UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2025

Commission File Number: 001-40300

KAROOOOO LTD.

(Exact name of registrant as specified in its

charter)

1 Harbourfront Avenue

Keppel Bay Tower #14-07

Singapore 098632

+65 6255 4151

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Karooooo Ltd. |

| |

|

| |

By: |

/s/ Isaias (Zak) Jose Calisto |

| |

|

Name: |

Isaias (Zak) Jose Calisto |

| |

|

Title: |

Chief Executive Officer |

Date: January 14, 2025

EXHIBIT INDEX

2

Exhibit 99.1

● Karooooo Subscribers Increased 17% Y/Y

to 2.22 Million

● Cartrack Net Quarterly Subscriber Additions

Increased 15% Y/Y to 86,617

● Karooooo Quarterly Adjusted Earnings Per

Share increased 21% Y/Y to a Record ZAR7.67

● Reaffirmed FY25 Outlook for Subscribers,

Cartrack Subscription Revenue and Adjusted EPS

SINGAPORE (January 14, 2025) - Karooooo Limited

(“Karooooo”) reported strong results and a positive outlook in the third quarter (“Q3 2025”) ended November 30,

2024. Karooooo owns 100% of Cartrack and 74.8% of Karooooo Logistics, (collectively, “the group”).

“We delivered another robust quarter of

customer acquisition while we continue to expand our distribution capabilities.” said Zak Calisto, Group CEO of Karooooo. “Importantly,

we have now settled in our newly built central office in South Africa, and now look forward to strong organic growth in this region. Our

investment in Europe over the last few quarters is starting to yield exciting results. Southeast Asia’s subscription revenue grew

by 26% on a constant currency basis and remains our biggest medium to long-term opportunity. Key to our success is our culture, product

innovation and financial discipline as evidenced by our strong unit economics, cash generation, and clean balance sheet.”

Third Quarter 2025 Financial Overview (Unaudited)

Highlights

(Comparisons are relative to Q3 2024, unless otherwise

stated.)

SCALE

| ● | Cartrack

subscribers increased 17% to 2,223,227 at November 30, 2024 (Q3 2024: 1,908,192) |

| ● | Net

Cartrack subscriber additions increased 15% to 86,617 (Q3 2024: 75,484) |

GROWTH

| |

● |

Karooooo’s subscription revenue increased 14% to ZAR1,032 million (Q3 2024: ZAR904 million) |

| |

|

|

| |

● |

Cartrack’s subscription revenue increased 14% to ZAR1,029 million (Q3 2024: ZAR900 million) |

| |

|

|

| |

● |

Karooooo Logistics’s B2B delivery-as-a-service (“DaaS”) revenue increased 20% to ZAR109 million (Q3 2024 : ZAR91 million) |

Presented in the U.S. Dollar Equivalent1

| ● | Karooooo’s

subscription revenue increased 19% to USD57 million. |

| ● | Cartrack’s

subscription revenue increased 19% to USD57 million. |

| ● | Karooooo

Logistics’s DaaS revenue increased 26% to USD6 million. |

| 1 | For

convenience purposes only, amounts in South African rand as at November 30, 2024 have been translated to U.S. dollars using an exchange

rate of ZAR 18.0405 to U.S.$1.00 (November 30, 2023: ZAR 18.8689), as set forth in the H.10 statistical release of the Board of Governors

of the Federal Reserve System. These translations should not be considered representations that any such amounts have been,

could have been or could be converted at that or any other exchange rate. |

Third Quarter 2025 Financial Overview

Supplemental Financial Information and Business

Metrics

| | |

Three

Months Ended November 30, | |

| | |

Cartrack | | |

| | |

Carzuka | | |

| | |

Karooooo

Logistics | | |

| | |

Karooooo

Consolidated | |

| Figures

in Rand Thousands | |

2024 | | |

2023 | | |

Y-o-Y

% | | |

2024 | | |

2023 | | |

Y-o-Y

% | | |

2024 | | |

2023 | | |

Y-o-Y

% | | |

2024 | | |

2023 | | |

Y-o-Y

% | |

| Subscription

revenue | |

| 1,028,734 | | |

| 900,484 | | |

| 14 | % | |

| - | | |

| - | | |

| - | | |

| 3,208 | | |

| 3,431 | | |

| (6 | )% | |

| 1,031,942 | | |

| 903,915 | | |

| 14 | % |

| Other

revenue1 | |

| 21,903 | | |

| 18,611 | | |

| 18 | % | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 21,903 | | |

| 18,611 | | |

| 18 | % |

| Vehicle

sales2 | |

| - | | |

| - | | |

| - | | |

| - | | |

| 70,463 | | |

| (100 | )% | |

| - | | |

| - | | |

| - | | |

| - | | |

| 70,463 | | |

| (100 | )% |

| Delivery

service | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 105,545 | | |

| 87,154 | | |

| 21 | % | |

| 105,545 | | |

| 87,154 | | |

| 21 | % |

| Revenue | |

| 1,050,637 | | |

| 919,095 | | |

| 14 | % | |

| - | | |

| 70,463 | | |

| (100 | )% | |

| 108,753 | | |

| 90,585 | | |

| 20 | % | |

| 1,159,390 | | |

| 1,080,143 | | |

| 7 | % |

| Cost

of Sales | |

| (276,925 | ) | |

| (246,867 | ) | |

| 12 | % | |

| - | | |

| (81,850 | ) | |

| (100 | )% | |

| (74,434 | ) | |

| (64,115 | ) | |

| 16 | % | |

| (351,359 | ) | |

| (392,832 | ) | |

| (11 | )% |

| Gross

Profit | |

| 773,712 | | |

| 672,228 | | |

| 15 | % | |

| - | | |

| (11,387 | ) | |

| (100 | )% | |

| 34,319 | | |

| 26,470 | | |

| 30 | % | |

| 808,031 | | |

| 687,311 | | |

| 18 | % |

| Gross

Profit Margin | |

| 74 | % | |

| 73 | % | |

| | | |

| - | | |

| (16 | )% | |

| | | |

| 32 | % | |

| 29 | % | |

| | | |

| 70 | % | |

| 64 | % | |

| | |

| Operating

Profit/(loss) | |

| 316,083 | | |

| 295,477 | | |

| 7 | % | |

| - | | |

| (28,092 | ) | |

| (100 | )% | |

| 9,092 | | |

| 7,321 | | |

| 24 | % | |

| 325,175 | | |

| 274,706 | | |

| 18 | % |

| Operating

Profit Margin | |

| 30 | % | |

| 32 | % | |

| | | |

| - | | |

| (40 | )% | |

| | | |

| 8 | % | |

| 8 | % | |

| | | |

| 28 | % | |

| 25 | % | |

| | |

| Adjusted

EBITDA (a non-IFRS measure) | |

| 491,264 | | |

| 446,991 | | |

| 10 | % | |

| - | | |

| (26,987 | ) | |

| (100 | )% | |

| 9,984 | | |

| 7,870 | | |

| 27 | % | |

| 501,248 | | |

| 427,874 | | |

| 17 | % |

| Adjusted

EBITDA Margin (a non-IFRS measure) | |

| 47 | % | |

| 49 | % | |

| | | |

| - | | |

| (38 | )% | |

| | | |

| 9 | % | |

| 9 | % | |

| | | |

| 43 | % | |

| 40 | % | |

| | |

| 1. |

Other revenue is non-subscription-based revenue and relates predominantly to the sale of telematics devices to large enterprise customers opting for non-bundled contracts. Cartrack remains focused on bundled sales. |

| |

|

| 2. |

Effective from Q1 2025, Carzuka has been fully integrated to support Cartrack operations, with the final on-hand vehicle sold off in Q1 2025. |

Total Revenue and Subscription Revenue

Excluding Carzuka, Karooooo’s revenue increased

15% to ZAR1,159 million (Q3 2024: 1,010 million), and subscription revenue increased 14% to ZAR1,032 million in Q3 2025 (Q3 2024: ZAR904

million).

