FALSE000148813900014881392024-08-302024-08-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 30, 2024

Ameresco, Inc.

(Exact Name of Registrant as Specified in Charter) | | | | | | | | | | | | | | |

| Delaware | | 001-34811 | | 04-3512838 |

(State or Other Juris-

diction of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | | | | |

| 111 Speen Street, | Suite 410, | Framingham, | MA | | 1701 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (508) 661-2200 (Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of Each Class | Trading Symbol | Name of exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | AMRC | New York Stock Exchange |

| | | | | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1033 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

|

| Emerging growth company | | | ☐ |

| | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | |

| ☐ |

Item 8.01 Other Events.

On August 30, 2024 Ameresco, Inc. (the "Company") reached an agreement (“Agreement”) with Southern California Edison Company (“SCE”) on the substantial completion of two of the three battery energy storage system (“BESS”) projects the Company has been designing and building for SCE. The design and build of the projects are subject to the Company’s Engineering, Procurement, Construction and Maintenance Agreement dated as of October 21, 2021 with SCE. As previously disclosed, due to supply chain delays, weather and other events, the Company was unable to complete the projects by the guaranteed completion date of August 1, 2022 and made related force majeure claims. In late 2022, SCE also instructed Ameresco to adjust the completion of the sites into 2023.

Pursuant to the Agreement, SCE agreed to the substantial completion of two of the three BESS projects and agreed to pay approximately $110 million in substantial completion milestone payments within seven days from the Agreement. The milestone payments reflect SCE’s set-off of liquidated damages that are still in dispute as well as approximately $3M for additional work SCE requires. Upon final acceptance of these two projects, the Company will invoice SCE for the remaining final acceptance milestone payments for these projects.

The Agreement also confirms that the final resolution related to Ameresco’s obligation to pay the liquidated damages withheld and the applicability and scope of any force majeure relief as well as cost recovery Ameresco may be entitled to remain subject to dispute. Ameresco is continuing discussions with SCE on these matters and its view continues to be that liquidated damages should not be applied.

Commissioning and testing activities continue on the third BESS project, which was significantly impacted by the heavy rainfall in California in 2023. This last site is expected to reach substantial completion in the fourth quarter of 2024 at which time substantial milestone payments for the project would be invoiced.

On September 3, 2024, the Company issued a press release announcing the agreement related to the substantial completion of two of the three SCE BESS projects. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

The information in Item 8.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is intended to be furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward Looking Statements

Any statements in this current report about the timing, completion and invoicing of the SCE projects and our expectations related to our agreement with SCE including the impact of delays and any requirement to pay liquidated damages, and other statements containing the words “projects,” “believes,” “anticipates,” “plans,” “expects,” “will” and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward looking statements as a result of various important factors, including: demand for our energy efficiency and renewable energy solutions; the timing of, and ability to, enter into contracts for awarded projects on the terms proposed or at all; the timing of work we do on projects where we recognize revenue on a percentage of completion basis; the ability to perform under signed contracts without delay and in accordance with their terms and related liquidated and other damages we may be subject to; the fiscal health of the government and the risk of government shutdowns; our ability to complete and operate our projects on a profitable basis and as committed to our customers; our cash flows from operations and our ability to arrange financing to fund our operations and projects; our customers’ ability to finance their projects and credit risk from our customers; our ability to comply with covenants in our existing debt agreements; the impact of macroeconomic challenges, weather related events and climate change on our business; our reliance on third parties for our construction and installation work; availability and cost of labor and equipment particularly given global supply chain challenges and global trade conflicts; global supply chain challenges, component shortages and inflationary pressures; changes in federal, state and local government policies and programs related to energy efficiency and renewable energy; the ability of customers to cancel or defer contracts included in our backlog; the output and performance of our energy plants and energy projects; cybersecurity incidents and breaches; regulatory and other risks inherent to constructing and operating energy assets; the effects of our acquisitions and joint ventures; seasonality in construction and in demand for our products and services; a customer’s decision to delay our work on, or other risks involved with, a particular project; the addition of new customers or the loss of existing customers; market price of our Class A Common stock prevailing from time to time; the nature of other investment opportunities presented to our Company from time to time; risks related to our international operation and

international growth strategy; and other factors discussed in our most recent Annual Report on Form 10-K and our quarterly reports on Form 10-Q. The forward-looking statements included in this press release represent our views as of the date of this current report. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this current report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The exhibits listed on the Exhibit Index immediately preceding such exhibits are furnished as part of this Current Report on Form 8-K

| | | | | | | | |

| | EXHIBIT INDEX |

| Exhibit No. | | Description |

| 99.1 | | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | | | | |

| | | | |

| AMERESCO, INC.

| |

| September 3, 2024 | By: | /s/ Mark A Chiplock |

| | Mark A Chiplock |

| | Executive Vice President, Chief Financial Officer and Chief Accounting Officer

|

|

Ameresco and Southern California Edison Reach Agreement on Substantial Completion Milestone for Two Battery Energy Storage Projects

FRAMINGHAM, MASSACHUSETTS – September 3, 2024 – Ameresco, Inc., (NYSE: AMRC), a leading cleantech integrator specializing in energy efficiency and renewable energy, today announced that it has reached an agreement with Southern California Edison Company (SCE) on the substantial completion of two out of three battery energy storage system projects. SCE will pay approximately $110 million within seven days for the milestone completion, reflecting a set-off of liquidated damages which are still in dispute and additional work costs. Final acceptance payments will follow upon project completion. The third project is expected to reach substantial completion in Q4 2024.

