false

--12-31

0001017491

0001017491

2024-09-25

2024-09-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 25, 2024

Seelos Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

000-22245 |

|

87-0449967 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| 300

Park Avenue, 2nd Floor,

New York, NY |

|

10022 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (646) 293-2100

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities Registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.001 par value |

SEEL |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 3.03.

Material Modification to Rights of Security Holders.

To

the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 herein is incorporated by reference into this

Item 3.03.

Item 5.03. Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On

September 24, 2024, Seelos Therapeutics, Inc. (the “Company”) filed a Certificate of Change (the “Certificate of

Change”) with the Secretary of State of the State of Nevada to (i) effect a 1-for-16 reverse stock split (the “Reverse

Stock Split”) of the Company’s issued and outstanding shares of common stock, par value $0.001 per share (the “Common

Stock”), and (ii) decrease the number of total authorized shares of Common Stock from 50,000,000 shares to 3,125,000 shares.

As

a result of the Reverse Stock Split, every sixteen (16) shares of the Company’s pre-Reverse Stock Split Common Stock will be

combined into one (1) share of the Company’s post-Reverse Stock Split Common Stock, without any change in par value per share.

Proportionate voting rights and other rights of common stock holders will not be affected by the Reverse Stock Split. No fractional shares

will be issued in connection with the Reverse Stock Split, and fractional shares resulting from the Reverse Stock Split will be rounded

up to the nearest whole share.

The

Reverse Stock Split is intended for the Company to regain compliance with the minimum bid price requirement of $1.00 per share of common

stock for continued listing on the Nasdaq Capital Market. The Reverse Stock Split is expected to be effective at 12:01 a.m., Eastern Time,

on September 27, 2024, and the Company’s common stock is expected to begin trading on a Reverse Stock Split-adjusted basis on the

Nasdaq Capital Market at the opening of the market on September 27, 2024. The trading symbol for the common stock will remain “SEEL,”

and the new CUSIP number of the Company’s common stock following the Reverse Stock Split is 81577F 406.

The Company’s

transfer agent, Equiniti Trust Company, LLC, is acting as the exchange agent for the Reverse Stock Split.

In

addition, the Reverse Stock Split will apply to the Company’s common stock issuable upon the exercise of the Company’s outstanding

warrants and stock options, with proportionate adjustments to be made to the exercise prices thereof, as applicable. Furthermore, the

number of shares of common stock available for issuance under the Company’s equity incentive plans will be proportionately adjusted

for the Reverse Stock Split ratio, such that fewer shares will be subject to such plans.

The

summary of the Certificate of Change does not purport to be complete and is qualified in its entirety by reference to the full text of

the Certificate of Change, a copy of which is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

Item 7.01.

Regulation FD Disclosure.

On

September 25, 2024 the Company issued a press release annpuncing the Reverse Stock Split. A copy of the press release is furnished herewith

as Exhibit 99.1 to this Current Report on Form 8-K (this “Form 8-K”) and is incorporated herein by reference.

The

information contained in this Item 7.01 and Exhibit 99.1 furnished as part of Item 9.01 of this Form 8-K is being furnished and shall

not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange

Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any registration

statement or other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by

specific reference to such filing.

Safe

Harbor

This

Form 8-K contains express or implied “forward-looking statements” within the meaning of the “safe harbor” provisions

of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “target,”

“believe,” “expect,” “will,” “may,” “anticipate,” “estimate,”

“would,” “positioned,” “future,” and other similar expressions that predict or indicate future events

or trends or that are not statements of historical matters. For example, when the Compnay discusses the effective date for the Reverse

Stock Split and the date that trading of the common stock on a Reverse Stock Split-adjusted basis on the Nasdaq Capital Market will begin,

it is using forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance.

Instead, they are based only on the Compnay’s management’s current beliefs, expectations and assumptions. Because forward-looking

statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to

predict and many of which are outside of the Company’s control. Therefore, investors should not rely on any of these forward-looking

statements and should review the risks and uncertainties described under the caption “Risk Factors” in the Compnya’s

most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission

(the “SEC”), and additional disclosures the Company makes in its other filings with the SEC, which are available on the SEC’s

website at www.sec.gov. Forward-looking statements are made as of the date of this Form 8-K, and except as provided by law, the Compnay

expressly disclaims any obligation or undertaking to update forward-looking statements.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Seelos Therapeutics, Inc. |

| |

|

| Date: September 25, 2024 |

By: |

/s/ Michael Golembiewski |

| |

|

Name: Michael Golembiewski |

| |

|

Title: Chief Financial Officer |

Exhibit 3.1

Exhibit 99.1

Seelos Therapeutics Announces 1-for-16 Reverse

Stock Split

NEW YORK, September 25, 2024 /PRNewswire/

-- Seelos Therapeutics, Inc. (Nasdaq: SEEL) ("Seelos" or the "Company"), a clinical-stage biopharmaceutical

company focused on the development of therapies for central nervous system disorders and rare diseases, today announced that its Board

of Directors approved a 1-for-16 reverse stock split of its outstanding shares of common stock, to be effective as of 12:01 a.m.