Cartrack increased total revenue 14% to ZAR1,051

million (Q3 2024: ZAR919 million). This growth is primarily driven by its subscription-based business model, as Cartrack also experienced

a 14% increase in subscription revenue to ZAR1,029 million in Q3 2025 (Q3 2024: ZAR900 million). Subscription revenue currently represents

98% of total revenue. Additionally, Cartrack achieved net subscriber additions of 86,617 during the quarter (Q3 2024: 75,484), reinforcing

its proven ability to scale and maintain consistent growth.

Karooooo Logistics demonstrated continued strong revenue

growth with a 20% increase to ZAR109 million (Q3 2024: ZAR91 million). Karooooo Logistics focuses on delivery-as-a-service (“DaaS”)

for our large enterprise customers wishing to scale and digitalise their e-commerce operations through a capital light model by connecting

them to an elastic fleet of third-party delivery drivers.

Operating Expenses

| | |

Three Months Ended November 30, | |

| Figures in Rand Thousands | |

2024 | | |

2023 | | |

Y-o-Y

% | |

| Karooooo’s Operating Expenses | |

| 486,264 | | |

| 414,142 | | |

| 17 | % |

| - Cartrack | |

| 461,054 | | |

| 378,288 | | |

| 22 | % |

| - Carzuka | |

| - | | |

| 16,705 | | |

| (100 | )% |

| - Karooooo Logistics | |

| 25,210 | | |

| 19,149 | | |

| 32 | % |

Karooooo’s operating expenses increased

17% to ZAR486 million (Q3 2024: ZAR414 million).

Of the total, ZAR461 million was attributable

to Cartrack (Q3 2024: ZAR378 million). This comprised investment in territorial expansion and growth. We continued to invest prudently

in scaling Karooooo Logistics, equating to ZAR25 million (Q3 2024: ZAR19 million) of total operating expenses.

Cartrack’s sales and marketing operating

expenses increased 32% to ZAR156 million (Q3 2024: ZAR118 million). This strategic investment in customer acquisition positions us well

for continued growth. Our customer lifetime value (LTV) to customer acquisition costs (CAC) ratio continues to exceed 9 times.

Cartrack’s general and administration operating

expenses increased 25% to ZAR228 million (Q3 2024: ZAR182 million). This planned increase reflects management’s commitment to building

strong infrastructure that supports our growth plans. While demonstrating our ability to contain costs, we plan to prudently increase

these costs to support our planned customer acquisition strategy.

Cartrack’s R&D operating expenses increased

9% to ZAR54 million (Q3 2024: ZAR50 million). We remain focused on driving substantial benefit from our R&D capital allocation.

Cartrack prudently provided for expected credit

losses of ZAR22 million (Q3 2024: ZAR28 million). We believe improved economic sentiment in South Africa contributed to the year-on-year

recovery.

Cartrack’s expenses as a proportion of subscription

revenue aligns with Karooooo’s long-term financial goals, and reflects our investment in growth.

| ● | Cartrack’s

sales and marketing expenses as a percentage of Cartrack’s subscription revenue increased to 15% (Q3 2024: 13%) |

| ● | Cartrack’s

general and administration expenses as a percentage of Cartrack’s subscription revenue increased to 22% (Q3 2024: 20%) |

| ● | Cartrack’s

R&D expenses as a percentage of Cartrack’s subscription revenue decreased to 5% (Q3 2024: 6%) |

Operating Profit and Earnings Per Share

Karooooo’s operating profit increased 18%

to ZAR325 million (Q3 2024: ZAR275 million) and earnings per share 21% to ZAR7.68 (Q3 2024: ZAR6.34).

Cartrack reported a growth of 7% in operating

profit to ZAR316 million (Q3 2024: ZAR295 million). The gross profit margin improved to 74% (Q3 2024: 73%) while maintaining a healthy

operating profit margin of 30% (Q3 2024: 32%).

Karooooo Logistics’s operating profit increased

24% to ZAR9 million (Q3 2024: ZAR7 million) as it continues to scale. The gross profit margin was 32% (Q3 2024: 29%) with a healthy operating

profit margin of 8% (Q3 2024: 8%).

Adjusted EBITDA

Karooooo’s Adjusted EBITDA (a non-IFRS measure)

increased 17% to ZAR501 million (Q3 2024: ZAR428 million).

Cartrack’s Adjusted EBITDA (a non-IFRS measure)

increased 10% to ZAR491 million (Q3 2024: ZAR447 million).

Karooooo Logistics’s Adjusted EBITDA (a

non-IFRS measure) increased 27% to ZAR10 million (Q3 2024: ZAR8 million).

See “Reconciliation of Profit for the Period

to Adjusted EBITDA (a non-IFRS measure)” below for a reconciliation of Adjusted EBITDA to profit, its most directly comparable IFRS

financial measure.

Nine Months Ended November 30, 2024 Financial

Overview (Unaudited)

Highlights

(Comparisons are relative to the nine months ended

November 30, 2023 (“YTD Q3 2024”), unless otherwise stated.)

SCALE

| ● | 2,223,227

Cartrack subscribers at November 30, 2024 increased 17% (YTD Q3 2024: 1,908,192) |

| ● | Net

Cartrack subscriber additions of 251,695 increased 32% (YTD Q3 2024: 191,115) |

GROWTH

| |

● |

Karooooo’s subscription revenue increased 15% to ZAR2,982 million (YTD Q3 2024: ZAR2,601 million) |

| |

|

|

| |

● |

Cartrack’s subscription revenue increased 15% to ZAR2,972 million (YTD Q3 2024: ZAR2,592 million) |

| |

|

|

| |

● |

Karooooo Logistics’s DaaS revenue increased 38% to ZAR310 million (YTD Q3 2024: ZAR224 million) |

Presented in the U.S. Dollar Equivalent1

| ● | Karooooo’s

subscription revenue increased 20% to USD165 million. |

| ● | Cartrack’s

subscription revenue increased 20% to USD165 million. |

| ● | Karooooo

Logistics’s DaaS revenue increased 45% to USD17 million. |

| 1 | For

convenience purposes only, amounts in South African rand as at November 30, 2024 have been translated to U.S. dollars using an exchange

rate of ZAR 18.0405 to U.S.$1.00 (November 30, 2023: ZAR 18.8698), as set forth in the H.10 statistical release of the Board of Governors

of the Federal Reserve System. These translations should not be considered representations that any such amounts have been,

