false

0000825324

0000825324

2024-12-12

2024-12-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported)

December 12, 2024

Good Times Restaurants Inc.

(Exact name of registrant as specified in its

charter)

| Nevada |

|

000-18590 |

|

84-1133368 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

651 Corporate Circle, Suite 200, Golden, CO 80401

(Address of principal executive offices including

zip code)

Registrant’s telephone number, including

area code: (303) 384-1400

Not applicable

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instruction A.2.):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.001 par value |

|

GTIM |

|

Nasdaq Capital Market |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule

12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On December 12, 2024, Good

Times Restaurants Inc. issued a press release announcing earnings and other financial results for the fourth fiscal quarter and fiscal

year ended September 24, 2024, and that management would review these results in a conference call on December 12, 2024, at 5:00 p.m.

ET.

On December 12, 2024, the

Company announced a $2 million expansion of its existing share repurchase program, which now provides authorization for a total of $7 million dollars of aggregate share repurchases.

The Company has purchased approximately $4.8 million dollars under its existing share repurchase program which was originally announced

February 3, 2022. This authorization to repurchase will continue until the maximum value of shares is purchased or the Company terminates

the program. The Company intends to make all repurchases in compliance with applicable regulatory guidelines and to administer the plan

in accordance with applicable laws, including Rule 10b-18 of the Securities Exchange Act of 1934, as amended. The timing and actual number

of shares repurchased will depend on a variety of factors, including price, general business and market conditions, and alternative investment

opportunities. The repurchase program does not obligate the Company to acquire any particular amount of common shares, and the repurchase

program may be suspended or discontinued at any time at the Company’s discretion.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits. The following exhibits are filed

as part of this report.

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GOOD TIMES RESTAURANTS INC. |

| |

|

|

| Date: December 12, 2024 |

By: |

|

| |

|

Ryan M. Zink |

| |

|

Chief Executive Officer |

2

Exhibit 99.1

| FOR IMMEDIATE RELEASE |

|

| December 12, 2024 |

Nasdaq Capital Markets - GTIM |

GOOD TIMES RESTAURANTS REPORTS RESULTS FOR

THE FOURTH QUARTER AND FISCAL YEAR ENDED SEPTEMBER 24, 2024

(GOLDEN, CO) Good Times Restaurants Inc. (Nasdaq:

GTIM), operator of Bad Daddy’s Burger Bar and Good Times Burgers & Frozen Custard, today reported financial results for the

fiscal fourth quarter and fiscal year ended September 24, 2024.

Highlights of the Company’s financial results include:

| · | Total Revenues increased 3.0% to $142.3 million for the year compared to the previous fiscal year |

| · | Total Restaurant Sales for company-owned Good Times restaurants increased $0.5 million to $10.0 million

for the fourth quarter compared to the same prior year fourth quarter and increased $3.0 million to $38.0 million for the year compared

to the previous fiscal year |

| · | Same Store Sales1

for Good Times restaurants decreased 0.1% for the fourth quarter compared to the prior-year fourth quarter and increased 2.9% for the

year compared to the 2023 fiscal year |

| · | Total Restaurant Sales for Bad Daddy’s restaurants increased $1.0 million to $25.6 million for the

fourth quarter compared to the prior-year fourth quarter and increased $1.3 million to $103.5 million for the year compared to the previous

fiscal year |

| · | Same Store Sales1 for Bad Daddy’s restaurants increased 3.2% for the fourth quarter compared

to the prior-year fourth quarter and decreased 1.2% for the year compared to the 2023 fiscal year |

| · | Net Income Attributable to Common Shareholders was $0.2 million for the fourth quarter. Net Income Attributable

to Common Shareholders was $1.6 million for the fiscal year |

| · | Adjusted EBITDA2 (a non-GAAP measure) was

$1.3 million for the fourth quarter and $5.4 million for the fiscal year |

| · | During fiscal 2024, the Company repurchased 543,530 shares of its common stock under its share repurchase

program and additionally repurchased 190,690 shares of its common stock through negotiated transactions with private individuals. |

Ryan M. Zink, the Company’s Chief Executive

Officer, said, “I am inspired by the turnaround in same store sales this year at Bad Daddy’s, a strong indication that our

back-to-basics approach to brand execution is effectively attracting and retaining guests at our restaurants. Bad Daddy’s performance

significantly beat the Black Box casual dining index for both sales and traffic during the quarter.”

