Liberty Media Corporation (“Liberty Media” or “Liberty”)

(NASDAQ: FWONA, FWONK, LLYVA, LLYVK) today reported third quarter

2024 results. Headlines include(1):

- Completed combination of Liberty SiriusXM Group and SiriusXM on

September 9th

- Attributed to Formula One Group

- Refinanced F1 debt facilities, extending maturities and

reducing margin on Term Loan B from 2.25% to 2.00% with anticipated

future step down to 1.75%

- Secured all funding for MotoGP transaction and on track to

close by year-end 2024

- Completed public offering of 12.2 million FWONK shares for $949

million gross proceeds in lieu of issuing equity to sellers

- Raised deal-contingent incremental $850 million Term Loan B and

$150 million Term Loan A commitments

- F1 announced several new and expanded sponsorship agreements,

including LVMH and Lenovo as Global Partners and American Express

and Santander as Official Partners

- Signed multi-year licensing deals with LEGO and Mattel Hot

Wheels which will see both brands launch F1 products in scale in

2025

- Attributed to Liberty Live Group

- Fair value of Live Nation investment was $7.6 billion as of

September 30th

“The third quarter was active both at the corporate level and at

our operating businesses. We closed the Liberty SiriusXM merger

with SiriusXM, refinanced the F1 debt facilities and secured all

necessary funding for our planned acquisition of MotoGP,” said Greg

Maffei, Liberty Media President and CEO. “Formula 1’s commercial

progress is incredible and we were thrilled to announce a number of

hallmark deals beginning in 2025, including our new multi-year

partnership with LVMH. Live Nation continues to see high global

demand for their events and is already positioned for a very strong

2025 with increased stadium activity.”

Corporate Updates

On September 9, 2024, Liberty Media completed the split-off (the

“Split-Off”) of its wholly owned subsidiary, Liberty Sirius XM

Holdings Inc. (“Liberty Sirius XM Holdings”). Liberty Sirius XM

Holdings was comprised of the businesses, assets and liabilities

attributed to the Liberty SiriusXM Group immediately prior to the

Split-Off. Following the Split-Off, a wholly owned subsidiary of

Liberty Sirius XM Holdings merged with and into Sirius XM Holdings

Inc. (“Sirius XM Holdings”), with Sirius XM Holdings surviving the

merger as a wholly owned subsidiary of Liberty Sirius XM Holdings.

As a result of these transactions, Liberty Sirius XM Holdings is an

independent company separate from Liberty Media and has been

renamed Sirius XM Holdings Inc. Liberty Sirius XM Holdings is

presented as a discontinued operation in Liberty Media’s condensed

consolidated financial statements.

Discussion of Results

Unless otherwise noted, the following discussion compares

financial information for the three months ended September 30, 2024

to the same period in 2023.

FORMULA ONE GROUP – The following table provides the

financial results attributed to Formula One Group for the third

quarter of 2024. In the third quarter, Formula One Group incurred

$21 million of corporate level selling, general and administrative

expense (including stock-based compensation expense).

3Q23

3Q24

amounts in millions

Formula One Group

Revenue

Formula 1

$

887

$

861

Corporate and other

—

70

Intergroup elimination

—

(20

)

Total Formula One Group

$

887

$

911

Operating Income (Loss)

Formula 1

$

132

$

146

Corporate and other

(25

)

(36

)

Total Formula One Group

$

107

$

110

Adjusted OIBDA (Loss)

Formula 1

$

215

$

221

Corporate and other

(18

)

(14

)

Total Formula One Group

$

197

$

207

F1 Operating Results

“Our business is benefitting from excellent competitive and

financial momentum. We signed a ground-breaking partnership with

LVMH for 2025, expanded our relationships with Lenovo and American

Express, and secured licensing agreements with LEGO and Mattel’s

Hot Wheels which expand F1 beyond our race calendar into the homes

of our fans,” said Stefano Domenicali, Formula 1 President and CEO.

“The thrilling racing and tight championship has benefitted

viewership and digital engagement as the season has progressed.

Race attendance is up season-to-date at 5.8 million with sellout

crowds at nearly all races. It is great to see the on-track talent

of both our seasoned drivers as well as young talent who hopefully

have long F1 careers ahead.”

The following table provides the operating results of Formula 1

(“F1”).

