0000751365FALSE00007513652024-12-092024-12-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of Report: December 9, 2024

VIRCO MFG. CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-8777 | | 95-1613718 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | |

| 2027 Harpers Way | | |

| Torrance | | California | | 90501 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (310) 533-0474

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.01 par value per share | | VIRC | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

TABLE OF CONTENTS

| | | | | |

Item 2.02 - Results of Operations and Financial Condition | |

| |

Item 9.01 - Financial Statements and Exhibits | |

SIGNATURES | |

| |

Item 2.02 Results of Operations and Financial Condition.

On December 9, 2024, Virco Mfg. Corporation (“Virco”) issued a press release announcing its financial results for the third quarter ended October 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 2.02 and Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

Item 7.01 Regulation FD Disclosure.

On December 5, 2024, the Company’s Board of Directors declared a cash dividend for the Company’s third fiscal quarter of

$0.025 on each outstanding share of common stock. The dividend is payable on January 10, 2025 to stockholders of record of the common stock as of the close of business on December 20, 2024. While the Company currently intends to pay future dividends on a quarterly basis, following review and approval by the Board of Directors, the declaration and payment of future dividends, as well as the amounts thereof, are subject to the discretion of the Board as well as restrictive covenants in the Company’s lending agreements. There can be no assurance that the Company will declare and pay dividends in future periods.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | VIRCO MFG. CORPORATION (Registrant) |

| |

| Date: December 9, 2024 | /s/ Robert A. Virtue |

| | (Signature) | | |

| | Name: | | Robert A. Virtue |

| | Title: | | Chief Executive Officer and Chairman of the Board of Directors |

Exhibit 99.1

Virco Reports Third Quarter Results: Robust Balance Sheet and Strengthening Cash Flows as School Furniture Market Returns to pre-Pandemic Seasonal Patterns

•Capital Efficiencies Improved

•Growth and Shareholder Returns Funded by Operating Cash Flows

•Quarterly Dividend of $0.025 per Share Declared

•Traditional Seasonality Returns to Shipments, Orders, Backlog

TORRANCE, CALIFORNIA: December 9, 2024 (Globe Newswire)—Virco Mfg. Corporation (NASDAQ:VIRC) a leading manufacturer and supplier of movable furniture and equipment for educational environments and public spaces, announced results for the Company’s Third Quarter and first Nine Months ended October 31, 2024:

For the Third Quarter, including the months of August, September, and October, revenue declined slightly to $82,620,000 from $84,252,000 in the same quarter of the prior year. For the first nine months, revenue grew 5.0% to $237,774,000 from $226,516,000 in the first nine months of last year.

Gross Profit for the Third Quarter declined 4.0% to $36,678,000 compared to $38,211,000 in last year’s Third Quarter. Through nine months, Gross Profit increased 7.3% to $107,243,000 compared to $99,991,000 last year. Gross Margin in the Third Quarter was 44.4% compared to 45.4% in the prior year. Through nine months, Gross Margin was 45.1% vs. 44.1% in the prior year.

Selling, General, and Administrative Expenses (SG&A) in the Third Quarter increased 8.8% to $25,565,000, or 30.9% of revenue, from $23,505,000, or 27.9% of revenue, in the same period of the prior year, primarily due to higher freight and installation costs. Through nine months, SG&A increased 9.1% to $71,265,000, or 30.0% of revenue, from $65,343,000, or 28.8% of revenue, driven by higher freight and installation costs as well as a proportionate increase in revenue. Inflation in services such as freight and installation are not reflected in the broader Consumer Price Index of inflation, but these expenses can be very impactful on a direct supplier such as Virco. Management anticipates a continuation of this trend in the short- to mid-term.

Operating Income for the Third Quarter declined to $11,113,000 or 13.5% of sales, compared to $14,706,000, or 17.5% of sales in the Third Quarter of the prior year. Through nine months, Operating Income is up 3.8% to $35,978,000 or 15.1% of sales, compared to $34,648,000, or 15.3% of sales, in the same period last year.

Net interest income in the Third Quarter was $24,000, compared to net interest expense of $765,000 in the same quarter of the prior year. This swing to net interest income reflects the fact that the Company was effectively debt-free during the bulk of the Third Quarter, and was not utilizing its seasonal line of credit to finance operations. Through nine months, net interest expense was $506,000 compared to $2,560,000 last year.

Net income for the Third Quarter was $8,401,000, down from $10,160,000 in the same period of the prior year. Through nine months, net income was $27,374,000, up from $24,252,000 in the first nine months of last year.

