Ares Management Corporation (NYSE: ARES) (“Ares” or the

“Company”) today announced the pricing of its previously announced

underwritten public offering (the “Offering”) of 27,000,000 shares

of Series B Mandatory Convertible Preferred Stock, par value $0.01

per share (“Mandatory Convertible Preferred Stock”), of the Company

at a public offering price of $50.00 per share of Mandatory

Convertible Preferred Stock. In addition, Ares has granted to the

underwriters of the Offering a 30-day option to purchase up to an

additional 3,000,000 shares of Mandatory Convertible Preferred

Stock at the public offering price, less underwriting discounts and

commissions, solely to cover over-allotments. The Offering is

expected to close on or about October 10, 2024, subject to

customary closing conditions.

Ares intends to use the net proceeds from the Offering for (i)

the payment of a portion of the cash consideration due in respect

of the Company’s previously announced acquisition of the

international business of GLP Capital Partners Limited and certain

of its affiliates, excluding its operations in Greater China (“GCP

International”), and existing capital commitments to certain

managed funds (the “GCP Acquisition”) and related fees, costs and

expenses and/or (ii) general corporate purposes, including

repayment of debt, other strategic acquisitions and growth

initiatives. Pending such use, Ares may invest the net proceeds in

short-term investments and/or repay borrowings under its

subsidiaries’ revolving credit facility.

The Mandatory Convertible Preferred Stock will accumulate

cumulative dividends at a rate per annum equal to 6.75% on the

liquidation preference thereof, which is $50 per share, payable

when, as and if declared by Ares’ board of directors, quarterly in

arrears on January 1, April 1, July 1 and October 1 of each year,

beginning on January 1, 2025 and ending on, and including, October

1, 2027. Unless previously converted or redeemed, each outstanding

share of Mandatory Convertible Preferred Stock will automatically

convert, for settlement on or about October 1, 2027, into between

0.2717 and 0.3260 shares of Ares’ Class A Common Stock, par value

$0.01 per share, subject to customary anti-dilution adjustments.

The preferred stockholders will have the right to convert all or

any portion of their shares of Mandatory Convertible Preferred

Stock at any time before the mandatory conversion settlement date.

Ares will have the right to redeem all, but not less than all, of

the Mandatory Convertible Preferred Stock if the GCP Acquisition

has not closed within a specified period of time.

Morgan Stanley & Co. LLC, Citigroup Global Markets Inc.,

Barclays Capital Inc., Goldman Sachs & Co. LLC, BofA

Securities, Inc., Jefferies LLC, J.P. Morgan Securities LLC and

Wells Fargo Securities, LLC are acting as joint book-running

managers for the offering. Ares Management Capital Markets LLC, BNY

Mellon Capital Markets, LLC, Deutsche Bank Securities Inc., MUFG

Securities Americas Inc., Truist Securities, Inc., RBC Capital

Markets, LLC, UBS Securities LLC, U.S. Bancorp Investments, Inc.,

Academy Securities, Inc., Loop Capital Markets LLC, R. Seelaus

& Co., LLC, Samuel A. Ramirez & Company, Inc. and Siebert

Williams Shank & Co., LLC are acting as co-managers for the

offering.

A registration statement on Form S-3 relating to these

securities has been filed with the Securities and Exchange

Commission (the “SEC”) and has become effective. The Offering may

be made only by means of a prospectus supplement and accompanying

prospectus. A copy of the final prospectus supplement and

accompanying prospectus related to the Offering can be obtained,

when available, for free by visiting the SEC’s website at

http://www.sec.gov or by contacting Morgan Stanley, 180 Varick

Street, 2nd Floor, New York, New York 10014, Attention: Prospectus

Department; or Citigroup Global Markets Inc., c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, New York

11717, or by email at batprospectusdept@citi.com, or by telephone:

(800) 831-9146.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy these securities, nor does it

constitute an offer, solicitation or sale of these securities in

any jurisdiction in which such offer, solicitation or sale is

unlawful. Nothing in this press release constitutes an offer to

sell or solicitation of an offer to buy any securities of Ares or

an investment fund managed by Ares or its affiliates.

About Ares Management Corporation

Ares Management Corporation (NYSE: ARES) is a leading global

alternative investment manager offering clients complementary

primary and secondary investment solutions across the credit, real

estate, private equity and infrastructure asset classes. We seek to

provide flexible capital to support businesses and create value for

our stakeholders and within our communities. By collaborating

across our investment groups, we aim to generate consistent and

attractive investment returns throughout market cycles. As of June

30, 2024, Ares Management Corporation’s global platform had over

$447 billion of assets under management, with more than 2,950

employees operating across North America, Europe, Asia Pacific and

the Middle East.

Forward-Looking Statements

Statements included herein contain forward-looking statements

within the meaning of the federal securities laws. You can identify

these forward-looking statements by the use of forward-looking

words such as “outlook,” “believes,” “expects,” “potential,”

“continues,” “may,” “will,” “should,” “seeks,” “approximately,”

“predicts,” “intends,” “plans,” “estimates,” “anticipates,”

“foresees” or negative versions of those words, other comparable

words or other statements that do not relate to historical or

factual matters. The forward-looking statements are based on our

beliefs, assumptions and expectations of our future performance,

taking into account all information currently available to us. Such

forward-looking statements are subject to various risks and

uncertainties, including our ability to consummate the Offering and

the GCP Acquisition and to effectively integrate GCP International

into our operations and to achieve the expected benefits therefrom,

and assumptions, including those relating to the GCP Acquisition,

the Offering and the intended use of proceeds, our operations,

financial results, financial condition, business prospects, growth

strategy and liquidity. Some of these factors are described in the

Annual Report on Form 10-K for the year ended December 31, 2023,

including under the headings “Item 1A. Risk Factors” and “Item 7.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and in the Quarterly Report on Form 10-Q

filed with the SEC on August 7, 2024, including under the heading

“Item 2. Management’s Discussion and Analysis of Financial

Condition and Results of Operations.” These factors should not be

construed as exhaustive and should be read in conjunction with the

risk factors and other cautionary statements that are included in

this report and in our other periodic filings. If one or more of

these or other risks or uncertainties materialize, or if our

underlying assumptions prove to be incorrect, our actual results

may vary materially from those indicated in these forward-looking

statements. New risks and uncertainties arise over time, and it is

not possible for the Company to predict those events or how they

may affect us. Therefore, you should not place undue reliance on

these forward-looking statements. Any forward-looking statement

speaks only as of the date on which it is made. Ares does not

undertake any obligation to update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241008416993/en/

Investors: Greg Mason or Carl Drake

irares@aresmgmt.com +1-888-818-5298

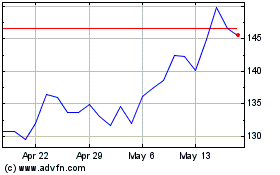

Ares Management (NYSE:ARES)

Historical Stock Chart

From Nov 2024 to Dec 2024

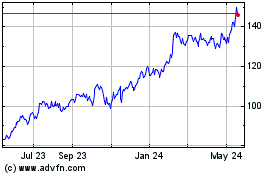

Ares Management (NYSE:ARES)

Historical Stock Chart

From Dec 2023 to Dec 2024