FANHUA Inc. (Nasdaq: FANH) (the “Company” or “FANHUA”), a leading

independent financial services provider in China, today announced

its unaudited financial results for the fourth quarter and fiscal

year ended December 31, 20231.

Financial Highlights for Year 2023

|

(In thousands, except per ADS data and percentages) |

2022 (RMB) |

2023 (RMB) |

2023(US$) |

Change % |

|

Total net revenues |

2,781,614 |

|

3,198,389 |

|

450,484 |

|

15.0 |

|

|

Operating income |

168,675 |

|

195,825 |

|

27,581 |

|

16.1 |

|

|

Net income attributable to shareholders |

100,272 |

|

280,477 |

|

39,504 |

|

179.7 |

|

|

Adjusted EBITDA2 |

184,786 |

|

243,300 |

|

34,268 |

|

31.7 |

|

|

Diluted net income per ADS |

1.87 |

|

5.21 |

|

0.74 |

|

178.6 |

|

|

Cash, cash equivalent, short-term investments at end of the

period |

915,279 |

|

1,449,808 |

|

204,201 |

|

58.4 |

|

|

Key operating metrics |

|

|

|

|

|

|

|

|

|

Total life gross written premiums (“GWP”) |

12,408,998 |

|

16,109,985 |

|

2,269,044 |

|

29.8 |

|

|

• First year premium (“FYP”) |

2,556,867 |

|

3,478,110 |

|

489,882 |

|

36.0 |

|

|

• Renewal premium |

9,852,131 |

|

12,631,875 |

|

1,779,162 |

|

28.2 |

|

|

Financial Highlights for the Fourth Quarter of

2023:(In thousands, except per ADS data and

percentages) |

2022Q4 (RMB) |

2023Q4 (RMB) |

2023Q4(US$) |

Change % |

|

Total net revenues |

767,365 |

|

603,392 |

|

84,986 |

|

(21.4 |

) |

|

Operating income |

84,893 |

|

16,242 |

|

2,288 |

|

(80.9 |

) |

|

Net income (loss) attributable to shareholders |

70,616 |

|

(27,189 |

) |

(3,829 |

) |

N/A |

|

|

Adjusted EBITDA2 |

77,103 |

|

40,150 |

|

5,655 |

|

(47.9 |

) |

|

Diluted net income (loss) per ADS |

1.31 |

|

(0.51 |

) |

(0.07 |

) |

N/A |

|

|

Key operating metrics |

|

|

|

|

|

|

|

|

|

Total life gross written premiums (“GWP”) |

3,465,190 |

|

3,969,430 |

|

559,083 |

|

14.6 |

|

|

• First year premium (“FYP”) |

918,822 |

|

564,170 |

|

79,462 |

|

(38.6 |

) |

|

• Renewal premium |

2,546,368 |

|

3,405,260 |

|

479,621 |

|

33.7 |

|

________________________

|

1 |

|

This announcement contains currency conversions of certain Renminbi

(“RMB”) amounts into U.S. dollars (US$) at specified rate solely

for the convenience of the reader. Unless otherwise noted, all

translations from RMB to U.S. dollars are made at a rate of

RMB7.0999 to US$1.00, the effective noon buying rate as of December

29, 2023 in The City of New York for cable transfers of RMB as set

forth in the H.10 weekly statistical release of the Federal Reserve

Board. |

| 2 |

|

Adjusted EBITDA is defined as net income before income tax expense,

share of income of affiliates, net of impairment, investment

income, interest income, financial cost, depreciation, amortization

of intangible assets, share-based compensation expenses and change

in fair value of equity investments and contingent

consideration. |

| |

|

|

| |

|

|

Mr. Yinan Hu, Founder, Vice-Chairman and

Chief Executive Officer, commented: “In 2023, we faced

challenges from both regulatory policy changes and industry

transformation. However, we demonstrated resilience and achieved

steady growth, fully showcasing the successful implementation of

our strategy of driving growth through 'Professionalization,

Specialization, Digitalization, and Open Platform.'

"In the past year, we have continuously

strengthened our efforts to develop top agents and to enhance their

professional capabilities with remarkable results; through digital

platforms, we have provided support to our insurance advisors,

offering end-customers a superior service experience; the

diversified service ecosystem we have built has already brought a

competitive advantage to the company and our open platform has

become one of the key drivers of our growth. In addition, our

internationalization strategy is also steadily advancing, with two

subsidiaries in Hong Kong recently officially commencing

operations.

“With the implementation of the policy on

reported and actual fee consistency and commission cap across all

distribution channels, the life insurance industry is expected to

face significant challenges. However, it will present favorable

opportunities for leading players like FANHUA that have

already achieved scale and are able to offer diversified services

and platform-based companies with digitization and artificial

intelligence capabilities. As such, we believe FANHUA is posed

to emerge as one of the greatest beneficiaries.

"The completion of the proposed strategic

investment from White Group in FANHUA will bring about an

upgrade to our strategies in terms of artificial intelligence

development and internationalization. With the support of White

Group, through mergers and acquisitions, we plan to accelerate our

expansion in the international market while also deepening our

presence in the field of family services globally. This will enable

us to provide customers with more comprehensive and efficient

family asset allocation services, thus creating broader development

opportunities for us and propelling the company to higher

levels.

“Looking ahead, we firmly believe that the

industry's development will move towards more concentration, with a

few major players taking dominating position. Service and

technology will be the primary driving forces. We will actively

explore the 'insurance + service + technology' model, providing

comprehensive products and diversified services to our customers

while leveraging technology to enhance service efficiency. Our

focus will be on serving the high-net-worth end-customers and

Million-dollar Round-table Members-qualified (“MDRT”) agents. In

2024, leveraging on industry-leading technology platforms,

comprehensive service capabilities, and capital strength to acquire

high-quality assets, we will further expand our business scale to

make market share."

Ben Lin, Director and Chief Strategy

Officer of FANHUA, commented: “Despite multiple challenges

in the macroeconomic environment and the insurance industry, we are

pleased to report solid results for the full year of 2023. Total

insurance premiums facilitated for the year reached RMB 16.4

billion, representing a year-on-year growth of 28.7%. First year

premiums amounted to RMB3.8 billion, reflecting a year-on-year

growth of 30.3%. Operating income came in at RMB195.8 million, an

increase of 16.1% compared to the previous year, with net income

attributable to shareholders reaching RMB280.5 million,

representing a remarkable growth of 179.7% year-on-year.