To learn more about the energy efficiency and renewable energy solutions offered by Ameresco, visit www.ameresco.com.

Contacts:

Media Relations Leila Dillon, 508.661.2264, news@ameresco.com

Investor Relations Eric Prouty, Advisiry Partners, 212.750.5800, eric.prouty@advisiry.com

Lynn Morgen, Advisiry Partners, 212.750.5800, lynn.morgen@advisiry.com

About Ameresco, Inc.

Founded in 2000, Ameresco, Inc. (NYSE:AMRC) is a leading cleantech integrator and renewable energy asset developer, owner and operator. Our comprehensive portfolio includes solutions that help customers reduce costs, decarbonize to net zero, and build energy resiliency while leveraging smart, connected technologies. From implementing energy efficiency and infrastructure upgrades to developing, constructing, and operating distributed energy resources – we are a trusted sustainability partner. Ameresco has successfully completed energy saving, environmentally responsible projects with Federal, state and local governments, utilities, healthcare and educational institutions, housing authorities, and commercial and industrial customers. With its corporate headquarters in Framingham, MA, Ameresco has more than 1,500 employees providing local expertise in North America and Europe. For more information, visit www.ameresco.com.

Forward Looking Statements Any statements in this press release about the timing, completion and invoicing of the SCE projects and our expectations related to our agreement with SCE including the impact of delays and any requirement to pay liquidated damages, and other statements containing the words “projects,” “believes,” “anticipates,” “plans,” “expects,” “will” and similar expressions, constitute forward-looking

statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward looking statements as a result of various important factors, including: demand for our energy efficiency and renewable energy solutions; the timing of, and ability to, enter into contracts for awarded projects on the terms proposed or at all; the timing of work we do on projects where we recognize revenue on a percentage of completion basis; the ability to perform under signed contracts without delay and in accordance with their terms and related liquidated and other damages we may be subject to; the fiscal health of the government and the risk of government shutdowns; our ability to complete and operate our projects on a profitable basis and as committed to our customers; our cash flows from operations and our ability to arrange financing to fund our operations and projects; our customers’ ability to finance their projects and credit risk from our customers; our ability to comply with covenants in our existing debt agreements; the impact of macroeconomic challenges, weather related events and climate change on our business; our reliance on third parties for our construction and installation work; availability and cost of labor and equipment particularly given global supply chain challenges and global trade conflicts; global supply chain challenges, component shortages and inflationary pressures; changes in federal, state and local government policies and programs related to energy efficiency and renewable energy; the ability of customers to cancel or defer contracts included in our backlog; the output and performance of our energy plants and energy projects; cybersecurity incidents and breaches; regulatory and other risks inherent to constructing and operating energy assets; the effects of our acquisitions and joint ventures; seasonality in construction and in demand for our products and services; a customer’s decision to delay our work on, or other risks involved with, a particular project; the addition of new customers or the loss of existing customers; market price of our Class A Common stock prevailing from time to time; the nature of other investment opportunities presented to our Company from time to time; risks related to our international operation and international growth strategy; and other factors discussed in our most recent Annual Report on Form 10-K and our quarterly reports on Form 10-Q. The forward-looking statements included in this press release represent our views as of the date of this press release. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

v3.24.2.u1

Cover

|

Aug. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 30, 2024

|

| Entity Registrant Name |

Ameresco, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34811

|

| Entity Tax Identification Number |

04-3512838

|

| Entity Address, Address Line One |

111 Speen Street,

|

| Entity Address, City or Town |

Framingham,

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

1701

|

| City Area Code |

508

|

| Local Phone Number |

661-2200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001488139

|

| Entity Address, Address Line Two |

Suite 410,

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

AMRC

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

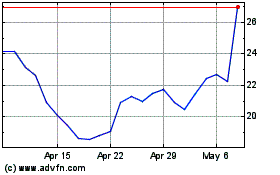

Ameresco (NYSE:AMRC)

Historical Stock Chart

From Sep 2024 to Oct 2024

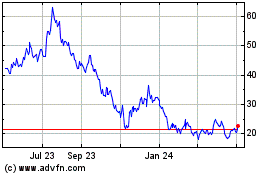

Ameresco (NYSE:AMRC)

Historical Stock Chart

From Oct 2023 to Oct 2024