Eastern Time on Friday, September 27, 2024.

The Company's common stock, par value $0.001,

will begin trading on a reverse stock split-adjusted basis at the opening of the market on Friday, September 27, 2024. Following

the reverse stock split, the Company's common stock will continue to trade on the Nasdaq Capital Market under the symbol "SEEL"

with the new CUSIP number, 81577F 406. The reverse stock split is intended for the Company to regain compliance with the minimum bid

price requirement of $1.00 per share of common stock for continued listing on the Nasdaq Capital Market. The reverse stock

split was approved by the Company’s Board of Directors pursuant to Section 78.207 of the Nevada Revised Statutes and was effectuated

by the filing of a Certificate of Change with office of the Nevada Secretary of State.

At the effective time of the reverse split, every

sixteen (16) issued and outstanding shares of the Company's common stock will be combined automatically into one (1) share of the Company's

common stock without any change in the par value per share. No fractional shares will be issued in connection with the reverse stock

split, and any fractional shares resulting from the reverse stock split will be rounded up to the nearest whole share. The reverse stock

split will reduce the number of authorized shares of the Company's common stock from 50,000,000 shares to 3,125,000 shares and the ownership

percentage of each stockholder will remain unchanged other than as a result of the rounding of fractional shares. In addition, the reverse

stock split will apply to the Company's common stock issuable upon the exercise of the Company's outstanding warrants and stock options,

with proportionate adjustments to be made to the exercise prices thereof and under the Company's equity incentive plans, as applicable.

The reverse stock split will reduce the number

of issued and outstanding shares of the Company's common stock from approximately 9.2 million to approximately 581 thousand.

About Seelos Therapeutics:

Seelos Therapeutics, Inc. is a clinical-stage

biopharmaceutical company focused on the development and advancement of novel therapeutics to address unmet medical needs for the benefit

of patients with central nervous system (CNS) disorders and other rare diseases. The Company's robust portfolio includes several late-stage

clinical assets targeting indications including Acute Suicidal Ideation and Behavior (ASIB) in Major Depressive Disorder (MDD), amyotrophic

lateral sclerosis (ALS) and spinocerebellar ataxia (SCA), as well as early-stage programs in Huntington's disease, Alzheimer's

disease, and Parkinson's disease.

Forward-Looking Statements:

Statements made in this press release, which

are not historical in nature, constitute forward-looking statements for purposes of the safe harbor provided by the Private Securities

Litigation Reform Act of 1995. These statements include, among others, those regarding the reverse stock split and the timing thereof,

the potential impact of the reverse split on the bid price of the Company's common stock, the potential for the Company to regain compliance

with the minimum bid price requirement of $1.00 per share of common stock for continued listing on the Nasdaq Capital Market

and the expected number of shares of common stock to be outstanding following the reverse stock split. These statements are based on

our current expectations and beliefs and are subject to a number of factors and uncertainties that could cause actual results to differ

materially from those described in the forward-looking statements. The risks and uncertainties involved include those associated with

general economic and market conditions, as well as other risk factors and matters set forth in our periodic filings with the SEC, including

our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. Although we believe that the expectations

reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. You are cautioned

not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, even if subsequently made available

by us on our website or otherwise. We do not undertake any obligation to update, amend or clarify these forward-looking statements, whether

as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Contact Information

Anthony Marciano

Chief Communications Officer

Seelos Therapeutics, Inc. (Nasdaq: SEEL)

300 Park Avenue, 2nd Floor

New York, NY 10022

(646) 293-2136

anthony.marciano@seelostx.com

Mike Moyer

Managing Director

LifeSci Advisors, LLC

250 West 55th St., Suite 3401

New York, NY 10019

(617) 308-4306

mmoyer@lifesciadvisors.com

v3.24.3

Cover

|

Sep. 25, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 25, 2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

000-22245

|

| Entity Registrant Name |

Seelos Therapeutics, Inc.

|

| Entity Central Index Key |

0001017491

|

| Entity Tax Identification Number |

87-0449967

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

300

Park Avenue

|

| Entity Address, Address Line Two |

2nd Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10022

|

| City Area Code |

646

|

| Local Phone Number |

293-2100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

SEEL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

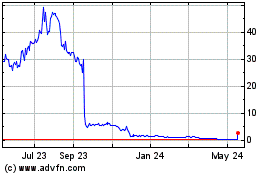

Seelos Therapeutics (NASDAQ:SEEL)

Historical Stock Chart

From Nov 2024 to Dec 2024

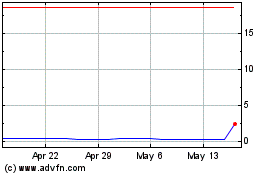

Seelos Therapeutics (NASDAQ:SEEL)

Historical Stock Chart

From Dec 2023 to Dec 2024