Eos Energy Enterprises, Inc. (NASDAQ: EOSE) ("Eos" or the

“Company”), a leading provider of safe, scalable, efficient, and

sustainable zinc-based long duration energy storage systems, today

announced financial results for the third quarter ended

September 30, 2024.

Third Quarter Highlights

- Revenue totaled $0.9 million, lower

than expected, as the Company experienced an acute supply chain

delivery delay in receiving new Z3 inline enclosures from a key

supplier. The supply chain delay had a significant impact on

revenue for the quarter. This delay has had no adverse impact on

Eos’ total committed backlog and the Company is actively working

with customers on updated delivery schedules.

- Cost

of Goods Sold totaled $25.8 million, a 21%

increase compared to the prior year period, driven by larger

customer projects undergoing field installation and commissioning

along with higher labor costs related to manual sub-assembly

manufacturing. This is expected to decrease significantly as

further automation is implemented.

- Other operating

expenses totaled $28.4 million, a 65% increase compared

to the prior year, driven by costs associated with the

state-of-the-art manufacturing line, higher legal and professional

fees related to Cerberus and Department of Energy financing

activities and non-cash equipment write-downs following Z3 design

enhancements.

- Net loss attributable to

shareholders of $342.9 million with an adjusted EBITDA loss of

$46.1 million.

- Net loss attributable to common

shareholders of $384.1 million with an earnings per share (EPS) of

$(1.77) and an adjusted EPS of $(0.44).

- Cash balance of $23.0

million (excluding $7.6 million restricted cash) as of

September 30, 2024.

- Commercial pipeline of $14.2

billion, up over $0.4 billion from the second quarter, with a 23%

increase in signed letters of intent, and an orders backlog of

$588.9 million as of September 30, 2024.

- As a result of Project AMAZE costs

coming in below forecast, along with the Delayed Draw Term Loan

from Cerberus, Eos has requested a reduced loan amount under its

2023 conditional commitment.

- As previously announced, signed a

960 MWh Letter of Intent in July with a solar plus storage

integrator and developer in Puerto Rico which is expected to

convert to backlog upon customer financing. Eos expects Puerto Rico

and surrounding island countries to be a significant market for

safe energy storage solutions going forward.

“We remain proud of the significant progress and

momentum we’ve made within the business, despite the short-term

enclosure supply chain challenges. We have successfully reached our

second set of performance milestones and secured additional

funding, all while focusing on converting our growing pipeline into

firm orders. Project AMAZE, together with our strategic partnership

with Cerberus, is rapidly enhancing Eos' capabilities and

bankability,” said Eos Chief Executive Officer Joe Mastrangelo. “Z3

system delivery delays have not impacted positive customer

sentiment, which is a testament to the growing affirmation of our

product and the quality of customer relationships we have

developed.”

Mastrangelo concluded, “As we look to 2025, I am

confident in our ability to deliver on our growth strategy. With

strong funding and enhanced commercial bankability, we believe Eos

is well positioned to deliver a readily available, safe and secure

storage system manufactured in the U.S., to meet the fast-growing

demand for longer duration energy storage.”

2024 Outlook

- The Company continues to forecast

positive contribution margin by year end. Contribution margin is

defined as sales price less direct labor and direct materials and

includes the benefit of the production tax credits.

- As a result of the enclosure supply

chain bottleneck and its impact on Eos’ second half 2024 shipments,

the Company expects to recognize approximately $15 million in

revenue for the full year 2024. The difference between Eos’ prior

and current guidance is expected to be shipped and recognized in

the first half of 2025. The Company has secured a no fee waiver on

the September 30 revenue covenant under the credit and guaranty

agreement with its strategic partner, Cerberus. The Company

anticipates a similar waiver or amendment for its December 31

revenue covenant.