could have been or could be converted at that or any other exchange rate. |

Nine Months Ended November 30, 2024 Financial

Overview

Supplemental Financial Information and Business Metrics

| | |

Nine

Months Ended November 30, | |

| | |

Cartrack | | |

Carzuka | | |

Karooooo

Logistics | | |

Karooooo

Consolidated | |

| Figures

in Rand Thousands | |

2024

| | |

2023

| | |

Y-o-Y

% | | |

2024 | | |

2023 | | |

Y-o-Y

% | | |

2024 | | |

2023 | | |

Y-o-Y

% | | |

2024 | | |

2023 | | |

Y-o-Y

% | |

| Subscription

revenue | |

| 2,971,790 | | |

| 2,592,371 | | |

| 15 | % | |

| - | | |

| - | | |

| - | | |

| 9,905 | | |

| 8,272 | | |

| 20 | % | |

| 2,981,695 | | |

| 2,600,643 | | |

| 15 | % |

| Other revenue1 | |

| 63,631 | | |

| 63,751 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| 63,631 | | |

| 63,751 | | |

| 0 | % |

| Vehicle

sales | |

| 2,099 | | |

| - | | |

| - | | |

| - | | |

| 236,699 | | |

| (100 | )% | |

| - | | |

| - | | |

| | | |

| 2,099 | | |

| 236,699 | | |

| (99 | )% |

| Delivery

service | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 300,511 | | |

| 216,050 | | |

| 39 | % | |

| 300,511 | | |

| 216,050 | | |

| 39 | % |

| Revenue | |

| 3,037,520 | | |

| 2,656,122 | | |

| 14 | % | |

| - | | |

| 236,699 | | |

| (100 | )% | |

| 310,416 | | |

| 224,322 | | |

| 38 | % | |

| 3,347,936 | | |

| 3,117,143 | | |

| 7 | % |

| Cost of

Sales | |

| (803,506 | ) | |

| (753,021 | ) | |

| 7 | % | |

| - | | |

| (234,470 | ) | |

| (100 | )% | |

| (210,322 | ) | |

| (155,265 | ) | |

| 35 | % | |

| (1,013,828 | ) | |

| (1,142,756 | ) | |

| (11 | )% |

| Gross

Profit | |

| 2,234,014 | | |

| 1,903,101 | | |

| 17 | % | |

| - | | |

| 2,229 | | |

| (100 | )% | |

| 100,094 | | |

| 69,057 | | |

| 45 | % | |

| 2,334,108 | | |

| 1,974,387 | | |

| 18 | % |

| Gross

Profit Margin | |

| 74 | % | |

| 72 | % | |

| | | |

| | | |

| 1 | % | |

| | | |

| 32 | % | |

| 31 | % | |

| | | |

| 70 | % | |

| 63 | % | |

| | |

| Operating

Profit/(loss) | |

| 896,331 | | |

| 779,833 | | |

| 15 | % | |

| - | | |

| (53,044 | ) | |

| (100 | )% | |

| 30,789 | | |

| 19,477 | | |

| 58 | % | |

| 927,120 | | |

| 746,266 | | |

| 24 | % |

| Operating

Profit Margin | |

| 30 | % | |

| 29 | % | |

| | | |

| | | |

| (22 | )% | |

| | | |

| 10 | % | |

| 9 | % | |

| | | |

| 28 | % | |

| 24 | % | |

| | |

| Adjusted

EBITDA (a non-IFRS measure) | |

| 1,397,109 | | |

| 1,256,033 | | |

| 11 | % | |

| - | | |

| (49,737 | ) | |

| (100 | )% | |

| 33,379 | | |

| 20,966 | | |

| 59 | % | |

| 1,430,488 | | |

| 1,227,262 | | |

| 17 | % |

| Adjusted

EBITDA Margin (a non-IFRS measure) | |

| 46 | % | |

| 47 | % | |

| | | |

| | | |

| (21 | )% | |

| | | |

| 11 | % | |

| 9 | % | |

| | | |

| 43 | % | |

| 39 | % | |

| | |

| 1. | Other

revenue is non-subscription-based revenue and relates predominantly to the sale of telematics devices to a large enterprise customer

opting for a non-bundled contract. Cartrack remains focused on bundled sales. |

Total Revenue and Subscription Revenue

Excluding Carzuka, Karooooo’s revenue increased

16% to ZAR3,346 million (YTD Q3 2024: ZAR2,880 million), and subscription revenue increased 15% to ZAR2,982 million in YTD Q3 2025 (YTD

Q3 2024: ZAR2,601 million).

Cartrack’s revenue increased 14% to ZAR3,038

million (YTD Q3 2024: ZAR2,656 million), and subscription revenue increased 15% to a record of ZAR2,972 million in YTD Q3 2025 (YTD Q3

2024: ZAR2,592 million). Subscription revenue equated to 98% of total revenue (YTD Q3 2024: 98%). Cartrack continues to build on its strong

track record of growing at scale.

As planned, Karooooo Logistics continued to scale

and bolster Karooooo’s revenue growth.

Karooooo Logistics’s revenue increased 38%

to a record of ZAR310 million in YTD Q3 2025 (YTD Q3 2024: ZAR224 million).

Operating Expenses

| | |

Nine Months Ended November 30, | |

| Figures in Rand Thousands | |

2024 | | |

2023 | | |

Y-o-Y

% | |

| Karooooo’s Operating Expenses | |

| 1,416,362 | | |

| 1,236,925 | | |

| 15 | % |

| - Cartrack | |

| 1,347,073 | | |

| 1,132,058 | | |

| 19 | % |

| - Carzuka | |

| - | | |

| 55,273 | | |

| (100 | )% |

| - Karooooo Logistics | |

| 69,289 | | |

| 49,594 | | |

| 40 | % |

Karooooo’s operating expenses increased

15% to ZAR1,416 million in YTD Q3 2025 (YTD Q3 2024: ZAR1,237 million).

The majority, ZAR1,347 million, was attributable

to Cartrack (YTD Q3 2024: ZAR1,132 million), comprising prudent investment in infrastructure and headcount for territorial expansion.

We continued to invest in brand building and infrastructure for Karooooo Logistics amounting to ZAR69 million of the group’s total

operating expenses (YTD Q3 2024: ZAR50 million).

Cartrack’s sales and marketing expenses

increased 29% to ZAR453 million in YTD Q3 2025 (YTD Q3 2024: ZAR352 million). We expect to see future benefit in customer acquisition

from this investment in growth.

Cartrack’s general and administration operating

expenses increased 19% to ZAR651 million (YTD Q3 2024: ZAR548 million). This reflects our investment in infrastructure to meet our growth

plans.

Cartrack’s R&D operating expenses increased

9% to ZAR161 million (YTD Q3 2024: ZAR148 million). Our planned investment in improving, enriching and expanding our Operations Cloud

and internal management systems is focused on enhancing our value proposition to our customers.

Cartrack provided for expected credit losses of

ZAR83 million (YTD Q3 2024: ZAR85 million), with expected credit losses for the period at 2.7% of revenue (YTD Q3 2024: 3.2%).

Operating Profit and Earnings per share

Karooooo’s operating profit increased 24%

to a record of ZAR927 million (YTD Q3 2024: ZAR746 million) and earnings per share increased 27% to ZAR21.70 (YTD Q3 2024: ZAR17.04).

After adjusting Karooooo’s earnings per

share to exclude the costs of a contemplated secondary public offering in July 2024, Adjusted EPS (a non-IFRS measure) increased 30% to

ZAR22.19 (YTD Q3 2024: ZAR17.04).

Cartrack’s operating profit increased 15%

to a record of ZAR896 million (YTD Q3 2024: ZAR780 million).

Karooooo Logistics’s operating profit increased

58% to a record of ZAR31 million (YTD Q3 2024: ZAR19 million).

Adjusted EBITDA and Adjusted EBITDA margin

Karooooo’s Adjusted EBITDA (a non-IFRS measure)

increased 17% to ZAR1,430 million (YTD Q3 2024: ZAR1,227 million).

Cartrack’s Adjusted EBITDA (a non-IFRS measure)

increased 11% to ZAR1,397 million (YTD Q3 2024: ZAR1,256 million).

Karooooo Logistics’s Adjusted EBITDA (a

non-IFRS measure) increased 59% to ZAR33 million (YTD Q3 2024: ZAR21 million).

See “Reconciliation of Profit for the Period

to Adjusted EBITDA (a non-IFRS measure)” below for a reconciliation of Adjusted EBITDA to profit, its most directly comparable IFRS

financial measure.

Outlook

We believe Karooooo is strongly positioned for

growth. We operate in a growing and largely underpenetrated market, with strong demand from customers needing to be competitive and digitalise

their operations.

Our proven, robust and consistently profitable

business model, underpinned by a strong balance sheet and healthy cash position, gives us multiple levers for expansion. We expect our

continuous investment in our AI products, platform and customer experience to generate robust results in the future.

We remain confident that our track record of success,

specifically our ability to generate healthy cash flows, is sustainable.

Our mission is to be a leading Operations Cloud

service provider.

Actual results may differ materially from Karooooo’s

outlook due to various factors, including those described under “Forward-Looking Statements” below and described under “Risk

Factors” in our latest Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission.

With Cartrack’s revenue making up the majority

of group revenue, the guidance below relates primarily to Cartrack.

Given our results, we reaffirm our previously

stated guidance for FY 2025 as detailed below:

| ● | Cartrack’s

number of subscribers expected to be between 2,300,000 and 2,400,000 |

| ● | Cartrack’s

subscription revenue expected to be between ZAR3,950 million and ZAR4,150 million |

| ● | Cartrack’s

operating profit margin expected to be between 27% and 31% |

| ● | Karooooo’s

Adjusted Earnings Per Share expected to be between ZAR27.50 and ZAR31.00 |

Balance Sheet, Liquidity and Cash Flow

Our strategic approach to capital allocation supports

Karooooo’s strong growth at scale, profitability and high cash-generation. Given our healthy capital structure and strong cash generation,

we believe that we have ample runway to accelerate our customer acquisition strategy while maintaining robust earnings.

