SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

TO

Tender

Offer Statement Under Section 14(d)(1) or 13(e)(1)

of

the Securities Exchange Act of 1934

TIGO

ENERGY, INC.

(Name

of Subject Company (Issuer))

TIGO

ENERGY, INC.

(Name

of Filing Person (Offeror))

Options

To Purchase Common Stock, Par Value $0.0001 Per Share

(Title

of Class of Securities)

77867P104

(CUSIP

Number of Class of Securities)

Bill

Roeschlein

Chief

Financial Officer

Tigo

Energy, Inc.

655

Campbell Technology Parkway, Suite 150

Campbell,

CA 95008

(408)

402-0802

(Name,

Address and Telephone Number of Person Authorized To Receive Notices and Communications on Behalf of the Filing Person)

Copies

to:

Laura

Katherine Mann

White

& Case LLP

609

Main Street

Houston,

Texas 77002

Telephone:

(713) 496-9700 |

Joel

Rubinstein

White

& Case LLP

1221

Avenue of the Americas

New

York, New York 10020

Telephone:

(212) 819-8200 |

| ☐ | Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check

the appropriate boxes below to designate any transactions to which the statement relates:

| ☐ | third-party

tender offer subject to Rule 14d-1. |

| ☒ | issuer

tender offer subject to Rule 13e-4. |

| ☐ | going-private

transaction subject to Rule 13e-3. |

| ☐ | amendment

to Schedule 13D under Rule 13d-2. |

Check

the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If

applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| ☐ | Rule

13e-4(i) (Cross-Border Issuer Tender Offer). |

| ☐ | Rule

14d-1(d) (Cross-Border Third-Party Tender Offer). |

SCHEDULE

TO

This

Tender Offer Statement on Schedule TO relates to an offer (the “Offer”) by Tigo Energy, Inc., a Delaware corporation (“Tigo”

or the “Company”), to eligible employees and directors to exchange certain outstanding options to purchase shares of our

Common Stock (“Common Stock”) for new options to purchase a number of shares of our Common Stock (“Replacement Options”).

Only

Eligible Options may be exchanged in the Option Exchange. For these purposes, “Eligible Options” are those options that (i)

were granted under the Tigo Energy, Inc. 2023 Equity Incentive Plan (the “Equity Incentive Plan”), (ii) have an exercise

price greater than 10.64 per share

and (iii) are held by an employee or director of the Company or its subsidiaries as of the grant date of the Replacement Options.

You

are eligible to participate in the Offer only if you (i) are an employee or director of the Company or any of its subsidiaries on the

date the Offer commences and remain an employee or director, as applicable, through the grant date of the Replacement Options, (ii) are

resident in the United States or Italy and (iii) hold at least one Eligible Option as of the Offer Expiration Date.

The

Offer commenced on November 12, 2024 and is currently scheduled to expire at 11:59 P.M. Eastern Time on December 10, 2024 (as may be

extended, the “Offer Expiration Date”).

Eligible

Options may be exchanged for Replacement Options upon the terms and subject to the conditions set forth in: (i) the Offer to Exchange

Certain Outstanding Options to Purchase Common Stock for a Number of Replacement Options, dated November 12, 2024 (the “Offer to

Exchange”), attached hereto as Exhibit (a)(1)(i), (ii) the Announcement Email to Holders of Eligible Options, attached hereto as

Exhibit (a)(1)(ii); and (iii) the Election Form, attached hereto as Exhibit (a)(1)(iii). The following disclosure materials also were

or may be made available to holders of Eligible Options: (i) the Withdrawal Form, attached hereto as Exhibit (a)(1)(iv); (ii) the Form

of Confirmation Email, attached hereto as Exhibit (a)(1)(v); (iii) the Forms of Reminder Emails, attached hereto as Exhibit (a)(1)(vi);

and (iv) the Form of Email to Holders Regarding Final Exchange Ratios, attached hereto as Exhibit (a)(1)(vii). These documents, as they

may be amended or supplemented from time to time, together constitute the “Disclosure Documents.”

The

information in the Disclosure Documents, including all schedules and exhibits to the Disclosure Documents, is incorporated herein by

reference to answer the items required in this Schedule TO.

Item 1. Summary Term Sheet.

The

information set forth under “Summary Term Sheet – Overview” and “Summary Term Sheet and Questions and Answers”

in the Offer to Exchange is incorporated herein by reference.

Item 2. Subject Company Information.

(a)

Name and Address. The issuer is Tigo Energy, Inc., a Delaware corporation. The Company’s principal executive offices are located

at 655 Campbell Technology Parkway, Suite 150, Campbell, CA 95008, and the telephone number of its principal executive offices is (408)

402-0802. The information set forth in the Offer to Exchange under “This Offer – Section 9 (Information Concerning the Company)”

is incorporated herein by reference.

(b)

Securities. The subject class of securities are the Eligible Options. As of November 8, 2024, Eligible Options outstanding under

our Equity Incentive Plan were exercisable for approximately 750,696 shares of Common Stock, or approximately 1.2% of our total shares

of Common Stock outstanding as of November 4, 2024, which was 60,743,162 shares.

The

information set forth in the Offer to Exchange under “Summary Term Sheet and Questions and Answers,” “Risk Factors,”

“This Offer – Section 1 (Eligibility; Number of Options; Offer Expiration Date),” “This Offer – Section

5 (Acceptance of Options for Exchange; Grant of Replacement Options),” and “This Offer – Section 8 (Source and Amount

of Consideration; Terms of Replacement Options)” is incorporated herein by reference.

(c)

Trading Market and Price. The information set forth in the Offer to Exchange under “This Offer – Section 7 (Price Range

of Shares of Common Stock Underlying the Options)” is incorporated herein by reference.

Item 3. Identity and Background of Filing Person.

(a)

Name and Address. The Company is both the subject company and the filing person. The information set forth under Item 2(a) above

and in the Offer to Exchange under “This Offer – Section 10 (Interests of Directors, Officers and Affiliates; Transactions

and Arrangements Concerning our Securities)” is incorporated herein by reference. Pursuant to General Instruction C to Schedule

TO, the information set forth on Schedule A to the Offer to Exchange is incorporated herein by reference.

Item 4. Terms of the Transaction.

(a)

Material Terms. The information set forth in the Offer to Exchange under “Summary Term Sheet and Questions and Answers”

and the sections under “This Offer” titled “Section 1 (Eligibility; Number of Options; Offer Expiration Date),”

“Section 3 (Procedures for Electing to Exchange Options),” “Section 4 (Withdrawal Rights),” “Section 5

(Acceptance of Options for Exchange; Grant of Replacement Options),” “Section 6 (Conditions of this Offer),”

“Section 7 (Price Range of Shares of Common Stock Underlying the Options),” “Section 8 (Source and Amount of Consideration;

Terms of Replacement Options),” “Section 9 (Information Concerning the Company),” “Section 11 (Status of Options

Acquired by Us in this Offer; Accounting Consequences of this Offer),” “Section 12 (Agreements; Legal Matters; Regulatory

Approvals),” “Section 13 (Material U.S. Federal Income Tax Consequences),” and “Section 14 (Extension of Offer;

Termination; Amendment)” is incorporated herein by reference.

(b)

Purchases. The information set forth in the Offer to Exchange under “This Offer – Section 10 (Interests of Directors,

Officers and Affiliates; Transactions and Arrangements Concerning our Securities)” is incorporated herein by reference.

Item 5. Past Contacts, Transactions, Negotiations and Agreements.

(e)

Agreements Involving the Subject Company’s Securities. The information set forth in the Offer to Exchange under “This

Offer – Section 10 (Interests of Directors, Officers and Affiliates; Transactions and Arrangements our Securities)” is incorporated

herein by reference. The documents incorporated herein by reference as Exhibit (d)(1) and Exhibit (d)(2) also contain information regarding

agreements relating to securities of the Company.

Item 6. Purposes of the Transaction and Plans or Proposals.