Recent Business Highlights

Cerberus Strategic

InvestmentThe Company successfully achieved all four of

the second tranche of performance milestones previously agreed upon

between Eos and an affiliate of Cerberus Capital Management LP

(“Cerberus”) as part of Cerberus’s strategic investment in the

Company. Achieving these performance milestones enabled the Company

to draw an additional $65 million from the Delayed Draw Term

Loan.

Eos has reached significant accomplishments in

its second set of performance milestones, including exceeding its

cost-out milestone target and demonstrating first pass yields that

already exceed future milestone requirements. These milestones

reflect the Company’s progress in optimizing its automated

production line, reducing material costs, enhancing the performance

of its Z3 technology, and accelerating backlog and cash

conversion.

The remaining tranche of funding is expected to

be drawn in the amount of $40.5 million upon the successful

completion of the January 31, 2025, milestones.

Commercial Growth Eos today

announced a 216 MWh order with City Utilities, its largest

municipal order to date for two project sites in Springfield,

Missouri. This landmark project marks a significant step forward in

Eos’ mission to deliver innovative, sustainable energy storage

solutions while expanding further into the municipal customer

segment. This project will leverage Eos' Z3™ technology to enhance

City Utilities' energy storage capabilities, directly advancing its

expansion goals and strengthening reliable energy delivery to the

community it serves.

With 2.2 GWh in late-stage approvals—including

grant awards, short-listed project closures, and final contracting

for Eos technology—the Company continues to advance its $14.2

billion commercial pipeline with strong momentum across key

markets.

Ensuring 2025 Commercial

BankabilityTo further accelerate the conversion of Eos’

pipeline into firm orders, Eos is strengthening its commercial

bankability by launching a comprehensive suite of insurance

products alongside additional third-party validations. The Company

has selected a major insurance provider to offer these policies

which is expected to be available to customers before year end.

Coupled with an extended 10-year warranty and continued financial

stability from Cerberus, the Company is positioned to achieve a

robust bankability profile heading into 2025 and beyond. This

customer-focused solution is expected to strengthen financial

assurance, facilitate project financing access and convert pipeline

opportunities into secured orders.

Software Optimization Recently,

the Company signed an agreement with Cerberus Technology Solutions

(CTS) to develop a secure, fully integrated Battery Management

software platform and customer interface that will include

performance management and analytical capabilities. CTS, an

operating company and subsidiary of Cerberus, is dedicated to

leveraging emerging technology, data, and advanced analytics to

drive operational transformation. As energy storage systems play an

increasingly vital role in stabilizing renewable energy, an

effective software solution is essential for maximizing operational

efficiency and value.

CTS will support the Company in deploying an

innovative solution designed to incorporate a new embedded AI

platform, enabling real-time optimization of resource utilization

for grid-scale customers. As a result, this should allow Eos’

customers to store energy more efficiently, reduce operational

costs, and extend the lifespan of its batteries. The system is

expected to be configured for uninterrupted power to critical

infrastructure, including data centers, healthcare facilities, and

other essential services, ensuring reliable and efficient energy

management across diverse applications. Through this integration of

AI and predictive analytics into its software ecosystem, the

Company is strategically positioning itself to lead in

long-duration energy storage, delivering innovative and reliable

solutions to its customers.

Earnings Conference Call and Audio

Webcast

Eos will host a conference call to discuss its

third quarter 2024 financial results on November 6, 2024, at 8:30

a.m. ET. A live webcast of the earnings call will be available on

the “Investor Relations” page of the Company’s website

at https://investors.eose.com or may be accessed using this

link (registration link). To avoid delays, we encourage

participants to join the conference call fifteen minutes ahead of

the scheduled start time.

The conference call replay will be available via

webcast through Eos’ investor relations website for twelve months

following the live presentation. The webcast replay will be

available from 11:30 a.m. ET on November 6, 2024, and can be

accessed by

visiting https://investors.eose.com/events-and-presentations.

