Kura Sushi USA, Inc. (“Kura Sushi” or the “Company”) (NASDAQ:

KRUS), a technology-enabled Japanese restaurant concept, today

announced financial results for the fiscal fourth quarter and

fiscal year ended August 31, 2024.

Fiscal Fourth Quarter 2024

Highlights

- Total sales were $66.0 million, compared to $54.9 million in

the fourth quarter of 2023;

- Comparable restaurant sales decreased 3.1% for the fourth

quarter of 2024 as compared to the fourth quarter of 2023;

- Operating loss was $5.8 million, compared to operating income

of $2.2 million in the fourth quarter of 2023;

- Net loss was $5.2 million, or $(0.46) per diluted share,

compared to net income of $2.9 million, or $0.25 per diluted share,

in the fourth quarter of 2023;

- Adjusted net income* was $1.0 million, or $0.09 per diluted

share, compared to an adjusted net income of $2.9 million or $0.25

per diluted share, in the fourth quarter of 2023;

- Restaurant-level operating profit* was $13.8 million, or 20.9%

of sales;

- Adjusted EBITDA* was $5.5 million; and

- One new restaurant opened during the fiscal fourth quarter of

2024.

* Adjusted net income, Restaurant-level

operating profit, and Adjusted EBITDA are non-GAAP measures and are

defined below under “Key Financial Definitions.” Please see the

reconciliation of non-GAAP measures accompanying this release. See

also “Non-GAAP Financial Measures” below.

Hajime Uba, President and Chief Executive

Officer of Kura Sushi, stated, “In fiscal 2024, we succeeded on our

key goals of achieving over 20%-unit growth and maintaining

best-in-class restaurant-level operating profit margins. I am

tremendously excited for this fiscal year 2025 and what we can

achieve in respect to these goals. Fiscal year 2025 is an

opportunity to demonstrate the next level of Kura Sushi’s

potential, and I am incredibly grateful for the excellent work by

our team members who have positioned us so well for the new

year.”

Review of Fiscal Fourth Quarter 2024

Financial Results

Total sales were $66.0 million compared to $54.9

million in the fourth quarter of 2023. Comparable restaurant sales

decreased 3.1% for the fourth quarter of 2024 as compared to the

fourth quarter of 2023.

Food and beverage costs as a percentage of sales

were 28.5% compared to 29.5% in the fourth quarter of 2023. The

decrease is primarily due to increase in menu prices and supply

chain initiatives.

Labor and related costs as a percentage of sales

were 31.1% compared to 28.8% in the fourth quarter of 2023. The

increase is primarily due to sales deleverage and increases in wage

rates.

Occupancy and related expenses were $4.6 million

compared to $3.6 million in the fourth quarter of 2023. The

increase is primarily due to fourteen new restaurants opening since

the fourth quarter of 2023.

Other costs as a percentage of sales increased

to 14.7% compared to 13.8% in the fourth quarter of 2023. The

increase was primarily driven by utilities, delivery fees, software

licenses and operating supplies.

General and administrative expenses were $13.4

million compared to $7.3 million in the fourth quarter of 2023.

This increase was primarily due to litigation costs,

compensation-related costs and professional fees. As a percentage

of sales, general and administrative expenses increased to 20.3%,

which includes $4.7 million in litigation costs, as compared to

13.2% in the fourth quarter of 2023.

Impairment of long-lived assets were $1.6

million in the fourth quarter of 2024 due to impairment charges

related to the property and equipment on one underperforming

restaurant location.

Operating loss was $5.8 million compared to

operating income of $2.2 million in the fourth quarter of 2023.

Income tax expense was $19 thousand compared to

$167 thousand in the fourth quarter of 2023.

Net loss was $5.2 million, or $(0.46) per

diluted share, compared to net income of $2.9 million, or $0.25 per

diluted share, in the fourth quarter of 2023.

