- Allego and Meridiam have entered into a definitive agreement

pursuant to which Meridiam will launch a tender offer for all

issued and outstanding ordinary shares of Allego not owned by

Meridiam or its affiliates, followed by Allego's voluntarily

delisting of its ordinary shares from the New York Stock Exchange

after completion of the offer

- The tender offer price of USD 1.70 per ordinary share in cash,

without interest represents a premium of 131% to Allego’s closing

price of USD 0.74 on 14 June 2024

- Shareholders that do not elect to tender their ordinary shares

will remain investors in the delisted Company

- Neither the tender offer nor the completion of the other parts

of the transaction are contingent on any minimum number of ordinary

shares in the capital of Allego being tendered and are not subject

to any financing or regulatory approval conditions

- As part of the transaction, Meridiam reaffirms its commitment

to the long-term interests of Allego and its business. It

reiterates its support for Allego’s existing strategy and commits

to make available to Allego an amount of EUR 46 million in order to

develop, operate and maintain charging sites in Germany and, once

delisted, an additional amount of EUR 310 million of new

equity-like capital to support Allego's growth

- The independent members of Allego’s board have unanimously

approved the transaction, and have determined that the transaction

is in the best interests of Allego and its business and promotes

the sustainable success and the sustainable long-term value

creation of its business, having taken into account the interests

of Allego’s stakeholders

Allego N.V. (“Allego” or the “Company”) (NYSE: ALLG), a leading

provider of electric vehicle charging network and Madeleine

Charging B.V. , Allego’s majority shareholder (“Meridiam”), jointly

announced today that Allego and Meridiam have entered into a

Transaction Framework Agreement (the “Agreement”) pursuant to which

Meridiam will launch a tender offer for all the issued and

outstanding ordinary shares of Allego (the “Shares”) that are not

owned by Meridiam or its affiliates (the “Offer”), followed by

Allego’s voluntarily delisting of the Shares (the “Delisting”) from

the New York Stock Exchange (the “NYSE”) and Meridiam making

additional funding and equity-like capital available to Allego, and

providing certain liquidity opportunities following the Delisting

to holders of Shares who do not tender their Shares in the Offer,

in each case as described below (collectively, the “Transaction”).

Meridiam currently owns approximately 73.0% of all issued and

outstanding shares of Allego.

Strategic Rationale

Meridiam and Allego believe that the Transaction represents a

key opportunity at a critical juncture for the Company, as the

current public listing does not allow the Company to fully realize

its growth plan. In addition, they believe that the low trading

liquidity and volatility of the market price of the Shares on the

NYSE, the limited analyst coverage and the lack of capital

available at competitive cost on public markets for EV charging

operators are clear impediments to the success of Allego today. The

Transaction is expected to, among other things, (a) allow Allego to

benefit from a broader range of more favorable options to fund its

growth plan, (b) allow Allego to achieve a more efficient capital

structure (both from a financing and capital requirements

perspective), (c) reduce the costs and eliminate the burdens of

complying with exchange listing rules and the costs and burdens of

being a public company, (d) place Allego in a better position to

compete with well-capitalized, non-publicly traded peers, and (e)

provide Allego’s minority shareholders with the opportunity to

either (i) remain invested in the delisted Company and benefit from

potential enhanced value creation over time; or (ii) exit their

investment in the Company with immediate liquidity at a premium to

the current market price of the Shares on the NYSE.

Emmanuel Rotat, Director of Meridiam, said: “Since our initial

investment in Allego in 2018, we have supported the Company along

the way. We are pleased today to announce this important milestone

for Allego: we strongly believe that operating in a private

context, with a continued support from Meridiam as majority

shareholder of the Company, will ideally position Allego for its

next phase of growth”.

Mathieu Bonnet, CEO of Allego, said: “The transaction presented

today reiterates the strong support of Meridiam to the Company’s

strategy and growth vision. It gives significant resources to the

Company to execute our business plan by extending its ultra-fast

charging stations network all over Europe. Our hundreds of

high-quality backlog sites will be rolled out to offer ubiquitous

best charging experience to our EV customers enabling Allego to be

a leader in the industry”.

