Red Cat Holdings Reports Financial Results for Fiscal Second Quarter 2025 and Provides Corporate Update

December 16 2024 - 3:10PM

Red Cat Holdings, Inc. (Nasdaq: RCAT) (“Red Cat” or “Company”), a

drone technology company integrating robotic hardware and software

for military, government, and commercial operations, reports its

financial results for the fiscal second quarter ended October 31,

2024 and provides a corporate update.

Recent Operational Highlights:

- Announced selection as the winner of the U.S. Army’s Short

Range Reconnaissance (SRR) Program of Record.

- Announced a strategic partnership with Palantir Technologies

Inc. (Nasdaq: PLTR) to integrate Visual Navigation software (VNav)

into Red Cat’s Black Widow drones.

- Announced several executive leadership team updates, including

Geoffrey Hitchcock’s promotion from General Manager of Teal Drones

to Chief Revenue Officer (CRO) for Red Cat and Chris Rill’s

transition from Director of Partner Integration to President of

Teal Drones.

- Secured a $1 million contract for its Edge 130 Blue drones from

the United States Army Communications-Electronics Command

(CECOM).

- Introduced its ARACHNID™ family of unmanned intelligence,

surveillance, and reconnaissance (ISR) and precision strike systems

at AUSA 2024.

- Closed on acquisition of Flight Wave giving us a completely new

revenue stream.

- Secured a Tactical Funding Increase (TACFI) contract

from the U.S. Air Force, validating FlightWave’s drone

technology for mission-critical defense applications.

- Broke ground on a plan for new manufacturing

facility, significantly enhancing production capacity to fulfill

existing contracts and scale future operations.

First Quarter 2025 Financial Highlights:

- Year-to-date revenue

of $4.3 million

- Ended the quarter

with cash and accounts receivable of $5.7 million

- Closed an additional

$6 million financing since quarter end

- Guidance of $80-$120

million for calendar year 2025 including SRR-related

sales

“In the second half of 2024, our company decided to focus on the

Black Widow, anticipating its success in the SRR final production

contract,” said Jeff Thompson, Red Cat CEO. “We halted production

of the Teal 2 to retool for the Black Widow, prioritizing long-term

growth over short-term revenue. This strategy has proven

successful, enabling us to meet the demands of the new Army

contract and all other Black Widow sales and programs of record

while managing critical technology integration through our Red Cat

Futures Initiative partners. We are now well-positioned to fulfill

these demands.”

“We are also pleased to announce our partnership with Palantir,”

added Thompson. “With Palantir’s Artificial Intelligence and visual

navigation, we believe the Black Widow is one of the most capable

drones ever fielded by the Department of Defense. This

rucksack-portable drone, powered by Palantir’s software, will boost

revenue per drone and increase gross margins.”

“This quarter’s accomplishments highlight Red Cat's growing

momentum and strong positioning in the drone technology sector,”

said Leah Lunger, Red Cat CFO. “Having been selected as the winner

of the U.S. Army’s Short Range Reconnaissance Program of Record

reflects the effectiveness of our strategic initiatives and we are

now well-positioned to support our projected revenue guidance for

calendar year 2025 while continuing to invest in scaling our

operations and manufacturing capacity.”

Conference Call Today

CEO Jeff Thompson, CFO Leah Lunger, and CRO Geoffrey Hitchcock

will host an earnings conference call at 4:30 p.m. ET on Monday,

December 16, 2024 to review financial results and provide an update

on corporate developments. Following management’s formal remarks,

there will be a question-and-answer session.

Interested parties can attend the conference call through a live

webcast that can be accessed at:

https://zoom.us/webinar/register/WN_t_SJfhxGSdyvpDz43XANqg

About Red Cat Holdings, Inc.

Red Cat (Nasdaq: RCAT) is a drone technology company integrating

robotic hardware and software for military, government, and

commercial operations. Through two wholly owned subsidiaries, Teal

Drones and FlightWave Aerospace, Red Cat has developed a

leading-edge Family of Systems. This includes the flagship Black

Widow™, a small unmanned ISR system that was awarded the U.S.

Army’s Short Range Reconnaissance (SRR) Program of Record contract.

The Family of Systems also includes TRICHON™, a fixed wing VTOL for

extended endurance and range, and FANG™, the industry's first line

of NDAA compliant FPV drones optimized for military

operations with precision strike capabilities. Learn more at

www.redcat.red.