Adjusted net income* was $1.0 million, or $0.09

per diluted share, compared to adjusted net income* of $2.9 million

or $0.25 per diluted share, in the fourth quarter of 2023.

Restaurant-level operating profit* was $13.8

million, or 20.9% of sales, compared to $13.4 million, or 24.4% of

sales, in the fourth quarter of 2023.

Adjusted EBITDA* was $5.5 million compared to

$6.3 million in the fourth quarter of 2023.

Review of Fiscal Year 2024 Financial

Results

Total sales were $237.9 million compared to

$187.4 million in fiscal year 2023. Comparable restaurant sales

increased 0.7% as compared to fiscal year 2023. Average unit

volumes were $4.2 million and $4.3 million in fiscal year 2024 and

2023, respectively.

Operating loss was $11.5 million compared to

operating income of $0.3 million in fiscal year 2023.

Income tax expense was $0.2 million for both

fiscal years 2024 and 2023.

Net loss was $8.8 million, or $(0.79) per

diluted share, compared to net income of $1.5 million, or $0.14 per

diluted share, in fiscal year 2023.

Adjusted net loss* was $1.8 million, or $(0.16)

per diluted share, compared to adjusted net income* of $1.5

million, or $0.14 per diluted share, in fiscal year 2023.

Restaurant-level operating profit* was $47.7

million, or 20.1% of sales, compared to $41.1 million or 21.9% of

sales, in fiscal year 2023.

Adjusted EBITDA* was $14.6 million compared to

$14.3 million in fiscal year 2023.

Restaurant Development

During the fiscal fourth quarter of 2024, the

Company opened one new restaurant in Lake Grove, New York.

Subsequent to August 31, 2024, the Company

opened five new restaurants in Beaverton, Oregon; Tacoma,

Washington; Rockville, Maryland; Cherry Hill, New Jersey; and

Bakersfield, California.

Fiscal Year 2025 Outlook

- Total sales between $275 million and $279 million;

- 14 new restaurants, maintaining an annual unit growth rate

above 20%, with average net capital expenditures per unit of

approximately $2.5 million;

- General and administrative expenses as a percentage of sales to

be approximately 13.5%

Conference Call

A conference call and webcast to discuss Kura

Sushi’s financial results is scheduled for 5:00 p.m. ET today.

Hosting the conference call and webcast will be Hajime “Jimmy” Uba,

President and Chief Executive Officer, Jeff Uttz, Chief Financial

Officer, and Benjamin Porten, SVP Investor Relations & System

Development.

Interested parties may listen to the conference

call via telephone by dialing 201-689-8471. A telephone replay will

be available shortly after the call has concluded and can be

accessed by dialing 412-317-6671; the passcode is 13748567. The

webcast will be available at www.kurasushi.com under the investor

relations section and will be archived on the site shortly after

the call has concluded.

About Kura Sushi USA, Inc.

Kura Sushi USA, Inc. is a technology-enabled

Japanese restaurant concept with 69 locations across 19 states and

Washington DC. The Company offers guests a distinctive dining

experience built on authentic Japanese cuisine and an engaging

revolving sushi service model. Kura Sushi USA, Inc. was established

in 2008 as a subsidiary of Kura Sushi, Inc., a Japan-based

revolving sushi chain with over 550 restaurants and 40 years of

brand history. For more information, please visit

www.kurasushi.com.

Key Financial Definitions

Adjusted Net Income (Loss), a

non-GAAP measure, is defined as net income (loss) before certain

items, such as litigation costs and restaurant impairments, that

the Company believes are not indicative of its core operating

results. Adjusted net income (loss) per diluted share represents

adjusted net income (loss) divided by the number of diluted

shares.

EBITDA, a non-GAAP measure, is

defined as net income (loss) before interest, income taxes and

depreciation and amortization expenses.

Adjusted EBITDA, a non-GAAP

measure, is defined as EBITDA plus stock-based compensation

expense, non-cash lease expense and asset disposals, closure costs

and restaurant impairments, as well as certain items, such as

litigation costs, that the Company believes are not indicative of

its core operating results. Adjusted EBITDA margin is defined as

adjusted EBITDA divided by sales.