3Q23

3Q24

% Change

amounts in millions

Primary Formula 1 revenue

$

790

$

758

(4

)%

Other Formula 1 revenue

97

103

6

%

Total Formula 1 revenue

$

887

$

861

(3

)%

Operating expenses (excluding stock-based

compensation):

Team payments

(432

)

(371

)

14

%

Other cost of Formula 1 revenue

(183

)

(190

)

(4

)%

Cost of Formula 1 revenue

$

(615

)

$

(561

)

9

%

Selling, general and administrative

expenses

(57

)

(79

)

(39

)%

Adjusted OIBDA

$

215

$

221

3

%

Stock-based compensation

(1

)

(1

)

—

%

Depreciation and Amortization(a)

(82

)

(74

)

10

%

Operating income (loss)

$

132

$

146

11

%

Number of races in period

8

7

_________________________

a)

Includes $74 million and $61

million of amortization related to purchase accounting for the

periods ended September 30, 2023 and September 30, 2024,

respectively, that is excluded from calculations for purposes of

team payments.

Primary F1 revenue represents the majority of F1’s revenue and

is derived from (i) race promotion revenue, (ii) media rights fees

and (iii) sponsorship fees.

There were seven races held in the third quarter of 2024,

compared to eight races held in the third quarter of 2023. There

are 24 events scheduled for the 2024 race calendar, compared to 22

events held in 2023.

Primary F1 revenue decreased in the third quarter due to less

media rights and sponsorship revenue driven by one fewer race held

in the current period which resulted in a lower proportion of

season-based revenue recognized. Sponsorship revenue also decreased

due to the impact of the mix of races on event specific fees,

partially offset by recognition of revenue from new sponsors. The

decline in media rights revenue recognized was partially offset by

contractual increases in fees and continued growth in F1 TV

subscription revenue. Race promotion revenue grew in the third

quarter due to fees from the different mix of events held compared

to the prior year period. Other F1 revenue increased in the third

quarter primarily due to higher licensing revenue and revenue

generated from third-party events at the Las Vegas Grand Prix

Plaza, partially offset by lower hospitality income due to the mix

of events in the current period.

Operating income and Adjusted OIBDA(2) increased in the third

quarter. Team payments decreased due to the pro rata recognition of

payments across the race season with one fewer race held in the

current period, partially offset by the expectation of higher team

payments for the full year. Other cost of F1 revenue is largely

variable in nature and is mostly derived from servicing both

Primary and Other F1 revenue opportunities. These costs increased

due to higher commissions and partner servicing costs associated

with servicing Primary F1 revenue streams and higher digital costs,

partially offset by lower FIA regulatory, technical, hospitality

and travel costs due to the mix of events held. Other cost of F1

revenue in the third quarter was also impacted by higher costs

associated with F1 Academy and lease expense for the Las Vegas

Grand Prix Plaza which wasn’t incurred in the prior year. Selling,

general and administrative expense increased due to higher

personnel, IT, property and marketing costs as well as legal and

other professional fees, partially offset by foreign exchange

favorability.

Corporate and Other Operating

Results

Corporate and Other revenue increased in the second quarter due

to the inclusion of Quint results and $7 million of rental income

related to the Las Vegas Grand Prix Plaza. In the third quarter,

Quint results were primarily driven by F1 Experiences across the

seven races held. Quint’s revenue is seasonal around its largest

events, which are generally during the second and fourth quarters.

Corporate and Other Adjusted OIBDA for the third quarter of 2024

includes the rental income related to the Las Vegas Grand Prix

Plaza, Quint results and other corporate overhead.

The businesses and assets attributed to Formula One Group

consist primarily of Liberty Media’s subsidiaries, F1 and

Quint.

LIBERTY LIVE GROUP – In the third quarter, $3 million of

corporate level selling, general and administrative expense

(including stock-based compensation expense) was allocated to

Liberty Live Group.

The businesses and assets attributed to Liberty Live Group

consist of Liberty Media’s interest in Live Nation and other

minority investments.

Share Repurchases

There were no repurchases of Liberty Media’s common stock from

August 1 through October 31, 2024. The total remaining repurchase

authorization for Liberty Media as of November 1, 2024 is $1.1

billion and can be applied to repurchases of common shares of any

of the Liberty Media tracking stocks.

FOOTNOTES

1)

Liberty Media will discuss these

headlines and other matters on Liberty Media's earnings conference

call that will begin at 10:00 a.m. (E.T.) on November 7, 2024. For

information regarding how to access the call, please see “Important

Notice” later in this document.

