false

0000865752

0000865752

2025-03-10

2025-03-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 10, 2025

Monster

Beverage Corporation

(Exact name of registrant as specified in its

charter)

Delaware

(State or other jurisdiction of incorporation)

| 001-18761 |

|

47-1809393 |

| (Commission

File Number) |

|

(IRS

Employer Identification No.) |

1

Monster Way

Corona,

California 92879

(Address

of principal executive offices and zip code)

(951)

739

- 6200

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common

Stock |

|

MNST |

|

Nasdaq

Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure of Directors or Principal Officers; Election

of Directors; Appointment of Principal Officers.

As indicated in

connection with the modified “Dutch auction” tender offer of 2024, Rodney C. Sacks, age 75, currently Co-Chief Executive

Officer and Chairman of the Board of Directors (the “Board”) of Monster Beverage Corporation (the

“Company”), notified the Board and management of the Company on March 10, 2025 that in connection with his

anticipated retirement, he will resign as Co-Chief Executive Officer of the Company, effective as of 11:59 p.m. on

June 12, 2025 (the “Transition Effective Time”). Effective June 13, 2025, Hilton H. Schlosberg will serve as

the Company’s sole Chief Executive Officer (the “CEO”).

Mr. Sacks and the Company

entered into a transition letter agreement (the “Transition Letter”), dated March 10, 2025, to confirm the terms of the

ongoing service of Mr. Sacks to the Company after the Transition Effective Time and to amend his employment agreement with the Company

accordingly. Pursuant to the Transition Letter, Mr. Sacks will continue to serve as Chairman of the Board, subject to his re-election

at each of the 2025 and 2026 annual meetings of stockholders of the Company, and will be responsible, in an employee capacity and in conformity

with the sentiment of the Board (as represented by its Lead Independent Director) and the CEO, for strategic direction over the Company’s

marketing, innovation and litigation efforts until his retirement as a Company employee, effective December 31, 2026 (the “Retirement

Date”). During such transition period, Mr. Sacks will receive a base salary at an annual rate of $900,000, effective July 1,

2025, as well as 2025 and 2026 target annual incentive award opportunities, long-term incentive award grants and certain additional benefits

described in the Transition Letter. Mr. Sacks will also continue to be eligible to vest in, and exercise, any outstanding long-term

incentive awards previously granted to him under the Company’s incentive plans as outlined in the Transition Letter and will continue

to be subject to his current share ownership guideline. Following the Retirement Date, Mr. Sacks will serve as a non-employee director

on the Board through and including (i) the date of the 2027 annual meeting of stockholders of the Company or (ii) such later

date as may be mutually agreed by Mr. Sacks and the Company (and approved by the Company’s shareholders).

The foregoing description

is qualified in its entirety by the Transition Letter, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein

by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Monster Beverage Corporation |

| |

|

| Date: March 10, 2025 |

/s/

Hilton H. Schlosberg |

| |

|

| |

Hilton H. Schlosberg |

| |

Vice Chairman of the Board of Directors

and |

| |

Co-Chief Executive Officer |

Exhibit 10.1

RODNEY C. SACKS TRANSITION LETTER

March 10, 2025

Rodney C. Sacks

Monster Beverage Corporation

Dear Rodney:

On behalf of the Board of Directors (the “Board”)

of Monster Beverage Corporation, a Delaware corporation (the “Corporation”), we thank you for your service and

are pleased to provide you with this transition letter (this “Transition Letter”) to confirm the terms of your

ongoing service to the Corporation during the transition period, which shall be from June 13, 2025 to December 31, 2026 (the

“Transition Period”), prior to your retirement from the Corporation as an employee, effective on December 31,

2026 (the “Retirement Date”). Following the Retirement Date, you will continue to serve as a non-employee director

on the Board through and including (i) the date of the Corporation’s 2027 annual stockholder meeting, or (ii) such later

date as may be mutually agreed by you and the Corporation and approved by the shareholders of the Corporation. By mutual agreement, you

may additionally or alternatively provide services to the Corporation as an advisor or consultant to the Corporation through the date

determined in accordance with the preceding sentence.

Prior to the commencement of the Transition Period,

you will continue to serve as Chairman of the Board (“Chairman”) and Co-Chief Executive Officer of the Corporation.

Effective 11:59 pm PT on June 12, 2025 (the “Transition Effective Time”), you will resign as Co-Chief Executive

Officer and will continue to serve as Chairman through December 31, 2026, subject to your re-election as Chairman in connection with

each of the 2025 and 2026 annual meetings of stockholders of the Corporation. You also will continue to be an employee subject to and

be eligible for benefits and programs under the terms and conditions of your Employment Agreement with the Corporation, dated March 18,

2014 (the “Employment Agreement”), which shall remain in full force and effect, except as expressly modified

by this Transition Letter.

