Twin Disc, Inc. (NASDAQ: TWIN) today reported

results for the fourth quarter and full fiscal year 2024 ended June

30, 2024.

Fiscal Full Year 2024 Highlights

- Sales increased 6.6% year-over-year to $295.1 million

- Net income attributable to Twin Disc was $11.0 million

- EBITDA* increased 2.9% year-over-year to $26.5 million

- Robust operating cash flow of $33.7 million

- Free cash flow* of $25.0 million compared to $15.0 million in

the year-ago period

- Strong six-month backlog of $133.7 million supported by

consistent end market demand

Fiscal Fourth Quarter 2024 Highlights

- Sales increased 0.6% year-over-year to $84.4 million

- Net income attributable to Twin Disc was $7.4 million

- Robust operating cash flow of $11.5 million

- Free cash flow* of $10.4 million compared to $14.9 million in

the year-ago period

CEO Perspective

“We closed fiscal 2024 on a strong note, maintaining our trend

of solid results to deliver revenue growth along with robust margin

expansion and free cash generation in the fourth quarter. While we

faced an evolving macroeconomic environment throughout the year, we

also captured healthy demand from our Land Based Transmissions and

Marine businesses and are seeing signs of stabilization in

Industrial,” commented John H. Batten, President and Chief

Executive Officer of Twin Disc. “Our consistent performance helped

us execute several strategic priorities during the fiscal year,

including further expansion of our global industrial product line

through the acquisition of Katsa Oy, as well as the reinstatement

of our quarterly cash dividend.”

“Looking ahead, we anticipate market conditions in fiscal 2025

to be fairly in-line with 2024. Supported by our reinforced balance

sheet, we are entering the new fiscal year from a position of

strength, giving us the confidence to provide updated medium-term

targets which illustrate our growth potential in the coming years,”

continued Mr. Batten. “We look forward to continuing along our

trajectory of profitable growth, enabling sustained value

generation for all stakeholders.”

Fourth Quarter & Full-Year Results

Sales for the fiscal 2024 fourth quarter increased 60 basis

points year-over-year to $84.4 million and fiscal 2024 sales

increased 6.6% to $295.1 million. Fourth quarter and full year

sales growth were both driven by demand for the Company’s

Land-Based Transmissions markets, with strength in Marine and

Propulsion Systems supporting full year sales.

Sales by product group (certain amounts have been reclassified

from marine to other):

|

Product Group |

Q4 FY24 Sales |

Q4 FY23 Sales |

Change (%) |

|

(Thousands of $): |

|

Marine and Propulsion Systems |

$ |

47,228 |

$ |

45,662 |

3.4 |

% |

|

Land-Based Transmissions |

|

24,989 |

|

22,864 |

9.3 |

% |

|

Industrial |

|

7,219 |

|

7,928 |

(8.9 |

%) |

|

Other |

|

4,982 |

|

7,469 |

(33.3 |

%) |

|

Total |

$ |

84,418 |

$ |

83,923 |

0.6 |

% |

|

Product Group |

FY24 Sales |

FY23 Sales |

Change (%) |

|

(Thousands of $): |

|

Marine and Propulsion Systems |

$ |

171,765 |

$ |

147,825 |

16.2 |

% |

|

Land-Based Transmissions |

|

78,519 |

|

73,048 |

7.5 |

% |

|

Industrial |

|

25,669 |

|

29,775 |

(13.8 |

%) |

|

Other |

|

19,174 |

|

26,312 |

(27.1 |

%) |

|

Total |

$ |

295,127 |

$ |

276,960 |

6.6 |

% |

| |

For fiscal 2024, Twin Disc delivered double-digit growth

year-over-year in the European and the Asia-Pacific regions. The

distribution of sales across geographical regions shifted, with a

greater proportion of sales coming from the Asia Pacific and Middle

East regions, with a lower proportion coming from North

America.