“During this quarter, Good Times experienced

softer sales, in part due to the return of extreme discounting in the quick service space, with many promotions from our much larger competitors

centered around the five dollar price point. We continue to be focused on delivering value through high quality products and the uncompromising

standards for our key suppliers of our all natural beef and chicken. History has shown that exaggerated discounting is a race to the bottom

and an unprofitable strategy in the long-term, so we are choosing a different path.” Zink continued.

Mr. Zink concluded, “We are approaching

the new year with a continuation of our strategy at Bad Daddy’s, and a similar back-to-basics approach to re-training our teams

and reaching for even higher standards of operations excellence at Good Times. Our confidence in the Good Times brand is evidenced through

the continuation of our brand evolution through our remodels, including updated signage with our refreshed logo, fresh technology for

our employees and guests, and community art through our exterior murals.”

1

Same store sales are a metric used in evaluating the performance of established restaurants and is a commonly

used metric in the restaurant industry. Same store sales for our brands are calculated using all company-owned units open for at least

18 full fiscal months and use the comparable operating weeks from the prior year to the current year period’s operating weeks.

2 For

a reconciliation of Adjusted EBITDA to the most directly comparable financial measures presented in accordance with GAAP and a discussion

of why the Company considers them useful, see the financial information schedules accompanying this release.

Share Repurchase

Additionally, the Company announced a $2 million

expansion of its existing share repurchase program, which now provides authorization for a total of $7 million dollars of aggregate share

repurchases. The Company has purchased approximately $4.8 million dollars under its existing share repurchase program which was originally

announced February 3, 2022. This authorization to repurchase will continue until the maximum value of shares is purchased or the Company

terminates the program. The Company intends to make all repurchases in compliance with applicable regulatory guidelines and to administer

the plan in accordance with applicable laws, including Rule 10b-18 of the Securities Exchange Act of 1934, as amended. The timing and

actual number of shares repurchased will depend on a variety of factors, including price, general business and market conditions, and

alternative investment opportunities. The repurchase program does not obligate the Company to acquire any particular amount of common

shares, and the repurchase program may be suspended or discontinued at any time at the Company’s discretion.

Conference Call

Management will host a conference call to discuss

its fiscal fourth quarter and year ended September 24, 2024, financial results on Thursday, December 12, 2024, at 5:00 p.m. ET. Hosting

the call will be Ryan M. Zink, its Chief Executive Officer and Keri A. August, its Senior Vice President of Finance and Accounting.

The conference call can be accessed live over

the phone by dialing 888-210-2831, access code 3024033. The conference call will also be webcast live from the Company's corporate website

www.goodtimesburgers.com. An archive of the webcast will be available at the same location on the corporate website shortly after the

call has concluded.

Good Times Restaurants Inc. (Nasdaq: GTIM)

Good Times Restaurants Inc. owns, operates, and

licenses 40 Bad Daddy’s Burger Bar restaurants through its wholly owned subsidiaries. Bad Daddy’s Burger Bar is a full-service

“small box” restaurant concept featuring a chef-driven menu of gourmet signature burgers, chopped salads, appetizers and sandwiches

with a full bar and a focus on a selection of craft beers in a high-energy atmosphere that appeals to a broad consumer base. Additionally,

through its wholly owned subsidiaries, Good Times Restaurants Inc. owns, operates and franchises 30 Good Times Burgers & Frozen Custard

restaurants primarily in Colorado. Good Times is a regional quick-service concept featuring 100% all-natural burgers and chicken sandwiches,

signature wild fries, green chili breakfast burritos and fresh frozen custard desserts.

