Bally’s Corporation Stockholders Approve Merger Agreement With Affiliate of Standard General L.P.

November 19 2024 - 3:59PM

Business Wire

Bally’s Corporation (NYSE: BALY) (“Bally’s” or the “Company”)

announced that at its Special Meeting of Stockholders held on

November 19, 2024, its stockholders, including its unaffiliated

stockholders, approved the adoption of its previously announced

definitive merger agreement with The Queen Casino &

Entertainment Inc. (“Queen”), a portfolio company majority-owned by

the Company’s largest stockholder, Standard General L.P. At the

Special Meeting, the Company stockholders also approved, on a

non-binding advisory basis, the compensation that may or will

become payable by Bally’s to its named executive officers in

connection with the transactions contemplated by the merger

agreement. The merger agreement has been adopted by the affirmative

vote of the holders of a majority of the outstanding shares of the

Company’s common stock as of the October 21, 2024 record date for

the Special Meeting and the affirmative vote of the holders of a

majority of the holders of the outstanding shares of the Company’s

common stock as of such record date, excluding those held by

Standard General L.P., Sinclair Broadcast Group, Inc., Noel Hayden

and certain executive officers and a director of the company.

Stockholders who validly elected to have their Company shares

remain issued and outstanding following the Company merger (the

“Rolling Share Election”) as of 5:00 p.m. ET today (November 19,

2024), will be assigned a new CUSIP number and their shares will

continue to be traded on the New York Stock Exchange (the “NYSE”)

under the new ticker symbol “BALY.T” (the “Rolling Company

Shares”), prior to the effective time of the Company merger (the

“Company Effective Time”). The Company, subject to the prior

approval by the Special Committee, reserves the right to open one

or more new Rolling Share Election periods prior to the Company

Effective Time. Bally’s will notify Company Stockholders of any

such additional election period and the related deadlines and

procedures by the filing with the Securities and Exchange

Commission (“SEC”) of a Form 8-K or such other report or schedule

as may be appropriate.

At the Company Effective Time, the Rolling Company Shares will

remain outstanding, and it is expected that such shares will revert

to the original “BALY” ticker symbol. The Rolling Company Shares

will remain registered with the SEC and is expected to continue

trading on the NYSE or another securities exchange in the United

States, based on applicable listing requirements.

Closing of the transactions contemplated by the merger agreement

is anticipated to occur in the first half of 2025 and remain

subject to the receipt of regulatory approvals and the satisfaction

of other customary closing conditions.

A final report on the results of the Special Meeting will be

made on a Form 8-K to be filed with the SEC.

About Bally’s Corporation

Bally’s Corporation is a global casino-entertainment company

with a growing omni-channel presence. It currently owns and manages

15 casinos across 10 states, a golf course in New York, a horse

racetrack in Colorado, and has access to OSB licenses in 18 states.

It also owns Bally’s Interactive International, formerly Gamesys

Group, a leading, global, interactive gaming operator, Bally Bet, a

first-in-class sports betting platform, and Bally Casino, a growing

iCasino platform.

With 10,600 employees, the Company’s casino operations include

approximately 15,300 slot machines, 580 table games and 3,800 hotel

rooms. Bally’s also has rights to developable land in Las Vegas

post the closure of the Tropicana.

Upon completion of the announced merger with The Queen Casino

& Entertainment Inc. (“Queen”) the above portfolio are expected

to be supplemented with four additional casinos across three

states, one of which will be an additional state that expands

Bally’s jurisdiction of operations to include the state of Iowa.

Queen will also add over 900 employees, and operations that

currently include approximately 2,400 slot machines, 50 table games

and 150 hotel rooms to the Bally’s portfolio. Bally’s will also

become the successor of Queen’s significant economic stake in a

global lottery management and services business through its

investment in Intralot S.A. (ATSE: INLOT).

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements in this communication include, but are not limited to,

statements regarding the proposed transaction, the ability of the

Company to complete the proposed transaction and the expected

timing thereof and statements regarding the future prospects of the

Company following the completion of the proposed transaction. By

their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. As a result,

these statements are not guarantees of future performance and

actual events may differ materially from those expressed in or

suggested by the forward-looking statements. Any forward-looking

statement made by the Company in this press release, its reports

filed with the SEC and other public statements made from

time-to-time speak only as of the date made. New risks and

uncertainties come up from time to time, and it is impossible for

the Company to predict or identify all such events or how they may

affect it. The Company has no obligation, and does not intend, to

update any forward-looking statements after the date hereof, except

as required by federal securities laws. Factors that could cause

these differences include, but are not limited to those included in

the Company’s Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and other reports and schedules filed by the Company with the

SEC. These statements constitute the Company’s cautionary

statements under the Private Securities Litigation Reform Act of

1995.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241119022382/en/

Media Diane Spiers (609) 377-4705 dspiers@ballys.com

Investor Marcus Glover Chief Financial Officer (401) 475-8564

ir@ballys.com

James Leahy, Joseph Jaffoni, Richard Land JCIR (212) 835-8500

baly@jcir.com

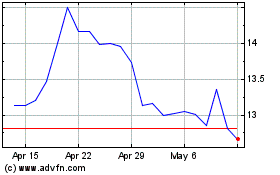

Ballys (NYSE:BALY)

Historical Stock Chart

From Dec 2024 to Jan 2025

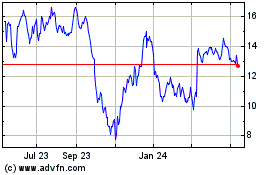

Ballys (NYSE:BALY)

Historical Stock Chart

From Jan 2024 to Jan 2025