Gross profit increased 1.4% to $25.1 million compared to $24.7

million for the fourth quarter of fiscal 2023. Fourth quarter gross

margin increased approximately 20 basis points to 29.7% from the

prior year period, reflecting the benefit of incremental volume, a

favorable product mix and the positive impact of cost reduction and

operational efficiency initiatives. For fiscal 2024, gross profit

increased 12.1% to $83.3 million. For the fiscal 2024 full year,

gross margin increased approximately 140 basis points to 28.2%.

Marketing, engineering and administrative (ME&A) expense

increased by $3.8 million, or 22.9%, to $20.4 million, compared to

$16.6 million in the prior year quarter. The increased ME&A

expense was primarily driven by an inflationary impact on wages and

benefits, costs related to the Katsa acquisition, investments to

drive our hybrid electric strategy and increased bonus and stock

compensation expenses. For the fiscal 2024 full year, ME&A

expense increased 15.1% to $71.6 million, primarily driven by the

same factors driving the fourth quarter increase, noted above.

Other income increased by $2.4 million, or 126%, to $4.3

million, compared to $1.9 million in the prior year quarter, driven

by a bargain purchase gain of $3.7 million on the acquisition of

Katsa. The purchase accounting on Katsa remains preliminary.

Net income attributable to Twin Disc for the quarter was $7.4

million, or $0.53 per diluted share, compared to net income

attributable to Twin Disc of $8.6 million, or $0.62 per diluted

share, for the fourth fiscal quarter of 2023. The year-over-year

change was driven by the increased level of ME&A expense in the

quarter, partially offset by favorable operating results and the

bargain purchase gain related to the Katsa acquisition. For fiscal

2024, the Company generated net income attributable to Twin Disc of

$11.0 million, or $0.79 per diluted share, an increase of 5.9% and

5.4%, respectively, from fiscal 2023. Earnings before interest,

taxes, depreciation, and amortization (EBITDA) of $11.8 million in

the fourth quarter, were down 9.1% compared to the fourth quarter

of fiscal 2023. Full year fiscal 2024 EBITDA increased 2.9% to

$26.5 million from $25.8 million in fiscal 2023.

On a consolidated basis, the backlog of orders to be shipped

over the next six months is approximately $133.7 million, compared

to $130.5 million at the end of the third quarter. As a percentage

of six-month backlog, inventory decreased slightly from 99.5% at

the end of the third quarter to 97.6% at the end of the fourth

quarter. Compared to the end of fiscal 2023, cash increased 51.3%

to $20.1 million, total debt increased 38.6% to $25.8 million, and

net debt* increased $0.4 million to $5.7 million. The increase was

primarily attributable to higher long-term debt related to the

Katsa acquisition.

CFO Perspective

Jeffrey S. Knutson, Vice President of Finance, Chief Financial

Officer, Treasurer and Secretary stated, “With continued strong

demand across our product segments, this year has been marked by

solid financial performance, underscored by our consistent margin

expansion and operating cash generation. It is clear that our

steadfast focus on operational execution and working capital

improvement has paid off. We plan to keep this momentum up as we

work towards achieving our updated financial targets and further

position Twin Disc for long-term success.”

Discussion of Results

Twin Disc will host a conference call to discuss these results

and to answer questions at 9:00 a.m. Eastern time on August 15,

2024. The live audio webcast will be available on Twin Disc’s

website at https://ir.twindisc.com. To participate in the

conference call, please dial (800) 715-9871 approximately ten

minutes before the call is scheduled to begin. A replay of the

webcast will be available at https://ir.twindisc.com shortly after

the call until August 14, 2025.

About Twin Disc

Twin Disc, Inc. designs, manufactures, and sells marine and

heavy-duty off-highway power transmission equipment. Products

offered include marine transmissions, azimuth drives, surface

drives, propellers, and boat management systems, as well as

power-shift transmissions, hydraulic torque converters, power

take-offs, industrial clutches, and control systems. The Company

sells its products to customers primarily in the pleasure craft,

commercial and military marine markets, as well as in the energy

and natural resources, government, and industrial markets. The

Company’s worldwide sales to both domestic and foreign customers

are transacted through a direct sales force and a distributor

network. For more information, please visit www.twindisc.com.