Forward Looking Statements

This press release contains forward looking statements

within the meaning of federal securities laws. The words “intend,” “may,” “believe,” “will,”

“should,” “anticipate,” “expect,” “seek”, “plan” and similar expressions are

intended to identify forward looking statements. These statements involve known and unknown risks, which may cause the Company’s

actual results to differ materially from results expressed or implied by the forward-looking statements. Such risks and uncertainties

include, among other things, the market price of the Company's stock prevailing from time to time, the nature of other investment opportunities

presented to the Company, the disruption to our business from pandemics and other public health emergencies, the impact and duration of

staffing constraints at our restaurants, the impact of supply chain constraints and the current inflationary environment, the uncertain

nature of current restaurant development plans and the ability to implement those plans and integrate new restaurants, delays in developing

and opening new restaurants because of weather, local permitting or other reasons, increased competition, cost increases or shortages

in raw food products, other general economic and operating conditions, risks associated with the acquisition of additional restaurants,

the adequacy of cash flows and the cost and availability of capital or credit facility borrowings to provide liquidity, changes in federal,

state, or local laws and regulations affecting the operation of our restaurants, including minimum wage and tip credit regulations, and

other matters discussed under the Risk Factors section of Good Times’ Annual Report on Form 10-K for the fiscal year ended September

24, 2024 filed with the SEC, and other filings with the SEC.

Investor Relations Contacts:

Ryan M. Zink, Chief Executive Officer (303) 384-1432

Christi Pennington (303) 384-1440

Category: Financial

Good Times Restaurants Inc.

Unaudited Supplemental Information

(In thousands, except per share amounts)

| | |

Fiscal Quarter Ended | | |

Fiscal Year Ended | |

| | |

September 24,

2024 | | |

September 26,

2023 | | |

September 24,

2024 | | |

September 26,

2023 | |

| NET REVENUES: | |

| | | |

| | | |

| | | |

| | |

| Restaurant sales | |

$ | 35,602 | | |

$ | 34,106 | | |

$ | 141,555 | | |

$ | 137,229 | |

| Franchise revenues | |

| 192 | | |

| 225 | | |

| 760 | | |

| 931 | |

| Total net revenues | |

| 35,794 | | |

| 34,331 | | |

| 142,315 | | |

| 138,160 | |

| | |

| | | |

| | | |

| | | |

| | |

| RESTAURANT OPERATING COSTS: | |

| | | |

| | | |

| | | |

| | |

| Food and packaging costs | |

| 11,080 | | |

| 10,725 | | |

| 43,704 | | |

| 42,910 | |

| Payroll and other employee benefit costs | |

| 12,164 | | |

| 12,072 | | |

| 48,689 | | |

| 47,549 | |

| Restaurant occupancy costs | |

| 2,389 | | |

| 2,289 | | |

| 10,087 | | |

| 9,607 | |

| Other restaurant operating costs | |

| 5,260 | | |

| 4,884 | | |

| 20,288 | | |

| 19,013 | |

| Preopening costs | |

| - | | |

| 374 | | |

| - | | |

| 484 | |

| Depreciation and amortization | |

| 942 | | |

| 923 | | |

| 3,755 | | |

| 3,663 | |

| Total restaurant operating costs | |

| 31,835 | | |

| 31,267 | | |

| 126,523 | | |

| 123,226 | |

| | |

| | | |

| | | |

| | | |

| | |

| General and administrative costs | |

| 2,725 | | |

| 2,095 | | |

| 10,516 | | |

| 9,165 | |

| Advertising costs | |

| 863 | | |

| 835 | | |

| 3,528 | | |

| 3,258 | |

| Impairment of long-lived assets | |

| 499 | | |

| 548 | | |

| 698 | | |

| 1,589 | |

| Loss (gain) on restaurant and equipment asset sales | |

| (10 | ) | |

| (9 | ) | |

| 2 | | |

| (41 | ) |

| Litigation contingencies | |

| - | | |

| - | | |

| (332 | ) | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| (LOSS) INCOME FROM OPERATIONS: | |

| (118 | ) | |

| (405 | ) | |

| 1,380 | | |

| 963 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other Expenses: | |

| | | |

| | | |

| | | |

| | |

| Interest and other expense, net | |

| (24 | ) | |

| (22 | ) | |

| (125 | ) | |

| (78 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NET (LOSS) INCOME BEFORE INCOME TAXES: | |

| (142 | ) | |

| (427 | ) | |

| 1,255 | | |

| 885 | |

| Provision for income taxes | |

| 426 | | |

| 284 | | |

| 624 | | |

| 10,787 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET INCOME (LOSS): | |

