EPIC Crude Completes Issuance of New $1,200 Million Senior Secured Term Loan B

October 16 2024 - 6:00AM

Business Wire

EPIC Crude Holdings, LP (“EPIC Crude” or “the Company”) today

announced that it has completed the issuance of a new $1,200

million senior secured Term Loan B due 2031. The Company used the

net proceeds from the Term Loan to repay its existing $1,125

million Term Loan B and Term Loan C due 2026 and repay its existing

$40 million senior secured revolver due 2026. As part of the

transaction, the Company entered into a new agreement for a

super-priority revolving credit facility of $125 million due 2029,

undrawn at close. This refinancing is a key component of the

overall transformation of the EPIC Crude business and is reflected

in the Company’s Ba3 and BB- credit ratings from Moody’s and

S&P, respectively. With the refinancing, EPIC Crude expects to

save more than $25 million in interest expense on an annual

basis.

“EPIC Crude has continued to transform its business on the heels

of the recent transaction with our Partners, Diamondback Energy,

Inc. (NASDAQ: FANG) and Kinetik Holdings Inc (NYSE: KNTK). This

refinancing continues to build upon our success by providing

additional financial strength and affirms the market support for

our team, our strategy, and our execution,” said Brian Freed, Chief

Executive Officer of EPIC. “We have created a strategic crude

position focused on the Permian and Corpus Christi markets with

extensive downstream and export optionality. We could not be

positioned any better with our focus now turning toward our

potential expansion project.”

About EPIC Crude Holdings, LP

EPIC Crude was formed in 2017 to build and operate the EPIC

Crude Oil Pipeline, a 700-mile, 30” crude oil pipeline that extends

from Orla, Texas to the Port of Corpus Christi and services the

Midland, Delaware and Eagle Ford basins. The Crude Oil Pipeline is

currently operating at a capacity of greater than 600,000 barrels

per day (bpd), expandable to 1,000,000 bpd, and has total

operational storage of approximately 6,800,000 barrels. EPIC Crude

includes terminals in Orla, Pecos, Saragosa, Crane, Wink, Midland,

Helena and Gardendale, with Port of Corpus Christi connectivity and

export access. EPIC Crude is backed by capital commitments from

funds managed by the Private Equity Group of Ares Management

Corporation (NYSE: ARES) as well as additional equity ownership by

Diamondback Energy, Inc. (NASDAQ: FANG) (“Diamondback”) and Kinetik

Holdings, Inc. (NYSE: KNTK) (“Kinetik”). For more information,

visit www.epicmid.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241016929010/en/

EPIC Midstream Holdings, LP Mike Garberding Chief Financial

Officer (346) 231-1776 Mike.garberding@epicmid.com

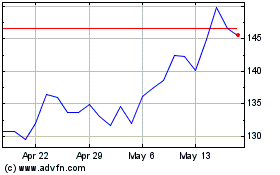

Ares Management (NYSE:ARES)

Historical Stock Chart

From Dec 2024 to Jan 2025

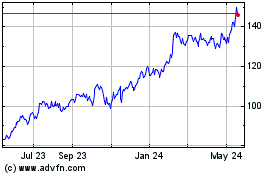

Ares Management (NYSE:ARES)

Historical Stock Chart

From Jan 2024 to Jan 2025