Silicon Motion Announces Annual Cash Dividend Payable Quarterly

October 28 2024 - 7:00AM

Silicon Motion Technology Corporation (NasdaqGS: SIMO)(“Silicon

Motion” or the “Company”), a global leader in designing and

marketing NAND flash controllers for solid state storage devices,

announces today its annual cash dividend of $2.00 per ADS.

The Board of Directors of the Company has declared an annual

dividend of $2.00 per ADS1,2 which will be paid in four quarterly

installments of $0.50 per ADS3 according to the following

anticipated record and payment dates:

| Record Date |

Payment Date |

| November 14, 2024 |

November 27, 2024 |

| February 13, 2025 |

February 27, 2025 |

| May 8, 2025 |

May 22, 2025 |

| August 7, 2025 |

August 21, 2025 |

| |

|

The Company’s depository bank’s DR books will be closed for

issuance and cancellation on each of the record dates.

“Silicon Motion’s business outlook and our ability to generate

free cash flow remains strong. Our focus continues to be in

distributing a meaningful portion of this to our shareholders as

dividend,” said Wallace Kou, President and CEO of Silicon

Motion.

The payment of the annual dividend to be paid in quarterly

installments will be made according to the anticipated record and

payment dates unless subsequently changed by the Board. The

declaration and payment of future cash dividends is subject to the

Board's continuing determination that the payment of dividends is

in the best interests of the Company’s shareholders and is in

compliance with all laws and agreements of the Company applicable

to the declaration and payment of cash dividends.

ABOUT SILICON MOTION:

We are the global leader in supplying NAND flash

controllers for solid state storage devices. We supply more

SSD controllers than any other company in the world for servers,

PCs and other client devices and are the leading merchant supplier

of eMMC and UFS embedded storage controllers used in smartphones,

IoT devices and other applications. We also supply customized

high-performance hyperscale data center and specialized industrial

and automotive SSD solutions. Our customers include most of

the NAND flash vendors, storage device module makers and leading

OEMs. For further information on Silicon Motion, visit us at

www.siliconmotion.com.

FORWARD-LOOKING STATEMENTS:

This press release contains “forward-looking

statements” within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. In some cases, you can

identify forward-looking statements by terminology such as “may,”

“will,” “should,” “expect,” “intend,” “plan,” “anticipate,”

“believe,” “estimate,” “predict,” “potential,” “continue,” or the

negative of these terms or other comparable terminology. Although

such statements are based on our own information and information

from other sources we believe to be reliable, you should not place

undue reliance on them. These statements involve risks and

uncertainties, and actual market trends or our actual results of

operations, financial condition or business prospects may differ

materially from those expressed or implied in these forward-looking

statements for a variety of reasons. Potential risks and

uncertainties include, but are not limited to the unpredictable

volume and timing of customer orders, which are not fixed by

contract but vary on a purchase order basis; the loss of one or

more key customers or the significant reduction, postponement,

rescheduling or cancellation of orders from one or more customers;

general economic conditions or conditions in the semiconductor or

consumer electronics markets; the impact of inflation on our

business and customer’s businesses and any effect this has on

economic activity in the markets in which we operate; the

functionalities and performance of our information technology

(“IT”) systems, which are subject

to cybersecurity threats and which support our critical

operational activities, and any breaches of our IT systems or those

of our customers, suppliers, partners and providers of third-party

licensed technology; the effects on our business and our customer’s

business taking into account the

ongoing U.S.-China tariffs and trade disputes; the

uncertainties associated with any future global or regional

pandemic; the continuing tensions between Taiwan and China

including enhanced military activities; decreases in the overall

average selling prices of our products; changes in the relative

sales mix of our products; changes in our cost of finished goods;

supply chain disruptions that have affected us and our industry as

well as other industries on a global basis; the payment,

or non-payment, of cash dividends in the future at the

discretion of our board of directors and any announced planned

increases in such dividends; changes in our cost of finished goods;

the availability, pricing, and timeliness of delivery of other

components and raw materials used in the products we sell given the

current raw material supply shortages being experienced in our

industry; our customers’ sales outlook, purchasing patterns, and

inventory adjustments based on consumer demands and general

economic conditions; any potential impairment charges that may be

incurred related to businesses previously acquired or divested in

the future; our ability to successfully develop, introduce, and

sell new or enhanced products in a timely manner; and the timing of

new product announcements or introductions by us or by our

competitors. For additional discussion of these risks and

uncertainties and other factors, please see the documents we file

from time to time with the U.S. Securities and Exchange

Commission, including our Annual Report on

Form 20-F filed with the U.S. Securities and Exchange

Commission on April 30, 2024. Other than as required under the

securities laws, we do not intend, and do not undertake any

obligation to, update or revise any forward-looking statements,

which apply only as of the date of this press release.

|

Investor Contact: |

Investor Contact: |

| Tom Sepenzis |

Selina Hsieh |

| Senior Director of IR & Strategy |

Investor Relations |

| E-mail: tsepenzis@siliconmotion.com |

E-mail: ir@siliconmotion.com |

_________________

1 One ADS is equivalent to four ordinary shares.2 $2.00 per ADS

is equivalent to $0.50 per ordinary share.3 $0.50 per ADS is

equivalent to $0.125 per ordinary share.

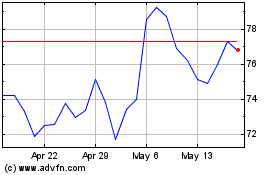

Silicon Motion Technology (NASDAQ:SIMO)

Historical Stock Chart

From Jan 2025 to Feb 2025

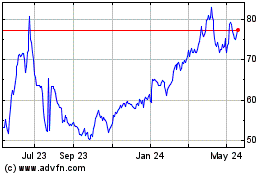

Silicon Motion Technology (NASDAQ:SIMO)

Historical Stock Chart

From Feb 2024 to Feb 2025