$ | 284 | | |

$ | (143 | ) | |

$ | 1,879 | | |

$ | 11,672 | |

| Income attributable to non-controlling interests | |

| (54 | ) | |

| (107 | ) | |

| (266 | ) | |

| (586 | ) |

| | |

| | | |

| | | |

| | | |

| | |

NET INCOME (LOSS) ATTRIBUTABLE TO COMMON

SHAREHOLDERS | |

$ | 230 | | |

$ | (250 | ) | |

$ | 1,613 | | |

$ | 11,086 | |

| | |

| | | |

| | | |

| | | |

| | |

NET INCOME (LOSS) PER SHARE, ATTRIBUTABLE TO

COMMON SHAREHOLDERS: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.02 | | |

$ | (0.02 | ) | |

$ | 0.15 | | |

$ | 0.94 | |

| Diluted | |

$ | 0.02 | | |

$ | (0.02 | ) | |

$ | 0.14 | | |

$ | 0.94 | |

| | |

| | | |

| | | |

| | | |

| | |

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 10,741 | | |

| 11,531 | | |

| 11,047 | | |

| 11,773 | |

| Diluted | |

| 10,851 | | |

| 11,531 | | |

| 11,148 | | |

| 11,828 | |

Good Times Restaurants Inc.

Unaudited Supplemental Information

(In thousands)

| | |

September 24, 2024 | | |

September 26, 2023 | |

| Selected Balance Sheet Data: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,853 | | |

$ | 4,182 | |

| | |

| | | |

| | |

| Current Assets | |

$ | 6,557 | | |

$ | 6,521 | |

| | |

| | | |

| | |

| Total assets | |

$ | 87,118 | | |

$ | 91,088 | |

| | |

| | | |

| | |

| Current Liabilities | |

$ | 15,687 | | |

$ | 14,890 | |

| | |

| | | |

| | |

| Shareholders’ equity | |

$ | 33,088 | | |

$ | 32,994 | |

Supplemental Information for Company-Owned Restaurants

(dollars in thousands):

| | |

Bad Daddy’s Burger Bar | | |

Good Times Burgers & Frozen Custard | |

| | |

Fourth Fiscal Quarter | | |

Fiscal Year Ended | | |

Fourth Fiscal Quarter | | |

Fiscal Year Ended | |

| | |

2024

(13 weeks) | | |

2023

(13 weeks) | | |

2024

(52 weeks) | | |

2023

(52 weeks) | | |

2024

(13 weeks) | | |

2023

(13 weeks) | | |

2024

(52 weeks) | | |

2023

(52 weeks) | |

| Restaurant sales | |

$ | 25,644 | | |

$ | 24,649 | | |

$ | 103,539 | | |

$ | 102,241 | | |

$ | 9,958 | | |

$ | 9,457 | | |

$ | 38,016 | | |

$ | 34,988 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Restaurants open at beginning

of period | |

| 40 | | |

| 39 | | |

| 40 | | |

| 40 | | |

| 26 | | |

| 23 | | |

| 25 | | |

| 23 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Restaurants opened or acquired

during period | |

| - | | |

| 1 | | |

| - | | |

| 1 | | |

| - | | |

| 2 | | |

| 1 | | |

| 2 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Restaurants closed during period | |

| 1 | | |

| - | | |

| 1 | | |

| 1 | | |

| 1 | | |

| - | | |

| 1 | | |

| - | |

| Restaurants open at period end | |

| 39 | | |

| 40 | | |

| 39 | | |

| 40 | | |

| 25 | | |

| 25 | | |

| 25 | | |

| 25 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Restaurant operating weeks | |