Restaurant-level Operating Profit

(Loss), a non-GAAP measure, is defined as operating income

(loss) plus depreciation and amortization expenses; stock-based

compensation expense; pre-opening costs and general and

administrative expenses which are considered normal, recurring,

cash operating expenses and are essential to supporting the

development and operations of restaurants; non-cash lease expense;

and asset disposals, closure costs and restaurant impairments; less

corporate-level stock-based compensation expense recognized within

general and administrative expenses. Restaurant-level operating

profit (loss) margin is defined as restaurant-level operating

profit (loss) divided by sales.

Comparable Restaurant Sales

Performance refers to the change in year-over-year sales

for the comparable restaurant base. The Company includes

restaurants in the comparable restaurant base that have been in

operation for at least full calendar 18 months prior to the start

of the accounting period presented due to new restaurants

experiencing a period of higher sales upon opening, including those

temporarily closed for renovations during the year. For restaurants

that were temporarily closed for renovations during the year, the

Company makes fractional adjustments to sales such that sales are

annualized in the associated period. Performance in comparable

restaurant sales represents the percent change in sales from the

same period in the prior year for the comparable restaurant

base.

Average Unit Volumes (“AUVs”)

consist of the average annual sales of all restaurants that have

been open for 18 full calendar months or longer at the end of the

fiscal year presented. AUVs are calculated by dividing (x) annual

sales for the fiscal year presented for all such restaurants by (y)

the total number of restaurants in that base. The Company makes

fractional adjustments to sales for restaurants that were not open

for the entire fiscal year presented (e.g., a restaurant is closed

for renovation) to annualize sales for such associated period.

Non-GAAP Financial Measures

To supplement the financial statements presented

in accordance with U.S. generally accepted accounting principles

(“GAAP”), the Company presents certain financial measures, such as

adjusted net income (loss), EBITDA, adjusted EBITDA, adjusted

EBITDA margin, restaurant-level operating profit (loss) and

restaurant-level operating profit (loss) margin (“non-GAAP

measures”) that are not recognized under GAAP. These non-GAAP

measures are intended as supplemental measures of its performance

that are neither required by, nor presented in accordance with,

GAAP. The Company is presenting these non-GAAP measures because the

Company believes that they provide useful information to management

and investors regarding certain financial and business trends

relating to its financial condition and operating results. These

measures also may not provide a complete understanding of the

operating results of the Company as a whole and such measures

should be reviewed in conjunction with its GAAP financial results.

Additionally, the Company presents restaurant-level operating

profit (loss) because it excludes the impact of general and

administrative expenses which are not incurred at the

restaurant-level. The Company also uses restaurant-level operating

profit (loss) to measure operating performance and returns from

opening new restaurants.

The Company believes that the use of these

non-GAAP financial measures provides an additional tool for

investors to use in evaluating ongoing operating results and trends

and in comparing the Company’s financial measures with those of

comparable companies, which may present similar non-GAAP financial

measures to investors. However, you should be aware that

restaurant-level operating profit (loss) and restaurant-level

operating profit (loss) margin are financial measures which are not

indicative of overall results for the Company, and restaurant-level

operating profit (loss) and restaurant-level operating profit

(loss) margin do not accrue directly to the benefit of stockholders

because of corporate-level and certain other expenses excluded from

such measures. In addition, you should be aware when evaluating

these non-GAAP financial measures that in the future the Company

may incur expenses similar to those excluded when calculating these

measures. The Company’s presentation of these measures should not

be construed as an inference that its future results will be

unaffected by unusual or non-recurring items. The Company’s

computation of these non-GAAP financial measures may not be

comparable to other similarly titled measures computed by other

companies, because all companies may not calculate these non-GAAP

financial measures in the same fashion. Because of these

limitations, these non-GAAP financial measures should not be

considered in isolation or as a substitute for performance measures

calculated in accordance with GAAP. The Company compensates for

these limitations by relying primarily on its GAAP results and

using these non-GAAP financial measures on a supplemental

basis.

