false

0001721484

0001721484

2024-12-31

2024-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 31, 2024

Longeveron Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-40060 |

|

47-2174146 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1951 NW 7th Avenue, Suite 520

Miami, Florida 33136

(Address of Principal Executive Offices)

Registrant’s Telephone Number, Including

Area Code: (305) 909-0840

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A Common Stock, $0.001 par value per share |

|

LGVN |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging Growth Company ☒

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02. Results of Operations and Financial Condition

On February 28, 2025, Longeveron Inc. (the “Company”)

issued a press release announcing its results for the fourth fiscal quarter ended December 31, 2024 and certain other business updates

and information. The full text of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by

reference herein.

The information provided under this Form 8-K (including

Exhibit 99.1) shall not be deemed “filed” for any purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange

Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The exhibits listed in the following Exhibit Index

are being furnished as part of this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LONGEVERON INC. |

| |

|

| Date: February 28, 2025 |

/s/ Wa’el Hashad |

| |

Name: |

Wa’el Hashad |

| |

Title: |

Chief Executive Officer |

2

Exhibit

99.1

Longeveron®

Announces Full-Year 2024 Financial Results and Provides Business Update

| ● | Pivotal

Phase 2b clinical trial (ELPIS II) evaluating Lomecel-BTM (laromestrocel) in Hypoplastic

Left Heart Syndrome (HLHS), a rare pediatric disease and orphan-designated indication, has

achieved more than 90% enrollment and is expected to complete enrollment in the second quarter

of 2025 |

| ● | Lomecel-BTM

Biological License Application (BLA) submission for full traditional approval anticipated

in 2026, if ELPIS II is successful |

| ● | FDA

meeting anticipated late in first quarter of 2025 to discuss possible development paths for

Lomecel-BTM in mild Alzheimer’s disease |

| ● | WHO

International Nonproprietary Names (INN) Expert Committee approved “laromestrocel”

for the non-proprietary name of Lomecel-B™ |

| ● | Total

Revenue for 2024 increased 237% year-over-year to $2.4 million, primarily due to the successful

initiation of contract manufacturing services and increased participant demand for the Bahamas

Registry Trial |

| ● | Company

to host conference call and webcast today at 4:30 p.m. ET |

MIAMI,

February 28, 2025 -- Longeveron Inc. (NASDAQ: LGVN), a clinical stage regenerative medicine biotechnology company developing cellular

therapies for life-threatening and chronic aging-related conditions, today reported financial results for the full-year ended December

31, 2024 and provided a business update.

“Throughout

2024, we continued to advance the development of our investigational cellular therapy candidate, Lomecel-BTM, as a potential

treatment for both Hypoplastic Left Heart Syndrome, or HLHS, and mild Alzheimer’s disease,” said Wa’el Hashad, Chief

Executive Officer of Longeveron. “We are now approaching multiple potentially transformational milestones over the next 12 months,

including, completion of enrollment in our pivotal Phase 2b clinical trial in HLHS, which may establish the timeline for a potential

Biological License Application, or BLA, submission for full traditional approval for HLHS, and our upcoming meeting with the FDA to determine

the development pathway for the Alzheimer’s disease program. Our team’s expertise in clinical development and manufacturing,

combined with several positive initial results across five clinical trials in three indications, continues to position Longeveron as

a leader in stem cell therapy research and, potentially, commercialization of cellular therapeutics.”

Development

Programs

Longeveron’s

investigational therapeutic candidate is Lomecel-BTM, a proprietary, scalable, allogeneic cellular therapy being evaluated

in multiple indications.

In

February 2025, the International Nonproprietary Names (INN) Expert Committee of the World Health Organization (WHO) approved “laromestrocel”

for the non-proprietary name of Lomecel-B™.