At November 30, 2024, Karooooo’s property,

plant and equipment had increased by ZAR325 million to ZAR2,358 million (February 29, 2024: ZAR2,033 million). This was primarily due

to an increase of ZAR208 million in in-vehicle capitalized telematic devices, an increase of ZAR48 million in telematic devices available

for future sales and an investment of ZAR55 million in building the South African central office. We have now occupied the South African

central office and do not expect significant capital allocation to the building going forward.

Karooooo’s property, plant and equipment

of uninstalled telematic devices for future sales was ZAR394 million (February 29, 2024: ZAR346 million).

In line with business growth and currency fluctuations,

trade and other payables increased to ZAR575 million (February 29, 2024: ZAR446 million). Trade and other receivables and prepayments

decreased to ZAR582 million (February 29, 2024: ZAR985 million). At February 29, 2024, fixed deposits placed with banks amounting to ZAR486

million, which matured in June and July 2024, were included in other receivables.

Debtor’s collection days remain within our

historical norms at 27 days (February 29, 2024: 29 days).

In line with the group’s cash management

policy, overseen by our capital allocation committee, Karooooo’s excess cash reserves are held in US Dollars.

Cash and Cash Equivalents

After allocating ZAR55 million to the now completed

South African central office and paying a dividend of USD33.4 million in this financial year, Karooooo reported a net cash and cash equivalents

balance of ZAR856 million at November 30, 2024 (February 29, 2024: ZAR436 million). At February 29, 2024, the net cash and cash equivalents

balance did not include bank fixed deposits maturing after 3 months amounting to ZAR486 million.

At November 30, 2024, the group had overdraft

facilities for growth initiatives and other general corporate purposes of ZAR300 million with Capitec Bank Limited.

Free Cash Flow (a non-IFRS measure)

Karooooo generated cash from operating activities

of ZAR442 million for the quarter ended November 30, 2024 (November 30, 2023 ZAR443 million). The group generated Free Cash Flow (a non-IFRS

measure) of ZAR188 million for the quarter ended November 30, 2024 (November 30, 2023: ZAR162 million).

Share Capital and Reserves

At November 30, 2024, Karooooo had 30,893,300

ordinary shares issued and outstanding, and paid-up share capital of USD505,956,659 plus SGD1,000.

The negative common control reserve of ZAR2.7

billion on the balance sheet relates to a common control transaction on November 18, 2020, in which the loan of USD194 million from Isaias

Jose Calisto was converted into Karooooo share capital. Consequently, Karooooo acquired control of Cartrack. On that date, 20,331,894

shares were issued to Isaias Jose Calisto and Karooooo registered ZAR2.7 billion in paid-up capital, resulting in the common control reserve.

The ZAR3.6 billion other reserve on the balance

sheet relates to the buyout of 95,350,657 Cartrack shares at ZAR42.00 per share from minorities when Cartrack delisted from the JSE, totaling

ZAR4.0 billion. This was offset by the ZAR0.4 billion previously reported in the non-controlling interest. The ZAR0.4 billion relates

to the net asset value of 95,350,657 Cartrack minority shares acquired by Karooooo.

ZAR12 million of capital reserve on the balance

sheet relates to the cancellation of Karooooo’s treasury shares and ZAR11.4 million of capital reserve relates to the repurchase

and cancellation of 279 ordinary shares of Karooooo Logistics, which represent 6.29% of Karooooo Logistics’s issued ordinary shares.

Geographical Overview for Cartrack

South Africa

Cartrack’s number of subscribers in this

region increased 16% to 1,675,473 at November 30, 2024 (November 30, 2023: 1,446,754), with subscription revenue growth of 14%.

We believe that the economic environment in South

Africa is improving and we are confident that our move to our newly built central office in September 2024 positions us to support strong

organic growth, allowing us to expand our customer base and increase subscription sales to existing customers in the region.

We believe that we are the largest and fastest

growing enterprise mobility SaaS provider on the African continent.

Asia Pacific, Middle East and United States

Cartrack’s number of subscribers in this

region increased 20% to 264,342 at November 30, 2024 (November 30, 2023: 220,700). This translates to 21% growth in subscription revenue

(or 26% on a constant currency basis, a non-IFRS measure).

As the second largest contributor to group revenue,

Southeast Asia continues to present the most compelling growth opportunity for the group in the medium to long term. In September 2024,

we started a strong, yet prudent drive to increase Sales and Marketing in Southeast Asia and believe that we will see the results in the

next financial year.

Europe

Cartrack’s number of subscribers in this

region increased 19% to 191,781 at November 30, 2024 (November 30, 2023: 161,635). This translates to 14% growth in subscription revenue

(or 18% on a constant currency basis, a non-IFRS measure).

Karooooo is building a leading mobility and connected-vehicle

platform to give our customers easier access to valuable insights. Demonstrating Karooooo’s standing as a platform of choice, leading

OEMs have partnered with us to give their customers access to our platform, seamlessly integrating their connected vehicle data. We are

poised to leverage our extensive offerings to further develop the connected-vehicle ecosystem, and expect these partnerships to contribute

to our results in the medium term. In addition, we are experiencing encouraging demand for our proprietary compliance technology in the

region as customers seek to simplify compliance with changing legislation.

Africa (excluding South Africa)

Cartrack’s number of subscribers in this

region increased 16% to 91,631 at November 30, 2024 (November 30, 2023: 79,103). While the number of subscribers increased, subscription

revenue remained stagnant due to the temporary suspension of subscription billing to our existing customers in Mozambique due to political

riots and mass demonstrations.

Since the October 2024 elections, Mozambique has

grappled with political and economic uncertainty. The ongoing instability has disrupted our customers’ normal operations, prompting

the temporary suspension of billing in order to support our customers during this crisis. Billing is expected to resume once the political

riots have ended. Additionally, the depreciation of the Mozambican Metical against the South African Rand has further intensified the

decline in reported revenue.

Despite the challenges, our investment in Mozambique

has demonstrated remarkable resilience. It has proven to be an attractive financial and strategic investment and has consistently delivered

a high dividend yield for over a decade (dividends to date equate to 148% of our full investment). We will continue to closely monitor

the situation and should the macroeconomic factors remain unchanged at year-end, we plan to prudently provide for an impairment of goodwill

in Q4 2025.

The region, including Mozambique, is of strategic

importance in supporting Karooooo’s South African customers with cross border operations.

Event subsequent to the end of the Third Quarter 2025

In Q4 2025, the Board approved a resolution for

Karooooo Logistics (Pty) Ltd to repurchase a number of its ordinary shares at a purchase price of ZAR52.3 million. The repurchased shares

will subsequently be cancelled. This is in compliance with the Companies Act in South Africa.

As a result, the Group’s effective shareholding

in Karooooo Logistics (Pty) Ltd will increase from 74.8% to 88.2% upon completion of the repurchase and cancellation.

Dividend Policy

The Board recognizes the importance of investment

in achieving growth at scale, and endeavors to avoid swings in dividend profile.

However, the payment and timing of dividends

in cash or other distributions (such as a return of capital to shareholders through share buy-backs, for example) are determined by the

Board after considering factors that include: earnings and free cash flow; current and anticipated capital requirements; economic conditions;

contractual, legal, tax and regulatory restrictions (including covenants contained in any financing agreements); the ability of group

subsidiaries to distribute funds to Karooooo; and such other factors the Board may deem relevant.

Karooooo aims to reinvest retained earnings to

the extent that it aligns with the group’s required return on incrementally reinvested capital, return on equity, and short- to

medium-term growth strategy.

Subject to Karooooo’s constitution and in

accordance with the Singapore Companies Act, the Board may, without the approval of shareholders, declare and pay interim dividends.