As Chairman, you will have the customary responsibilities

and duties of a chairman serving on the Board. In addition, during the Transition Period, you will be responsible for strategic direction

over the Corporation’s marketing, innovation, and litigation efforts in conformity with the sentiment of the Board (as represented

by the lead independent director) and the CEO in an employee capacity (the “Transition Duties”), including for

purposes of all federal, state and local laws and regulations governing employment, as well as for tax laws. For the sake of clarity,

the Corporation’s CEO shall have full management authority with respect to all operations of the Corporation. You will also continue

to be subject to the employment policies and procedures of the Corporation and its affiliates during the Transition Period. During the

Transition Period, you shall perform the Transition Duties in such manner and time as may be reasonably agreed between you and the Board.

In connection therewith, Section 5 of the Employment Agreement (Position and Duties) is hereby deleted in its entirety and replaced

with “Intentionally omitted.”

Notwithstanding anything to the contrary in the

Employment Agreement and unless as expressly provided herein, during the Transition Period:

| · | You shall receive a base salary, payable bi-weekly or in such other installments as may be agreed upon

at the same annual rate as in effect as of the date of this Transition Letter through and including June 30, 2025. Effective as of

July 1, 2025 you will receive a base salary at an annual rate of $900,000 (the “Base Salary”). |

| · | Your 2025 target annual incentive award opportunity will be fixed at 135% of your total salary for 2025

to reflect the portion of 2025 while you serve as Co-Chief Executive Officer and Chairman and the remaining portion of 2025 while you

serve as Chairman, payable at such times, and in such amounts, as set forth in the annual incentive award agreement and which may be fixed

from time to time by the Compensation Committee of the Board (the “Compensation Committee”). |

| · | Your 2026 target annual incentive award opportunity will be fixed at 100% of the Base Salary, payable

at such times, and in such amounts, as set forth in the annual incentive award agreement and which may be fixed from time to time by the

Compensation Committee. For the sake of clarity, you will not be required to be an active employee of the Corporation at the time 2026

annual incentive awards are paid in order to receive payment for your 2026 target annual incentive. |

| · | Your (i) 2025 long-term incentive award grant will be calculated based on the weighted-average of

your service as (A) Chairman and Co-Chief Executive Officer prior to July 1, 2025, and (B) Chairman from July 1, 2025

to December 31, 2025 (representing an aggregate grant date fair value of approximately $2.35 million) and (ii) 2026 long-term

incentive award grant will be calculated based on your service as Chairman from January 1, 2026 to December 31, 2026 (representing

an aggregate grant date fair value of approximately $4.7 million) ((i) and (ii) collectively, the “Incentive Grants”)

under the Monster Beverage Corporation 2020 Omnibus Incentive Plan, as amended (the “2020 Omnibus Incentive Plan”),

and will remain subject to the same mix applicable to certain senior executives of the Corporation: 25% stock options, 25% time-based

restricted stock units, and 50% performance share units. |

| · | Your

Incentive Grants will be governed by the applicable award agreements and the 2020 Omnibus

Incentive Plan; provided however, that notwithstanding any contradictory

provisions included in the award agreements governing any performance share unit awards,

you will be eligible for full continued vesting (as opposed to pro rata vesting) for each

performance period applicable to the Incentive Grants following your retirement. |

| · | You will continue to be eligible to vest in, and exercise, any outstanding long-term incentive awards

previously granted to you under the Monster Beverage Corporation 2011 Omnibus Incentive Plan, as amended and the 2020 Omnibus Incentive

Plan (collectively, the “Incentive Plans”) in accordance with the terms and conditions of the applicable award

agreements issued thereunder. |

| · | You are expected to continue to meet your current share ownership guideline of six times your Base Salary. |

| · | You will be entitled to full reimbursement by the Corporation in connection with reasonable expenses incurred

for personal security services from January 1, 2025 to June 30, 2025. From July 1, 2025 to December 31, 2025, the

Corporation will reimburse you for reasonable expenses incurred for personal security services which do not exceed fifty percent 50% of

the aggregate cost of the reasonable personal security services incurred by you which were reimbursed by the Corporation from January 1,

2025 to June 30, 2025. Effective January 1, 2026, you will no longer be eligible for reimbursement by the Corporation in connection

with expenses incurred for personal security services. |

Your transition of employment from Co-Chief Executive

Officer and Chairman to Chairman, effective as of June 13, 2025, and your decision to retire from the Corporation as an employee,

effective as of the Retirement Date, in each case shall not constitute a termination of your employment and service by reason of a Constructive

Termination (as defined in the Employment Agreement), and by signing this Transition Letter, you agree to waive, and are precluded from

asserting, that your transition to Chairman or termination of employment with the Corporation in connection with your retirement was

due to a Constructive Termination. Notwithstanding anything to the contrary in this Transition Letter or in the Employment Agreement,

