0000896878false00008968782024-07-102024-07-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

July 10, 2024

Date of Report (Date of earliest event reported):

INTUIT INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 000-21180 | | 77-0034661 |

(State or other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

2700 Coast Avenue, Mountain View, CA 94043

(Address of principal executive offices, including zip code)

(650) 944-6000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| | Title of Each Class | | Trading Symbol | | Name of Exchange on Which Registered |

| | Common Stock, $0.01 par value | | INTU | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

ITEM 2.05 COSTS ASSOCIATED WITH EXIT OR DISPOSAL ACTIVITIES.

On July 10, 2024, Intuit Inc. (the “Company”) announced a plan of reorganization (the “Plan”) focused on reallocating resources to the Company’s key growth areas. As part of the Plan, approximately 1,800 employees will exit the Company and the Company will close its Boise and Edmonton sites in service to growing technology teams and capabilities in strategic locations. The Company expects to hire a nearly equivalent number of employees in fiscal 2025 to support the Company’s declared growth areas and expects overall headcount to grow in fiscal 2025 and beyond.

The Company estimates that it will incur approximately $250 million to $260 million in charges in connection with the Plan, primarily in its fourth fiscal quarter ending July 31, 2024. These charges consist of approximately $217 million to $227 million in future cash expenditures related to severance payments and employee benefits and approximately $33 million in non-cash charges for share-based compensation and charges associated with the site closures. The Company expects substantially all of the actions associated with the Plan to be completed by its first fiscal quarter ending October 31, 2024, subject to local law and consultation requirements.

The estimate of the charges that the Company expects to incur in connection with the Plan, and the timing thereof, are subject to a number of assumptions, including local law requirements in various jurisdictions, and actual amounts may differ materially from estimates. In addition, the Company may incur other charges not currently contemplated due to unanticipated events that may occur, including in connection with the implementation of the Plan.

ITEM 7.01 REGULATION FD DISCLOSURE.

On July 10, 2024, Sasan Goodarzi, the Company’s Chief Executive Officer, sent an email to the Company’s employees regarding the Plan. A copy of this email is attached to this Current Report on Form 8-K as Exhibit 99.01 and is incorporated herein by reference.

The information in this Item 7.01 and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly stated by specific reference in such filing.

Forward-looking statements

This report contains forward-looking statements, including expectations regarding the impact of the Plan on the Company’s results of operations and workforce and the amount and timing of the costs related to the Plan. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause the Company’s actual results to differ materially from the expectations expressed in the forward-looking statements. These risks and uncertainties may be amplified by the effects of global developments and conditions or events, including macroeconomic uncertainty and geopolitical conditions, which have caused significant global economic instability and uncertainty. Given these risks and uncertainties, persons regarding this communication are cautioned not to place any undue reliance on such forward-looking statements. These factors include, without limitation, the following: our ability to realize the anticipated benefits of the Plan; risks related to the preliminary nature of the estimate of the charges to be incurred in connection with Plan, which is subject to change; risks related to any delays in the timing for implementing the Plan or potential disruptions to our business or operations as we execute on the Plan; our ability to compete successfully; potential governmental encroachment in our tax businesses; our ability to develop, deploy, and use artificial intelligence in our platform and products; our ability to adapt to technological change and to successfully extend our platform; our ability to predict consumer behavior; our reliance on intellectual property; our ability to protect our intellectual property rights; any harm to our reputation; risks associated with our ESG and DEI practices; risks associated with acquisition and divestiture activity; the issuance of equity or incurrence of debt to fund acquisitions or for general business purposes; cybersecurity incidents (including those affecting the third parties we rely on); customer concerns about privacy and cybersecurity incidents; fraudulent activities by third parties using our offerings; our failure to process transactions effectively; interruption or failure of our information technology; our ability to maintain critical third-party business relationships; our ability to attract and retain talent and the success of our hybrid work model; any deficiency in the quality or accuracy of our offerings (including the advice given by experts

on our platform); any delays in product launches; difficulties in processing or filing customer tax submissions; risks associated with international operations; risks associated with climate change; changes to public policy, laws or regulations affecting our businesses; legal proceedings in which we are involved; fluctuations in the results of our tax business due to seasonality and other factors beyond our control; changes in tax rates and tax reform legislation; global economic conditions (including, without limitation, inflation); exposure to credit, counterparty and other risks in providing capital to businesses; amortization of acquired intangible assets and impairment charges; our ability to repay or otherwise comply with the terms of our outstanding debt; our ability to repurchase shares or distribute dividends; volatility of our stock price; and our ability to successfully market our offerings.

