Largest acquisition in UMB history will

increase total assets by more than 40% and significantly expand

geographic footprint

UMB investment community call today, Monday,

April 29, at 7:30 a.m. (CT) / 8:30 a.m. (ET)

UMB Financial Corporation (Nasdaq: UMBF) and Heartland

Financial, USA Inc. (Nasdaq: HTLF) announced today that they have

entered into a definitive merger agreement under which UMB

Financial Corporation (UMB) will acquire Heartland Financial USA,

Inc. (HTLF), in an all-stock transaction valued at approximately

$2.0 billion.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240429502428/en/

Founded in 1981, HTLF is headquartered in Denver and has $19.4

billion in assets, $16.2 billion in total deposits and $12.1

billion in total loans, as of March 31, 2024. The combination of

companies will create a leading, regional banking powerhouse,

spanning a 13-state branch footprint, adding California, Minnesota,

New Mexico, Iowa and Wisconsin to UMB’s existing eight-state

footprint, which includes Missouri, Illinois, Colorado, Kansas,

Oklahoma, Nebraska, Arizona and Texas.

“This is a historic and exciting milestone for our company,”

said UMB Financial Corporation Chairman and CEO Mariner Kemper.

“While we have maintained an outstanding pace of organic growth

during the past decade, this compelling combination with HTLF marks

a truly momentous expansion of all our core services in both

existing and new markets. This synergy, along with a like-minded

culture and customer approach, is an ideal fit for our business

model, our credit and risk profiles, and our associates, customers

and communities.”

This transaction, the largest in UMB’s 111-year history, will

result in UMB having $64.5 billion in assets, elevating it to the

top 5% of the 616 publicly traded banks in the U.S. The transaction

will increase UMB’s private wealth management’s AUM/AUA by 31% and

nearly doubles its retail deposit base. It will also add 107

branches and 237 ATMs to UMB’s 90 branches and 238 ATMs,

dramatically expanding the network for both companies’

customers.

“This acquisition further diversifies our business, adding more

scale to our consumer and small business capabilities,” Kemper

said. “It also significantly expands our market share in several

existing markets and leverages our commercial banking expertise to

HTLF customers and prospects in our newly acquired markets.”

Under the terms of the merger agreement, which were approved by

the Boards of Directors of each company, HTLF stockholders will

receive a fixed exchange ratio of 0.55 shares of UMB common stock

for each share of HTLF common stock. This per share consideration

is valued at $45.74 per share based on UMB’s closing price of

$83.17 on April 26, 2024. Following completion of this contemplated

transaction, former HTLF stockholders are expected to collectively

represent approximately 31% of the combined company. At the closing

of the transaction, five members of the HTLF Board of Directors

will join the UMB Board, which will be expanded to 16 members.

“HTLF’s merger with UMB represents our continued focus on

ensuring we deliver the best products, services and expertise to

our customers,” said Bruce K. Lee, HTLF President and CEO. “This is

an excellent match for HTLF, and we’re truly excited for what this

means for our employees, customers, stockholders and

communities.”

Within its 11-state footprint, HTLF does business as: Minnesota

Bank & Trust, Wisconsin Bank & Trust, Dubuque Bank &

Trust, Illinois Bank & Trust, Bank of Blue Valley, Citywide

Banks, Premier Valley Bank, Arizona Bank & Trust, New Mexico

Bank & Trust and First Bank & Trust.

UMB is deeply invested in the communities in which it does

business, providing support through products, services, and

investments as well as corporate and associate giving. UMB is

committed to being a strong financial steward and will share more

information in the near future about how it will provide this

support throughout its newly expanded footprint.

HTLF has 1,900 associates and UMB has 3,600. Until the

transaction closes, the companies will continue to operate

independently.

The transaction is subject to customary closing conditions,

including regulatory approvals and approval by UMB shareholders and

HTLF stockholders, and is expected to close in the first quarter of

2025.

Conference Call

UMB will host a call for the investment community on Monday,

April 29, at 7:30 a.m. (CT) / 8:30 a.m. (ET). This call has been

rescheduled from the previously announced date and time.

