SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13A-16

OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2025

(Commission File No. 1-14862 )

BRASKEM S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant's name into English)

Rua Eteno, 1561, Polo Petroquimico de Camacari

Camacari, Bahia - CEP 42810-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1). _____

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7). _____

Indicate by check mark whether the

registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____.

| 1. 4Q24 HIGHLIGHTS |

5 |

| 2. KEY INDICATORS |

6 |

| 3. EXECUTIVE SUMMARY |

7 |

| 4. GLOBAL PETROCHEMICAL INDUSTRY |

8 |

| 5. PERFORMANCE BY SEGMENT |

10 |

| 5.1 BRAZIL/SOUTH AMERICA |

10 |

| 5.2 UNITED STATES AND EUROPE |

18 |

| 5.3 MEXICO |

21 |

| 6. CONSOLIDATED FINANCIAL OVERVIEW |

27 |

| 6.1 CONSOLIDATED REVENUE |

27 |

| 6.2 COST OF GOODS SOLD (COGS) |

28 |

| 6.3 OTHER INCOME (EXPENSES), NET |

28 |

| 6.4 RECURRING EBITDA |

28 |

| 6.5 CONSOLIDATED FINANCIAL RESULT |

29 |

| 6.6 NET INCOME (LOSS) |

30 |

| 6.7 INVESTMENTS |

30 |

| 6.8 CASH FLOW |

32 |

| 6.9 DEBT MATURITY PROFILE AND RATING |

33 |

| 7. CAPITAL MARKETS |

35 |

| 7.1 STOCK PERFORMANCE |

35 |

| 7.2 PERFORMANCE OF CORPORATE DEBT SECURITIES |

36 |

| 8. LIST OF ANNEXES |

37 |

FORWARD-LOOKING STATEMENTS

This Earnings Release may

contain forward-looking statements. These statements are not historical facts and are based on the current view and estimates of the Company's

management regarding future economic and other circumstances, industry conditions, financial performance and results, including any potential

or projected impact regarding the geological event in Alagoas and related legal procedures on the Company's business, financial condition

and operating results. The words “project,” “believe,” “estimate,” “expect,” “plan,”

“aim” and other similar expressions, when referring to the Company, are used to identify forward-looking statements. Statements

related to the possible outcome of legal and administrative proceedings, implementation of operational and financing strategies and investment

plans, guidance on future operations, the objective of expanding its efforts to achieve the sustainable macro goals disclosed by the Company,

as well as factors or trends that affect the financial condition, liquidity or operating results of the Company are examples of forward-looking

statements. Such statements reflect the current views of the Company's management and are subject to various risks and uncertainties,

many of which are beyond the Company’s control. There is no guarantee that the events, trends or expected results will actually

occur. The statements are based on various assumptions and factors, including, but not limited to, general economic and market conditions,

industry conditions, operating factors, and availability, development and financial access to new technologies. Any change in these assumptions

or factors, including the projected impact from the geological event in Alagoas and related legal procedures and the unprecedented impact

on businesses, employees, service providers, shareholders, investors and other stakeholders of the Company could cause actual results

to differ significantly from current expectations. For a comprehensive description of the risks and other factors that could impact any

forward-looking statements in this document, especially the factors discussed in the sections, see the reports filed with the Brazilian

Securities and Exchange Commission (CVM). This Earnings Release is not an offer of securities for sale in Brazil. No securities may be

offered or sold in Brazil without being registered or exempted from registration, and any public offering of securities carried out in

Brazil will be made by means of a prospectus that may be obtained from Braskem and that will contain detailed information on Braskem and

management, as well as its financial statements.

BRASKEM S.A. (B3:

BRKM3, BRKM5 and BRKM6; NYSE: BAK; LATIBEX: XBRK), the leading resins producer in the Americas and the world leader in biopolymers, announces

the calendar for its 4Q24 and 2024 disclosures, as follows.

Conference Call

Portuguese (original

audio) with simultaneous translation into English

February 27, 2025 (Thursday)

Time: 11 a.m. Brasília

| 9 a.m. U.S. ET | 2 p.m. London

Zoom Link:

Click here

Investor Relations Channels

Investor

Relations Website: www.braskem-ri.com.br

IR mailbox:

braskem-ri@braskem.com.br

Telephone:

+55 (11) 3576-9531

Braskem reports

Recurrent Cash Generation of R$261 million in 4Q24

Recurring

EBITDA of US$1.1 billion in 2024 (46% higher than 2023)

The

global frequency rate of accidents with and without time off work (CAF + SAF) was 0.91 events per million hours worked in the year to

date for 2024, a reduction of approximately 16% compared to 2023, where 1.08 events per million hours worked were recorded.

During

4Q24, the main spreads in the international market decreased compared to the previous quarter and were lower than the average for the

year 2024, with emphasis on the reduction in PE and main chemical spreads, impacting the Company's results in the quarter.

In

terms of demand for 4Q24, it was noted in the Brazilian market the lowest quarterly demand for resins in 2024, primarily due to the slowdown

in industrial economic activity, the maintenance of interest rates at historically high levels, and the buildup of inventories by the

processing chain that occurred in 3Q24, a movement also observed in the United States.

In

this context, sales in the Brazilian market were lower compared to the previous quarter, which was partially offset by the higher export

volume due to the higher availability of products for export. In this context, the Consolidated Recurring EBITDA for 4Q24, including effects

of idleness, inventory and other non-cash provisions, was US$102 million (R$557 million), with an operating cash generation of R$1.1 billion

and a recurring cash generation of R$265 million. Including payments related to Alagoas, the Company's cash consumption was R$542 million.

In

the year, consolidated Recurring EBITDA was US$1.1 billion, up 46% from 2023, with negative recurring cash generation of approximately

R$560 million.

On

December 31, 2024, the balance of the corporate gross debt was U$8.6 billion, with 92% of debts in US dollars, an average term of around

9 years, and 68% of the debt maturing from 2030 onwards. The average weighted cost of the Company's corporate debt was exchange variation

+6.34% p.a.

At

the end of December 2024, the Company's cash position was US$2.4 billion, sufficient to cover the payment of all debts coming due in the

next 47 months, not considering the international stand-by credit facility of US$1.0 billion available until December 2026.

In

October 2024, the Company issued a debt instrument in the international market (bond) in the amount of US$850 million at a cost of 8.00%

p.a. In November 2024, the Company completed the repurchase offer for the Hybrid Bond, buying back a principal amount of US$369 million,

with the total outstanding amount of US$241 million.

Regarding

net debt, the balance at the end of December 2024 was US$6.2 billion. Corporate leverage ended the quarter at 7.42x.

| 4. | GLOBAL PETROCHEMICAL INDUSTRY |

International Market Petrochemical Spreads – 4Q24 vs.

3Q24

BRAZIL/SOUTH AMERICA

PE spread was lower

(-23%) compared to 3Q24, due to (i) the lower PE price in the United States (-12%), impacted by lower demand, due to seasonality of the

period and the higher availability of PE in the region; and (ii) the lower ARA naphtha price (-4%), due to the lower oil price in the

period which were influenced by uncertainties about China's demand in 2025 following the Chinese government's announcement of a consumption

stimulus package that led to negative market expectations.

PP spread was higher

(+6%) compared to the previous quarter, due to the lower price of naphtha ARA (-4%), as explained previously, offsetting the reduction

of the PP price in the period.

PVC Par spread

increased (+12%) compared to 3Q24, due to the (i) lower price of Brent oil (-7%), as previously mentioned; (ii) the reduction in the price

of Caustic Soda in the USA, due to interruptions in production in the region, affected by the hurricane season; and (iii) the reduction

in the price of ethylene (-5%), due to the reduction in demand in the period explained by the expectation of an increase in ethylene global

capacity.

Spread of Main Chemicals

it was lower (-24%) compared to the previous quarter mainly due to (i) the lower price of benzene (-18%), the higher supply in the region,

with the resumption of operations and lower demand for its derivatives, especially in the styrene chain; (ii) the lower price of propylene

in the United States (-21%), reflecting the lower utilization rates of PP plants due to high inventories and lower demand in the transformation

chain in the region; and (iii) the lower price of gasoline (-12%), influenced by the end of the driving season in the USA.