| 514 | | |

| 512 | | |

| 2,074 | | |

| 2,042 | | |

| 335 | | |

| 313 | | |

| 1,309 | | |

| 1,210 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Average weekly sales per

restaurant | |

$ | 49.8 | | |

$ | 48.1 | | |

$ | 49.9 | | |

$ | 50.1 | | |

$ | 29.7 | | |

$ | 30.2 | | |

$ | 29.0 | | |

$ | 28.9 | |

Margin Analysis:

| | |

Quarter Ended (13 Weeks) | | |

Year-to-Date Period Ended (52 weeks) | |

| | |

September 24, 2024 | | |

September 26, 2023 | | |

September 24, 2024 | | |

September 26, 2023 | |

| Bad Daddy’s Burger Bar: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Restaurant sales | |

$ | 25,644 | | |

| 100.0 | % | |

$ | 24,649 | | |

| 100.0 | % | |

$ | 103,539 | | |

| 100.0 | % | |

$ | 102,241 | | |

| 100.0 | % |

| Restaurant operating costs (exclusive of depreciation and amortization and pre-opening costs): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Food and packaging costs | |

| 7,999 | | |

| 31.2 | % | |

| 7,839 | | |

| 31.8 | % | |

| 32,155 | | |

| 31.1 | % | |

| 31,972 | | |

| 31.3 | % |

| Payroll and benefits costs | |

| 8,791 | | |

| 34.3 | % | |

| 8,942 | | |

| 36.3 | % | |

| 35,831 | | |

| 34.6 | % | |

| 35,892 | | |

| 35.1 | % |

| Restaurant occupancy costs | |

| 1,488 | | |

| 5.8 | % | |

| 1,517 | | |

| 6.2 | % | |

| 6,676 | | |

| 6.4 | % | |

| 6,642 | | |

| 6.5 | % |

| Other restaurant operating costs | |

| 3,875 | | |

| 15.1 | % | |

| 3,749 | | |

| 15.2 | % | |

| 15,296 | | |

| 14.8 | % | |

| 14,834 | | |

| 14.5 | % |

Restaurant-level operating profit

(a non-GAAP measure) | |

$ | 3,491 | | |

| 13.6 | % | |

$ | 2,602 | | |

| 10.6 | % | |

$ | 13,581 | | |

| 13.1 | % | |

$ | 12,901 | | |

| 12.6 | % |

| Good Times Burgers & Frozen Custard: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Restaurant sales | |

$ | 9,958 | | |

| 100.0 | % | |

$ | 9,457 | | |

| 100.0 | % | |

$ | 38,016 | | |

| 100.0 | % | |

$ | 34,988 | | |

| 100.0 | % |

| Restaurant operating costs (exclusive of depreciation and amortization and pre-opening costs): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Food and packaging costs | |

| 3,081 | | |

| 30.9 | % | |

| 2,886 | | |

| 30.5 | % | |

| 11,549 | | |

| 30.4 | % | |

| 10,938 | | |

| 31.3 | % |

| Payroll and benefits costs | |

| 3,373 | | |

| 33.9 | % | |

| 3,130 | | |

| 33.1 | % | |

| 12,858 | | |

| 33.8 | % | |

| 11,657 | | |

| 33.3 | % |

| Restaurant occupancy costs | |

| 901 | | |

| 9.0 | % | |

| 772 | | |

| 8.2 | % | |

| 3,411 | | |

| 9.0 | % | |

| 2,965 | | |

| 8.5 | % |

| Other restaurant operating costs | |

| 1,385 | | |

| 13.9 | % | |

| 1,135 | | |

| 12.0 | % | |

| 4,992 | | |

| 13.1 | % | |

| 4,179 | | |

| 11.9 | % |

Restaurant-level operating profit

(a non-GAAP measure) | |

$ | 1,218 | | |

| 12.2 | % | |

$ | 1,534 | | |

| 16.2 | % | |

$ | 5,206 | | |

| 13.7 | % | |

$ | 5,249 | | |

| 15.0 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total restaurant-level operating profit (a non-GAAP measure) | |

$ | 4,709 | | |

| 13.2 | % | |

$ | 4,136 | | |

| 12.1 | % | |

$ | 18,787 | | |

| 13.3 | % | |

$ | 18,150 | | |

| 13.2 | % |

Certain percentage amounts in the table above

do not total due to rounding as well as the fact that restaurant operating costs are expressed as a percentage of restaurant revenues

(as opposed to total revenues).