2)

For a definition of Adjusted

OIBDA (as defined by Liberty Media) and the applicable

reconciliation, see the accompanying schedule.

NOTES

The following financial information with respect to Liberty

Media's equity affiliates, available for sale securities, cash and

debt is intended to supplement Liberty Media's condensed

consolidated balance sheet and statement of operations to be

included in its Form 10-Q for the period ended September 30,

2024.

Fair Value of Corporate Public

Holdings

(amounts in millions)

6/30/2024

9/30/2024

Formula One Group

Other Monetizable Public Holdings(a)

50

—

Total Formula One Group

$

50

$

—

Liberty Live Group

Live Nation Investment(b)

6,529

7,625

Total Liberty Live Group

$

6,529

$

7,625

Total Liberty Media

$

6,579

$

7,625

_________________________

a)

Represents the carrying value of

other public holdings that are accounted for at fair value. Formula

One Group liquidated $50 million of time deposits during the third

quarter of 2024.

b)

Represents the fair value of the

equity investment in Live Nation. In accordance with GAAP, Liberty

Media accounts for its investment in the equity of Live Nation

using the equity method of accounting and includes it in its

condensed consolidated balance sheet at $319 million and $422

million as of June 30, 2024 and September 30, 2024,

respectively.

Cash and Debt

The following presentation is provided to separately identify

cash and debt information.

(amounts in millions)

6/30/2024

9/30/2024

Cash and Cash Equivalents Attributable

to:

Formula One Group(a)

$

1,491

$

2,666

Liberty Live Group

406

388

Total Consolidated Cash and Cash

Equivalents (GAAP)

$

1,897

$

3,054

Debt:

2.25% convertible notes due 2027(b)

475

475

Formula 1 term loan and revolving credit

facility

2,389

2,384

Other corporate level debt

56

54

Total Attributed Formula One Group

Debt

$

2,920

$

2,913

Fair market value adjustment

(8

)

15

Total Attributed Formula One Group Debt

(GAAP)

$

2,912

$

2,928

Formula 1 leverage(c)

1.3x

1.1x

0.5% Live Nation exchangeable senior

debentures due 2050(b)

62

50

2.375% Live Nation exchangeable senior

debentures due 2053(b)

1,150

1,150

Live Nation margin loan

—

—

Total Attributed Liberty Live Group

Debt

$

1,212

$

1,200

Unamortized discount, fair market value

adjustment and deferred loan costs

91

237

Total Attributed Liberty Live Group

Debt (GAAP)

$

1,303

$

1,437

Total Liberty Media Corporation Debt

(GAAP)

$

4,215

$

4,365

_________________________

a)

Includes $1,245 million and

$1,383 million of cash held at F1 as of June 30, 2024 and September

30, 2024, respectively, and $58 million and $65 million of cash

held at Quint as of June 30, 2024 and September 30, 2024,

respectively.

b)

Face amount of the convertible

notes and exchangeable debentures with no fair market value

adjustment. The 0.5% Live Nation exchangeable senior debentures due

2050 were redeemed in September 2024 and remaining exchange

obligations were settled in October 2024.

c)

Net leverage as defined in F1’s

credit facilities for covenant calculations.

Liberty Media and F1 are in compliance with their debt covenants

as of September 30, 2024.

In August, Liberty Media issued 12.2 million shares of Series C

Formula One common stock for $949 million gross proceeds to

increase the cash consideration related to its planned acquisition

of Dorna Sports, S.L., the parent company of MotoGP. Total cash and

cash equivalents attributed to Formula One Group increased $1,175

million during the third quarter primarily due to the August equity

issuance and cash from operations at F1.

Total debt at Formula One Group was relatively flat in the third

quarter. In September, F1 refinanced its Term Loan B and extended

the maturities of its facilities. The Term Loan A and revolving

credit facility have been extended to mature in September 2029 and

the Term Loan B has been extended to mature in September 2031. The

margin on F1’s Term Loan B was permanently reduced from 2.25% to

2.00% with the potential to permanently step down to 1.75% if a

certain leverage test is met on or after the earlier of the closing

or termination of the MotoGP acquisition. As part of the terms

obtained under the September refinancing, F1 also raised an

incremental $850 million of Term Loan B commitment in addition to

the incremental $150 million Term Loan A commitment obtained in

April. The incremental term loans will be used to fund a portion of

the MotoGP acquisition and are conditioned upon transaction

close.