More details about these and other risks that may impact our business are included in our Form 10-K for fiscal 2023 and in our other SEC filings. You can locate these reports through our website at http://investors.intuit.com. Forward-looking statements represent the judgment of the management of Intuit as of the date of this presentation. Except as required by law, we do not undertake any duty to update any forward-looking statement or other information in this report.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

| | | | | | | | |

| | |

| 99.01 | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | | |

| Date: | July 10, 2024 | | INTUIT INC. |

| | | |

| | | By: | | /s/ SANDEEP S. AUJLA |

| | | | | Sandeep S. Aujla |

| | | | | Executive Vice President and

Chief Financial Officer |

To: All Employees

Email Subject Line: Investing in our future

Date: July 10, 2024

Hi team,

As I’ve shared many times, the era of AI is one of the most significant technology shifts of our lifetime. This is truly an extraordinary time - AI is igniting global innovation at an incredible pace, transforming every industry and company in ways that were unimaginable just a few years ago. Companies that aren’t prepared to take advantage of this AI revolution will fall behind and, over time, will no longer exist.

Intuit is at a critical moment in our history. For over 40 years, we’ve had a successful track record of self-disruption and reinvention, transforming through multiple technological shifts. We were early to bet on and invest in AI, building one of the largest AI-driven expert platforms to fuel the success of consumers, small and mid-market businesses, and important partners like accountants, financial institutions, and marketing agencies who rely on us daily to prosper. With the introduction of GenAI, we are now delivering even more compelling customer experiences, increasing monetization potential, and driving efficiencies in how the work gets done within Intuit. But it’s just the beginning of the AI revolution.

Intuit is in a position of strength; we have the strategy and momentum that we need to succeed. To fulfill our mission to power the prosperity of our customers around the world and strengthen our leadership position, we must accelerate our innovation and investments in the areas that are most important to our future success. With this context, I am sharing some very difficult decisions my leadership team and I have made to ensure we are able to increase investment in these key growth areas. Today we will be communicating to approximately 1,800 employees, which is 10% of our workforce, that they will be leaving Intuit. These are extremely painful decisions for me and my team because we deeply understand the impact these decisions have on our friends and colleagues who will be leaving. We are very grateful for the great work they have done and the amazing contributions they have made while at Intuit.

We do not do layoffs to cut costs, and that remains true in this case. The changes we are making today enable us to allocate additional investments to our most critical areas to support our customers and drive growth as detailed below. This includes reinvesting in the necessary skills and capabilities to support these areas, and, as such, we will hire approximately 1,800 new people primarily in engineering, product, and customer facing roles such as sales, customer success, and marketing. In context of the actions we are taking today, we expect our overall headcount to grow in FY25 and beyond.

Accelerating investments in the areas that matter most

We will accelerate our investments and hiring in the following areas to support growth, aligned to our company strategy and Big Bets:

•Revolutionize Speed to Benefit (Big Bet 1): Our GenAI-powered financial assistant, Intuit Assist, coupled with our network of experts, allows us to deliver delightful “done-for-you” experiences with a gateway to human expertise. To deliver these capabilities, we will accelerate investing in data and AI, leveraging GenOS to reimagine our products from traditional workflows to AI-native experiences that eliminate work, save time, and put more money in our customers’ pockets. We are accelerating our hiring of top engineering talent across the technology ecosystem to support these investments.

•Connecting People to Experts (Big Bet 2): Our AI-driven expert platform is a game-changer for Intuit. No other company can deliver a digital platform with embedded AI-powered human expertise at our scale to serve the financial needs of consumers, small and mid-market businesses, and partners. We are increasing investments in data and AI to more effectively leverage accurate and complete data to do the work for our customers and match customers to the “right” experts in real-time to provide the specific, personalized assistance to fuel their success. To advance this area, we are hiring additional talent to bolster our expert network teams that are augmented by AI to assist our customers and we are investing in hiring marketing talent with deep expertise in digital services.

•Accelerating Money Solutions: We’ve successfully built a fintech platform that enables our customers to manage their money end-to-end and to improve cash flow. This is an important driver to improving the success rate of our small and mid-market customers. We are accelerating our investment to deliver best-in-class, seamless payments, capital, banking, bill pay, and invoicing solutions across several geographies. We are hiring additional experienced fintech talent in engineering, design, risk, and customer success.