Hypoplastic

Left Heart Syndrome (HLHS) – a rare pediatric congenital heart birth defect in which the left ventricle (one of the pumping

chambers of the heart) is severely underdeveloped.

| ● | Phase

2b controlled clinical trial (ELPIS II) evaluating Lomecel-BTM as a potential

adjunct therapy for HLHS is currently enrolling 38 pediatric patients at twelve premiere

infant and children’s treatment institutions across the country. ELPIS II has achieved

more than 90% enrollment and is currently anticipated to complete enrollment in the second

quarter of 2025. |

| ● | In

2024, the U.S. Food and Drug Administration (FDA) indicated that ELPIS II is a pivotal trial

and, if it demonstrates sufficient evidence of efficacy, it would be acceptable for a Biologics

License Application (BLA) submission for full traditional approval. |

| ● | ELPIS

II is being conducted in collaboration with the National Heart, Lung, and Blood Institute

(NHLBI) through grants from the National Institutes of Health (NIH). |

| ● | In

the open-label Phase 1 ELPIS I study, 10 children treated with Lomecel-B™ achieved

100% transplant-free survival up to five years post-Glenn surgery. This represents a significant

improvement compared to historical control data, which show an 80% transplant-free survival

rate at five years. These findings underscore the potential of Lomecel-B™ to enhance

long-term outcomes and quality of life for children with single ventricle congenital heart

disease. |

| ● | The

FDA has granted Lomecel-BTM Orphan Drug designation, Fast Track designation, and

Rare Pediatric Disease designation for the treatment of HLHS. |

Alzheimer’s

disease (AD) – a neurodegenerative disorder that leads to progressive memory loss and death and currently has very limited

therapeutic options.

| ● | The

Company anticipates meeting with the FDA late in the first quarter of 2025 to discuss possible

development paths in mild Alzheimer’s disease. |

| ● | The

FDA has granted Lomecel-B™ both Regenerative Medicine Advanced Therapy (RMAT) designation

and Fast Track designation for the treatment of mild Alzheimer’s disease. |

2024

Summary Financial Results

| ● | Revenues: Revenues

for the year ended December 31, 2024 and 2023 were $2.4 million and $0.7 million, respectively.

This represents an increase of $1.7 million, or 237%, in 2024 compared to 2023, primarily

driven by higher participant demand for our investigational Frailty and Cognitive Impairment

registry trial in the Bahamas (the “Bahamas Registry Trial”) and the addition

of a third-party manufacturing services contract. Clinical trial revenue, which is derived

from the Bahamas Registry Trial, for the year ended December 31, 2024 and 2023 was $1.4 million

and $0.7 million, respectively. This increase of $0.7 million, or 110%, for the year ended

December 31, 2024 was a result of increased participant demand. Contract manufacturing revenue

for the year ended December 31, 2024 was $1.0 million, consisting of $0.5 million from manufacturing

lease services and $0.5 million from manufacturing services contract. |

| ● | Cost

of Revenues and Gross Profit: Cost of revenues for the year ended December 31, 2024

and 2023 was $0.5 million and $0.5 million, respectively. This resulted in a gross profit

of approximately $1.9 million for the year ended December 31, 2024, an increase of $1.7 million,

or 752%, compared to a gross profit of $0.2 million in 2023. |

| ● | General

and Administrative Expenses: General and administrative expenses for the year ended December

31, 2024 decreased to approximately $10.3 million, compared to $12.2 million for the same

period in 2023. This decrease of approximately $1.9 million, or 16%, was primarily due to

lower personnel expenses as a result of reduced severance in 2024 and lower legal and other

administrative expenses. |

| ● | Research

and Development Expenses: Research and development expenses for the year ended December