Reconciliation of U.S. GAAP Results to Non-GAAP Measurements

Reconciliation of Income (Loss) from Operations

to Non-GAAP Restaurant-Level Operating Profit

(In thousands)

| | |

Quarter Ended (13 Weeks) | | |

Year-to-Date Period Ended (52 weeks) | |

| | |

September 24, 2024 | | |

September 26, 2023 | | |

September 24, 2024 | | |

September 26, 2023 | |

| Income (loss) from operations | |

$ | (118 | ) | |

$ | (405 | ) | |

$ | 1,380 | | |

$ | 963 | |

| Less: | |

| | | |

| | | |

| | | |

| | |

| Franchise revenues | |

| 192 | | |

| 225 | | |

| 760 | | |

| 931 | |

| Add: | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 2,725 | | |

| 2,095 | | |

| 10,516 | | |

| 9,165 | |

| Depreciation and amortization | |

| 942 | | |

| 923 | | |

| 3,755 | | |

| 3,663 | |

| Advertising costs | |

| 863 | | |

| 835 | | |

| 3,528 | | |

| 3,258 | |

| Impairment of long-lived assets | |

| 499 | | |

| 548 | | |

| 698 | | |

| 1,589 | |

| Litigation contingencies | |

| - | | |

| - | | |

| (332 | ) | |

| - | |

Loss (gain) on restaurant and equipment

asset sales | |

| (10 | ) | |

| (9 | ) | |

| 2 | | |

| (41 | ) |

| Pre-opening costs | |

| - | | |

| 374 | | |

| - | | |

| 484 | |

| Restaurant-level operating profit | |

$ | 4,709 | | |

$ | 4,136 | | |

$ | 18,787 | | |

$ | 18,150 | |

The Company believes that restaurant-level operating

profit is an important measure for management and investors because it is widely regarded in the restaurant industry as a useful metric

by which to evaluate restaurant-level operating efficiency and performance. The Company defines restaurant-level operating profit to be

restaurant revenues minus restaurant-level operating costs, excluding restaurant closures and impairment costs. The measure includes restaurant-level

occupancy costs, which include fixed rents, percentage rents, common area maintenance charges, real estate and personal property taxes,

general liability insurance and other property costs, but excludes depreciation. The measure excludes depreciation and amortization expense,

substantially all of which is related to restaurant level assets, because such expenses represent historical sunk costs which do not reflect

current cash outlay for the restaurants. The measure also excludes selling, general and administrative costs, and therefore excludes occupancy

costs associated with selling, general and administrative functions, and pre-opening costs. The Company excludes restaurant closure costs

as they do not represent a component of the efficiency of continuing operations. Restaurant impairment costs are excluded because, like

depreciation and amortization, they represent a non-cash charge for the Company’s investment in its restaurants and not a component

of the efficiency of restaurant operations. Restaurant-level operating profit is not a measurement determined in accordance with generally

accepted accounting principles (“GAAP”) and should not be considered in isolation, or as an alternative, to income (loss)

from operations or net income as indicators of financial performance. Restaurant-level operating profit as presented may not be comparable

to other similarly titled measures of other companies. The tables above set forth certain unaudited information for the current and prior

year fiscal quarters and year-to-date periods for fiscal 2024 and fiscal 2023, expressed as a percentage of total revenues, except for

the components of restaurant operating costs, which are expressed as a percentage of restaurant revenues.