“Looking ahead to 2024, due to the significant

uncertainty surrounding the specific timing and intensity of the

upcoming policy on commission cap across all distribution channels,

we are unable to accurately predict the full-year performance

targets yet. However, it is foreseeable that while the

implementation of this policy may result in short-term challenges,

it will also present important opportunities for the development of

our open platform.

“Under this backdrop, our strategic focus will

center on:

1) Maximizing the opportunities brought about by

policy changes to grow the number of high-quality agents,

especially MDRT members;2) Further expanding the ‘insurance+’

service ecosystem by connecting to resources in education, elderly

care, and overseas travel;3) Actively exploring development

opportunities in the Southeast Asian market in collaboration with

partners to expand our global presence; and4) Leveraging our

capital advantage to accelerate the pace of mergers and

acquisitions, facilitating global and intelligent development.

"We believe that these initiatives will create

broader development opportunities for the company's long-term

sustainable and high-quality growth."

Open Platform and M&A Contributions

over the Year 2023

- The number of platform professional

users who used our Open Platform reached 854 as of December 31,

2023, generating RMB1.1 billion in first year premiums for 2023

which accounted for 32.4% of our life insurance FYP;

- 23.7% of our life insurance FYP and

24.2% of our net revenues for the life insurance business for 2023

were generated from entities we acquired within the past 12

months.

Share Repurchase Program

On December 20, 2022, the Company’s board of

directors announced a share repurchase program under which the

Company may repurchase its American depositary shares, or ADSs,

with an aggregate value of US$20 million from time to time. As of

December 31, 2023, the Company had repurchased an aggregate of

598,906 ADSs, at an average price of approximately US$7.7 per ADS

for a total amount of approximately US$4.6 million under this share

repurchase program.

Business Outlook and

Guidance

We expect adjusted EBITDA to be no less than

RMB50.0 million for the first quarter of 2024. This forecast is

based on the current market conditions and reflects FANHUA’s

preliminary estimate, which is subject to change caused by various

uncertainties.

Analysis of our Financial Results for

the Fourth Quarter of 2023

Revenues

Total net revenues were

RMB603.3 million (US$85.0 million) for the fourth quarter of 2023,

representing a decrease of 21.4% from RMB767.4 million for the

corresponding period in 2022.

-

Net revenues for agency business were RMB483.5

million (US$68.1 million) for the fourth quarter of 2023,

representing a decrease of 27.1% from RMB662.8 million for the

corresponding period in 2022. Total GWP increased by 13.3%

year-over-year to RMB4,048.0 million, of which FYP decreased by

37.4% year-over-year to RMB642.7 million while renewal premiums

grew by 33.7% year-over-year to RMB3,405.3 million.

- Net

revenues for the life insurance business were RMB446.5

million (US$62.9 million) for the fourth quarter of 2023,

representing a decrease of 28.8% from RMB627.5 million for the

corresponding period in 2022. The decrease was mainly due to (i)

the business fluctuation caused by the pricing rate change to life

insurance products from 3.5% to 3% effective on August 1, 2023

which caused a spike in new business sales in July 2023 and then

followed by a significant drop in sales since August 2023,

partially offset by ii) contribution from entities acquired in the

first quarter of 2023. Total life insurance GWP increased by 14.6%

year-over-year to RMB3,969.4 million of which life insurance FYP

decreased by 38.6% year-over-year to RMB564.2 million while renewal

premiums grew by 33.7% year-over-year to RMB3,405.3 million.Net

revenues generated from our life insurance business accounted for

74.0% of our total net revenues in the fourth quarter of 2023, as

compared to 81.8% in the same period of 2022.

- Net

revenues for the non-life insurance business (formerly categorized

as “property and casualty insurance business”) were

RMB37.0 million (US$5.2 million) for the fourth quarter of 2023,

representing an increase of 4.8% from RMB35.3 million for the

corresponding period in 2022. Net revenues generated from the

non-life insurance business accounted for 6.1% of our total net

revenues in the fourth quarter of 2023, as compared to 4.6% in the

same period of 2022.

-

Net revenues for the claims adjusting business

were RMB119.8 million (US$16.9 million) for the fourth quarter of

2023, representing an increase of 14.5% from RMB104.6 million for

the corresponding period in 2022. The increase was mainly due to

business recovery after the pandemic. Net revenues generated from

the claims adjusting business accounted for 19.9% of our total net

revenues in the fourth quarter of 2023, as compared to 13.6% in the

same period of 2022.

Gross profit

Total gross profit was RMB219.9

million (US$31.0 million) for the fourth quarter of 2023,

representing a decrease of 19.5% from RMB273.0 million for the

corresponding period in 2022. By product line, the results

were:

-

Life insurance business recorded a gross profit of

RMB162.3 million (US$22.9 million), representing a decrease of

26.7% from RMB221.3 million for the fourth quarter of 2022. Gross

margin for the period was 36.3%, as compared with 35.3% in the same

period of 2022.

-

Non-life insurance business recorded a gross

profit of RMB11.0 million (US$1.5 million), representing a decrease

of 14.1% from RMB12.8 million for the fourth quarter of 2022. Gross

margin for the period was 29.7%, as compared with 36.3% in the same

period of 2022. The decrease in gross margin was mainly due to

changes in product mix.

-

Claims adjusting business recorded a gross profit

of RMB46.6 million (US$6.6 million), representing an increase of

19.8% from RMB38.9 million for the fourth quarter of 2022. Gross

margin for the period was 38.9%, as compared with 37.2% in the same

period of 2022.

Operating expenses

Selling expenses were RMB60.2

million (US$8.5 million) for the fourth quarter of 2023,

representing an decrease of 2.6% from RMB61.8 million for the

corresponding period in 2022. The decrease was due to cost savings

from personnel optimization and decreased rental costs of our sales

outlets.