Selected Transaction

Terms

Under the terms of the Offer, Meridiam will offer Allego

shareholders the option to tender their Shares for USD 1.70 per

Share in cash, without interest, which represents:

- a premium of approximately 131 percent on

the closing price of the Shares on the NYSE of USD 0.74 on 14 June

2024;

- a premium of approximately 97 percent on

the 1-month volume-weighted average price of the Shares on the NYSE

as of the same date;

- a premium of approximately 29 percent on

the 3-month volume-weighted average price of the Shares on the NYSE

as of the same date; and

- a premium of approximately 32 percent on

the 6-month volume-weighted average price of the Shares on the NYSE

as of the same date.

Meridiam intends to launch the Offer with the purpose of

providing an immediate exit opportunity to all Allego minority

shareholders. Allego shareholders are not required to tender their

Shares in the Offer, and Meridiam does not intend to pursue a

squeeze-out of any minority Allego shareholders.

Allego shareholders that do not tender their Shares in the Offer

will remain investors in the delisted Company. As a part of the

Transaction, Meridiam has committed to provide these shareholders

with access to liquidity opportunities at certain points in time

post-Delisting, including priority tag along rights upon sales of

Shares by Meridiam or its affiliates and commitments by Meridiam

and Allego to organize liquidity events for those shareholders

within 18 months after the Delisting and again prior to 31 December

2027. Further information on the Transaction, including the Offer,

will be included in the offer to purchase, letter of transmittal

and related materials and will be filed with the Securities and

Exchange Commission (the “SEC”) in connection with the commencement

of the Offer.

By entering into the Agreement, Meridiam reaffirms its

commitment to supporting the Company strategically and financially,

and to cooperate closely with Allego’s management team. Contingent

upon the Delisting, Meridiam SAS, through its managed funds, has

committed to making available to Allego an amount of EUR 46 million

in order to develop, operate and maintain charging sites in

Germany, as well as an additional amount of EUR 310 million of new

equity-like capital to support the delivery of Allego’s growth

plan. The EUR 310 million financing shall be made in three

instalments, with the first instalment of at least EUR 150 million

being paid to the Company by 31 December 2024.

Timing and Approvals

The transaction committee, comprised of the independent members

of the Board of Directors of the Company (the “Transaction

Committee”), has unanimously approved the Transaction, and has

determined that the Transaction is in the best interests of Allego

and its business and promotes the sustainable success and the

sustainable long-term value creation of its business, having taken

into account the interests of Allego's stakeholders.

Meridiam intends to commence the Offer as promptly as

practicable. The completion of the Offer is not subject to any

conditions requiring a minimum number of tendered Shares, the

receipt of any regulatory or third-party approvals, or the

completion of any financing to provide funding for the Offer.

Meridiam and the Company expect that the Offer and the Delisting

will be completed in the third quarter of 2024.

Advisors

Morgan Stanley & Co. LLC acted as financial advisor to

Meridiam, and Allen Overy Shearman Sterling LLP is acting as legal

counsel to Meridiam.

Citigroup Global Markets Europe AG acted as financial advisor to

Allego. Weil, Gotshal & Manges LLP and NautaDutilh N.V. are

acting as legal counsel to Allego.

UBS Securities LLC acted as financial advisor to the Transaction

Committee of Allego.

About Allego

Allego is a leading electric vehicle charging solutions provider

dedicated to accelerating the transition to electric mobility with

100% renewable energy. Allego has developed a comprehensive

portfolio of innovative charging infrastructure and proprietary

software, including Allamo and EV Cloud platforms. With a network

of 35,000 charging points (and counting) spanning 16 countries,

Allego delivers independent, reliable, and safe charging solutions,

agnostic of vehicle model or network affiliation. Founded in 2013

and publicly listed on the NYSE in 2022, Allego now employs a team

of 220 people striving daily to make charging accessible,

sustainable, and enjoyable for all.

For reference you'll find all releases here:

https://ir.allego.eu/events-publications/press-releases.