Forward-Looking Statements

This press release may contain statements that are forward

looking as defined by the Securities and Exchange Commission in its

rules, regulations, and releases. The words “anticipates,”

“believes,” “intends,” “estimates,” and “expects,” or similar

anticipatory expressions, usually identify forward-looking

statements. The Company intends that such forward-looking

statements qualify for the safe harbors from liability established

by the Private Securities Litigation Reform Act of 1995. All

forward-looking statements are based on current expectations and

are subject to certain risks and uncertainties that could cause

actual results or outcomes to differ materially from current

expectations. Such risks and uncertainties include the impact of

general economic conditions and the cyclical nature of many of the

Company’s product markets; foreign currency risks and other risks

associated with the Company’s international sales and operations;

the ability of the Company to successfully implement price

increases to offset increasing commodity costs; the ability of the

Company to generate sufficient cash to pay its indebtedness as it

becomes due; and the possibility of unforeseen tax consequences and

the impact of tax reform in the U.S. or other jurisdictions. These

and other risks are described under the caption “Risk Factors” in

Item 1A of the Company’s most recent Form 10-K filed with the

Securities and Exchange Commission, as supplemented in subsequent

periodic reports filed with the Securities and Exchange Commission.

Accordingly, the making of such statements should not be regarded

as a representation by the Company or any other person that the

results expressed therein will be achieved. The Company assumes no

obligation, and disclaims any obligation, to publicly update or

revise any forward-looking statements to reflect subsequent events,

new information, or otherwise.

*Non-GAAP Financial

Information

Financial information excluding the impact of asset impairments,

restructuring charges, foreign currency exchange rate changes and

the impact of acquisitions, if any, in this press release are not

measures that are defined in U.S. Generally Accepted Accounting

Principles (“GAAP”). These items are measures that management

believes are important to adjust for in order to have a meaningful

comparison to prior and future periods and to provide a basis for

future projections and for estimating our earnings growth

prospects. Non-GAAP measures are used by management as a

performance measure to judge profitability of our business absent

the impact of foreign currency exchange rate changes and

acquisitions. Management analyzes the company’s business

performance and trends excluding these amounts. These measures, as

well as EBITDA, provide a more consistent view of performance than

the closest GAAP equivalent for management and investors.

Management compensates for this by using these measures in

combination with the GAAP measures. The presentation of the

non-GAAP measures in this press release are made alongside the most

directly comparable GAAP measures.

Definitions

Earnings before interest, taxes, depreciation, and amortization

(EBITDA) is calculated as net earnings or loss excluding interest

expense, the provision or benefit for income taxes, depreciation,

and amortization expenses.

Net debt is calculated as total debt less cash.

Free cash flow is calculated as net cash provided (used) by

operating activities less acquisition of fixed assets.

Investors: RiveronTwinDiscIR@Riveron.com

Source: Twin Disc, Incorporated

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME(In thousands; except share amounts,