General and administrative

expenses were RMB143.5 million (US$20.2 million) for the

fourth quarter of 2023, representing an increase of 13.6% from

RMB126.3 million for the corresponding period in 2022. The increase

was mainly due to expenses incurred by the acquired business which

was consolidated since the first quarter of 2023 amounting to

approximately RMB15.9 million (US$2.2 million) and increased IT

cloud service.

As a result of the foregoing factors, we

recorded operating income of RMB16.2 million

(US$2.3 million) for the fourth quarter of 2023, representing a

decrease of 80.9% from RMB84.9 million for the corresponding period

in 2022.

Operating margin was 2.7% for

the fourth quarter of 2023, compared to 11.1% for the corresponding

period in 2022.

Loss from fair value change was

RMB61.5 million (US$8.7 million) for the fourth quarter of 2023,

which primarily represents: (i) an unrealized holding loss of

RMB68.1 million (US$9.6 million) in the fourth quarter of 2023, to

reflect the change in the fair value of the Company's owned 2.8%

equity interests in Cheche Group Inc. ("Cheche"); (ii) partially

offset by an unrealized income of RMB6.6 million (US$0.9 million)

representing the fair value change of the contingent consideration

in regard to business combinations in the first quarter of

2023.

Investment income was RMB22.2

million (US$3.1 million) for the fourth quarter of 2023,

representing an increase of 152.3% from RMB8.8 million for the

corresponding period in 2022. The increase reflects the quarterly

fluctuation in yields from short-term investments in financial

products as it is recognized when the investment matures or is

disposed of.

Income tax expense was RMB5.0

million (US$0.7 million) for the fourth quarter of 2023,

representing a decrease of 73.0% from RMB18.5 million for the

corresponding period in 2022.

Net loss was

RMB15.1 million (US$2.1 million) for the fourth quarter of 2023, as

compared with net income of RMB65.5 million for the corresponding

period in 2022, primarily due to a change in the fair value of the

Company's equity investment in Cheche.

Net loss attributable to the Company’s

shareholders was RMB27.2 million (US$3.8 million) for the

fourth quarter of 2023, as compared with net income attributable to

the Company's shareholders of RMB70.6 million for the corresponding

period in 2022.

Net margin was -4.5% for the

fourth quarter of 2023, as compared to 9.2% for the corresponding

period in 2022.

Adjusted

EBITDA2 was RMB40.2 million (US$5.7

million) for the fourth quarter of 2023, representing an decrease

of 47.9% from RMB77.1 million for the corresponding period in

2022.

Adjusted EBITDA margin3 was

6.7% for the fourth quarter of 2023, as compared to 10.0% for the

corresponding period in 2022.

Basic and diluted net loss per

ADS were RMB0.51 (US$0.07) and RMB0.51 (US$0.07) for the

fourth quarter of 2023, respectively, as compared to Basic and

diluted net income per ADS of RMB1.31 and RMB1.31 for the

corresponding period in 2022, respectively.

Basic4

and diluted5 adjusted

EBITDA per ADS were RMB0.75 (US$0.11) and RMB0.75

(US$0.11) for the fourth quarter of 2023, representing a decrease

of 47.9% and 47.6% from RMB1.44 and RMB1.43 for the corresponding

period in 2022, respectively.

As of December 31, 2023, the Company had

RMB1,449.8 million (US$204.2 million) in cash,

cash equivalents and short-term

investments.

________________________

|

3 |

|

Adjusted EBITDA margin is defined as adjusted EBITDA as a

percentage of net revenues. |

| 4 |

|

Basic adjusted EBITDA per ADS is defined as adjusted EBITDA divided

by total weighted average number of ADSs of the Company outstanding

during the period. |

| 5 |

|

Diluted

adjusted EBITDA per ADS is defined as adjusted EBITDA divided by

total weighted average number of diluted ADSs of the Company

outstanding during the period. |

| |

|

|

Analysis of our Financial Results for

the Year 2023

Revenues

Total net revenues were

RMB3,198.3 million (US$450.5 million) for 2023, representing an

increase of 15.0% from RMB2,781.6 million in 2022.

-

Net revenues for agency business were RMB2,760.4

million (US$388.8 million) for 2023, representing an increase of

16.1% from RMB2,376.9 million for 2022. Total GWP increased by

28.7% year-over-year to RMB16,444.6 million, of which FYP grew by

30.3% year-over-year to RMB3,812.7 million while renewal premiums

increased by 28.2% year-over-year to RMB12,631.9 million.

- Net

revenues for the life insurance business were RMB2,593.8

million (US$365.3 million) for 2023, representing an increase of

15.9% from RMB2,237.3 million for 2022. The increase was mainly due

to (i) productivity improvement in performing agents and increase

in contributions from top-performing agents; (ii) contribution from

newly acquired entities, partially offset by the decrease in

renewal commission income as a result of the decreased average

portfolio based renewal commission rate, and to a lesser extent,

due to changes in product mix. Total life insurance GWP increased

by 29.8% year-over-year to RMB16,110.0 million, of which FYP grew

by 36.0% year-over-year to RMB3,478.1 million while renewal

premiums increased by 28.2% year-over-year to RMB12,631.9

million.Net revenues generated from our life insurance business

accounted for 81.1% of our total net revenues in 2023, as compared

to 80.4% in 2022.

- Net

revenues for the non-life insurance business (formerly categorized

as “property and casualty insurance business”) were

RMB166.6 million (US$23.5 million) for 2023, representing an

increase of 19.4% from RMB139.5 million for 2022. Net revenues

generated from the non-life insurance business accounted for 5.2%

of our total net revenues in 2023, as compared to 5.0% in

2022.

-

Net revenues for the claims adjusting business

were RMB437.9 million (US$61.7 million) for 2023, representing an

increase of 8.2% from RMB404.8 million for 2022. The increase was

mainly due to business recovery after the pandemic. Net revenues

generated from the claims adjusting business accounted for 13.7% of

our total net revenues in 2023, as compared to 14.6% in 2022.

Gross profit

Total gross profit was

RMB1,052.9 million (US$148.3 million) for 2023, representing an

increase of 6.8% from RMB986.0 in 2022. By product line, the

results were:

-

Life insurance business recorded a gross profit of

RMB844.3 million (US$118.9 million), representing an increase of

5.4% from RMB800.7 million for 2022. Gross margin for the period

was 32.6%, as compared with 35.8% in the same period of 2022.

