FlexShopper, Inc. (Nasdaq: FPAY) (“FlexShopper” or the

“Corporation”) reminds right holders, who wish to subscribe for

units or over-subscribe, that many broker-dealers ask for unit

rights subscription and over-subscription submissions by or before

Wednesday, December 18, 2024 even though the anticipated expiration

of the rights offering is Friday, December 20, 2024. FlexShopper

encourages its right holders to contact their broker or financial

advisor’s Corporate Actions Department immediately to participate

in the rights offering. Rights offering information can be found at

https://www.sec.gov and https://investors.flexshopper.com.

The rights offering includes an over-subscription privilege,

which entitles each right holder that exercises all its basic

subscription privileges in full the right to purchase additional

units that remain unsubscribed at the expiration of the rights

offering. Both the subscription rights and over-subscription

privileges are subject to the availability and pro-rata allocation

of units among participants. All subscription rights and

over-subscription privileges may only be exercised during the

subscription period. If a rights holder does not exercise their

subscription rights before the expiration date, such rights will be

deemed expired and void and will have no value.

FlexShopper has commenced the rights offering to raise capital

to equitize its balance sheet through funding the repurchase of

over 90% of its Series 2 Convertible Preferred Stock, and by

repaying a portion of its credit facility and other outstanding

debt facilities. Any remaining proceeds will be used for general

corporate purposes, including potential acquisitions of other

companies. Officers and directors of the Corporation have given

indications they intend to purchase at least $5.0 million in the

rights offering in a combination of units and Series A, B and C

rights. In addition, holders of the subordinated debt are able to

convert into unsubscribed units prior to closing. All units will be

at the same price and on the same terms as the other investors in

the offering.

The rights offering allow FlexShopper’s stockholders of record

as of December 2, 2024, to purchase up to 35,000,000 units. The

rights offering was made through a dividend in the form of two

non-transferable basic subscription rights for each share of common

stock or common stock equivalent owned on the record date. Each

right permits the holder to purchase one unit at a fixed

subscription price of $1.70 per unit. Each unit consists of one

share of common stock, as well as short-term Series A, B and C

rights to purchase additional shares of common stock at varying

discounted market-based prices.

If shares of common stock are held in the rights holder’s name,

and subscription rights will not be exercised through a broker,

dealer, custodian bank or other nominee (including any mobile

investment platform), then the subscription certificate, all other

required subscription documents and subscription payments should be

sent by mail to Continental Stock Transfer, the Subscription Agent,

at the address below, to be received before the expiration date.

Participants should refer to the instructions included with the

subscription documents for complete information regarding

completing and submitting the subscription documents.

| |

|

| By Hand or Overnight Courier or

Regular Mail: |

Continental Stock Transfer &

Trust Company1 State Street, 30th FloorNew York, NY 10004Attention:

Corporate Actions – FlexShopper, Inc. |

| |

|

A copy of the prospectus and related materials were sent to

holders of record on December 3, 2024. Additionally, a copy of the

prospectus may be requested from, and questions relating to the

rights offering may be directed to, the information agent for the

rights offering, as follows:

Rights Offering Information Agent

MacKenzie Partners, Inc.7 Penn Plaza,

Suite 503New York, NY 10001Telephone at (212) 929-5500 (bankers and

brokers) or (800) 322-2885 (all

others)rightsoffer@mackenziepartners.com

FlexShopper has engaged Moody Capital Solutions, Inc. (“Moody

Capital”) to act as dealer-manager for the rights offering. Moody

Capital Solutions, Inc. invites any broker-dealers interested in

participating in the rights offering to contact

info@moodycapital.com. Moody Capital is offering a selected dealer

fee of $0.051 per unit to registered broker-dealers (who do not

manage accounts on a discretionary basis) in connection with the

solicitation and exercise of the subscription rights and acceptance

by the Corporation of such subscription. Moody Capital has a

selected dealer agreement and W-9 that must be completed before

such selected dealer can accept payment from Moody Capital. Moody

Capital is also offering 3% to selected dealers on the solicitation

and exercise of Series A, Series B and Series C rights.