The Company has recently seen order rates and timing return to a more traditional seasonal pattern. Management’s preferred measure of business velocity is “Shipments plus Backlog,” a non-GAAP metric that combines actual shipments with the unshipped backlog. As of this press release (December 9, 2024), Shipments plus Backlog is approximately 1% higher than on the same date last year. This reflects both a moderation in the rate of order growth as well as a return to more traditional seasonal patterns, during which orders and related production peak in spring, followed by heavy shipments in summer when schools are out of session. The return to this pattern continued in the Third Quarter, with the bulk of the metric being concentrated in actual year-to-date shipments with a relatively smaller component of unshipped backlog.

The Company’s overall financial position continued to improve in the Third Quarter. As of October 31, 2024, all major activities including operations, regular maintenance capital expenditures, and shareholder returns were being funded by free cash from operations. As of October 31, 2024, the Company had $38,858,000 of cash on hand and was not utilizing any of its available credit under its seasonal revolver with PNC Bank. Management anticipates

that this positive condition will persist through much of the coming year, with only modest borrowings under its seasonal revolver during peak delivery season in summer.

Other elements of the Balance Sheet are similarly strong. Inventories have been appropriately matched to shippable orders and were down 16.9% to $48,948,000 compared to $58,931,000 at the end of last year’s Third Quarter. The Company’s domestic factories and early upstream visibility of product specifications and installation details—provided by its proprietary PlanSCAPE project management service—has supported a gradual shift toward Make-to-Order versus Make-to-Stock. This shift has had a similar financial benefit for Virco as “Just-in-Time” used to have for importers before the supply chain disruptions of a few years ago. Virco is currently able to tailor all levels of inventory—from raw materials, through work-in-process, to final finished goods—to match actual customer demand. Management believes this efficiency is reflected not only in financial results but also in customer satisfaction, especially with complex projects and highly customized products, both of which have recently become a larger part of the Company’s revenue mix.

At the end of the Third Quarter, Accounts Receivable had declined 14.7% to $28,168,000 from $33,029,000 at the same period last year. Management views this decline as favorable, since it reflects faster collections on overall higher annual revenue, further reflecting the Company’s strong on-time and complete-delivery performance during this year’s peak summer season.

Stockholder’s Equity was $115,859,000 at the end of the Third Quarter, an increase of 23.5% from $93,789,000 at the same period last year. The Company’s strong financial position will allow it to continue its record of customer support and service, as well as its generous and fair benefits and compensation for its U.S. workers. In addition, Management continues to make strategic investments in new manufacturing processes and platforms, while also remaining open to opportunistic acquisitions that would expand the Company’s current product and service offerings or allow extensions into adjacent markets with characteristics that match Virco’s skills and capabilities.

On December 5, 2024, The Company’s Board of Directors declared a quarterly dividend of $0.025 per share, payable on January 10, 2025 to shareholders of record as of December 20, 2024. Additionally, the Company has $3.5 million remaining under its current authorization for open-market share repurchases. Management continues to believe the Company’s shares represent an attractive investment and will balance planned repurchases with other capital projects, including investments in major manufacturing platforms as well as potential acquisitions.

Commenting on recent developments, Virco Chairman and CEO Robert Virtue said: “I’m proud of the Virco team, including our direct sales force, our customer service staff, our highly skilled manufacturing and engineering personnel, our incredible warehousing and logistics team, and our steady, experienced executives who have collectively guided us through the last several challenging years.

“I attribute our success to Virco’s dedicated American workforce, as well as the resilience and social importance of education, which is the market we serve. I also must recognize Virco’s shareholders, who collectively supported Management’s very-long-term strategy that allowed us not just to keep our domestic U.S. factories open, but to continue investing in them and our employees, so that we are globally competitive in all facets of operations, including automation, quality control, speed of execution, customization, project management, and field services.

“There is also a high value to the innovation that happens inside factories, where proximity to tangible materials and processes inspires tinkering and creativity. Many of our very best ideas—and not just for products— have originated on the factory floor. This also includes our warehouses, where innovations in the storage and handling of very heavy, bulky, and highly seasonal products can have equal or greater impacts on customer satisfaction and financial performance.

“We have never offered guidance despite being asked quite often to do so. We prefer instead to focus on preparedness. We have prudently reinforced our balance sheet thanks to the success we’ve enjoyed in the last two years. We have also continued to invest in what we think of as “operating annuities:” new equipment, processes, and software for our factories and operating systems. Given the skill and experience of our maintenance teams we can often extend the useful life of these investments far beyond traditional depreciation schedules. For example, Virco’s very first tubemill, a machine that makes the steel tubing used in school furniture, was purchased in 1950, the year Virco was founded. That same tubemill, maintained with multiple upgrades and repairs, continues to operate today in our Torrance, California factory.