-

Non-life insurance business recorded a gross

profit of RMB47.4 million (US$6.7 million), representing a decrease

of 2.3% from RMB48.5 million for 2022. Gross margin for the current

period was 28.5%, as compared with 34.8% for the same period of

2022. The decrease in gross margin was mainly due to changes in

product mix.

-

Claims adjusting business recorded a gross profit

of RMB161.2 million (US$22.7 million), representing an increase of

17.8% from RMB136.8 million for 2022. Gross margin for the period

was 36.8%, as compared with 33.8% in the same period of 2022.

Operating expenses

Selling expenses were RMB250.2

million (US$35.2 million) for 2023, representing a decrease of 8.3%

from RMB272.7 million in 2022. The decrease was due to expenses

savings from personnel optimization and decreased number of sales

outlets, partially offset by the increase in sales conference

events and the recognition of RMB13.6 million (US$1.9 million)

share-based compensation expenses related to shares options granted

to MDRT agents.

General and administrative

expenses were RMB606.9 million (US$85.5 million) for 2023,

representing an increase of 11.4% from RMB544.6 million in 2022.

The increase was mainly due to the expenses incurred by the

acquired business which was consolidated since the first quarter of

2023 amounting to approximately RMB76.2 million (US$10.7 million)

and increased IT services, partially offset by cost savings from

personnel optimization and decrease in the number of branches since

2022.

As a result of the foregoing factors, we

recorded operating income of RMB195.8 million

(US$27.6 million) for 2023, representing an increase of 16.1% from

RMB168.7 million in 2022.

Operating margin was 6.1% for

2023, compared to 6.1% in 2022.

Gains from fair value change

was RMB102.9 million (US$14.5 million), primarily represents: (i)

an unrealized holding gain of RMB96.2 million (US$13.6 million) in

2023, reflecting a change in the fair value of the Company's owned

equity interests in Cheche; (ii) an unrealized income of RMB6.6

million (US$0.9 million) representing a change in the fair value of

the contingent consideration in regard to business combinations in

the first quarter of 2023.

Investment income was RMB49.1

million (US$6.9 million) for 2023, representing an increase of

175.8% from RMB17.8 million in 2022. The investment income in 2023

consisted of yields from short-term investments in financial

products and is recognized when the investment matures or is

disposed of.

Income tax expense was RMB59.4

million (US$8.4 million) for 2023, representing an increase of

44.9% from RMB41.0 million in 2022. The effective tax rate for 2023

was 17.0% compared with 20.9% in 2022.

Net income was RMB289.1 million

(US$40.7 million) for 2023, representing an increase of 237.3% from

RMB85.7 million in 2022.

Net income attributable to the Company’s

shareholders was RMB280.5 million (US$39.5 million) for

2023, representing an increase of 179.7% from RMB100.3 million in

2022.

Net margin was 8.8% for 2023,

as compared to 3.6% in 2022.

Adjusted

EBITDA2 was RMB243.3 million (US$34.3

million) for 2023, representing an increase of 31.7% as compared to

RMB184.8 million in 2022.

Adjusted EBITDA

margin3 was 7.6% for 2023, as compared to

6.6% in 2022.

Basic and diluted net income per

ADS were RMB5.22 (US$0.74) and RMB5.21 (US$0.74) for 2023,

respectively, representing an increase of 179.1% and 178.6% from

RMB1.87 and RMB1.87 in 2022, respectively.

Basic4

and diluted5 adjusted

EBITDA per ADS were RMB4.53 (US$0.64) and RMB4.52

(US$0.64) for the fourth quarter of 2023, respectively,

representing an increase of 31.7% and 31.4% from RMB3.44 and

RMB3.44 in 2022, respectively.

FANHUA’s Insurance Sales and Service

Distribution Network:

- As of

December 31, 2023, excluding newly acquired entities, FANHUA’s

distribution network consisted of 561 sales outlets in 23 provinces

and 80 services outlets in 31 provinces as of December 31, 2023,

compared with 675 sales outlets in 24 provinces and 99 services

outlets in 31 provinces as of December 31, 2022. The decrease in

the number of sales outlets reflected our focus on growing

profitable branches, coupled with the challenging decisions to

close those which were not yielding profits. The number of the

Company's in-house claims adjustors was 2,303 as of December 31,

2023, compared with 2,170 as of December 31, 2022.

Conference Call

The Company will host a conference call to

discuss its fourth quarter and fiscal year 2023 financial results

as per the following details.

Time: 9:00 p.m. Eastern Daylight Time on March 20, 2024

or 9:00 a.m. Beijing/Hong Kong Time on March

21, 2024

Please pre-register online in advance to join

the conference call by navigating to the link provided below and

dial in 10 minutes before the call is scheduled to begin.

Conference call details will be provided upon registration.

Conference Call Preregistration:

https://register.vevent.com/register/BI91a942d345f74c0a8c371f7dee5f6bfb

Additionally, a live and archived webcast of the

conference call will be available at FANHUA’s investor relations

website:

https://edge.media-server.com/mmc/p/pbcb4gmh

About FANHUA Inc.

Driven by its digital technologies and

professional expertise in the insurance industry, FANHUA Inc. is

the leading independent financial service provider in China,

focusing on providing insurance-oriented family asset allocation

services that covers customers’ full lifecycle and a one-stop

service platform for individual sales agents and independent

insurance intermediaries.

With strategic focus on long-term life insurance

products, we offer a broad range of insurance products, claims

adjusting services and various value-added services to meet

customers’ diverse needs, through an extensive network of digitally

empowered sales agents and professional claims adjustors. We also

operate Baowang (www.baoxian.com), an online insurance platform

that provides customers with a one-stop insurance shopping

experience.

For more information about FANHUA Inc., please visit

https://ir.fanhgroup.com.