•Disrupting the Mid-Market (Big Bet 5): We continue to have a massive opportunity to fuel mid-market customers’ success with our offerings, building a significant growth engine for Intuit. Our vision is to be an AI-driven expert platform for mid-market customers, delivering industry-specific experiences to fuel their success as the complexity of their business grows. We are accelerating investments to serve these customers on our platform, such as more sophisticated accounting and reporting capabilities, money solutions, human capital management, and customer acquisition solutions with Mailchimp, all assisted by AI-powered human experts. To achieve this goal, we are accelerating hiring talent with deep mid-market customer experience in product, account management, marketing, sales, and customer success.

•Accelerating International Growth: International continues to be a significant opportunity for us. Bringing QuickBooks and Mailchimp together to create one growth platform around the world, where we have product market fit, including in Canada, UK, and Australia, is important to driving our success. We are investing in expanding our AI-driven expert platform in these markets and leveraging Mailchimp’s international

footprint to lead our expansion in Europe and “rest of world.” This investment will enable us to offer a greater set of our ecosystem of services to customers in international markets, and we remain committed to our international hubs in London, Toronto, and Sydney. We are hiring talent with international experience, including in product, engineering, and go-to-market skills to accelerate our progress in this area.

Taking care of our people

It is never easy to say goodbye to our colleagues and friends and we are committed to treating everyone who has been impacted by these changes with the compassion and respect they deserve.

Let me first start with who is impacted by these decisions:

•We’ve significantly raised the bar on our expectations of employee performance, resulting in approximately 1,050 employees leaving the company who are not meeting expectations and who we believe will be more successful outside of Intuit.

•To continue increasing our velocity of decision making and empowering our employees to deliver for our customers, we are reducing the number of executives (director and above) by approximately 10%, expanding certain executive roles and responsibilities.

•We are also consolidating 80 technology roles to sites where we are strategically growing our technology teams and capabilities, including Atlanta, Bangalore, New York, Tel Aviv, and Toronto, aligned to Intuit’s site strategy. This strategy allows us to better align these resources with the product and technology teams that are accountable for end-to-end ownership of discrete technology capabilities and critical customer problems. Related to this strategy, we have made the decision to close two of our sites in Edmonton and Boise, where we have over 250 employees, with a certain number of employees relocating to other sites within Intuit or leaving the company.

•We are also eliminating more than 300 roles across the company to streamline work and reallocate resources toward key growth areas.

To support everyone leaving, we are providing generous support, including:

•Financial: All US employees will receive a package that includes a minimum of 16 weeks of pay, plus two additional weeks for every year of service. All employees in the US will have 60 days before they leave the company with a last day of September 9, 2024. Employees outside the US will receive similar support, taking into account local requirements. This timing allows everyone leaving to reach their July vesting date for restricted stock units (RSUs) and the July 31 eligibility date for annual IPI bonuses. Those not on an IPI plan will be able to reach the eligibility date for July or Q4 incentives.

•Health care: We will provide at least six months of health insurance coverage. Everyone leaving will also have access to the Employee Assistance Program to help with mental health support during the transition period.

•Career: Each impacted employee will have access to career transition and job placement services. Services include resume development, interviewing techniques, and recruiting and job search help.

•Immigration: For those that need immigration support, the extended transition period will allow individuals on visas extra time to look for other roles. Intuit will also provide access to external immigration experts for advice and support at no cost.

Moving forward together

By 9:00 AM PT today, all employees impacted by these changes will receive a calendar invitation from their manager titled "Leaving Intuit Discussion”. Those who do not receive an Outlook invitation by 9:00 AM PT can assume they are not impacted and we ask that you support your colleagues as they process this news.

Today is an incredibly difficult day and our hearts go out to all of you who are leaving Intuit. We sincerely thank you for all you have done for the company. We know you will continue to make a significant impact and achieve great success in your next chapter.

With the strength of our people, culture, and mission, we are positioned to take advantage of this AI revolution and revolutionize our customers’ experiences to deliver undisputed benefits in ways that we could never imagine. Today is “Day 1”. Together, we will focus on the future and all the possibilities to power prosperity around the world.

I will be hosting a Town Hall on Tuesday, July 16 at 9:00 AM PT to answer your questions.

Please take good care of yourself and each other.

Sasan

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

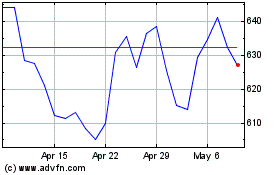

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Jul 2023 to Jul 2024