(a)

Purposes. The information set forth in the Offer to Exchange under “Summary Term Sheet and Questions and Answers” and

“This Offer – Section 2 (Purpose of this Offer)” is incorporated herein by reference.

(b)

Use of Securities Acquired. The information set forth in the Offer to Exchange under “This Offer – Section 5 (Acceptance

of Options for Exchange; Grant of Replacement Options),” and “This Offer – Section 11 (Status of Options Acquired by

Us in this Offer; Accounting Consequences of this Offer)” is incorporated herein by reference.

(c)

Plans. The information set forth in the Offer to Exchange under “Summary Term Sheet and Questions and Answers” and “This

Offer – Section 2 (Purpose of this Offer)” is incorporated herein by reference.

Item 7. Source and Amount of Funds or Other Consideration.

(a)

Source of Funds. The information set forth in the Offer to Exchange under “This Offer – Section 8 (Source and Amount

of Consideration; Terms of Replacement Options)” and “This Offer – Section 15 (Fees and Expenses)” is incorporated

herein by reference.

(b)

Conditions. The information set forth in the Offer to Exchange under “This Offer – Section 6 (Conditions of this Offer)”

is incorporated herein by reference. There are no alternative financing arrangements or financing plans for this Offer.

(d)

Borrowed Funds. Not applicable.

Item 8. Interest in Securities of the Subject Company.

(a)

Securities Ownership. The information set forth in the Offer to Exchange under “This Offer –Section 10 (Interests of

Directors, Officers and Affiliates; Transactions and Arrangements Concerning our Securities)” is incorporated herein by reference.

(b)

Securities Transactions. The information set forth in the Offer to Exchange under “This Offer – Section 10 (Interests

of Directors, Officers and Affiliates; Transactions and Arrangements Concerning our Securities)” is incorporated herein by reference.

Item 9. Persons/Assets, Retained, Employed, Compensated or Used.

(a) Solicitations

or Recommendations. Not applicable.

Item 10. Financial Statements.

(a)

Financial Information. The information set forth in the Offer to Exchange under “This Offer – Section 9 (Information

Concerning the Company)” and “This Offer – Section 16 (Additional Information)” is incorporated herein by reference.

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the Securities and Exchange Commission (the “SEC”)

on March 21, 2024, including the financial information set forth in Item 8 – Financial Statements and Supplementary Data of our

Annual Report on Form 10-K, and our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2024, June 30, 2024, and September

30, 2024, filed with the SEC on May 14, 2024, August 6, 2024 and November 6, 2024, respectively, including the financial information

set forth in Item 1 – Condensed Consolidated Financial Statements (unaudited) therein are incorporated herein by reference. Our

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q are available electronically on the SEC’s website at http://www.sec.gov.

(b) Pro

Forma Financial Information. Not applicable.

(c)

Summary Information. The information set forth in the Offer to Exchange under “This Offer – Section 9 (Information Concerning

the Company) – Summary Financial Information” is incorporated herein by reference.

Item 11. Additional Information.

(a)

Agreements, Regulatory Requirements and Legal Proceedings. The information set forth in the Offer to Exchange under “This Offer

– Section 10 (Interests of Directors, Officers and Affiliates; Transactions and Arrangements Concerning our Securities),”

and “This Offer – Section 12 (Agreements; Legal Matters; Regulatory Approvals)” is incorporated herein by reference.

(c) Other

Material Information. Not applicable.

Item 12. Exhibits.

The

Exhibit Index attached to this Schedule TO is incorporated herein by reference.

Item 13. Information Required by Schedule 13E-3.

Not

applicable.

SIGNATURE

After

due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| Dated:

November 12, 2024 |

TIGO

ENERGY, INC. |

| |

|

|

| |

By: |

/s/

Bill Roeschlein |

| |

Name: |

Bill

Roeschlein |

| |

Title: |

Chief

Financial Officer |

EXHIBIT

INDEX

6

Exhibit

(a)(1)(i)

Tigo

Energy, INC.

OFFER

TO EXCHANGE CERTAIN OUTSTANDING OPTIONS

TO PURCHASE SHARES OF COMMON STOCK

FOR A NUMBER OF REPLACEMENT OPTIONS

SUMMARY

TERM SHEET – OVERVIEW

THIS

OFFER AND WITHDRAWAL RIGHTS EXPIRE

AT 11:59 P.M. EASTERN TIME ON DECEMBER 10, 2024

UNLESS THIS OFFER IS EXTENDED

Tigo

Energy, Inc., which is sometimes referred to herein as “Tigo,” the “Company,” “our,”

“us,” or “we,” is offering eligible employees and directors the opportunity to exchange

certain outstanding options to purchase shares of our common stock, par value $0.0001 per share (“Common Stock”),

for new options to purchase a number of shares of our Common Stock (“Replacement Options”). We expect to grant

the Replacement Options effective promptly following the Offer Expiration Date (as defined below). We are making this offer (“Offer”)

upon the terms, and subject to the conditions, set forth in this Offer to Exchange Certain Outstanding Options to Purchase Shares of

Common Stock for a Number of Replacement Options (this “Offer to Exchange”) and in the related Terms of Election

(the “Terms of Election” and, together with this Offer to Exchange, as they may be amended from time to time,

the “Option Exchange”).

Eligibility.

Only Eligible Options may be exchanged in the Option Exchange. For these purposes, “Eligible Options”

are those options that:

| ● | were

granted under the Tigo Energy, Inc. 2023 Equity Incentive Plan (the “Equity Incentive Plan”); |

| ● | have

an exercise price greater than $10.64 per share; and |

| ● | are

held by an employee or director of the Company or its subsidiaries as of the Replacement Option Grant Date (as defined below). |

Options

granted under any equity incentive plan other than the Equity Incentive Plan or held by an individual who is not an employee or director

of Tigo or its subsidiaries as of the Replacement Option Grant Date are not eligible to be exchanged in the Option Exchange.

You

are eligible to participate in the Option Exchange only if you:

| ● | are

an employee or director of the Company or any of its subsidiaries on the date this Offer commences and remain an employee or director,

as applicable, through the Replacement Option Grant Date; |

| ● | are

resident in the United States or Italy and |

| ● | hold

at least one Eligible Option as of the Offer Expiration Date. |

The

outstanding options that you hold under the Equity Incentive Plan give you the right to purchase shares of our Common Stock once those

options vest by paying the applicable exercise price (and satisfying any applicable tax withholding obligations). Thus, when we use the

term “option” in this Offer to Exchange, we refer to the actual options you hold to purchase shares of our Common Stock and

not the shares of Common Stock underlying those options.

Exchange

Ratios. If you participate in the Offer, the number of Replacement Options you receive will depend on the exercise price and

grant date of the Eligible Options that you elect to exchange. The exchange ratios will be calculated on an approximate “value-for-value”

basis, meaning that they will be determined in a manner intended to result in the grant of Replacement Options with an aggregate fair

value that is approximately the same as the aggregate fair value of the Eligible Options they replace, calculated as of the Offer Expiration

Date, which will be the time that we set the exchange ratios.

The

exchange ratio for each Eligible Option cannot be calculated as of the date of this Offer because the ratios will be based in part on

the future value of our common stock during and at the end of the Offer. The exchange ratios are structured so that in no event would

the number of Replacement Options received by you exceed the number of shares underlying the Eligible Options exchanged for the Replacement

Options.

After

3:00 P.M. (and no later than 8:00 P.M.) Eastern Time, on the Offer Expiration Date (as defined below), we will distribute by email to

you at your Company email (or if you are a director, at the email we have on file for you) the exact exchange ratios to be used in the

Offer with respect to each of their Eligible Options.

If

you are eligible to participate in the Option Exchange, you can exchange your Eligible Options on a grant-by-grant basis, i.e., based

on the original grant date and exercise price of the Eligible Option (referred to herein as a “Separate Option Grant”).