“I’d say we’ve gotten our money out of that one. But we’re not done with it yet. We see more opportunities on the horizon, both for our company and for the students, families, and educators that we serve. We look forward to those opportunities. And we thank our shareholders for supporting us in this important work.”

Contact:

Virco Mfg. Corporation

(310) 533-0474

Robert A. Virtue, Chairman and Chief Executive Officer

Doug Virtue, President

Robert Dose, Chief Financial Officer

Statement Concerning Forward-Looking Information

This news release contains “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements regarding: our future financial results and growth in our business; business strategies; market demand and product development; estimates of unshipped backlog; order rates and trends in seasonality; product relevance; economic conditions and patterns; the educational furniture industry generally, including the domestic market for classroom furniture; cost control initiatives; absorption rates; and supply chain challenges. Forward-looking statements are based on current expectations and beliefs about future events or circumstances, and you should not place undue reliance on these statements. Such statements involve known and unknown risks, uncertainties, assumptions and other factors, many of which are out of our control and difficult to forecast. These factors may cause actual results to differ materially from those that are anticipated. Such factors include, but are not limited to: uncertainties surrounding the ongoing and long-term effects of the COVID-19 pandemic; changes in general economic conditions including raw material, energy and freight costs; state and municipal bond funding; state, local, and municipal tax receipts; order rates; the seasonality of our markets; the markets for school and office furniture generally, the specific markets and customers with which we conduct our principal business; the impact of cost-saving initiatives on our business; the competitive landscape, including responses of our competitors and customers to changes in our prices; demographics; and the terms and conditions of available funding sources. See our Annual Report on Form 10-K for the year ended January 31, 2024, our Quarterly Reports on Form 10-Q, and other reports and material that we file with the Securities and Exchange Commission for a further description of these and other risks and uncertainties applicable to our business. We assume no, and hereby disclaim any, obligation to update any of our forward-looking statements. We nonetheless reserve the right to make such updates from time to time by press release, periodic reports, or other methods of public disclosure without the need for specific reference to this press release. No such update shall be deemed to indicate that other statements which are not addressed by such an update remain correct or create an obligation to provide any other updates.

Financial Tables Follow

Virco Mfg. Corporation

Unaudited Condensed Consolidated Balance Sheets

| | | | | | | | | | | | | | | | | |

| 10/31/2024 | | 1/31/2024 | | 10/31/2023 |

(In thousands) |

| | | | | |

Assets | | | | | |

Current assets | | | | | |

Cash | $ | 38,858 | | | $ | 5,286 | | | $ | 4,887 | |

Trade accounts receivables, net | 28,168 | | | 23,161 | | | 33,029 | |

Inventories | 48,948 | | | 58,371 | | | 58,931 | |

Prepaid expenses and other current assets | 3,479 | | | 2,208 | | | 1,988 | |

Total current assets | 119,453 | | | 89,026 | | | 98,835 | |

Non-current assets | | | | | |

Property, plant and equipment | | | | | |

Land | 3,731 | | | 3,731 | | | 3,731 | |

Land improvements | 697 | | 694 | | 694 |

Buildings and building improvements | 51,950 | | | 51,576 | | | 51,498 | |

Machinery and equipment | 118,324 | | | 114,400 | | | 116,695 | |

Leasehold improvements | 523 | | 523 | | 976 |

Total property, plant and equipment | 175,225 | | | 170,924 | | | 173,594 | |

Less accumulated depreciation and amortization | 139,604 | | | 136,356 | | | 138,650 | |

Net property, plant and equipment | 35,621 | | | 34,568 | | | 34,944 | |

Operating lease right-of-use assets | 36,876 | | | 6,508 | | | 7,156 | |

Deferred tax assets, net | 6,550 | | | 6,634 | | | 7,031 | |

Other assets, net | 11,645 | | | 9,709 | | | 9,073 | |

Total assets | $ | 210,145 | | | $ | 146,445 | | | $ | 157,039 | |

Virco Mfg. Corporation

Unaudited Condensed Consolidated Balance Sheets

| | | | | | | | | | | | | | | | | |

| 10/31/2024 | | 1/31/2024 | | 10/31/2023 |

| (In thousands, except share and par value data) |

| | | | | |

Liabilities | | | | | |

Current liabilities | | | | | |

Accounts payable | $ | 15,381 | | | $ | 12,945 | | | $ | 14,351 | |

Accrued compensation and employee benefits | 12,439 | | | 10,880 | | | 11,102 | |

