Northern Trust and Hamilton Lane Announce Strategic Collaboration to Provide Advanced Private Market Analytics and Decision Support

October 22 2024 - 8:00AM

Business Wire

Hamilton Lane’s market leading analytics and

data will be available to help Northern Trust Asset Servicing

clients gain insight into their private market investments

Northern Trust (Nasdaq: NTRS) announced today that it has

entered into a strategic agreement with Hamilton Lane (Nasdaq:

HLNE), a leading global private markets investment management firm,

to provide its proprietary software Cobalt LP ® and integrated

services to Northern Trust Asset Servicing clients.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241015608800/en/

Under the agreement, Northern Trust will offer clients access to

Hamilton Lane’s private market data, analytics, and tools through

its suite of Northern Trust Total Portfolio Analytics solutions, an

ecosystem that comprises integrated technology and capabilities

across the entire investment lifecycle.

Hamilton Lane’s tech-enabled solutions available to asset

servicing clients will include Cobalt LP ®, which provides advanced

private market analytics and pre-commitment research capabilities

in a digital, turn-key format. In addition, Northern Trust clients

will be able to leverage Hamilton Lane’s underlying portfolio

company data service which includes the tracking of core portfolio

company metrics, company fundamentals and asset class specific

metrics across clients’ private markets portfolios.

“As our global clients maintain significant exposure to private

markets, their need for sophisticated analytics continues to

increase,” said Melanie Pickett, Head of Asset Owners, Americas and

Global Total Portfolio Solutions at Northern Trust. “We are proud

to offer a full front-to-back office decision-making solution

featuring Hamilton Lane’s front office analytics combined with our

core Front Office Solutions investment book of record (IBOR)

support.”

Hamilton Lane’s Cobalt LP ® platform includes a suite of tools

and services expertly designed to meet the strategic objectives and

complex investment goals of private market investors.

“At Hamilton Lane, our Cobalt LP ® platform and integrated

services are designed to help asset allocators make informed

decisions with greater confidence, precision and insight,” said

Griffith Norville, Head of Technology Solutions at Hamilton Lane.

“Through this exciting collaboration, we seek to deliver a new

level of transparency and timeliness to Northern Trust client

portfolios."

Northern Trust has had an unwavering and longstanding commitment

to the asset owner space for many decades. The goal within the

asset owner segment is to empower the missions of its clients,

helping them to maximize investment returns so that they may then

serve their constituents, their communities and the world.

About Hamilton Lane

Hamilton Lane (Nasdaq: HLNE) is one of the largest private

markets investment firms globally, providing innovative solutions

to institutional and private wealth investors around the world.

Dedicated exclusively to private markets investing for more than 30

years, the firm currently employs approximately 700 professionals

operating in offices throughout North America, Europe, Asia Pacific

and the Middle East. Hamilton Lane has more than $940 billion in

assets under management and supervision, composed of nearly $130

billion in discretionary assets and more than $810 billion in

non-discretionary assets, as of June 30, 2024. Hamilton Lane

specializes in building flexible investment programs that provide

clients access to the full spectrum of private markets strategies,

sectors and geographies. For more information, please visit our

website or follow Hamilton Lane on LinkedIn.

About Northern Trust

Northern Trust Corporation (Nasdaq: NTRS) is a leading provider

of wealth management, asset servicing, asset management and banking

to corporations, institutions, affluent families and individuals.

Founded in Chicago in 1889, Northern Trust has a global presence

with offices in 24 U.S. states and Washington, D.C., and across 22

locations in Canada, Europe, the Middle East and the Asia-Pacific

region. As of June 30, 2024, Northern Trust had assets under

custody/administration of US$16.6 trillion, and assets under

management of US$1.5 trillion. For more than 130 years, Northern

Trust has earned distinction as an industry leader for exceptional

service, financial expertise, integrity and innovation. Visit us on

northerntrust.com. Follow us on X (formerly Twitter) @NorthernTrust

or Northern Trust Corporation on LinkedIn.

Northern Trust Corporation, Head Office: 50 South La Salle

Street, Chicago, Illinois 60603 U.S.A., incorporated with limited

liability in the U.S. Global legal and regulatory information can

be found at https://www.northerntrust.com/terms-and-conditions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241015608800/en/

Media Contacts Europe, Middle East,

Africa & Asia-Pacific:

Camilla Greene +44 (0) 20 7982 2176 Camilla_Greene@ntrs.com

Simon Ansell + 44 (0) 20 7982 1016 Simon_Ansell@ntrs.com

US & Canada:

John O’Connell +1 312 444 2388 John_O’Connell@ntrs.com

Tia Wilson twilson@hamiltonlane.com +1 484 816 6982

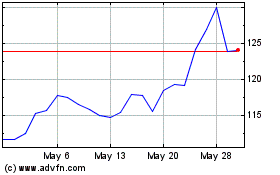

Hamilton Lane (NASDAQ:HLNE)

Historical Stock Chart

From Nov 2024 to Dec 2024

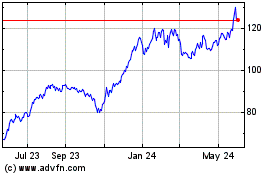

Hamilton Lane (NASDAQ:HLNE)

Historical Stock Chart

From Dec 2023 to Dec 2024