About Eos Energy

Enterprises

Eos Energy Enterprises, Inc. is accelerating the

shift to clean energy with positively ingenious solutions that

transform how the world stores power. Our breakthrough Znyth™

aqueous zinc battery was designed to overcome the limitations of

conventional lithium-ion technology. It is safe, scalable,

efficient, sustainable, manufactured in the U.S., and the core of

our innovative systems that today provides utility, industrial, and

commercial customers with a proven, reliable energy storage

alternative for 3 to 12-hour applications. Eos was founded in 2008

and is headquartered in Edison, New Jersey. For more information

about Eos (NASDAQ: EOSE), visit eose.com.

|

Contacts |

|

| Investors: |

ir@eose.com |

| Media: |

media@eose.com |

| |

|

Forward Looking Statements

Except for the historical information contained

herein, the matters set forth in this press release are

forward-looking statements within the meaning of the "safe harbor"

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include, but are not limited to,

statements regarding our expected revenue, contribution margins,

orders backlog and opportunity pipeline for the fiscal year ended

December 31, 2024, our path to profitability and strategic outlook,

the tax credits available to our customers or to Eos pursuant to

the Inflation Reduction Act of 2022, the delayed draw term loan,

milestones thereunder and the anticipated use of proceeds

therefrom, statements regarding our ability to secure final

approval of a loan from the Department of Energy LPO, or our

anticipated use of proceeds from any loan facility provided by the

US Department of Energy, statements regarding the impact of future

automation, statements regarding our bankability in 2025 and

beyond, statements that refer to outlook, projections, forecasts or

other characterizations of future events or circumstances,

including any underlying assumptions. The words "anticipate,"

"believe," "continue," "could," "estimate," "expect," "intends,"

"may," "might," "plan," "possible," "potential," "predict,"

"project," "should," "would" and similar expressions may identify

forward-looking statements, but the absence of these words does not

mean that a statement is not forward-looking. Forward-looking

statements are based on our management’s beliefs, as well as

assumptions made by, and information currently available to, them.

Because such statements are based on expectations as to future

financial and operating results and are not statements of fact,

actual results may differ materially from those projected.

Factors which may cause actual results to differ

materially from current expectations include, but are not limited

to: changes adversely affecting the business in which we are

engaged; our ability to forecast trends accurately; our ability to

generate cash, service indebtedness and incur additional

indebtedness; our ability to achieve the operational milestones on

the delayed draw term loan; our ability to raise financing in the

future, including the discretionary revolving facility from

Cerberus; risks associated with the credit agreement with Cerberus,

including risks of default, dilution of outstanding Common Stock,

consequences for failure to meet milestones and contractual lockup

of shares; our customers’ ability to secure project financing; the

amount of final tax credits available to our customers or to Eos

pursuant to the Inflation Reduction Act, uncertainties around our

ability to meet the applicable conditions precedent and secure

final approval of a loan, in a timely manner or at all from the

Department of Energy, Loan Programs Office, or the timing of

funding and the final size of any loan that is approved; the

possibility of a government shutdown while we work to meet the

applicable conditions precedent and finalize loan documents with

the U.S. Department of Energy Loan Programs Office or while we

await notice of a decision regarding the issuance of a loan from

the Department Energy Loan Programs Office; our ability to continue

to develop efficient manufacturing processes to scale and to

forecast related costs and efficiencies accurately; fluctuations in

our revenue and operating results; competition from existing or new

competitors; our ability to convert firm order backlog and pipeline

to revenue; risks associated with security breaches in our

information technology systems; risks related to legal proceedings

or claims; risks associated with evolving energy policies in the

United States and other countries and the potential costs of

regulatory compliance; risks associated with changes to the U.S.

trade environment; risks resulting from the impact of global

pandemics, including the novel coronavirus, Covid-19; our ability

to maintain the listing of our shares of common stock on NASDAQ;

our ability to grow our business and manage growth profitably,

maintain relationships with customers and suppliers and retain our

management and key employees; risks related to the adverse changes

in general economic conditions, including inflationary pressures

and increased interest rates; risk from supply chain disruptions

and other impacts of geopolitical conflict; changes in applicable

laws or regulations; the possibility that Eos may be adversely

affected by other economic, business, and/or competitive factors;

other factors beyond our control; risks related to adverse changes

in general economic conditions; and other risks and

uncertainties.