Any final dividends must be approved by an ordinary resolution at a general meeting of shareholders.

The Board may review and amend the dividend policy

from time to time.

Corruption, Bribery and Whistleblowing

The Karooooo Anti-Bribery and Corruption policy,

Code of Ethics, Whistleblowing policy and employment contracts contain clear guidelines with regard to bribery, corruption, client confidentiality

and acceptable behavior towards fellow employees, customers, contractors and suppliers. Annual awareness and practical training are provided

to all employees, reinforced by individual affirmations on an annual basis. These measures ensure awareness and understanding of our business

principles and the consequences of non-compliance. Our policies also apply to third-party providers.

We provide a contact email and hotline for whistleblowing

and reporters are assured of confidentiality.

Webinar Information

Karooooo management will host a Zoom webinar on

Wednesday, January 15, 2025 at 08:00 a.m. Eastern Time (03:00 p.m. South African time; 09:00 p.m. Singaporean time).

Investors are invited to join the Zoom at: https://us02web.zoom.us/j/87606283475

Webinar ID: 876 0628 3475

Telephone:

| ● | US

(New York) Toll-free: +1 646 558 8656 |

| ● | South

Africa Toll-free: +27 87 551 7702 |

A replay will be available at www.karooooo.com

approximately three hours after the conclusion of the live event.

IFRS Accounting

We prepare our consolidated financial statements

in accordance with IFRS as issued by the IASB. The summary consolidated financial information presented has been derived from the consolidated

financial statements of Karooooo.

About Karooooo

Karooooo is the provider of a leading operational

IoT SaaS cloud that maximizes the value of operations and workflow data by providing insightful real-time data analytics to thousands

of enterprise customers by digitally transforming their operations. The Cartrack (wholly owned by Karooooo) SaaS platform provides customers

with differentiated insights and data analytics to optimize their business operations. Cartrack assists customers to sustainably improve

workflows, manage field workers, increase efficiency, decrease costs, improve safety, monitor environmental impact, assist with regulatory

compliance and manage risk.

Currently, there are over 2,250,000 connected

vehicles and equipment on the Cartrack cloud platform.

For more information, visit www.karooooo.com.

| Investor Relations Contact |

IR@karooooo.com |

| |

|

| Media Contact |

media@karooooo.com |

KAROOOOO LTD.

CONSOLIDATED STATEMENT OF PROFIT AND LOSS

(UNAUDITED)

| | |

Three Months Ended

November 30, | | |

Nine Months Ended

November 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Rand Thousands) | |

| Revenue | |

| 1,159,390 | | |

| 1,080,143 | | |

| 3,347,936 | | |

| 3,117,143 | |

| Cost of sales | |

| (351,359 | ) | |

| (392,832 | ) | |

| (1,013,828 | ) | |

| (1,142,756 | ) |

| Gross profit | |

| 808,031 | | |

| 687,311 | | |

| 2,334,108 | | |

| 1,974,387 | |

| Other income | |

| 3,408 | | |

| 1,537 | | |

| 9,374 | | |

| 8,804 | |

| Operating expenses | |

| (486,264 | ) | |

| (414,142 | ) | |

| (1,416,362 | ) | |

| (1,236,925 | ) |

| Sales and marketing | |

| (156,981 | ) | |

| (124,978 | ) | |

| (454,127 | ) | |

| (377,573 | ) |

| General and administration | |

| (249,508 | ) | |

| (207,753 | ) | |

| (710,420 | ) | |

| (614,775 | ) |

| Research and development | |

| (57,447 | ) | |

| (53,657 | ) | |

| (169,165 | ) | |

| (159,343 | ) |

| Expected credit losses on financial assets | |

| (22,328 | ) | |

| (27,754 | ) | |

| (82,650 | ) | |

| (85,234 | ) |

| Operating profit | |

| 325,175 | | |

| 274,706 | | |

| 927,120 | | |

| 746,266 | |

| Offering costs | |

| 407 | | |

| - | | |

| (15,063 | ) | |

| - | |

| Finance income | |

| 8,824 | | |

| 8,203 | | |

| 33,745 | | |

| 28,368 | |

| Finance costs | |

| (16,784 | ) | |

| (4,250 | ) | |

| (34,244 | ) | |

| (9,406 | ) |

| Profit before taxation | |

| 317,622 | | |

| 278,659 | | |

| 911,558 | | |

| 765,228 | |

| Taxation | |

| (76,897 | ) | |

| (79,327 | ) | |

| (229,784 | ) | |

| (225,735 | ) |

| Profit for the period | |

| 240,725 | | |

| 199,332 | | |

| 681,774 | | |

| 539,493 | |

| | |

| | | |

| | | |

| | | |

| | |

| Profit attributable to: | |

| | | |

| | | |

| | | |

| | |

| Owners of the parent | |

| 237,264 | | |

| 196,338 | | |

| 670,391 | | |

| 527,497 | |

| Non-controlling interest | |

| 3,461 | | |

| 2,994 | | |

| 11,383 | | |

| 11,996 | |

| | |

| 240,725 | | |

| 199,332 | | |

| 681,774 | | |

| 539,493 | |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings per share | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted earnings per share (ZAR) | |

| 7.68 | | |

| 6.34 | | |

| 21.70 | | |

| 17.04 | |

KAROOOOO LTD.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(UNAUDITED)