About Meridiam

Meridiam was founded in 2005 by Thierry Déau, with the belief

that the alignment of interests between the public and private

sector can provide critical solutions to the collective needs of

communities. Meridiam is an independent investment Benefit

Corporation and an asset manager. The firm specializes in the

development, financing, and long-term management of sustainable

public infrastructure in three core sectors: sustainable mobility,

critical public services and innovative low carbon solutions. With

offices in Addis Ababa, Amman, Dakar, Istanbul, Johannesburg,

Libreville, Luxembourg, Paris, Vienna and Washington DC, Meridiam

manages over US$22 billion and more than 125 projects to date.

Meridiam is certified ISO 9001: 2015, Advanced Sustainability

Rating by VigeoEiris (Moody’s), ISO 37001 Anti-Corruption

certification by AFNOR and applies a unique methodology in relation

to ESG and impact based on United Nations’ Sustainable Development

Goals (SDGs).

For reference you'll find all releases here:

https://www.meridiam.com/news/.

Important Additional Information and Where to Find It

Meridiam will commence, or will cause to be commenced, a tender

offer for all of the outstanding Shares not held, directly or

indirectly, by Meridiam or its affiliates. The tender offer has not

commenced. This press release is for informational purposes only,

is not a recommendation and is neither an offer to purchase nor a

solicitation of an offer to sell securities of Allego. It is also

not a substitute for the tender offer materials that Meridiam will

file with the SEC upon commencement of the tender offer. At the

time that the tender offer is commenced, Meridiam will file tender

offer materials on Schedule TO with the SEC, and Allego will file a

Solicitation/Recommendation Statement on Schedule 14D-9 (the

“Schedule 14D-9”) and Allego and Meridiam will jointly file a Rule

13e-3 Transaction Statement on Schedule 13E-3 (the “Schedule

13E-3”) with the SEC with respect to the tender offer. THE TENDER

OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE AND CERTAIN OTHER

TENDER OFFER DOCUMENTS), THE SCHEDULE 14D-9 AND THE SCHEDULE 13E-3

WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY

AND CONSIDERED BY ALLEGO’S SHAREHOLDERS BEFORE ANY DECISION IS MADE

WITH RESPECT TO THE TENDER OFFER. The tender offer materials, the

Schedule 14D-9 and the Schedule 13E-3 will be made available to

Allego’s shareholders free of charge. A free copy of the tender

offer materials, the Schedule 14D-9 and the Schedule 13E-3 will

also be made available to all of Allego Shareholders by contacting

Allego at investors@allego.eu, or by visiting Allego’s website

www.allego.eu. In addition, the tender offer materials, the

Schedule 14D-9 and the Schedule 13E-3 (and all other documents

filed by Allego with the SEC) will be available at no charge on the

SEC’s website (www.sec.gov) upon filing with the SEC. ALLEGO

SHAREHOLDERS ARE ADVISED TO READ THE TENDER OFFER MATERIALS, THE

SCHEDULE 14D-9, AND THE SCHEDULE 13E-3 AS EACH MAY BE AMENDED OR

SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS

FILED BY MERIDIAM OR ALLEGO WITH THE SEC WHEN THEY BECOME AVAILABLE

BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER.

THESE MATERIALS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TENDER

OFFER, MERIDIAM, MERIDIAM SAS AND ALLEGO.

Cautionary Statement Regarding Forward-Looking

Statements

This press release including exhibits may contain certain

statements that are, or may be deemed to be, forward-looking

statements with respect to the financial condition, results of

operations and business of Allego and certain plans and objectives

of Meridiam and Meridiam SAS with respect thereto. These

forward-looking statements include, but are not limited to,

statements regarding the satisfaction of conditions to the

completion of the tender offer and the proposed transactions and

the expected completion of the tender offer and the proposed

transactions, the timing and benefits thereof, as well as other

statements that are not historical fact. These forward-looking

statements can be identified by the fact that they do not relate to

historical or current facts. Forward-looking statements also often

use words such as “anticipate,” “target,” “continue,” “estimate,”

“expect,” “forecast,” “intend,” “may,” “plan,” “goal,” “believe,”

“hope,” “aims,” “continue,” “could,” “project,” “should,” “will” or

other words of similar meaning. These statements are based on

assumptions and assessments made by Allego, Meridiam and/or

Meridiam SAS (as applicable) in light of their experience and

perception of historical trends, current conditions, future

developments and other factors they believe appropriate. By their

nature, forward-looking statements involve risk and uncertainty,

because they relate to events and depend on circumstances that will

occur in the future and the factors described in the context of

such forward-looking statements in this communication could cause

actual results and developments to differ materially from those

expressed in or implied by such forward-looking statements.