No partial exchanges of Separate Option Grants will be permitted; however, you can choose to exchange one or more of your eligible Separate

Option Grants without having to exchange all of your eligible Separate Option Grants. If you have previously exercised a portion of an

eligible Separate Option Grant, only the portion of the eligible Separate Option Grant which has not yet been exercised will be eligible

to be exchanged.

All

Eligible Options that we accept pursuant to the Option Exchange will be canceled on the expiration date of this Offer, currently scheduled

for 11:59 P.M. Eastern Time on December 10, 2024 (as may be extended, the “Offer Expiration Date”), and Eligible

Options elected for exchange will no longer be exercisable after that time. We expect to grant the Replacement Options effective promptly

following the Offer Expiration Date, with the date of grant for the Replacement Options referred to in this Offer as the “Replacement

Option Grant Date.” The Replacement Options will have a per share exercise price equal to the per share closing trading

price of our Common Stock on the Nasdaq Stock Market LLC (“Nasdaq”), on the Replacement Option Grant Date (or

the immediately preceding trading day if the Replacement Option Grant Date is not a trading day).

Terms

of Replacement Options. We will grant the Replacement Options under the Equity Incentive Plan, on the Replacement Option

Grant Date, which we expect will be on or about December 10, 2024. In order to be granted a Replacement Option, you must remain

continuously employed by the Company or one of our subsidiaries or in continuous service as a non-employee director of the Company

through the Replacement Option Grant Date.

The

Replacement Options:

| ● | will

have a per share exercise price equal to the per share closing trading price of our Common

Stock on Nasdaq on the Replacement Option Grant Date (or the immediately preceding trading

day if the Replacement Option Grant Date is not a trading day); |

| ● | will

have the same vesting schedule as the tendered Eligible Option; |

| ● | will

have a term equal to the remaining term of the tendered Eligible Option and will expire on the same expiration date as the tendered Eligible Option; |

| ● | will

have the terms and be subject to the conditions as provided for in the Equity Incentive Plan

and the stock option agreement evidencing the Replacement Option. |

Although

our Board of Directors (the “Board”) has approved this Offer, neither we nor our Board make any recommendation as

to whether you should elect to exchange or refrain from electing to exchange all or any of your Eligible Options. You must make your

own decision regarding whether to elect to exchange all or any of your Eligible Options.

This

Offer is not conditioned upon a minimum aggregate number of Eligible Options being surrendered for exchange. This Offer is subject to

certain conditions which we describe in Section 6 of this Offer to Exchange and the terms described in this Offer.

Shares

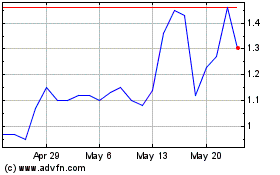

of our Common Stock are listed on Nasdaq under the symbol “TYGO.” On November 8, 2024, the closing price of shares of our

Common Stock on Nasdaq was 1.08 per share. We recommend that you obtain current market quotations for shares of our Common Stock before

deciding whether to elect to exchange your Eligible Options.

As

of November 8, 2024, Eligible Options outstanding under our Equity Incentive Plan were exercisable for approximately 750,696 shares of

Common Stock, or approximately 1.2% of our total shares of Common Stock outstanding as of November 4, 2024, which was 60,743,162 shares.

IMPORTANT

If

you wish to participate in this Offer, you must properly complete, sign and deliver the election form so that we receive it on or before

11:59 P.M. Eastern Time, on the Offer Expiration Date, which is currently scheduled for December 10, 2024, by email (by PDF or similar

imaged document file) delivered to: stockadmin@tigoenergy.com. Election submissions that are received after this deadline will not

be accepted. In order to participate in this Offer and submit your election, you will be required to acknowledge your agreement to all

of the terms and conditions of the Offer to Exchange as set forth in the Offer documents.

For

subsequent withdrawals and elections, please deliver the properly completed and signed election form (or Notice of Withdrawal of election

form) so that we receive it before 11:59 p.m., Eastern Time, on the Offer Expiration Date, which is currently scheduled for December

10, 2024, by email (by PDF or similar imaged document file) delivered to: stockadmin@tigoenergy.com.

You

are responsible for making sure that the election form is delivered as indicated above. You must allow for sufficient time to complete,

sign and deliver your election form to ensure that we receive your election form before the Offer Expiration Date. We intend to confirm

the receipt of your election form by email within two business days after receiving your election form. If you do not receive a confirmation,

it is your responsibility to confirm that we have timely received your election form.

You

do not need to return your stock option agreement(s) for your Eligible Options to be cancelled and exchanged in the Offer because they

will be automatically cancelled effective as of the Offer Expiration Date if we accept your Eligible Options for exchange.

You

should direct questions about this Offer and requests for additional copies of this Offer to Exchange and the other Offer documents by

emailing stockadmin@tigoenergy.com.

We

are not making this Offer to, nor will we accept any election to exchange options from or on behalf of, option holders in any jurisdiction

outside of the United States or Italy. However, we may, at our discretion, take any actions necessary or desirable for us to make this

Offer to option holders in any such jurisdiction.

THIS

OPTION EXCHANGE OFFER DOCUMENT HAS NOT BEEN APPROVED OR DISAPPROVED BY THE U.S. SECURITIES AND EXCHANGE COMMISSION (THE “SEC”)

OR ANY STATE OR FOREIGN SECURITIES COMMISSION NOR HAS THE SEC OR ANY STATE OR FOREIGN SECURITIES COMMISSION PASSED UPON THE FAIRNESS

OR MERITS OF THIS EXCHANGE OFFER OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DOCUMENT. ANY REPRESENTATION TO

THE CONTRARY IS A CRIMINAL OFFENSE.

THE

COMPANY HAS NOT AUTHORIZED ANY PERSON TO MAKE ANY RECOMMENDATION ON OUR BEHALF AS TO WHETHER YOU SHOULD ELECT TO EXCHANGE OR REFRAIN

FROM ELECTING TO EXCHANGE YOUR OPTIONS PURSUANT TO THIS OFFER. YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS DOCUMENT OR

OTHER INFORMATION TO WHICH WE HAVE REFERRED YOU. THE COMPANY HAS NOT AUTHORIZED ANYONE TO GIVE YOU ANY INFORMATION OR TO MAKE ANY REPRESENTATION

IN CONNECTION WITH THIS OFFER OTHER THAN THE INFORMATION AND REPRESENTATIONS CONTAINED IN THIS DOCUMENT OR IN THE RELATED TERMS OF ELECTION.

IF ANYONE MAKES ANY RECOMMENDATION OR REPRESENTATION TO YOU OR GIVES YOU ANY INFORMATION, YOU MUST NOT RELY UPON THAT RECOMMENDATION,

REPRESENTATION OR INFORMATION AS HAVING BEEN AUTHORIZED BY THE COMPANY.

NOTHING

IN THIS DOCUMENT SHALL BE CONSTRUED TO GIVE ANY PERSON THE RIGHT TO REMAIN IN THE EMPLOYMENT OR SERVICE OF THE COMPANY OR TO AFFECT OUR

RIGHT TO TERMINATE THE EMPLOYMENT OR SERVICE OF ANY PERSON AT ANY TIME WITH OR WITHOUT CAUSE TO THE EXTENT PERMITTED UNDER LAW. NOTHING

IN THIS DOCUMENT SHOULD BE CONSIDERED A CONTRACT OR GUARANTEE OF WAGES OR COMPENSATION.

THE

COMPANY RESERVES THE RIGHT TO AMEND OR TERMINATE THE Equity Incentive Plan AT ANY TIME, AND THE GRANT OF AN OPTION UNDER THE Equity Incentive

Plan OR THIS OFFER DOES NOT IN ANY WAY OBLIGATE US TO GRANT ADDITIONAL OPTIONS OR OFFER FURTHER OPPORTUNITIES TO PARTICIPATE IN ANY OPTION

EXCHANGE IN ANY FUTURE YEAR. THE GRANT OF AN OPTION AND ANY FUTURE OPTIONS GRANTED UNDER THE Equity Incentive Plan OR IN RELATION TO

THIS OFFER IS WHOLLY DISCRETIONARY IN NATURE AND IS NOT TO BE CONSIDERED PART OF ANY NORMAL OR EXPECTED COMPENSATION THAT IS OR WOULD

BE SUBJECT TO SEVERANCE, RESIGNATION, REDUNDANCY, TERMINATION OR SIMILAR PAY, OTHER THAN TO THE EXTENT REQUIRED BY LOCAL LAW.