31, 2024 decreased to approximately $8.1 million from approximately $9.1 million for the

same period in 2023. This decrease of $1.0 million, or 10%, was primarily driven by a reduction

of $2.3 million in expenses related to the completed CLEAR MIND Alzheimer’s disease

clinical trial, reduced costs for the Aging-related Frailty clinical trial following our

decision to discontinue trial activities in Japan, and a $0.9 million decrease in supply

costs. These reductions were partially offset by $1.7 million in higher compensation and

benefit costs and a $0.3 million increase in equity-based compensation expenses allocated

to research and development. |

| ● | Other

Income (Expense), net: Other income (expense) for the years ended December 31, 2024

and 2023 was an income of $0.6 million and an expense of $0.4 million, respectively. Net

other income for 2024 was driven by higher interest income, compared to net other expense

for 2023 driven by realized losses on sales of marketable securities of $0.3 million, write-offs

of intangible assets of $0.3 million and reduced benefit of tax credits of $0.3 million. |

| ● | Net

Loss: Net loss decreased to approximately $16.0 million for the year ended December

31, 2024, from a net loss of $21.4 million for the same period in 2023. The decrease in the

net loss of $5.4 million, or 25%, was for reasons outlined above. |

| ● | Cash

and cash equivalents as of December 31, 2024 were $19.2 million. The Company currently

believes its existing cash and cash equivalents will enable it to fund its operating expenses

and capital expenditure requirements into the fourth quarter of 2025 based on its current

operating budget and cash flow forecast. However, as a result of its successful Type C meeting

with the FDA in August 2024 with respect to the HLHS regulatory pathway, the Company has

started to ramp up BLA enabling activities as it currently anticipates a potential filing

with the FDA in 2026, if the current ELPIS II trial is successful. The Company’s operating

expenses and capital expenditure requirements are expected to accelerate in calendar year

2025 as a result of these activities, including CMC (Chemistry, Manufacturing, and Controls)

and manufacturing readiness, and there will be a need to increase its current proposed spend

and further increase its capital investments. The Company intends to seek additional financing

and non-dilutive funding options to support these activities, and current cash projections

may be impacted by these ramped up activities and any financing transactions entered into. |

Conference

Call and Webcast Details:

| Conference

Call Number: |

1.877.407.0789 |

| Conference ID: |

13751432 |

| |

|

| Call meTM

Feature: |

Click Here |

| Webcast: |

Click Here |

An

archived replay of the webcast will be available on the “Events & Presentations” section of the Company’s website

following the conference.

About

Longeveron Inc.

Longeveron

is a clinical stage biotechnology company developing regenerative medicines to address unmet medical needs. The Company’s lead

investigational product is Lomecel-B™, an allogeneic medicinal signaling cell (MSC) therapy product isolated from the bone marrow

of young, healthy adult donors. Lomecel-B™ has multiple potential mechanisms of action encompassing pro-vascular, pro-regenerative,

anti-inflammatory, and tissue repair and healing effects with broad potential applications across a spectrum of disease areas. Longeveron

is currently pursuing three pipeline indications: hypoplastic left heart syndrome (HLHS), Alzheimer’s disease, and Aging-related

Frailty. Lomecel-BTM development programs have received five distinct and important FDA designations: for the HLHS program

- Orphan Drug designation, Fast Track designation, and Rare Pediatric Disease designation; and, for the AD program - Regenerative Medicine

Advanced Therapy (RMAT) designation and Fast Track designation. For more information, visit www.longeveron.com or follow Longeveron on

LinkedIn, X, and Instagram.

Forward-Looking

Statements

Certain

statements in this press release that are not historical facts are forward-looking statements made pursuant to the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995, which reflect management’s current expectations, assumptions, and estimates

of future operations, performance and economic conditions, and involve known and unknown risks, uncertainties, and other important factors

that could cause actual results, performance, or achievements to differ materially from those anticipated, expressed, or implied by the

statements made herein. Forward-looking statements are generally identifiable by the use of forward-looking terminology such as “anticipate,”

“believe,” “contemplate,” “continue,” “could,” “estimate,” “expects,”

“intend,” “looks to,” “may,” “on condition,” “plan,” “potential,”

“predict,” “preliminary,” “project,” “see,” “should,” “target,”

“will,” “would,” or the negative thereof or comparable terminology, or by discussion of strategy or goals or

other future events, circumstances, or effects and include, but are not limited to, statements about the various below-listed factors.

