UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-31909

ASPEN INSURANCE HOLDINGS LIMITED

(Translation of registrant’s name into English)

141 Front Street

Hamilton HM 19

Bermuda

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ý Form 40-F ¨

Dividend Announcement

On November 29, 2024, Aspen Insurance Holdings Limited (“Aspen” or the “Company”) issued a press release announcing dividends on its preference shares. The dividends are payable on January 1, 2025 to the holders of record as of the close of business on December 15, 2024.

The press release, furnished as Exhibit 99.1 to this Form 6-K, is incorporated by reference as part of this Form 6-K.

Redemption of 5.95% Fixed-to-Floating Rate Perpetual Non-Cumulative Preference Shares

On November 29, 2024, the Company issued a press release announcing that it intends to redeem all 11,000,000 shares of its outstanding 5.95% Fixed-to-Floating Rate Perpetual Non-Cumulative Preference Shares (the “Preference Shares”). Redemption of the Preference Shares is expected to take place on January 1, 2025 (the “Redemption Date”). The redemption will be conducted pursuant to the terms of the Certificate of Designation for the Preference Shares, dated as of May 2, 2013. The redemption price will be US$25.00 per Preference Share (the “Redemption Price”). The Redemption Price will be paid on January 2, 2025, which is the next business day following the Redemption Date. Since the Redemption Date is also a dividend payment date, the Redemption Price does not include any declared and unpaid dividends. The Company will use the net proceeds from its previously announced offering of depositary shares, each representing a 1/1,000th interest in a share of its 7.00% Perpetual Non-Cumulative Preference Shares, which closed on November 26, 2024, as well as general corporate funds, to redeem the Preference Shares.

The press release, furnished as Exhibit 99.2 to this Form 6-K, is incorporated by reference as part of this Form 6-K.

The information included in this Form 6-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| ASPEN INSURANCE HOLDINGS LIMITED |

| | |

| Dated: November 29, 2024 | By: | /s/ | Mark Pickering |

| Name: | | Mark Pickering |

| Title: | | Chief Financial Officer |

Aspen Declares Dividends on Preference Shares

Hamilton, Bermuda, November 29, 2024 – Aspen Insurance Holdings Limited (“Aspen”) (NYSE:AHL) announced today that the Board of Directors has declared the following dividends on its Preference Shares:

•Quarterly dividend of $0.6196 per share on its Fixed-to-Floating Rate Perpetual Non-Cumulative Preference Shares with a $25 liquidation preference per share (NYSE:AHL PRC);

•Quarterly dividend of $0.3516 per share on its 5.625% Perpetual Non-Cumulative Preference Shares with a $25 liquidation preference per share (NYSE:AHL PRD); and

•Quarterly dividend of $351.56 per share on its 5.625% Perpetual Non-Cumulative Preference Shares with a $25,000 liquidation preference per preference share, represented by depositary shares, each depositary share representing a 1/1000th interest in a preference share (NYSE: AHL PRE), with a $25 liquidation preference per depositary share, with holders of such depository shares to receive $0.35156 per depositary share.

The above dividends will be payable on January 1, 2025 to holders of record as of the close of business on December 15, 2024.

In connection with the dividends declared and to be paid on the AHL PRC Preference Shares, given the cessation of LIBOR as from the final publication on June 30, 2023 and the failure of any qualifying banks to provide quotes to the appointed calculation agent as contemplated by the floating rate determination language set forth in the governing instrument, then, in accordance with the provisions of such instrument, the floating rate to be applied to dividends on the AHL PRC Shares will equal the 3-month LIBOR on June 29, 2023 (representing 3-month LIBOR for the previous floating rate period at the applicable determination date), plus 4.06%, being, in the case of this applicable floating rate dividend period, a coupon rate payable of 9.59343%. It is expected, but not certain, that the banks will continue to be unable to provide quotes and this coupon rate will remain at 9.59343% for future dividend periods, as contemplated by the terms of the governing instrument.

- Ends -

About Aspen Insurance Holdings Limited

Aspen provides insurance and reinsurance coverage to clients in various domestic and global markets through wholly-owned operating subsidiaries in Bermuda, the United States and the United Kingdom, as well as its branch operations in Canada, Singapore and Switzerland. For the year ended December 31, 2023, Aspen reported $15.2 billion in total assets, $7.8 billion in gross loss reserves, $2.9 billion in total shareholders’ equity and $4.0 billion in gross written premiums. Aspen's operating subsidiaries have been assigned a rating of “A-” by Standard & Poor’s Financial Services LLC and an

“A” (“Excellent”) by A.M. Best Company Inc. For more information about Aspen, please visit www.aspen.co.

Cautionary Statement Regarding Forward-Looking Statements:

This communication or any other written or oral statements made by or on behalf of the Company may contain written “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are made pursuant to the “safe harbor” provisions of The Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts. In particular, statements using the words such as “expect,” “intend,” “plan,” “believe,” “aim,” “project,” “anticipate,” “seek,” “will,” “likely,” “assume,” “estimate,” “may,” “continue,” “guidance,” “objective,” “outlook,” “trends,” “future,” “could,” “would,” “should,” “target,” “predict,” “potential,” “on track” or their negatives or variations and similar terminology and words of similar import generally involve forward-looking statements.