The forward-looking statements contained in this

press release are also subject to additional risks, uncertainties,

and factors, including those more fully described in the Company’s

most recent filings with the Securities and Exchange Commission,

including the Company’s most recent Annual Report on Form 10-K and

subsequent reports on Forms 10-Q and 8-K. Further information on

potential risks that could affect actual results will be included

in the subsequent periodic and current reports and other filings

that the Company makes with the Securities and Exchange Commission

from time to time. Moreover, the Company operates in a very

competitive and rapidly changing environment, and new risks and

uncertainties may emerge that could have an impact on the

forward-looking statements contained in this press release.

Forward-looking statements speak only as of the

date they are made. Readers are cautioned not to put undue reliance

on forward-looking statements, and, except as required by law, the

Company assumes no obligation and does not intend to update or

revise these forward-looking statements, whether as a result of new

information, future events, or otherwise.

Key Metrics

Backlog. Our backlog represents

the amount of revenue that we expect to realize from existing

agreements with our customers for the sale of our battery

energy storage systems and performance of services. The

backlog is calculated by adding new orders in the current

fiscal period to the backlog as of the end of the prior fiscal

period and then subtracting the shipments in the current

fiscal period. If the amount of an order is modified or cancelled,

we adjust orders in the current period and our backlog accordingly,

but do not retroactively adjust previously published backlogs.

There is no comparable US-GAAP financial measure for backlog. We

believe that the backlog is a useful indicator regarding the future

revenue of our Company.

Pipeline. Our pipeline

represents projects for which we have submitted technical proposals

or non-binding quotes plus letters of intent (“LOI”) or firm

commitments from customers. Pipeline does not include lead

generation projects.

Booked Orders. Booked orders

are orders where we have legally binding agreements with a Purchase

Order (“PO”), or Master Supply Agreement (“MSA”) executed by both

parties.

Non-GAAP Financial Measures

To provide investors with additional information

regarding our financial results, we have disclosed in this earnings

release non-GAAP financial measures, including adjusted EBITDA and

adjusted EPS, which are non-GAAP financial measures as defined

under the rules of the SEC. These non-GAAP financial measures

should be considered supplemental to, not a substitute for, or

superior to, the financial measures of the Company’s calculated in

accordance with U.S. generally accepted accounting principles

(“GAAP”). The Company believes adjusted EBITDA, and adjusted EPS

are useful measures in evaluating its financial and operational

performance distinct and apart from financing costs, certain

non-cash expenses and non-operational expenses.

We believe that non-GAAP financial information,

when taken collectively may be helpful to our investors in

assessing its operating performance. There are a number of

limitations related to the use of these non-GAAP financial measures

and their nearest GAAP equivalents. For example, the Company’s

definitions of non-GAAP financial measures may differ from non-GAAP

financial measures used by other companies. Below is a description

of the non-GAAP financial information included herein as well as

reconciliations to the most directly comparable GAAP measure. You

should review the reconciliations below but not rely on any single

financial measure to evaluate our business.