Factors that could cause actual results to differ materially from those expressed or implied in any forward-looking statements in this

release include, but are not limited to, our cash position and need to raise additional capital, the difficulties we may face in obtaining

access to capital, and the dilutive impact it may have on our investors; our financial performance, and ability to continue as a going

concern; the period over which we estimate our existing cash and cash equivalents will be sufficient to fund our future operating expenses

and capital expenditure requirements; the ability of our clinical trials to demonstrate safety and efficacy of our product candidates,

and other positive results; the timing and focus of our ongoing and future preclinical studies and clinical trials, and the reporting

of data from those studies and trials; the size of the market opportunity for certain of our product candidates, including our estimates

of the number of patients who suffer from the diseases we are targeting; our ability to scale production and commercialize the product

candidate for certain indications; the success of competing therapies that are or may become available; the beneficial characteristics,

safety, efficacy and therapeutic effects of our product candidates; our ability to obtain and maintain regulatory approval of our product

candidates in the U.S. and other jurisdictions; our plans relating to the further development of our product candidates, including additional

disease states or indications we may pursue; our plans and ability to obtain or protect intellectual property rights, including extensions

of existing patent terms where available and our ability to avoid infringing the intellectual property rights of others; the need to

hire additional personnel and our ability to attract and retain such personnel; and our estimates regarding expenses, future revenue,

capital requirements and needs for additional financing.

Further

information relating to factors that may impact the Company’s results and forward-looking statements are disclosed in the Company’s

filings with the Securities and Exchange Commission, including Longeveron’s Annual Report on Form 10-K for the year ended December

31, 2024, filed with the Securities and Exchange Commission on February 28, 2025, its Quarterly Reports on Form 10-Q, and its Current

Reports on Form 8-K. The Company operates in highly competitive and rapidly changing environment; therefore, new factors may arise, and

it is not possible for the Company’s management to predict all such factors that may arise nor assess the impact of such factors

or the extent to which any individual factor or combination thereof, may cause results to differ materially from those contained in any

forward-looking statements. The forward-looking statements contained in this press release are made as of the date of this press release

based on information available as of the date of this press release, are inherently uncertain, and the Company disclaims any intention

or obligation, other than imposed by law, to update or revise any forward-looking statements, whether as a result of new information,

future events, or otherwise.

Investor

and Media Contact:

Derek

Cole

Investor Relations Advisory Solutions

derek.cole@iradvisory.com

---tables

follow---

Longeveron

Inc.

Condensed

Balance Sheets

(In

thousands, except share and per share data)

| | |

December 31, | |

| | |

2024 | | |

2023 | |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 19,232 | | |

$ | 4,949 | |

| Marketable equity securities | |

| - | | |

| 412 | |

| Prepaid expenses and other current assets | |

| 308 | | |

| 376 | |

| Accounts and grants receivable | |

| 84 | | |

| 111 | |

| Total current assets | |

| 19,624 | | |

| 5,848 | |

| Property and equipment, net | |

| 2,449 | | |

| 2,529 | |

| Intangible assets, net | |

| 2,401 | | |

| 2,287 | |

| Operating lease asset | |

| 882 | | |

| 1,221 | |

| Other assets | |

| 202 | | |

| 193 | |

| Total assets | |

$ | 25,558 | | |

$ | 12,078 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

| 99 | | |

| 638 | |

| Accrued expenses | |

| 1,820 | | |

| 2,152 | |

| Current portion of operating lease liability | |

| 623 | | |

| 593 | |

| Deferred revenue | |

| 40 | | |

| 506 | |

| Total current liabilities | |

| 2,582 | | |

| 3,889 | |

| Long-term liabilities: | |

| | | |

| | |

| Long-term portion of operating lease liability | |

| 824 | | |

| 1,448 | |

| Other liabilities | |

| 265 | | |

| - | |

| Total long-term liabilities | |

| 1,089 | | |

| 1,448 | |

| Total liabilities | |

| 3,671 | | |

| 5,337 | |

| Commitments and contingencies (Note 9) | |

| | | |

| | |

| Stockholders’ Equity: | |

| | | |

| | |

Preferred stock, $0.001 par value per share, 5,000,000 shares authorized, no shares