| | |

As of

November 30,

2024 | | |

As of

February 29,

2024 | | |

As of

November 30,

2023 | |

| | |

(Rand Thousands) | |

| ASSETS | |

| | |

| | |

| |

| Non-current assets | |

| | |

| | |

| |

| Property, plant and equipment4 | |

| 2,357,611 | | |

| 2,032,794 | | |

| 1,982,755 | |

| Capitalized commission assets | |

| 456,171 | | |

| 374,521 | | |

| 352,883 | |

| Intangible assets | |

| 78,642 | | |

| 83,123 | | |

| 82,254 | |

| Goodwill | |

| 215,867 | | |

| 227,380 | | |

| 223,946 | |

| Loans to related parties | |

| - | | |

| 28,200 | | |

| 25,800 | |

| Long-term other receivables and prepayments | |

| 41,671 | | |

| 18,831 | | |

| 19,672 | |

| Non-current financial asset | |

| - | | |

| - | | |

| 388 | |

| Deferred tax assets6 | |

| 115,739 | | |

| 81,903 | | |

| 66,421 | |

| Total non-current assets | |

| 3,265,701 | | |

| 2,846,752 | | |

| 2,754,119 | |

| Current assets | |

| | | |

| | | |

| | |

| Inventories | |

| 3,796 | | |

| 6,582 | | |

| 41,393 | |

| Trade and other receivables and prepayments | |

| 581,938 | | |

| 985,398 | | |

| 519,104 | |

| Income tax receivables | |

| 13,517 | | |

| 8,714 | | |

| 9,105 | |

| Cash and cash equivalents | |

| 921,736 | | |

| 459,527 | | |

| 781,980 | |

| Total current assets | |

| 1,520,987 | | |

| 1,460,221 | | |

| 1,351,582 | |

| Total assets | |

| 4,786,688 | | |

| 4,306,973 | | |

| 4,105,701 | |

| EQUITY AND LIABILITIES | |

| | | |

| | | |

| | |

| Equity | |

| | | |

| | | |

| | |

| Share capital | |

| 7,131,059 | | |

| 7,142,853 | | |

| 7,142,853 | |

| Treasury shares | |

| - | | |

| (23,816 | ) | |

| - | |

| Capital reserve1,3 | |

| (3,609,451 | ) | |

| (3,582,568 | ) | |

| (3,582,568 | ) |

| Common control reserve2 | |

| (2,709,236 | ) | |

| (2,709,236 | ) | |

| (2,709,236 | ) |

| Foreign currency translation reserve | |

| 246,111 | | |

| 330,812 | | |

| 281,778 | |

| Retained earnings | |

| 1,861,451 | | |

| 1,803,482 | | |

| 1,592,791 | |

| Equity attributable to equity holders of parent | |

| 2,919,934 | | |

| 2,961,527 | | |

| 2,725,618 | |

| Non-controlling interest | |

| 45,994 | | |

| 40,935 | | |

| 45,190 | |

| Total equity | |

| 2,965,928 | | |

| 3,002,462 | | |

| 2,770,808 | |

| Liabilities | |

| | | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Term loans5,7 | |

| 283,552 | | |

| 41,645 | | |

| 43,328 | |

| Lease liabilities | |

| 118,260 | | |

| 131,285 | | |

| 129,824 | |

| Deferred revenue | |

| 126,317 | | |

| 121,302 | | |

| 121,467 | |

| Deferred tax liabilities | |

| 73,708 | | |

| 69,840 | | |

| 60,574 | |

| Total non-current liabilities | |

| 601,837 | | |

| 364,072 | | |

| 355,193 | |

| Current liabilities | |

| | | |

| | | |

| | |

| Term loans5,7 | |

| 36,720 | | |

| 6,534 | | |

| 7,387 | |

| Trade and other payables | |

| 575,285 | | |

| 446,284 | | |

| 475,699 | |

| Loans from related parties | |

| 355 | | |

| 924 | | |

| 901 | |

| Lease liabilities | |

| 73,058 | | |

| 63,055 | | |

| 68,776 | |

| Deferred revenue | |

| 343,687 | | |

| 325,848 | | |

| 320,135 | |

| Bank overdraft | |

| 65,810 | | |

| 23,362 | | |

| - | |

| Income tax payables | |

| 123,054 | | |

| 73,375 | | |

| 105,580 | |

| Provision for warranties | |

| 954 | | |

| 1,057 | | |

| 1,222 | |

| Total current liabilities | |

| 1,218,923 | | |

| 940,439 | | |

| 979,700 | |

| Total liabilities | |

| 1,820,760 | | |

| 1,304,511 | | |

| 1,334,893 | |

| Total equity and liabilities | |

| 4,786,688 | | |

| 4,306,973 | | |

| 4,105,701 | |

| 1. | The

ZAR3.6 billion negative capital reserve on the balance sheet relates to the buyout of 95,350,657 Cartrack shares at ZAR42.00 per share

from minorities when Cartrack delisted from the JSE totaling ZAR4.0 billion, offset by the ZAR0.4 billion previously reported in the

non-controlling interest reserve line item. The ZAR0.4 billion relates to the net asset value of the 95,350,657 Cartrack minority shares

bought by Karooooo. |

| 2. |

The negative common control reserve of ZAR2.7 billion on the balance sheet relates to a common control transaction on November 18, 2020 in which the loan of USD194 million from Isaias Jose Calisto was converted into Karooooo share capital and as a consequence Karooooo acquired control of Cartrack. On that date, 20,331,894 shares were issued to Isaias Jose Calisto and Karooooo registered ZAR2.7 billion paid-up capital resulting in the common control reserve. |

| |

|

| 3. |

Included in capital reserves are ZAR12 million relating to the cancellation of Karooooo’s treasury shares and ZAR11.4 million of capital reserve relating to the repurchase and cancellation of Karooooo Logistics’s ordinary shares. |

| 4. |

Included in property, plant and equipment are: |

| | |

As of

November 30,

2024 | | |

As of

February 29,

2024 | | |

As of

November 30,

2023 | |

| | |

(Rand Thousands) | |

| Capitalized telematics devices – Work in progress | |

| 134,219 | | |

| 130,511 | | |

| 155,515 | |

| Capitalized telematic devices – Uninstalled | |

| 259,987 | | |

| 215,539 | | |

| 214,716 | |

| Capitalized telematic devices – Installed | |

| 1,240,005 | | |

| 1,032,250 | | |

| 983,961 | |

| Construction of South African Central Office | |

| 321,708 | | |

| 266,870 | | |

| 230,787 | |

| 5. | In

June 2024, The Standard Bank of South Africa Limited extended a loan of ZAR 250 million to Purple Rain Properties No. 444 Proprietary

Limited (the owner of the regional South Africa central office) at the South Africa Prime Interest Rate less 1.5%. The loan will mature

on 21 December 2025 and these funds were used to settle an intercompany loan from Cartrack Pty Ltd. |

| 6. |

The movement in deferred tax assets reflects the recognition past tax losses by now-profitable entities and temporary differences between tax and accounting profits within group entities. |

| |

|

| 7 |

In September 2024, Cartrack Portugal, S.A., secured a EUR2 million loan from Banco Comercial Português, S.A. The loan bears an interest rate of 6-month Euribor rate plus 0.75%, with repayments scheduled over a seven-year period. |

KAROOOOO LTD.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(UNAUDITED)

| | |

Three Months Ended

November 30, | | |

Nine Months Ended

November 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Rand Thousands) | |

| Net cash flows from operating activities | |

| 442,420 | | |

| 442,851 | | |

| 1,672,782 | | |

| 1,086,929 | |

| Net cash flows utilized by investing activities | |

| (268,604 | ) | |

| (293,845 | ) | |

| (789,081 | ) | |

| (736,774 | ) |

| Net cash flows utilized by financing activities | |

| 12,438 | | |

| (17,548 | ) | |

| (414,380 | ) | |

| (553,845 | ) |

| Net cash and cash equivalents movements for the period | |

| 186,254 | | |

| 131,458 | | |

| 469,321 | | |

| (203,690 | ) |

| Cash and cash equivalents as at the beginning of the period | |

| 674,324 | | |

| 651,115 | | |

| 436,165 | | |

| 965,750 | |

| Translation differences on cash and cash equivalents | |

| (4,652 | ) | |

| (593 | ) | |

| (49,560 | ) | |

| 19,920 | |

| Total cash and cash equivalents at the end of the period | |

| 855,926 | | |

| 781,980 | | |

| 855,926 | | |

| 781,980 | |

KAROOOOO LTD.

RECONCILIATION OF FREE CASH FLOW (A NON-IFRS MEASURE)

(UNAUDITED)

| | |

Three Months Ended

November 30, | | |

Nine Months Ended

November 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Rand Thousands) | |

| Net cash generated from operating activities | |

| 442,420 | | |

| 442,851 | | |

| 1,672,782 | | |

| 1,086,929 | |

| Less: purchase of property, plant and equipment1 | |

| (254,811 | ) | |

| (280,400 | ) | |

| (750,669 | ) | |

| (699,233 | ) |

| Free Cash Flow (a non-IFRS measure) | |

| 187,609 | | |

| 162,451 | | |

| 922,113 | | |

| 387,696 | |

| 1. | For

the quarter ended November 30, 2024, included in the purchase of property, plant and equipment are development cost of ZAR 6 million

(November 30, 2023: ZAR 68 million) for the new South African Central Office in Rosebank, Johannesburg. |

KAROOOOO LTD.

RECONCILIATION OF PROFIT FOR THE PERIOD TO ADJUSTED EBITDA (A NON-IFRS MEASURE)

(UNAUDITED)

| | |

Three Months Ended

November 30, | | |

Nine Months Ended

November 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Rand Thousands) | |

| Profit for the period | |

| 240,725 | | |

| 199,332 | | |

| 681,774 | | |

| 539,493 | |

| Taxation | |

| 76,897 | | |

| 79,327 | | |

| 229,784 | | |

| 225,735 | |

| Finance income | |

| (8,824 | ) | |

| (8,203 | ) | |

| (33,745 | ) | |

| (28,368 | ) |

| Finance costs | |

| 16,784 | | |

| 4,250 | | |

| 34,244 | | |

| 9,406 | |

| Offering costs | |

| (407 | ) | |

| - | | |

| 15,063 | | |

| - | |

| Depreciation of property, plant and equipment and amortization of intangible assets | |

| 176,073 | | |

| 153,168 | | |

| 503,368 | | |

| 480,996 | |

| Adjusted EBITDA (a

non-IFRS measure) | |

| 501,248 | | |

| 427,874 | | |

| 1,430,488 | | |

| 1,227,262 | |

| Profit margin | |

| 21 | % | |

| 18 | % | |

| 20 | % | |

| 17 | % |

| Adjusted EBITDA margin

(a non-IFRS measure) | |

| 43 | % | |

| 40 | % | |

| 43 | % | |

| 39 | % |

KAROOOOO LTD.

