UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-40649

REE AUTOMOTIVE LTD.

(Exact name of registrant as specified in its

charter)

Kibbutz Glil-Yam

4690500, Israel

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

CONTENTS

On

May 30, 2024, REE Automotive, Ltd. (the “Company”) announced its financial results for the first quarter ended March 31, 2024.

The full text of the press release (the “Press Release”) issued in connection with the announcement is furnished as Exhibit 99.1

to this Report of Foreign Private Issuer on Form 6-K. In the Press Release, the Company also announced that it will be holding a webcast

and conference call on May 30, 2024, at 8:30am ET to discuss its financial results for the first quarter ended March 31, 2024.

The sections titled

“Q1 2024 and Recent Highlights”, “Business”, “Technology”, “Operations”,

“Financials”, the Company’s “Condensed Consolidated Statements of Comprehensive Loss (Unaudited)”, the

Company’s “Condensed Consolidated Balance Sheets (Unaudited)”, and the Company’s “Condensed

Consolidated Staements of Cash Flows (Unaudited)” in the press release attached to this Form 6-K as Exhibit 99.1 are

incorporated by reference into the Company’s registration statements, including its registration statements on Form S-8 (File

No. 333-261130, File

No. 333-272145 and File No. 333-278319) and

registration statements on Form F-3 (File Nos. 333-266902

and 333-276757), and

shall be a part thereof, to the extent not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

REE AUTOMOTIVE LTD. |

| |

|

|

| |

By: |

/s/ Avital Futterman |

| |

Name: |

Avital Futterman |

| |

Title: |

General Counsel |

Date: May 30, 2024

3

Exhibit 99.1

REE Automotive Reports First Quarter 2024 Financial

Results:

Deliveries to Customers Have Begun Including

to Penske, U-Haul and Airbus

| ● | Penske

Truck Leasing begins to offer Powered by REE® Electric Vehicles to its customers |

| | | |

| ● | U-Haul received Powered by REE electric platform and

is evaluating it as the first solution to support the electrification of its fleet |

| | | |

| ● | Airbus and REE collaborate on an autonomous program utilizing REE’s

P7-C full by-wire and autonomous-ready technology, which opens REE to new autonomous driving markets |

| | | |

| ● | Demo program underway, with a growing number of trucks already delivered

and an increasing number of fleets that continue to provide excellent reviews through REE’s network of 20 dealers, 66 sales and

service locations, reaching a potential 200 fleet customers across North America |

| | | |

| ● | In

discussions with several automotive manufacturers to incorporate REEcorner®

by-wire technology into their electric offerings |

| | | |

| ● | P7-C is the first full by-wire truck to achieve U.S. FMVSS certification;

now eligible for customer incentives of over $100,000 per truck |

| | | |

| ● | Cash and equivalents of $77.5 million as of March 31, 2024; $15 million

(gross) proceeds raised in a public offering at $6.50 per share led by M&G, a strategic automotive investor and REE’s largest

shareholder |

| | | |

| ● | First quarter GAAP net loss narrowed by 29% quarter-over-quarter (QoQ)

with Non-GAAP net loss narrowing by 33% QoQ mainly due to the completion of the engineering phase and operational efficiencies |

| | | |

| ● | Company will hold a conference call at 8:30 a.m. Eastern Time today, May

30, 2024 which can be accessed via webcast at investors.ree.auto or webcast registration LINK; and via conference call dial-in LINK. |

TEL AVIV (May 30, 2024) – REE Automotive Ltd. (Nasdaq:

REE) (“REE” or the “Company”), an automotive technology company and provider of full by-wire electric trucks and

platforms, today announced its financial results and operational highlights for the three months ended March 31, 2024.