Forward-Looking Statements

Except for historical information contained

herein, the statements in this press release or otherwise made by

the Company’s management in connection with the subject matter of

this press release are forward-looking statements (as such term is

defined in the Private Securities Litigation Reform Act of 1995)

and involve risks and uncertainties and are subject to change based

on various important factors. This press release includes

forward-looking statements that are based on management’s current

estimates or expectations of future events or future results. These

statements are not historical in nature and can generally be

identified by such words as “target,” “may,” “might,” “will,”

“objective,” “intend,” “should,” “could,” “can,” “would,” “expect,”

“believe,” “design,” “estimate,” “continue,” “predict,”

“potential,” “plan,” “anticipate” or the negative of these terms,

and similar expressions. Management’s expectations and assumptions

regarding future results are subject to risks, uncertainties and

other factors that could cause actual results to differ materially

from the anticipated results or other expectations expressed in the

forward-looking statements included in this press release. These

risks and uncertainties include but are not limited to: the

Company’s ability to successfully maintain increases in our

comparable restaurant sales; the Company’s ability to successfully

execute our growth strategy and open new restaurants that are

profitable; the Company’s ability to expand in existing and new

markets; the Company’s projected growth in the number of its

restaurants; macroeconomic conditions and other economic factors,

including rising interest rates, the possibility of a recession and

instability in financial markets; the Company’s ability to compete

with many other restaurants; the Company’s reliance on vendors,

suppliers and distributors, including its majority stockholder Kura

Sushi, Inc.; changes in food and supply costs, including the impact

of inflation and tariffs; concerns regarding food safety and

foodborne illness; changes in consumer preferences and the level of

acceptance of the Company’s restaurant concept in new markets;

minimum wage increases and mandated employee benefits that could

cause a significant increase in labor costs, as well as the impact

of labor availability; the failure of the Company’s automated

equipment or information technology systems or the breach of its

network security; the loss of key members of the Company’s

management team; the impact of governmental laws and regulations;

volatility in the price of the Company’s common stock; and other

risks and uncertainties as described in the Company’s filings with

the Securities and Exchange Commission (“SEC”). These and other

factors that could cause results to differ materially from those

described in the forward-looking statements contained in this press

release can be found in the Company’s other filings with the SEC.

Undue reliance should not be placed on forward-looking statements,

which are only current as of the date they are made. The Company

assumes no obligation to update or revise its forward-looking

statements, except as may be required by applicable law.

Investor Relations Contact:Jeff Priester or

Steven Boediarto(657) 333-4010investor@kurausa.com

|

Kura Sushi USA, Inc.Statements of

Operations and Comprehensive Income (Loss)(in

thousands, except per share amounts; unaudited) |

|

|

|

|

|

Three months ended August 31, |

|

|

Twelve months ended August 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Sales |

|

$ |

66,012 |

|

|

$ |

54,929 |

|

|

$ |

237,860 |

|

|

$ |

187,429 |

|

|

Restaurant operating costs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Food and beverage costs |

