Golub Capital BDC, Inc. (the “Company,” “we,” “us” or “our”), a

business development company (Nasdaq: GBDC), announced that it has

priced an underwritten public offering of an additional $150

million in aggregate principal amount of 6.000% notes due 2029. The

notes will mature on July 15, 2029 and may be redeemed in whole or

in part at the Company’s option at any time prior to June 15, 2029,

at par plus a “make-whole” premium, and thereafter at par.

The notes will constitute a further issuance of, have the same

terms (except the issue date, the offering price and the initial

interest payment date) as, rank equally in right of payment with,

and be fungible and form a single series with the $600 million in

aggregate principal amount of the 6.000% notes due 2029 that the

Company initially issued on February 1, 2024. Upon the issuance of

the notes, the outstanding aggregate principal amount of the

Company’s 6.000% notes due 2029 will be $750 million.

SMBC Nikko Securities America, Inc., J.P. Morgan Securities LLC,

Santander US Capital Markets LLC, Truist Securities, Inc., Capital

One Securities, Inc., MUFG Securities Americas Inc., Regions

Securities LLC, SG Americas Securities, LLC and Wells Fargo

Securities, LLC are acting as joint book-running managers for this

offering. BNP Paribas Securities Corp., CastleOak Securities, L.P.,

CIBC World Markets Corp., Comerica Securities, Inc., Goldman Sachs

& Co. LLC, Morgan Stanley & Co. LLC, U.S. Bancorp

Investments, Inc. and WauBank Securities LLC are acting as

co-managers for the offering. The offering is expected to close on

December 3, 2024, subject to customary closing conditions.

The Company intends to use the net proceeds from this offering

to repay outstanding indebtedness under the Company’s senior

secured revolving credit facility with JPMorgan Chase Bank, N.A.

(the “JPM Credit Facility”) or the $383.6 million term debt

securitization issued by Golub Capital BDC 3 CLO 2 LLC, a Delaware

limited liability company and indirect subsidiary of the Company,

acquired as part of the Company’s June 2024 acquisition of Golub

Capital BDC 3, Inc. However, the Company may reborrow under the JPM

Credit Facility for general corporate purposes, which may include

investing in portfolio companies in accordance with its investment

strategy.

Investors are advised to carefully consider the investment

objective, risks, charges and expenses of the Company before

investing. The preliminary prospectus supplement dated November 25,

2024 and the accompanying prospectus dated June 9, 2022, each of

which have been filed with the Securities and Exchange Commission

(the “SEC”), contain this and other information about the Company

and should be read carefully before investing.

The pricing term sheet, the preliminary prospectus supplement,

the accompanying prospectus and this press release are not offers

to sell any securities of the Company and are not soliciting an

offer to buy the notes in any jurisdiction where such offer and

sale is not permitted.

The offering may be made only by means of a preliminary

prospectus supplement and an accompanying prospectus. Copies of the

preliminary prospectus supplement and the accompanying prospectus

may be obtained by calling SMBC Nikko Securities America, Inc. at

1-212-224-5135, J.P. Morgan Securities LLC at 1-212-834-4533,

Santander US Capital Markets LLC at 1-855-403-3636 and Truist

Securities, Inc. at 1-800-685-4786.

ABOUT GOLUB CAPITAL BDC, INC.

The Company is an externally-managed, non-diversified closed-end

management investment company that has elected to be treated as a

business development company under the Investment Company Act of

1940, as amended. The Company invests primarily in one stop and

other senior secured loans of U.S. middle-market companies that are

often sponsored by private equity investors. The Company’s

investment activities are managed by its investment adviser, GC

Advisors LLC, an affiliate of the Golub Capital group of companies

(“Golub Capital”).

ABOUT GOLUB CAPITAL

Golub Capital is a market-leading, award-winning direct lender

and experienced private credit manager. The firm specializes in

delivering reliable, creative and compelling financing solutions to

companies backed by private equity sponsors. Golub Capital’s

sponsor finance expertise also forms the foundation of its Broadly

Syndicated Loan and Credit Opportunities investment programs. Golub

Capital nurtures long-term, win-win partnerships that inspire

repeat business from private equity sponsors and investors.

As of October 1, 2024, Golub Capital had more than 1,000

employees and over $70 billion of capital under management, a gross

measure of invested capital including leverage. The firm has

offices in North America, Europe and Asia.

FORWARD-LOOKING STATEMENTS

Some of the statements in this press release constitute

forward-looking statements because they relate to future events or

our future performance or financial condition. The forward-looking

statements may include statements as to the Company’s notes

offering, the expected net proceeds from the offering, and the

anticipated use of the net proceeds of the offering. In addition,

words such as “anticipate,” “believe,” “expect,” “seek,” “plan,”

“should,” “estimate,” “project” and “intend” indicate

forward-looking statements, although not all forward-looking

statements include these words. The forward-looking statements

contained in this press release involve risks and uncertainties.

Our actual results could differ materially from those implied or

expressed in the forward-looking statements for any reason,

including the factors set forth in “Risk Factors” and elsewhere in

our annual report on Form 10-K and our other filings with the SEC.

Other factors that could cause actual results to differ materially

include: changes in the economy, financial and lending markets and

geopolitical environment; changes in the markets in which we

invest; changes in the interest rate environment and its impact on

our business and our portfolio companies; the impact off elevated

levels of inflation and its impact on our portfolio companies and

the industries in which we invest; future changes in laws or

regulations (including the interpretation of these laws and

regulations by regulatory authorities) and conditions in our

operating areas, particularly with respect to business development

companies or regulated investment companies; and other

considerations that may be disclosed from time to time in our

publicly disseminated documents and filings.

We have based the forward-looking statements included in this

press release on information available to us on the date of this

press release, and we assume no obligation to update any such

forward-looking statements. Although we undertake no obligation to

revise or update any forward-looking statements, whether as a

result of new information, future events or otherwise, you are

advised to consult any additional disclosures that we may make

directly to you or through reports that we in the future may file

with the SEC, including annual reports on Form 10-K, quarterly

reports on Form 10-Q and current reports on Form 8-K.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125844170/en/

Investor Contact: Christopher Ericson 312-212-4036

cericson@golubcapital.com

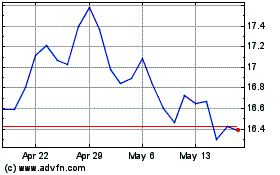

Golub Capital BDC (NASDAQ:GBDC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Golub Capital BDC (NASDAQ:GBDC)

Historical Stock Chart

From Dec 2023 to Dec 2024