“We started 2024 with strong momentum and catalytic milestones,

from achieving U.S. certification to starting to deliver trucks against our order book as part of our demo program with our dealers across

North America. These demos are used by dealers to generate orders from their fleet customers, potentially further growing our order book

value, which recently crossed $50 million. As our dealer network is now sufficiently built to properly cover North America, we are pivoting

to focus on adding fleet orders to our order book and to serve some of the largest fleet companies in the world, including Penske Truck

Leasing (“Penske”) and U-Haul International, Inc. (“U-Haul”). We are excited to partner with Penske and have them

offer our electric trucks to their customers and we are proud to be the first electrification partner for U-Haul which we believe both

demonstrates our leadership in the industry and the value our technology delivers,” stated Daniel Barel, REE’s co-founder

and CEO.

“We believe that our REEcorner®

technology uniquely positions us in a lucrative portion of the commercial electric vehicles (“EV”) value chain.

The U.S. Federal Motor Vehicle Safety Standards (“FMVSS”), U.S. Environmental Protection Agency (“EPA”)

and California Air Resources Board (“CARB”) certifications attained solidified our technological leadership. We see growth

in market penetration through our dealers’ network across North America, as well as increasing demand from other automotive manufacturers

to adopt our REEcorner® technology. We continue to see interest in our mature full by-wire technology for autonomous

solutions as we have shown through our collaboration with Airbus UpNext (“Airbus”) in its autonomous program. We believe

that this, coupled with our capital expenditure (“CapEx”)-light manufacturing and operations strategy, enables us to rapidly

reach our commercial market and financial goals. We believe our initial customer deliveries, and the feedback we receive on our products,

show strong potential, and we expect it will generate significant growth in our order book supporting our production strategy,”

Barel concluded.

Q1 2024 and Recent Highlights:

Business:

| ● | Penske

begins to offer Powered by REE® EVs to its customers. Subsequent

to quarter end, REE delivered to Penske a P7-C upfitted with a 16-foot Wabash (NYSE: WNC)

DuraPlate® body for demos and orders across North America. Penske is a leading

global transportation services provider managing a fleet of approximately 450,000 vehicles

with more than 2,650 rental locations across North America. The Penske truck debuted at the

2024 ACT Expo generating interest from large fleets. |

| ● | U-Haul

received and is evaluating a Powered by REE® class 5 electric platform as

the first solution to support the electrification of its fleet. U-Haul is a subsidiary

of the U-Haul Holding Company (NYSE: UHAL) founded in 1945, U-Haul operates more than 23,000

rental locations across all 50 states and 10 Canadian provinces with a fleet of 192,200 trucks,

138,500 trailers and 44,500 towing devices. |

| ● | Airbus

selected the Powered by REE® vehicle for a fully autonomous program

based on REE’s full by-wire capabilities. REE believes that this solidifies the

maturity of its full by-wire technology and potentially opens REE to the autonomous driving

market. |

| ● | Deliveries have commenced to REE’s distribution network of 20

dealers with 66 points of sales and service and access to a potential of over 200 fleets across the U.S and Canada. Demos of REE’s

P7-C have begun to be delivered to fleets for orders, potentially adding further momentum to the current $50 million order book value.

|

| ● | Launched demo program to expand fleets’ exposure to REE’s

commercial EV. Subsequent to quarter-end more than 120 demo rides were performed with multiple prospects, with the aim to generate

follow-on orders based on continued positive feedback received from fleets. The demos give fleets the opportunity to experience the first

FMVSS certified full by-wire commercial vehicle, secure the inventory they need to transition their fleets to electric and aim to showcase

the P7-C’s driver-centric cabin, modular design and tight maneuverability firsthand. |

| ● | Two

new complete P7-C solutions were showcased at the National Truck and Equipment Association’s

Work Truck Week in Indianapolis, Indiana. Addressing Pritchard’s demand, a full P7-C

truck was upfitted with a KUV body from Knapheide, North America’s most popular manufacturer

of work truck bodies and truck beds. Subsequent to quarter-end, at the ACT Expo, REE presented

the P7-C truck upfitted with a 16-foot Wabash DuraPlate® body, built per Penske’s

requirements. |

Technology:

| ● | P7-C is the first full by-wire truck to achieve U.S. FMVSS and EPA certifications.