Income tax payable | 1,463 | | | 145 | | 3,130 | |

Current portion of long-term debt | 256 | | 248 | | 245 |

Current portion of operating lease liability | 863 | | 5,744 | | | 5,465 | |

Other accrued liabilities | 11,142 | | | 8,570 | | | 7,339 | |

Total current liabilities | 41,544 | | | 38,532 | | | 41,632 | |

Non-current liabilities | | | | | |

Accrued self-insurance retention | 1,033 | | | 650 | | 748 |

Accrued pension expenses | 9,345 | | | 9,429 | | | 9,334 | |

Income tax payable, less current portion | 261 | | 128 | | — | |

Long-term debt, less current portion | 3,943 | | | 4,136 | | | 7,946 | |

Operating lease liability, less current portion | 37,380 | | | 1,829 | | | 2,933 | |

Other long-term liabilities | 780 | | 562 | | 657 |

Total non-current liabilities | 52,742 | | | 16,734 | | | 21,618 | |

Commitments and contingencies (Notes 6, 7 and 13) | | | | | |

Stockholders’ equity | | | | | |

Preferred stock: | | | | | |

Authorized 3,000,000 shares, $0.01 par value; none issued or outstanding | — | | | — | | | — | |

Common stock: | | | | | |

Authorized 25,000,000 shares, $0.01 par value; issued and outstanding 16,289,406 shares at 10/31/2024, and 16,347,314 at 1/31/2024 and 10/31/2023 | 163 | | 164 | | 164 |

Additional paid-in capital | 119,796 | | | 121,373 | | | 121,201 | |

Accumulated deficit | (2,734) | | | (29,048) | | | (26,379) | |

Accumulated other comprehensive loss | (1,366) | | | (1,310) | | | (1,197) | |

Total stockholders’ equity | 115,859 | | | 91,179 | | | 93,789 | |

Total liabilities and stockholders’ equity | $ | 210,145 | | | $ | 146,445 | | | $ | 157,039 | |

Virco Mfg. Corporation

Unaudited Condensed Consolidated Statements of Income

| | | | | | | | | | | |

| Three months ended |

| 10/31/2024 | | 10/31/2023 |

| (In thousands, except per share data) |

Net sales | $ | 82,620 | | | $ | 84,252 | |

Costs of goods sold | 45,942 | | | 46,041 | |

Gross profit | 36,678 | | | 38,211 | |

Selling, general and administrative expenses | 25,565 | | | 23,505 | |

Operating income | 11,113 | | | 14,706 | |

Unrealized (gain) loss on investment in trust account | (246) | | | 176 |

Pension expense | 106 | | 301 |

Interest (income) expense | (24) | | | 765 |

Income before income taxes | 11,277 | | | 13,464 | |

Income tax expense | 2,876 | | | 3,304 | |

Net income | $ | 8,401 | | | $ | 10,160 | |

| | | |

Cash dividends declared per common share: | $ | 0.025 | | | $ | — | |

| | | |

Net income per common share: | | | |

Basic | $ | 0.52 | | | $ | 0.62 | |

Diluted | $ | 0.52 | | | $ | 0.62 | |

Weighted average shares of common stock outstanding: | | | |

Basic | 16,289 | | | 16,347 | |

Diluted | 16,296 | | | 16,428 | |

Virco Mfg. Corporation

Unaudited Condensed Consolidated Statements of Income

| | | | | | | | | | | |

| Nine months ended |

| 10/31/2024 | | 10/31/2023 |

| (In thousands, except per share data) |

Net sales | $ | 237,774 | | | $ | 226,516 | |

Costs of goods sold | 130,531 | | | 126,525 | |

Gross profit | 107,243 | | | 99,991 | |

Selling, general and administrative expenses | 71,265 | | | 65,343 | |

Operating income | 35,978 | | | 34,648 | |

Unrealized gain on investment in trust account | (1,058) | | | (448) | |

Pension expense | 320 | | 623 |

Interest expense | 506 | | 2,560 | |

Income before income taxes | 36,210 | | | 31,913 | |

Income tax expense | 8,836 | | | 7,661 | |

Net income | $ | 27,374 | | | $ | 24,252 | |

| | | |

Cash dividends declared per common share: | $ | 0.065 | | | $ | — | |

| | | |

Net income per common share: | | | |

Basic | $ | 1.67 | | | $ | 1.49 | |

Diluted | $ | 1.67 | | | $ | 1.48 | |

Weighted average shares of common stock outstanding: | | | |

Basic | 16,379 | | | 16,277 | |

Diluted | 16,382 | | | 16,334 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

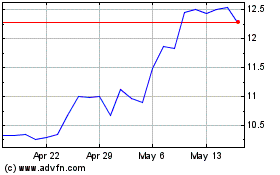

Virco Manufacturing (NASDAQ:VIRC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Virco Manufacturing (NASDAQ:VIRC)

Historical Stock Chart

From Jan 2024 to Jan 2025