Forward Looking Statements This press release

contains "forward-looking statements" that are subject to

substantial risks and uncertainties. All statements, other than

statements of historical fact, contained in this press release are

forward-looking statements. Forward-looking statements contained in

this press release may be identified by the use of words such as

"anticipate," "believe," "contemplate," "could," "estimate,"

"expect," "intend," "seek," "may," "might," "plan," "potential,"

"predict," "project," "target," "aim," "should," "will" "would," or

the negative of these words or other similar expressions, although

not all forward-looking statements contain these words.

Forward-looking statements are based on Red Cat Holdings, Inc.'s

current expectations and are subject to inherent uncertainties,

risks and assumptions that are difficult to predict. Further,

certain forward-looking statements are based on assumptions as to

future events that may not prove to be accurate. These and other

risks and uncertainties are described more fully in the section

titled "Risk Factors" in the Form 10-K filed with the Securities

and Exchange Commission on July 27, 2023. Forward-looking

statements contained in this announcement are made as of this date,

and Red Cat Holdings, Inc. undertakes no duty to update such

information except as required under applicable law.

Contact:

INVESTORS: E-mail: Investors@redcat.red

NEWS MEDIA: Phone: (347) 880-2895

Email: peter@indicatemedia.com

|

RED CAT HOLDINGS |

|

Condensed Consolidated Balance Sheets |

|

|

|

|

|

|

|

|

|

|

October 31, |

|

|

April 30, |

|

|

|

|

|

2024 |

|

|

2024 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and marketable securities |

|

$ |

4,611,092 |

|

|

$ |

6,067,169 |

|

|

|

Accounts receivable, net |

|

|

1,121,398 |

|

|

|

4,361,090 |

|

|

|

Inventory, including deposits |

|

|

12,554,330 |

|

|

|

8,610,125 |

|

|

|

Intangible assets including goodwill, net |

|

|

26,403,796 |

|

|

|

12,882,939 |

|

|

|

Other |

|

|

6,401,772 |

|

|

|

7,473,789 |

|

|

|

Equity method investee |

|

|

— |

|

|

|

5,142,500 |

|

|

|

Note receivable |

|

|

— |

|

|

|

4,000,000 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

51,092,388 |

|

|

$ |

48,537,612 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

3,244,776 |

|

|

$ |

2,703,922 |

|

|

|

Debt obligations |

|

|

356,964 |

|

|

|

751,570 |

|

|

|

Operating lease liabilities |

|

|

1,551,316 |

|

|

|

1,517,590 |

|

|

|

Convertible notes payable |

|

|

11,911,307 |

|

|

|

— |

|

|

|

Acquisition consideration payable |

|

|

7,000,000 |

|

|

|

— |

|

|

|

Total liabilities |

|

|

24,064,363 |

|

|

|

4,973,082 |

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ capital |

|

|

133,909,751 |

|

|

|

124,690,641 |

|

|

|

Accumulated deficit/comprehensive loss |

|

|

(106,881,726 |

) |

|

|

(81,126,111 |

) |

|

|

Total stockholders' equity |

|

|

27,028,025 |

|

|

|

43,564,530 |

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

|

$ |

51,092,388 |

|

|

$ |

48,537,612 |

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of

Operations |

|

|

|

|

|

Three months ended October 31, |

|

Six months ended October 31, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenues |

|

$ |

1,534,727 |

|

|

$ |

3,930,868 |

|

|

$ |

4,311,262 |

|

|

$ |

5,678,997 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold |

|

|

1,558,202 |

|

|

|

2,730,286 |

|

|

|

4,818,128 |

|

|

|

4,303,750 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross (loss) profit |

|

|

(23,475 |

) |

|

|

1,200,582 |

|

|

|

(506,866 |

) |

|

|

1,375,247 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

2,231,470 |

|

|

|

2,222,137 |

|

|

|

3,857,910 |

|

|

|

3,575,688 |

|

|

Sales and marketing |

|

|

2,343,779 |

|

|

|

1,032,645 |

|

|

|

4,385,290 |

|

|

|

2,321,405 |

|

|

General and administrative |

|

|

4,517,695 |

|

|

|

2,838,080 |

|

|

|

8,000,790 |

|

|

|

5,701,838 |

|

|

Impairment loss |

|

|

— |

|

|

|

— |

|

|

|

93,050 |

|

|

|

— |

|

|

Total operating expenses |

|

|

9,092,944 |

|

|

|

6,092,862 |

|

|

|

16,337,040 |

|

|

|

11,598,931 |

|

|

Operating loss |

|

|

(9,116,419 |

) |

|

|

(4,892,280 |

) |

|

|

(16,843,906 |

) |

|

|

(10,223,684 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (income) expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible notes payable fair value adjustment |

