proposed offering will be filed with the SEC and will be available

on the SEC’s website located at www.sec.gov. Electronic copies of the preliminary prospectus supplement and the accompanying prospectus

may be obtained, when available, by contacting Aegis Capital Corp., Attention: Syndicate Department, 1345 Avenue of the Americas, 27th

floor, New York, NY 10105, by email at syndicate@aegiscap.com, or by telephone at +1 (212) 813-1010. Before investing in the Offering,

interested parties should read in their entirety the prospectus, which provides more information about the Company and such Offering.

This

press release shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of these securities

in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of any such state or jurisdiction.

About

Digital Ally, Inc.

Digital

Ally, Inc. (Nasdaq: DGLY) through its subsidiaries, is engaged in video solution technology, human & animal health protection products,

healthcare revenue cycle management, ticket brokering and marketing, event production and jet chartering. Digital Ally continues to add

organizations that demonstrate the common traits of positive earnings, growth potential, innovation and organizational synergies.

For

additional news and information please visit www.digitalally.com.

Forward-Looking

Statements

The

foregoing material may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934, each as amended. Forward-looking statements include all statements that do not

relate solely to historical or current facts, including without limitation statements regarding the closing of the proposed offering,

and can be identified by the use of words such as “may,” “will,” “expect,” “project,”

“estimate,” “anticipate,” “plan,” “believe,” “potential,” “should,”

“continue” or the negative versions of those words or other comparable words. Forward-looking statements are not guarantees

of future actions or performance. These forward-looking statements are based on information currently available to the Company and its

current plans or expectations and are subject to a number of risks and uncertainties that could significantly affect current plans. Should

one or more of these risks or uncertainties materialize, or the underlying assumptions prove incorrect, actual results may differ significantly

from those anticipated, believed, estimated, expected, intended, or planned. Although the Company believes that the expectations reflected

in the forward-looking statements are reasonable, the Company cannot guarantee future results, performance, or achievements. Except as

required by applicable law, including the security laws of the United States, the Company does not intend to update any of the forward-looking

statements to conform these statements to actual results.

Stanton

Ross, CEO

Tom Heckman, CFO

Digital Ally, Inc.

913-814-7774

info@digitalallyinc.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

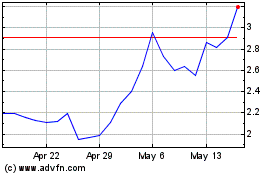

Digital Ally (NASDAQ:DGLY)

Historical Stock Chart

From Jan 2025 to Feb 2025

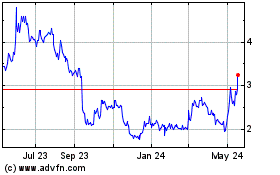

Digital Ally (NASDAQ:DGLY)

Historical Stock Chart

From Feb 2024 to Feb 2025