P7-C vehicles are now eligible for a U.S. federal tax credit of up to $40,000 per vehicle and are expected to be eligible for over $100,000

of incentives per vehicle with additional state incentives. |

Operations:

| ● | REE

is progressing with its CapEx light manufacturing strategy to achieve bill of materials break-even

in the low hundreds of vehicles. The two-step manufacturing approach involves U.S. assembly

of full vehicles and continued production of REEcorners® at the Company’s

automated Coventry, UK facility, which has an annual capacity of 10,000 vehicle sets. |

| ● | The

tooling investment for the REEcorner® in the UK has been deployed, resulting

in a highly efficient, automated production line consisting of 13 robotic stations, run by

only seven human operators. REEcorners® are built upon customer order,

not inventory, thus optimizing working capital. |

| ● | Financing options are being evaluated to fund scale production of full

vehicles by the end of 2024 and subsequent scaling in 2025 and beyond. Once funding is secured, REE plans to ramp up production in

the U.S. against its order book, in parallel to the completion of the production tooling program. Once the U.S. production tooling

comes online, REE plans to scale production responsibly according to available working capital and demand, with a goal of de-risking execution. |

Financials:

| ● | First quarter GAAP net loss narrowed by 29% QoQ to $25.2 million compared

to $35.2 million in Q4 2023 and narrowed by 12% year-over-year (YoY) compared to $28.6 million in Q1 2023. The YoY decrease was mainly

driven by operational efficiencies implemented, which reduced payroll and related costs and other operational expenses, as well as lower

share-based compensation expenses. These decreases were partially offset by losses from remeasurement of warrants and financial expenses

related to convertible notes as well as an increase in income tax expenses. The decrease compared to the previous quarter was mainly attributed

to the increased non-recurring engineering development costs in Q4 2023. |

| ● | Non-GAAP net loss in the quarter narrowed by 33% QoQ to $21.7 million

compared to $32.2 million in Q4 2023 and narrowed by 10% from $24.0 million in Q1 2023. |

| ● | REE ended Q1 2024 with liquidity of $77.5 million comprised of cash

and cash equivalents and short-term investments, inclusive of a $15 million credit facility. |

| ● | Free cash flow (FCF) burn continued to narrow in Q1 2024, with a 6% reduction

from Q4 2023, consistent with the trend in full year 2023 when REE reported a 25% YoY decrease in FCF burn. |

| ● | During the first quarter, the Company raised approximately $15 million

(gross) in proceeds through a public offering of ordinary shares priced at $6.50 per share. The equity raise was led by M&G Investment

Management Limited, one of Europe’s largest investment firms, a strategic automotive investor, and REE’s largest shareholder.

In addition, from January 2024 through May 30, 2024, the Company issued 54,938 Class A Ordinary Shares under the At the Market Offering

Agreement with H.C. Wainwright & Co., LLC for total gross proceeds of approximately $0.3 million. |

A reconciliation of GAAP to non-GAAP measures has been provided in

the financial statement tables included in this press release. An explanation of these measures is also included below under the heading

“Non-GAAP Financial Measures.”

Non-GAAP Financial Measures

We have provided in this release financial information that has not

been prepared in accordance with Generally Accepted Accounting Principles (GAAP). These non-GAAP financial measures are not based on any

standardized methodology prescribed by GAAP and are not necessarily comparable to similar measures presented by other companies. We use

these non-GAAP financial measures internally in analyzing our financial results and believe they are useful to investors, as a supplement

to GAAP measures, in evaluating our ongoing operational performance. We believe that the use of these non-GAAP financial measures provides

an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing our financial results with

peer companies, many of which present similar non-GAAP financial measures to investors.

