Luminar Technologies, Inc./DE0001758057false00017580572024-11-132024-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2024

LUMINAR TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38791 | | 83-1804317 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

2603 Discovery Drive, Suite 100

Orlando, Florida 32826

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (800) 532-2417

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange

on which registered |

| Class A Common Stock, par value of $0.0001 per share | | LAZR | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(d) On November 13, 2024, the Board of Directors (the “Board”) of Luminar Technologies, Inc. (the “Company” or “Luminar”) elected Dominick Schiano to the Board to fill the vacancy created by an increase in the size of the Board from eight to nine members, as approved by the Board. Mr. Schiano will serve as a Class III director with an initial term to expire at the annual meeting of stockholders to be held in 2026 and will serve as a member of the Audit Committee of the Board.

Mr. Schiano is known for his expertise helping companies refocus their business units and for driving positive change. He is also an accomplished dealmaker. Mr. Schiano founded Evergreen Capital Partners LLC to provide strategic, operational, and financial guidance to private equity firms and their portfolio companies. Prior to that, he served in a number of director and executive roles in the automotive industry, including at Textron Automotive and TRW, Inc. Mr. Schiano attended Long Island University, majoring in Finance, the University of Pennsylvania - Wharton School Management Development Program, and the Northwestern University - Kellogg School Mergers and Acquisitions Program.

Mr. Schiano does not have any family relationships with any of Luminar’s directors or executive officers and is not a party to any transactions of the type required to be disclosed under Item 404(a) of Regulation S-K. There are no arrangements or understandings between Mr. Schiano and any other person pursuant to which he was or is to be selected as a director.

Mr. Schiano will receive cash and equity compensation in accordance with Luminar’s Director Compensation Policy for non-employee directors. Mr. Schiano also is expected to enter into an indemnification agreement with Luminar consistent with the form agreement executed with each of Luminar’s current directors.

Item 7.01 Regulation FD Disclosure.

As previously disclosed, at a special meeting of stockholders held on October 30, 2024, the stockholders of the Company approved a proposal to authorize the Company’s Board to amend the Company’s Second Amended and Restated Certificate of Incorporation, as amended (the “Charter”), to effect a reverse stock split of all of the outstanding Class A common stock of the Company, par value $0.0001 per share (“Class A Common Stock”), and Class B common stock of the Company, par value $0.0001 per share (“Class B Common Stock,” and together with the Class A Common Stock, “Common Stock”) and any Common Stock held by the Company as treasury shares, at any time prior to December 31, 2024, at a ratio of 1-for-5 to 1-for-20 (the “Reverse Stock Split”), as determined by the Board in its discretion. On November 13, 2024, the Board approved the Reverse Stock Split at a ratio of 1-for-15. The Reverse Stock Split is expected to become effective at 5:01 p.m., Eastern Time, on November 20, 2024, following the filing of a certificate of amendment to the Charter with the Secretary of State of the State of Delaware.

Trading of the Class A Common Stock on The Nasdaq Global Select Market is expected to commence on a split-adjusted basis on November 21, 2024 under the existing trading symbol “LAZR.” The new CUSIP number for the Class A Common Stock following the Reverse Stock Split will be 550424 303.

No fractional shares will be issued in connection with the Reverse Stock Split. Stockholders who would otherwise be entitled to receive fractional shares as a result of the Reverse Stock Split will be entitled to a cash payment in lieu thereof at a price equal to the fraction to which the stockholder would otherwise be entitled multiplied by the closing sales price per share of the Class A Common Stock (as adjusted for the Reverse Stock Split) on The Nasdaq Global Select Market on November 20, 2024.

The information in this Item 7.01 is being furnished, shall not be deemed “filed” for any purpose, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

On March 21, 2024, Plaintiff James Smith (“Plaintiff”), a putative shareholder of the Company, filed a putative class action complaint, captioned James Smith v. Alec Gores, et al., C.A. No. 2024-0285-MTZ (Del. Ch.) (the “Action”), against the Company and its directors in the Delaware Court of Chancery challenging a Company bylaw governing the process for nominating a candidate to the board of directors as preclusive and coercive. In August 2024, the Company adopted an amendment to its bylaws mooting the Action, and the Plaintiff voluntarily dismissed the suit, with the court retaining jurisdiction solely for the purpose of determining Plaintiff’s counsel’s application for attorneys’ fees and reimbursement of expenses (the “Fee Application”). Solely to avoid the time and expense of continued litigation, the parties agreed to resolve the Fee Application in exchange for a payment by the Company of $125,000 to Plaintiff’s counsel.

Forward-Looking Statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These statements include statements related to the expected effective date of the Reverse Stock Split and the possible effects of the Reverse Stock Split on the Common Stock and the trading of the Class A Common Stock on a split-adjusted basis. These forward-looking statements are based on the Company’s current expectations and inherently involve significant risks and uncertainties. Actual results could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which are discussed under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and subsequent reports filed with the Securities and Exchange Commission. Readers should not place undue reliance on forward-looking statements, which speak only as of the date they are first made. Any forward-looking statements contained in this current report speak only as of the date hereof, and the Company specifically disclaims any obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Luminar Technologies, Inc. |

| | |

| Date: November 15, 2024 | By: | /s/ Thomas J. Fennimore |

| Name: | Thomas J. Fennimore |

| Title: | Chief Financial Officer |

Cover

|

Nov. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 13, 2024

|

| Entity Registrant Name |

Luminar Technologies, Inc./DE

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38791

|

| Entity Tax Identification Number |

83-1804317

|

| Entity Address, Address Line One |

2603 Discovery Drive

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Orlando

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32826

|

| City Area Code |

800

|

| Local Phone Number |

532-2417

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value of $0.0001 per share

|

| Trading Symbol |

LAZR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001758057

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

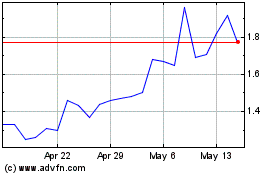

Luminar Technologies (NASDAQ:LAZR)

Historical Stock Chart

From Jan 2025 to Feb 2025

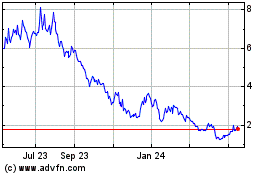

Luminar Technologies (NASDAQ:LAZR)

Historical Stock Chart

From Feb 2024 to Feb 2025