Total cash and cash equivalents attributed to Liberty Live Group

decreased $18 million during the third quarter primarily due to net

debt repayment, interest payments and corporate overhead. Total

debt attributed to Liberty Live Group decreased $12 million during

the quarter due to the redemption of a portion of the 0.5%

exchangeable senior debentures due 2050. In August 2024, Liberty

Media issued a redemption notice for all of its 0.5% exchangeable

senior debentures due 2050. Any debentures that were not so

purchased or properly surrendered for exchange were redeemed in

full on September 1, 2024. In October 2024, Liberty Live Group

settled the $50 million principal amount of the 0.5% exchangeable

senior debentures due 2050 surrendered for exchange with cash on

hand.

Important Notice: Liberty Media Corporation (Nasdaq:

FWONA, FWONK, LLYVA, LLYVK) will discuss Liberty Media's earnings

release on a conference call which will begin at 10:00 a.m. (E.T.)

on November 7, 2024. The call can be accessed by dialing (877)

704-2829 or (215) 268-9864, passcode 13744092 at least 10 minutes

prior to the start time. The call will also be broadcast live

across the Internet and archived on our website. To access the

webcast go to

https://www.libertymedia.com/investors/news-events/ir-calendar.

Links to this press release will also be available on the Liberty

Media website.

This press release includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements about business strategies, market

potential, future financial performance and prospects, the planned

acquisition of MotoGP, Formula 1 debt matters, expectations

regarding Live Nation’s business and other matters that are not

historical facts. These forward-looking statements involve many

risks and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements,

including, without limitation, the satisfaction of all conditions

to closing for the transaction with MotoGP, possible changes in

market acceptance of new products or services, regulatory matters

affecting our businesses, the unfavorable outcome of future

litigation, the failure to realize benefits of acquisitions, rapid

industry change, failure of third parties to perform, continued

access to capital on terms acceptable to Liberty Media and changes

in law, including consumer protection laws, and their enforcement.

These forward-looking statements speak only as of the date of this

press release, and Liberty Media expressly disclaims any obligation

or undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein to reflect any change in

Liberty Media's expectations with regard thereto or any change in

events, conditions or circumstances on which any such statement is

based. Please refer to the publicly filed documents of Liberty

Media, including the most recent Forms 10-K and 10-Q, for

additional information about Liberty Media and about the risks and

uncertainties related to Liberty Media's business which may affect

the statements made in this press release.

LIBERTY MEDIA

CORPORATION

BALANCE SHEET

INFORMATION

September 30, 2024

(unaudited)

Attributed

Formula

Liberty

One

Live

Intergroup

Consolidated

Group

Group

Eliminations

Liberty

amounts in millions

Assets

Current assets:

Cash and cash equivalents

$

2,666

388

—

3,054

Trade and other receivables, net

122

—

—

122

Other current assets

503

—

—

503

Total current assets

3,291

388

—

3,679

Investments in affiliates, accounted for

using the equity method

35

448

—

483

Property and equipment, at cost

1,010

—

—

1,010

Accumulated depreciation

(183

)

—

—

(183

)

827

—

—

827

Goodwill

4,192

—

—

4,192

Intangible assets subject to amortization,

net

2,757

—

—

2,757

Other assets

878

419

(27

)

1,270

Total assets

$

11,980

1,255

(27

)

13,208

Liabilities and Equity

Current liabilities:

Accounts payable and accrued

liabilities

$

404

—

—

404

Current portion of debt

21

55

—

76

Deferred revenue

756

—

—

756

Other current liabilities

37

—

—

37

Total current liabilities

1,218

55

—

1,273

Long-term debt

2,907

1,382

—

4,289

Deferred income tax liabilities

27

—

(27

)

—

Other liabilities

186

1

—

187

Total liabilities

4,338

1,438

(27

)

5,749

Equity / Attributed net assets

7,642

(206

)

—

7,436

Noncontrolling interests in equity of

subsidiaries

—

23

—

23

Total liabilities and equity

$

11,980

1,255

(27

)

13,208

LIBERTY MEDIA

CORPORATION

STATEMENT OF OPERATIONS

INFORMATION

Three months ended September

30, 2024 (unaudited)