issued and outstanding at December 31, 2024 and December 31, 2023 | |

| - | | |

| - | |

Class A common stock, $0.001 par value per share, 84,295,000 shares

authorized, 13,407,441 shares issued and outstanding at December 31, 2024;

1,025,183 issued and outstanding at December 31, 2023 | |

| 13 | | |

| 1 | |

Class B common stock, $0.001 par value per share, 15,705,000 shares authorized,

1,484,005 shares issued and outstanding at December 31, 2024; 1,485,560

issued and outstanding at December 31, 2023 | |

| 1 | | |

| 1 | |

| Additional paid-in capital | |

| 131,480 | | |

| 91,823 | |

| Stock subscription receivable | |

| - | | |

| (100 | ) |

| Accumulated deficit | |

| (109,607 | ) | |

| (84,984 | ) |

| Total stockholders’ equity | |

| 21,887 | | |

| 6,741 | |

| Total liabilities and stockholders’ equity | |

$ | 25,558 | | |

$ | 12,078 | |

See

accompanying notes to unaudited condensed financial statements.

Longeveron

Inc.

Condensed

Statements of Operations

(In

thousands, except per share data)

(Unaudited)

| | |

Year Ended

December 31, | |

| | |

2024 | | |

2023 | |

| Revenues | |

| | |

| |

| Clinical trial revenue | |

$ | 1,402 | | |

$ | 668 | |

| Contract manufacturing lease revenue | |

| 503 | | |

| - | |

| Contract manufacturing revenue | |

| 487 | | |

| - | |

| Grant revenue | |

| - | | |

| 41 | |

| Total revenues | |

| 2,392 | | |

| 709 | |

| Cost of revenues | |

| 508 | | |

| 488 | |

| Gross profit | |

| 1,884 | | |

| 221 | |

| | |

| | | |

| | |

| Operating expenses | |

| | | |

| | |

| General and administrative | |

| 10,269 | | |

| 12,184 | |

| Research and development | |

| 8,137 | | |

| 9,066 | |

| Total operating expenses | |

| 18,406 | | |

| 21,250 | |

| Loss from operations | |

| (16,522 | ) | |

| (21,029 | ) |

| Other income and (expense) | |

| | | |

| | |

| Lawsuit expense | |

| - | | |

| (30 | ) |

| Other refundable tax credits | |

| - | | |

| 23 | |

| Other income (expense), net | |

| 549 | | |

| (377 | ) |

| Total other income (expenses), net | |

| 549 | | |

| (384 | ) |

| Net loss | |

$ | (15,973 | ) | |

$ | (21,413 | ) |

| Deemed dividend - warrant inducement offers | |

| (8,650 | ) | |

| (798 | ) |

| Net loss attributable to common stockholders | |

$ | (24,623 | ) | |

$ | (22,211 | ) |

| Basic and diluted net loss per share | |

$ | (2.62 | ) | |

$ | (10.22 | ) |

| Basic and diluted weighted average common shares outstanding | |

| 9,411,164 | | |

| 2,173,490 | |

See

accompanying notes to unaudited condensed financial statements.

6

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

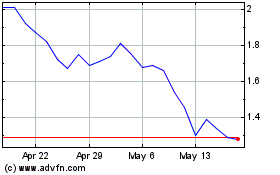

Longeveron (NASDAQ:LGVN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Longeveron (NASDAQ:LGVN)

Historical Stock Chart

From Mar 2024 to Mar 2025