UNITED STATES AND EUROPE

PP spread in the United

States remained in line with 3Q24, while PP spread in Europe was lower (-11%), due to the reduction (-7%) in the PP, due to

the lower seasonal demand and lower propylene price in Europe (-6%).

MEXICO

PE spread in Mexico

was lower (-21%) compared to 3Q24, due to the lower PE price in the USA (-15%), as explained previously and the higher ethane price (+40%)

explained by (i) the increase in the price of natural gas due to the start of winter in the northern hemisphere; (ii) the resumption of

demand after the normalization of petrochemical plants in the region, which had been affected in 3Q24 by the hurricane season; and (iii)

the increase in export volumes, due to the start-up of the Plaquemines LNG terminal in the Gulf.

For more information on

the petrochemical industry in the quarter, see appendix 8.1 of this document.

The average resin spread was

lower compared to 3Q24 (-12%), mainly influenced by the USA PE spread, due to the seasonality of the period associated with higher PE

availability in the United States, which registered record production in November 2024.

The average spread of main chemicals

was also lower compared to the previous quarter (-24%), mainly due to reduction in prices of benzene, propylene and gasoline in the quarter.

The volume of resin sales in

the Brazilian market was lower compared to 3Q24, mainly due to the seasonality of the period, partially offset by the higher volume of

exports to South America. The sales volume of the main chemicals was lower compared to the previous quarter, primarily due to reduced

product availability for sale, associated with a lower utilization rate during the quarter.

In this context, the Recurring

EBITDA for the Brazil/South America segment was lower compared to 3Q24.

| 5.1.1 | OPERATIONAL OVERVIEW |

a) Demand for resins

in Brazil (PE, PP and PVC): lower than in 3Q24 (-6%), explained by (i) lower demand for PE, mainly from the food sector due to its

higher inventory level; (ii) lower demand for PP, mainly from the hygiene and cleaning, and packaging sectors; and (iii) stagnation in

industrial production and a 0.5% reduction in retail sales, associated with higher inflation.

Compared to 4Q23, the

increase (+16%) is explained by (i) higher demand for PE by the packaging sector and the build-up of inventories in the supply chain;

(ii) higher demand for PP, mainly by the household appliances, agriculture, and packaging sectors; and (iii) growth in industrial production

and retail sales by approximately 2.5% and 3%, respectively.

b) Average utilization

rate of petrochemical complexes: reduction in relation to 3Q24 (-3 p.p.), mainly explained by (i) seasonality of the period; (ii)

operational instability at the Rio Grande do Sul petrochemical complex caused by adjustments to its power grid; (iii) a scheduled maintenance

shutdown at the PVC plant in Bahia, beginning at the end of November and concluding in January 2025; and (iv) reduced availability of

feedstock for the Rio de Janeiro petrochemical complex due to a maintenance shutdown by a domestic supplier.

Compared to 4Q23, the

increase in the utilization rate (+4 p.p.) is mainly explained by the normalization of operations following a scheduled maintenance shutdown

at the Camaçari petrochemical complex, in Bahia, in 4Q23.

c) Resin

sales volume: in the Brazilian market, resin sales were lower (-7%) compared to 3Q24, mainly due

to the lower demand for PE and PP explained by the seasonality of the period.

Compared to 4Q23, the

increase (+3%) is mainly explained by the higher sales volume of PE and PP due to the greater availability of product for sale.

Exports increased when

compared to 3Q24 (+9%), primarily due to a higher volume of PP sales in South America, which is attributed to a greater availability of

the product for export, resulting from lower demand in the Brazilian market. The increase (+10%) compared to 4Q23 is mainly due to the

greater availability of product for sale.

d) Sales volume of main

chemicals1: in the Brazilian market, main chemicals sales

were lower than in 3Q24 (-4%) due to: (i) lower sales volume of gasoline and paraxylene, associated with lower availability of product

for sale; and (ii) lower sales volume of benzene, due to reduced demand during the period.

Compared to 4Q23, the increase

(+23%) is mainly explained by the higher sales volume of gasoline, butadiene, benzene, and paraxylene due to higher product availability

for sale, explained by the maintenance shutdown at the Bahia petrochemical complex that occurred in 4Q23.

Exports were lower compared

to 3Q24 (-6%) mainly due to the lower sales volume of gasoline and butadiene, as a result of prioritizing the Brazilian market. The reduction

compared to 4Q23 (-36%) is mainly explained by the lower sales volume of gasoline and toluene, as a result of prioritizing the Brazilian

market.

1Main

chemicals refer to: ethylene, propylene, butadiene, cumene, gasoline, benzene, toluene and paraxylene, given these products’ share

of net revenue in the segment.

UPDATES ABOUT ALAGOAS

The provision for the geological

event in Alagoas, based on its assessment and that of its external advisors, considering the short and long-term effects, and the best

estimate of expenses for implementing the various measures, showed the following movement at the end of 4Q24:

Based on a new recommendation

from the specialized technical consultancy hired by the Company to conduct studies on the definitive closure of the salt cavities, an

increase was recorded in the provision for filling the 11 pressurized cavities with solid material, currently belonging to the Plugging

and Pressurization group.

These actions were taken from

the evolution of knowledge about the long-term stabilization of the cavities, based on the set of monitoring data collected to date and

the need to define the definitive closure of the Mine, as provided for in mining legislation.

The estimated additional provision

amount considers the existing planning and closure studies, with the approximate amount of R$1.2 billion related to measures for filling

the pressurized cavities which, if necessary, will begin from 2027, with execution over several years or decades.

Thus, if necessary, all actions

that ensure the 35 cavities reach a maintenance-free state in the long term are provisioned.

Additionally, by the end of

January 2025, the main advances in other fronts of action in Maceió were:

| (i) | In the Financial Compensation and Relocation

Support Program (PCF), 99.9% (19,189) of the proposals were presented, with around 98.9% of proposals paid; |

| (ii) | 99.8% of the residents of the total residential,

commercial, and mixed properties had already been relocated; and |

| (iii) | In the socio-urban measures front, 11 projects

were defined for urban mobility, with 6 completed, 2 in progress, and 3 in planning phase. |

For more information on

advances made on the action fronts in Alagoas during the quarter, see appendix 8.3 of this document.

A) Net Revenue: lower

in U.S. dollar compared to 3Q24 (-10%), mainly due to: (i) a reduction of 59 thousand tons, or 7%, in the volume of resin sales in the

Brazilian market; (ii) a 12% decrease in the international price reference of the main chemicals; (iii) a reduction of 43 thousand tons,

or 4%, in the sales volume of the main chemicals in the Brazilian market; (iv) a decrease of 6%, or 4 thousand tons, in the export volume

of main chemicals; and (v) an 8% reduction in the average international reference price of resins, notably PE, which decreased by 12%

compared to 3Q24.

Compared to 4Q23, the increase

in U.S. dollar (+2%) is mainly explained by: (i) a 5% and 3% increase in the international reference price of resins, respectively; (ii)

a 3% increase in the international resin reference; (iii) a 3% increase, or 25 thousand tons, in the volume of resin sales in the Brazilian

market; (iv) a 10% increase, or 20 thousand tons, in the volume of resin exports; (v) a 20% increase, or 114 thousand tons, in the sales

volume of the main chemicals in the Brazilian market. In Brazilian real, the increase (+20%) is also explained by the depreciation of

the average Brazilian real against the average U.S. dollar by 18% during the period.

B) Cost of Goods Sold

(COGS): reduction in U.S. dollar (-5%), mainly due to (i) a decrease of 59 thousand tons, or 7%, in the sales volume of resins in

the Brazilian market; (ii) a decrease of 43 thousand tons, or 4%, in the sales volume of main chemicals in the Brazilian market; (iii)

a reduction of 6%, or 4 thousand tons, in the export volume of main chemicals; and (iv) a 4% decrease in international naphtha price references.

In reais, COGS remained in line in relation to 3Q24. Compared to 4Q23, the Cost of Goods Sold remained in line (+1%) in dollars, mainly

due to (i) an increase of 3%, or 25 thousand tons, in the volume of resin sales in the Brazilian market; (ii) increase of 10%, or 114

thousand tons, in the volume of sales of main chemicals in the Brazilian market. In the Brazilian real, the increase (+19%) is mainly

explained by the depreciation of the average real against the average dollar of 18% in the period, associated with the inventory effect

of feedstock acquired in previous periods.