Attributed

Formula

Liberty

Liberty

One

Live

SiriusXM

Consolidated

Group

Group

Group

Liberty

amounts in millions

Revenue:

Formula 1 revenue

$

848

—

—

848

Other revenue

63

—

—

63

Total revenue

911

—

—

911

Operating costs and expenses:

Cost of Formula 1 revenue (exclusive of

depreciation shown separately below)

554

—

—

554

Other cost of sales

41

—

—

41

Other operating expenses

2

—

—

2

Selling, general and administrative

(1)

113

3

—

116

Impairment and acquisition costs

3

—

—

3

Depreciation and amortization

88

—

—

88

801

3

—

804

Operating income (loss)

110

(3

)

—

107

Other income (expense):

Interest expense

(54

)

(8

)

—

(62

)

Share of earnings (losses) of affiliates,

net

(1

)

117

—

116

Realized and unrealized gains (losses) on

financial instruments, net

39

(94

)

—

(55

)

Other, net

21

8

—

29

5

23

—

28

Earnings (loss) from continuing operations

before income taxes

115

20

—

135

Income tax (expense) benefit

2

(5

)

—

(3

)

Net earnings (loss) from continuing

operations

117

15

—

132

Net earnings (loss) from discontinued

operations

—

—

(3,002

)

(3,002

)

Net earnings (loss)

117

15

(3,002

)

(2,870

)

Less net earnings (loss) attributable to

the noncontrolling interests

—

—

(502

)

(502

)

Net earnings (loss) attributable to

Liberty stockholders

$

117

15

(2,500

)

(2,368

)

(1) Includes stock-based compensation

expense as follows:

Selling, general and administrative

$

6

1

—

7

LIBERTY MEDIA

CORPORATION

STATEMENT OF OPERATIONS

INFORMATION

Three months ended September

30, 2023 (unaudited)

Attributed

Formula

Liberty

Liberty

One

Live

SiriusXM

Braves

Consolidated

Group

Group

Group

Group

Liberty

amounts in millions

Revenue:

Formula 1 revenue

$

887

—

—

—

887

Other revenue

—

—

—

49

49

Total revenue

887

—

—

49

936

Operating costs and expenses:

Cost of Formula 1 revenue (exclusive of

depreciation shown separately below)

615

—

—

—

615

Other operating expenses

—

—

—

38

38

Selling, general and administrative

(1)

79

5

—

9

93

Depreciation and amortization

86

—

—

3

89

780

5

—

50

835

Operating income (loss)

107

(5

)

—

(1

)

101

Other income (expense):

Interest expense

(56

)

(2

)

(1

)

(3

)

(62

)

Share of earnings (losses) of affiliates,

net

2

90

50

1

143

Realized and unrealized gains (losses) on

financial instruments, net

66

(72

)

45

—

39

Unrealized gains (losses) on intergroup

interests

16

—

—

(20

)

(4

)

Other, net

14

(35

)

1

1

(19

)

42

(19

)

95

(21

)

97

Earnings (loss) from continuing operations

before income taxes

149

(24

)

95

(22

)

198

Income tax (expense) benefit

(31

)

5

(21

)

1

(46

)

Net earnings (loss) from continuing

operations

118

(19

)

74

(21

)

152

Net earnings (loss) from discontinued

operations

—

—

291

—

291

Net earnings (loss)

118

(19

)

365

(21

)

443

Less net earnings (loss) attributable to

the noncontrolling interests

—

—

58

—

58

Net earnings (loss) attributable to

Liberty stockholders

$

118

(19

)

307

(21

)

385

(1) Includes stock-based compensation

expense as follows:

Selling, general and administrative

4

1

—

1

6

LIBERTY MEDIA

CORPORATION

STATEMENT OF CASH FLOWS

INFORMATION

Nine months ended September

30, 2024 (unaudited)

Attributed

Formula

Liberty

Liberty

One

Live

SiriusXM

Consolidated

Group

Group

Group

Liberty

amounts in millions

Cash flows from operating activities:

Net earnings (loss)

$

218

76

(2,412

)

(2,118

)

Adjustments to reconcile net earnings

(loss) to net cash provided by operating activities:

Net (earnings) loss from discontinued

operations

—

—

2,412

2,412

Depreciation and amortization

263

—

—

263

Stock-based compensation

24

3

—

27

Share of (earnings) loss of affiliates,

net

6

(181

)

—

(175

)

