UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13G

Under

the Securities Exchange Act of 1934

(Amendment

No. )*

Yunji

Inc.

(Name

of Issuer)

Class

A ordinary shares, par value US$0.000005 per share

(Title

of Class of Securities)

98873N

2061

(CUSIP

Number)

October

13, 2023

(Date

of Event which Requires Filing of this Statement)

Check

the appropriate box to designate the rule pursuant to which this Schedule is filed:

☐

Rule 13d-1(b)

☐

Rule 13d-1(c)

☒

Rule 13d-1(d)

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a

prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

1

This CUSIP number applies to the Issuer’s American Depositary Shares, each representing one hundred Class A ordinary shares of

the Issuer.

| 1. |

NAMES

OF REPORTING PERSONS

Corus

Investments Pte. Ltd. |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see

instructions)

(a)

☐

(b)

☐ |

| 3. |

SEC

USE ONLY

|

| 4. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Singapore |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

5. |

SOLE

VOTING POWER

215,800,000

Class A Shares (See Item 4) |

| 6. |

SHARED

VOTING POWER

0 |

| 7. |

SOLE

DISPOSITIVE POWER

215,800,000

Class A Shares (See Item 4) |

| 8. |

SHARED

DISPOSITIVE POWER

0 |

| 9. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

215,800,000

Class A Shares |

| 10. |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

(see

instructions) ☐

|

| 11. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

21.2%

of Class A Shares2 (or 11.0% of the total ordinary shares assuming conversion of all outstanding Class B Shares into

the same number of Class A Shares3) |

| 12. |

TYPE

OF REPORTING PERSON (see instructions)

CO |

2

As a percentage of 1,016,418,532 Class A ordinary shares of the Issuer (“Class A Shares”) as of December 31, 2023, as

set forth in the Issuer's annual report on Form 20-F filed on April 25, 2024.

3

As a percentage of 1,966,378,532ordinary shares of the Issuer as of December 31, 2023, comprised of 1,016,418,532 Class A Shares and

949,960,000 Class B ordinary shares of the Issuer (“Class B Shares”) issued and outstanding, as set forth in the

Issuer's annual report on Form 20-F filed on April 25, 2024. Each Class B Share is convertible into one Class A Share at any time

but the Class A Shares are not convertible into Class B Shares under any circumstances. Each Class A Share is entitled to one vote,

and each Class B Share is entitled to ten votes. The voting power of the ordinary shares beneficially owned by the reporting person

represents 2.1% of the total outstanding voting power of all Class A and Class B Shares of the Issuer.

| 1. |

NAMES

OF REPORTING PERSONS

Crescent Capital Investments Ltd. |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see

instructions)

(a)

☐

(b)

☐ |

| 3. |

SEC

USE ONLY

|

| 4. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Cayman

Islands |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

5. |

SOLE

VOTING POWER

215,800,000

Class A Shares (See Item 4) |

| 6. |

SHARED

VOTING POWER

0 |

| 7. |

SOLE

DISPOSITIVE POWER

215,800,000

Class A Shares (See Item 4) |

| 8. |

SHARED

DISPOSITIVE POWER

0 |

| 9. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

215,800,000

Class A Shares |

| 10. |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

(see

instructions) ☐

|

| 11. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

21.2%

of Class A Shares4 (or 11.0% of the total ordinary shares assuming conversion of all outstanding Class B Shares into

the same number of Class A Shares5) |

| 12. |

TYPE

OF REPORTING PERSON (see instructions)

CO |

4

As a percentage of 1,016,418,532 Class A ordinary shares of the Issuer (“Class A Shares”) as of December 31, 2023, as

set forth in the Issuer's annual report on Form 20-F filed on April 25, 2024.

5

As a percentage of 1,966,378,532ordinary shares of the Issuer as of December 31, 2023, comprised of 1,016,418,532 Class A Shares and

949,960,000 Class B ordinary shares of the Issuer (“Class B Shares”) issued and outstanding, as set forth in the

Issuer's annual report on Form 20-F filed on April 25, 2024. Each Class B Share is convertible into one Class A Share at any time

but the Class A Shares are not convertible into Class B Shares under any circumstances. Each Class A Share is entitled to one vote,

and each Class B Share is entitled to ten votes. The voting power of the ordinary shares beneficially owned by the reporting person

represents 2.1% of the total outstanding voting power of all Class A and Class B Shares of the Issuer.

| 1. |

NAMES

OF REPORTING PERSONS

Ares

Management Corporation |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see

instructions)

(a)

☐

(b)

