Horizon Technology Finance Management Announces Executive Promotions

August 27 2024 - 3:15PM

Business Wire

Horizon Technology Finance Management LLC ("Horizon" or the

“Company”), the manager and investment adviser for Horizon

Technology Finance Corporation (NASDAQ: HRZN), a leading specialty

finance company that provides capital in the form of secured loans

to venture capital-backed companies in the technology, life

science, healthcare information and services, and sustainability

industries, and an affiliate of Monroe Capital, announced today

four senior members of its origination team have been promoted to

new or expanded roles. These new positions will enhance the

Company’s origination capabilities and portfolio management to

better serve the needs of its existing and potential borrowers and

their venture investors.

“We are delighted to announce the expanded roles of four of the

key members of the Horizon team. The promotions are a testament to

the expertise each of them has gained in the venture lending market

and the value they have brought to Horizon over many years,” said

Daniel Devorsetz, Executive Vice President, Chief Operating Officer

and Chief Investment Officer of Horizon. “As the venture lending

market has evolved, these new roles better serve our partners in

the venture ecosystem and utilize the respective strengths of each

team member.”

The executive promotions are:

Kevin May – Head of Originations, Senior

Vice President and Senior Managing Director Kevin will be

responsible for growing Horizon’s strong market presence and

executing Horizon’s venture lending strategy across all platforms

and geographies. Kevin has served as Senior Vice President and

Senior Managing Director responsible for business development for

the West Coast life science markets as well as leading the

Company’s West Coast operations. He joined Horizon in 2005 and has

had success in multiple roles, including life science and

technology originations, and credit underwriting.

Mishone Donelson – Head of Life Science

Lending, Senior Vice President and Senior Managing Director

Mishone has served as Senior Vice President and Senior Managing

Director responsible for business development for the East Coast

life science markets. In his additional role, Mishone will expand

his reach nationwide to lead Horizon’s life science originations.

Mishone joined Horizon in 2016 and is a talented relationship

manager and originator with a broad network of investors and

business professionals across the life sciences community.

Todd McDonald – Head of Technology Lending

and Senior Managing Director Todd will lead Horizon’s

nationwide technology lending efforts, bringing over 20 years of

technology lending experience to the position. Todd first joined

Horizon in 2012 and has most recently served as Senior Managing

Director responsible for business development in the Mid-Atlantic

and Southeast technology markets and is a long-tenured venture

lender and origination professional.

Kevin Walsh – Head of Portfolio Management

and Senior Managing Director Kevin will help lead Horizon’s

portfolio management efforts. Since joining Horizon in 2006, Kevin

has had success in leadership roles in both origination and

underwriting. He has most recently served as Senior Managing

Director responsible for business development in the West Coast

technology markets. Kevin previously spent 10 years as a Senior

Credit Officer, with a critical role in the Company’s underwriting

and portfolio management operations.

About Horizon Technology Finance Management LLC Horizon

Technology Finance Management, an affiliate of Monroe Capital, is a

registered investment adviser that underwrites and manages secured

loans to venture capital backed companies in the technology, life

science, healthcare information and services, and sustainability

industries, and is the external adviser for Horizon Technology

Finance Corporation (NASDAQ: HRZN). The investment objective of

Horizon is to maximize its investment portfolios’ returns by

generating current income from its debt investments and capital

appreciation from the warrants received when making such debt

investments. Horizon is headquartered in Farmington, Connecticut

with a regional office in Pleasanton, California, and investment

professionals located throughout the U.S. Monroe Capital is a $19.5

billion asset management firm specializing in private credit

markets across various strategies, including direct lending,

technology finance, venture debt, opportunistic, structured credit,

real estate and equity. To learn more, please visit

www.horizontechfinance.com.

Forward-Looking Statements Statements included herein may

constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Statements other

than statements of historical facts included in this press release

may constitute forward-looking statements and are not guarantees of

future performance, condition or results and involve a number of

risks and uncertainties. Actual results may differ materially from

those in the forward-looking statements as a result of a number of

factors, including those described from time to time in Horizon’s

filings with the Securities and Exchange Commission. Horizon

undertakes no duty to update any forward-looking statement made

herein. All forward-looking statements speak only as of the date of

this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240827999046/en/

Investor Relations: ICR Garrett Edson ir@horizontechfinance.com

(646) 200-8885

Media Relations: ICR Chris Gillick HorizonPR@icrinc.com (646)

677-1819

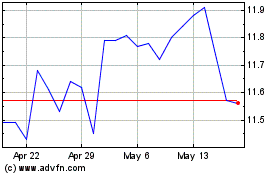

Horizon Technology Finance (NASDAQ:HRZN)

Historical Stock Chart

From Nov 2024 to Dec 2024

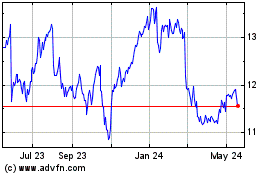

Horizon Technology Finance (NASDAQ:HRZN)

Historical Stock Chart

From Dec 2023 to Dec 2024