- Increased offer price to $3.65 per share, a $0.55 per share

increase

- Improved offer unanimously approved by Revance Board of

Directors

- Crown to extend tender offer until 11:59 p.m., Eastern Time, on

February 4, 2025

- Crown’s offer is the only fully-financed offer currently

available to Revance’s stockholders

- Outside termination date under the A&R Merger Agreement is

February 7, 2025

Crown Laboratories, Inc. (“Crown”) and Revance Therapeutics,

Inc. (NASDAQ: RVNC) (“Revance”), today announced that, on January

17, 2025, they amended their previously announced Amended and

Restated Merger Agreement (the “Second Amendment,” together with

the Amended and Restated Merger Agreement, dated December 7, 2024,

the “A&R Merger Agreement”).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250121493847/en/

Under the terms of the Second Amendment, which has been

unanimously approved by the Revance Board of Directors, Revance’s

stockholders will receive $3.65 per share of common stock, par

value $0.001 per share (each, a “Share”) in cash, without interest

and less any applicable tax withholding, representing $0.55 or 17%

per share more than the prior offer price. Crown will extend its

existing tender offer for all of Revance’s outstanding Shares until

one minute past 11:59 p.m., Eastern Time, on February 4, 2025.

“We are pleased to have reached this agreement with Crown which

increases value for our stockholders while also providing them with

deal certainty,” said Mark J. Foley, Chief Executive Officer of

Revance. “After a robust process, our Board concluded that Crown’s

offer represented the best outcome for our stockholders. Crown’s

offer is the only fully-financed offer currently available to

Revance’s stockholders, and we recommend they tender their shares

in support of the transaction.”

“Our improved and fully-financed offer provides a meaningful

increase in the consideration paid to Revance’s stockholders, and

we are pleased that the Revance Board of Directors has unanimously

endorsed it,” said Jeff Bedard, founder and Chief Executive Officer

of Crown. “We look forward to closing the transaction in short

order so we can bring the companies together and continue working

on our important mission.”

Transaction and Tender Offer Details

The Crown transaction, which has been unanimously recommended by

Revance’s Board of Directors, is the only fully-financed offer that

Revance has received since the parties initially entered into the

original merger agreement on August 11, 2024, and in the more than

six weeks since the parties entered into the Amended and Restated

Merger Agreement on December 7, 2024.

Crown’s tender offer, which was previously scheduled to expire

one minute past 11:59 p.m., Eastern Time, on January 28, 2025, has

been extended until one minute past 11:59 p.m., Eastern Time, on

February 4, 2025, unless the tender offer is further extended or

earlier terminated. Subject to customary closing conditions,

including the tender of more than 50% of the Shares into the tender

offer, the transaction is expected to close by February 6,

2025.

The outside termination date for the A&R Merger Agreement

(as amended by the Second Amendment) remains February 7, 2025.

Crown does not intend to extend the outside termination date of the

A&R Merger Agreement. There is not sufficient time for a third

party to consummate a tender offer for the Shares prior to February

7, 2025, at which time the Crown offer will have lapsed due to the

outside termination date.

Computershare Trust Company, N.A., the depositary and paying

agent for the tender offer, has advised Crown that, as of 4:00

p.m., Eastern time, on January 17, 2025, approximately 6,322,768

Shares have been validly tendered and not properly withdrawn in the

tender offer, representing approximately 6.025% of the issued and

outstanding Shares, as of such date and time. Holders that have

previously tendered their Shares do not need to re-tender their

Shares or take any other action in response to the extension of the

tender offer.

The tender offer continues to be subject to the remaining

conditions set forth in the Offer to Purchase that Crown and its

acquisition subsidiary filed with the Securities and Exchange

Commission (“SEC”), as amended or supplemented from time to time.

Complete terms and conditions of the tender offer can be found in

the Offer to Purchase, the Letter of Transmittal, and certain other

materials contained in the tender offer statement on Schedule TO

originally filed with the U.S. SEC on December 12, 2024 by Crown

and its acquisition subsidiary, as amended and as may be further

amended from time to time, and are available at www.sec.gov. Except

as described in this press release, the terms of the tender offer

remain the same as set forth in the Offer to Purchase, the Letter

of Transmittal, in each case, as amended.

Advisors

Centerview Partners LLC is serving as exclusive financial

advisor for Revance; Skadden, Arps, Slate, Meagher & Flom LLP

is serving as legal advisor for Revance.

Leerink Partners and PJT Partners are serving as financial

advisors to Crown; Kirkland & Ellis LLP and Lowenstein Sandler

LLP are serving as legal advisors to Crown.

About Crown

Crown, a privately held, fully integrated global skincare

company, is committed to developing and providing a diverse

portfolio of aesthetic, premium and therapeutic skincare products

that improve the quality of life for its consumers throughout their

skincare journey. An innovative company focused on skin science for

life, Crown’s unyielding pursuit of delivering therapeutic

excellence and enhanced patient outcomes is why it has become a

leader in Dermatology and Aesthetics. Crown has been listed on the

Inc. 5000 Fastest Growing Privately Held Companies List for 11

years and has expanded its distribution to over 50 countries. For

more information, visit www.crownlaboratories.com.

The “Crown” logo, PanOxyl and Blue Lizard are registered

trademarks of Crown Laboratories, Inc. SkinPen and StriVectin are

registered trademarks of Bellus Medical, LLC and StriVectin

Operating Company, Inc., respectively.

About Revance

Revance is a biotechnology company setting the new standard in

healthcare with innovative aesthetic and therapeutic offerings that

enhance patient outcomes and physician experiences. Revance’s

portfolio includes DAXXIFY (DaxibotulinumtoxinA-lanm) for injection

and the RHA Collection of dermal fillers. RHA® technology is

proprietary to and manufactured in Switzerland by Teoxane SA.