☐ |

| 3. |

SEC

USE ONLY

|

| 4. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

5. |

SOLE

VOTING POWER

215,800,000

Class A Shares (See Item 4) |

| 6. |

SHARED

VOTING POWER

0 |

| 7. |

SOLE

DISPOSITIVE POWER

215,800,000

Class A Shares (See Item 4) |

| 8. |

SHARED

DISPOSITIVE POWER

0 |

| 9. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

215,800,000

Class A Shares |

| 10. |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

(see

instructions) ☐

|

| 11. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

21.2%

of Class A Shares6 (or 11.0% of the total ordinary shares assuming conversion of all outstanding Class B Shares into

the same number of Class A Shares7) |

| 12. |

TYPE

OF REPORTING PERSON (see instructions)

CO |

6 As a percentage of 1,016,418,532 Class A ordinary shares of the Issuer (“Class A Shares”) as of December 31, 2023,

as set forth in the Issuer's annual report on Form 20-F filed on April 25, 2024.

7 As a percentage of 1,966,378,532ordinary shares of the Issuer as of December 31, 2023, comprised of 1,016,418,532 Class A Shares

and 949,960,000 Class B ordinary shares of the Issuer (“Class B Shares”) issued and outstanding, as set forth in the Issuer's

annual report on Form 20-F filed on April 25, 2024. Each Class B Share is convertible into one Class A Share at any time but the Class

A Shares are not convertible into Class B Shares under any circumstances. Each Class A Share is entitled to one vote, and each Class

B Share is entitled to ten votes. The voting power of the ordinary shares beneficially owned by the reporting person represents 2.1%

of the total outstanding voting power of all Class A and Class B Shares of the Issuer.

Item

1.

| |

(a) |

Name

of Issuer

Yunji

Inc. (the “Issuer”) |

| |

|

|

| |

(b) |

Address

of Issuer’s Principal Executive Offices

15/F,

South Building

Hipark

Phase 2, Xiaoshan District

Hangzhou,

Zhejiang, 310000

People’s

Republic of China |

Item

2.

| |

(a) |

Name

of Person Filing |

| |

|

|

| |

|

This

Schedule 13G is filed by and on behalf of:

(a)

Corus Investments Pte. Ltd. (“Corus”);

(b)

Crescent Capital Investments Ltd. (“Crescent Capital”); and

(c)

Ares Management Corporation (“Ares”) |

| |

|

|

| |

(b) |

Address

of the Principal Office or, if none, residence |

| |

|

|

| |

|

For

Corus and Crescent Capital:

One

Nexus Way

Camana

Bay

KY1-9005

Grand Cayman

Cayman

Islands

For

Ares:

2000

AVE OF THE STARS,

12TH

FLOOR, LOS ANGELES,

CA,

90067 |

| |

|

|

| |

(c) |

Citizenship |

| |

|

|

| |

|

Corus

— Singapore

Crescent

Capital — Cayman Islands

Ares

— United States |

| |

|

|

| |

(d) |

Title

of Class of Securities |

| |

|

|

| |

|

Class

A ordinary shares of the Issuer, par value US$0.000005 per share.

The

Issuer’s ordinary shares consist of Class A Shares and Class B Shares. Holders of Class A Shares and Class B Shares have the

same rights except for voting and conversion rights. Each Class A Share is entitled to one vote, and each Class B Share is entitled

to ten votes and is convertible into one Class A Share at any time. Class A ordinary shares are not convertible into Class B Shares

under any circumstances. |

| |

|

|

| |

(e) |

CUSIP

Number |

| |

|

|

| |

|

98873N

206 (American depositary shares of the Issuer) |

Item

3. Statement filed pursuant to §§240.13d-1(b) or 240.13d-2(b) or (c):

Not

applicable

Item

4. Ownership.

The

following table sets forth the beneficial ownership of the ordinary shares of the Issuer by each of the reporting persons as of [*]:

| | |

Number of shares as to which such person has: | |

| Reporting Person | |

Amount Beneficially Owned | | |

Percent of Class8 | | |

Sole Power to Vote or Direct the Vote | | |

Shared Power to Vote or to Direct the Vote | | |

Sole Power to Dispose or to Direct the Disposition of | | |

Shared Power to Dispose or to Direct the Disposition of | |

| Corus | |

| 215,800,000 | 9 | |

| 21.2 | %10 | |

| 215,800,000 | | |

| 0 | | |

| 215,800,000 | | |

| 0 | |

| Crescent Capital | |

| 215,800,000 | 9 | |

| 21.2 | %10 | |

| 215,800,000 | | |

| 0 | | |

| 215,800,000 | | |

| 0 | |

| Ares | |

| 215,800,000 | 9 | |

| 21.2 | %10 | |

| 215,800,000 | | |

| 0 | | |

| 215,800,000 | | |

| 0 | |

8

As a percentage of 1,016,418,532 Class A Shares as of December 31, 2023, as set forth in the Issuer's annual report on Form 20-F

filed on April 25, 2024.