Interested parties may access the call by dialing (toll-free)

833-470-1428 or (international) 404-975-4839 and requesting to join

the UMB Financial call with access code 397231. The live call may

also be accessed by visiting investorrelations.umb.com or by using

the following the link:

UMB Financial Conference Call

A replay of the conference call may be heard through May 13,

2024, by calling (toll-free) 866-813-9403 or (international)

929-458-6194. The replay access code required for playback is

182605. The call replay may also be accessed at

investorrelations.umb.com.

Advisors

BofA Securities, Inc. is serving as financial advisor to UMB and

Davis Polk and Wardwell LLP is serving as UMB’s legal advisor.

Keefe, Bruyette & Woods, A Stifel Company, is serving as

financial advisor to HTLF and Wachtell, Lipton, Rosen & Katz is

serving as HTLF’s legal advisor.

About UMB

UMB Financial Corporation (Nasdaq: UMBF) is a financial services

company headquartered in Kansas City, Missouri. UMB offers

commercial banking, which includes comprehensive deposit, lending

and investment services, personal banking, which includes wealth

management and financial planning services, and institutional

banking, which includes asset servicing, corporate trust solutions,

investment banking, and healthcare services. UMB operates branches

throughout Missouri, Illinois, Colorado, Kansas, Oklahoma,

Nebraska, Arizona and Texas. As the company’s reach continues to

grow, it also serves business clients nationwide and institutional

clients in several countries. For more information, visit UMB.com,

UMB Blog, UMB Facebook and UMB

LinkedIn.

About HTLF

Heartland Financial USA, Inc. is a Denver, Colorado-based bank

holding company operating under the brand name HTLF, with assets of

$19 billion as of March 31, 2024. HTLF’s banks serve customers in

the West, Southwest and Midwest regions. HTLF is committed to

serving the banking needs of privately owned businesses, their

owners, executives and employees. Our core commercial business is

supported by a strong retail banking operation, in addition to a

diversified line of financial services including treasury

management, wealth management and investments. Additional

information is available at www.htlf.com.

Cautionary Note Regarding Forward Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Rule 175 promulgated thereunder, and Section 21E of

the Securities Exchange Act of 1934, as amended, and Rule 3b-6

promulgated thereunder, which statements involve inherent risks and

uncertainties. Any statements about UMB, HTLF or the combined

company’s plans, objectives, expectations, strategies, beliefs, or

future performance or events constitute forward-looking statements.

Such statements are generally identified as those that include

words or phrases such as “believes,” “expects,” “anticipates,”

“plans,” “trend,” “objective,” “continue,” or similar expressions

or future or conditional verbs such as “will,” “would,” “should,”

“could,” “might,” “may,” or similar expressions. Forward-looking

statements involve known and unknown risks, uncertainties,

assumptions, estimates, and other important factors that change

over time and could cause actual results to differ materially from

any results, performance, or events expressed or implied by such

forward-looking statements. Such forward-looking statements include

but are not limited to statements about the benefits of the

business combination transaction between UMB and HTLF (the

“Transaction”), including future

financial and operating results, the combined company’s plans,

objectives, expectations and intentions, and other statements that

are not historical facts.