Non-GAAP financial measures should not be considered in isolation from,

or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the reconciliation

of these non-GAAP financial measures to their most directly comparable GAAP financial measures provided in the financial statement tables

below.

We believe that adjusted EBITDA, non-GAAP net loss, non-GAAP operating

expenses, non-GAAP basic and diluted net loss per share, reflect additional means of evaluating REE’s ongoing operating results

and trends. We believe that these non-GAAP measures provide useful information about our operating results, enhance the overall understanding

of our past performance and future prospects and allow for greater visibility with respect to key metrics used by our management in its

financial and operational decision-making.

We believe that Free Cash Flow to be a liquidity measure that provides

useful information to management and investors about the amount of cash used in our operational activities and capital expenditures. Free

Cash flow burn represents the negative cash outflow used in our activities as explained above.

REE AUTOMOTIVE LTD.

Condensed Consolidated Statements of Comprehensive Loss

U.S. dollars in thousands

(except share and per share data) (Unaudited)

| | |

Three Months Ended | |

| | |

March 31,

2024 | | |

December 31,

2023 | | |

March 31,

2023 | |

| Revenues | |

$ | 160 | | |

$ | 455 | | |

$ | — | |

| Cost of revenues | |

| 804 | | |

| 913 | | |

| — | |

| Gross loss | |

$ | (644 | ) | |

$ | (458 | ) | |

$ | — | |

| Operating expenses: | |

| | | |

| | | |

| | |

| Research and development expenses, net | |

| 15,358 | | |

| 28,587 | | |

| 18,874 | |

| Selling, general and administrative expenses | |

| 7,170 | | |

| 8,125 | | |

| 10,843 | |

| Total operating expenses | |

| 22,528 | | |

| 36,712 | | |

| 29,717 | |

| Operating loss | |

$ | (23,172 | ) | |

$ | (37,170 | ) | |

$ | (29,717 | ) |

| Income (loss) from warrants remeasurement | |

| (706 | ) | |

| 396 | | |

| — | |

| Financial income, net | |

| 131 | | |

| 341 | | |

| 1,061 | |

| Net loss before income tax | |

| (23,747 | ) | |

| (36,433 | ) | |

| (28,656 | ) |

| Income tax expense (income) | |

| 1,436 | | |

| (1,200 | ) | |

| (34 | ) |

| Net loss | |

$ | (25,183 | ) | |

$ | (35,233 | ) | |

$ | (28,622 | ) |

| Net comprehensive loss | |

$ | (25,183 | ) | |

$ | (35,233 | ) | |

$ | (28,622 | ) |

| Basic and diluted net loss per Class A ordinary share (1) | |

$ | (2.28 | ) | |

$ | (3.44 | ) | |

$ | (2.87 | ) |

| Weighted average number of ordinary shares used in computing basic and diluted net loss per share (1) | |

| 11,023,880 | | |

| 10,236,827 | | |

| 9,961,218 | |

| (1) | On October 18, 2023, the Company effected a reverse share

split of the Company’s Class A ordinary shares and Class B ordinary shares at the ratio of 1-for-30. As a result, all Ordinary

Class A shares, Ordinary Class B shares, options for Ordinary Class A Shares, exercise price and net loss per share amounts were adjusted

retroactively for all periods presented above as if the stock reverse split had been in effect as of the date of these periods. For further

details, see the Company’s Annual Report on Form 20-F filed with the Securities and Exchange Commission (the “SEC”)

on March 27, 2024. |

REE AUTOMOTIVE LTD.

