Horizon Technology Finance Announces Monthly Distributions for January, February and March 2025 Totaling $0.33 per Share

October 29 2024 - 3:20PM

Business Wire

Horizon Technology Finance Corporation (NASDAQ: HRZN)

(“Horizon”) (the “Company”), an affiliate of Monroe Capital, and a

leading specialty finance company that provides capital in the form

of secured loans to venture capital-backed companies in the

technology, life science, healthcare information and services, and

sustainability industries, announced today that its board of

directors has declared monthly cash distributions of $0.11 per

share, payable in each of January, February and March 2025. The

following tables show these distributions, payable as set forth in

the tables below, total $0.33 per share. Since its 2010 initial

public offering, Horizon has paid a total of $286 million in

distributions to its shareholders.

Monthly Distributions Declared in Fourth Quarter 2024

Ex-Dividend Date

Record Date

Payment Date

Amount per Share

December 16, 2024

December 16, 2024

January 15, 2025

$0.11

January 16, 2025

January 16, 2025

February 14, 2025

$0.11

February 18, 2025

February 18, 2025

March 14, 2025

$0.11

Total:

$0.33

When declaring distributions, Horizon’s board of directors

reviews estimates of taxable income available for distribution,

which may differ from consolidated net income under generally

accepted accounting principles due to (i) changes in unrealized

appreciation and depreciation, (ii) temporary and permanent

differences in income and expense recognition, and (iii) the amount

of spillover income carried over from a given year for distribution

in the following year. The final determination of taxable income

for each tax year, as well as the tax attributes for distributions

in such tax year, will be made after the close of the tax year.

Horizon maintains a “Dividend Reinvestment Plan” (“DRIP”) that

provides for the reinvestment of distributions on behalf of its

stockholders, unless a stockholder has elected to receive

distributions in cash. As a result, if Horizon declares a

distribution, its stockholders who have not “opted out” of the DRIP

by the distribution record date will have their distribution

automatically reinvested into additional shares of Horizon’s common

stock. Horizon has the option to satisfy the share requirements of

the DRIP through the issuance of new shares of common stock or

through open market purchases of common stock by the DRIP plan

administrator. Newly-issued shares will be valued based upon the

final closing price of Horizon’s common stock on a specified

valuation date for each distribution as determined by Horizon’s

board of directors. Shares purchased in the open market to satisfy

the DRIP requirements will be valued based upon the average price

of the applicable shares purchased by the DRIP plan administrator,

before any associated brokerage or other costs, which are borne by

Horizon.

About Horizon Technology Finance

Horizon Technology Finance Corporation (NASDAQ: HRZN),

externally managed by Horizon Technology Finance Management LLC, an

affiliate of Monroe Capital, is a leading specialty finance company

that provides capital in the form of secured loans to venture

capital backed companies in the technology, life science,

healthcare information and services, and sustainability industries.

The investment objective of Horizon is to maximize its investment

portfolio’s return by generating current income from the debt

investments it makes and capital appreciation from the warrants it

receives when making such debt investments. Horizon is

headquartered in Farmington, Connecticut, with a regional office in

Pleasanton, California, and investment professionals located

throughout the U.S. Monroe Capital is a $19.5 billion asset

management firm specializing in private credit markets across

various strategies, including direct lending, technology finance,

venture debt, opportunistic, structured credit, real estate and

equity. To learn more, please visit horizontechfinance.com.

Forward-Looking Statements

Statements included herein may constitute “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Statements other than statements of historical

facts included in this press release may constitute forward-looking

statements and are not guarantees of future performance, condition

or results and involve a number of risks and uncertainties. Actual

results may differ materially from those in the forward-looking

statements as a result of a number of factors, including those

described from time to time in Horizon’s filings with the

Securities and Exchange Commission. Horizon undertakes no duty to

update any forward-looking statement made herein. All

forward-looking statements speak only as of the date of this press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029257377/en/

Investor Relations: ICR Garrett Edson ir@horizontechfinance.com

(646) 200-8885

Media Relations: ICR Chris Gillick HorizonPR@icrinc.com (646)

677-1819

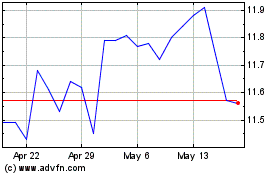

Horizon Technology Finance (NASDAQ:HRZN)

Historical Stock Chart

From Dec 2024 to Jan 2025

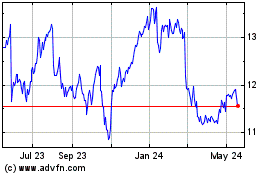

Horizon Technology Finance (NASDAQ:HRZN)

Historical Stock Chart

From Jan 2024 to Jan 2025