unaudited) |

| |

| |

|

For the Quarter Ended |

|

For the Year Ended |

| |

|

|

|

|

|

|

|

|

| |

|

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

June 30, 2023 |

|

Net sales |

$ |

84,418 |

|

$ |

83,923 |

|

$ |

295,127 |

|

$ |

276,960 |

|

| Cost of goods sold |

|

59,332 |

|

|

59,177 |

|

|

208,709 |

|

|

202,628 |

|

| Cost of goods sold - Sale of

boat management system product line and related inventory |

|

- |

|

|

- |

|

|

3,099 |

|

|

- |

|

| Gross profit |

|

25,086 |

|

|

24,746 |

|

|

83,319 |

|

|

74,332 |

|

| |

|

|

|

|

|

|

|

|

| Marketing, engineering, and

administrative expenses |

|

20,356 |

|

|

16,556 |

|

|

71,622 |

|

|

62,243 |

|

| Restructuring expenses |

|

11 |

|

|

(31 |

) |

|

218 |

|

|

177 |

|

| Other operating income |

|

- |

|

|

(1 |

) |

|

- |

|

|

(4,148 |

) |

| Income from operations |

|

4,719 |

|

|

8,222 |

|

|

11,479 |

|

|

16,060 |

|

| |

|

|

|

|

|

|

|

|

| Other expense (income): |

|

|

|

|

|

|

|

|

| Interest expense |

|

394 |

|

|

571 |

|

|

1,443 |

|

|

2,253 |

|

| Bargain purchase gain |

|

(3,724 |

) |

|

- |

|

|

(3,724 |

) |

|

- |

|

| Other expense (income),

net |

|

(961 |

) |

|

(2,492 |

) |

|

(1,607 |

) |

|

(658 |

) |

| |

|

(4,291 |

) |

|

(1,921 |

) |

|

(3,888 |

) |

|

1,595 |

|

| Income before income taxes and

noncontrolling interest |

|

9,010 |

|

|

10,143 |

|

|

15,367 |

|

|

14,465 |

|

| |

|

|

|

|

|

|

|

|

| Income tax expense |

|

1,515 |

|

|

1,439 |

|

|

4,121 |

|

|

3,788 |

|

| Net income |

|

7,495 |

|

|

8,704 |

|

|

11,246 |

|

|

10,677 |

|

| Less: Net earnings

attributable to noncontrolling interest, net of tax |

|

(85 |

) |

|

(110 |

) |

|

(258 |

) |

|

(297 |

) |

| Net income attributable to

Twin Disc |

$ |

7,410 |

|

$ |

8,594 |

|

$ |

10,988 |

|

$ |

10,380 |

|

| |

|

|

|

|

|

|

|

|

| Dividends per share |

$ |

0.04 |

|

$ |

- |

|

$ |

0.12 |

|

$ |

- |

|

| Income per share data: |

|

|

|

|

|

|

|

|

|

Basic income per share attributable to Twin Disc common

shareholders |

$ |

0.54 |

|

$ |

0.64 |

|

$ |

0.80 |

|

$ |

0.77 |

|

|

Diluted income per share attributable to Twin Disc common

shareholders |

$ |

0.53 |

|

$ |

0.62 |

|

$ |

0.79 |

|

$ |

0.75 |

|

| |

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding data: |

|

|

|

|

|

|

|

|

|

Basic shares outstanding |

|

13,748 |

|

|

13,508 |

|

|

13,683 |

|

|

13,468 |

|

|

Diluted shares outstanding |

|

13,911 |

|

|

13,844 |

|

|

13,877 |

|

|

13,811 |

|

| |

|

|

|

|

|

|

|

|

| Comprehensive income |

|

|

|

|

|

|

|

|

|

Net income |

$ |

7,495 |

|

$ |

8,704 |

|

$ |

11,246 |

|

$ |

10,677 |

|

|

Benefit plan adjustments, net of income taxes |

|

(191 |

) |

|

85 |

|

|

(2,114 |

) |

|

666 |

|

|

Foreign currency translation adjustment |

|

1,587 |

|

|

(2,483 |

) |

|

657 |

|

|

635 |

|

|

Unrealized gain on hedges, net of income taxes |

|

120 |

|

|

81 |

|

|

46 |

|

|

54 |

|

|

Comprehensive income |

|

9,011 |

|

|

6,387 |

|

|

9,835 |

|

|

12,032 |

|

|

Less: Comprehensive income attributable to noncontrolling

interest |

|

(42 |

) |

|

(30 |

) |

|

183 |

|

|

248 |

|

| Comprehensive income

attributable to Twin Disc |

$ |

9,053 |

|

$ |

6,417 |

|

$ |

9,652 |

|

$ |

11,784 |

|

|

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF CONSOLIDATED NET INCOME TO

