Continuing Strong Asset Quality With

Improved Metrics

HomeStreet, Inc. (Nasdaq: HMST) (including its consolidated

subsidiaries, the "Company", "HomeStreet" or "we"), the parent

company of HomeStreet Bank, today announced the financial results

for the quarter ended June 30, 2024. As we present non-GAAP

measures in this release, the reader should refer to the non-GAAP

reconciliations set forth below under the section “Non-GAAP

Financial Measures.”

Operating Results

Second quarter 2024 compared

to first quarter 2024

Reported Results:

- Net loss: $6.2 million compared to $7.5 million

- Loss per fully diluted share: $0.33 compared to $0.40

- Net interest margin: 1.37% compared to 1.44%

Core Results (1):

- Loss: $4.3 million compared to $5.5 million

- Loss per fully diluted share: $0.23 compared to $0.29

(1)

Core loss and core loss per fully diluted

share are non-GAAP measures. For a reconciliation of these measures

to the nearest comparable GAAP measure see "Non-GAAP financial

measures" in this earnings release.

"In the second quarter, our net loss was $6.2 million and our

core net loss was $4.3 million, both of which were $1.2 million

less than the comparable losses incurred in the first quarter,"

said Mark Mason, Chairman of the Board, President, and Chief

Executive Officer. "Our net interest margin declined to 1.37% due

to increased funding costs as lower cost deposits continued to

migrate to higher yielding products, our noninterest income was

$3.8 million higher and our noninterest expenses decreased by $1.2

million. During this challenging earnings period we continue to

focus on reducing expenses where possible. In the quarter, our full

time equivalent employees declined to 840 from 858 in the prior

quarter. Additionally, while interest rates have stabilized, high

current rates may continue to adversely impact our funding costs

relative to earning assets yields in the near term."

Financial Position

As of and for the quarter

ended June 30, 2024

- Excluding brokered deposits, total deposits increased by $13

million

- Uninsured deposits were $492 million, or 8% of total

deposits

- Loans held for investment ("LHFI"), decreased by $65

million

- Nonperforming assets to total assets: 0.42% compared to 0.56%

at March 31, 2024

- Delinquencies(2): 0.66% compared to 0.82% at March 31,

2024

- Allowance for credit losses to LHFI: 0.55%

- Book value per share: $27.58

- Tangible book value per share: $27.14 (3)

(2)

Total past due and nonaccrual loans as a

percentage of total loans held for investment.

(3)

Tangible book value per share is a

non-GAAP measure. For a reconciliation of this measure to the

nearest comparable GAAP measure see "Non-GAAP financial measures"

in this earnings release.

"Our quarter-end and average deposit balances, excluding

brokered deposits, were stable during the first and second

quarter," continued Mark Mason. "We have noticed that the migration

of deposits to higher yielding products has slowed significantly

during the latter part of the second quarter. If these trends

continue we expect that our funding costs will stabilize."

"Our loan balances decreased $65 million during the second

quarter as our originations decreased from the first quarter levels

and we started to see a low level of prepayments in our commercial

real estate loan portfolio. Our loan originations continue to be

focused on variable rate loan products with appropriate margins

over incremental funding costs," added Mark Mason. "In the second

quarter our nonaccrual and nonperforming assets decreased by 25%

due to payoffs, resulting in a ratio of nonaccrual assets to total

assets of 0.42%. Our total loan delinquencies decreased from 0.82%

to 0.66% during the quarter. Our credit quality remains strong and

we have not identified any potentially significant credit issues in

our loan portfolio. Additionally, our analysis of multifamily loans

repricing through the end of 2025 does not indicate any meaningful

increased risk of loss."

About HomeStreet

HomeStreet, Inc. (Nasdaq: HMST) is a diversified financial

services company headquartered in Seattle, Washington, serving

consumers and businesses in the Western United States and Hawaii.

The Company is principally engaged in real estate lending,

including mortgage banking activities, and commercial and consumer

banking. Its principal subsidiary is HomeStreet Bank. Certain

information about our business can be found on our investor

relations web site, located at http://ir.homestreet.com. HomeStreet

Bank is a member of the FDIC and is an Equal Housing Lender.

Forward-Looking Statements

This earnings release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

(the “Reform Act”). Generally, forward-looking statements include

the words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“may,” “plan,” “potential,” “goal,” “upcoming,” “outlook,”

“guidance” or "project" or the negation thereof, or similar

expressions. In addition, all statements in this earnings release

(including but not limited to those found in the quotes of our

Chief Executive Officer) that address and/or include beliefs,

assumptions, estimates, projections and expectations of our future

performance and financial condition and trends in product mixes and

expected impact on costs are forward-looking statements within the

meaning of the Reform Act. Forward-looking statements involve

inherent risks, uncertainties and other factors, many of which are

difficult to predict and are generally beyond management’s control.