OPTION

EXCHANGE

TABLE

OF CONTENTS

| SUMMARY

TERM SHEET AND QUESTIONS AND ANSWERS |

1 |

| Exchange

Design |

1 |

| Administrative/Timing |

4 |

| Other

Important Questions |

8 |

| RISK

FACTORS |

10 |

| THIS

OFFER |

12 |

| Consideration |

19 |

| Terms

of Replacement Options |

20 |

| Vesting

of Replacement Options |

20 |

| Exercise |

21 |

| U.S.

Federal Income Tax Consequences of Options |

21 |

| Registration

of Option Shares |

21 |

| Tigo

Energy, Inc. 2020 Incentive Award Plan |

21 |

| Interests

of our Directors, Officers and Affiliates |

28 |

| Transactions

and Arrangements Concerning our Securities |

29 |

| SCHEDULE A A GUIDE TO TAX & LEGAL ISSUES FOR NON-U.S. EMPLOYEES AND DIRECTORS |

35 |

| SCHEDULE B INFORMATION

CONCERNING THE DIRECTORS AND EXECUTIVE OFFICERS OF TIGO ENERGY, INC. |

36 |

SUMMARY

TERM SHEET AND QUESTIONS AND ANSWERS

The

following are answers to some of the questions that you may have about this Offer. We urge you to read carefully the following questions

and answers, as well as the remainder of this Offer to Exchange. Where applicable, we have included section references to the remainder

of this Offer to Exchange where you can find a more complete description of the topics in this question and answer summary. We suggest

that you consult with your personal financial and tax advisors before deciding whether to participate in this Offer. Please review this

summary term sheet and questions and answers, and the remainder of this Offer to Exchange and the Terms of Election to ensure that you

are making an informed decision regarding your participation in this Offer.

For

your ease of use, the questions have been separated into three sections:

| 3. | Other

Important Questions. |

Exchange

Design

1. What is the Option Exchange?

The

Option Exchange is being offered by the Company to allow eligible employees and directors of the Company or its subsidiaries to

exchange their outstanding options that were granted under the Equity Incentive Plan for new options to purchase a lesser amount of

shares of Common Stock, which we refer to as Replacement Options. The number of shares subject to Replacement Options that will be

granted in exchange for existing Eligible Options will be determined by the exchange ratios set forth in a personalized notification

form sent to you at your Company email (or if you are a director, at the email we have on file for you) after 3:00 P.M. (and no

later than 8:00 P.M.) Eastern Time, on the Offer Expiration Date. The Replacement Options will be granted on the Replacement Option

Grant Date, which we expect will be on or about December 10, 2024. The Replacement Options will have an exercise price equal to the

closing price of shares of our Common Stock on the Replacement Option Grant Date (or the immediately preceding trading day if the

Replacement Option Grant Date is not a trading day). The Replacement Options will be subject to the terms and conditions as provided

for in the Equity Incentive Plan. Each Replacement Option will have (x) a term equal to the remaining term of the tendered Eligible

Option and expire on the same expiration date as the tendered Eligible Option and

(y) the same vesting schedule as the tendered Eligible Option.

2. Why are we making this Offer?

An

objective of our equity incentive programs has been, and continues to be, to align the interests of Equity Incentive Plan participants

with those of our stockholders, and we believe that the Option Exchange is an important component in our efforts to achieve that goal.

We are implementing the Option Exchange using exchange ratios designed to result in grants of Replacement Options with an accounting

value that will be approximately equal to the accounting value of the Eligible Options that are surrendered in the Option Exchange.

A

significant majority of our employees’ and directors’ options have exercise prices that exceed, in some cases significantly,

the trading price range of shares of our Common Stock over the past year. For example, the exercise prices of the Eligible Options range

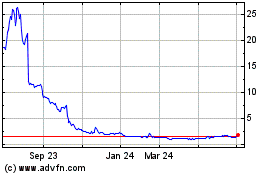

from $10.65 to $11.50, and since November 13, 2023, the high and low closing sales prices of shares of our Common Stock as listed on Nasdaq

has ranged from $3.24 to $0.92, respectively. The closing sale price of our Common Stock has exceeded $2.00 only once during calendar

year 2024. We believe these underwater options are no longer effective as incentives to motivate and retain our employees. In the face

of a competitive market for exceptional employees, the need for adequate and appropriate incentives and retention tools remains strong.

The Offer will also allow our non-employee directors to be fairly compensated for their service on our Board.

As

of November 8, 2024, we had an aggregate of 5,757,295 shares subject to outstanding options under our equity incentive plans or available

for issuance under the Equity Incentive Plan, which we collectively refer to as our “overhang,” constituting approximately

9.5% of our outstanding shares of Common Stock as of November 4, 2024, which was 60,743,162 shares. As of November 8, 2024, Eligible

Options outstanding under our Equity Incentive Plan were exercisable for approximately 750,696 shares of Common Stock, or approximately

1.2% of our total shares of Common Stock outstanding as of November 4, 2024.

Eligible

Options remain outstanding and contribute to overhang until such time as they expire, terminate or are otherwise canceled. Although Eligible

Options are not likely to be exercised as long as our share price is lower than the applicable exercise price, they will remain an expense

on our financial statements with the potential to dilute stockholders’ interests for up to the full term of the options, while

delivering relatively little retentive or incentive value. We believe that the Replacement Options will be more likely to be exercised,

which would reduce our overhang. Further, surrendered Eligible Options will be canceled and returned to the pool of shares reserved for

future grant under the Equity Incentive Plan.

The

Option Exchange is voluntary and will allow eligible employees and directors to choose whether to keep their existing options

at existing exercise prices and vesting schedules or to exchange those options for Replacement Options with new exercise prices. We intend

the Option Exchange to enable eligible employees and directors to recognize value from their options, but this cannot be guaranteed considering

the unpredictability of the stock market. See Section 2 of the Offer to Exchange entitled “Purpose of this Offer” below for

additional information.

Subject

to the limitations set forth in Sections 6 and 14 of the Offer to Exchange entitled “Conditions of this Offer” and “Extension

of Offer; Termination; Amendment,” respectively, we reserve the right before the Offer Expiration Date, to terminate or amend this

Offer and to postpone our acceptance and cancellation of any options elected for exchange, if at any time on or after the date of commencement

of the Offer and prior to the Offer Expiration Date certain events have occurred.

3. How many Replacement Options will I receive for the Eligible Options that I exchange?

The

exchange ratio applicable to each of your Eligible Options and the number of Replacement Options that may be granted in exchange for

each of your Eligible Options will be set forth in a personalized notification form sent to you at your Company email address (or if

you are a director, at the email address we have on file for you) after 3:00 P.M. (and no later than 8:00 P.M.) Eastern Time, on the

Offer Expiration Date. The exchange ratios will be calculated on an approximate “value-for-value” basis, meaning that the

exchange ratios will be determined in a manner intended to result in the grant of Replacement Options with an aggregate fair value that

is approximately the same as the aggregate fair value of the Eligible Options they replace, calculated as of the Offer Expiration Date,

which will be the time that we set the exchange ratios.

The

value of the Eligible Options was calculated using the Black-Scholes option pricing model. The value of the Replacement Options will

be calculated using the Hull-White I Lattice Model (the “Lattice Model”) as of the Replacement Option Grant Date. This valuation model calculates

the theoretical present value of a stock option using variables such as stock price, exercise price, volatility, and expected exercise behavior. Because underwater stock options will be less valuable than Replacement Options, you will need to exchange more than one

Eligible Option to receive one Replacement Option.