Although it is believed that the expectations reflected in such

forward-looking statements are reasonable, no assurance can be

given that such expectations will prove to be correct and you are

therefore cautioned not to place undue reliance on these

forward-looking statements, which speak only as at the date of this

communication.

Forward-looking statements are not guarantees of future

performance. Such forward-looking statements involve known and

unknown risks and uncertainties that could significantly affect

expected results and are based on certain key assumptions. Such

risks and uncertainties include, but are not limited to, the

potential failure to satisfy conditions to the completion of the

tender offer and proposed transactions; the failure to obtain

necessary regulatory or other approvals; the outcome of legal

proceedings that may be instituted against Allego and/or others

relating to the transaction; the possibility that competing offers

will be made; potential adverse reactions or changes to business

relationships resulting from the announcement or completion of the

tender offer and proposed transactions; significant or unexpected

costs, charges or expenses resulting from the tender offer and

proposed transactions; and negative effects of this communication

or the consummation of the tender offer and proposed transactions

on the market price of the Ordinary Shares. Many factors could

cause actual results to differ materially from those projected or

implied in any forward-looking statements. Among the factors that

could cause actual results to differ materially from those

described in the forward-looking statements are (i) changes

adversely affecting Allego’s business, (ii) the price and

availability of electricity and other energy sources, (iii) the

risks associated with vulnerability to industry downturns and

regional or national downturns, (iv) fluctuations in Allego’s

revenue and operating results, (v) unfavorable conditions or

further disruptions in the capital and credit markets, (vi)

Allego’s ability to generate cash, comply with existing or new debt

covenants, service indebtedness and incur additional indebtedness,

(vii) competition from existing and new competitors, (viii) the

growth of the electric vehicle market, (ix) Allego’s ability to

integrate any businesses it may acquire, (x) the agreement of

various landowners to deployment of Allego charging stations, (xi)

Allego’s ability to recruit and retain experienced personnel, (xii)

risks related to legal proceedings or claims, including liability

claims, (xiii) Allego’s dependence on third-party contractors to

provide various services, (xiv) data security breaches or other

network outage, (xv) Allego’s ability to obtain additional capital

on commercially reasonable terms, (xvi) the impact of a pandemic or

other health crises, including COVID-19 related supply chain

disruptions and expense increases, (xvii) general economic or

political conditions, including the Russia/Ukraine and Israel/Hamas

conflicts or increased trade restrictions between the United

States, Russia, China and other countries and (xviii) other factors

detailed under the section entitled “Risk Factors” in the Company’s

filings with the SEC. If any one or more of these risks or

uncertainties materializes or if any one or more of the assumptions

prove incorrect, actual results may differ materially from those

expected, estimated or projected. Such forward-looking statements

should therefore be construed in the light of such factors. A more

complete description of these and other material risks can be found

in Allego’s filings with the SEC, including its Annual Report on

Form 20-F for the year ended December 31, 2023, subsequent filings

on Form 6-K and other documents that may be filed from time to time

with the SEC, as well as, the Schedule TO and related tender offer

documents to be filed by Meridiam and Meridiam SAS and the Schedule

14D-9 and the Schedule 13E-3 to be filed by Allego. Due to such

uncertainties and risks, readers are cautioned not to place undue

reliance on such forward-looking statements, which speak only as of

the date of this communication. None of Meridiam, Meridiam SAS or

Allego undertakes any obligation to update or revise any

forward-looking statement as a result of new information, future

events or otherwise, except as required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240617496680/en/

Investors: investors@allego.eu

Media press@allego.eu a.lenoir@meridiam.com / Antoine

Lenoir / +33 1 53 34 96 92

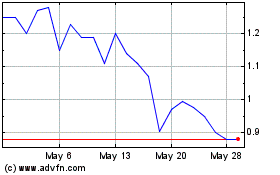

Allego NV (NYSE:ALLG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Allego NV (NYSE:ALLG)

Historical Stock Chart

From Jan 2024 to Jan 2025