In 4Q24, COGS was positively

impacted by PIS/COFINS credits on the purchase of feedstock (REIQ) of US$ 12 million (R$ 72 million) and by Reintegra credits of US$ 0.4

million (R$ 2.3 million) and was negatively impacted by the recognition of idleness2

expenses of approximately US$20 million.

C) SG&A Expenses:

increase in U.S. dollar (+4%) compared to 3Q24, primarily due to higher expenses with contract terminations and third-party services.

Compared to 4Q23, the reduction

in U.S. dollar (-27%) and in Brazilian real (-13%) is mainly explained by; (i) the decrease in provisions for losses on accounts receivable;

and (ii) reduced storage expenses as a result of logistics optimization efforts.

D) Other Revenue (Expense),

Net: the increase in U.S. dollar (+198%) and in Brazilian real (+228%) compared to 3Q24 is mainly explained by (i) the increase in

the provisions related to the Alagoas Geological

2

According to the accounting standard on Inventories - CPC 16 (IAS 2), the value of the fixed cost

allocated to each unit produced cannot be increased due to a low production volume or idleness, and in this case, fixed costs not allocated

to the products accounted for in inventory must be recognized directly in COGS, impacting the result during the period in which they were

incurred.

Event; and (ii) the annual

revision of provisions for environmental damage of the industrial units located in Brazil of approximately US$34 million (approximately

R$200 million).

E) Recurring EBITDA:

stood at US$113 million (R$640 million), a decrease in U.S. dollar (-66%) and in reais (-66%) compared to 3Q24, primarily due to: (i)

a 24% reduction in the average spread of main chemicals on the international market; (ii) a decrease of 59,000 tons, or 7%, in the volume

of resin sales in the Brazilian market; (iii) a reduction of 43,000 tons, or 4%, in the sales volume of main chemicals in the Brazilian

market; (iv) a reduction of 6%, or 4,000 tons, in the export volume of main chemicals; (v) a 12% in the average spread of resins in the

international market; (vi) the annual review of environmental provisions in the amount of approximately US$34 million; and (vii) higher

expenses with idleness in the period.

Compared to 4Q23, the reduction

in U.S. dollar (-9%) is mainly explained by (i) the 10% decrease in the average spread of main chemicals; and (ii) the annual review of

environmental provisions in the amount of approximately US$34 million. In Brazilian real, the increase (+3%) is explained by the depreciation

of the average Brazilian real against the average U.S. dollar by 18% during the period.

| 5.1.3.1 | OPERATIONAL OVERVIEW |

a) Green ethylene utilization

rate: a reduction compared to 3Q24 (-18 p.p.), primarily due to operational instability at the Rio Grande do Sul petrochemical complex

caused by adjustments to the regional power grid and a scheduled maintenance shutdown.

The increase compared to 4Q23

(+15 p.p.) is mainly explained by the normalization of ethanol supply, which had been affected by regional weather conditions at the end

of 2023.

b) Sales volume of Green

PE (I'm greenTM biobased): increase compared to 3Q24 (+24%), mainly explained by the higher demand for Green PE in Europe

and Asia. The increase compared to 4Q23 (+17%) is mainly explained by the greater availability of product for sale.

The sales volume of Green PE

in 4Q24, totaling 57 thousand tons, was the highest quarterly sales volume since the beginning of unit’s operations in 2010.

| 5.1.3.2 | FINANCIAL OVERVIEW |

A) Net Sales Revenue of Green

PE and ETBE3: increase compared to 3Q24 (+5%) and in line with

4Q23, mainly explained by the increase of about 11 thousand and 8 thousand tons, respectively, in the sales volume of Green PE, partially

offset by the lower sales volume of ETBE, due to the lower availability of product for sale associated with the scheduled maintenance

shutdown in the ETBE production area.

3

Product that uses renewable feedstock, ethanol in its composition

| 5.2 | UNITED STATES AND EUROPE |

The average PP spread in the

United States and Europe was lower than in 3Q24, mainly attributed to the reduction in the PP spread in Europe, primarily explained by

the decrease in the PP price as a result of the seasonality of the period.

PP sales volume was lower than

in 3Q24, mainly due to reduced demand during the period and maintenance shutdowns at plants in Europe.

The Recurring EBITDA of the

United Sates and Europe segment was lower when compared to 3Q24.

| 5.2.1 | OPERATIONAL OVERVIEW |

a) PP demand: PP demand

in North America was lower (-6%) compared to 3Q24, mainly due to the seasonality of the period. Compared to 4Q23, demand in North America

was higher (+6%), primarily due to improvements in the region's economic conditions compared to the same period the previous year.

In Europe, PP demand was lower

compared to 3Q24 (-7%), mainly due to (i) the seasonality of the period; (ii) the advance purchasing in 3Q24 driven by expectations of

rising monomer prices in the period; and (iii) higher import freight costs. Compared to 4Q23, demand was in line.

b) Average utilization

rate of PP plants: lower than in 3Q24 (-9 p.p.) and 4Q23 (-15 p.p.), mainly explained by: (i) the adjustment of the utilization rate

in the United States due to lower demand in the region; and (ii) unscheduled maintenance shutdowns at plants in Europe.

c) PP sales volume: lower

compared to 3Q24 (-10%) and 4Q23 (-12%) mainly explained by; (i) the seasonality of the period resulting from the destocking process in

the transformation chain; and (ii) lower product availability for sale in Europe, due to lower utilization rate.

A) Net Revenue: lower

in U.S. dollar (-18%) and in Brazilian real (-14%), compared to 3Q24, mainly due to (i) a reduction of 52 thousand tons, or 10%, in the

volume of PP sales; and (ii) a 13% decrease in the average international PP price references.

Compared to 4Q23, the reduction

in U.S. dollar (-12%) is mainly explained by: (i) a reduction of 64 thousand tons, or 12%, in PP sales volume; and (ii) a 5% reduction

in the average international PP price references. The increase in Brazilian real (+4%) is mainly explained by the depreciation of the

average Brazilian real against the average U.S. dollar by 18% during the period.

B) Cost of Goods Sold (COGS):

reduction in dollars (-11%) and in reais (-6%) mainly due to (i) reduction of 52 thousand tons, or 10%, in PP sales volume; (ii) reduction

of 21% and 6% in the price of propylene in the United States and Europe, respectively. These effects were partially offset by the inventory

effect of propylene acquired in previous periods.

Compared to 4Q23, the reduction

in dollars (-3%) is mainly explained by the reduction of 63 thousand tons, or 12%, in the volume of PP sales, partially offset by the

inventory effect of propylene acquired in previous periods. In reais, the increase (+14%) is mainly explained by the depreciation of the

average real against the average dollar of 18% in the period. In the quarter, the COGS of the United States and Europe segment was negatively

impacted by approximately US$ 12 million by the recognition of idleness4

expenses in the period.

C) SG&A Expenses:

increase in dollars (+16%) and in reais (+23%) compared to 3Q24 mainly due to expenses with terminations and project engineering expenses.

Compared to 4Q23, the reduction

in U.S. dollar (-2%) is mainly explained by lower expenses with consulting services. The increase in Brazilian real (+16%) is mainly attributed

to the depreciation of the average Brazilian real against the average U.S. dollar by 18% in the period.

D) Other Revenue (Expenses),

Net: US$7 million, explained by the reversal of the provision for the purchase of wagons, due to the end of the current leasing contract.

E) Recurring EBITDA:

US$ -10 million (R$ 58 million), lower than 3Q24, mainly due to (i) the inventory effect of propylene acquired in previous periods; (ii)

the 2% reduction in the average PP spread in the period; and (iii) higher expenses with idleness in the period.

The decrease compared to 4Q23

is mainly explained by (i) a reduction of 64 thousand tons, or 12%, in PP sales volume and inferior sales mix; (ii) the inventory effect

of propylene acquired in previous periods; and (iii) the recognition of higher expenses with idleness in the period.