Realized and unrealized (gains) losses on

financial instruments, net

(86

)

75

—

(11

)

Deferred income tax expense (benefit)

22

22

—

44

Intergroup tax allocation

(97

)

(1

)

—

(98

)

Intergroup tax (payments) receipts

128

3

—

131

Other, net

25

(4

)

—

21

Changes in operating assets and

liabilities

Current and other assets

(71

)

—

—

(71

)

Payables and other liabilities

155

(4

)

—

151

Net cash provided (used) by operating

activities

587

(11

)

—

576

Cash flows from investing activities:

Investments in equity method affiliates

and debt and equity securities

(7

)

(3

)

—

(10

)

Cash proceeds from dispositions

—

107

—

107

Cash (paid) received for acquisitions, net

of cash acquired

(205

)

—

—

(205

)

Capital expended for property and

equipment, including internal-use software and website

development

(52

)

—

—

(52

)

Other investing activities, net

(13

)

1

—

(12

)

Net cash provided (used) by investing

activities

(277

)

105

—

(172

)

Cash flows from financing activities:

Borrowings of debt

644

—

—

644

Repayments of debt

(671

)

(12

)

—

(683

)

Issuance of Series C Liberty Formula One

common stock

939

—

—

939

Other financing activities, net

42

1

—

43

Net cash provided (used) by financing

activities

954

(11

)

—

943

Effect of foreign exchange rate changes on

cash, cash equivalents and restricted cash

1

—

—

1

Net cash provided (used) by discontinued

operations:

Cash provided (used) by operating

activities

—

—

879

879

Cash provided (used) by investing

activities

—

—

(709

)

(709

)

Cash provided (used) by financing

activities

—

—

(485

)

(485

)

Net cash provided (used) by discontinued

operations

—

—

(315

)

(315

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

1,265

83

(315

)

1,033

Cash, cash equivalents and restricted cash

at beginning of period

1,408

305

315

2,028

Cash, cash equivalents and restricted cash

at end of period

$

2,673

388

—

3,061

Cash and cash equivalents

$

2,666

388

—

3,054

Restricted cash included in other current

assets

7

—

—

7

Total cash and cash equivalents and

restricted cash at end of period

$

2,673

388

—

3,061

LIBERTY MEDIA

CORPORATION

STATEMENT OF CASH FLOWS

INFORMATION

Nine months ended September

30, 2023 (unaudited)

Attributed

Formula

Liberty

Liberty

One

Live

SiriusXM

Braves

Consolidated

Group

Group

Group

Group

Liberty

amounts in millions

Cash flows from operating activities:

Net earnings (loss)

$

124

(19

)

802

(109

)

798

Adjustments to reconcile net earnings

(loss) to net cash provided by operating activities:

Net (earnings) loss from discontinued

operations

—

—

(757

)

—

(757

)

Depreciation and amortization

254

—

—

37

291

Stock-based compensation

14

1

—

7

22

Share of (earnings) loss of affiliates,

net

1

(90

)

(127

)

(12

)

(228

)

Realized and unrealized (gains) losses on

financial instruments, net

(83

)

72

59

(3

)

45

Unrealized (gains) losses on intergroup

interests, net

(15

)

—

—

83

68

Deferred income tax expense (benefit)

19

(4

)

14

(5

)

24

Intergroup tax allocation

(135

)

(1

)

(1

)

—

(137

)

Intergroup tax (payments) receipts

91

—

—

(1

)

90

Other, net

6

34

6

4

50

Changes in operating assets and

liabilities

Current and other assets

(122

)

(10

)

—

(34

)

(166

)

Payables and other liabilities

400

14

1

65

480

Net cash provided (used) by operating

activities

554

(3

)

(3

)

32

580

Cash flows from investing activities:

Investments in equity method affiliates

and debt and equity securities

(173

)

—

—

—

(173

)

Cash proceeds from dispositions

110

1

—

—

111

Capital expended for property and

equipment, including internal-use software and website

development

(308

)

—

—

(35

)

(343

)

Other investing activities, net

(20

)

—

—

—

(20

)

Net cash provided (used) by investing

activities

(391

)

1

—

(35

)

(425

)

Cash flows from financing activities:

Borrowings of debt

—

1,135

—

30

1,165

Repayments of debt

(64

)

(918

)

—

(20

)

(1,002

)

Settlement of intergroup interests

(273

)

—

—

—

(273

)

Atlanta Braves Holdings, Inc.

