MORNING UPDATE: brokersXpress, LLC issues alerts for ET, MCD, VC, BBI, and OVTI

August 09 2005 - 9:27AM

PR Newswire (US)

CHICAGO, Aug. 9 /PRNewswire/ -- brokersXpress, LLC issues the

following Morning Update at 8:30 AM EDT with new PriceWatch Alerts

for key stocks. Before the open... PriceWatch Alerts for ET, MCD,

VC, BBI, and OVTI, Market Overview, Today's Economic Calendar, and

the Quote Of The Day. QUOTE OF THE DAY "It isn't that the Fed

strategy isn't clear, but it's whether the Fed strategy will work."

-- John P. Waterman, chief investment officer, Rittenhouse Asset

Management New PriceWatch Alerts for ET, MCD, VC, BBI, and OVTI...

PRICEWATCH ALERTS - HIGH RETURN COVERED CALL OPTIONS ----------- --

E-trade Group (NYSE:ET) Last Price 16.10 - OCT 16.00 CALL OPTION@

$0.90 -> 5.3 % Return assigned* -- McDonalds Corp. (NYSE:MCD)

Last Price 32.14 - DEC 32.50 CALL OPTION@ $1.50 -> 6.1 % Return

assigned* -- Visteon Corp. (NYSE:VC) Last Price 9.85 - DEC 7.50

CALL OPTION@ $2.75 -> 5.6 % Return assigned* -- Blockbuster Inc.

(NYSE:BBI) Last Price 8.01 - SEP 7.50 CALL OPTION@ $0.90 -> 5.5

% Return assigned* -- OmniVision Technologies Inc. (NASDAQ:OVTI)

Last Price 12.19 - DEC 10.00 CALL OPTION@ $2.80 -> 6.5 % Return

assigned* * To learn more about how to use these alerts and for our

FREE report, "The 18 Warning Signs That Tell You When To Dump A

Stock", go to: http://www.investorsobserver.com/mu18 (Note: You may

need to copy the link above into your browser then press the

[ENTER] key) ** FREE Access to the Market Intelligence Center where

you will find the news, insight and intelligence that can make a

difference in the way you invest, go to:

http://www.investorsobserver.com/FreeMIC NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. NEWS LEADERS AND LAGGARDS So far today,

Clear Channel Communications, Biogen Idec, and MCI lead the list of

companies with the most news stories while King Pharmaceuticals and

NRG Energy are showing a spike in news. Pixar, Time Warner, and

AmeriCredit have the highest srtIndex scores to top the list of

companies with positive news while Blockbuster and Amgen lead the

list of companies with negative news reports. Walt Disney Co has

popped up with a high positive news sraIndex score. For the FREE

article titled, "Earnings Season Decoded - An Essential 15 Point

Checklist For Finding Winning Stocks." go to:

http://www.wallstreetsecretsplus.com/go/freemu/ MARKET OVERVIEW

Overseas trading is cautiously higher ahead of today's

interest-rate report from the FOMC, as eight of the 15 foreign

indices that we track are currently in positive territory. This

trepidation is reflected in the group's cumulative average return

of a mere 0.169. In Japan, traders appeared to be largely

unaffected by the political upheaval that followed parliament's

defeat of the government's postal privatization bill on Monday. The

Nikkei surged more than 121 points on the day, helped by

better-than-expected domestic June machinery orders. In the rest of

Asia, rising oil prices boosted indices. The economic calendar is

packed today, as we are set to receive the preliminary non-farm

productivity and unit labor costs for the second quarter before the

open. Also, we get a peek at retail sales for the past week from

the Redbook Retail Sales Index. However, the report that every one

is waiting for is the FOMC decision on interest rates. While the

Fed is largely expected to lift this key rate by 25 basis points to

3.5 percent, the wording of this release is always carefully

scrutinized. Keep an eye out at 2:15 p.m. Eastern time for that

first tick after the announcement, it could indicate the direction

of the market heading into the close. Be prepared for the investing

week ahead with Bernie Schaeffer's FREE Monday Morning Outlook. For

more details and to sign up, go to:

http://www.investorsobserver.com/freemo DYNAMIC MARKET

OPPORTUNITIES The second week of August started brightly, with

George Bush finally inking the new Energy Bill, worth around

US$14.5 billion. Since this is double what he originally asked for,

the president looks to have achieved a significant personal

victory. However, one look at the oil market to see crude prices

marching to yet another record high over US$64 a barrel will

deflate his mood a little. The spike comes as the US closed its

Embassy and Consulates in Saudi Arabia, the world's leading oil

producer. The US government said that it received terrorist threats

against the buildings. Traders worry that if terrorists strike

against US positions in Saudi Arabia, they will probably also

strike against oil production plants there, forcing refinery

shutdowns that would reduce supply. Oil prices are rising even

though the OPEC oil cartel said it had increased production by

300,000 barrels a day in the past two weeks to 30.4 million barrels

per day. But the market seemingly prefers to focus more on the

streak of problems plaguing US refineries lately. More than half a

dozen, including Exxon-Mobil, BP, Valero Energy, and

ConocoPhillips, have experienced unplanned outages over the past

two weeks, reducing output of consumer end fuels like gasoline.