Because

options with different exercise prices and expiration dates have different Lattice Model values, different grants may have different

exchange ratios. The exchange ratios will show you how many Eligible Options you need to exchange to get one Replacement Option.

The

exchange ratio for each Eligible Option cannot be calculated as of the date of this Offer because the ratios will be based in part on

the future value of our common stock during and at the end of the Offer. The exchange ratios are structured so that in no event would

the number of Replacement Options received by you exceed the number of shares underlying the Eligible Options exchanged for the Replacement

Options.

After

3:00 P.M. (and no later than 8:00 P.M.) Eastern Time, on the Offer Expiration Date (as defined below), we will distribute to you at your

Company email (or if you are a director, at the email we have on file for you) the exact exchange ratios to be used in the Offer with

respect to each of their Eligible Options.

If

your total exchanged options would result in less than one Replacement Option, we will round up your Replacement Options so that you

get a minimum of one Replacement Option. See Section 1 of the Offer to Exchange entitled “Eligibility; Number of Options; Offer

Expiration Date” and Section 8 of the Offer to Exchange entitled “Source and Amount of Consideration; Terms of Replacement

Options” below for additional information.

Replacement

Options will be granted with a per share exercise price equal to the per share closing trading price of our Common Stock on Nasdaq

on the Replacement Option Grant Date (or the immediately preceding trading day if the Replacement Option Grant Date is not a trading

day), which we expect will be on or about December 10, 2024. Participating in the Option Exchange requires an eligible employee to

make a voluntary election to tender Eligible Options on or before 11:59 P.M. Eastern Time on December 10, 2024, unless this Offer is

extended, after which time such election will be irrevocable.

4. Which options are eligible for this Offer?

Options

eligible for exchange are those held by employees and directors of us and our subsidiaries who are resident in the United States or Italy

that were granted under the Equity Incentive Plan.

5. Who is eligible to participate in this Offer?

You

are eligible to participate in this Offer only if (i) you are an employee or director of the Company or any of its subsidiaries as of

the Offer commencement date and remain an employee or director through the Replacement Option Grant Date, (ii) you are resident in the

United States or Italy and (iii) you hold at least one Eligible Option on the Offer Expiration Date.

6. What if I leave the Company before the Replacement Option Grant Date?

If

you are no longer employed with, or cease serving as a director of, the Company or any of its subsidiaries, whether voluntarily, involuntarily,

or for any other reason, before the Replacement Option Grant Date, you will not be able to participate in this Offer.

ACCORDINGLY,

IF YOU ARE NOT AN EMPLOYEE OR DIRECTOR OF THE COMPANY OR ANY OF ITS SUBSIDIARIES AS DESCRIBED ABOVE WHO IS RESIDENT IN THE UNITED STATES

OR ITALY ON THE REPLACEMENT OPTION GRANT DATE, EVEN IF YOU HAD ELECTED TO PARTICIPATE IN THIS OFFER AND HAD TENDERED SOME OR ALL OF YOUR

OPTIONS FOR EXCHANGE, YOUR TENDER WILL AUTOMATICALLY BE DEEMED WITHDRAWN AND YOU WILL NOT PARTICIPATE IN THIS OFFER, AND YOU WILL RETAIN

YOUR OUTSTANDING OPTION(S) IN ACCORDANCE WITH THEIR CURRENT TERMS AND CONDITIONS. IN THE CASE OF A TERMINATION OF YOUR SERVICE, YOU MAY

BE ENTITLED TO EXERCISE YOUR OUTSTANDING OPTION(S) DURING A LIMITED PERIOD OF TIME FOLLOWING THE TERMINATION OF SERVICE IN ACCORDANCE

WITH THEIR TERMS TO THE EXTENT THAT THEY ARE VESTED AS OF SUCH TERMINATION OF SERVICE. See Section 1 of the Offer to Exchange entitled

“Eligibility; Number of Options; Offer Expiration Date” and Section 5 of the Offer to Exchange entitled “Acceptance

of Options for Exchange; Grant of Replacement Options” below for additional information.

7. Why aren’t the exchange ratios set at one-for-one?

The

exchange ratios for the Option Exchange will be determined using the Lattice Model and will be based on, among other things, the trading

price of our common stock during and at the end of the Offer, the exercise prices of the Eligible Options, and the remaining terms of

the Eligible Options and the Replacement Options. The exchange ratios will be calculated to result in an aggregate fair value, for accounting

purposes, of the Replacement Options approximately equal to the aggregate fair value of the Eligible Options they replace, the

trading price of our common stock during and at the end of the Offer, in order to balance the compensatory goals of the Option Exchange

and the interests of our stockholders, including reducing our total number of shares of Common Stock underlying outstanding options,

avoiding further dilution to our stockholders and minimizing the accounting expense of the grants of Replacement Options. If we were

to exchange the options on a one-for-one basis, but reduce the exercise price to the lower current fair market value of shares of our

Common Stock, the fair value of the Replacement Options and the associated accounting expense would be greater than the current fair

value of the Eligible Options. Accordingly, the higher-value Replacement Options will cover fewer shares of our Common Stock than the

lower-value Eligible Options they replace to achieve the same value.

The

exchange ratio for each Eligible Option cannot be calculated as of the date of this Offer because the ratios will be based in part on

the future value of our common stock during and at the end of the Offer. The exchange ratios are structured so that in no event would

the number of Replacement Options received by you exceed the number of shares underlying the Eligible Options exchanged for the Replacement

Options.

After

3:00 P.M. (and no later than 8:00 P.M.) Eastern Time, on the Offer Expiration Date (as defined below), we will distribute to you at your

Company email (or if you are a director, at the email we have on file for you) the exact exchange ratios to be used in the Offer with

respect to each of their Eligible Options.

8. If I participate, what will happen to my exchanged options?

Eligible

Options that you elect to exchange will be cancelled on the Offer Expiration Date, which is currently scheduled for 11:59 P.M. Eastern

Time on December 10, 2024, unless this Offer is extended.

9. If I elect to exchange some of my Eligible Options, do I have to elect to exchange all of my Eligible Options?

No.

You may elect to exchange your Eligible Options on a grant-by-grant basis (determined based on options having the same grant date and

exercise price), that is you may elect to exchange or not exchange each Separate Option Grant. If you elect to exchange any portion of

a Separate Option Grant in the Offer, you must elect to exchange the entire Separate Option Grant. No partial exchanges of Separate Option

Grants will be permitted.

10. What happens to Eligible Options that I choose not to exchange or that you do not accept for exchange?

Eligible

Options that you choose not to exchange or that we do not accept for exchange will remain outstanding and will retain their existing

terms, exercise prices and vesting schedules.

11. Will I receive non-qualified stock options or incentive stock options if I participate in this Offer?

A

Replacement Option granted in replacement of a canceled non-qualified stock option will be a non-qualified stock option. A Replacement

Option granted in replacement of a canceled incentive stock option may be an incentive stock option to the maximum extent permitted under

U.S. tax law.

There

may be circumstances under which all or a portion of a Replacement Option granted in replacement of a canceled incentive stock option

will not qualify as an incentive stock option. Please see the section “Risks relating to tax effects” under “Risk Factor”

as well as Question 29 below regarding U.S. federal tax consequences.

12. What are the conditions to this Offer?

This

Offer is subject to the conditions described in Section 6. This Offer is not conditioned upon a minimum aggregate number of options being

elected for exchange. See Section 6 of the Offer to Exchange entitled “Conditions of this Offer” below for additional information.

Administrative/Timing

13. How do I participate in this Offer?

If

you are a holder of Eligible Options, you may tender your Eligible Options for exchange at any time before the Offer Expiration Date,

which is currently scheduled for 11:59 p.m., Eastern Time, December 10, 2024 (or such later date as may apply if the Offer is extended).