4

According to the accounting standard on Inventories - CPC 16 (IAS 2), the value

of the fixed cost allocated to each unit produced cannot be increased due to a low production volume or idleness, and in this case, fixed

costs not allocated to the products accounted for in inventory must be recognized directly in COGS, impacting the result during the period

in which they were incurred.

The PE spread in North America

was lower than in 3Q24, mainly due to the lower PE price, which is explained by the seasonality of the period associated with higher availability

in the United States, where a production record was registered in November 2024, and by the higher ethane prices during the quarter due

to winter seasonality and the resumption in ethane demand following the normalization of petrochemical complexes' operations in the Gulf,

which had been previously affected by the hurricane season.

The PE sales volume was lower

than in 3Q24, mainly due to the seasonality of the period and the inventory replenishment process.

In this context, Recurring EBITDA

of the Mexico segment was lower than in 3Q24.

a) PE demand in the

Mexican market: lower than in 3Q24 (-11%), mainly due to the seasonality of the period associated with higher buildup of inventories

in the previous quarter. Compared to 4Q23, PE demand in the Mexican market was lower (-2%) due to the higher inventory formation observed

in 3Q24.

b) Average

utilization rate of PE plants: higher compared to 3Q24 (+3 p.p.), mainly due to: (i) the increased

ethane supply by PEMEX, around 30 thousand barrels per day, in line with the minimum volume established in the contract; and (ii) the

normalization of operations following a scheduled maintenance shutdown in one of the PE plants in the previous quarter.

In relation to 4Q23, the

reduction (-7 p.p.) is mainly explained by the lower ethane supply by PEMEX in 4Q24 compared to the average of 35 thousand barrels per

day in 4Q23, above the minimum volume established in the contract.

The volume of ethane imported

through the Fast Track solution was 19 thousand barrels per day, in line with 3Q24 and higher than the 18 thousand barrels per day in

4Q23.

c) PE sales volume:

reduction compared to 3Q24 (-6%), mainly due to the seasonality of the period and the PE inventory replenishment process.

In relation to 4Q23, the increase

(+9%) is mainly explained by the buildup of inventories in 4Q23 following an unscheduled shutdown due to failures in the national power

grid caused by thunderstorms in the region in 3Q23.

A) Net Revenue: lower

in U.S. dollar (-16%) and in Brazilian real (-12%) compared to 3Q24, mainly due to: (i) a reduction of 13 thousand tons, or 6%, in the

PE sales volume; and (ii) a 15% reduction in the international PE price reference.

The increase compared to 4Q23

(+7%) is mainly explained by: (i) an increase of 17 thousand tons, or 6%, in the PE sales volume; and (ii) a 4% increase in the international

PE price reference in the quarter. In Brazilian real, the increase (+26%) is mainly explained by the depreciation of the average Brazilian

real against the average U.S. dollar by 18% during the period.

Sales by region (% in

tons)

B) Cost of Goods Sold (COGS):

reduction in U.S. dollar (-2%) compared to 3Q24, mainly explained by the reduction of 13 thousand tons, or 6%, in PE sales volume,

partially offset by the impact in the international ethane reference price in relation to the previous quarter. In Brazilian real, the

increase (+3%) is mainly explained by the depreciation of the average Brazilian real against the average U.S. dollar by 5% during the

period.

Compared to 4Q23, the increase

in U.S. dollar (+2%) is mainly explained by the increase of 17 thousand tons, or 6%, in the PE sales volume. In Brazilian real, the increase

(+19%) is mainly explained by the depreciation of the average Brazilian real against the average U.S. dollar by 18% during the period.

C) SG&A Expenses:

increase in U.S. dollar compared to 3Q24 (+76%) due to commercial expenses related to the ethane resale operation in the international

market. The portion of the revenue impacted Other Operating Revenue.

Compared to 4Q23, the reduction

in U.S. dollar (-25%) and in Brazilian real (-9%) is mainly explained by lower expenses with ethane resale operations in 4Q24.

D) Other Revenue (Expenses),

Net: US$10 million, higher than in 3Q24 due to revenue from ethane resale operations in the quarter.

E) Recurring EBITDA

was US$35 million (R$202 million), lower than in 3Q24 (-56%), mainly due to: (i) a 21% reduction in the PE spread; and (ii) a reduction

of 13 thousand tons, or 6%, in the PE sales volume.

Compared to 4Q23, Recurring

EBITDA was higher in U.S. dollar (+34%) and in Brazilian real (+55%), mainly explained by: (i) the increase of 17 thousand tons, or 6%,

in PE sales volume; and (ii) the 6% increase in the PE spread during the period.

By the end of 2024, Braskem

Idesa had invested approximately US$248 million, 2% lower than the initial estimate of US$252 million.

Operating Investments

in 2024: the operating investments made by Braskem Idesa were mainly in initiatives to enhance asset reliability and integrity,

as well as in health, safety and environmental measures, totaling US$58 million for the year.

Strategic Investments

in 2024: refer to the ongoing construction of the ethane import terminal through Terminal Química Puerto México

(TQPM), which is financed by the Syndicated Project Finance Loan, totaling US$190 million for the year.

Investments in

2025

The investment planned

by Braskem Idesa for 2025 is US$104 million (R$623 million), with US$23 million allocated to the completion of the construction of the

ethane import terminal, financed through the Syndicated Project Finance Loan issued by the Terminal Química Puerto México

(TQPM). This financing will not require additional disbursements from the shareholders Braskem Idesa and Advario.

Operating Investments

for 2025: operational investments will be allocated, mainly, to the general scheduled maintenance shutdown of the petrochemical

complex, worth approximately US$50 million, projects related to operational efficiency, such as maintenance, productivity and HSE.

Strategic Investments

for 2025: strategic investments refer to the ongoing construction of the ethane import terminal through Terminal Química

Puerto México (TQPM).

| 5.3.3.1 | ETHANE IMPORT TERMINAL |

In 2021, Braskem Idesa approved

and launched the project to build an ethane import terminal in Mexico, with capacity for up to 80 thousand barrels of ethane per day,

enabling it to operate at 100% of its production capacity. In the same year, a joint venture was established between Braskem Idesa and

Advario, through the subsidiary Terminal Química Puerto México (TQPM), with a 50% ownership interest for each shareholder.

The total estimated amount

for the construction of the terminal is US$446 million (CAPEX ex-VAT), of which US$408 million is financed via Syndicated Project Finance

Loan, announced by TQPM in November 2023.

The total amount disbursed

on the ethane import terminal from the beginning of the project to the end of 4Q24 was approximately US$380 million, with the net disbursements

made by Braskem Idesa totaling approximately US$95 million5. In 2024,

the cash needs for the construction of the terminal were disbursed through the financing obtained, without the need for an additional

equity contribution by Braskem Idesa. The amount invested by TQPM in the ethane import terminal in 4Q24 was US$35 million (R$206 million),

using the financing obtained as the source of funds.

The construction of the terminal,

which began in July 2022, had achieved 94% physical progress by December 2024. The start of operations is estimated for the second quarter

of 2025.

| 5.3.4DEBT | MATURITY PROFILE AND RATING |

As of December 31, 2024, the

average debt term was around 5.9 years, with 95% maturing from 2029. Braskem Idesa's weighted average cost of debt was exchange variation

plus 7.3% p.a.

The liquidity position of

US$231 million is sufficient to cover the payment of all liabilities coming due in the next 22 months.

5

Includes Value Added Tax (VAT).

Shareholder Loan Capitalization

On

October 16, 2024, the Company together with the Idesa Group, a non-controlling shareholder of Idesa, approved an increase in Braskem Idesa's

capital through the capitalization of the principal balance of the Shareholder Loan in the amount of approximately US$1.6 billion (R$8.8

billion). As a result, a substantial part of the debt was converted into shares and delivered to each shareholder, maintaining the proportion

of shares held before the transaction. Only the interest accrued up to the date of capitalization in the amount of US$561 million (R$3.5

billion) remains open, with payment expected by March 31, 2032.