Forward-looking Statements

This press release contains statements of a

forward-looking nature. These statements, including the statements

relating to the Company’s future financial and operating results,

are made under the “safe harbor” provisions of the U.S. Private

Securities Litigation Reform Act of 1995. You can identify these

forward-looking statements by terminology such as “will,”

“expects,” “believes,” “anticipates,” “intends,” “estimates” and

similar statements. Among other things, management’s quotations and

the Business Outlook section contain forward-looking statements.

These forward-looking statements involve known and unknown risks

and uncertainties and are based on current expectations,

assumptions, estimates and projections about FANHUA and the

industry. Potential risks and uncertainties include, but are not

limited to, those relating to its ability to attract and retain

productive agents, especially entrepreneurial agents, its ability

to maintain existing and develop new business relationships with

insurance companies, its ability to execute its growth strategy,

its ability to adapt to the evolving regulatory environment in the

Chinese insurance industry, its ability to compete effectively

against its competitors, quarterly variations in its operating

results caused by factors beyond its control including

macroeconomic conditions in China. Except as otherwise indicated,

all information provided in this press release speaks as of the

date hereof, and FANHUA undertakes no obligation to update any

forward-looking statements to reflect subsequent occurring events

or circumstances, or changes in its expectations, except as may be

required by law. Although FANHUA believes that the expectations

expressed in these forward-looking statements are reasonable, it

cannot assure you that its expectations will turn out to be

correct, and investors are cautioned that actual results may differ

materially from the anticipated results. Further information

regarding risks and uncertainties faced by FANHUA is included in

FANHUA’s filings with the U.S. Securities and Exchange Commission,

including its annual report on Form 20-F.

About Non-GAAP Financial

Measures

In addition to the Company’s consolidated

financial results under generally accepted accounting principles in

the United States (“GAAP”), the Company also provides adjusted

EBITDA, adjusted EBITDA margin and basic and diluted adjusted

EBITDA per ADS, all of which are non-GAAP financial measures, as

supplemental measures to review and assess operating performance.

Adjusted EBITDA is defined as net income before income tax expense,

share of income of affiliates, net of impairment, investment

income, interest income, financial cost, depreciation, amortization

of intangible assets, share-based compensation expenses and change

in fair value of equity investments and contingent consideration.

Adjusted EBITDA margin is defined as adjusted EBITDA as a

percentage of net revenues. Basic adjusted EBITDA per ADS is

defined as adjusted EBITDA divided by total weighted average number

of ADSs of the Company outstanding during the period. Diluted

adjusted EBITDA per ADS is defined as adjusted EBITDA divided by

total weighted average number of diluted ADSs of the Company

outstanding during the period. The Company believes that both

management and investors benefit from referring to these non-GAAP

financial measures in assessing the Company’s performance and when

planning and forecasting future periods. The Company’s non-GAAP

financial measures do not reflect all items of income and expenses

that affect the Company’s operations. Specifically, the Company’s

non-GAAP measures exclude interest income, investment income,

financial cost, income tax expense, depreciation, amortization of

intangible assets, share of income of affiliates, net of

impairment, share-based compensation expenses and change in fair

value of equity investments and contingent consideration. Further,

these non-GAAP financial measures may not be comparable to

similarly titled measures presented by other companies, including

peer companies. The presentation of these non-GAAP financial

measures has limitations as analytical tools, and investors should

not consider them in isolation from, or as a substitute for

analysis of, the financial information prepared and presented in

accordance with GAAP. We encourage investors and other interested

persons to review our financial information in its entirety and not

rely on a single financial measure.

For more information on these non-GAAP financial

measures, please see the tables captioned “Reconciliations of Net

Income to Adjusted EBITDA and Adjusted EBITDA Margin” set forth at

the end of this press release.