To

validly tender your Eligible Options, you must deliver a properly completed and signed election form, and any other documents required

by the election form, by email (by PDF or similar imaged document file) to stockadmin@tigoenergy.com.

You

do not need to return your stock option agreements relating to any tendered Eligible Options as they will be automatically cancelled

effective as of the Replacement Option Grant Date if we accept your Eligible Options for exchange. We will separately provide to you

the grant documents relating to your Replacement Options for your acceptance following the Replacement Option Grant Date.

Your

Eligible Options will not be considered tendered until we receive your properly completed and signed election form. We must receive your

properly completed and signed election form before 11:59 P.M. Eastern Time, on the Offer Expiration Date, which is currently scheduled

for December 10, 2024, by email (by PDF or similar imaged document file) delivered to: stockadmin@tigoenergy.com. If you miss this deadline,

you will not be permitted to participate in the Offer.

We

will accept delivery of the signed election form only by email (by PDF or similar imaged document file). You are responsible for making

sure that the election form is delivered to the email address indicated above. You must allow for sufficient time to complete and deliver

your election form to ensure that we receive your election form before the Offer Expiration Date.

We

intend to confirm the receipt of your election form by email within two business days after receiving your election form. If you do not

receive a confirmation, it is your responsibility to confirm that we have timely received your election form.

We

reserve the right to reject any or all tenders of Eligible Options that we determine are not in appropriate form or that we determine

would be unlawful to accept. Subject to our rights to extend, terminate and amend the Exchange Offer, we expect to accept all properly

tendered Eligible Options on the Replacement Option Grant Date.

See

Section 3 of the Offer to Exchange entitled “Procedures for Electing to Exchange Options” below for additional information.

14. Whom can I contact if I have questions about the Offer or if I need additional copies of the Offer documents?

You

should direct questions about this Offer and requests for additional copies of this Offer to Exchange and the other Offer documents by

emailing stockadmin@tigoenergy.com.

15. What will happen if I do not submit my election by the deadline?

If

you do not submit your election by the deadline, then you will not participate in this Offer, and all options currently held by you will

remain intact at their original exercise price and subject to their original terms and conditions. See “Risk Factors” below

for additional information.

IF

YOU FAIL TO PROPERLY SUBMIT YOUR ELECTION BY THE DEADLINE, YOU WILL NOT BE PERMITTED TO PARTICIPATE IN THIS OFFER.

16. During what period of time can I withdraw or change my previous elections?

You

can withdraw or change your previously submitted election to exchange or not exchange Eligible Options at any time on or before 11:59

P.M. Eastern Time on the Offer Expiration Date, which is scheduled to occur on December 10, 2024, unless extended by us. If this Offer

is extended beyond December 10, 2024, you can withdraw or change your election at any time until the extended expiration of this Offer.

For subsequent withdrawals and elections, please deliver the properly completed and signed election form (or Notice of Withdrawal of

election form) so that we receive it before 11:59 p.m., Eastern Time, on the Offer Expiration Date, which is currently scheduled for

December 10, 2024, by email (by PDF or similar imaged document file) delivered to: stockadmin@tigoenergy.com. It is your responsibility

to confirm that we have received your correct election before the deadline. In all cases, the last election submitted and received prior

to the deadline will be final and irrevocable. See Section 4 of the Offer to Exchange entitled “Withdrawal Rights” below

for additional information.

AFTER

THE DEADLINE TO WITHDRAW OR CHANGE YOUR ELECTION HAS OCCURRED, YOU WILL NOT BE PERMITTED TO WITHDRAW OR CHANGE YOUR ELECTION.

17. Can I exchange the remaining portion of an Eligible Option grant that I have already partially exercised?

Yes,

any unexercised portion of a separate Eligible Option grant can be exchanged. If you have previously exercised a portion of an Eligible

Option grant, only the portion of that option grant that has not yet been exercised will be eligible to be exchanged. Any portion of

a Separate Option Grant that has been exercised is not eligible to participate in the Option Exchange. The Replacement Option will only

replace the portion of Eligible Option grant that is cancelled upon the expiration of this Offer.

18. Can I select which of my Eligible Options to exchange?

Yes.

You can exchange your Eligible Options on a grant-by-grant basis, determined based on the grant date and exercise price of the original

option. However, no partial exchanges of Separate Option Grants will be permitted.

19. Can I exchange both vested and unvested Eligible Options?

Yes.

You can exchange Eligible Options, whether or not they are vested (and you must exchange all of the unexercised portion of a Separate

Option Grant if you choose to exchange such Separate Option Grant). Each Replacement Option will have the same vesting schedule as the

tendered Eligible Option.

20. What will be my new option exercise price?

The

per share exercise price of the Replacement Options will be the per share closing trading price of our Common Stock on Nasdaq on the

Replacement Option Grant Date, which is expected to occur on or about December 10, 2024. See Section 1 of the Offer to Exchange

entitled “Eligibility; Number of Options; Offer Expiration Date,” Section 2 of the Offer to Exchange entitled

“Purpose of this Offer” and “Risk Factors” below for additional information.

21. When will the Replacement Options be granted?

We

will grant the Replacement Options on the Replacement Option Grant Date, which we expect to occur on or about December 10, 2024. If

this Offer is extended beyond the Offer Expiration Date, then the Replacement Options will be granted on an extended Offer

Expiration Date. See Section 8 of the Offer to Exchange entitled “Source and Amount of Consideration; Terms of Replacement

Options” below for more information.

22. When will the Replacement Options vest?

Replacement

Options will be subject to the same vesting schedule as the tendered Eligible Option. Like all of our outstanding options, the vesting

of the Replacement Options is dependent upon continued service with the Company or its subsidiaries through the applicable vesting date.

Replacement Options are subject to the terms and conditions as provided for in the Equity Incentive Plan and may be forfeited if not

vested at the time of a termination of service. See Section 8 of the Offer to Exchange entitled “Source and Amount of Consideration;

Terms of Replacement Options” below for additional information.

23. What will be the terms and conditions of my Replacement Options?

Replacement

Options will have terms and conditions set forth in the Equity Incentive Plan and will be subject to an applicable form of option award

agreement (based on whether you are an employee or director). In addition, the number of shares subject to the Replacement Options and

the Replacement Options’ exercise prices will be different from such terms that are applicable to Eligible Options, but the Replacement

Options will otherwise have terms and conditions generally similar to the surrendered Eligible Options.

You

are encouraged to consult the Equity Incentive Plan and the forms of option award agreements for complete information about the

terms of the Replacement Options, which are available upon request by emailing stockadmin@tigoenergy.com. Each Replacement Option

will have a term equal to the remaining term of the tendered Eligible Option and will expire on the same expiration date as the

tendered Eligible Option, subject to earlier expiration of the option following termination of your employment or service, as

applicable, with the Company or any of its subsidiaries. See Section 8 of the Offer to Exchange entitled “Source and Amount of

Consideration; Terms of Replacement Options” below for additional information.

24. What if my employment or service with the Company is terminated after the Replacement Options are granted?

If

your service with the Company and its subsidiaries terminates for any reason after the Replacement Option has been granted, you will

forfeit any shares of Common Stock underlying your Replacement Options that are unvested at the date of your termination, subject to

any provisions providing for accelerated vesting. You may exercise your Replacement Options that are vested as of the date of your termination

must be exercised within the time set forth in your option award agreement (generally, within three months following the date of your

termination of service). See Section 8 of the Offer to Exchange entitled “Source and Amount of Consideration; Terms of Replacement

Options” below for additional information.

25. What happens if the Company is subject to a change in control AFTER the Replacement Options are granted?

Although

we are not currently contemplating a merger or similar transaction that could result in a change in control of our Company, we are reserving

the right to take any actions that we deem necessary or appropriate to complete a transaction that our Board believes is in the best

interest of our Company and our stockholders. It is possible that, after the grant of Replacement Options, we might effect or enter into

an agreement, such as a merger or other similar transaction, in which the current share ownership of our Company will change such that

a new group of stockholders has the number of votes necessary to control stockholder voting decisions. We refer to this type of transaction

as a change in control transaction.