Condensed Consolidated Balance Sheets

U.S. dollars in thousands

(except share and per share data)

| | |

March 31,

2024 | | |

December 31,

2023 | |

| | |

(Unaudited) | | |

(Audited) | |

| ASSETS | |

| | |

| |

| CURRENT ASSETS: | |

| | |

| |

| Cash and cash equivalents | |

$ | 53,612 | | |

$ | 41,232 | |

| Short-term investments | |

| 23,880 | | |

| 44,395 | |

| Accounts receivable | |

| 45 | | |

| 455 | |

| Inventory | |

| 1,500 | | |

| 463 | |

| Other accounts receivable and prepaid expenses | |

| 8,143 | | |

| 6,959 | |

| Total current assets | |

| 87,180 | | |

| 93,504 | |

| | |

| | | |

| | |

| NON-CURRENT ASSETS: | |

| | | |

| | |

| Non-current restricted cash | |

| 3,009 | | |

| 3,008 | |

| Other accounts receivable | |

| 2,348 | | |

| 2,871 | |

| Operating lease right-of-use assets | |

| 20,591 | | |

| 21,418 | |

| Property and equipment, net | |

| 17,113 | | |

| 17,099 | |

| Total non-current assets | |

| 43,061 | | |

| 44,396 | |

| TOTAL ASSETS | |

$ | 130,241 | | |

$ | 137,900 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Short term loan | |

$ | 15,015 | | |

$ | 15,019 | |

| Trade payables | |

| 3,430 | | |

| 3,703 | |

| Other accounts payable and accrued expenses | |

| 12,985 | | |

| 14,046 | |

| Operating lease liabilities | |

| 2,407 | | |

| 2,411 | |

| Total current liabilities | |

| 33,837 | | |

| 35,179 | |

| | |

| | | |

| | |

| NON-CURRENT LIABILITIES: | |

| | | |

| | |

| Warrants liability | |

| 4,106 | | |

| 3,400 | |

| Convertible promissory notes | |

| 5,577 | | |

| 4,806 | |

| Deferred tax liability | |

| 725 | | |

| — | |

| Operating lease liabilities | |

| 15,659 | | |

| 16,440 | |

| Total non-current liabilities | |

| 26,067 | | |

| 24,646 | |

| TOTAL LIABILITIES | |

| 59,904 | | |

| 59,825 | |

| | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY: | |

| | | |

| | |

| Ordinary shares | |

| — | | |

| — | |

| Additional paid-in capital | |

| 931,656 | | |

| 914,211 | |

| Accumulated deficit | |

| (861,319 | ) | |

| (836,136 | ) |

| Total shareholders’ equity | |

| 70,337 | | |

| 78,075 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

$ | 130,241 | | |

$ | 137,900 | |

REE AUTOMOTIVE LTD.

Condensed Consolidated Statements of Cash Flows

U.S. dollars in thousands

(Unaudited)

| | |

Three Months Ended | |

| | |

March 31,

2024 | | |

March 31,

2023 | |

| Cash flows from operating activities: | |

| | |

| |

| | |

| | |

| |

| Net loss | |

$ | (25,183 | ) | |

$ | (28,622 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation | |

| 813 | | |

| 483 | |

| Accretion income on short-term investments | |

| — | | |

| (328 | ) |

| Share-based compensation | |

| 2,823 | | |

| 4,658 | |

| Change in fair value of warrants liability | |

| 706 | | |

| — | |

| Change in fair value of derivative liability | |

| 441 | | |

| — | |

| Amortization of convertible promissory note | |

| 112 | | |

| — | |

| Interest expenses | |

| 215 | | |

| — | |

| Decrease in accrued interest on short-term investments | |

| 515 | | |

| 171 | |

| Increase in inventory | |

| (1,037 | ) | |

| — | |

| Decrease in accounts receivable | |

| 410 | | |

| — | |

| Increase in other accounts receivable and prepaid expenses | |

| (661 | ) | |

| (806 | ) |

| Change in operating lease right-of-use assets and liabilities, net | |

| 42 | | |

| (293 | ) |

| Decrease in trade payables | |

| (235 | ) | |

| (944 | ) |

| Decrease in other accounts payable and accrued expenses | |

| (911 | ) | |

| (780 | ) |

| Increase in deferred tax liability, net | |

| 725 | | |

| — | |

| Other | |

| — | | |

| 31 | |

| Net cash used in operating activities | |

| (21,225 | ) | |

| (26,430 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Purchase of property and equipment | |