Rating

In December 2024, Fitch Ratings

affirmed the rating of Braskem Idesa at “B+”, updating the outlook from “Negative” to “Stable”.

| CORPORATE CREDIT RISK - BRASKEM IDESA |

| Agency |

Rating |

Outlook |

Date |

| FITCH |

B+ |

Stable |

12/13/2024 |

| S&P |

B |

Negative |

07/05/2024 |

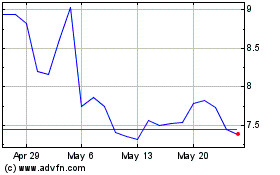

| 5.3.5PERFORMANCE | OF BRASKEM IDESA'S DEBT INSTRUMENTS |

| 6. | CONSOLIDATED FINANCIAL OVERVIEW |

| 6.2 | COST OF GOODS SOLD (COGS) |

| 6.3 | OTHER INCOME (EXPENSES), NET |

As of December 31, 2024, the

Company recorded a total net expense of R$1,596 million, higher than in 3Q24, mainly attributed by (i) the addition to the provision for

the geological event in Alagoas due to updated cost estimates related to updates in the closure plan of the wells, implementation, and

advancement in the maturity of projects, initiatives, and programs included in the action fronts in Alagoas in the amount of R$1,289 million;

and (ii) revision of provisions for recovery of environmental damage of industrial units in Brazil in the net amount of R$200 million.

Braskem's Recurring EBITDA was

US$102 million (R$557 million) in 4Q24, lower than in 3Q24 (-76%), mainly due to; (i) lower average spreads in the international market

for Main Chemicals (-24%) and Resins (-12%) in Brazil, PE in Mexico (-21%) and PP in the United States and Europe segment (-2%); (ii)

the lower

6

Braskem’s consolidated result corresponds to the sum of the results in Brazil, United

States & Europe and Mexico, minus eliminations and reclassifications of purchases and sales among the segments reported by the Company,

plus Other Segments.

consolidated sales volume (-5%)

in the period; (iii) the annual update of environmental provisions in the amount of approximately US$ 34 million; (iv) higher expenses

with idleness in the period; and (v) the effect of the inventory of feedstock acquired in previous periods.

The decrease compared to 4Q23

(-52%) is mainly explained by (i) lower average spreads in the international market for Main Chemicals (-10%); (ii) the annual update

of environmental provisions in the amount of approximately US$ 34 million; (iii) higher expenses with idleness in the period; and (iv)

the inventory effect of feedstock acquired in previous periods.

| 6.5 | CONSOLIDATED FINANCIAL RESULT |

Financial expenses:

higher compared to 3Q24 (+36%) mainly explained by (i) higher interest expenses, due to the increase in gross debt with the raising of

the US$850 million bond in October, partially offset by the prepayment of the hybrid bond in the amount of US$369 million, and the depreciation

of the average real against the average dollar in the period of approximately 5%; and (ii) for the amortization of transaction costs associated

with hybrid Bond pre-payment. Compared to 4Q23, the increase (+35%) is explained by higher interest expenses due to the 18% depreciation

of the average real against the average dollar for the period, which impacted the increase in the gross debt balance in reais in the period.

Gross debt in dollars remained in line.

Financial income:

increased from 3Q24 (+3%) mainly due to reversal of the fair value provision on Braskem Idesa's Shareholder Loan after its capitalization,

partially offset by lower income from interest on financial investments. Compared to 4Q23, the reduction (-9%) is mainly explained by

lower income from interest on financial investments due to the reduction in the cash position in the period.

Net exchange variations:

the negative variation in 4Q24, in relation to 3Q24, is mainly explained by (i) the impact of hedge accounting in the amount of R$894

million; (ii) the depreciation of around 14% of the real at the end of the period against the dollar on the average net exposure to the

dollar in the amount of US$3.8 billion; and (iii) the depreciation of around 3% of the Mexican peso at the end of the period against the

dollar on Braskem Idesa's average net exposure to the dollar in the amount of US$ 1.2 billion.

Transactions in financial

instruments under hedge accounting

In relation to the hedge accounting

of exports by Braskem S.A., the Company carried out US$200 million (R$728.3 million) in exports in the quarter from a flow discontinued

in 2021. The designated initial rate was R$/US$2.0017, defined in March 2013, while the realization rate was R$/US$5.6430, defined in

October 2021. The balance of financial instruments designated for this hedge accounting ended 4Q24 at US$5.15 billion.

In relation to the hedge accounting

of exports by Braskem Idesa, the Company carried out US$101.6 million (MXN574.7 million) in exports from designated and discontinued flows

between 2016 and 2021. The average initial designation rate was US$1/MXN14.3938, and the average realization rate was US$1/MXN20.0518.

The balance of instruments designated for this hedge accounting ended 4Q24 at US$2.2 billion.

Long-term Currency

Hedge Program

Braskem’s feedstock and

products have prices denominated or strongly influenced by international commodity prices, which are usually denominated in U.S. dollar.

Since 2016, Braskem has contracted derivative instruments to mitigate part of the exposure of its cash flow denominated in Brazilian real.

The main purpose of the program is to mitigate U.S. dollar call and put option agreements, thus protecting the estimated flows for a horizon

of up to 18 months.

On December 31, 2024, Braskem

had a notional value of outstanding put options of US$1.4 billion, at an average exercise price of R$/US$4.71. At the same time, the Company

also had a notional value of outstanding call options of US$0.79 billion, at an average exercise price of R$/US$6.81. The contracted operations

have a maximum term of 18 months. The fair value of these Zero Cost Collar (“ZCC”) operations was negative at R$132 million

at the end of the quarter.

Due to the low volatility of

the U.S. dollar during the period, no options were exercised, with no cash effect in 4Q24.

In the quarter, the Company

posted net loss of US$1.0 billion, or R$5.9 billion, mainly due to the impact of R$4.7 billion of negative exchange rate variation on

the financial consolidated result.

In the year, the Company registered

net loss of US$2.2 billion, or R$12.1 billion, attributed to the negative exchange rate variation of R$ 11.5 billion on the financial

result. Net loss attributable to shareholders was US$2.1 billion, or R$11.3 billion, in 2024.

At the end of 2024, Braskem

made corporate investments of approximately US$429 million, 2% lower than the initial estimate of US$440 million. This was in line with

the company's strategy of optimizing and prioritizing investments throughout the year.

Operating investments

in 2024: the main operating investments made include: (i) scheduled maintenance shutdowns at plants in Brazil, the United States

and Europe; (ii) investments to improve the mechanical integrity of assets in Brazil; and (iii) investments related to enhancing the reliability

and operational safety of industrial assets.

Strategic investments

in 2024: the funds were mainly allocated to: (i) the completion of payments for the capacity expansion project of the green ethylene

plant in Brazil; (ii) projects related to enhancing the energy efficiency of industrial assets and reducing CO2 emissions;

and (iii) initiatives in innovation and technology.

In 2024, the main investments

related to the Sustainable Development Macro Goals were; (i) projects related to reducing CO2e emissions and enhancing the

energy efficiency of industrial assets; and (ii) projects related to industrial safety.

Investments for 2025

The investment expected to be

made throughout 2025 by Braskem (ex-Braskem Idesa and Ex-REIQ Investimentos) is US$404 million¹ (R$2.4 billion), around 39% lower

than the historical average of the last 6 years (US$672 million). Considering the investments to be made through REIQ Investimentos, the

investment planned for 2025 totals US$484 million (R$2.9 billion), classified as follows:

Operating investments:

(i) scheduled maintenance stoppages at the Rio de Janeiro plant and other resin plants in Brazil; (ii) regulatory investments and those

related to operational and process safety; and (iii) asset mechanical integrity program and spare parts acquisition for operational continuity.

Strategic investments:

(i) investments in technological developments; and (ii) acquisition of industrial land in the Duque de Caxias industrial hub in Rio de

Janeiro.

REIQ Investimentos:

In January 2025, REIQ Investimentos was announced, which consists of a presumed credit of 1.5% of PIS/COFINS linked to investments in

the Brazilian chemical industry. Braskem, within this context, announced seven projects worth an estimated total of R$614 million to increase

its production capacity

by 139 thousand tons, distributed between

PE, PVC and other chemical products, in three states: Bahia, Rio Grande do Sul and Alagoas. For 2025, the estimated investment is R$477

million (US$80 million).

For 2025, investments related

to the sustainable development macro goals will amount to US$142 million (R$851 million), accounting for 30% of corporate investments.