These forward-looking statements are subject to risks and

uncertainties that may cause actual results to differ materially

from those projected. In addition to factors previously disclosed

in UMB’s and HTLF’s reports filed with the U.S. Securities and

Exchange Commission (the “SEC”), the

following factors, among others, could cause actual results to

differ materially from forward-looking statements or historical

performance: the occurrence of any event, change, or other

circumstance that could give rise to the right of one or both of

the parties to terminate the definitive merger agreement between

UMB and HTLF; the outcome of any legal proceedings that may be

instituted against UMB or HTLF; the possibility that the

Transaction does not close when expected or at all because required

regulatory, shareholder, or other approvals and other conditions to

closing are not received or satisfied on a timely basis or at all

(and the risk that such approvals may result in the imposition of

conditions that could adversely affect the combined company or the

expected benefits of the Transaction); the risk that the benefits

from the Transaction may not be fully realized or may take longer

to realize than expected, including as a result of changes in, or

problems arising from, general economic and market conditions,

interest and exchange rates, monetary policy, laws and regulations

and their enforcement, and the degree of competition in the

geographic and business areas in which UMB and HTLF operate; the

ability to promptly and effectively integrate the businesses of UMB

and HTLF; the possibility that the Transaction may be more

expensive to complete than anticipated, including as a result of

unexpected factors or events; reputational risk and potential

adverse reactions of UMB’s or HTLF’s customers, employees or other

business partners, including those resulting from the announcement

or completion of the Transaction; the dilution caused by UMB’s

issuance of additional shares of its capital stock in connection

with the Transaction; and the diversion of management’s attention

and time from ongoing business operations and opportunities on

merger-related matters.

These factors are not necessarily all of the factors that could

cause UMB’s, HTLF’s or the combined company’s actual results,

performance, or achievements to differ materially from those

expressed in or implied by any of the forward-looking statements.

Other factors, including unknown or unpredictable factors, also

could harm UMB’s, HTLF’s or the combined company’s results.

All forward-looking statements attributable to UMB, HTLF, or the

combined company, or persons acting on UMB’s or HTLF’s behalf, are

expressly qualified in their entirety by the cautionary statements

set forth above. Forward-looking statements speak only as of the

date they are made and UMB and HTLF do not undertake or assume any

obligation to update publicly any of these statements to reflect

actual results, new information or future events, changes in

assumptions, or changes in other factors affecting forward-looking

statements, except to the extent required by applicable law. If UMB

or HTLF update one or more forward-looking statements, no inference

should be drawn that UMB or HTLF will make additional updates with

respect to those or other forward-looking statements. Further

information regarding UMB, HTLF and factors which could affect the

forward-looking statements contained herein can be found in UMB’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2023 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000101382/000095017024018456/umbf-20231231.htm),

and its other filings with the SEC, and in HTLF’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2023 (and which is

available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/920112/000092011224000026/htlf-20231231.htm),

and its other filings with the SEC.

Additional Information about the Transaction and Where to

Find It

This press release does not constitute an offer to buy or sell,

or the solicitation of an offer to buy or sell, any securities or a

solicitation of any vote or approval. In connection with the

Transaction, UMB will file with the SEC a Registration Statement on

Form S-4 to register the shares of UMB capital stock to be issued

in connection with the Transaction. The Registration Statement will

include a joint proxy statement of UMB and HTLF that also

constitutes a prospectus of UMB. The definitive joint proxy

statement/prospectus will be sent to the shareholders of UMB and

stockholders of HTLF seeking their approval of the Transaction and

other related matters.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE

REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY

STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON

FORM S-4 WHEN THEY BECOME AVAILABLE, AS WELL AS ANY OTHER RELEVANT

DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR

INCORPORATED BY REFERENCE INTO THE JOINT PROXY

STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION REGARDING UMB, HTLF, THE TRANSACTION AND RELATED

MATTERS.

Investors and security holders may obtain free copies of these

documents and other documents filed with the SEC by UMB or HTLF

through the website maintained by the SEC at http://www.sec.gov or

from UMB at its website, www.UMB.com, or from HTLF at its website,

www.htlf.com. Documents filed with the SEC by UMB will be available

free of charge by accessing the “Investor Relations” page of UMB’s

website at https://investorrelations.umb.com/overview/default.aspx,

or alternatively by directing a request by mail to UMB, Attention:

Corporate Secretary, 1010 Grand Boulevard, Kansas City, Missouri

64106, and documents filed with the SEC by HTLF will be available

free of charge by accessing HTLF’s website at www.htlf.com under

the “Investor Relations” tab or, alternatively, by directing a

request by mail to HTLF’s Corporate Secretary, 1800 Larimer Street,

Suite 1800, Denver, Colorado 80202.

