Base Carbon Inc. (Cboe CA: BCBN) (OTCQX: BCBNF) with operations

through its wholly-owned subsidiary, Base Carbon Capital Partners

Corp. (“

BCCPC”, together, with affiliates,

“

Base Carbon”, or the “

Company”),

is pleased to announce its third-quarter 2024 consolidated

financial results and operational highlights. All financial

references are denominated in U.S. dollars, unless otherwise noted.

“Base Carbon has continued to execute

commercially, having achieved multiple key milestones in recent

months. During the third quarter, the Company received over $11

million in cash proceeds from the sale of carbon credits. Last

month, we achieved completion of planting of all 6.5 million trees

for the India ARR project and from our Rwanda project the Company

was issued over 1 million additional carbon credits. The Company

currently has a total inventory of over 1.7 million Article 6

Authorized labeled carbon credits on balance sheet, and as we move

through Q4 and look forward to 2025, we continue to be encouraged

by recent positive market developments applicable to our curated

portfolio of carbon projects and short-term credit inventories,”

said Michael Costa, Chief Executive Officer of Base Carbon.

Company Highlights:

- Received payments totalling

approximately $11.2 million from the sale of carbon credits

generated from the Vietnam and Rwanda projects.

- Received total payments of

approximately $30.0 million from the Vietnam project to date,

representing full capital expenditure payback and initial returns

on invested capital of approximately $9.2 million (or 43.9%) within

27 months of first dollar deployment.

- Subsequent to quarter-end,

received 1,014,635 Article 6 Authorized labeled carbon credits from

the Rwanda project. The Company now holds a current inventory of

1,712,193 Article 6 Authorized labeled carbon

credits.

- Achieved key India ARR

project milestone with completion of planting all 6.5 million

planned project trees which are expected to generate 1.6 million

carbon credits over the project life with first credit production

expected in 2025.

- As of September 30, 2024,

the Company had total assets of $126.9 million, including $13.6

million in cash and cash equivalents, $9.2 million in carbon credit

inventory and $101.4 million in investments in carbon credit

projects.

Financial Highlights:

|

(in thousands of United States Dollars) |

Three months ended |

Three months ended |

|

|

September 30, 2024 |

September 30, 2023 |

|

Gain on investments in carbon credit projects |

$2,161 |

- |

|

Loss on carbon credit sales |

(79) |

- |

|

Total operating expenses |

(1,783) |

(1,679) |

|

Operating income (loss) for the period |

299 |

(1,679) |

|

Net income (loss) before income tax |

360 |

(1,745) |

|

Income tax recovery (expense) |

(299) |

- |

|

Net income (loss) for the period |

61 |

(1,745) |

|

Basic income (loss) per share |

0.00 |

(0.01) |

|

Diluted income (loss) per share |

$0.00 |

$(0.01) |

|

(in thousands of United States Dollars) |

September 30, 2024 |

December 31, 2023 |

|

Cash and Cash Equivalents |

$13,550 |

$1,401 |

|

Carbon credit inventory |

9,161 |

- |

|

Current investment in carbon credit projects |

24,468 |

34,813 |

|

Non-current investment in carbon credit projects |

76,904 |

102,273 |

|

Total Assets |

$126,858 |

$141,243 |

Vietnam Household Devices Project

Update

Including a payment of approximately $11.0

million received during the quarter, as of September 2024, Base

Carbon has received approximately $30.0 million from the contracted

sale of carbon credits generated from the Vietnam project,

achieving full payback of the Company’s capital investment of

approximately $20.8 million and a significant initial capital

return of approximately $9.2 million, or 43.9%.

The Company expects additional proceeds of

approximately $6.3 million in future payments from the project

off-take arrangement within the next 12 months.

The Company has no further unfunded capital

commitments to the Vietnam project.

Rwanda Cookstoves Project

Update

In August 2024, the Company completed an initial

market sale of 20,000 carbon credits generated from its Rwanda

project. The sale was designed as a market-based “test-trade” to

ensure commercial capabilities. This initial test-trade represented

less than 3% of the initial carbon credits issued to the Company as

of the sale date. As of September 30, 2024, the Company held a

carbon credit inventory of 697,558 Article 6 Authorized labeled

carbon credits from the Rwanda project with a carrying value of

$9,160,919.