Forward-looking statements are based on the Company’s expectations

at the time such statements are made and speak only as of the date

made. The Company does not assume any obligation or undertake to

update any forward-looking statements after the date of this

release as a result of new information, future events or

developments, except as required by federal securities or other

applicable laws, although the Company may do so from time to time.

The Company does not endorse any projections regarding future

performance that may be made by third parties. For all

forward-looking statements, the Company claims the protection of

the safe harbor for forward-looking statements contained in the

Reform Act.

We caution readers that actual results may differ materially

from those expressed in or implied by the Company’s forward-looking

statements. Rather, more important factors could affect the

Company’s future results, including but not limited to the

following: (1) our ability to successfully consummate the pending

merger (the "Merger") with FirstSun Capital Bancorp ("FirstSun"),

(2) the ability of HomeStreet and FirstSun to obtain required

governmental approvals of the Merger, (3) the failure to satisfy

the closing conditions in the definitive Agreement and Plan of

Merger (the “Merger Agreement”), dated as of January 16, 2024, as

amended on April 30, 2024, by and between HomeStreet and FirstSun,

or any unexpected delay in closing the Merger, (4) the ability to

achieve expected cost savings, synergies and other financial

benefits from the Merger within the expected time frames and costs

or difficulties relating to integration matters being greater than

expected, (5) the diversion of management time from core banking

functions due to Merger-related issues; (6) potential difficulty in

maintaining relationships with customers, associates or business

partners as a result of the announced Merger, (7) changes in the

U.S. and global economies, including business disruptions,

reductions in employment, inflationary pressures and an increase in

business failures, specifically among our customers; (8) changes in

the interest rate environment may reduce interest margins; (9)

changes in deposit flows, loan demand or real estate values may

adversely affect the business of our primary subsidiary, HomeStreet

Bank (the “Bank”), through which substantially all of our

operations are carried out; (10) there may be increases in

competitive pressure among financial institutions or from

non-financial institutions; (11) our ability to attract and retain

key members of our senior management team; (12) the timing and

occurrence or non-occurrence of events may be subject to

circumstances beyond our control; (13) our ability to control

operating costs and expenses; (14) our credit quality and the

effect of credit quality on our credit losses expense and allowance

for credit losses; (15) the adequacy of our allowance for credit

losses; (16) changes in accounting principles, policies or

guidelines may cause our financial condition to be perceived or

interpreted differently; (17) legislative or regulatory changes

that may adversely affect our business or financial condition,

including, without limitation, changes in corporate and/or

individual income tax laws and policies, changes in privacy laws,

and changes in regulatory capital or other rules, and the

availability of resources to address or respond to such changes;

(18) general economic conditions, either nationally or locally in

some or all areas in which we conduct business, or conditions in

the securities markets or banking industry, may be less favorable

than what we currently anticipate; (19) challenges our customers

may face in meeting current underwriting standards may adversely

impact all or a substantial portion of the value of our rate-lock

loan activity we recognize; (20) technological changes may be more

difficult or expensive than what we anticipate; (21) a failure in

or breach of our operational or security systems or information

technology infrastructure, or those of our third-party providers

and vendors, including due to cyber-attacks; (22) success or

consummation of new business initiatives may be more difficult or

expensive than what we anticipate; (23) our ability to grow

efficiently both organically and through acquisitions and to manage

our growth and integration costs; (24) staffing fluctuations in

response to product demand or the implementation of corporate

strategies that affect our work force and potential associated

charges; (25) litigation, investigations or other matters before

regulatory agencies, whether currently existing or commencing in

the future, may delay the occurrence or non-occurrence of events

longer than what we anticipate; and (26) our ability to obtain

regulatory approvals or non-objection to take various capital

actions, including the payment of dividends by us or the Bank, or

repurchases of our common stock. A discussion of the factors, risks

and uncertainties that could affect our financial results, business

goals and operational and financial objectives cited in this

release, other releases, public statements and/or filings with the

Securities and Exchange Commission (“SEC”) is also contained in the

“Risk Factors” sections of the Company's Forms 10-K and 10-Q. We

strongly recommend readers review those disclosures in conjunction

with the discussions herein.

All future written and oral forward-looking statements

attributable to the Company or any person acting on its behalf are

expressly qualified in their entirety by the cautionary statements

contained or referred to above. New risks and uncertainties arise

from time to time, and factors that the Company currently deems

immaterial may become material, and it is impossible for the

Company to predict these events or how they may affect the

Company.

HomeStreet, Inc. and Subsidiaries Non-GAAP Financial

Measures

To supplement our unaudited condensed consolidated financial

statements presented in accordance with GAAP, we use certain

non-GAAP measures of financial performance.