| (865 | ) | |

| (1,269 | ) |

| Purchases of short-term investments | |

| — | | |

| (22,364 | ) |

| Proceeds from short-term investments | |

| 20,000 | | |

| 55,100 | |

| Net cash provided by investing activities | |

| 19,135 | | |

| 31,467 | |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Proceeds from issuance of ordinary shares, net | |

| 14,471 | | |

| — | |

| Proceeds from exercise of options and warrants | |

| — | | |

| 68 | |

| Repayment of short term loan | |

| (15,000 | ) | |

| — | |

| Proceeds from short term loan | |

| 15,000 | | |

| — | |

| Net cash provided by financing activities | |

| 14,471 | | |

| 68 | |

| | |

| | | |

| | |

| Increase in cash, cash equivalents and restricted cash | |

| 12,381 | | |

| 5,105 | |

| Cash, cash equivalents and restricted cash at beginning of year | |

| 44,240 | | |

| 59,925 | |

| Cash, cash equivalents and restricted cash at end of period | |

$ | 56,621 | | |

$ | 65,030 | |

Reconciliation of GAAP Financial Metrics to Non-GAAP

U.S. dollars in thousands

(except share and per share data)

(Unaudited)

Reconciliation of Net Loss to Adjusted EBITDA

| | |

Three Months Ended | |

| | |

Mar 31,

2024 | | |

Dec 31,

2023 | | |

Mar 31,

2023 | |

| Net Loss on a GAAP Basis | |

$ | (25,183 | ) | |

$ | (35,233 | ) | |

$ | (28,622 | ) |

| Financial income, net | |

| (131 | ) | |

| (341 | ) | |

| (1,061 | ) |

| Income tax expense (income) | |

| 1,436 | | |

| (1,200 | ) | |

| (34 | ) |

| Loss (income) from warrants remeasurement | |

| 706 | | |

| (396 | ) | |

| — | |

| Depreciation, amortization and accretion | |

| 1,640 | | |

| 1,541 | | |

| 1,060 | |

| Share-based compensation | |

| 2,823 | | |

| 3,388 | | |

| 4,658 | |

| Adjusted EBITDA | |

$ | (18,709 | ) | |

$ | (32,241 | ) | |

$ | (23,999 | ) |

Reconciliation of net cash used in operating activities to Free

Cash Flow

| | |

Three Months Ended | |

| | |

Mar 31,

2024 | | |

Dec 31,

2023 | | |

Mar 31,

2023 | |

| Net cash used in operating activities | |

| (21,225 | ) | |

| (23,084 | ) | |

| (26,430 | ) |

| Purchase of property and equipment | |

| (865 | ) | |

| (392 | ) | |

| (1,269 | ) |

| Free Cash Flow | |

| (22,090 | ) | |

| (23,476 | ) | |

| (27,699 | ) |

Reconciliation of GAAP operating expenses to

Non-GAAP operating expenses; GAAP net loss to Non-GAAP net loss, and presentation of Non-GAAP net loss per Share, basic and diluted:

| | |

Three Months Ended | |

| | |

Mar 31,

2024 | | |

Dec 31,

2023 | | |

Mar 31,

2023 | |

| GAAP operating expenses | |

| 22,528 | | |

| 36,712 | | |

| 29,717 | |

| Share-based compensation | |

| (2,823 | ) | |

| (3,388 | ) | |

| (4,658 | ) |

| Non-GAAP operating expenses | |

| 19,705 | | |

| 33,324 | | |

| 25,059 | |

| | |

| | | |

| | | |

| | |

| GAAP net loss | |

| (25,183 | ) | |

| (35,233 | ) | |

| (28,622 | ) |

| Loss (income) from warrants remeasurement | |

| 706 | | |

| (396 | ) | |

| — | |

| Share-based compensation | |

| 2,823 | | |

| 3,388 | | |

| 4,658 | |

| Non-GAAP net loss | |

$ | (21,654 | ) | |

$ | (32,241 | ) | |

$ | (23,964 | ) |

| | |

| | | |

| | | |

| | |

| Weighted average number of ordinary shares used in computing basic and diluted net loss per share (1) | |