The Corporation recommends that current shareholders

consider notifying their broker or financial advisor about the

rights offering to ensure their ability to participate in the

rights offering.

The Company’s registration statement on Form S-1 was declared

effective by the U.S. Securities and Exchange Commission on

November 29, 2024. The prospectus relating to and describing the

terms of the rights offering has been filed with the SEC on

December 2, 2024, and is available on the SEC’s website at

www.sec.gov. This announcement shall not constitute an offer to

sell, or the solicitation of an offer to buy, any securities, nor

shall there be any sale of these securities in any state in which

such offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of any such

state.

About FlexShopper

FlexShopper, Inc. is a leading national financial technology

company that offers innovative payment options to consumers.

FlexShopper provides a variety of flexible funding options for

underserved consumers through its direct-to-consumer online

marketplace at Flexshopper.com and in partnership with merchants

both online and at brick-and-mortar locations. FlexShopper’s

solutions are crafted to meet the needs of a wide range of consumer

segments through lease-to-own and lending products.

Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 (the “Act”)

provides a safe harbor for forward-looking statements made by or on

behalf of the Corporation. The information contained in this press

release may include, but are not limited to, statements about

undertaking the Rights Offering, as well as, operating performance,

trends, events that we expect or anticipate will occur in the

future, statements about sales levels, restructuring, profitability

and anticipated expenses and cash outflows. All statements in this

document other than statements of historical fact are statements

that are, or could be, deemed “forward-looking statements” within

the meaning of the Act and words such as “may,” “intend,”

“believe,” “expect,” “anticipate,” “estimate,” “project,”

“forecast” and other terms of similar meaning that indicate future

events and trends are also generally intended to identify

forward-looking statements. Forward-looking statements speak only

as of the date on which such statements are made, are not

guarantees of future performance or expectations and involve risks

and uncertainties. For the Corporation, these risks and

uncertainties include, but are not limited to: our ability to

obtain adequate financing to fund our business operations in the

future; the failure to successfully manage and grow our

FlexShopper.com e-commerce platform; our ability to maintain

compliance with financial covenants under our credit agreement; our

dependence on the success of our third-party retail partners and

our continued relationships with them; our compliance with various

federal, state and local laws and regulations, including those

related to consumer protection; the failure to protect the

integrity and security of customer and employee

information; and those discussed more fully in documents filed

with the SEC by the Corporation, particularly in Item 1A, Risk

Factors, in Part I of the Corporation’s Annual Report on Form 10-K

for the year ended December 31, 2023, and Part II of the

Corporation’s subsequently filed Quarterly Reports on Form 10-Q.

The Corporation cannot guarantee any future results, levels of

activity, performance or achievements. In addition, there may be

events in the future that the Corporation may not be able to

predict accurately or control which may cause actual results to

differ materially from expectations expressed or implied by

forward-looking statements. Except as required by U.S. federal

securities law, we assume no obligation, and disclaim any

obligation, to update forward-looking statements whether as a

result of new information, events or otherwise.

Contact Information

For FlexShopper:Investor

Relationsir@flexshopper.com

Investor and Media Contact:Andrew Berger,

Managing DirectorSM Berger & Company, Inc.Tel: (216)

464-6400andrew@smberger.com

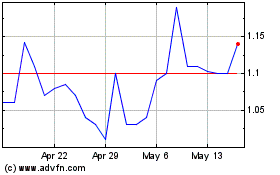

FlexShopper (NASDAQ:FPAY)

Historical Stock Chart

From Dec 2024 to Jan 2025

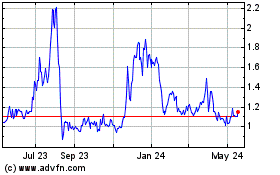

FlexShopper (NASDAQ:FPAY)

Historical Stock Chart

From Jan 2024 to Jan 2025