(i) you hereby waive your right to any severance payments contemplated in Section 8(e) of the Employment Agreement (Voluntary

Termination by the Executive), including, for the avoidance of doubt, in connection with your retirement from the Corporation as an employee

on the Retirement Date and (ii) you will remain entitled to receive the payments and benefits contemplated by Section 8(f) of

the Employment Agreement (Termination by Corporation other than for Cause or Disability and Termination by the Executive for Constructive

Termination) in the event of a qualifying termination of employment with the Corporation as more fully described therein; provided however,

that (A) the words “at the rate in effect on the Date of Termination” in Sections 8(f)(i)(A) and 8(f)(i)(B) shall

be replaced with the words “at the rate in effect immediately prior to the Transition Effective Time” and (B) for the

avoidance of doubt, the Corporation and you expressly acknowledge and agree that the retirement from your service as an employee of the

Corporation on the Retirement Date shall not give rise to any severance or other payment or benefit to the Executive under Section 8(f) of

the Employment Agreement.

Effective on the Retirement Date, the Employment

Agreement (as modified by this Transition Letter) shall terminate and you shall resign as an employee of the Corporation. For any continued

Board service following the Retirement Date, you will be eligible to participate in the Corporation’s non-employee director compensation

program on the same basis as the other non-employee directors of the Corporation and continue to be eligible to vest in, and exercise,

any outstanding long-term incentive awards previously granted to you under the Incentive Plans in accordance with the terms and conditions

of the applicable award agreements issued thereunder. Prior to the Retirement Date, the Corporation will consider in good faith the potential

for any necessary amendments to any award agreements governing the grants of outstanding stock options to permit exercisability through

the expiration date of such awards. For the sake of clarity, the Corporation’s receipt of this Transition Letter shall be deemed

to satisfy any applicable notice requirements such that you will be deemed to satisfy the requirements of a Retirement as such term is

defined in the Incentive Grants as well as any future awards granted to you under the 2020 Omnibus Incentive Plan.

This Transition Letter sets forth certain provisions

of the Employment Agreement that are incorporated by reference to this Agreement, as modified hereby. In addition, Section 6 (Compensation),

Section 7 (Termination), Section 8 (Obligations of the Corporation upon Termination), Section 9 (Non-exclusivity of Rights),

Section 10 (280G), Section 11 (Full Settlement), Section 12 (Legal Fees and Expenses), Section 13(a) (Special

Obligations of the Executive – Confidential Information), Section 14 (Successors), Section 15 (Section 409A), and

Section 16 (Miscellaneous) of the Employment Agreement are incorporated herein by reference and shall continue in full force and

effect as if fully set forth in this Transition Letter. All such provisions referenced in this Transition Letter shall be deemed to include

their correlative provisions, defined terms and cross references in the Employment Agreement, but shall be deemed modified to the extent

necessary for the appropriate meaning and context of this Transition Letter. For this purpose, and except as provided in the foregoing

provisions of this paragraph, all references in the Employment Agreement to “this Agreement” shall be deemed to be references

to the Employment Agreement as modified by this Transition Letter. You shall continue to be covered by the Corporation’s Directors

and Officers Liability Insurance Policy (“D&O Insurance”) for so long as you provide services (including,

for the sake of clarity, solely as a director on the Board) to the Corporation. Any tail coverage period applicable to the D&O insurance

shall begin to run as of the date you cease to provide services to the Corporation (including service solely as a director on the Board).

You shall also sign all letters of resignation

and other documentation as may be reasonably requested to effectuate the foregoing.

If you agree with all of the terms of this Transition

Letter, please sign below, indicating that you understand, agree with and intend to be legally bound by this Transition Letter.

| |

Sincerely, |

| |

|

| |

Monster Beverage Corporation |

| |

|

| |

/s/ Hilton H.

Schlosberg |

| |

Hilton H. Schlosberg |

| |

Co-Chief Executive Officer and Vice Chairman |

| |

|

| |

/s/ Mark Vidergauz |

| |

Mark Vidergauz |

| |

Lead Independent Director |

UNDERSTOOD AND AGREED, INTENDING TO BE LEGALLY

BOUND:

| /s/ Rodney

C. Sacks | | March

10, 2025 |

| Rodney C. Sacks | | Date |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

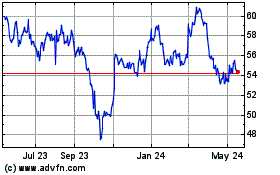

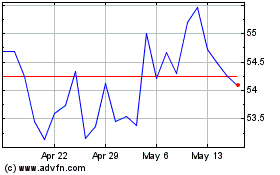

Monster Beverage (NASDAQ:MNST)

Historical Stock Chart

From Feb 2025 to Mar 2025

Monster Beverage (NASDAQ:MNST)

Historical Stock Chart

From Mar 2024 to Mar 2025