|

|

|

FANHUA INC.Unaudited Condensed

Consolidated Balance Sheets (In

thousands) |

|

|

|

|

As of December 31, |

|

As of December 31, |

|

As of December 31, |

|

|

2022 |

|

2023 |

|

2023 |

|

|

RMB |

|

RMB |

|

US$ |

|

ASSETS: |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

567,525 |

|

521,538 |

|

73,457 |

|

Restricted cash |

59,957 |

|

53,238 |

|

7,498 |

|

Short term investments |

347,754 |

|

928,270 |

|

130,744 |

|

Accounts receivable, net |

667,554 |

|

639,418 |

|

90,060 |

|

Insurance premium receivables |

— |

|

16 |

|

2 |

|

Other receivables |

231,049 |

|

111,754 |

|

15,740 |

|

Other current assets |

419,735 |

|

121,331 |

|

17,090 |

|

Total current assets |

2,293,574 |

|

2,375,565 |

|

334,591 |

|

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

Restricted bank deposit – non-current |

20,729 |

|

27,228 |

|

3,835 |

|

Contract assets, net - non-current |

385,834 |

|

711,424 |

|

100,202 |

|

Property, plant, and equipment, net |

98,459 |

|

91,659 |

|

12,910 |

|

Goodwill and intangible assets, net |

109,997 |

|

432,465 |

|

60,912 |

|

Deferred tax assets |

20,402 |

|

40,735 |

|

5,737 |

|

Investment in affiliates |

4,035 |

|

— |

|

— |

|

Other non-current assets |

11,400 |

|

235,752 |

|

33,205 |

|

Right of use assets |

145,086 |

|

136,056 |

|

19,163 |

|

Total non-current assets |

795,942 |

|

1,675,319 |

|

235,964 |

|

Total assets |

3,089,516 |

|

4,050,884 |

|

570,555 |

|

Current liabilities: |

|

|

|

|

Short-term loan |

35,679 |

|

|

164,300 |

|

|

23,141 |

|

|

Accounts payable |

436,784 |

|

|

406,807 |

|

|

57,298 |

|

|

Insurance premium payables |

16,580 |

|

|

14,943 |

|

|

2,105 |

|

|

Other payables and accrued expenses |

174,326 |

|

|

185,999 |

|

|

26,197 |

|

|

Accrued payroll |

96,279 |

|

|

94,305 |

|

|

13,283 |

|

|

Income tax payable |

130,024 |

|

|

100,260 |

|

|

14,121 |

|

|

Current operating lease liability |

62,304 |

|

|

57,164 |

|

|

8,051 |

|

|

Total current liabilities |

951,976 |

|

|

1,023,778 |

|

|

144,196 |

|

|

|

|

|

|

|

Non-current liabilities: |

|

|

|

|

Accounts payable – non-current |

192,917 |

|

|

401,385 |

|

|

56,534 |

|

|

Other tax liabilities |

36,647 |

|

|

34,368 |

|

|

4,841 |

|

|

Deferred tax liabilities |

102,455 |

|

|

149,151 |

|

|

21,007 |

|

|

Non-current operating lease liability |

74,190 |

|

|

71,311 |

|

|

10,044 |

|

|

Other non-current liabilities |

— |

|

|

33,373 |

|

|

4,701 |

|

|

Total non-current liabilities |

406,209 |

|

|

689,588 |

|

|

97,127 |

|

|

Total liabilities |

1,358,185 |

|

|

1,713,366 |

|

|

241,323 |

|

|

|

|

|

|

|

Ordinary shares |

8,091 |

|

|

8,675 |

|

|

1,222 |

|

|

Treasury stock |

(10 |

) |

|

(178 |

) |

|

(25 |

) |

|

Additional Paid-in capital |

461 |

|

|

162,721 |

|

|

22,919 |

|

|

Statutory reserves |

559,520 |

|

|

608,376 |

|

|

85,688 |

|

|

Retained earnings |

1,087,984 |

|

|

1,319,605 |

|

|

185,862 |

|

|

Accumulated other comprehensive loss |

(32,643 |

) |

|

(27,936 |

) |

|

(3,935 |

) |

|

Total shareholders’ equity |

1,623,403 |

|

|

2,071,263 |

|

|

291,731 |

|

|

Non-controlling interests |

107,928 |

|

|

266,255 |

|

|

37,501 |

|

|

Total equity |

1,731,331 |

|

|

2,337,518 |

|

|

329,232 |

|

|

Total liabilities and equity |

3,089,516 |

|

|

4,050,884 |

|

|

570,555 |

|

|

|

|

FANHUA INC.Unaudited Condensed

Consolidated Statements of Income and Comprehensive Income

(In thousands, except for shares and per

share data) |

|

|

|

|

For the Three Months Ended |

|

|

For the Twelve Months Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2022 |

|

2023 |

|

2023 |

|

|

2022 |

|

2023 |

|

2023 |

|

| |

RMB |

|

RMB |

|

US$ |

|

|

RMB |

|

RMB |

|

US$ |

|

| Net

revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Agency |

662,755 |

|

483,552 |

|

68,107 |

|

|

2,376,851 |

|

2,760,448 |

|

388,801 |

|

|

Life insurance business |

627,479 |

|

446,510 |

|

62,890 |

|

|

2,237,312 |

|

2,593,803 |

|

365,330 |

|

|

Non-life insurance business |

35,276 |

|

37,042 |

|

5,217 |

|

|

139,539 |

|

166,645 |

|

23,471 |

|

| Claims adjusting |

104,610 |

|

119,840 |

|

16,879 |

|

|

404,763 |

|

437,941 |

|

61,683 |

|

| Total net

revenues |

767,365 |

|

603,392 |

|

84,986 |

|

|

2,781,614 |

|

3,198,389 |

|

450,484 |

|

| Operating costs and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Agency |

(428,707 |

) |

(310,200 |

) |

(43,691 |

) |

|

(1,527,572 |

) |

(1,868,672 |

) |

(263,197 |

) |

|

Life insurance business |

(406,188 |

) |

(284,161 |

) |

(40,023 |

) |

|

(1,436,606 |

) |

(1,749,475 |

) |

(246,408 |

) |

|

Non-life insurance business |

(22,519 |

) |

(26,039 |

) |

(3,668 |

) |

|

(90,966 |

) |

(119,197 |

) |

(16,789 |

) |

| Claims adjusting |

(65,702 |

) |

(73,210 |

) |

(10,311 |

) |

|

(268,031 |

) |

(276,744 |

) |

(38,979 |

) |

| Total operating

costs |

(494,409 |

) |

(383,410 |

) |

(54,002 |

) |

|

(1,795,603 |

) |

(2,145,416 |

) |

(302,176 |

) |

| Selling expenses |

(61,754 |

) |

(60,245 |

) |

(8,485 |

) |

|

(272,706 |

) |

(250,223 |

) |

(35,243 |

) |

| General and administrative

expenses |

(126,309 |

) |

(143,495 |

) |

(20,211 |

) |

|

(544,630 |

) |

(606,925 |

) |

(85,484 |

) |

| Total operating costs

and expenses |

(682,472 |

) |

(587,150 |

) |

(82,698 |

) |

|

(2,612,939 |

) |

(3,002,564 |

) |

(422,903 |

) |

| Income from

operations |

84,893 |

|

16,242 |

|

2,288 |

|

|

168,675 |

|

195,825 |

|

27,581 |

|

| Other income (loss), net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gains (loss) from fair value

change |

— |

|

(61,459 |

) |

(8,656 |

) |

|

— |

|

102,867 |

|

14,489 |

|

| Investment income |

8,765 |

|

22,224 |

|

3,130 |

|

|

17,809 |

|

49,106 |

|

6,916 |

|

| Interest income |

3,899 |

|

2,576 |

|

363 |

|

|

13,674 |

|

15,047 |

|

2,119 |

|

| Financial cost |

— |

|

(2,009 |

) |

(283 |

) |

|

— |

|

(9,357 |

) |

(1,318 |

) |

| Others, net |

(12,743 |

) |

12,896 |

|

1,816 |

|

|

(3,823 |

) |

(3,670 |

) |

(517 |

) |

| Income (loss) from

operations before income taxes and share income of

affiliates |

84,814 |

|

(9,530 |

) |

(1,342 |

) |

|

196,335 |

|

349,818 |

|

49,270 |

|

| Income tax expense |

(18,465 |

) |

(5,000 |

) |

(704 |

) |

|

(41,016 |

) |

(59,402 |

) |

(8,367 |

) |

| Share of income (loss) of

affiliates, net of impairment |

(841 |

) |

(554 |

) |

(78 |

) |

|

(69,596 |

) |

(1,317 |

) |

(185 |

) |

| Net

income(loss) |

65,508 |

|

(15,084 |

) |

(2,124 |

) |

|

85,723 |

|

289,099 |

|

40,718 |

|

| Less: net (loss) income

attributable to non-controlling interests |

(5,108 |

) |

12,105 |

|

1,705 |

|

|

(14,549 |

) |

8,622 |

|

1,214 |

|

| Net income (loss)