These funds will be primarily allocated to projects focused on health and safety, sustainable innovation, and operational eco-efficiency.

The Company reported an operating

cash generation of R$1.1 billion in 4Q24. This result is mainly explained by the positive variation in working capital, which was partially

offset by the lower Recurring EBITDA in the period.

During 4Q24, the positive

variation in working capital is mainly explained by:

(i) the

impact on inventories due to lower spreads in the international market, the reduction in inventories of finished products and feedstock

due to the seasonality of the period; and

(ii) the

impact on accounts receivable due to lower sales volume and international price references reduction in the period.

Recurring cash generation

totaled R$265 million in 4Q24. The variation in relation to 3Q24 is explained by (i) the increased operating cash generation, explained

by the positive variation in working capital, which was partially offset by the lower EBITDA in the period; and (ii) the lower interest

payment due to the semiannual interest payments on debt securities issued in the international market by the Company, which are concentrated

in the first and third quarters of the year.

Compared to 4Q23, recurring

cash generation was higher by R$211 million, mainly due to: (i) higher operating cash generation, explained by the positive variation

in working capital, which was partially offset by lower

EBITDA in the period; (ii)

lower income tax payments. These effects were partially offset by the increase in interest payments.

Considering the disbursements

related to the geological event in Alagoas, the Company registered cash outflow of R$542 million in 4Q24.

| 6.9 | DEBT MATURITY PROFILE AND RATING |

On December 31, 2024, the balance

of corporate gross debt stood at U$8.6 billion, composed of 95% long-term maturities and 5% short-term maturities. At the end of the period,

corporate debt in foreign currency accounted for 92% of the Company's total debt.

As of December 31, 2024, the

average term of corporate debt was around 9 years, with 68% of debts concentrated from 2030 onwards. The weighted average cost of the

Company's corporate debt was exchange variation +6.34% p.a.

Regarding net debt, the balance

at the end of December 2024 was US$6.2 billion.

In November 2024, the Company

completed the repurchase offer for the Hybrid Bond, buying back a principal amount of US$369 million, leaving a remaining balance of US$241

million.

As a result of the partial prepayment

of the Hybrid Bond, Standard & Poor's and Fitch Ratings no longer apply a 50% equity treatment.

The cash position of US$2.4

billion in December 2024 is sufficient to cover the payment of all debts coming due in the next 47 months, not considering the international

stand-by credit facility of US$1.0 billion available through December 2026.

Rating

| CORPORATE CREDIT RATING - GLOBAL SCALE |

| Agency |

Rating |

Outlook |

Date |

| FITCH |

BB+ |

Negative |

10/07/2024 |

| S&P |

BB+ |

Negative |

10/07/2024 |

| |

|

|

|

| CORPORATE CREDIT RATING - NATIONAL SCALE |

| Agency |

Rating |

Outlook |

Date |

| FITCH |

AAA(bra) |

Stable |

10/07/2024 |

| S&P |

brAAA |

Negative |

10/07/2024 |

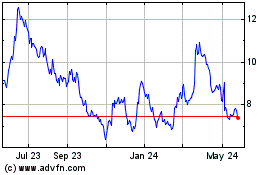

On December 31, 2024, Braskem’s

stock was quoted at R$11.58/share (BRKM5) and US$3.80/share (BAK). The Company’s shares are listed on Level 1 corporate

governance segment of B3 – Brasil, Bolsa e Balcão and on the New York Stock Exchange (NYSE) through Level 2 American Depositary

Receipts (ADRs), with each Braskem ADR (BAK) corresponding to two class “A” preferred shares issued by the Company, and on

the Madrid Stock Exchange (LATIBEX) under the ticker XBRK.

7.2 PERFORMANCE OF CORPORATE DEBT SECURITIES

BRAZIL/SOUTH AMERICA

| · | PE Spread7:

decreased from 3Q24 (-23%). |

| o | PE price in the United States was lower (-12%) than in 3Q24, impacted by (i) reduced demand, due to the

seasonality of the period; and (ii) the higher availability of PE in the region, reaching the historical record volume of PE production

in December 2024. |

| o | ARA naphtha price decreased (-4%) compared to 3Q24, due to the lower oil price during the period, explained

by uncertainties about China's demand in 2025, (i) following the Chinese government's announcement of a consumption stimulus package that

led to negative market expectations, and (ii) resulting in a challenging scenario with the slowdown of the industrial and infrastructure

sectors. |

| o | Compared to 4Q23, the spread was higher (+14%) mainly due to higher PE prices in the United States, explained

by the increase in global demand, driven by the growth of the packaging, construction and automotive sectors in international markets. |

| · | PP Spread8:

decreased compared to 3Q24 (+6%). |

| o | PP price in Asia decreased (-1%) from 3Q24, mainly due to: (i) an increased PP supply in Asia as new capacities

came into operation, surpassing the growth in demand during the period; and (ii) lower seasonal demand, due to the impact of winter on

activities in the construction sectors, affecting the inventory levels of producers in the region. |

| o | Naphtha ARA price decreased (-4%) compared to 3Q24, as previously explained, compensating for the lower

price of PP in the period. |

| o | Compared to the same quarter of 2023, the spread was higher (+12%) due to: (i) a higher PP price in Asia

(+3%), explained by the increased margin of marginal producers in the region, resulting from greater local competitiveness due to the

closure of production plant activities in the region, directly impacting the high demand for PP and increasing export prices; and (ii)

a lower ARA naphtha price (-1%) as previously mentioned. |

| · | PVC Par Spread9:

increased from 3Q24 (+12%). |

| o | PVC price was lower compared to 3Q24 (-7%), mainly impacted by (i) lower demand from the construction

sector in China; (ii) uncertainties regarding increased export restrictions to India due to new local regulations; and (iii) the increase

in supply due to higher operating rates and the entry of new PVC production capacities. |

| o | The reduction in the price of PVC was offset by (i) the higher price of Caustic Soda in the United States

compared to 3Q24 (+22%), due to interruptions in production in the region affected by the hurricane season; and (ii) lower Brent oil price

(-7%), as mentioned previously. |

| o | Compared to 4Q23, PVC Par spread was higher (+28%), mainly impacted by: (i) the increase in soda prices

(+40%) due to the reduction in supply in 3Q24, as a result of the hurricane season in the Gulf, partially offsetting the lower price of

PVC (-7%) in the period, as previously mentioned. |

| · | Spread on Main Basic Chemicals[10]:

decreased from 3Q24 (-24%). |

7

(U.S. PE Price – naphtha ARA price)*82%+(U.S. PE Price – 50% U.S. ethane price –

50% U.S. propane price)*18%.

8

Asia PP price – ARA naphtha price.

9The

PVC Par spread better reflects the profitability of the Vinyls business, which is more profitable compared to the temporary/non-integrated

business model of 2019/20, when the Company imported EDC and caustic soda to serve its clients. Its calculation formula is: Asia PVC Price

+ (0.685*U.S. Caustic Soda) - (0.48*Europe Ethylene) - (1.014*Brent)

| o | The price of main chemicals decreased (-12%) compared to the previous quarter, mainly due to: (i) lower

benzene price (-18%), explained by increased supply in the region, with the resumption of operations and lower demand for derivatives,

especially in the styrene chain, due to seasonality and reduced exports; (ii) lower propylene price (-21%) in the United States, reflecting

lower utilization rates of PP plants due to higher inventories and reduced demand in the processing chain; and (iii) lower gasoline price