To

obtain detailed change in control provisions governing your current options, you can refer to our Equity Incentive Plan, as applicable,

and the prospectus for our Equity Incentive Plan, which is available upon request by emailing stockadmin@tigoenergy.com. Your stock option

agreement(s) and certain other agreements between you and the Company may also contain provisions that affect the treatment of your options

in the event of a change in control.

26. What happens if the Company is subject to a change in control BEFORE the Replacement Options are granted?

Although

we are not currently contemplating a merger or similar transaction that could result in a change in control of our Company, we reserve

the right to take any actions that we deem necessary or appropriate to complete a transaction that our Board believes is in the best

interest of our Company and our stockholders. This could include terminating this Offer and/or your right to receive Replacement Options

under this Offer.

Any

change in control transaction, or announcement of such transaction, could have a substantial effect on our share price, including potentially

substantial appreciation in the price of shares of our Common Stock. Depending on the structure of such a transaction, price appreciation

in the shares of Common Stock associated with the Replacement Options could be drastically altered. For example, if shares of our Common

Stock were to be acquired in a cash merger, the fair market value of our shares, and hence the price at which we grant the Replacement

Options, would likely be a price at or near the cash price being paid for the shares of Common Stock in the transaction. As a result

of such a transaction, it is possible that the exercise price of the Replacement Options may be more than you might otherwise anticipate.

In addition, in the event of an acquisition of our Company for stock, tendering option holders might receive options to purchase shares

of a different issuer. See Section 2 of the Offer to Exchange entitled “Purpose of this Offer” below for additional information.

27. Are there other circumstances where I would not be granted Replacement Options?

Yes.

Even if we accept your tendered options, we will not grant Replacement Options to you if we are prohibited by applicable law or regulations

from doing so, or until all necessary government approvals have been obtained. We will use reasonable efforts to avoid a prohibition,

but if prohibited by applicable law or regulation on the Offer Expiration Date, you will not be granted Replacement Options, if at all,

until all necessary government approvals have been obtained. In addition, we will not grant Replacement Options to you if you are

not an employee or director of us or our subsidiaries on the Replacement Option Grant Date. See Section 12 of the Offer to Exchange

entitled “Agreements; Legal Matters; Regulatory Approvals” below for additional information.

28. After the Offer Expiration Date, what happens if my options end up underwater again?

The

price of shares of our Common Stock may not appreciate over the long term, and your Replacement Options may become underwater after the

Offer Expiration Date. WE CAN PROVIDE NO ASSURANCE AS TO THE PRICE OF SHARES OF OUR COMMON STOCK AT ANY TIME IN THE FUTURE. See Section

2 of the Offer to Exchange entitled “Purpose of this Offer” below for additional information.

Other

Important Questions

29. What are the U.S. Federal tax consequences of my participation in this Offer?

The

following is a summary of the material U.S. federal income tax consequences of the exchange of options for new options pursuant to the

offer for eligible option holders subject to U.S. federal income tax. This discussion is based on the United States Internal Revenue

Code of 1986, as amended, referred to as the “Code,” its legislative history, treasury regulations promulgated thereunder,

and administrative and judicial interpretations as of the date of this Offer to Exchange, all of which are subject to change, possibly

on a retroactive basis. This summary does not discuss all of the tax consequences that may be relevant to you in light of your particular

circumstances, including the application of the alternative minimum tax and the Medicare tax on net investment income, nor is it intended

to be applicable in all respects to all categories of option holders. If you are subject to the tax laws of another country (even if

you are also a citizen or a resident of the United States), or if you change your residence or citizenship after the new options are

granted to you, you should be aware that there might be other tax and social security consequences that may apply to you.

We

strongly recommend that you consult your tax advisor with respect to the federal, state, local, non-U.S. and any other tax consequences

of your participation in this offer, as the tax consequences to you are dependent on your specific individual tax situation.

Eligible

option holders who exchange eligible options for new options pursuant to this offer generally will not be required to recognize income

for U.S. federal income tax purposes at the time of the exchange. We believe that the exchange will be treated as a non-taxable exchange.

However, see the discussion below under the heading “Incentive Stock Options” for information concerning the possibility

that, even if you elect not to participate in the offer, your incentive stock options may be affected.

For

U.S. tax purposes, new options that are issued in exchange for eligible options that were incentive stock options will also be incentive

stock options, unless federal tax rules limit this characterization, and new options that are issued in exchange for eligible options

that were nonstatutory stock options will also be nonstatutory stock options.

If

you are considering participating in this Offer, you should consult your own financial, legal and/or tax advisors concerning the federal,

state and local tax consequences in light of your particular situation and any consequences arising under the laws of any other taxing

jurisdiction applicable to you.

If

you accept this Offer and are subject to taxation in the United States, under current law, you generally will not recognize income for

federal income tax purposes either at the time your exchanged options are cancelled or when the Replacement Options are granted.

If

you are subject to the tax laws of a country other than the United States, even if you are a resident of the United States, you should

be aware that there may be other tax consequences that may apply to you. Tax consequences may vary depending on each individual’s

circumstances. You should review these disclosures carefully before deciding whether or not to participate in this Offer.

See

Section 13 of the Offer to Exchange entitled “Material U.S. Federal Income Tax Consequences” below for additional information.

30. How should I decide whether or not to participate?

The

decision to participate must be each individual’s personal decision and will depend largely on each individual’s assumptions

about the future of our business, our share price, the overall economic environment, and the performance of publicly traded stocks generally.

The likely lower exercise price of Replacement Options may allow you to recognize value from your option sooner. There is an inflection

point, however, at higher share prices where the value of the Eligible Option you surrendered would have been greater than the value

of the Replacement Option. The reason for this is because your Replacement Option will cover fewer shares than the Eligible Option you

surrendered. The inflection point for each option grant varies depending on the exercise price and the exchange ratio of such Eligible

Option grant.

We

understand that this will be a challenging decision for all eligible individuals. THE OPTION EXCHANGE CARRIES CONSIDERABLE RISK, AND

THERE ARE NO GUARANTEES OF OUR FUTURE SHARE PERFORMANCE OR THE PRICE OF SHARES OF OUR COMMON STOCK ON THE OFFER EXPIRATION DATE. See

Section 17 of the Offer to Exchange entitled “Miscellaneous” below for additional information.

31. What do the executive officers and the members of our Board think of this Offer? Who can I contact to help me decide whether or not I should exchange my Eligible Options?

Although

our Board has approved this Offer, neither our executive officers nor the members of our Board make any recommendation as to whether

you should elect to exchange or refrain from exchanging your Eligible Options. Please contact your personal financial and tax advisors

to assist you in determining if you should exchange your Eligible Options.

32. What are some of the potential risks if I choose to exchange my outstanding Eligible Options?

We

cannot predict how shares of our Common Stock or the stock market will perform before the date that the Replacement Options will be granted,

and the price of the Company’s shares of Common Stock may increase significantly. This could result in the new grants having a

higher exercise price than those you exchanged and could make the Replacement Options less valuable than those you exchanged. In addition,

because the Replacement Option you will receive will be exercisable for fewer shares than the Eligible Option you surrendered, there

is an inflection point at higher share prices where the value of the Eligible Option you surrendered would have been greater than the

value of your Replacement Option.

If

you elect to participate in this Offer, the vesting of each Replacement Option granted to you will be subject to the same vesting schedule

as the tendered Eligible Option. If your services to the Company and its subsidiaries terminate for any reason prior to vesting of your

Replacement Option, you will forfeit the then-unvested portion of your Replacement Option. See “Risk Factors” below for additional

information.