BASIC AND DILUTED EARNINGS PER SHARE AND

ADJUSTED EARNING PER SHARE (A NON-IFRS MEASURE)

(UNAUDITED)

| | |

Three Months Ended

November 30, | | |

Nine Months Ended

November 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Rand Thousands) | |

| Reconciliation between basic earnings and adjusted earnings (a non-IFRS measure) | |

| | |

| | |

| | |

| |

| Profit attributable to ordinary shareholders | |

| 237,264 | | |

| 196,338 | | |

| 670,391 | | |

| 527,497 | |

| Adjust for: | |

| | | |

| | | |

| | | |

| | |

| Offering costs | |

| (407 | ) | |

| - | | |

| 15,063 | | |

| - | |

| Adjusted profit attributable

to ordinary shareholders (a non-IFRS measure) | |

| 236,857 | | |

| 196,338 | | |

| 685,454 | | |

| 527,497 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of ordinary shares in issue at period end (000’s) on which the per share figures have been calculated | |

| 30,893 | | |

| 30,951 | | |

| 30,895 | | |

| 30,951 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted earnings per share | |

| 7.68 | | |

| 6.34 | | |

| 21.70 | | |

| 17.04 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted

basic and diluted earnings per share1 (a non-IFRS measure) | |

| 7.67 | | |

| 6.34 | | |

| 22.19 | | |

| 17.04 | |

| 1. | Adjusted earnings per share, (a non-IFRS measure) is defined

as, earnings per share defined by IFRS excluding the impact of specific non-recurring operational expenses as outlined in the reconciliation. |

CONSTANT CURRENCY (A NON-IFRS MEASURE)

Constant currency information has been presented

to illustrate the impact of changes in currency rates on the group’s results. The tables below provide the unaudited constant currency

reconciliation to the reported measure for the periods presented.

Three Months and Nine Months Ended November

30, 2024

The constant currency information has been determined

by adjusting the current financial reporting period results to the results reported for the three months and nine months ended November

30, 2023, as applicable using the average of the monthly exchange rates applicable to that period. The measurement has been performed

for each of the group’s operating currencies.

SUBSCRIPTION REVENUE

| | |

Three Months Ended November 30, | |

| | |

2024 | | |

2023 | | |

Quarter-

on-Quarter

Change | |

| | |

(Rand Thousands) | | |

Percentage | |

| Subscription revenue as reported | |

| 1,031,942 | | |

| 903,915 | | |

| 14 | % |

| Conversion impact of other currencies | |

| 10,809 | | |

| - | | |

| | |

| Subscription revenue on a constant currency basis | |

| 1,042,751 | | |

| 903,915 | | |

| 15 | % |

TOTAL REVENUE

| | |

Three Months Ended November 30, | |

| | |

2024 | | |

2023 | | |

Quarter-

on-Quarter Change | |

| | |

(Rand Thousands) | | |

Percentage | |

| Total revenue as reported | |

| 1,159,390 | | |

| 1,080,143 | | |

| 7 | % |

| Conversion impact of other currencies | |

| 11,038 | | |

| - | | |

| | |

| Total revenue on a constant currency basis | |

| 1,170,428 | | |

| 1,080,143 | | |

| 8 | % |

SUBSCRIPTION REVENUE

| | |

Nine Months Ended November 30, | |

| | |

2024 | | |

2023 | | |

Year-

on-Year

Change | |

| | |

(Rand Thousands) | | |

Percentage | |

| Subscription revenue as reported | |

| 2,981,695 | | |

| 2,600,643 | | |

| 15 | % |

| Conversion impact of other currencies | |

| 19,485 | | |

| - | | |

| - | |

| Subscription revenue on a constant currency basis | |

| 3,001,180 | | |

| 2,600,643 | | |

| 15 | % |

TOTAL REVENUE

| | |

Nine Months Ended November 30, | |

| | |

2024 | | |

2023 | | |

Year-

on-Year Change | |

| | |

(Rand Thousands) | | |

Percentage | |

| Total revenue as reported | |

| 3,347,936 | | |

| 3,117,143 | | |

| 7 | % |

| Conversion impact of other currencies | |

| 19,935 | | |

| - | | |

| - | |

| Total revenue on a constant currency basis | |

| 3,367,871 | | |

| 3,117,143 | | |

| 8 | % |

DEFINITIONS

Adjusted Earnings per Share

Adjusted earnings per share, (a non-IFRS measure)

is defined as, earnings per share defined by IFRS excluding the impact of specific non-recurring operational expenses as outlined in the

reconciliation.

Adjusted EBITDA

We define Adjusted EBITDA (a non-IFRS measure)

as profit less finance income, plus finance costs, taxation, depreciation and amortization, plus impact of non-recurring operational expenses,

if any. In addition to our results determined in accordance with IFRS, we believe Adjusted EBITDA (a non-IFRS measure) is useful in evaluating

our operating performance. We use Adjusted EBITDA in our operational and financial decision-making and believe Adjusted EBITDA is useful

to investors because similar measures are frequently used by securities analysts, investors, ratings agencies and other interested parties

to evaluate our competitors and to measure profitability. However, non-IFRS financial information is presented for supplemental informational

purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information

presented in accordance with IFRS. Investors are encouraged to review the related IFRS financial measure and the reconciliation of Adjusted

EBITDA to profit, its most directly comparable IFRS financial measure, and not to rely on any single financial measure to evaluate our

business.

Adjusted EBITDA Margin

We define Adjusted EBITDA Margin (a non-IFRS measure)

as Adjusted EBITDA (a non-IFRS measure) divided by revenue. In addition to our results determined in accordance with IFRS, we believe

Adjusted EBITDA Margin (a non-IFRS measure) is useful in evaluating our operating performance. We use Adjusted EBITDA Margin in our operational

and financial decision-making and believe Adjusted EBITDA Margin is useful to investors because similar measures are frequently used by

securities analysts, investors, ratings agencies and other interested parties to evaluate our competitors and to measure profitability.

However, non-IFRS financial information is presented for supplemental informational purposes only, has limitations as an analytical tool

and should not be considered in isolation or as a substitute for financial information presented in accordance with IFRS.

Delivery-as-a-service Revenue (DaaS)

We define Delivery-as-a-Service (DaaS) revenue

as the total revenue generated from last-mile delivery services, including subscription-based revenue associated with these services.

Annualized Delivery-as-a-service Revenue (DaaS)

DaaS Revenue (a non-IFRS) measure) is defined

as the annualized business to business (B2B) delivery-as-a-service revenue during the month and multiplying by twelve.

Annualized Recurring Revenue (SaaS ARR)

SaaS ARR (a non-IFRS measure) is defined as the

annual run-rate subscription revenue of subscription agreements from all customers at a point in time, calculated by taking the monthly

subscription revenue for all customers during that month and multiplying by twelve.

Average Revenue per Subscriber per month (ARPU)

ARPU (a non-IFRS measure) is calculated on a quarterly

basis by dividing the cumulative subscription revenue for the quarter by the average of the opening subscriber balance at the beginning

of the quarter and closing subscriber balance at the end of the quarter and dividing this by three.

Cartrack Holdings (“Cartrack”)

Earnings per share

Basic earnings per share in accordance with IFRS.

Free Cash Flow and Adjusted Free Cash Flow

We define Free Cash Flow (a non-IFRS measure)

as net cash generated from operating activities less purchases of property, plant and equipment. In addition to our results determined

in accordance with IFRS, we believe Free Cash Flow (a non-IFRS measure), is useful in evaluating our operating performance. We believe

that Free Cash Flow is a useful indicator of liquidity and the ability of the group to turn revenues into Free Cash Flow, respectively,

that provide information to management and investors about the amount of cash generated from our operations that, after the investments

in property, plant and equipment, can be used for strategic initiatives, including investing in our business, and strengthening our financial

position. However, non-IFRS financial information is presented for supplemental informational purposes only, has limitations as an analytical

tool and should not be considered in isolation or as a substitute for financial information presented in accordance with IFRS. Investors

are encouraged to review the related IFRS financial measure and the reconciliation of Free Cash Flow to net cash generated operating activities

and net cash generated from operating activities as a percentage of revenue, their most directly comparable IFRS financial measure, and

not to rely on any single financial measure to evaluate our business.