Split-Off

—

—

—

(188

)

(188

)

Reclassification

(100

)

100

—

—

—

Other financing activities, net

11

—

3

8

22

Net cash provided (used) by financing

activities

(426

)

317

3

(170

)

(276

)

Net cash provided (used) by discontinued

operations:

Cash provided (used) by operating

activities

—

—

1,301

—

1,301

Cash provided (used) by investing

activities

—

—

(565

)

—

(565

)

Cash provided (used) by financing

activities

—

—

(771

)

—

(771

)

Net cash provided (used) by discontinued

operations

—

—

(35

)

—

(35

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

(263

)

315

(35

)

(173

)

(156

)

Cash, cash equivalents and restricted cash

at beginning of period

1,733

NA

370

173

2,276

Cash, cash equivalents and restricted cash

at end of period

$

1,470

315

335

—

2,120

Cash and cash equivalents

$

1,470

315

—

NA

1,785

Cash and cash equivalents included in

current assets of discontinued operations

—

—

327

NA

327

Restricted cash included in noncurrent

assets of discontinued operations

—

—

8

NA

8

Total cash and cash equivalents and

restricted cash at end of period

$

1,470

315

335

NA

2,120

NON-GAAP FINANCIAL MEASURES AND SUPPLEMENTAL

DISCLOSURES

SCHEDULE 1

To provide investors with additional information regarding our

financial results, this press release includes a presentation of

Adjusted OIBDA, which is a non-GAAP financial measure, for Formula

One Group, Liberty Live Group and the former Braves Group, together

with reconciliations to operating income, as determined under GAAP.

Liberty Media defines Adjusted OIBDA as operating income (loss)

plus depreciation and amortization, stock-based compensation,

separately reported litigation settlements, restructuring,

acquisition and other related costs and impairment charges.

Liberty Media believes Adjusted OIBDA is an important indicator

of the operational strength and performance of its businesses by

identifying those items that are not directly a reflection of each

business’ performance or indicative of ongoing business trends. In

addition, this measure allows management to view operating results

and perform analytical comparisons and benchmarking between

businesses and identify strategies to improve performance. Because

Adjusted OIBDA is used as a measure of operating performance,

Liberty Media views operating income as the most directly

comparable GAAP measure. Adjusted OIBDA is not meant to replace or

supersede operating income or any other GAAP measure, but rather to

supplement such GAAP measures in order to present investors with

the same information that Liberty Media's management considers in

assessing the results of operations and performance of its

assets.

The following table provides a reconciliation of Adjusted OIBDA

for Liberty Media to operating income (loss) calculated in

accordance with GAAP for the three months ended September 30, 2023

and September 30, 2024, respectively.

QUARTERLY

SUMMARY

(amounts in millions)

3Q23

3Q24

Formula One Group

Operating income

$

107

$

110

Depreciation and amortization

86

88

Stock compensation expense

4

6

Impairment and acquisition costs(a)

—

3

Adjusted OIBDA

$

197

$

207

Liberty Live Group

Operating income

$

(5

)

$

(3

)

Stock compensation expense

1

1

Adjusted OIBDA

$

(4

)

$

(2

)

Braves Group

Operating income

$

(1

)

N/A

Depreciation and amortization

3

N/A

Stock compensation expense

1

N/A

Adjusted OIBDA

$

3

N/A

Liberty Media Corporation

(Consolidated)

Operating income

$

101

$

107

Depreciation and amortization

89

88

Stock compensation expense

6

7

Impairment and acquisition costs

—

3

Adjusted OIBDA

$

196

$

205

_________________________

a)

During the three months ended

September 30, 2024, Formula One Group incurred $3 million of costs

related to corporate acquisitions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106993785/en/

Shane Kleinstein (720) 875-5432

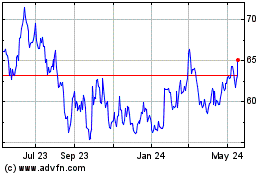

Liberty Media (NASDAQ:FWONA)

Historical Stock Chart

From Oct 2024 to Nov 2024

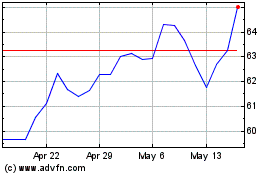

Liberty Media (NASDAQ:FWONA)

Historical Stock Chart

From Nov 2023 to Nov 2024