9

Represents 215,800,000 Class A Shares held by Corus. Crescent Capital owns 1 ordinary share of Corus and has the sole voting power

and investment power over the shares held by Corus. Crescent Capital is ultimately controlled by Ares (NYSE: ARES). Pursuant to Section

13(d) of the Securities Exchange Act of 1934, as amended, and the rules promulgated thereunder, each of Crescent Capital and Ares may

be deemed to share beneficial ownership of the ordinary shares of the Issuer directly held by Corus. Each of Crescent Capital and Ares

disclaims the beneficial ownership of any of the ordinary shares of the Issuer directly held by Corus, except to the extent of their

pecuniary interests therein. The filing of this Schedule 13G shall not be construed as an admission that the reporting person is the

beneficial owner of the Shares for any other purpose than Section 13(d) of the Securities Exchange Act of 1934.

10

21.2% of the total ordinary shares assuming conversion of all outstanding Class B Shares into the same number of Class A Shares.

The voting power of the ordinary shares beneficially owned by the reporting person represents 2.1% of the total outstanding voting power

of all Class A and Class B Shares of the Issuer.

Item

5. Ownership of Five Percent or Less of a Class.

Not

applicable

Item

6. Ownership of More than Five Percent on Behalf of Another Person.

Not

applicable.

Item

7. Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on By the Parent Holding Company.

Not

applicable.

Item

8. Identification and Classification of Members of the Group.

Not

applicable.

Item

9. Notice of Dissolution of Group.

Not

applicable.

Item

10. Certification.

Not

applicable.

SIGNATURE

IN

WITNESS WHEREOF, the undersigned hereby execute this Agreement as of August 12, 2024.

| |

Corus

Investments Pte. Ltd. |

| |

|

|

| |

By: |

/s/

David M. Hand |

| |

Name: |

David

M. Hand |

| |

Title: |

Authorized

Signatory |

| |

|

|

| |

Crescent

Capital Investments Ltd. |

| |

|

|

| |

By: |

/s/

David M. Hand |

| |

Name: |

David

M. Hand |

| |

Title: |

Authorized

Signatory |

| |

|

|

| |

Ares

Management Corporation |

| |

|

|

| |

By: |

/s/

David M. Hand |

| |

Name: |

David

M. Hand |

| |

Title: |

Authorized

Signatory |

LIST

OF EXHIBITS

Exhibit 99.1

Joint Filing Agreement

In accordance with Rule 13d-1(k)

promulgated under the Securities Exchange Act of 1934, as amended, the undersigned hereby agree to the joint filing with all other Reporting

Persons (as such term is defined in the Schedule 13G referred to below) on behalf of each of them of a statement on Schedule 13G (including

amendments thereto) with respect to the Class A ordinary shares, par value US$0.000005 per share, of Yunji Inc., a Cayman Islands company,

and that this Agreement may be included as an Exhibit to such joint filing. This Agreement may be executed in any number of counterparts,

all of which taken together shall constitute one and the same instrument.

[Remainder of this page has been left intentionally

blank.]

SIGNATURE

IN WITNESS WHEREOF, the undersigned hereby execute

this Agreement as of August 12, 2024.

| |

Corus Investments Pte. Ltd. |

| |

|

|

| |

By: |

/s/ David

M. Hand |

| |

Name: |

David M. Hand |

| |

Title: |

Authorized Signatory |

| |

|

|

| |

Crescent Capital Investments Ltd. |

| |

|

|

| |

By: |

/s/ David

M. Hand |

| |

Name: |

David M. Hand |

| |

Title: |

Authorized Signatory |

| |

|

|

| |

Ares Management Corporation |

| |

|

|

| |

By: |

/s/ David

M. Hand |

| |

Name: |

David M. Hand |

| |

Title: |

Authorized Signatory |

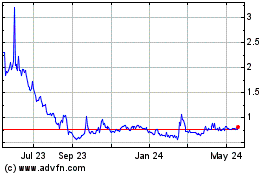

Yunji (NASDAQ:YJ)

Historical Stock Chart

From Feb 2025 to Mar 2025

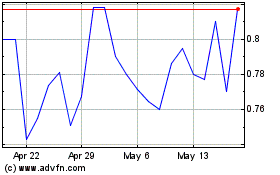

Yunji (NASDAQ:YJ)

Historical Stock Chart

From Mar 2024 to Mar 2025