| 11,023,880 | | |

| 10,236,827 | | |

| 9,961,218 | |

| Non-GAAP basic and diluted net loss per share (1) | |

$ | (1.96 | ) | |

$ | (3.15 | ) | |

$ | (2.41 | ) |

| (1) | On October 18, 2023, the Company effected a reverse share

split of the Company’s Class A ordinary shares and Class B ordinary shares at the ratio of 1-for-30. As a result, all Ordinary

Class A shares, Ordinary Class B shares, options for Ordinary Class A Shares, exercise price and net loss per share amounts were adjusted

retroactively for all periods presented above as if the stock reverse split had been in effect as of the date of these periods. For further

details, see the Company’s Annual Report on Form 20-F filed with SEC on March 27, 2024. |

To learn more about REE Automotive’s patented technology and

unique value proposition that position the company to break new ground in e-mobility, visit www.ree.auto.

About REE Automotive

REE Automotive (Nasdaq: REE) is an automotive

technology company that allows companies to build electric vehicles of various shapes and sizes on their modular platforms. With complete

design freedom, vehicles Powered by REE® are equipped with the revolutionary REEcorner®, which packs critical

vehicle components (steering, braking, suspension, powertrain and control) into a single compact module positioned between the chassis

and the wheel. As the first company to FMVSS certify a full by-wire vehicle in the U.S., REE’s proprietary by-wire technology for

drive, steer and brake control eliminates the need for mechanical connection. Using four identical REEcorners® enables

REE to make the industry’s flattest EV platforms with more room for passengers, cargo and batteries. REE platforms are future proofed,

autonomous capable, offer a low total cost of ownership (TCO), and drastically reduce the time to market for fleets looking to electrify.

To learn more visit www.ree.auto.

Media Contact

Malory Van Guilder

Skyya PR for REE Automotive

+1 651-335-0585

ree@skyya.com

Investor Contact

Dana Rubinstein

Chief Strategy Officer | REE Automotive

investors@ree.auto

Caution About Forward-Looking Statements

This communication includes certain forward-looking

statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements

include, but are not limited to, statements regarding REE or its management team’s expectations, hopes, beliefs, intentions or

strategies regarding the future. For example, REE is using forward-looking statements when it discusses that its REEcorner®

technology uniquely positions it in a lucrative portion of the commercial EV value chain, the growing demand to adopt its REEcorner®

technology and products, its outlook that deliveries are expected to grow to the low thousands of vehicles in 2025, working

up to a cumulative delivery goal of approximately 6,000 vehicles by the end of 2026, putting it in a position for positive cash flow,

access to a potential of 200 fleets across North America, benefits and advantages of REE trucks, that P7-C vehicles are expected to be

eligible for over $100,000 of incentives per vehicle with additional state credits, that it is evaluating its financing options to fund

the scaling of production of full vehicles by the end of 2024, its planned subsequent scaling in 2025 and beyond, that once funding is

secured, and that once U.S. production tooling comes online, that it plans to ramp up production responsibly according to available working

capital and demand, with a goal of de-risking execution. In addition, any statements that refer to plans, projections, forecasts or other

characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words

“aim” “anticipate,” “appear,” “approximate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “foresee,” “intends,” “may,” “might,”

“plan,” “possible,” “potential,” “predict,” “project,” “seek,”

“should,” “would”, “designed,” “target” and similar expressions (or the negative version

of such words or expressions) may identify forward-looking statements, but the absence of these words does not mean that a statement

is not forward-looking. All statements, other than statements of historical facts, may be forward-looking statements. Forward-looking

statements in this communication may include, among other things, statements about REE’s strategic and business plans, technology,

relationships and objectives, including its ability to meet certification requirements, the impact of trends on and interest in our business,

or product, intellectual property, REE’s expectation for growth, and its future results, operations and financial performance and

condition.