Participants in the Solicitation

UMB, HTLF, and certain of their respective directors and

executive officers may be deemed to be participants in the

solicitation of proxies from the shareholders of UMB and

stockholders of HTLF in connection with the Transaction under the

rules of the SEC. Information about the interests of the directors

and executive officers of UMB and HTLF and other persons who may be

deemed to be participants in the solicitation of shareholders of

UMB and stockholders of HTLF in connection with the Transaction and

a description of their direct and indirect interests, by security

holdings or otherwise, will be included in the joint proxy

statement/prospectus related to the Transaction, which will be

filed with the SEC. Information about the directors and executive

officers of UMB and their ownership of UMB common stock is also set

forth in the definitive proxy statement for UMB’s 2024 Annual

Meeting of Shareholders, as filed with the SEC on Schedule 14A on

March 3, 2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000101382/000119312524066457/d706079ddef14a.htm).

Information about the directors and executive officers of UMB,

their ownership of UMB common stock, and UMB’s transactions with

related persons is set forth in the sections entitled “Directors,

Executive Officers and Corporate Governance,” “Security Ownership

of Certain Beneficial Owners and Management and Related Stockholder

Matters,” and “Certain Relationships and Related Transactions, and

Director Independence” included in UMB’s annual report on Form 10-K

for the fiscal year ended December 31, 2023, which was filed with

the SEC on February 22, 2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000101382/000095017024018456/umbf-20231231.htm),

and in the sections entitled “Our Board of Directors” and “Stock

Owned by Directors, Nominees, and Executive Officers” included in

UMB’s definitive proxy statement in connection with its 2024 Annual

Meeting of Stockholders, as filed with the SEC on March 3, 2024

(and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000101382/000119312524066457/d706079ddef14a.htm).

To the extent holdings of UMB common stock by the directors and

executive officers of UMB have changed from the amounts of UMB

common stock held by such persons as reflected therein, such

changes have been or will be reflected on Statements of Change in

Ownership on Form 4 filed with the SEC. Information about the

directors and executive officers of HTLF and their ownership of

HTLF common stock can also be found in HTLF’s definitive proxy

statement in connection with its 2024 Annual Meeting of

Stockholders, as filed with the SEC on April 9, 2024 (and which is

available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/920112/000092011224000086/htlf-20240409.htm)

and other documents subsequently filed by HTLF with the SEC.

Information about the directors and executive officers of HTLF,

their ownership of HTLF common stock, and HTLF’s transactions with

related persons is set forth in the sections entitled “Directors,

Executive Officers and Corporate Governance,” “Security Ownership

of Certain Beneficial Owners and Management and Related Stockholder

Matters,” and “Certain Relationships and Related Transactions, and

Director Independence” included in HTLF’s annual report on Form

10-K for the fiscal year ended December 31, 2023, which was filed

with the SEC on February 23, 2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/920112/000092011224000026/htlf-20231231.htm),

and in the sections entitled “Security Ownership of Certain

Beneficial Owners and Management” and “Related Person Transactions”

included in HTLF’s definitive proxy statement in connection with

its 2024 Annual Meeting of Stockholders, as filed with the SEC on

April 9, 2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/920112/000092011224000086/htlf-20240409.htm).

To the extent holdings of HTLF common stock by the directors and

executive officers of HTLF have changed from the amounts of HTLF

common stock held by such persons as reflected therein, such

changes have been or will be reflected on Statements of Change in

Ownership on Form 4 filed with the SEC. Free copies of these

documents may be obtained as described above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240429502428/en/

UMB Investors: Kay Gregory 816.860.7106 UMB Media:

Kristin Kovach 816.507.1069 kkovach@barkleyokrp.com

HTLF Investors: Kevin Thompson Chief Financial Officer

303.365.3813 kthompson@htlf.com HTLF Media: Ryan Lund SVP,

Director of Corporate Communications 952.746.0439

rlund@htlf.com

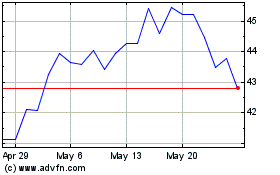

Heartland Financial USA (NASDAQ:HTLF)

Historical Stock Chart

From Feb 2025 to Mar 2025

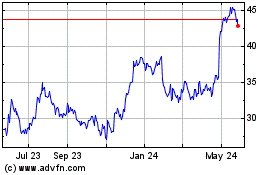

Heartland Financial USA (NASDAQ:HTLF)

Historical Stock Chart

From Mar 2024 to Mar 2025