Subsequent to the quarter-end, in October 2024,

the Company received its second issuance of carbon credits from the

Rwanda project when project developer the DelAgua Group transferred

1,014,635 Article 6 Authorized labeled carbon credits to the

Company. The Company now holds an inventory of 1,712,193 Article 6

Authorized labeled carbon credits.

The Company has no further unfunded capital

commitments to the Rwanda project.

In October 2024, Verra, the carbon registry for

the Company’s projects, announced a significant milestone with the

United Nations International Civil Aviation Organization’s (ICAO)

approval of the Verified Carbon Standard (VCS) Program for the

Carbon Offsetting and Reduction Scheme for International Aviation

(CORSIA), anticipated to broaden the Company’s opportunities to

participate in the market. For further details, see Verra’s press

release.

India Afforestation, Reforestation, and

Revegetation (ARR) Project Update

The Company, through BCCPC, executed a project

agreement with Value Network Ventures Advisory Services Pte Ltd. to

fund an expected $13.6 million related to the reforestation of

degraded rural farmlands in the northern Indian state of Uttar

Pradesh. Subsequent to the quarter-end, the Company announced the

completion of planting all 6.5 million planned project trees

representing the achievement of a key project milestone. The

project is expected to generate 1.6 million high-quality

nature-based removal carbon credits over an expected 20-year

project life with the first carbon credit issuance expected in

2025.

As of September 30, 2024, Base Carbon has funded

43% of the committed project capital with all further capital

commitment funding tied to achievement of specific project

milestones. Project validation is ongoing with Verra, the carbon

registry, with completion of the validation process expected early

in the first quarter of 2025.

About Base Carbon

Base Carbon is a financier of projects involved

primarily in the global voluntary carbon markets. We endeavor to be

the preferred carbon project partner in providing capital and

management resources to carbon removal and abatement projects

globally and, where appropriate, will utilize technologies within

the evolving environmental industries to enhance efficiencies,

commercial credibility, and trading transparency. For more

information, please visit www.basecarbon.com.

Media and Investor

Inquiries

Base Carbon Inc.Investor RelationsTel: +1 647

952 3979E-mail: investorrelations@basecarbon.com

Media InquiriesE-mail:

media@basecarbon.com

Cautionary Statement Regarding Forward

Looking Information

This press release contains “forward-looking

information” within the meaning of applicable securities laws

relating to the focus of Base Carbon’s business, the expected

issuance, and timing, of carbon credits, the application of Article

6 of the Paris Agreement and the “Article 6 Authorized Label” and

market reaction thereto, the receipt of proceeds from the

disposition of carbon credits, the implementation of the CORSIA

framework and eligibility of carbon credits thereunder, including

carbon credits generated by the Company’s projects, and the timing

of project validation and continued development of the India

project. In some cases, but not necessarily in all cases,

forward-looking information may be identified by the use of

forward-looking terminology such as “expects”, “anticipates”,

“intends”, “contemplates”, “believes”, “projects”, “plans” or

variations of such words and similar expressions or state that

certain actions, events or results “may”, “could”, “would”,

“might”, “will” or “will be taken”, “occur” or “be achieved”. In

addition, any statements that refer to expectations, projections or

other characterizations of future events or circumstances contain

forward-looking information. Statements containing forward-looking

information are not historical facts but instead represent

management’s expectations, estimates and projections regarding

future events. These statements should not be read as guarantees of

future performance, results, or achievements.

Although management believes that the

anticipated future results, performance or achievements expressed

or implied by the forward-looking information are based upon

reasonable assumptions and expectations, readers should not place

undue reliance on forward-looking information because it involves

assumptions, known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements to differ materially from anticipated future results,

performance or achievements expressed or implied by such

forward-looking information.