Rule of 60

The sum of revenue growth and adjusted EBITDA

margin for a reporting period sum to greater than 60.

Unit economics

These are non-IFRS financial measures that are

used as reference of Cartrack’s performance.

Lifetime value (LTV of a Customer) of customer

relationships to customer acquisition costs (CAC)

We calculate the LTV of our customer relationships

as of a measurement date by dividing (i) the product of our subscription revenue gross margin measured over the past twelve months, and

the difference between our current period SaaS ARR and prior comparative period (twelve months) SaaS ARR by (ii) the percentage of SaaS

ARR lost as a result of customer churn over the past twelve months. We calculate our CAC as our annual sales and marketing expense measured

over the past twelve months.

Lifetime value (LTV of a Subscriber), cost

of acquiring a subscriber (CAS) and cost of servicing a subscriber (CSS)

It is important to distinguish between the subscriber

contract life cycle (the life cycle of a vehicle or other equipment on our connected cloud) and the customer lifecycle (one customer normally

has multiple ongoing subscriber contract life cycles as customers de-fleet and re-fleet their vehicle parc and other equipment on our

connected cloud).

We calculate the LTV of a subscriber by multiplying

the ARPU with the expected contract life cycle months, multiplied by the subscription revenue gross margin percentage, which is defined

as gross profit relating to subscription revenue divided by subscription revenue.

We calculate CAS, which is calculated on a per

subscriber basis, as (i) sales and marketing expenses, plus (ii) sales commissions, plus (iii) cost of installing IoT equipment, divided

by (iv) the average subscriber base for such period.

We calculate CSS, which is calculated on a per

subscriber basis, as (i) operating expenses excluding estimated general business expansion costs, plus (ii) costs of sales that relates

to subscription revenue, less (iii) all costs used to calculate CAS, divided by (iv) the average subscriber balance for such period.

We estimate our long-term unit economics operational

profit by multiplying (i) the product of the expected life cycle of a subscriber on our connected cloud by ARPU, minus (ii) CAS added

to the product of the expected life cycle of a subscriber on our connected cloud by CSS.

Forward-Looking Statements

The information in this announcement (which includes

any oral statements made in connection therewith, as applicable) includes “forward-looking statements.” Forward-looking statements

are based on our beliefs and assumptions and on information currently available to us, and include, without limitation, statements regarding

our business, financial condition, strategy, results of operations, certain of our plans, objectives, assumptions, expectations, prospects

and beliefs and statements regarding other future events or prospects, including outlook statements. Forward-looking statements include

all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believe,”

“expect,” “plan,” “intend,” “seek,” “anticipate,” “estimate,”

“predict,” “potential,” “assume,” “continue,” “may,” “will,” “should,”

“could,” “shall,” “risk” or the negative of these terms or similar expressions that are predictions

of or indicate future events and future trends.

By their nature, forward-looking statements involve

risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution

you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition

and liquidity, the development of the industry in which we operate, the effect of acquisitions and operating decisions on us may differ

materially from those made in or suggested by the forward-looking statements contained in this announcement. In addition, even if our

results of operations, financial condition and liquidity, the development of the industry in which we operate, the effect of acquisitions

and operating decisions on us are consistent with the forward-looking statements contained in this announcement, those results or developments

may not be indicative of results or developments in subsequent periods.

Factors that could cause actual results to vary

from projected results include, but are not limited to:

| ● | our

ability to acquire new customers and retain existing customers; |

| ● | our

ability to acquire new subscribers and retain existing subscribers; |

| ● | our

expectations regarding the effects of a pandemic or widespread outbreak of an illness, the Russia-Ukraine conflict, geopolitical tensions

or other regional events such as recent civil unrest in Mozambique and similar macroeconomic events, including financial distress caused

by recent or potential bank failures, global supply chain challenges, foreign currency fluctuations, elevated inflation and interest

rates and monetary policy changes, upon our and our customers’ and partners’ respective businesses; |

| ● | our

anticipated growth strategies, including our ability to increase sales to existing customers, the introduction of new solutions and international

expansion; |

| ● | our

ability to adapt to rapid technological change in our industry; |

| ● | our

dependence on cellular networks; |

| ● | competition

from industry consolidation; |

| ● | market

adoption of software-as-a-service (“SaaS”) fleet management platform; |

| ● | automotive

market conditions and the evolving nature of the automotive industry towards autonomous vehicles; |

| ● | expected

changes in our profitability and certain cost or expense items as a percentage of our revenue; |

| ● | our

dependence on certain key component suppliers and vendors; |

| ● | our

ability to maintain or enhance our brand recognition; |

| ● | our

ability to maintain our key personnel or attract, train and retain other highly qualified personnel; |

| ● | the

impact and evolving nature of laws and regulations relating to the internet, including cybersecurity and data privacy; |

| ● | our

ability to protect our intellectual property and proprietary technologies and address any infringement claims; |

| ● | significant

disruption in service on, or security breaches of, our websites or computer systems; |

| ● | dependence

on third-party technology and licenses; |

| ● | fluctuations

in the value of the South African rand and inflation rates in the countries in which we conduct business; |

| ● | our

ability to access the capital markets in the future; and |

| ● | other

risk factors discussed under “Risk Factors” in our latest Annual Report on Form 20-F and other reports filed with the U.S.

Securities and Exchange Commission. |

Forward-looking statements speak only as of the

date they are made, and we do not undertake any obligation to update them in light of new information or future developments or to release

publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated

events.

You are cautioned not to place undue reliance

on any forward-looking statements. We disclaim any duty to update and do not intend to update any forward-looking statements, all of which

are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this announcement.

Non-IFRS Financial Measures

This announcement includes certain non-IFRS financial

measures. These non-IFRS financial measures are not measures of financial performance in accordance with IFRS and may exclude items that

are significant in understanding and assessing our financial results. Therefore, these measures should not be considered in isolation

or as an alternative or superior to IFRS measures. You should be aware that our announcement of these measures may not be comparable to

similarly titled measures used by other companies.

Market and Industry Data

We include statements and information in this

announcement concerning our industry ranking and the markets in which we operate, including our general expectations and market opportunity,

which are based on information from independent industry organizations and other third-party sources (including a third-party market study,

industry publications, surveys and forecasts). While Karooooo believes these third-party sources to be reliable as of the date of this

announcement, we have not independently verified any third-party information and such information is inherently imprecise. In addition,

projections, assumptions and estimates of the future performance of the industry in which we operate, and our future performance are necessarily

subject to a high degree of uncertainty and risk due to a variety of risks. These and other factors could cause results to differ materially

from those expressed in the estimates made by the independent parties and by us.

Trademarks and Trade Names

In our key markets, we have rights to use, or

hold, certain trademarks relating to Cartrack, or the respective applications for trademark registration are underway. We do not hold

or have rights to any other additional patents, trademarks or licenses, that, if absent, would have had a material adverse effect on our

business operations. Solely for convenience, trademarks and trade names referred to in this announcement may appear without the “®”

or “™” symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest

extent possible under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not

intend our use or display of other companies’ tradenames, trademarks or service marks to imply a relationship with, or endorsement

or sponsorship of us by, any other companies. Each trademark, trade name or service mark of any other company appearing in this announcement

is the property of its respective holder.

25

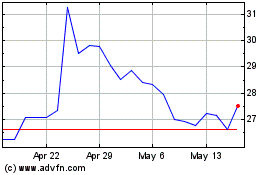

Karooooo (NASDAQ:KARO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Karooooo (NASDAQ:KARO)

Historical Stock Chart

From Jan 2024 to Jan 2025