Since March, the companies have operated at more than 90% of

capacity, in hopes of meeting surging demand for gasoline and

diesel. That, coupled with a decade of under-investment, and with

no new refineries having been built in the US for over 30 years,

means many plants are now finally starting to fail. To add to the

turmoil in Saudi Arabia, Iran said it has resumed work at its

uranium conversion plant, risking sanctions by restarting its

nuclear program. Read more analysis from the 247Profits Group every

trading day with the FREE 247Profits e-Dispatch, featuring

insightful economic commentary, profitable investment

recommendations, and full access to a leading team of financial

experts. Register for free here:

http://www.247profits.com/enter.html TODAY'S ECONOMIC CALENDAR 7:45

a.m. Aug 6 ICSC Store Sales Index 8:30 a.m. 2Q Prelim Non-Farm

Productivity 8:30 a.m. 2Q Prelim Unit Labor Costs 8:55 a.m. Aug 6

Redbook Retail Sales Index 10:00 a.m. June Wholesale Trade 2:15

p.m. FOMC decision on interest rates 5:00 p.m. Aug 6 ABC/Washington

Post Consumer Confidence Index The Mankus Lavelle Group is an

independent brokerage branch of brokersXpress, LLC, a wholly owned

subsidiary of optionsXpress Holdings, Inc. The Mankus Lavelle Group

has some of the most experienced, respected options professionals

in the industry. Both novice option investors and experienced

traders are attracted to MLG. Less experienced investors appreciate

Mankus Lavelle Group's friendly expert guidance while more seasoned

investors value Mankus Lavelle Group's highly trained staff of

option experts. To improve your understanding of options get a free

option kit at: http://www.mlgos.com/. If you are familiar with

stock investing but not sure what options can do for you, call

1-800-230-5570 for a FREE 3-point portfolio check up. Securities

offered through brokersXpress, LLC Member NASD/SPIC. Corporate

Office: 39 South LaSalle Street - Suite 220 - Chicago, Illinois

60603-1608 brokersXpress(SM) is the online broker-dealer for

independent reps and advisors. Powered by the award-winning

technology of optionsXpress(R), its parent company, brokersXpress

provides a leading-edge trading platform particularly powerful for

reps and advisors who employ option strategies. For more

information on how partnering with brokersXpress can empower your

business to new levels, contact us confidentially by e-mail at .

Member NASD/SPIC. CRD# 127081 This Morning Update was prepared with

data and information provided by: InvestorsObserver.com - Better

Strategies for Making Money -> For Investors With a Sense of

Humor. Only $1 for your first month plus seven free bonuses worth

over $420, see: http://www.investorsobserver.com/must Quote.com

QCharts- Real time quotes and streaming technical charts to keep

you up with the market. Analyze, predict, and stay ahead. for a

Free 30 day trial go to: http://www.investorsobserver.com/MUQuote2

247profits.com: You'll get exclusive financial commentary, access

to a global network of experts and undiscovered stock alerts.

Register NOW for the FREE 247profits e-Dispatch. Go to:

http://www.investorsobserver.com/TPA Schaeffer's Investment

Research - Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus - The Best

Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.investorsobserver.com/poweropt All stocks and options

shown are examples only. These are not recommendations to buy or

sell any security and they do not represent in any way a positive

or negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Michael at 800-230-5570 or

at http://www.cboe.com/Resources/Intro.asp. Privacy policy

available upon request. DATASOURCE: brokersXpress, LLC CONTACT:

Mike Lavelle of Mankus-Lavelle Group, +1-800-230-5570

Copyright

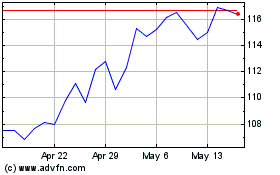

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

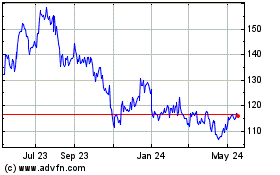

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024