|

|

18,818 |

|

|

|

16,191 |

|

|

|

69,509 |

|

|

|

56,631 |

|

|

Labor and related costs |

|

|

20,517 |

|

|

|

15,796 |

|

|

|

75,926 |

|

|

|

56,547 |

|

|

Occupancy and related expenses |

|

|

4,613 |

|

|

|

3,637 |

|

|

|

16,792 |

|

|

|

13,141 |

|

|

Depreciation and amortization expenses |

|

|

3,068 |

|

|

|

2,113 |

|

|

|

11,362 |

|

|

|

7,422 |

|

|

Other costs |

|

|

9,725 |

|

|

|

7,559 |

|

|

|

34,748 |

|

|

|

24,911 |

|

|

Total restaurant operating costs |

|

|

56,741 |

|

|

|

45,296 |

|

|

|

208,337 |

|

|

|

158,652 |

|

| General

and administrative expenses |

|

|

13,416 |

|

|

|

7,259 |

|

|

|

39,050 |

|

|

|

28,035 |

|

|

Depreciation and amortization expenses |

|

|

107 |

|

|

|

145 |

|

|

|

425 |

|

|

|

410 |

|

|

Impairment of long-lived assets |

|

|

1,553 |

|

|

|

— |

|

|

|

1,553 |

|

|

|

— |

|

|

Total operating expenses |

|

|

71,817 |

|

|

|

52,700 |

|

|

|

249,365 |

|

|

|

187,097 |

|

|

Operating income (loss) |

|

|

(5,805 |

) |

|

|

2,229 |

|

|

|

(11,505 |

) |

|

|

332 |

|

| Other

expense (income): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

12 |

|

|

|

16 |

|

|

|

47 |

|

|

|

69 |

|

|

Interest income |

|

|

(635 |

) |

|

|

(879 |

) |

|

|

(2,915 |

) |

|

|

(1,472 |

) |

| Income

(loss) before income taxes |

|

|

(5,182 |

) |

|

|

3,092 |

|

|

|

(8,637 |

) |

|

|

1,735 |

|

| Income

tax expense |

|

|

19 |

|

|

|

167 |

|

|

|

167 |

|

|

|

233 |

|

| Net

income (loss) |

|

$ |

(5,201 |

) |

|

$ |

2,925 |

|

|

$ |

(8,804 |

) |

|

$ |

1,502 |

|

| Net

income (loss) per Class A and Class B shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.46 |

) |

|

$ |

0.26 |

|

|

$ |

(0.79 |

) |

|

$ |

0.15 |

|

|

Diluted |

|

$ |

(0.46 |

) |

|

$ |

0.25 |

|

|

$ |

(0.79 |

) |

|

$ |

0.14 |

|

| Weighted

average Class A and Class B shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

11,247 |

|

|

|

11,126 |

|

|

|

11,204 |

|

|

|

10,305 |

|

|

Diluted |

|

|

11,247 |

|

|

|

11,500 |

|

|

|

11,204 |

|

|

|

10,640 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income

(loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on short-term investments |

|

$ |

— |

|

|

$ |

50 |

|

|

$ |

(43 |

) |

|

$ |

43 |

|

|

Comprehensive income (loss) |

|

$ |

(5,201 |

) |

|

$ |

2,975 |

|

|

$ |

(8,847 |

) |

|

$ |

1,545 |

|

|

Kura Sushi USA, Inc.Selected Balance Sheet

Data and Selected Operating Data(in thousands,

except restaurants and percentages; unaudited) |

|

|

|

|

|

August 31, 2024 |

|

|

August 31, 2023 |

|

|

Selected Balance Sheet Data: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

50,986 |

|

|

$ |

69,697 |

|

| Total

assets |

|

$ |

328,522 |

|

|

$ |

304,659 |

|

| Total

liabilities |

|

$ |

165,984 |

|

|

$ |

140,018 |

|

| Total

stockholders’ equity |

|

$ |

162,538 |

|

|

$ |

164,641 |

|

|

|

|

Three months ended August 31, |

|

|

Twelve months ended August 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Selected Operating Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Restaurants at the end of period |