Revance has partnered with Teoxane SA to supply HA fillers for U.S.

distribution. Revance has also partnered with Viatris Inc. to

develop a biosimilar to onabotulinumtoxinA for injection and

Shanghai Fosun Pharmaceutical to commercialize DAXXIFY in China.

Revance’s global headquarters and experience center are located in

Nashville, Tennessee. Learn more at Revance.com,

RevanceAesthetics.com, DAXXIFY.com,

HCP.DAXXIFYCervicalDystonia.com, or connect with us on

LinkedIn.

“Revance,” the Revance logo, and DAXXIFY are registered

trademarks of Revance Therapeutics, Inc. Resilient Hyaluronic Acid®

and RHA are trademarks of TEOXANE SA.

Additional Information and Where to Find It

In connection with its proposed acquisition of Revance, Crown

caused its acquisition subsidiary to commence a tender offer to

acquire all outstanding Shares of Revance. This communication is

for informational purposes only and is not an offer to buy nor a

solicitation of an offer to sell any securities of Revance, nor is

it a substitute for the tender offer materials that Crown and its

acquisition subsidiary filed with the SEC upon commencement of the

tender offer. A solicitation and offer to buy all outstanding

Shares of Revance is only being made pursuant to the tender offer

statement on Schedule TO, including an offer to purchase, a letter

of transmittal and other related materials that Crown and its

acquisition subsidiary have filed with the SEC. In addition,

Revance has filed with the SEC a Solicitation/Recommendation

Statement on Schedule 14D-9 with respect to the tender offer.

THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A

RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER

DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE

PARTIES THERETO. INVESTORS AND STOCKHOLDERS OF REVANCE ARE URGED TO

READ THESE DOCUMENTS CAREFULLY (AS EACH MAY BE AMENDED OR

SUPPLEMENTED FROM TIME TO TIME) BECAUSE THEY CONTAIN IMPORTANT

INFORMATION THAT INVESTORS AND STOCKHOLDERS OF REVANCE SHOULD

CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR

SHARES OF COMMON STOCK IN THE TENDER OFFER.

Investors may obtain a free copy of these materials (including

the tender offer statement, Offer to Purchase and a related Letter

of Transmittal, as well as the Solicitation/Recommendation

Statement) and other documents filed by Crown and Revance with the

SEC at the website maintained by the SEC at www.sec.gov. Investors

may also obtain, at no charge, any such documents filed with or

furnished to the SEC by Revance under the “News” section of

Revance’s website at www.revance.com. The information contained in,

or that can be accessed through, Revance’s or Crown’s website is

not a part of, or incorporated by reference herein.

Forward-Looking Statements

Certain statements contained in this press release are

“forward-looking statements.” The use of words such as

“anticipates,” “hopes,” “may,” “should,” “intends,” “projects,”

“estimates,” “expects,” “plans” and “believes,” among others,

generally identify forward-looking statements. All statements,

other than statements of historical fact, are forward-looking

statements. These forward-looking statements include, among others,

statements relating to Revance’s and Crown’s future financial

performance, business prospects and strategy, expectations with

respect to the tender offer and the anticipated merger, including

the timing thereof and Revance’s and Crown’s ability to

successfully complete such transactions and realize the anticipated

benefits. Actual results could differ materially from those

contained in these forward-looking statements for a variety of

reasons, including, among others, the risks and uncertainties

inherent in the tender offer and the anticipated merger, including,

among other things, regarding how many of Revance’s stockholders

will tender their Shares in the tender offer, the possibility that

competing offers will be made, the ability to obtain requisite

regulatory approvals, the ability to satisfy the conditions to the

closing of the tender offer and the anticipated merger, the

expected timing of the tender offer and the anticipated merger, the

possibility that the anticipated merger will not be completed,

difficulties or unanticipated expenses in connection with

integrating the parties’ operations, products and employees and the

possibility that anticipated synergies and other anticipated

benefits of the transaction will not be realized in the amounts

expected, within the expected timeframe or at all, the effect of

the tender offer and the anticipated merger on Revance’s and

Crown’s business relationships (including, without limitations,

partners and customers), the occurrence of any event, change or

other circumstances that could give rise to the termination of the

Merger Agreement, the expected tax treatment of the transaction,

and the impact of the transaction on the businesses of Revance and

Crown, and other circumstances beyond Revance’s and Crown’s

control. You should not place undue reliance on these

forward-looking statements. Certain of these and other risks and

uncertainties are discussed in Revance’s and Crown’s filings with

the SEC, including the Schedule TO (including the offer to

purchase, a related letter of transmittal and related documents)

Crown and its acquisition subsidiary have filed with the SEC, and

the Solicitation/Recommendation Statement on Schedule 14D-9 the

Company has filed with the SEC, and Revance’s most recent Form 10-K

and Form 10-Q filings with the SEC. Except as required by law,

neither Revance nor Crown undertakes any duty to update

forward-looking statements to reflect events after the date of this

press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250121493847/en/

Media: Alecia Pulman/Brittany Fraser ICR

Crown@icrinc.com

Investors: Laurence Watts NewStreet

laurence@newstreetir.com

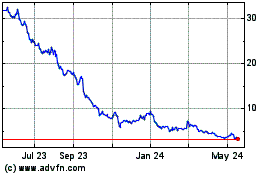

Revance Therapeutics (NASDAQ:RVNC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Revance Therapeutics (NASDAQ:RVNC)

Historical Stock Chart

From Jan 2024 to Jan 2025