Combined market ACV up 20% in Q4, driven by

33% growth in cloud services

Managed services growth slows to less than

3%

Combined market ACV hits record $104 billion

for the full year

ISG forecasts 18% growth for XaaS, 4.5%

growth for managed services in 2025

Global spending on IT and business services rose by

double-digits in the fourth quarter, fueled by a sharp increase in

cloud demand driven by AI, according to the latest state-of-the

industry report from Information Services Group (ISG) (Nasdaq:

III), a leading global technology research and advisory firm.

Data from the ISG Index™, which measures commercial outsourcing

contracts with annual contract value (ACV) of $5 million or more,

show fourth-quarter ACV for the combined global market (both

managed services and cloud-based services) at a record $28.2

billion, up 20 percent versus the prior year. It was the fourth

consecutive quarter the combined market grew year over year, and

the second straight quarter it established a new high for ACV.

A sharp increase in cloud spending propelled market growth this

past quarter, with ACV for cloud services up 33 percent versus the

prior year, to $17.7 billion. Within this segment,

infrastructure-as-a-service (IaaS) soared 42 percent, to $13.4

billion, while software-as-a-service (SaaS) grew 12 percent, to

$4.3 billion.

“Demand for cloud services continued its upward trajectory – a

complete turnaround from the down market it faced in 2023,” said

Steve Hall, president of ISG, and the firm’s chief AI officer.

“We’re seeing enterprises reaccelerating their cloud migrations and

looking to the cloud to power their AI ambitions. This is great

news for the big three hyperscalers and their ecosystem partners,

which are building more and more AI apps on hyperscaler platforms.

Indeed, AI now accounts for about 6 percent of provider revenues –

and climbing.”

Managed services, meanwhile, grew at a much more modest pace, up

2.6 percent in the fourth quarter, to $10.5 billion of ACV. Demand

slowed sequentially, down 3 percent from the third quarter. Within

this segment, IT outsourcing (ITO) was essentially flat (up 0.6

percent), at $7.9 billion, while business process outsourcing (BPO)

advanced 9 percent, to $2.6 billion.

During the fourth quarter, 715 managed services contracts were

awarded, up 6 percent from the prior year. Among them were 10

mega-deals (contracts with annual value of $100 million or more)

with combined ACV of $1.7 billion, up 31 percent year over year. It

was the first time since 2007-2008 the global market has produced

at least 10 mega-deals for three consecutive quarters.

At the same time, the number of deals on the other end of the

spectrum (those valued at between $5 million and $10 million) rose

14 percent from the prior year.

Full-Year Results

Combined market ACV for the full year was a record $104 billion,

up 11 percent from the prior year.

The ACV of cloud-based services reached a record $62.4 billion,

up 19 percent, with IaaS up 25 percent, to $46.6 billion, and SaaS

up 4.6 percent, to $15.8 billion.

Managed services ACV advanced less than 2 percent, to a record

$41.7 billion, as demand slowed from the average 6 percent growth

of the previous two years. ITO was flat, at $30.6 billion, while

BPO was up 6 percent, to $11 billion.

A total of 2,868 managed services contracts were awarded in

2024, up nearly 5 percent from the prior year, including 34

mega-deals, one less than in 2023. Meanwhile, the number of

new-scope awards (1,926) and their combined ACV ($27 billion) were

both up 6 percent, with new-scope ACV at a record high.

“Managed services bookings grew at a slower pace in 2024

compared with the previous two years, primarily due to continued

pressure on discretionary spending, especially in the banking and

manufacturing sectors, which make up nearly half of the contract

value in the market,” Hall said. “That cost pressure, however, led

to a second consecutive year of strong mega-deal activity as

enterprises looked to move the needle on their cost profile through

large-scale transformations.”

Hall said enterprise decision-making accelerated in the second

half of 2024, noting an increase in the number of smaller deals in

the $5 to $9 million ACV range. “This could be an indication that

discretionary spending is beginning to loosen up.”

2025 Forecast

For the full year, ISG is forecasting 4.5 percent revenue growth

for managed services, and 18 percent revenue growth for cloud-based

services (as-a-service or XaaS).

“Looking at 2025, we expect a gradual recovery in enterprise

demand for IT and business services,” Hall said. “We base our view

on the likelihood the U.S. Federal Reserve will keep interest rates

in restrictive territory, with at least two rate cuts expected,

while the strong U.S. dollar continues to pose challenges for

multinational corporations. In Europe, we are likely to see subdued

growth, with the upcoming elections in Germany creating uncertainty

in the market until the second half.

“At the same time, we see several macroeconomic tailwinds at

play,” Hall continued. “AI spending continues to gain momentum,

with hundreds of billions being spent on infrastructure, setting

the stage for widespread adoption among enterprises and

individuals. Productivity gains from AI are expected to be

substantial, presenting a massive market opportunity. In managed

services, we're seeing early signs of improvement in the BFSI

[banking, financial services and insurance] sector as discretionary

spending begins to pick up. Broader market demand could also

improve, thanks to greater clarity on the rate-cutting cycle,

enterprises acknowledging their growing technical debt, and the

rapidly increasing demand for GenAI.”

About the ISG Index™

The ISG Index™ is recognized as the authoritative source for

marketplace intelligence on the global technology and business

services industry. For 89 consecutive quarters, it has detailed the

latest industry data and trends for financial analysts, enterprise

buyers, software and service providers, law firms, universities and

the media.

The 4Q24 Global ISG Index results were presented during a

webcast today. To view a replay of the webcast and download

presentation slides, visit this webpage.

About ISG

ISG (Information Services Group) (Nasdaq: III) is a leading

global technology research and advisory firm. A trusted business

partner to more than 900 clients, including more than 75 of the

world’s top 100 enterprises, ISG is committed to helping

corporations, public sector organizations, and service and

technology providers achieve operational excellence and faster

growth. The firm specializes in digital transformation services,

including AI, cloud and data analytics; sourcing advisory; managed

governance and risk services; network carrier services; strategy

and operations design; change management; market intelligence and

technology research and analysis. Founded in 2006, and based in

Stamford, Conn., ISG employs more than 1,600 digital-ready

professionals operating in more than 20 countries—a global team

known for its innovative thinking, market influence, deep industry

and technology expertise, and world-class research and analytical

capabilities based on the industry’s most comprehensive marketplace

data. For more information, visit www.isg-one.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250116043493/en/

Press Contacts: Will Thoretz, ISG +1 203 517 3119

will.thoretz@isg-one.com Julianna Sheridan, Matter Communications

for ISG +1 978-518-4520 isg@matternow.com

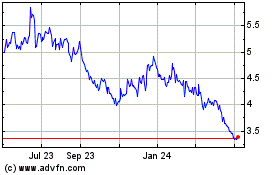

Information Services (NASDAQ:III)

Historical Stock Chart

From Dec 2024 to Jan 2025

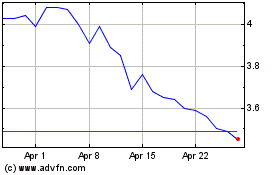

Information Services (NASDAQ:III)

Historical Stock Chart

From Jan 2024 to Jan 2025