Adjusted EBITDA is defined as earnings (net

loss) attributable to Eos adjusted for interest expense, income

tax, depreciation and amortization, non-cash stock-based

compensation expense, change in fair value of debt and derivatives,

debt extinguishment, and other non-cash or non-recurring items as

determined by management which it does not believe to be indicative

of its underlying business trends. Adjusted EPS is defined as GAAP

net loss per common share as adjusted for non-cash stock-based

compensation expense change in fair value of debt and derivatives

and debt extinguishment per common share.

|

|

|

EOS ENERGY ENTERPRISES, INC. |

|

EARNINGS RELEASE TABLES |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

AND COMPREHENSIVE (LOSS) INCOME |

|

(In thousands, except share and per share data) |

| |

| |

|

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember

30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

|

|

|

|

|

|

|

|

| Total

revenue |

|

$ |

854 |

|

|

$ |

684 |

|

|

$ |

8,353 |

|

|

$ |

9,768 |

|

| Costs and

expenses |

|

|

|

|

|

|

|

|

| Cost of goods sold |

|

|

25,764 |

|

|

|

21,262 |

|

|

|

68,114 |

|

|

|

59,448 |

|

| Research and development

expenses |

|

|

7,428 |

|

|

|

3,228 |

|

|

|

16,878 |

|

|

|

13,699 |

|

| Selling, general and

administrative expenses |

|

|

17,796 |

|

|

|

13,076 |

|

|

|

43,331 |

|

|

|

40,169 |

|

| Loss from write-down of

property, plant and equipment |

|

|

3,192 |

|

|

|

955 |

|

|

|

3,528 |

|

|

|

7,151 |

|

| Total costs and

expenses |

|

|

54,180 |

|

|

|

38,521 |

|

|

|

131,851 |

|

|

|

120,467 |

|

| Operating

loss |

|

|

(53,326 |

) |

|

|

(37,837 |

) |

|

|

(123,498 |

) |

|

|

(110,699 |

) |

| Other (expense)

income |

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

(133 |

) |

|

|

(4,994 |

) |

|

|

(7,915 |

) |

|

|

(14,709 |

) |

| Interest expense - related

party |

|

|

(5,291 |

) |

|

|

(4,449 |

) |

|

|

(15,054 |

) |

|

|

(32,962 |

) |

| Change in fair value of debt -

related party |

|

|

(3,036 |

) |

|

|

— |

|

|

|

(3,276 |

) |

|

|

— |

|

| Change in fair value of

warrants |

|

|

(66,469 |

) |

|

|

34,406 |

|

|

|

(71,510 |

) |

|

|

(24,957 |

) |

| Change in fair value of

derivatives - related parties |

|

|

(213,034 |

) |

|

|

27,398 |

|

|

|

(260,227 |

) |

|

|

(962 |

) |

| Gain (loss) on debt

extinguishment |

|

|

— |

|

|

|

— |

|

|

|

68,478 |

|

|

|

(3,510 |

) |

| Other (expense) income |

|

|

(1,593 |

) |

|

|

421 |

|

|

|

(4,727 |

) |

|

|

(474 |

) |

| (Loss) income before

income taxes |

|

$ |

(342,882 |

) |

|

$ |

14,945 |

|

|

$ |

(417,729 |

) |

|

$ |

(188,273 |

) |

| Income tax (benefit)

expense |

|

|

(16 |

) |

|

|

13 |

|

|

|

17 |

|

|

|

25 |

|

| Net (loss) income

attributable to shareholders |

|

$ |

(342,866 |

) |

|

$ |

14,932 |

|

|

$ |

(417,746 |

) |

|

$ |

(188,298 |

) |

| Accretion of Preferred

Stock |

|

|

(41,267 |

) |

|

|

— |

|

|

|

(64,938 |

) |

|

|

— |

|

| Net (loss) income

attributable to common shareholders |

|

$ |

(384,133 |

) |

|

$ |

14,932 |

|

|

$ |

(482,684 |

) |

|

$ |

(188,298 |

) |

| Other comprehensive

(loss) income |

|

|

|

|

|

|

|

|

| Change in fair value of debt -

credit risk |

|

$ |

(4,642 |

) |

|

$ |

— |

|

|

$ |

(4,642 |

) |

|

$ |

— |

|

| Foreign currency translation

adjustment, net of tax |

|

|

3 |

|

|

|

(6 |

) |

|

|

(1 |

) |

|

|

(3 |

) |

| Comprehensive (loss)