attributable to the Company’s shareholders |

70,616 |

|

(27,189 |

) |

(3,829 |

) |

|

100,272 |

|

280,477 |

|

39,504 |

|

| |

|

FANHUA INC.Unaudited Condensed

Consolidated Statements of Income and Comprehensive

Income-(Continued) (In thousands,

except for shares and per share

data) |

| |

| |

For The Three Months Ended |

|

|

For The Twelve Months Ended |

| |

December 30, |

|

|

December 30, |

|

|

2022 |

|

2023 |

|

2023 |

|

|

2022 |

|

2023 |

|

2023 |

|

|

RMB |

|

RMB |

|

US$ |

|

|

RMB |

|

RMB |

|

US$ |

| Net income

(loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

0.07 |

|

(0.03 |

) |

— |

|

|

0.09 |

|

0.26 |

|

0.04 |

|

Diluted |

0.07 |

|

(0.03 |

) |

— |

|

|

0.09 |

|

0.26 |

|

0.04 |

| Net income

(loss) per ADS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

1.31 |

|

(0.51 |

) |

(0.07 |

) |

|

1.87 |

|

5.22 |

|

0.74 |

|

Diluted |

1.31 |

|

(0.51 |

) |

(0.07 |

) |

|

1.87 |

|

5.21 |

|

0.74 |

| Shares used in

calculating net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

1,074,204,304 |

|

1,070,501,493 |

|

1,070,501,493 |

|

|

1,074,196,310 |

|

1,074,372,067 |

|

1,074,372,067 |

|

Diluted |

1,075,017,689 |

|

1,070,501,493 |

|

1,070,501,493 |

|

|

1,074,457,821 |

|

1,076,740,198 |

|

1,076,740,198 |

| Net income

(loss) |

65,508 |

|

(15,084 |

) |

(2,124 |

) |

|

85,723 |

|

289,099 |

|

40,718 |

| Other comprehensive (loss)

income, net of tax: Foreign currency translation adjustments |

(1,018 |

) |

(6,354 |

) |

(895 |

) |

|

3,728 |

|

2,249 |

|

317 |

|

Share of other comprehensive income of affiliates |

— |

|

— |

|

— |

|

|

4,688 |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized net (losses) gains

on available-for-sale investments |

(3,157 |

) |

(5,625 |

) |

(792 |

) |

|

(1,919 |

) |

2,458 |

|

346 |

| Comprehensive income

(loss) |

61,333 |

|

(27,063 |

) |

(3,811 |

) |

|

92,220 |

|

293,806 |

|

41,381 |

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive (loss) income

attributable to the non-controlling interests |

(5,108 |

) |

12,105 |

|

1,706 |

|

|

(14,549 |

) |

8,622 |

|

1,214 |

| Comprehensive income

(loss) attributable to the Company’s

shareholders |

66,441 |

|

(39,168 |

) |

(5,517 |

) |

|

106,769 |

|

285,184 |

|

40,167 |

|

|

|

FANHUA INC.Unaudited Condensed

Consolidated Statements of Cash

Flow(In thousands, except for

shares and per share data) |

|

|

|

|

For the Three Months Ended |

|

|

For the Twelve Months

Ended |

|

|

December 31, |

|

|

December 31, |

|

|

2022 |

|

2023 |

|

2023 |

|

|

2022 |

|

2023 |

|

2023 |

|

|

|

RMB |

|

RMB |

|

US$ |

|

|

RMB |

|

RMB |

|

US$ |

|

|

OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

65,508 |

|

(15,084 |

) |

(2,124 |

) |

|

85,723 |

|

289,099 |

|

40,718 |

|

| Adjustments to reconcile net

income to net cash generated from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment income |

(8,032 |

) |

(8,479 |

) |

(1,194 |

) |

|

(10,963 |

) |

(17,047 |

) |

(2,401 |

) |

| Share of loss (income) of

affiliates, net of impairment |

841 |

|

554 |

|

78 |

|

|

69,596 |

|

1,317 |

|

185 |

|

|

Other non-cash adjustments |

53,295 |

|

90,583 |

|

12,733 |

|

|

168,371 |

|

67,194 |

|

9,464 |

|

|

Changes in operating assets and liabilities |

43,305 |

|

(9,064 |

) |

(1,253 |

) |

|

(174,975 |

) |

(235,578 |

) |

(33,179 |

) |

|

Net cash generated from operating activities |

154,917 |

|

58,510 |

|

8,240 |

|

|

137,752 |

|

104,985 |

|

14,787 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of short-term investments |