These forward-looking statements are based on REE’s current expectations

and assumptions about future events and are based on currently available information as of the date of this communication and current

expectations, forecasts, and assumptions. Although REE believes that the expectations reflected in forward-looking statements are reasonable,

such statements involve an unknown number of risks, uncertainties, judgments, and other factors that may cause our actual results, performance

or achievements to be materially different from any future results, performance or achievements expressed or implied by forward-looking

statements. These factors are difficult to predict accurately and may be beyond REE’s control. Forward-looking statements in this

communication speak only as of the date made and REE undertakes no obligation to update its forward-looking statements, whether as a result

of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other

applicable laws. In light of these risks and uncertainties, investors should keep in mind that results, events or developments discussed

in any forward-looking statement made in this communication may not occur.

Uncertainties and risk factors that could affect REE’s future

performance and could cause actual results to differ include, but are not limited to: REE’s ability to commercialize its strategic

plan, including its plan to successfully evaluate, obtain regulatory approval, produce and market its P7 lineup; REE’s ability to

maintain and advance relationships with current Tier 1 suppliers and strategic partners; development of REE’s advanced prototypes

into marketable products; REE’s ability to grow and scale manufacturing capacity through relationships with Tier 1 suppliers; REE’s

estimates of unit sales, expenses and profitability and underlying assumptions; REE’s reliance on its UK Engineering Center of Excellence

for the design, validation, verification, testing and homologation of its products; REE’s limited operating history; risks associated

with building out of REE’s supply chain; risks associated with plans for REE’s initial commercial production; REE’s

dependence on potential suppliers, some of which will be single or limited source; development of the market for commercial EVs; risks

associated with data security breach, failure of information security systems and privacy concerns; risks related to lack of compliance

with Nasdaq’s minimum bid price requirement; future sales of our securities by existing material shareholders or by us could cause

the market price for the Class A Ordinary Shares to decline; potential disruption of shipping routes due to accidents, political events,

international hostilities and instability, piracy or acts by terrorists; intense competition in the e-mobility space, including with competitors

who have significantly more resources; risks related to the fact that REE is incorporated in Israel and governed by Israeli law; REE’s

ability to make continued investments in its platform; the impact of the COVID-19 pandemic, interest rate changes, the ongoing conflict

between Ukraine and Russia and any other worldwide health epidemics or outbreaks that may arise and adverse global conditions, including

macroeconomic and geopolitical uncertainty; the global economic environment, the general market, political and economic conditions in

the countries in which we operate; the ongoing military conflict in Israel; fluctuations in interest rates and foreign exchange rates;

the need to attract, train and retain highly-skilled technical workforce; changes in laws and regulations that impact REE; REE’s

ability to enforce, protect and maintain intellectual property rights; REE’s ability to retain engineers and other highly qualified

employees to further its goals; and other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary

Note Regarding Forward-Looking Statements” in REE’s annual report filed with the U.S. Securities and Exchange Commission (the

“SEC”) on March 27, 2024 and in subsequent filings with the SEC.

3

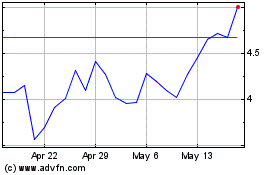

REE Automotive (NASDAQ:REE)

Historical Stock Chart

From Nov 2024 to Dec 2024

REE Automotive (NASDAQ:REE)

Historical Stock Chart

From Dec 2023 to Dec 2024