income attributable to common shareholders |

|

$ |

(388,772 |

) |

|

$ |

14,926 |

|

|

$ |

(487,327 |

) |

|

$ |

(188,301 |

) |

| Basic and diluted

(loss) income per share attributable to common

shareholders |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(1.77 |

) |

|

$ |

0.11 |

|

|

$ |

(2.30 |

) |

|

$ |

(1.65 |

) |

| Diluted |

|

$ |

(1.77 |

) |

|

$ |

(0.05 |

) |

|

$ |

(2.30 |

) |

|

$ |

(1.65 |

) |

| Weighted average

shares of common stock |

|

|

|

|

|

|

|

|

| Basic |

|

|

216,898,374 |

|

|

|

138,005,222 |

|

|

|

209,820,480 |

|

|

|

114,209,090 |

|

| Diluted |

|

|

216,898,374 |

|

|

|

156,325,284 |

|

|

|

209,820,480 |

|

|

|

114,209,090 |

|

|

EOS ENERGY ENTERPRISES, INC. |

|

EARNINGS RELEASE TABLES |

|

UNAUDITED CONSOLIDATED BALANCE SHEETS DATA |

|

(In thousands) |

| |

| |

|

September 30, 2024 |

|

December 31, 2023 |

| Balance sheet data |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

23,015 |

|

|

$ |

69,473 |

|

| Other current assets |

|

126,195 |

|

|

52,858 |

|

| Property and equipment,

net |

|

51,546 |

|

|

37,855 |

|

| Other assets |

|

16,085 |

|

|

26,306 |

|

| Total assets |

|

216,841 |

|

|

186,492 |

|

| Total liabilities |

|

634,528 |

|

|

297,292 |

|

| Total deficit |

|

(573,756 |

) |

|

(110,880 |

) |

|

UNAUDITED STATEMENTS OF CASH FLOW DATA |

|

(In thousands) |

| |

| |

|

September 30, 2024 |

|

September 30, 2023 |

| |

|

|

|

|

|

Cash used in operating activities |

|

$ |

(111,252 |

) |

|

$ |

(107,578 |

) |

| Cash used in investing

activities |

|

|

(20,062 |

) |

|

|

(21,186 |

) |

| Cash provided by financing

activities |

|

|

77,285 |

|

|

|

170,607 |

|

| Effect of foreign exchange on

cash, cash equivalents and restricted cash |

|

|

2 |

|

|

|

(5 |

) |

| Net (decrease) increase in

cash, cash equivalents and restricted cash |

|

|

(54,027 |

) |

|

|

41,838 |

|

| Cash, cash equivalents and

restricted cash, beginning of period¹ |

|

|

84,667 |

|

|

|

31,223 |

|

| Cash, cash equivalents and

restricted cash, end of period¹ |

|

$ |

30,640 |

|

|

$ |

73,061 |

|

|

(1) Includes current and long-term restricted cash, as reflected on

the balance sheet |

|

EOS ENERGY ENTERPRISES, INC. |

|

UNAUDITED RECONCILIATION OF NET LOSS TO EBITDA AND ADJUSTED

EBITDA |

|

(In thousands) |

| |

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net (loss)