In respect of the Rwanda cookstoves project and

the Vietnam household devices project, certain factors that

influence the commercial success of such projects, including the

timing and number of expected carbon credits, include among other

things: (i) the Company has retained industry leading

experts/consultants/advisors to assist with the evaluation,

planning, negotiation and execution of such projects, (ii) the work

product, including monitoring reports, of each project’s validation

and verification body, (iii) project carbon credit market prices,

(iv) the verification of ongoing project monitoring reports and

issuance of carbon credits by Verra, (v) changes to laws,

regulation or policies in applicable jurisdictions, and (vi) the

Company has sufficient funds on hand to make any required carbon

credit purchase price payments.

In respect of the Rwanda cookstoves project and

the Vietnam household devices project, certain assumptions that

influence the commercial success of such projects, including the

timing and number of expected carbon credits, include among other

things: (i) distributed cookstoves and water purifiers perform to

specification when used and participating households use the

devices as contemplated by project estimates, (ii) the Company’s

in-country project partners, being the DelAgua Group in the case of

the Rwanda cookstoves project and SIPCO and the project offtaker in

the case of the Vietnam household devices project, perform their

obligations in connection with the development and operation of the

projects, and (iii) continued participant involvement and public

support, including that of applicable governmental authorities, of

the voluntary carbon market.

In respect of the India afforestation,

reforestation, and revegetation project, certain factors that

influence the commercial success of the project include, among

other things: (i) the Company’s expertise with respect to the

evaluation, planning and negotiation of the project, (ii) the

conduct of the project counterparties, including cooperation with

local small-land owners, (iii) project costs and carbon credit

market prices, (iv) ongoing project monitoring and issuance of

carbon credits by Verra, (v) changes to laws and regulation in the

Republic of India, and (vi) extreme weather event and natural

disasters.

In respect of the India afforestation,

reforestation, and revegetation project, certain assumptions that

influence the commercial success of the project include, among

other things: (i) the development the project remains in line with

anticipated timelines and costs, (ii) project counterparties,

including project partner Value Network Ventures Advisory Services

Pte Ltd., its subcontractors and local small-land owners, perform

their contractual and/or standard operating procedures, (iii) the

survival of trees, (iv) the growth rates of trees are consistent

with the expectations under the project which is then reflected by

monitor reports accepted by Verra, (v) the Company has sufficient

funds to satisfy its capital commitments, and (vi) continued

participant involvement and public support of the voluntary carbon

market.

The forward-looking statements made herein are

subject to a variety of risk factors and uncertainties, many of

which are beyond the Company’s control, which could cause actual

events or results to differ materially and adversely from those

reflected in the forward-looking statements. Readers are cautioned

that forward-looking statements are not guarantees of future

performance. Specific reference is made to the management’s

discussion and analysis for the Company’s third quarter ended

September 30, 2024 and the most recent Annual Information Form on

file with the Canadian provincial securities regulatory authorities

(and available on www.sedarplus.ca) for a more detailed discussion

of some of the factors underlying forward-looking statements and

the risks that may affect the Company’s ability to achieve the

expectations set forth in the forward-looking statements contained

in this press release.

Should one or more of the risks and

uncertainties materialize, or should underlying assumptions prove

incorrect, actual events or results may vary materially and

adversely from those described in the forward-looking information.

The forward-looking information contained in this press release is

provided as of the date of this press release, and the Company

expressly disclaims any obligation to update or alter statements

containing any forward-looking information, or the factors or

assumptions underlying them, whether as a result of new

information, future events or otherwise, except as required by

law.

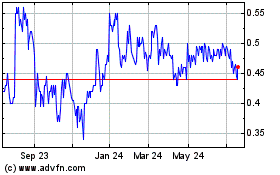

Base Carbon (NEO:BCBN)

Historical Stock Chart

From Feb 2025 to Mar 2025

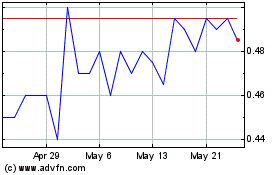

Base Carbon (NEO:BCBN)

Historical Stock Chart

From Mar 2024 to Mar 2025