(-12%), influenced by the end of the driving season in the United States. |

| o | In relation to 4Q23, the spread of Main Basic Chemicals was lower (-10%), influenced by the reduction

in the prices of benzene (-16%), gasoline (-11%), propylene and paraxylene, due to factors such as global economic slowdown, increased

inventories and lower demand. However, the increase (+57%) in the butadiene price, resulting from the lower supply after the resumption

of operations, partially offset these reductions. |

UNITED STATES AND EUROPE

| · | U.S. PP Spread11:

remained in line with 3Q24. |

| o | Compared to the same quarter last year, the spread remained in line. |

| · | Europe PP Spread12:

decreased (-11%) from 3Q24. |

| o | PP price compared to 3Q24 decreased (-7%), due to lower seasonal demand, which was partially offset by the postponement of maintenance

shutdowns because of the early onset of the cold season in the region, which affected energy costs in the production chain. |

| o | Propylene price in Europe decreased (-6%) compared to 3Q24, in line with the decline observed in the naphtha

price. |

| o | Compared to 4Q23, the spread was higher (+4%), mainly impacted by mainly due to the lower propylene price

in Europe (-2%), also in line with the drop in naphtha during the period. |

MEXICO

| · | North America PE Spread13:

decreased compared to 3Q24 (-21%). |

| o | PE price in the United States was lower (-15%) in relation to 3Q24, as previously explained. |

| o | Ethane price was higher (+40%) compared to 3Q24, attributed to: (i) the increase in natural gas price

due to the onset of the winter seasonality; and (ii) the resumption of demand following the normalization of crackers in the Gulf, affected

in 3Q24 by the hurricane season, and; (iii) the increase in export volumes, due to the start of operations of the Plaquemines LNG terminal

in the Gulf. |

| o | In relation to the same period last year, spread was higher (+6%), mainly impacted by higher PE price

in the United States (+24%), influenced by the factors mentioned previously. |

11Average price of the main chemicals (Ethyne

(20%), Butadiene (10%), Propylene (10%), Cumene (5%), Benzene (20%), Paraxylene (5%), Gasoline (25%) and Toluene (5%), according to Braskem's

sales volume mix) - price of ARA naphtha.

12U.S. PP – U.S. propylene prices

13EU PP – EU propylene prices

14U.S. PE – U.S.

ethane prices

Resin sales by sector (%) | Brazil/South

America segment

Resin sales by sector (%)

| Mexico segment

The Company operated, since

its formation and subsequently as the successor of the company Salgema, salt mining wells located in Maceió city, Alagoas state,

with the purpose of supplying feedstock to its chlor-alkali and dichloroethane plant. In March 2018, an earthquake hit certain districts

of Maceió, where the wells are located, and cracks were found in buildings and public streets of Pinheiro, Bebedouro, Mutange,

and Bom Parto districts.

In May 2019, the Geological

Survey of Brazil (“CPRM”) issued a report, indicating that the geological phenomenon identified in certain neighborhoods of

the municipality of Maceió, Alagoas, could be related to the rock salt well exploration activities developed by Braskem. The salt

mining operation, from this moment on, was fully ended by the Company.

Since then, the Company has

been devoting its best efforts to understand the geological event, its possible effects on surfaces, stability of rock salt cavities and

in carrying out precautionary measures to ensure public safety. The results arising from the understanding of the geological phenomenon

are being shared with the Brazilian National Mining Agency (“ANM”) and other pertinent authorities.

As a result of the geological

phenomenon, negotiations were conducted with public and regulatory authorities that resulted in the Agreements executed, including the

following agreement in progress:

| (i) | Instrument of Agreement to Support the Relocation

of People in Risk Areas (“Agreement for Compensation of Residents"), entered into with State Prosecution Office (“MPE”),

the State Public Defender’s Office (“DPE”), the Federal Prosecution Office (“MPF”) and the Federal Public

Defender’s Office (“DPU”), which was ratified by the court on January 3, 2020, adjusted by its resolutions and subsequent

amendments, which establish cooperative actions for relocating residents from risk areas, defined in the Map of Sectors of Damages and

Priority Action Lines by the Civil Defense of Maceió (“Civil Defense Map”), as updated in December 2020 (version 4),

and guaranteed their safety, which provides support, under the Financial Compensation and Support for Relocation Program (“PCF”)

implemented by Braskem to the population in the areas of the Civil Defense Map. Following ratification by the courts of the Agreement

for Compensation of Residents, the Public-Interest Civil Action for Resident Reparation was dismissed; |

| (ii) | Instrument of Agreement to Dismiss the Public-Interest

Civil Action on Socio-Environmental Reparation and the Agreement to define the measures to be adopted regarding the preliminary injunctions

of the Public-Interest Civil Action on Socio-Environmental Reparation (jointly referred to as “Agreement for Socio-Environmental

Reparation”), signed with the MPF with the MPE as the intervening party, on December 30, 2020, in which the Company mainly undertook

to: (i) adopt measures to stabilize and monitor the subsidence phenomenon arising from salt mining; (ii) repair, mitigate or compensate

possible environmental impacts and damages arising from salt mining in the Municipality of Maceió; and (iii) repair, mitigate or

compensate possible socio-environmental impacts and damages arising from salt mining in the Municipality of Maceió. Additionally,

the agreement provides for the allocation of the amount of R$ 300 for compensation for social damages and collective pain and suffering

and for any contingencies related to actions in vacated areas and urban mobility actions. Following ratification by the courts of this

agreement, the Public-Interest Civil Action for Socio-environmental Reparation was dismissed; |

| (iii) | Instrument of Agreement for Implementation of Socioeconomic Measures for

the Requalification of the Flexal Area (“Flexal Agreement”) entered into with MPF, MPE, DPU and the Municipality of Maceió

and ratified on October 26, 2022 by the 3rd Federal Court of Maceió, which establishes the adoption of requalification actions

in the Flexais region, compensation to the Municipality of Maceió and indemnities to the residents of this location; and |

| (iv) | Instrument of Global Agreement with the Municipality

of Maceió (“Instrument of Global Agreement”) ratified on July 21, 2023 by the 3rd Federal Court of Maceió, which

establishes, among other things: (a) payment of R$1.7 billion as indemnity, compensation and full reimbursement for any property and non-property

damages caused to the Municipality of Maceió; (b) adherence of the Municipality of Maceió to the terms of the Socio-environmental

Agreement, including the Social Actions Plan (PAS). |

The Company's Management,

based on its assessment and that of its external advisers, taking into account the short and long-term effects of technical studies prepared,

available information and the best estimate of expenses for implementing the measures related to the geological event in Alagoas, presents

the following changes to the provision in the fiscal years ended December 31, 2024 and 2023:

The total amounts recorded

from the beginning of actions related the geological event until the period ending December 31, 2024, are segregated into the following

action fronts:

a)

Support for relocation and compensation:

Refers to initiatives to support relocation and compensation of the residents, business and real state owners of properties located in

the Civil Defense Map (version 4) updated in December 2020, including establishments that requires special measures for their relocation,

such as hospitals, schools and public equipment.

These actions have a provision

of R$997 million (2023: R$1,353 million) comprising expenses related to relocation actions, such as relocation allowance, rent allowance,

household goods transportation, negotiation of individual agreements for financial compensation and compensation for establishments that

require special relocation arrangements.

By January 31, 2025, 99.8%

of residents of all residential, commercial and mixed properties had already been relocated. 19,189 proposals were presented (99,9% of

the total predicted). Additionally, 19,058 proposals for financial compensation were accepted (99.3% of the total forecast) and 18,978

were paid (98.9% of the total forecast). Under the Financial Compensation and Relocation Support Program (PCF), approximately R$4.2 billion

was disbursed from the start of the program until the end of January 2025.

b)

Actions for closing and monitoring the salt cavities, environmental actions

and other technical matters: Based on the findings of sonar and technical

studies, stabilization and monitoring actions were defined for all 35 existing mining areas.

On December 10, 2023, after

an atypical microseismic activity, cavity 18 collapsed. Considering the best technical information available to date, there is an indication

that the direct impacts of this occurrence are restricted to the location of this cavity, within the protection area, which has been unoccupied

since April 2020.

Additionally, in March 2024,

based on the recommendation of specialized consultancies, it was defined that for 6 depressurized cavities, previously classified as Monitoring

Group, monitored via sonar on a periodic basis, closure by filling with solid material (sand) proved to be the most appropriate closure

method, considering the results of the most recent geomechanical studies.

In December 2024, based on

the new recommendation of the expert consulting firm hired by the Company to conduct studies on the planning and closure of the salt cavities,

the increase in the provision related to the filling with solid material of the 11 pressurized cavities, indicated in item (iii) below,

currently belonging to the Buffering and Pressurization group, was recorded. The actions are planned to start from 2027, if necessary,

with execution over several years or decades. These actions were taken from the evolution of knowledge about the long-term stabilization

of the cavities, based on the set of monitoring data collected so far, as well as the collapse of cavity 18 and the need to define the

definitive closure of the Mine, as provided for in mining legislation.

