UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act

of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Under §240.14a-12 |

EOS ENERGY ENTERPRISES, INC.

(Exact Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

Eos Energy Enterprises, Inc.

3920 Park Avenue

Edison, New Jersey 08820

SUPPLEMENT TO THE PROXY STATEMENT FOR THE ANNUAL

MEETING OF STOCKHOLDERS TO BE HELD ON SEPTEMBER 10, 2024

Unless the context otherwise requires, references

in this proxy statement supplement (this “Supplement”) to “Eos,” the “Company,” “we,”

“us,” or “our,” refer to Eos Energy Enterprises, Inc., a Delaware corporation.

The following information supplements and amends the

Definitive Proxy Statement on Schedule 14A (the “Proxy Statement”) that was filed by the Company with the Securities and Exchange

Commission (the “SEC”) on August 8, 2024 and furnished to the Company’s stockholders in connection with the solicitation

of proxies by the Company’s Board of Directors (the “Board”) for the Company’s 2024 special meeting of stockholders

(the “Special Meeting”) and any postponement(s) or adjournment(s) thereof. This Supplement is being filed with the SEC and

being made available to stockholders on or about September 3, 2024. All capitalized terms not otherwise defined herein shall have their

respective meanings as set forth in the Proxy Statement.

As previously disclosed, on June 21, 2024, Eos

Energy Enterprises, Inc. (the “Company”) entered into a credit and guaranty agreement (the “Credit Agreement”),

by and among the Company, certain of the Company’s subsidiaries as guarantors party thereto, CCM Denali Debt Holdings, LP, acting

through Cerberus Capital Management II, L.P. (“Cerberus”), as administrative agent and collateral agent and the lenders party

thereto from time to time (the “Lenders”), pursuant to which the Lenders have provided a $210.5 million secured multi-draw

facility (the “Delayed Draw Term Loan”), and a $105 million revolving credit facility, to be made available at the Lenders’

sole discretion and only if the Delayed Draw Term Loan is fully funded (the “Revolving Facility” and together with the Delayed

Draw Term Loan, the “Facilities”), on terms and subject to conditions set forth in the Credit Agreement.

Upon each draw under the Delayed Draw Term Loan,

the Company will issue Warrants and/or Preferred Stock (each as defined in the Proxy Statement) in amounts representing predetermined,

fully diluted, percentages (an “Applicable Percentage”) of Company common stock, par value $0.0001 per share (the “Common

Stock”). Upon any failure to achieve a milestone, in addition to not being able to receive a draw on the Delayed Draw Term Loan

unless waived by the Lenders, the Applicable Percentage will be subject to up to a 4.0% increase for all milestone events as to each of

the four milestone measurement dates.

On August 28, 2024, the Company and Cerberus mutually

confirmed that the Company satisfied all four applicable performance milestones comprising the first milestone (the “First Milestone”)

ahead of the August 31, 2024 milestone measurement date (the “First Milestone Measurement Date”), related to the Company’s

automated line, materials cost, Z3 technology and backlog/cash conversion, pursuant to the terms of the Credit Agreement. On August 29,

2024, the Company submitted a borrowing request under the Credit Agreement, and the Lenders funded the full amount of the scheduled $30

million draw under the Delayed Draw Term Loan.

In connection with the additional draw and pursuant

to the terms and conditions of that certain Securities Purchase Agreement (the “Securities Purchase Agreement”), dated June

21, 2024, by and between the Company and Cerberus, the Applicable Percentage increased by 4.9%, and as a result the Company issued to

Cerberus 7 shares of a newly designated Series A-2 Preferred Stock, par value $0.0001 per share (the “Series A-2 Preferred Stock”),

with the number of shares of such series having a liquidation value as if such shares were convertible into an aggregate of 28,806,463

shares of Common Stock. Collectively, the Initial Warrant issued on June 21, 2024 and the liquidation values of the Series A-1 Preferred

Stock issued on June 21, 2024 and the Series A-2 Preferred Stock equate to 104,022,720 shares of Common Stock, or an Applicable Percentage

of 24.8%. If Stockholder Approval is obtained, the Series A-2 Preferred Stock will be convertible into a number of shares of Series B-2

Preferred Stock, par value $0.0001 per share (“Series B-2 Preferred Stock”) that are convertible into an equal number of shares

of Common Stock as then represented by the liquidation value of the Series A-2 Preferred Stock.

The Certificate of Designation for the Series

A-2 Preferred Stock contains substantially similar terms to the Series A-1 Preferred Stock Certificate of Designation except that under

the terms of the Series A-2 Certificate of Designation, each share of Series A-2 Preferred Stock has an original issue price of $9,555,515.30

(the “A-2 Original Issue Price”) and a liquidation value, payable pari passu with the Common Stock, as if such share was convertible

into 4,115,209 shares, or an aggregate of 28,806,463 shares of Common Stock, subject to adjustment. The Series A-2 Preferred Stock will

become convertible into shares of Series B-2 Preferred Stock if Stockholder Approval is obtained.