(556,540 |

) |

(1,481,600 |

) |

(208,679 |

) |

|

(2,550,300 |

) |

(4,399,910 |

) |

(619,714 |

) |

|

Proceeds from disposal of short-term investments |

751,694 |

|

1,493,611 |

|

210,371 |

|

|

3,239,556 |

|

4,226,001 |

|

595,220 |

|

|

Prepayment for acquisition of short-term investments |

(200,000 |

) |

—- |

|

— |

|

|

(540,000 |

) |

— |

|

— |

|

|

Cash rendered for loan receivables from third parties |

— |

|

(50,000 |

) |

(7,042 |

) |

|

(205,800 |

) |

(160,000 |

) |

(22,536 |

) |

|

Cash received for loan receivables from third parties |

4,500 |

|

9,000 |

|

1,268 |

|

|

24,500 |

|

229,000 |

|

32,254 |

|

|

Purchase of a long-term investment |

— |

|

(10,463 |

) |

(1,474 |

) |

|

— |

|

(135,463 |

) |

(19,080 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Others |

(1,271 |

) |

(7,540 |

) |

(1,062 |

) |

|

(95,518 |

) |

(5,449 |

) |

(767 |

) |

|

Net cash used in investing activities |

(1,617 |

) |

(46,992 |

) |

(6,618 |

) |

|

(127,562 |

) |

(245,821 |

) |

(34,623 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends paid |

— |

|

— |

|

— |

|

|

(52,069 |

) |

— |

|

— |

|

|

Proceeds from bank and other borrowings |

35,679 |

|

32 |

|

5 |

|

|

35,679 |

|

182,300 |

|

25,676 |

|

|

Repayment of bank and other borrowings |

— |

|

(35,712 |

) |

(5,030 |

) |

|

— |

|

(56,627 |

) |

(7,976 |

) |

|

Interests paid |

— |

|

(2,930 |

) |

(413 |

) |

|

— |

|

(9,358 |

) |

(1,318 |

) |

|

Acquisition of additional equity interests in non-wholly owned

subsidiaries |

— |

|

— |

|

— |

|

|

— |

|

(110 |

) |

(15 |

) |

|

Repurchase of ordinary shares from open market |

(3,984 |

) |

(5,012 |

) |

(706 |

) |

|

(3,984 |

) |

(29,044 |

) |

(4,091 |

) |

|

Capital contribution from non-controlling interests |

— |

|

7,330 |

|

1,032 |

|

|

— |

|

7,330 |

|

1.032 |

|

|

Others |

— |

|

— |

|

— |

|

|

3 |

|

— |

|

— |

|

|

Net cash generated from (used in) financing

activities |

31,695 |

|

(36,292 |

) |

(5,112 |

) |

|

(20,371 |

) |

94,491 |

|

13,308 |

|

|

Net increase (decrease) in cash, cash equivalents and

restricted cash |

184,995 |

|

(24,774 |

) |

(3,490 |

) |

|

(10,181 |

) |

(46,345 |

) |

(6,528 |

) |

|

Cash, cash equivalents and restricted cash at beginning of

period |

462,837 |

|

633,006 |

|

89,157 |

|

|

656,522 |

|

648,211 |

|

91,299 |

|

|

Effect of exchange rate changes on cash and cash equivalents |

379 |

|

(6,228 |

) |

(877 |

) |

|

1,870 |

|

138 |

|

19 |

|

|

Cash, cash equivalents and restricted cash at end of

period |

648,211 |

|

602,004 |

|

84,790 |

|

|

648,211 |

|

602,004 |

|

84,790 |

|

| |

|

FANHUA INC.Reconciliations of Net Income

to Adjusted EBITDA and Adjusted EBITDA Margin(In

thousands, except for shares and per share data) |

| |

| |

For The Three Months Ended |

|

|

For The Twelve Months

Ended |

|

| |

December 31 |

|

|

December 31 |

|

|

|

2022 |

|

2023 |

|

2023 |

|

|

2022 |

|

2023 |

|

2023 |

|

| |

RMB |

|

RMB |

|

USD |

|

|

RMB |

|

RMB |

|

USD |

|

|

Net income |

65,508 |

|

(15,084 |

) |

(2,124 |

) |

|

85,723 |

|

289,099 |

|

40,718 |

|

| Income tax expense |

18,465 |

|

5,000 |

|

704 |

|

|

41,016 |

|

59,402 |

|

8,367 |

|

| Share of income(loss) of

affiliates, net of impairment |

841 |

|

554 |

|

78 |

|

|

69,596 |

|

1,317 |

|

185 |

|

| Investment income |

(8,765 |

) |

(22,224 |

) |

(3,130 |

) |

|

(17,809 |

) |

(49,106 |

) |

(6,916 |

) |

| Interest income |

(3,899 |

) |

(2,576 |

) |

(363 |

) |

|

(13,674 |

) |

(15,047 |

) |

(2,119 |

) |

| Financial cost |

— |

|

2,009 |

|

283 |

|

|

— |

|

9,357 |

|

1,318 |

|

| Depreciation |

4,654 |

|

3,909 |

|

551 |

|

|

19,473 |

|

16,192 |

|

2,281 |

|

| Amortization of intangible

assets |

— |

|

4,198 |

|

591 |

|

|

— |

|

17,858 |

|

2,515 |

|

| Share-based compensation

expenses |

299 |

|

2,905 |

|

409 |

|

|

461 |

|

17,095 |

|

2,408 |

|

| Change in fair value of equity

investments and contingent consideration |

— |

|

61,459 |

|

8,656 |

|

|

— |

|

(102,867 |

) |

(14,489 |

) |

| Adjusted

EBITDA |

77,103 |

|

40,150 |

|

5,655 |

|

|

184,786 |

|

243,300 |

|

34,268 |

|

| Total net revenues |

767,365 |

|

603,392 |

|

84,986 |

|

|

2,781,614 |

|

3,198,389 |

|

450,484 |

|

| Adjusted EBITDA Margin |

10.0% |

|

6.7% |

|

6.7% |

|

|

6.6% |

|

7.6% |

|

7.6% |

|

| Adjusted EBITDA per

ADS : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

1.44 |

|

0.75 |

|

0.11 |

|

|

3.44 |

|

4.53 |

|

0.64 |

|

|

Diluted |

1.43 |

|

0.75 |

|

0.11 |

|

|

3.44 |

|

4.52 |

|

0.64 |

|

| Shares used in

calculating adjusted EBITDA per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

1,074,204,304 |

|

1,070,501,493 |

|

1,070,501,493 |

|

|

1,074,196,310 |

|

1,074,372,067 |

|

1,074,372,067 |

|

|

Diluted |

1,075,017,689 |

|

1,070,501,493 |

|

1,070,501,493 |

|

|

1,074,457,821 |

|

1,076,740,198 |

|

1,076,740,198 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: FANHUA Inc.

For more information, please contact:

Investor Relations

Tel: +86 (20) 8388-3191

Email: qiusr@fanhgroup.com

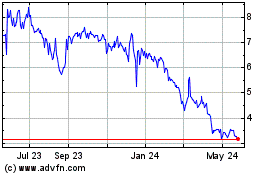

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Nov 2024 to Dec 2024

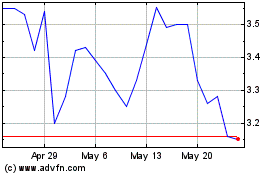

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Dec 2023 to Dec 2024