All forward-looking statements rely on a number of assumptions, estimates and data concerning future results and events and that are subject to a number of uncertainties, assumptions and other factors, many of which are outside Aspen’s control that could cause actual results to differ materially from such forward-looking statements. Accordingly, there are important factors that could cause our actual results to differ materially from those anticipated in the forward-looking statements, including, but not limited to, our exposure to weather-related natural disasters and other catastrophes, the direct and indirect impact of global climate change, our relationship with, and reliance upon, a limited number of brokers for both our insurance and reinsurance business, the impact of inflation, our exposure to credit, currency, interest and others risks within our investment portfolio, the cyclical nature of the insurance and reinsurance industry and many other factors. For a detailed description of these uncertainties and other factors that could impact the forward-looking statements in this press release and other communications issued by or on behalf of Aspen, please see the “Risk Factors” section in Aspen’s Annual Report on Form 20-F for the twelve months ended December 31, 2023, as filed with the SEC, which should be deemed incorporated herein.

The inclusion of forward-looking statements in this press release or any other communication should not be considered as a representation by Aspen that current plans or expectations will be achieved. Aspen undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

For further information:

Media

Jo Scott

Head of Corporate Communications

Jo.Scott@aspen.co

+44 7843 060406

PRESS RELEASE

Aspen Announces Redemption of 5.95% Fixed-to-Floating Rate Perpetual Non-Cumulative Preference Shares

Hamilton, Bermuda—November 29, 2024—Aspen Insurance Holdings Limited (“Aspen” or the “Company”) announced today that it has decided to call all 11,000,000 of its outstanding 5.95% Fixed-to-Floating Rate Perpetual Non-Cumulative Preference Shares (NYSE: AHLPRC; CUSIP: G05384154) (the “Preference Shares”) for redemption on January 1, 2025 (the “Redemption Date”). The redemption price will be US$25.00 per Preference Share (the “Redemption Price”), representing an aggregate amount of US$275,000,000. The Redemption Price will be paid on January 2, 2025, which is the next business day following the Redemption Date. Since the Redemption Date is also a dividend payment date, the Redemption Price does not include any declared and unpaid dividends. Declared dividends of US$0.6196 per Preference Share, which were previously declared by Aspen’s Board of Directors, for the full current quarterly dividend period from and including October 1, 2024, to but excluding January 1, 2025, will be paid separately in the customary manner on January 2, 2025 to holders of record at the close of business on December 15, 2024. On and after the Redemption Date, the Preference Shares so redeemed will no longer be deemed to be outstanding, dividends on such Preference Shares will cease to accumulate and all rights of the holders of such Preference Shares will cease, except for the right to receive the Redemption Price.

The Company will use the net proceeds from its previously announced offering of depositary shares, each representing a 1/1,000th interest in a share of its 7.00% Perpetual Non-Cumulative Preference Shares, which closed on November 26, 2024, as well as general corporate funds, to redeem the Preference Shares.

The notice of redemption specifying the terms and procedures for the redemption (the “Redemption Notice”) has been mailed to holders of record of the Preference Shares today. Requests for additional copies of the Redemption Notice should be directed to:

Computershare, Inc.

Attention: Corporate Actions Department

150 Royall Street / Suite 101

Canton, Massachusetts 02021

Telephone: (800) 546-5141

This press release does not constitute a Redemption Notice under the certificate of designation governing the Preference Shares and is qualified in its entirety by reference to the Redemption Notice issued by the Company.

About Aspen Insurance Holdings Limited

Aspen provides insurance and reinsurance coverage to clients in various domestic and global markets through wholly-owned operating subsidiaries in Bermuda, the United States and the United Kingdom, as well as its branch operations in Canada, Singapore and Switzerland. For the year ended December 31, 2023, Aspen reported US$15.2 billion in total assets, US$7.8 billion in gross loss reserves, US$2.9 billion in total shareholders’ equity and US$4.0 billion in gross written premiums. Aspen's operating subsidiaries have been assigned a rating of “A-” by Standard & Poor’s Financial Services LLC and an “A” (“Excellent”) by A.M. Best Company Inc.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which include, but are not limited to, statements related to the Company’s expectations regarding the redemption of the Preference Shares, and are made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts. In particular, statements that use the words such as “believe,” “anticipate,” “expect,” “assume,” “objective,” “target,” “plan,” “estimate,” “project,” “seek,” “will,” “may,” “aim,” “likely,” “continue,” “intend,” “guidance,” “outlook,” “trends,” “future,” “could,” “would,” “should,” “target,” “predict,” “potential,” “on track” or their negatives or variations and similar terminology and words of similar import generally involve forward-looking statements. These statements reflect the Company’s current views with respect to future events and because the Company’s business is subject to numerous risks, uncertainties and other factors, the Company’s actual results could differ materially from those anticipated in the forward-looking statements.

All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in these statements. For a description of uncertainties and other factors that could impact the forward-looking statements in this press release, please see the “Risk Factors” section in Aspen’s Annual Report on Form 20-F for the year ended December 31, 2023 as filed with the U.S. Securities and Exchange Commission.

The inclusion of forward-looking statements in this press release or any other communication should not be considered as a representation by Aspen that current plans or expectations will be achieved. Aspen undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

For Further Information:

Media

Jo Scott

Head of Corporate Communications

Jo. Scott@aspen.co

+44 7843 060406

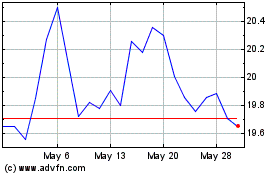

Aspen Insurance (NYSE:AHL-D)

Historical Stock Chart

From Nov 2024 to Dec 2024

Aspen Insurance (NYSE:AHL-D)

Historical Stock Chart

From Dec 2023 to Dec 2024