Karooooo Increases Earnings by 31% Driven by Strong Subscription Revenue Growth and Higher Gross Margins

October 15 2024 - 5:37AM

Business Wire

Karooooo Limited (“Karooooo”) reported strong results and a

positive outlook in the second quarter (“Q2 2025”) and Half-Year

(“HY 2025”) ended August 31, 2024. Karooooo owns 100% of Cartrack

and 74.8% of Karooooo Logistics, (collectively, “the group”).

Financial and operational highlights include:

- Karooooo subscribers increased 17% Y/Y to 2.14 million

- Cartrack net subscriber additions increased 18% Y/Y to a record

89,168

- Cartrack gross margin improved approximately 300bps Y/Y to

74%

- Karooooo adjusted earnings per share increased 31% Y/Y to a

record ZAR7.35

- Raising FY25 outlook for subscribers and Cartrack subscription

revenue at midpoint

Zak Calisto, CEO and Founder:

“We delivered another strong quarter of profitable growth in the

second quarter. Importantly, we recently completed the move to our

newly built central office in South Africa, which positions us to

support higher organic growth in the region. In addition, we

started to increase our investment in sales and marketing in

Southeast Asia to capitalize on the compelling growth opportunity

for the group in the region. Despite increased capital allocation

to growth in Southeast Asia, we remain committed to a disciplined

approach to growth as evidenced by our continued strong unit

economics.”

Karooooo grew subscription revenue by 15% to ZAR986 million (Q2

2024: ZAR860 million) in Q2 2025, and operating profit grew by 22%

to ZAR302 million (Q2 2024: ZAR247 million).

Cartrack grew subscription revenue by 15% to a record ZAR983

million in Q2 2025 (Q2 2024: ZAR858 million). Subscription revenue

equated to 98% of total revenue. Cartrack achieved 89,168 net

subscriber additions in the quarter, building on its solid track

record of growing at scale.

Karooooo Logistics grew revenue by 40% to ZAR101 million (Q2

2024: ZAR72 million). Karooooo Logistics focuses on

delivery-as-a-service (“DaaS”) for large enterprise customers

wishing to scale and digitalise their e-commerce operations without

investing unnecessarily in additional assets by connecting them

into an elastic fleet of third-party delivery drivers.

Our proven, robust and consistently profitable business model,

underpinned by a strong balance sheet and healthy cash position,

positions us to capitalize on a growing and largely underpenetrated

market.

For the full earnings, visit: www.karooooo.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241014203395/en/

ir@karooooo.com

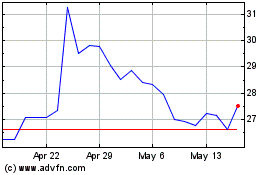

Karooooo (NASDAQ:KARO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Karooooo (NASDAQ:KARO)

Historical Stock Chart

From Jan 2024 to Jan 2025