|

|

64 |

|

|

|

50 |

|

|

|

64 |

|

|

|

50 |

|

| Average

unit volumes |

|

N/A |

|

|

N/A |

|

|

$ |

4,228 |

|

|

$ |

4,281 |

|

|

Comparable restaurant sales performance |

|

|

(3.1 |

)% |

|

|

6.5 |

% |

|

|

0.7 |

% |

|

|

9.5 |

% |

|

EBITDA |

|

$ |

(2,630 |

) |

|

$ |

4,487 |

|

|

$ |

282 |

|

|

$ |

8,164 |

|

| Adjusted

EBITDA |

|

$ |

5,496 |

|

|

$ |

6,277 |

|

|

$ |

14,564 |

|

|

$ |

14,342 |

|

|

Adjusted EBITDA margin |

|

|

8.3 |

% |

|

|

11.4 |

% |

|

|

6.1 |

% |

|

|

7.7 |

% |

|

Operating income (loss) |

|

$ |

(5,805 |

) |

|

$ |

2,229 |

|

|

$ |

(11,505 |

) |

|

$ |

332 |

|

|

Operating income (loss) margin |

|

|

(8.8 |

)% |

|

|

4.1 |

% |

|

|

(4.8 |

)% |

|

|

0.2 |

% |

|

Restaurant-level operating profit |

|

$ |

13,829 |

|

|

$ |

13,399 |

|

|

$ |

47,703 |

|

|

$ |

41,063 |

|

|

Restaurant-level operating profit margin |

|

|

20.9 |

% |

|

|

24.4 |

% |

|

|

20.1 |

% |

|

|

21.9 |

% |

|

Kura Sushi USA, Inc.Reconciliation of Net

Income (Loss) and Net Income (Loss) Per Diluted Share toAdjusted

Net Income (Loss) and Adjusted Net Income (Loss) Per Diluted

Share(in thousands, except income (loss) per share amounts;

unaudited) |

|

|

|

|

|

Three months ended August 31, |

|

|

Twelve months ended August 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net income (loss) |

|

$ |

(5,201 |

) |

|

$ |

2,925 |

|

|

$ |

(8,804 |

) |

|

$ |

1,502 |

|

|

Litigation(3) |

|

|

4,683 |

|

|

|

— |

|

|

|

5,450 |

|

|

|

— |

|

|

Impairment of long-lived assets(5) |

|

|

1,553 |

|

|

|

— |

|

|

|

1,553 |

|

|

|

— |

|

| Adjusted

net income (loss) |

|

$ |

1,035 |

|

|

$ |

2,925 |

|

|

$ |

(1,801 |

) |

|

$ |

1,502 |

|

| Net

income (loss) per Class A and Class B diluted shares |

|

$ |

(0.46 |

) |

|

$ |

0.25 |

|

|

$ |

(0.79 |

) |

|

$ |

0.14 |

|

|

Litigation(3) |

|

|

0.41 |

|

|

|

— |

|

|

|

0.49 |

|

|

|

— |

|

|

Impairment of long-lived assets(5) |

|

|

0.14 |

|

|

|

— |

|

|

|

0.14 |

|

|

|

— |

|

| Adjusted

net income (loss) per Class A and Class B diluted shares |

|

$ |

0.09 |

|

|

$ |

0.25 |

|

|

$ |

(0.16 |

) |

|

$ |

0.14 |

|

| Weighted

average Class A and Class B shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted shares |

|

|

11,247 |

|

|

|

11,500 |

|

|

|

11,204 |

|

|

|

10,640 |

|

|

Adjusted diluted shares |

|

|

11,501 |

|

|

|

11,500 |

|

|

|

11,204 |

|

|

|

10,640 |

|

|

Kura Sushi USA, Inc.Reconciliation of Net

Income (Loss) to EBITDA and Adjusted EBITDA(in

thousands; unaudited) |

|

|

|

|

|

Three months ended August 31, |

|

|

Twelve months ended August 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net income (loss) |