33. To whom should I ask questions regarding this Offer?

If

you have questions regarding the Offer or have requests for assistance (including requests for additional copies of this Offer to Exchange

document or other documents relating to the Offer), please email stockadmin@tigoenergy.com.

the

Company MAKES NO RECOMMENDATION AS TO WHETHER

YOU SHOULD PARTICIPATE IN THE OFFER. YOU MUST MAKE YOUR OWN DECISION WHETHER AND TO WHAT EXTENT TO PARTICIPATE. WE ENCOURAGE YOU TO SPEAK

WITH YOUR FINANCIAL, LEGAL AND/OR TAX ADVISORS, AS NECESSARY, BEFORE DECIDING WHETHER TO PARTICIPATE IN THE OFFER.

RISK

FACTORS

Participation

in this Offer involves a number of potential risks and uncertainties, including those described below. This list and the risk factors

set forth under the heading entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023,

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, our Quarterly Report on Form 10-Q for the quarter ended June

30, 2024, our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 and our other filings with the SEC, highlight the

material risks related to the Company which may impact your decision of participating in this Offer. You should carefully consider these

risks and we encourage you to speak with your financial, legal and/or tax advisors before deciding whether to participate in this Offer.

In addition, we strongly urge you to read the sections in this Option Exchange discussing the tax consequences of participating in this

Offer, as well as the rest of this Option Exchange for a more in-depth discussion of the risks that may apply to you.

In

addition, this Option Exchange and our SEC reports referred to above include forward-looking statements concerning our business, operations

and financial performance and condition, as well as our plans, objectives and expectations for our business, operations and financial

performance and condition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking

statements. These statements involve known and unknown risks, uncertainties and other important factors that are in some cases beyond

our control and may cause our actual results, performance or achievements to be materially different from any future results, performance

or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by

terminology such as such as “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “strive,” “would” and similar expressions

may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Factors

that could cause or contribute to such differences include, but are not limited to, those identified below and those discussed in the

section titled “Risk Factors” included in our Annual Report on Form 10-K for the year ended December 31, 2023, our Quarterly

Report on Form 10-Q for the quarter ended March 31, 2024, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, our

Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 and our other filings with the SEC. Furthermore, such forward-looking

statements speak only as of the date of this report. We undertake no obligation to publicly update or revise any forward-looking statements

contained herein for any reason after the date of this report to conform these statements to new information, actual results or changes

in our expectations, except as required by applicable law.

The

safe harbor provided in the Private Securities Litigation Reform Act of 1995, by its terms, does not apply to statements made in connection

with this Offer.

Risks

Related to This Offer

If

the price of shares of our Common Stock increases after the date of grant of the Replacement Options, your surrendered Eligible Options

might have been worth more than the Replacement Options that you will receive in exchange for them.

Because

you will receive Replacement Options covering fewer shares than the Eligible Options surrendered, your Replacement Options will have

less potential for increases in value due to significantly higher share prices.

The

exchange ratios used in the offer may not accurately reflect the value of your Eligible Options at the time of their exchange.

The

calculation of the exchange ratios for the Eligible Options in the Offer will be based on the Lattice Model and relies on numerous assumptions.

If a different method or different assumptions are used, or if the exchange ratios are calculated as of a different date, the exchange

ratio for an Eligible Option grant may vary from the exchange ratio applicable to that particular Eligible Option grant in this Offer.

The valuation method that we used for establishing the exchange ratios is designed to estimate a fair value of options as of the date

the exchange ratios are calculated and is not a prediction of the future value that might be realized through Eligible Options or Replacement

Options. The valuation techniques employed to determine the exchange ratio are consistent with the valuation techniques

that will be used to determine the accounting impact of the Option Exchange for financial reporting.

The

exchange ratio for each Eligible Option cannot be calculated as of the date of this Offer because the ratios will be based in part on

the future value of our common stock during and at the end of the Offer. The exchange ratios are structured so that in no event would

the number of Replacement Options received by you exceed the number of shares underlying the Eligible Options exchanged for the Replacement

Options.

You

should be aware that option valuation is inherently difficult to estimate and imprecise. The utilization of different assumptions in

the Lattice Model can produce significantly different results for the ultimate value of an option.

Moreover,

even experts can disagree on the correct assumptions to use for any particular option valuation exercise. The assumptions we used for

purposes of this offer may not be the same as those used by others and, therefore, our valuation of the eligible options and/or the exchange

ratios may not be consistent with those obtained using other valuation techniques or input assumptions and may not reflect the actual

value of these options.

Risks

Related to Our Business and Shares of Common Stock

You

should carefully review the risk factors contained in our Quarterly Reports on Form 10-Q for the quarters ended March 31, June 30, and

September 30, 2024, and our Annual Report on Form 10-K for the year ended December 31, 2023, and also the other information provided

in this Option Exchange and the other materials that we have filed with the SEC, before making a decision on whether or not to tender

your Eligible Options. You may access these filings electronically at the SEC’s website at http://www.sec.gov. In addition, we

will provide without charge to you, upon your request, a copy of any or all of the documents to which we have referred you. See “This

Offer - Additional Information” for more information regarding reports we file with the SEC and how to obtain copies of or otherwise

review these reports. These reports can also be accessed free of charge at https://investors.tigoenergy.com/financials-filings/sec-filings.

Risks

Related to Tax Effects

This

offer currently is expected to remain open for 20 business days. However, if we extend the offer so that it remains open for 30 or more

days, U.S. employees will be required to restart the measurement periods necessary to qualify incentive stock options for favorable tax

treatment, even if they choose not to exchange such options in the offer.

Generally,

your incentive stock option qualifies for favorable tax treatment if you hold the option for more than two years after the grant date

and for more than one year after the date of exercise. We do not expect that the offer will affect the eligibility of any incentive stock

options not tendered for exchange in the offer for favorable tax treatment under U.S. tax laws. Thus, if you do not tender your incentive

stock option, the holding period will continue to be measured from your original grant date.

However,

if the offer period lasts for 30 days or more, any eligible options that are incentive stock options that you have not exchanged in the

offer may be deemed modified, and the holding period for such options will restart. As a result, in order to qualify for favorable tax

treatment, you would not be able to sell or otherwise dispose of any shares received upon exercise of such options until more than two

years from the date this offer commenced on November 12, 2024, and more than one year after the date you exercise such options, whichever

date is later.

If

you are a U.S. taxpayer, you and the Company may be subject to certain U.S. federal income tax obligations when you exercise your new

options and when you sell the shares underlying your new options.

If

you participate in the offer, you generally will not incur any immediate U.S. federal income tax at the time of the exchange as a result

of either electing to retain your eligible options or electing to exchange your eligible options for new options. However, except in

the case of an incentive stock option, you generally will have taxable ordinary income when you exercise your new options, at which time

Tigo also will have a tax withholding obligation, which will be satisfied in the manner specified in the option agreement relating to

your new options. Subject to certain exceptions, you will also have taxable capital gains when you sell the shares underlying the new

options. Please see “Material U.S. federal income tax consequences” for a reminder of the general tax consequences associated

with options.

If

you are subject to foreign tax laws, even if you are a resident of the United States, there may be tax and social insurance consequences

relating to this Offer.

If

you are subject to the tax laws of another country, even if you are a resident of the United States, you should be aware that there may

be other tax and social insurance consequences that may apply to you. You should be certain to consult your own tax advisors to discuss

these consequences. You should read Schedule A attached to this Offer to Exchange. Schedule A discusses the tax consequences

relating to this Offer for your country of residence. You should also be certain to consult your own tax advisors to discuss these consequences.

Please

note that, depending on where you live, state and local income taxes may also apply to you, and Tigo may have tax withholding obligations

with respect to such taxes. You should consult your own tax advisor to discuss these consequences to you in your particular circumstances.

If

you are a tax resident of multiple countries, there may be tax and/or social security consequences of more than one country that apply

to you.

If

you are subject to the tax laws in more than one jurisdiction, you should be aware that there might be tax and/or social security consequences

of more than one country that may apply to you. You should consult your own tax advisor to discuss these consequences to you in your

particular circumstances.

THIS

OFFER

1. Eligibility; Number of Options; Offer Expiration Date.

Upon