If Cerberus, as the purchaser, funds all draws

under the Delayed Draw Term Loan and the Company meets each of the remaining milestones under the Delayed Draw Term Loan, Cerberus will

be entitled to receive Preferred Stock or Warrants aggregating to an Applicable Percentage of 33.0% or assuming the number of our outstanding

shares of Common Stock on a fully diluted basis does not change after August 29, 2024, Preferred Stock and Warrants with respect to an

aggregate of 155,357,957 shares of Common Stock, including the Initial Warrant, Series A-1 Preferred Stock and Series A-2 Preferred Stock

already issued to Cerberus. If Stockholder Approval is obtained, such shares of Preferred Stock and Warrants would be directly or indirectly

convertible into or exercisable for shares of Common Stock, subject only to a beneficial ownership cap of 49.9% of the issued and outstanding

Common Stock of the Company.

As a result of meeting the First Milestone, if

Cerberus funds all draws under the Delayed Draw Term Loan and the Company fails to meet all of the remaining milestones under the Delayed

Draw Term Loan, Cerberus would be entitled to receive Preferred Stock or Warrants aggregating to a maximum Applicable Percentage of 45.0%

(previously 49.0%), or assuming the number of our outstanding shares of Common Stock on a fully diluted basis does not change after August

29, 2024, Preferred Stock and Warrants with respect to an aggregate of 258,073,962 shares of Common Stock, including the Initial Warrant,

Series A-1 Preferred Stock and Series A-2 Preferred Stock already issued to Cerberus. If Stockholder Approval is obtained such shares

of Preferred Stock and Warrants would be directly or indirectly convertible into or exercisable for shares of Common Stock, subject only

to a beneficial ownership cap of 49.9% of the issued and outstanding Common Stock of the Company.

The information in this Supplement is in addition

to the information provided by the Proxy Statement, and except for the changes herein, this Supplement does not modify any other information

set forth in the Proxy Statement.

THE PROXY STATEMENT CONTAINS IMPORTANT ADDITIONAL

INFORMATION, AND THIS SUPPLEMENT SHOULD BE READ IN CONJUNCTION WITH THE PROXY STATEMENT.

Important Information and Where You Can

Find It

In connection with obtaining the requisite Stockholder

Approval, the Company filed the Proxy Statement on August 8, 2024, which is available at the SEC’s website (http://www.sec.gov)

and has been sent to the stockholders of the Company, seeking certain approvals related to the issuance to Cerberus of more than 19.99%

of our outstanding Common Stock.

INVESTORS AND SECURITY HOLDERS OF THE COMPANY

AND ITS RESPECTIVE AFFILIATES ARE URGED TO READ THE PROXY STATEMENT, THIS SUPPLEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED

WITH THE SEC IN CONNECTION WITH OBTAINING STOCKHOLDER APPROVAL, AS WELL AS ANY FUTURE AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND OBTAINING STOCKHOLDER APPROVAL. Investors and security holders will be able

to obtain a free copy of the Proxy Statement, this Supplement as well as other relevant documents filed with the SEC containing information

about the Company, without charge, at the SEC’s website (http://www.sec.gov). Copies of documents filed with the SEC can also be

obtained, without charge, by directing a request to Investor Relations, Eos Energy Enterprises, Inc. at 862-207-7955 or email ir@eose.com.

Participants in the Solicitation of Proxies

in Connection with Obtaining Stockholder Approval

The Company and certain of its respective directors,

executive officers and employees may be deemed under the rules of the SEC to be participants in the solicitation of proxies with respect

to the obtaining the requisite Stockholder Approval. Information regarding the Company directors and officers is available in (i) its

definitive proxy statement for the 2024 annual stockholders meeting, which was filed with the SEC on April 2, 2024, and (ii) its current

reports on Form 8-K filed by the Company on June 24, 2024, and July 29, 2024. Other information regarding the participants in the solicitation

of proxies in respect to Stockholder Approval and the description of their direct and indirect interests, as security holders or otherwise,

is contained in the Proxy Statement and other relevant materials to be filed by the Company with the SEC. Free copies of these documents,

when available, may be obtained as described in the preceding paragraph.

Proxy Card

The proxy card included with the Proxy Statement

remains valid, and we will not make available or distribute, and you do not need to submit, a new proxy card or provide new voting instructions

solely as a result of the updates provided for in this Supplement. All proxy cards and voting instructions returned by stockholders will

be voted at the Special Meeting unless revoked. If you have already submitted a proxy and do not wish to change your vote, no further

action is required. If you have submitted a proxy and wish to change your vote, you may revoke your proxy and change your vote as described

under “Can I change my vote after submitting my proxy?” on page 17 of the Proxy Statement.

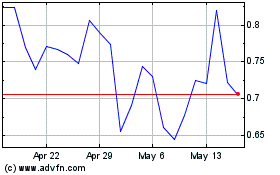

Eos Energy Enterprises (NASDAQ:EOSE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Eos Energy Enterprises (NASDAQ:EOSE)

Historical Stock Chart

From Nov 2023 to Nov 2024