EBITDA(In thousands; unaudited) |

| |

| |

For the Quarter Ended |

|

For the Year Ended |

| |

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

June 30, 2023 |

| |

|

|

|

|

|

|

|

|

Net income attributable to Twin Disc |

$ |

7,410 |

|

$ |

8,594 |

|

$ |

10,988 |

|

$ |

10,380 |

| Interest expense |

|

394 |

|

|

571 |

|

|

1,443 |

|

|

2,253 |

| Income tax expense |

|

1,515 |

|

|

1,439 |

|

|

4,121 |

|

|

3,788 |

| Depreciation and

amortization |

|

2,528 |

|

|

2,423 |

|

|

9,981 |

|

|

9,359 |

| Earnings before interest,

taxes, depreciation, and amortization (EBITDA) |

$ |

11,847 |

|

$ |

13,027 |

|

$ |

26,533 |

|

$ |

25,780 |

|

RECONCILIATION OF TOTAL DEBT TO NET DEBT(In

thousands; unaudited) |

| |

| |

June 30, 2024 |

|

June 30, 2023 |

| |

|

|

|

|

Current maturities of long-term debt |

$ |

2,000 |

|

$ |

2,000 |

| Long-term debt |

|

23,811 |

|

|

16,627 |

| Total debt |

|

25,811 |

|

|

18,627 |

| Less cash |

|

20,070 |

|

|

13,263 |

| Net debt |

$ |

5,741 |

|

$ |

5,364 |

|

RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES

TO FREE CASH FLOW(In thousands; unaudited) |

| |

| |

For the Quarter Ended |

|

For the Year Ended |

|

|

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

June 30, 2023 |

|

Net cash provided by operating activities |

$ |

11,499 |

|

|

$ |

16,037 |

|

|

$ |

33,716 |

|

|

$ |

22,898 |

|

| Acquisition of fixed

assets |

|

(1,109 |

) |

|

|

(1,108 |

) |

|

|

(8,707 |

) |

|

|

(7,918 |

) |

| Free cash flow |

$ |

10,390 |

|

|

$ |

14,929 |

|

|

$ |

25,009 |

|

|

$ |

14,980 |

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS(In

thousands; except share amounts, unaudited) |

|

|

|

|

|

June 30, 2024 |

|

June 30, 2023 |

| ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash |

$ |

20,070 |

|

$ |

13,263 |

|

|

Trade accounts receivable, net |

|

52,207 |

|

|

54,760 |

|

|

Inventories |

|

130,484 |

|

|

131,930 |

|

|

Assets held for sale |

|

- |

|

|

2,968 |

|

|

Prepaid expenses |

|

8,656 |

|

|

8,459 |

|

|

Other |

|

8,214 |

|

|

8,326 |

|

|

Total current assets |

|

219,631 |

|

|

219,706 |

|

|

|

|

|

|

|

| Property, plant and equipment,

net |

|

58,074 |

|

|

38,650 |

|

| Right-of-use assets operating

leases |

|

16,622 |

|

|

13,133 |

|

| Intangible assets, net |

|

12,686 |

|

|

12,637 |

|

| Deferred income taxes |

|

2,339 |

|

|

2,244 |

|

| Other assets |

|

2,706 |

|

|

2,811 |

|

| Total assets |

$ |

312,058 |

|

|

289,181 |

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Current maturities of long-term debt |

$ |

2,000 |

|

$ |

2,010 |

|

|

Accounts payable |

|

32,586 |

|

|

36,499 |

|

|

Accrued liabilities |

|

64,930 |

|

|

61,586 |

|

|

Total current liabilities |

|

99,516 |

|

|

100,095 |

|

|

. |

|

|

|

|

| Long-term debt |

|

23,811 |

|

|

16,617 |

|

| Lease obligations |

|

14,376 |

|

|

10,811 |

|

| Accrued retirement

benefits |

|

7,854 |

|

|

7,608 |

|

| Deferred income taxes |

|

5,340 |

|

|

3,280 |

|

| Other long-term

liabilities |

|

6,107 |

|

|

5,253 |

|

| Total liabilities |

|

157,004 |

|

|

143,664 |

|

| |

|

|

|

|

| Twin Disc shareholders'

equity: |

|

|

|

|

| Preferred shares authorized:

200,000; issued: none; no par value |

|

- |

|

|

- |

|

| Common shares authorized:

30,000,000; issued: 14,632,802; no par value |

|

41,798 |

|

|

42,855 |

|

| Retained earnings |

|

129,592 |

|

|

120,299 |

|

| Accumulated other

comprehensive loss |

|

(6,905 |

) |

|

(5,570 |

) |

|

|

|

164,485 |

|

|

157,584 |

|

| Less treasury stock, at cost

(638,712 and 814,734 shares, respectively) |

|

9,783 |

|

|

12,491 |

|

|

|

|

|

|

|

| Total Twin Disc shareholders'

equity |

|

154,702 |

|

|

145,093 |

|

|

|

|

|

|

|

| Noncontrolling interest |

|

352 |

|

|

424 |

|

| Total equity |

|

155,054 |

|

|

145,517 |

|

|

|

|

|

|

|

| Total liabilities and

equity |

$ |

312,058 |

|

$ |

289,181 |

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS(In

thousands; unaudited) |

|

|

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

|

|

|

Net income |

$ |

11,246 |

|

|

$ |

10,677 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

9,981 |

|

|

|

9,359 |

|

|

Gain on sale of assets |

|

(91 |

) |

|

|

(4,264 |

) |

|

Loss on sale of boat management product line and related

inventory |

|

3,099 |

|

|

|

- |

|

|

Gain on Katsa acquisition |

|

(3,724 |

) |

|

|

- |

|

|

Restructuring |

|

(82 |

) |

|

|

137 |

|

|

Provision for deferred income taxes |

|

(560 |

) |

|

|

(634 |

) |

|

Stock compensation expense and other non-cash changes, net |

|

3,836 |

|

|

|

3,197 |

|

|

Net change in operating assets and liabilities |

|

10,011 |

|

|

|

4,426 |

|

|

Net cash provided by operating activities |

|

33,716 |

|

|

|

22,898 |

|

| |

|

|

|

|

|

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

|

| Acquisition of property,

plant, and equipment |

|

(8,707 |

) |

|

|

(7,918 |

) |

| Acquisition of Katsa, less

cash acquired |

|

(23,178 |

) |

|

|

- |

|

| Proceeds from sale of fixed

assets |

|

- |

|

|

|

7,177 |

|

| Other, net |

|

(184 |

) |

|

|

333 |

|

|

Net cash used by investing activities |

|

(32,069 |

) |

|

|

(408 |

) |

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

|

|

| Borrowings under revolving

loan arrangements |

|

90,534 |

|

|

|

81,620 |

|

| Repayments of revolving loan

arrangements |

|

(81,109 |

) |

|

|

(97,774 |

) |

| Repayments of other long-term

debt |

|

(2,010 |

) |

|

|

(2,037 |

) |

| Dividends paid to

shareholders |

|

(1,695 |

) |

|

|

- |

|

| Dividends paid to

noncontrolling interest |

|

(254 |

) |

|

|

(236 |

) |

| Payments of finance lease

obligations |

|

(921 |

) |

|

|

(621 |

) |

| Payments of withholding taxes

on stock compensation |

|

(1,791 |

) |

|

|

(463 |

) |

| Net cash provided (used) by

financing activities |

|

2,754 |

|

|

|

(19,511 |

) |

| Effect of exchange rate

changes on cash |

|

2,406 |

|

|

|

(2,237 |

) |

| Net change in cash |

|

6,807 |

|

|

|

742 |

|

| Cash: |

|

|

|

|

|

| Beginning of period |

|

13,263 |

|

|

|

12,521 |

|

| End of period |

$ |

20,070 |

|

|

$ |

13,263 |

|

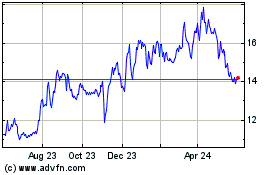

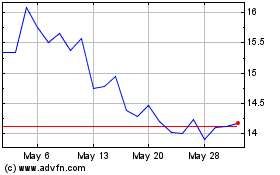

Twin Disc (NASDAQ:TWIN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Twin Disc (NASDAQ:TWIN)

Historical Stock Chart

From Nov 2023 to Nov 2024