|

$ |

(5,201 |

) |

|

$ |

2,925 |

|

|

$ |

(8,804 |

) |

|

$ |

1,502 |

|

|

Interest income, net |

|

|

(623 |

) |

|

|

(863 |

) |

|

|

(2,868 |

) |

|

|

(1,403 |

) |

|

Income tax expense |

|

|

19 |

|

|

|

167 |

|

|

|

167 |

|

|

|

233 |

|

|

Depreciation and amortization expenses |

|

|

3,175 |

|

|

|

2,258 |

|

|

|

11,787 |

|

|

|

7,832 |

|

| EBITDA |

|

|

(2,630 |

) |

|

|

4,487 |

|

|

|

282 |

|

|

|

8,164 |

|

|

Stock-based compensation expense(1) |

|

|

1,145 |

|

|

|

980 |

|

|

|

4,314 |

|

|

|

3,550 |

|

|

Non-cash lease expense(2) |

|

|

745 |

|

|

|

810 |

|

|

|

2,965 |

|

|

|

2,628 |

|

|

Litigation(3) |

|

|

4,683 |

|

|

|

— |

|

|

|

5,450 |

|

|

|

— |

|

|

Impairment of long-lived assets(5) |

|

|

1,553 |

|

|

|

— |

|

|

|

1,553 |

|

|

|

— |

|

| Adjusted EBITDA |

|

$ |

5,496 |

|

|

$ |

6,277 |

|

|

$ |

14,564 |

|

|

$ |

14,342 |

|

|

Kura Sushi USA, Inc.Reconciliation of

Operating Income (Loss) to Restaurant-level Operating

Profit(in thousands; unaudited) |

|

|

|

|

|

Three months ended August 31, |

|

|

Twelve months ended August 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Operating income (loss) |

|

$ |

(5,805 |

) |

|

$ |

2,229 |

|

|

$ |

(11,505 |

) |

|

$ |

332 |

|

|

Depreciation and amortization expenses |

|

|

3,175 |

|

|

|

2,258 |

|

|

|

11,787 |

|

|

|

7,832 |

|

|

Stock-based compensation expense(1) |

|

|

1,145 |

|

|

|

980 |

|

|

|

4,314 |

|

|

|

3,550 |

|

|

Pre-opening costs(4) |

|

|

554 |

|

|

|

719 |

|

|

|

3,165 |

|

|

|

1,730 |

|

|

Non-cash lease expense(2) |

|

|

745 |

|

|

|

810 |

|

|

|

2,965 |

|

|

|

2,628 |

|

|

Impairment of long-lived assets(5) |

|

|

1,553 |

|

|

|

— |

|

|

|

1,553 |

|

|

|

— |

|

|

General and administrative expenses |

|

|

13,416 |

|

|

|

7,259 |

|

|

|

39,050 |

|

|

|

28,035 |

|

|

Corporate-level stock-based compensation included in general and

administrative expenses |

|

|

(954 |

) |

|

|

(856 |

) |

|

|

(3,626 |

) |

|

|

(3,044 |

) |

|

Restaurant-level operating profit |

|

$ |

13,829 |

|

|

$ |

13,399 |

|

|

$ |

47,703 |

|

|

$ |

41,063 |

|

|

(1) |

Stock-based

compensation expense includes non-cash stock-based compensation,

which is comprised of restaurant-level stock-based compensation

included in other costs and corporate-level stock-based

compensation included in general and administrative expenses in the

statements of operations and comprehensive income (loss). |

| (2) |

Non-cash lease expense includes lease expense from the date of

possession of restaurants that did not require cash outlay in the

respective periods. |

| (3) |

Litigation includes expenses related to legal claims or

settlements. |

| (4) |

Pre-opening costs consist of labor costs and travel expenses

for new employees and trainers during the training period,

recruitment fees, legal fees, cash-based lease expenses incurred

between the date of possession and opening day of restaurants, and

other related pre-opening costs. |

| (5) |

Impairment of long-lived assets includes losses incurred due to

the impairment of property and equipment on one underperforming

restaurant location. |

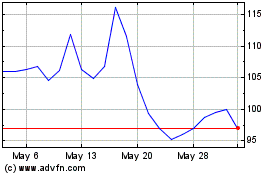

Kura Sushi USA (NASDAQ:KRUS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Kura Sushi USA (NASDAQ:KRUS)

Historical Stock Chart

From Dec 2023 to Dec 2024