The closure plan of 35 mining

areas currently considers the following:

| i) | 18 cavities are expected to be filled with solid

material, including 6 cavities that were previously planned to be monitored and 5 that were previously planned to be closed by buffering

and that, during 2024, based on the Mine Closure Plan definitions and the recommendation of expert consulting firms, closure by filling

with solid material (sand) proved to be the most appropriate closure method. To date, 6 cavities have already been filled (cavities 04,

07, 11, 17, 19 e 25), 4 cavities are in the filling process (cavity 27: 69.1%, cavity 15: 32.1% e cavities 20/21: 33.4% until January

31, 2025) and the remaining 8 cavities are in the preparation and planning activities; |

| ii) | 6 cavities were naturally filled and, therefore,

do not indicate the need for additional measures to date. Cavity 18, which collapsed on December 10, 2023, is currently undergoing technical

studies to confirm its natural filling, indicating that filling them with solid material will not be necessary; |

| iii) | 11 cavities remain within the salt layer and

suitable for pressurization. At the end of 2024, the Company, based on the technical note issued by the specialized consultancy, considered

the recommendation to fill these pressurized cavities with solid material in the long term, that is, over several years to decades, and

after the completion of the current filling plan, in order to achieve a maintenance-free state for the 35 cavities, suitable for the definitive

closure of the field. |

Note that any need for additional

actions is assessed on an ongoing basis by the Company and are based on technical studies prepared by external specialists, whose recommendations

may be updated periodically according to the changes in the geological event and knowledge obtained, being submitted to competent authorities

and following the execution timeframe agreed under the mine closure plan, which is public and regularly revaluated with ANM. Subsidence

is a dynamic process occurring in the area outlined by the priority action lines map and should continue to be monitored during and after

the actions envisaged in the closure plan. The results of the monitoring activities will be important to assess the need for potential

future actions, with a focus on security and monitoring of stability in the region. Any potential future actions may result in significant

additional costs and expenses that may differ from current estimates and provisions.

The provisioned amount of

R$2,607 million (2023: R$1,583 million) to implement the actions for closing and monitoring the salt cavities, environmental actions and

other technical matters was calculated based on currently known techniques and the solutions planned for the current conditions of the

cavities, including expenses with technical studies and monitoring, as well as environmental actions already identified. The provision

amount may change based on new information, such as: the results of monitoring of the cavities, the progress of implementing the plans

to close mining areas, possible changes that may be required in the environmental plan, the monitoring of the ongoing measures and other

possible natural alterations.

Regarding environmental actions,

in compliance with the Agreement for Socio-environmental Reparation, Braskem continues implementing the actions established in the environmental

plan approved by the MPF and sharing the results of its actions with the authorities As one of the results of the collapse of cavity 18,

as agreed in the Socio-Environmental Reparation Agreement, a specialized company is preparing a specific Environmental Diagnosis to evaluate

potential impacts caused by the collapse of said cavity. The delivery of the diagnosis is expected for the first half of 2025.

c)

Social and urban measures: Refers

to actions to implement social and urban measures under the Agreement for Socio-environmental Reparation signed on December 30, 2020 for

the adoption of actions and measures in vacated areas, urban mobility and social compensation actions, indemnification for social damages

and collective pain and suffering and possible contingencies related to the actions in the vacated areas and related to urban mobility.

To date, of the 11 projects defined for urban mobility, 6 have already been completed (Sistema Chã da Jaqueira, Ladeira Santa Amélia,

Rua Marquês de Abrantes, Via Lateral da Av. Menino Marcelo and Binário da Ladeira do Cálmon and the Intelligent Traffic

Light System and Surveillance that are under in assisted operation), 2 are in progress, being that the first stage of the Side Roads of

Avenida Durval de Goes Monteiro completed and the remaining projects are in the planning stages. The expectation is to complete all urban

mobility actions by 2027. Regarding actions in vacated areas, the overall progress of the Encosta do Mutange Stabilization project is

90%, as of January 31, 2024, and demolition activities in this area have been completed Other actions, such as earthworks, construction

of a drainage system, and planting of vegetation cover in the involved area, are ongoing, with completion expected by the first quarter

of 2025. Other activities related to emergency demolitions in the areas are proceeding as requested by the DCM and have reached 58% of

the total area to be demolished (69% in number of properties). Additionally, the Company continues to take actions to care for the neighborhoods,

including property security, waste management, and pest control. Regarding the Social and Urban Action Plan ("PAS"), 48 actions

have already been validated with signatories to the agreement, defined based on the social and urban diagnosis carried out by a specialized

and independent company, of these, 30 are the responsibility of Braskem and 18 of the municipality of Maceió, covering four areas

of action (Social policies and vulnerability reduction; Economic activity, work, and income;

Urban and environmental qualification;

Preservation of culture and memory). Among the actions in the Culture area three stand out (Cultural Support Program, Cultural Heritage

Inventory, and Call for Proposals to Support Culture), continue in execution. The current provision amount is R$1,141 million (2023: R$1,369

million).

d)

Medidas adicionais: Refers

to actions related to: (i) actions related to the Technical Cooperation Agreements entered into by the Company; (ii) expenses relating

to communication, compliance, legal services, etc.; (iii) additional measures to assist the region and maintenance of areas, including

actions for requalification and indemnification directed to Flexais region; and (iv) other matters classified as a present obligation

for the Company, even if not yet formalized. Regarding the Urban Integration and Development Project of Flexais, significant progress

has been made in the process of compensating residents (Financial Support Program - PAF), with 1,810 proposals submitted (99.5% of the

total) and 1,804 payments completed (99.9% of the proposals) by January 31, 2025. The project’s goal is to promote access to essential

public services and encourage the local economy of Flexais, aiming to address the socio-economic isolation of the region. Of the 23 actions

established in the project, 14 have been implemented (12 are ongoing and 2 have been fully completed), 4 are in execution, and 5 are planned

to start in the coming months. The balance of additional measures described in this item totals R$825 million (2023: R$935 million).

The provisions of the Company

are based on current estimates and assumptions and may be updated in the future due to new facts and circumstances, including, but not

limited to: changes in the execution time, scope and method and the success of action plans; new repercussions or developments arising

from the geological event, including possible revision of the Civil Defense Map; and possible studies that indicate recommendations from

specialists, including the Technical Monitoring Committee, according to Agreement for Compensation of Residents, as detailed in item 23.1

(i) of the consolidated and individual Financial Statements as of December 31, 2024, and other new developments in the matter.

The actions to repair, mitigate

or offset potential environmental impacts and damages, as provided for in the Socio-environmental Reparation Agreement, were defined considering

the environmental diagnosis already prepared by a specialized and independent company. After the conclusion of all discussions with authorities

and regulatory agencies, as per the process established in the agreement, an action plan was agreed to be part of the measures for a Plan

to Recover Degraded Areas (“PRAD”).

On May 21, 2024, the final

report of the Parliamentary Investigative Committee ("CPI"), set up by the Senate on December 13, 2023, was approved, with the

purpose of investigating the effects of the Company's socio-environmental legal liability related to the geological event in Alagoas.

On this date, the aforementioned CPI was declared closed, with the subsequent submission of the final report to the appropriate institutions.

There are also administrative

proceedings related to the geological event in Alagoas in progress before the Federal Accounting Court ("TCU") and the Securities

and Exchange Commission of Brazil ("CVM"). The Company informs that it has been monitoring the issues and their developments.

In October 2024, the Company

has been informed of the conclusion of the Federal Police investigation in Alagoas, which had been ongoing since 2019. The inquiry records

were sent to the Prosecution Office for evaluation, which requested additional investigations. The Company reinforces that it has always

been at the disposal of the authorities and has been providing all information related to salt mining over the course of the investigation.

The Company has been making

progress with local authorities about other indemnification requests to understand them better. Although future disbursements may occur

as a result of progress in negotiations, as of the reporting date, the Company is unable to predict the results and timeframe for concluding

these negotiations or its possible scope and the total associated costs in addition to those already provisioned for.

It is not possible to anticipate

all new claims, related to damages or other nature, that may be brought by individuals or groups, including public or private entities,