By Natasha Khan and Yifan Wang

HONG KONG -- Big American retailers are getting tough with

Chinese suppliers as import tariffs bite, cutting orders,

negotiating down prices and demanding faster turnarounds.

Walmart Inc. and Home Depot Inc. have pulled some planned

purchases forward to get ahead of any potential increases or

expansion of tariffs, according to a Walmart spokesperson and the

transcript of an earnings call from Home Depot. Amazon.com Inc. cut

back purchases and orders for certain of its private-label products

where the tariffs make it no longer profitable to offer those goods

to customers at sub-competitor prices, according to a person

familiar with the matter. The person declined to comment on

specific product lines, but added that Amazon sources a bulk of its

consumer electronics from China.

Dollar Tree Inc. said in an emailed statement it has negotiated

price concessions from vendors, canceled orders and changed its

product mix. Target Corp. said in an emailed statement it has "many

levers" it can pull to remain price competitive, without

elaborating.

In China, manufacturers of handbags, lighting, footwear and

other products say they are feeling the strain. Many are trying to

find new customers outside the U.S. and some have resorted to

offering discounts in a bid to halt a slide in orders.

The U.S. imported $1.4 billion worth of handbags and $14.7

billion worth of footwear from China in 2017, while imports of

lighting equipments reached $711 million, according to figures from

the United Nations Comtrade Database.

Both sides are hoping that trade talks between Presidents Donald

Trump and Xi Jinping at the G-20 summit this week in Buenos Aires

will reduce trade tensions and stave off a more damaging round of

duties.

The latest levies at 10% on $200 billion in Chinese goods took

effect on Sept. 24 and are slated to rise to 25% at the beginning

of next year. Mr. Trump has threatened to expand the list to more

than $250 billion worth of new products, covering almost all other

goods imported from China.

In an interview with The Wall Street Journal, this week

President Trump said he expects to move ahead with boosting tariff

levels on $200 billion of Chinese goods to 25%, calling it "highly

unlikely" that he would accept Beijing's request to hold off on the

increase.

Walmart, the world's biggest retailer, said in an emailed answer

to questions before that interview that it hopes the meeting will

"produce a constructive framework to resolve the trade

tensions."

U.S. companies have stressed to investors efforts they are

making to mitigate the impact of tariffs on their margins,

including by passing cost increases along to customers where they

can't win concessions from suppliers. Retailers in particular say

that, while the tariffs so far haven't had a huge impact on their

operations, that could change if they get steeper or are applied to

more products.

While last month's export data from China showed an increase,

manufacturers have said that is partly due to buyers "frontloading"

orders to move batches to the U.S. before January's expected tariff

increase.

Dozens of these Chinese manufacturers interviewed by The Wall

Street Journal report dampened sales. Sunshine Leisure Products, a

maker of camping chairs in the eastern province of Zhejiang, said

orders are down about 30% even as it lowered prices by up to 7%. A

supplier of LED decoration lights in the eastern province of

Shandong said orders for next year -- typically settled by November

-- were still in abeyance, as American customers ask it to bear the

10% tariff. In the southern city of Shenzhen, a sales manager for

Homegard International, which produces tables, chairs and sofas,

said orders have fallen by half.

Extended haggling over orders is throwing supply-chain

negotiations into disarray. Typically, in the final quarter of the

year merchants begin discussions about new products, models and

orders for the next year. But many say that hasn't happened.

Order negotiations have dragged on, says Andy Li, sales manager

for a company in the southern province of Fujian that supplies

backpacks and other assorted textile gifts for companies such as

Walmart. Usually order negotiations take about two weeks, but it

has been at least a month with no resolution with some customers,

Mr. Li said, declining to identify them.

Taizhou Shilin Shoes, based in the eastern province of Zhejiang,

says its two American customers have told it they need to order

from factories that manufacture lower-priced shoes made with

inferior materials to reconcile prices.

At a recent trade fair in Guangzhou, exhibitors reported fewer

American buyers. That is spurring Chinese suppliers to look for

other sources of revenue, they said, such as more aggressively

targeting European buyers.

The impact has extended to products not yet on the tariff list,

such as toys, for fears that they will be hit if trade relations

worsen. One toy maker says buyers are seeking to get orders ready

for shipping in much shorter time than the customary

six-to-eight-week turnaround period.

If levies do expand to toys -- and 82% of toys sold in the U.S.

are imported from China, according to the U.S. Department of

Commerce -- buyers may have to pay more for them, said John Tong,

honorary president of Hong Kong Toys Council. "In the short term,

there's no other country that can achieve a comparable capacity,"

he said.

Hasbro said in a statement that prolonged trade tensions will be

"damaging to our industry and our company."

Home Depot anticipates price rises if additional 25% tariffs go

in place as planned, adding in a conference call with analysts that

it saw increases in washing-machine prices when tariffs hit earlier

in the year.

Walmart's merchants are combing through a list of each item

affected by tariffs, working with suppliers to bring costs down,

Walmart Chief Financial Officer Brett Biggs said in an

interview.

"If we get tariffs as discussed in January prices are going to

go up," according to Mr. Biggs.

Sarah Nassauer in New York and Yasufumi Saito in Hong Kong

contributed to this article.

Write to Natasha Khan at natasha.khan@wsj.com

(END) Dow Jones Newswires

November 28, 2018 07:18 ET (12:18 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

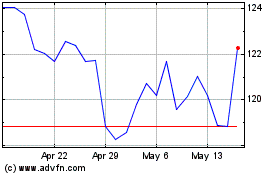

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Jan 2025 to Feb 2025

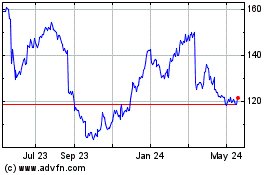

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Feb 2024 to Feb 2025