income |

|

$ |

(342,866 |

) |

|

$ |

14,932 |

|

|

$ |

(417,746 |

) |

|

$ |

(188,298 |

) |

|

add: Interest expense |

|

|

5,424 |

|

|

|

9,443 |

|

|

|

22,969 |

|

|

|

47,671 |

|

|

(deduct) add: Income tax expense |

|

|

(16 |

) |

|

|

13 |

|

|

|

17 |

|

|

|

25 |

|

|

add: Depreciation and amortization |

|

|

2,691 |

|

|

|

2,165 |

|

|

|

5,259 |

|

|

|

7,316 |

|

| EBITDA

(loss) |

|

|

(334,767 |

) |

|

|

26,553 |

|

|

|

(389,501 |

) |

|

|

(133,286 |

) |

|

add: Stock based compensation |

|

|

6,142 |

|

|

|

4,456 |

|

|

|

10,940 |

|

|

|

10,123 |

|

|

add (deduct): Change in fair value of derivatives |

|

|

279,503 |

|

|

|

(61,804 |

) |

|

|

331,737 |

|

|

|

25,919 |

|

|

add (deduct): Change in fair value of debt |

|

|

3,036 |

|

|

|

— |

|

|

|

3,276 |

|

|

|

— |

|

|

(deduct) add: (Gain) loss on debt extinguishment |

|

|

— |

|

|

|

— |

|

|

|

(68,478 |

) |

|

|

3,510 |

|

| Adjusted EBITDA

(loss) |

|

$ |

(46,086 |

) |

|

$ |

(30,795 |

) |

|

$ |

(112,026 |

) |

|

$ |

(93,734 |

) |

|

EOS ENERGY ENTERPRISES, INC. |

|

UNAUDITED RECONCILIATION OF NET (LOSS) INCOME |

|

TO ADJUSTED NET (LOSS) INCOME PER SHARE |

|

(In thousands, except share and per share data) |

| |

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net (loss) income

attributable to common shareholders |

|

$ |

(384,133 |

) |

|

$ |

14,932 |

|

|

$ |

(482,684 |

) |

|

$ |

(188,298 |

) |

|

add: Stock based compensation |

|

|

6,142 |

|

|

|

4,456 |

|

|

|

10,940 |

|

|

|

10,123 |

|

|

add (deduct): Change in fair value of derivatives |

|

|

279,503 |

|

|

|

(61,804 |

) |

|

|

331,737 |

|

|

|

25,919 |

|

|

add (deduct): Change in fair value of debt |

|

|

3,036 |

|

|

|

— |

|

|

|

3,276 |

|

|

|

— |

|

|

add (deduct): (Gain) loss on debt extinguishment |

|

|

— |

|

|

|

— |

|

|

|

(68,478 |

) |

|

|

3,510 |

|

| Adjusted net loss

attributable to common shareholders |

|

$ |

(95,452 |

) |

|

$ |

(42,416 |

) |

|

$ |

(205,209 |

) |

|

$ |

(148,746 |

) |

| |

|

|

|

|

|

|

|

|

| Basic and diluted

(loss) income per share attributable to common

shareholders |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(1.77 |

) |

|

$ |

0.11 |

|

|

$ |

(2.30 |

) |

|

$ |

(1.65 |

) |

|

Diluted |

|

$ |

(1.77 |

) |

|

$ |

(0.05 |

) |

|

$ |

(2.30 |

) |

|

$ |

(1.65 |

) |

| |

|

|

|

|

|

|

|

|

| Basic and diluted

adjusted (loss) per share attributable to common

shareholders |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.44 |

) |

|

$ |

(0.31 |

) |

|

$ |

(0.98 |

) |

|

$ |

(1.30 |

) |

|

Diluted |

|

$ |

(0.44 |

) |

|

$ |

(0.26 |

) |

|

$ |

(0.98 |

) |

|

$ |

(1.30 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average

shares of common stock |

|

|

|

|

|

|

|

|

|

Basic |

|

|

216,898,374 |

|

|

|

138,005,222 |

|

|

|

209,820,480 |

|

|

|

114,209,090 |

|

|

Diluted |

|

|

216,898,374 |

|

|

|

156,325,284 |

|

|

|

209,820,480 |

|

|

|

114,209,090 |

|

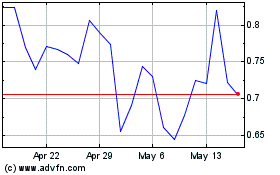

Eos Energy Enterprises (NASDAQ:EOSE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Eos Energy Enterprises (NASDAQ:EOSE)

Historical Stock Chart

From Nov 2023 to Nov 2024