| | |

Quarter Ended (13 Weeks) | | |

Fiscal Year Ended (52 Weeks) | |

| | |

Sept. 24, 2024 | | |

Sept. 26, 2023 | | |

Sept. 24, 2024 | | |

Sept. 26, 2023 | |

| Calculation of Adjusted EBITDA | |

| | |

| | |

| | |

| |

| Net Income (loss), as reported | |

$ | 230 | | |

$ | (250 | ) | |

$ | 1,613 | | |

$ | 11,086 | |

| Depreciation and amortization3 | |

| 940 | | |

| 926 | | |

| 3,757 | | |

| 3,617 | |

| Interest expense, net | |

| 24 | | |

| 22 | | |

| 125 | | |

| 78 | |

| Provision for income taxes | |

| (426 | ) | |

| (284 | ) | |

| (624 | ) | |

| (10,787 | ) |

| EBITDA | |

| 768 | | |

| 414 | | |

| 4,871 | | |

| 3,994 | |

| Preopening expense | |

| - | | |

| 374 | | |

| - | | |

| 484 | |

| Non-cash stock-based compensation | |

| 28 | | |

| 28 | | |

| 134 | | |

| 131 | |

| Asset impairment | |

| 499 | | |

| 548 | | |

| 698 | | |

| 1,589 | |

| Gain on restaurant asset sales and lease termination3 | |

| (20 | ) | |

| (9 | ) | |

| (8 | ) | |

| (41 | ) |

| Litigation contingencies | |

| - | | |

| - | | |

| (332 | ) | |

| - | |

| Adjusted EBITDA | |

$ | 1,275 | | |

$ | 1,355 | | |

$ | 5,363 | | |

$ | 6,157 | |

Adjusted EBITDA is a supplemental measure of operating

performance that does not represent and should not be considered as an alternative to net income (loss) or cash flow from operations,

as determined by GAAP, and our calculation thereof may not be comparable to that reported by other companies. This measure is presented

because we believe that investors' understanding of our performance is enhanced by including this non-GAAP financial measure as a reasonable

basis for evaluating our ongoing results of operations.

Adjusted EBITDA is calculated as net income (loss)

before interest expense, provision for income taxes and depreciation and amortization and further adjustments to reflect the additions

and eliminations presented in the table above.

3

Depreciation and amortization and the gain on restaurant and equipment asset sales have been reduced by

any amounts attributable to non-controlling interests.

Adjusted EBITDA is presented because: (i) we believe

it is a useful measure for investors to assess the operating performance of our business without the effect of non-cash charges such as

depreciation and amortization expenses and asset disposals, closure costs and restaurant impairments, and (ii) we use adjusted EBITDA

internally as a benchmark for certain of our cash incentive plans and to evaluate our operating performance or compare our performance

to that of our competitors. The use of adjusted EBITDA as a performance measure permits a comparative assessment of our operating performance

relative to our performance based on our GAAP results, while isolating the effects of some items that vary from period to period without

any correlation to core operating performance or that vary widely among similar companies. Companies within our industry exhibit significant

variations with respect to capital structures and cost of capital (which affect interest expense and income tax rates) and differences

in book depreciation of property, plant and equipment (which affect relative depreciation expense), including significant differences

in the depreciable lives of similar assets among various companies. Our management believes that Adjusted EBITDA facilitates company-to-company

comparisons within our industry by eliminating some of these foregoing variations. Adjusted EBITDA, as presented, may not be comparable

to other similarly titled measures of other companies, and our presentation of Adjusted EBITDA should not be construed as an inference

that our future results will be unaffected by excluded or unusual items.

8

v3.24.3

Cover

|

Dec. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 12, 2024

|

| Entity File Number |

000-18590

|

| Entity Registrant Name |

Good Times Restaurants Inc.

|

| Entity Central Index Key |

0000825324

|

| Entity Tax Identification Number |

84-1133368

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

651 Corporate Circle

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Golden

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80401

|

| City Area Code |

(303)

|

| Local Phone Number |

384-1400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

GTIM

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

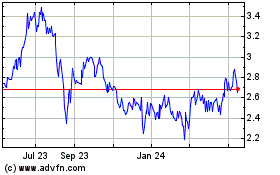

Good Times Restaurants (NASDAQ:GTIM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Good Times Restaurants (NASDAQ:GTIM)

Historical Stock Chart

From Jan 2024 to Jan 2025