|

|

4,230,307 |

|

|

|

— |

|

|

|

4,230,307 |

|

|

|

— |

|

|

Loss on sale of equity method investment |

|

|

— |

|

|

|

— |

|

|

|

4,008,357 |

|

|

|

— |

|

|

Equity method loss |

|

|

— |

|

|

|

— |

|

|

|

734,143 |

|

|

|

— |

|

|

Investment loss, net |

|

|

— |

|

|

|

333,867 |

|

|

|

— |

|

|

|

573,357 |

|

|

Interest (income) expense, net |

|

|

(14,634 |

) |

|

|

19,696 |

|

|

|

(39,188 |

) |

|

|

41,553 |

|

|

Other, net |

|

|

2,526 |

|

|

|

(1,544 |

) |

|

|

(26,531 |

) |

|

|

— |

|

|

Other expense |

|

|

4,218,199 |

|

|

|

352,019 |

|

|

|

8,907,088 |

|

|

|

614,910 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

loss from continuing operations |

|

|

(13,334,618 |

) |

|

|

(5,244,299 |

) |

|

|

(25,750,994 |

) |

|

|

(10,838,594 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from discontinued operations |

|

|

— |

|

|

|

(599,511 |

) |

|

|

— |

|

|

|

(842,084 |

) |

| Net

loss |

|

$ |

(13,334,618 |

) |

|

$ |

(5,843,810 |

) |

|

$ |

(25,750,994 |

) |

|

$ |

(11,680,678 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share - basic and diluted |

|

$ |

(0.18 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.34 |

) |

|

$ |

(0.21 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic and diluted |

|

|

76,184,777 |

|

|

|

55,606,336 |

|

|

|

75,342,629 |

|

|

|

55,270,838 |

|

|

Condensed Consolidated Statements of Cash

Flows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six months ended October 31, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Cash Flows from Operating Activities |

|

|

|

|

|

|

|

|

|

Net loss from continuing operations |

|

$ |

(25,750,994 |

) |

|

$ |

(10,838,594 |

) |

|

Non-cash expenses |

|

|

12,662,208 |

|

|

|

3,411,397 |

|

|

Changes in operating assets and liabilities |

|

|

601,073 |

|

|

|

(3,813,162 |

) |

|

Net cash used in operating activities |

|

|

(12,487,713 |

) |

|

|

(11,240,359 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities |

|

|

|

|

|

|

|

|

|

Proceeds from sale of equity method investment and note

receivable |

|

|

4,400,000 |

|

|

|

— |

|

|

Proceeds from sale of marketable securities |

|

|

— |

|

|

|

10,205,501 |

|

|

Other |

|

|

(123,793 |

) |

|

|

(139,860 |

) |

|

Net cash provided by investing activities |

|

|

4,276,207 |

|

|

|

10,065,641 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Financing Activities |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of convertible notes payable, net |

|

|

7,681,000 |

|

|

|

— |

|

|

Payments of debt obligations, net |

|

|

(394,606 |

) |

|

|

(279,126 |

) |

|

Payments related to employee equity transactions |

|

|

(530,965 |

) |

|

|

(16,292 |

) |

|

Proceeds from issuance of common stock through ATM facility,

net |

|

|

— |

|

|

|

9,212 |

|

|

Net cash used in financing activities |

|

|

6,755,429 |

|

|

|

(286,206 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net cash used in discontinued operations |

|

|

— |

|

|

|

(384,094 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net decrease in Cash |

|

|

(1,456,077 |

) |

|

|

(1,845,018 |

) |

|

Cash, beginning of period |

|

|

6,067,169 |

|

|

|

3,260,305 |

|

|

Cash, end of period |

|

|

4,611,092 |

|

|

|

1,415,287 |

|

|

Less: Cash of discontinued operations |

|

|

— |

|

|

|

(6,310 |

) |

|

Cash of continuing operations, end of period |

|

|

4,611,092 |

|

|

|

1,408,977 |

|

|

Marketable securities |

|

|

— |

|

|

|

2,615,289 |

|

|

Cash of continuing operations and marketable securities |

|

$ |

4,611,092 |

|

|

$ |

4,030,576 |

|

|

|

|

|

|

|

|

|

|

|

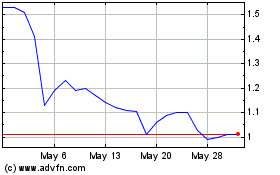

Red Cat (NASDAQ:RCAT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Red Cat (NASDAQ:RCAT)

Historical Stock Chart

From Feb 2024 to Feb 2025