In this earnings release, we use the following non-GAAP

measures: (i) tangible common equity and tangible assets as we

believe this information is consistent with the treatment by bank

regulatory agencies, which exclude intangible assets from the

calculation of capital ratios; (ii) core income (loss) and

effective tax rate on core income (loss) before taxes, which

excludes goodwill impairment charges and merger related expenses

and the related tax impact as we believe this measure is a better

comparison to be used for projecting future results and (iii) an

efficiency ratio which is the ratio of noninterest expense to the

sum of net interest income and noninterest income, excluding

certain items of income or expense and excluding taxes incurred and

payable to the state of Washington as such taxes are not classified

as income taxes and we believe including them in noninterest

expense impacts the comparability of our results to those companies

whose operations are in states where assessed taxes on business are

classified as income taxes.

These supplemental performance measures may vary from, and may

not be comparable to, similarly titled measures provided by other

companies in our industry. Non-GAAP financial measures are not in

accordance with, or an alternative for, GAAP. Generally, a non-GAAP

financial measure is a numerical measure of a company’s performance

that either excludes or includes amounts that are not normally

excluded or included in the most directly comparable measure

calculated and presented in accordance with GAAP. A non-GAAP

financial measure may also be a financial metric that is not

required by GAAP or other applicable requirements.

We believe that these non-GAAP financial measures, when taken

together with the corresponding GAAP financial measures, provide

meaningful supplemental information regarding our performance by

providing additional information used by management that is not

otherwise required by GAAP or other applicable requirements. Our

management uses, and believes that investors benefit from referring

to, these non-GAAP financial measures in assessing our operating

results and when planning, forecasting and analyzing future

periods. These non-GAAP financial measures also facilitate a

comparison of our performance to prior periods. We believe these

measures are frequently used by securities analysts, investors and

other parties in the evaluation of companies in our industry. These

non-GAAP financial measures should be considered in addition to,

not as a substitute for or superior to, financial measures prepared

in accordance with GAAP. In the information below, we have provided

reconciliations of, where applicable, the most comparable GAAP

financial measures to the non-GAAP measures used in this earnings

release, or the computation of the non-GAAP financial measure.

HomeStreet, Inc. and Subsidiaries Non-GAAP Financial

Measures

Reconciliations of non-GAAP results of operations to the nearest

comparable GAAP measures or calculations of the non-GAAP

measure:

As of or for the Quarter

Ended

(in thousands, except share and per share

data)

June 30, 2024

March 31, 2024

Core net income (loss)

Net income (loss)

$

(6,238

)

$

(7,497

)

Adjustments (tax effected)

Merger related expenses

1,897

2,028

Total

$

(4,341

)

$

(5,469

)

Core net income (loss) per fully diluted

share

Fully diluted shares

18,857,566

18,856,870

Computed amount

$

(0.23

)

$

(0.29

)

Return on average tangible equity

(annualized)

Average shareholders' equity

$

522,904

$

537,627

Less: Average goodwill and other

intangibles

(8,794

)

(9,403

)

Average tangible equity

$

514,110

$

528,224

Core net income (loss) (per above)

$

(4,341

)

$

(5,469

)

Adjustments (tax effected)

Amortization of core deposit

intangibles

487

488

Tangible income (loss) applicable to

shareholders

$

(3,854

)

$

(4,981

)

Ratio

(3.0

)%

(3.8

)%

Efficiency ratio

Noninterest expense

Total

$

50,931

$

52,164

Adjustments:

Merger related expenses

(2,432

)

(2,600

)

State of Washington taxes

(463

)

(452

)

Adjusted total

$

48,036

$

49,112

Total revenues

Net interest income

$

29,701

$

32,151

Noninterest income

13,227

9,454

Adjusted total

$

42,928

$

41,605

Ratio

111.9

%

118.0

%

Return on average assets (annualized) -

Core

Average Assets

$

9,272,131

$

9,502,189

Core net income (loss) (per above)

(4,341

)

(5,469

)

Ratio

(0.19

)%

(0.23

)%

Tangible book value per share

Shareholders' equity

$

520,117

$

527,333

Less: Goodwill and other intangibles

(8,391

)

(9,016

)

Tangible shareholders' equity

$

511,726

$

518,317

Common shares outstanding

18,857,565

18,857,565

Computed amount

$

27.14

$

27.49

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240729914501/en/

Executive Vice President and Chief Financial Officer

HomeStreet, Inc. John Michel (206) 515-2291

john.michel@homestreet.com http://ir.homestreet.com

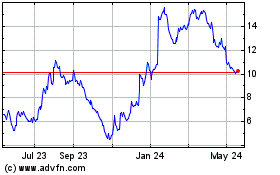

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Dec 2024 to Jan 2025

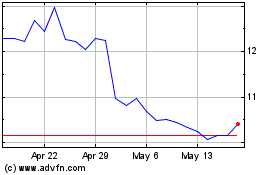

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Jan 2024 to Jan 2025